- THE ECB BLOG

- 4 August 2020

The macroeconomic impact of the pandemic and the policy response

Blog post by Philip R. Lane, Member of the Executive Board of the ECB

My aims in this blog post are twofold. First, I will compare Eurostat’s flash estimate of Q2 GDP (published last Friday) to the June Eurosystem staff projections.[1] Second, I will discuss the role of the pandemic emergency purchase programme (PEPP) in supporting the euro area economy and protecting medium-term price stability.

Second quarter GDP: the maximum impact of the pandemic

It has long been clear that the maximum impact of the pandemic on economic activity would fall in the second quarter. While the economy had already taken a significant hit in the first quarter, the most extensive lockdown measures were implemented in April. Higher-frequency data indicate that there was some recovery during May and June (on account of initial progress in stabilising the spread of the virus and the associated easing of lockdown measures), but the scale of the April contraction and the partial nature of the rebound in May and June meant that the data would inevitably show a substantial decline in the average level of economic activity during the second quarter.

Eurostat’s preliminary flash estimate for euro area output in the second quarter makes for sobering reading, with a quarter-on-quarter decline in GDP of 12.1 percent. Taken together with the 3.6 percent decline in the first quarter, the cumulative decline in output in the first half of 2020 was 15.3 percent.

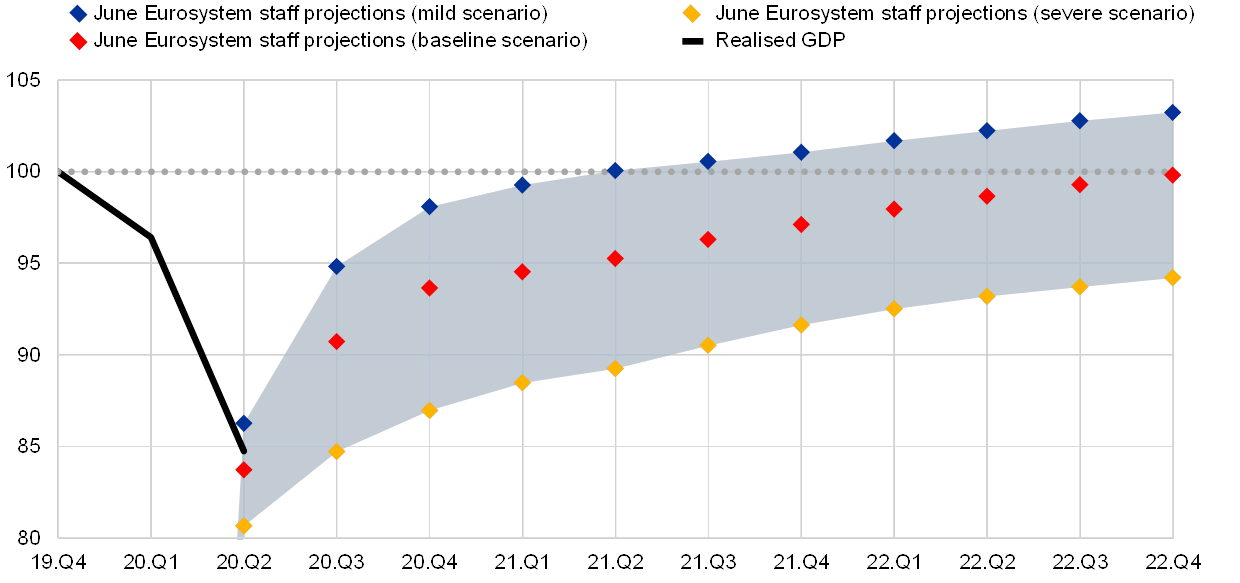

As shown in Chart 1, the second quarter outcome is slightly less severe than the 13 percent decline envisaged in the June Eurosystem staff projections. Across the range of scenarios studied by the Eurosystem staff, the third quarter is projected to see a significant increase in the level of economic activity, even if the scenarios differ in terms of the overall duration and severity of the pandemic shock, with the baseline only seeing a return to the pre-pandemic level of economic activity in 2022.

Realised and projected output

(indexed real GDP, Q4 2019 = 100)

Sources: ECB and Eurostat.

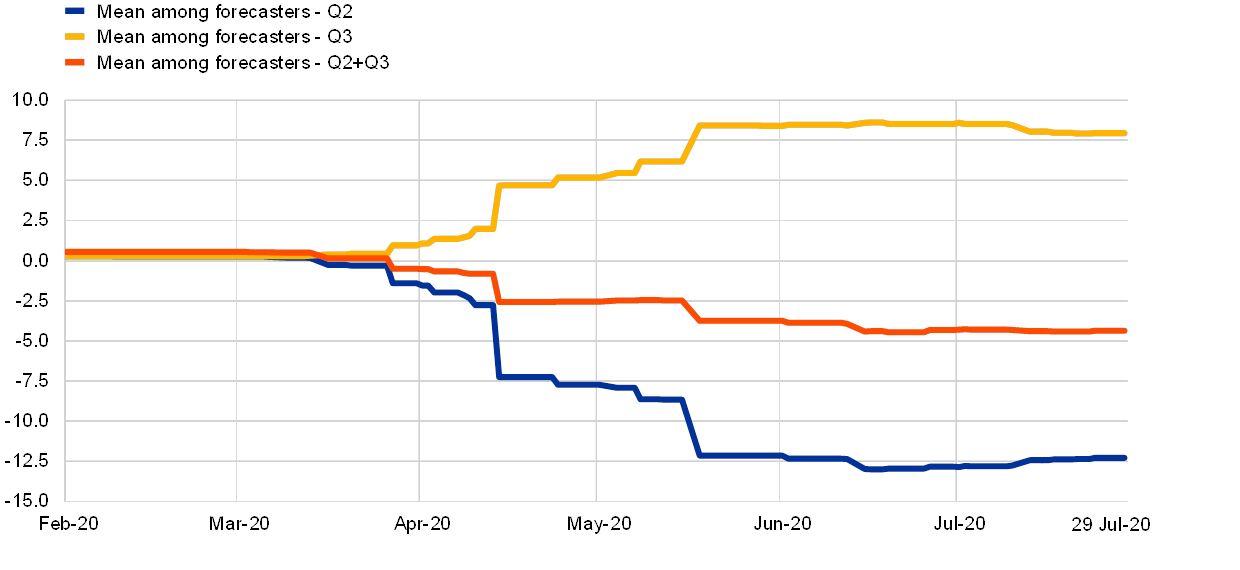

In drawing inferences from the flash estimate published by Eurostat, it is also important to take into account the negative correlation in many forecast exercises between the second-quarter and third-quarter output growth rates (see Chart 2). In particular, to the extent that the unlocking of the European economy advanced more quickly in May and June than was originally expected, this may imply a less-steep step up in economic activity in the third quarter, with more sectors transitioning from the reopening phase to a more gradual growth rate. Accordingly, it would be unwise to draw strong conclusions from the second quarter outturn: at the least, the data for the second and third quarters should be jointly assessed.

GDP growth forecasts by private banks for the second and third quarters of 2020

(percentages)

Source: Bloomberg.Notes: Private forecasts are provided by the 29 largest commercial and investment banks. “Mean” refers to the average of the forecast among private banks. The latest observations are for 29 July 2020.

In analysing the prospects for the third quarter, the containment of the virus remains the most important factor. The rise of new coronavirus (COVID-19) cases in parts of Europe over the past couple of weeks has led to renewed local containment efforts and revised travel guidelines. In addition to the direct adverse impact on some sectors (especially tourism), setbacks in the containment of the virus are also weighing on consumer and investor sentiment. In a similar vein, the resurgence in COVID-19 transmission rates in a number of major non-euro area economies is dampening sentiment and impairing spending in those economies, with a measureable impact on the external demand for euro area exports.

More generally, the exceptionally-elevated uncertainty about the evolution of the pandemic continues to dampen business investment. Taken together, actual and expected declines in employment and income can be expected to keep precautionary household savings at elevated levels. Moreover, while overall bank lending conditions remain favourable, the second quarter bank lending survey signals that banks expect a net tightening of credit standards for loans to firms, in part related to the projected tapering-off of state credit guarantee schemes. These factors help to explain why the economy is expected to take a significant amount of time to recover fully from the pandemic shock and why significant fiscal and monetary policy support is necessary.

The role of the PEPP in supporting the euro area economy

As the severity of the economic and financial implications of the pandemic crisis became apparent, the ECB adopted a series of measures to ease financial conditions in order to avoid adverse feedback loops between the financial system and the real economy, support confidence and proactively respond to the downward shift in the outlook for growth and inflation.[2] More specifically, the ECB acted through its liquidity operations and asset purchases, which included the establishment of the PEPP.[3]

As I described in an earlier blog post, the PEPP has a dual role.[4] First, alongside the ECB’s other monetary policy instruments, asset purchases are the most important mechanism for delivering the additional monetary accommodation required to support the economic recovery and safeguard price stability in the medium term. Second, the flexibility embedded in the PEPP – across time, asset classes and jurisdictions – is essential in enabling the ECB to stabilise financial markets in an efficient and effective manner.

Let me begin by discussing the latter role in more detail. The PEPP’s market stabilisation function has proved successful in recent months, with the ECB making use of the PEPP’s flexibility by frontloading asset purchases and directing them to those market segments where they have been most warranted. The risk of fragmentation has been significantly reduced since the onset of the pandemic crisis.

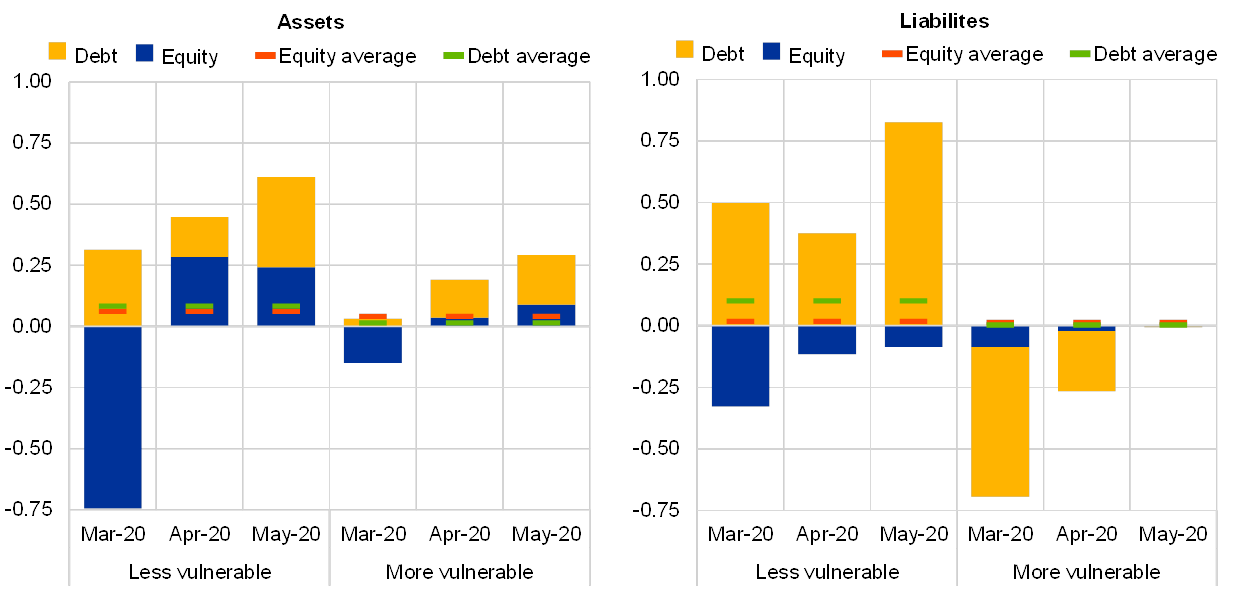

Chart 3 illustrates this point with balance of payments data for March, April and May across two country groups (less vulnerable and more vulnerable). Following the severe fragmentation patterns that began to develop in March – patterns consistent with the nature of a flight-to-safety episode – signs of stabilisation emerged in April and were even more evident in the May data. On the asset side, net inflows into both less and more vulnerable countries increased (left panel); on the liability side, net outflows of debt securities issued by more vulnerable countries came to a halt, after two months of sizeable net sales (right panel).

Cross-border portfolio investment flows by country group – assets and liabilities

(monthly flows as a percentage of euro area GDP)

Sources: ECB and Eurostat.Notes: Data recorded on the basis of the Sixth Edition of the IMF Balance of Payments and International Investment Position Manual (BPM6). Averages calculated from January 2008 to May 2020. “Less vulnerable” countries are Austria, Belgium, Finland, France, Germany and the Netherlands; “more vulnerable” countries are Greece, Italy, Portugal and Spain.

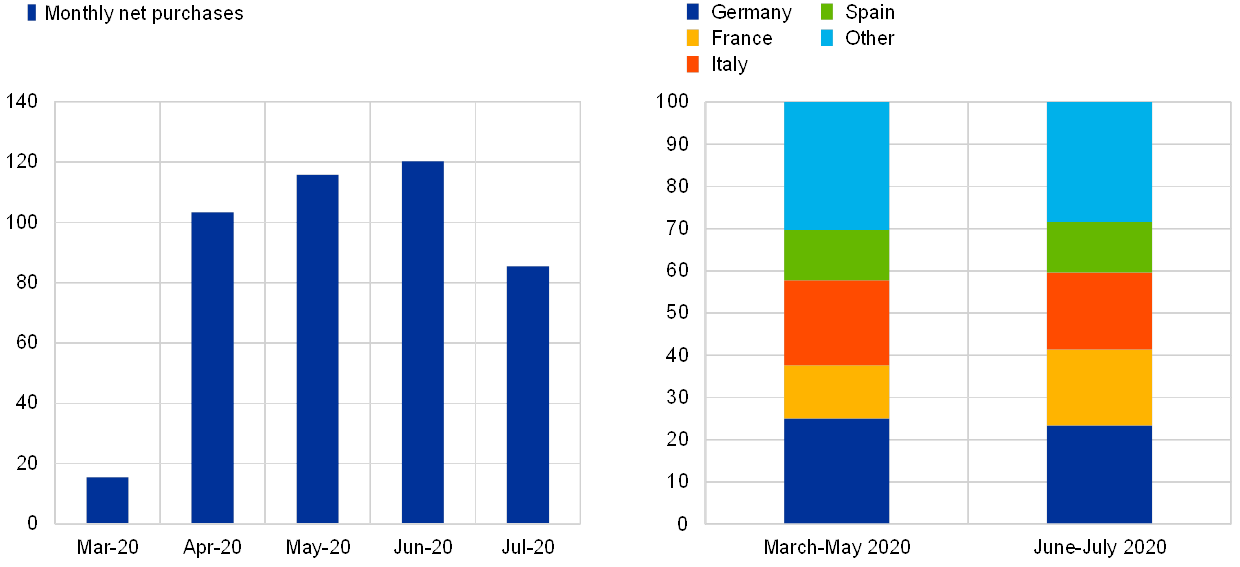

The success of the PEPP’s market stabilisation role to date, combined with the flexibility embedded in the programme, has allowed for adjustments in the timing and composition of purchases in line with the evolution of market conditions. Taking this into account, and keeping in mind the usual summer lull in market activity, the latest PEPP data releases show that there has been a reduction in the pace of PEPP purchases in July (see Chart 4, left panel). Purchases of public sector securities in those countries that were most affected early on by the pandemic have also been adjusted as market conditions have improved (see Chart 4, right panel).

However, while the monthly pace and composition of the PEPP can be flexibly adjusted in line with the risks to market stability and the transmission mechanism, the overall envelope of PEPP purchases is a core determinant of the ECB’s overall monetary stance.[5] In line with the ECB’s price stability mandate, the inflation outlook plays the central role in determining the appropriate monetary stance. Prior to the pandemic, the December 2019 Eurosystem staff projections for the euro area foresaw annual HICP inflation at 1.6 percent in 2022. In the June 2020 staff projections, the outlook for HICP inflation in 2022 had been revised downwards to 1.3 percent. This downward revision to the inflation outlook motivated the scaling-up of the PEPP envelope from €750 billion to €1,350 billion at the June meeting of the ECB’s Governing Council.

Eurosystem purchases under the PEPP

(left panel: total monthly net purchases, EUR billions; right panel: geographical distribution of public sector securities purchases, percentages of total public sector securities purchases during respective period)

Source: ECB.Notes: End-of-period book values. Figures are preliminary and may be subject to revision. The monthly purchase volumes are reported on a settlement basis and net of redemptions.

Conclusion

In summary, while there has been some rebound in economic activity, the level of economic slack remains extraordinarily high and the outlook highly uncertain. Further progress in persistently containing the virus will be central in determining the size and speed of the economic recovery, together with sufficiently-supportive fiscal and monetary policies. In tandem with the appropriate calibration of national fiscal policies and the various EU-level initiatives already announced in April, the recently agreed Next Generation EU (NGEU) instrument will be vitally important in ensuring sufficient fiscal support across EU Member States in the coming years. For our part, the ECB is committed to providing the monetary stimulus needed to support the economic recovery and secure a robust convergence of inflation towards our medium-term aim.

- [1]I am grateful to Danielle Kedan and Simon Mee for their contributions to this blog post.

- [2]I discussed the ECB’s response to the COVID-19 crisis in more detail in a recent speech. See Lane, P.R. (2020), “The ECB’s monetary policy response to the pandemic: liquidity, stabilisation and supporting the recovery”, 24 June.

- [3]In order for the liquidity and asset purchase measures to be fully effective, it was also important to undertake a comprehensive set of collateral easing measures (see De Guindos, L. and Schnabel, I. (2020), “Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures”, The ECB Blog, 22 April). The supervisory arm of the ECB also took significant supervisory actions in order to avoid a procyclical tightening in credit conditions (see Enria, A. (2020), “Flexibility in supervision: how ECB Banking Supervision is contributing to fighting the economic fallout from the coronavirus”, The Supervision Blog, 27 March).

- [4]See Lane, P.R. (2020), “The market stabilisation role of the pandemic emergency purchase programme”, The ECB Blog, 22 June.

- [5]The PEPP operates alongside the more standard suite of policy instruments (the level of the key policy rates, our forward guidance, the size of the asset purchase programme (APP) – which has been boosted by an extra €120 billion – and the targeted longer-term refinancing operation (TLTRO) programme).