28 September 2022

Russia’s unprovoked invasion of Ukraine marks the return of geopolitical risk to Europe. Here the ECB blog looks at how global stock markets reacted to this risk and what role time and distance have played.

Though much ink has been spilled trying to understand stock markets, there is limited evidence on how geopolitics shape their performance. Establishing links between stock market performance and geopolitical concerns is challenging, as geopolitical effects are difficult to identify. We look at the market reaction after the Russian invasion of Ukraine to unveil the effect of geopolitical risk depending on those markets’ distances from Kyiv. We also construct a daily news index of geopolitical tensions tailored specifically for this war. Quantifying the effect of geopolitical tensions on markets helps us to assess risks for the economy and financial stability across countries.

The Russian invasion revealed a geopolitical risk premium in equity markets

The Russian invasion of Ukraine reverberated across global equity markets. It is widely acknowledged that it is difficult to identify and measure geopolitical effects because it is usually challenging to isolate these from other confounding factors, as pointed out for instance by Eichengreen et al. (2019 and 2021)[1]. We overcome this challenge by using the physical distance between Kyiv and the capitals of other countries. We use this as a proxy to reflect a country’s exposure to the war itself, in a similar vein as Federle et al. (2022)[2]. The exposure may be due to trade and economic linkages, higher refugee flows or potential military spillovers, putting a strain on economic activity and hence on the associated stock market performance. In peace time, the distance to Kyiv does not influence the cross-country variation in the performance of global equity markets. But in the immediate aftermath of the invasion, distance became an important determinant of their performance. It explained almost 20% in the cross-country variation in equity markets in a sample of 80 countries. In other words, equity markets priced in a negative geopolitical risk premium. Stock prices in countries in the vicinity of the war, in particular stock prices in Europe, were hit much harder than those in parts of the world that are more distant from the invasion (Chart 1). Most European equity markets have subsequently recovered.

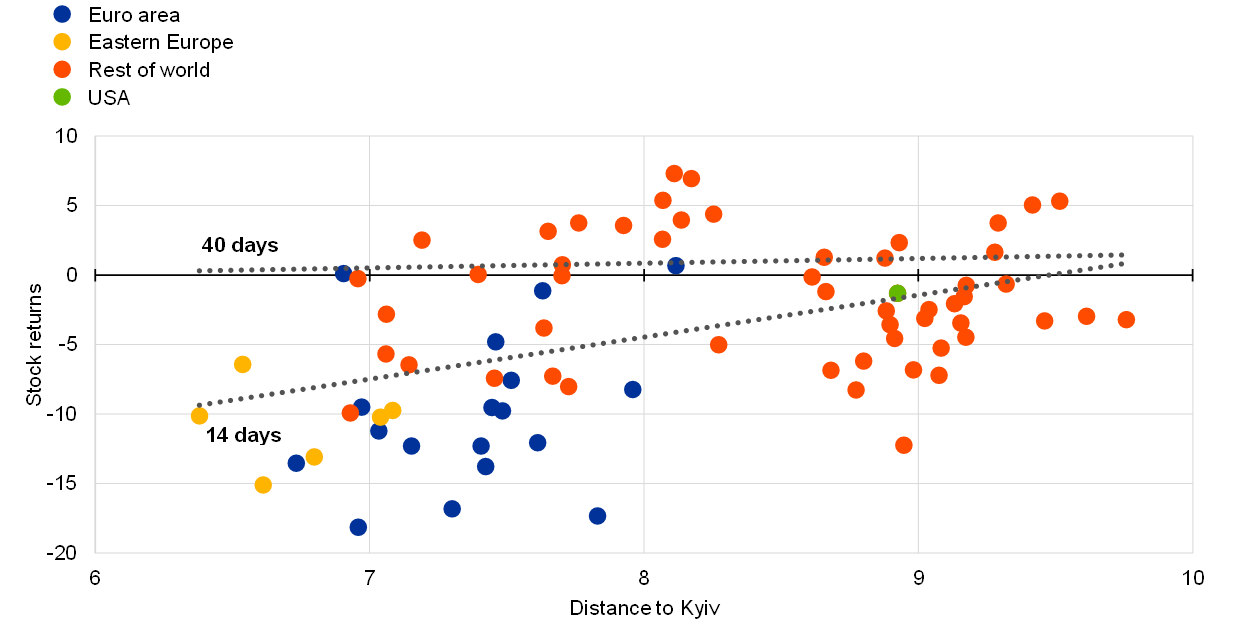

Chart 1

Geopolitical risk premium observable in equity markets

Stock market returns vs distance to Kyiv

(y-axis: percentage change, x-axis: log kilometers)

Sources: Haver Analytics, CEPII and ECB calculations.

Notes: The dots show the percentage change in the respective countries’ stock indices within the 14- day period starting on 25 February versus the distance (in log) between the capitals of each country and Kyiv. The first regression line suggests that equity markets in countries bordering Ukraine, notably the European markets, have corrected more significantly in the first days after the invasion compared to other equity markets in the rest of the world that are more distant to the invasion. The second regression line is flat suggesting that the relation does not hold anymore after 40 days as the geopolitical premium fades due to contamination effects from other shocks.

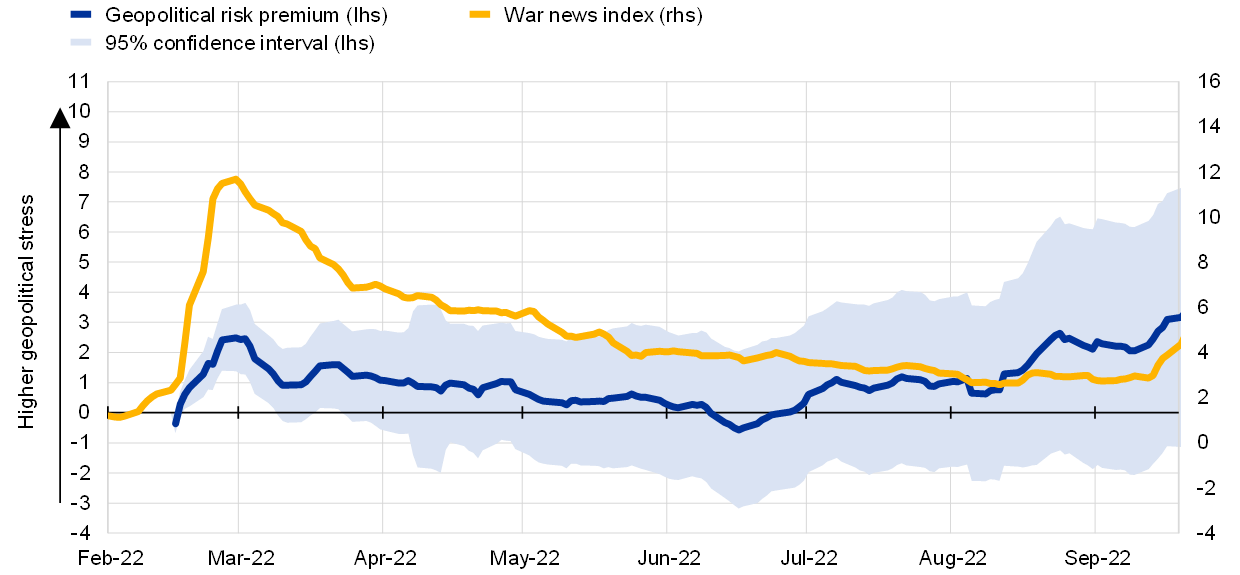

Estimating the change in equity prices over time shows that the geopolitical risk premium, i.e. the effect of a country’s distance to Kyiv on the stock market, was clearly visible in the immediate aftermath of the invasion (Chart 1, 14-days regression line and Chart 2, blue line). But the premium faded away subsequently (Chart 1, 40-days regression line and Chart 2, blue line). It may however resurface depending on the intensity of the conflict. This suggests that equity markets may not be pricing the geopolitical risk premium as a rare disaster event à la Rietz (1988)[3] and Barro (2006)[4], who assume disasters to be permanently reflected in the risk premium, but rather à la Gabaix (2012)[5], in the sense that the risk premium associated with rare disasters varies over time.

A novel daily index of the news-intensity of the Russia-Ukraine war

In order to capture the conflict intensity, we construct a novel daily news index of geopolitical tensions, in a similar vein as Caldara and Iacoviello (2022)[6] and Ferrari Minesso et al. (2022)[7]. Our indicator focuses on press coverage of the war in Ukraine (see Chart 2, yellow line). The daily frequency is important so that we capture and monitor perceptions of geopolitical risk from the invasion in a timely fashion. We use Dow Jones Factiva, which gathers articles from major newspapers around the world, to count the number of articles published each day that discuss war and refer to either Russia or Ukraine. When there is a risk of an armed escalation between the two countries, newspapers devote more space to its discussion and the index records higher values. The indicator comoved with the geopolitical premium (see Chart 2, yellow and blue lines, respectively). It peaked on 27 February 2022, shortly after the invasion, declined thereafter and slowly stabilised albeit at a relatively high level as the war in Ukraine has continued.

Russia’s invasion of Ukraine revealed the existence of a negative geopolitical risk premium priced in by equity markets. Using distance to Kyiv as a proxy for geopolitical risk, we show that European equity markets were hit harder compared to the rest of the world but rebounded subsequently. We also construct a novel daily news index of geopolitical risk specifically tailored to measure the intensity of the Russian invasion of Ukraine. This indicator peaked shortly after the invasion, declined thereafter but has plateaued at a relatively high level as the conflict drags on.

Chart 2

Geopolitical equity risk premium and news intensity index of Russian invasion comove

Estimated geopolitical equity risk premium and news-based war indicator

(lhs y-axis: estimated effect, percent, rhs y-axis: percent of total articles)

Sources: Dow Jones Factiva and ECB calculations.

Notes: The blue line displays the estimated geopolitical risk premium, i.e. the effect of a country’s distance to Kyiv (in log) on the changes in equity prices between the 21 February 2022 and the date indicated on the x-axis, estimated in a rolling cross-sectional regression. The yellow line presents a news-based Russia-Ukraine war indicator constructed as the share of news articles resulting from a search on Dow Jones Factiva, which gathers articles from major newspapers around the world, using the following search query: ("Russia” AND “war") or ("Ukraine" AND "war”). Sources: All top sources (i.e. Reuters Newswires or The Wall Street Journal - All sources or Dow Jones Newswires or Major News and Business Sources or Press Release Wires). Subject: All subjects. Language: English. The index is standardised for the total number of articles published each day in the same news outlets to have a consistent measure across time. The frequency is daily since 1 February 2022, a 7-day moving average is displayed.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

See Eichengreen, B., A. Mehl and L. Chiţu (2019), “Mars or Mercury? The Geopolitics of International Currency Choice”, Economic Policy, CEPR; CES; MSH, vol. 34(98), pp. 315-363 and Eichengreen, B., A. Mehl and L. Chiţu (2021), “Mars or Mercury Redux: The Geopolitics of Bilateral Trade Agreements”, The World Economy, Volume 44, Issue 1, January 2021, pp. 21-44.

Federle, J., Meier, A., Müller, G. and V. Sehn (2022), “Proximity to War: The stock market response to the Russian invasion of Ukraine”, CEPR Discussion Paper 17185.

Rietz, T., (1988), “The Equity Risk Premium: A Solution”, Journal of Monetary Economics, 22 (1988), 117–131.

Barro, R. J., (2006), “Rare Disasters and Asset Markets in the Twentieth Century”, The Quarterly Journal of Economics, 121(3): 823–866.

Gabaix, X. (2012) “Variable Rare Disasters: An exactly solved framework for ten puzzles in macro-finance”, The Quarterly Journal of Economics,127, 645–700.

Caldara, D. and M. Iacoviello (2022), “Measuring Geopolitical Risk”, American Economic Review, 112(4): 1194-1225.

Ferrari Minesso, M., Lebastard, L. and H. Le Mezo, (2022), “Text-based recession probabilities”, IMF Economic Review.