- THE ECB BLOG

The ECB’s commercial paper purchases: A targeted response to the economic disturbances caused by COVID-19

Blog post by Luis de Guindos, Vice-President of the ECB, and Isabel Schnabel, Member of the Executive Board of the ECB

3 April 2020

The outbreak and escalating diffusion of the COVID-19 pandemic has confronted Europe with a health emergency that, in addition to the humanitarian crisis, poses severe challenges to the euro area economy and financial system, as well as to the transmission of the common monetary policy.

In response to these challenges, the Governing Council has decided to act swiftly and decisively.[1] Our actions include additional liquidity-providing measures for banks (both targeted and non-targeted), supported by measures on collateral easing, as well as substantial additional purchases of public and private sector assets under the Asset Purchase Programme (APP) and the Pandemic Emergency Purchase Programme (PEPP).

The key features of these measures are described in detail in recent blog entries by the ECB President and by Philip Lane. Collectively, these actions contribute to mitigating the adverse economic impact of the pandemic on European citizens and ensure that all sectors of the economy continue to benefit from supportive financing conditions.

This blog focuses on the ECB’s purchases of private sector assets. More specifically, it explains the rationale for expanding purchases of non-financial commercial paper in the current economic environment.[2]

Under the APP, private sector purchases play an important role in the implementation of the ECB’s monetary policy. In addition to covered bonds and asset-backed securities, the ECB has purchased corporate bonds since the start of the Corporate Sector Purchase Programme (CSPP) in June 2016. Empirical evidence confirms that such purchases have contributed to both a significant easing of financing conditions for euro area firms and to stronger bond issuance. By freeing up bank balance sheet capacity, they have also had positive spillover effects on firms that do not directly benefit from bond purchases.[3]

As corporate bond spreads widened materially in the wake of the coronavirus pandemic, and as issuance stalled, the Governing Council decided, first, to increase private sector purchases and, second, to expand the eligibility of non-financial commercial paper to securities with a remaining maturity of at least 28 days. Previously, only commercial paper with a remaining maturity of at least six months had been eligible for purchase under the CSPP.

Some facts about the commercial paper market

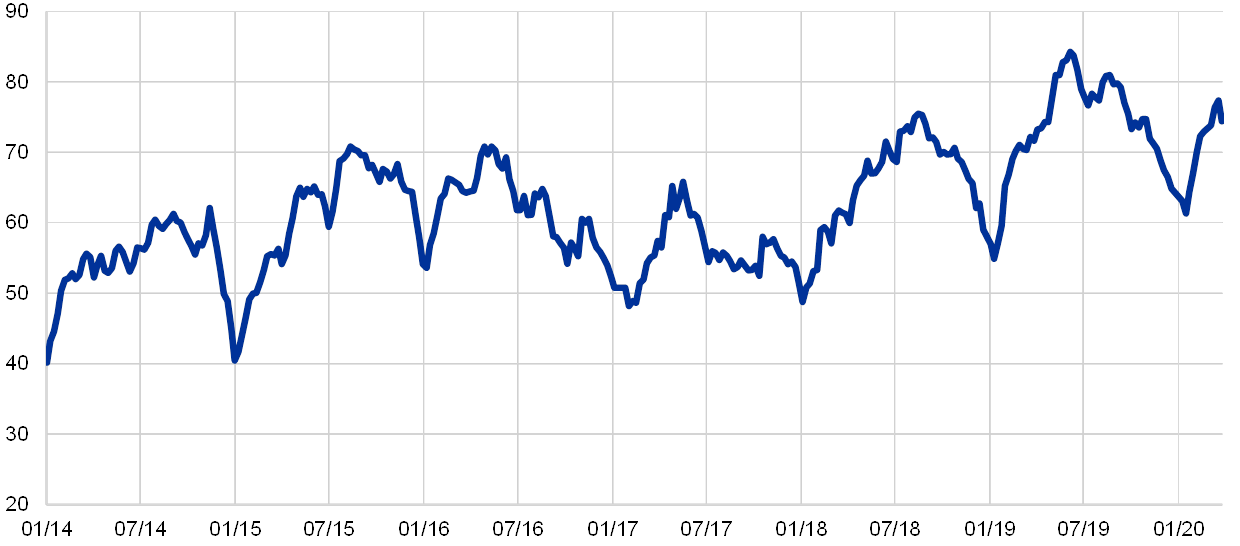

Commercial paper is an unsecured debt instrument that is used by both financial and non-financial corporates to cover short-term funding needs. Its maturity is typically well below one year. Chart 1 illustrates the evolution of the size of the market for outstanding EUR-denominated corporate commercial paper since 2014.

Chart 1. Outstanding amount of EUR-denominated corporate commercial paper

(EUR bn)

Source: ECB calculations, Banque de France, National Bank of Belgium, Suomen Pankki, Eligible Assets Database (EADB), Short-Term European Paper (STEP) database.

Note: Latest observation on 25 March 2020.

The development shows a strong cyclical pattern around a marked positive trend in the size of the overall market. ECB estimates indicate that the market for corporate commercial paper denominated in euro currently amounts to approximately EUR 75 bn. However, the depth of the commercial paper market differs widely across jurisdictions, with France accounting for the largest issuance volume in the euro area.[4]

The majority of euro area commercial paper is issued by monetary financial institutions (MFIs, Chart 2). But over time, non-financial corporations (NFCs) have become more active in the commercial paper market. Commercial paper accounted for slightly below 5% of outstanding market-based debt issued by euro area NFCs, and around 0.8% of their outstanding total debt as of Q3 2019, according to ECB estimates. In spite of these relatively low shares, commercial paper is an important instrument for euro area corporates to manage their short-term cash needs.

Chart 2. Outstanding commercial paper by type of issuer group

(%)

Source: Statistical Data Warehouse, Short-Term European Paper (STEP) database.

Note: The sectors are classified according to the European System of Accounts 1995 (ESA95) and draw upon existing issuer sector classifications used by the dynamic data providers, which have been mapped to the ESA sectors utilised by the ECB in its publications. “MFI”: Monetary Financial Institution. “NFC”: Non-Financial Corporation. “Other” includes: General Government, Other Financial Intermediaries, Supranational and International organisations, and Insurance Corporations and Pension Funds. Latest observation on 27 March 2020.

Corporate sector funding during the COVID-19 crisis

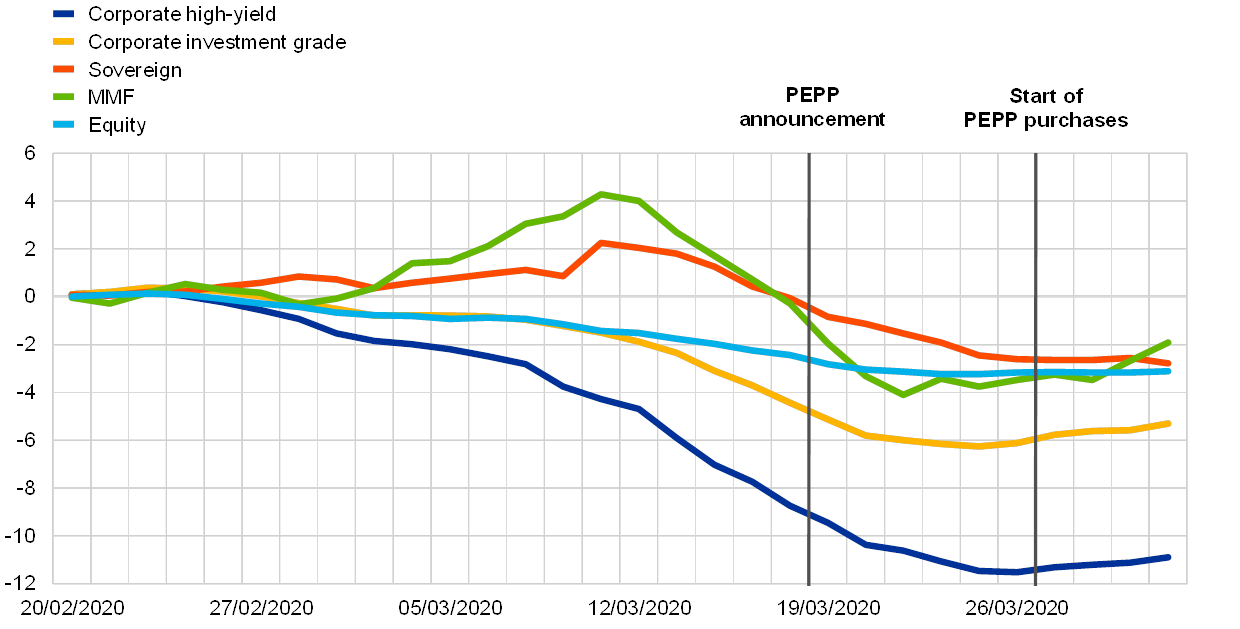

As concerns about the economic outlook intensified in recent weeks, and as financial market liquidity dried up, financing conditions for corporates tightened significantly, both in the high-yield segment and, albeit to a lesser extent, for investment grade corporates (Chart 3). At the same time, corporate bond issuance activity came to a virtual standstill ahead of the Governing Council decisions in March.

Chart 3. Corporate credit spreads

(bps)

Source: iBoxx Markit, ECB calculations.

Note: Latest observation on 2 April 2020.

These developments threatened to impair the transmission of our monetary policy and thus exacerbate the costs of the economic fallout from the crisis. If left unchecked, they could have ultimately posed serious risks to the medium-term inflation outlook.

The financial turmoil also resulted in tensions in the commercial paper market, with potentially severe ramifications for both the economy and financial stability. For example, amid growing concerns about redemptions, traditional private sector investors in commercial paper – including money market funds (MMFs) – have recently been increasingly reluctant to invest in commercial paper or have tried to sell it in a search for cash.

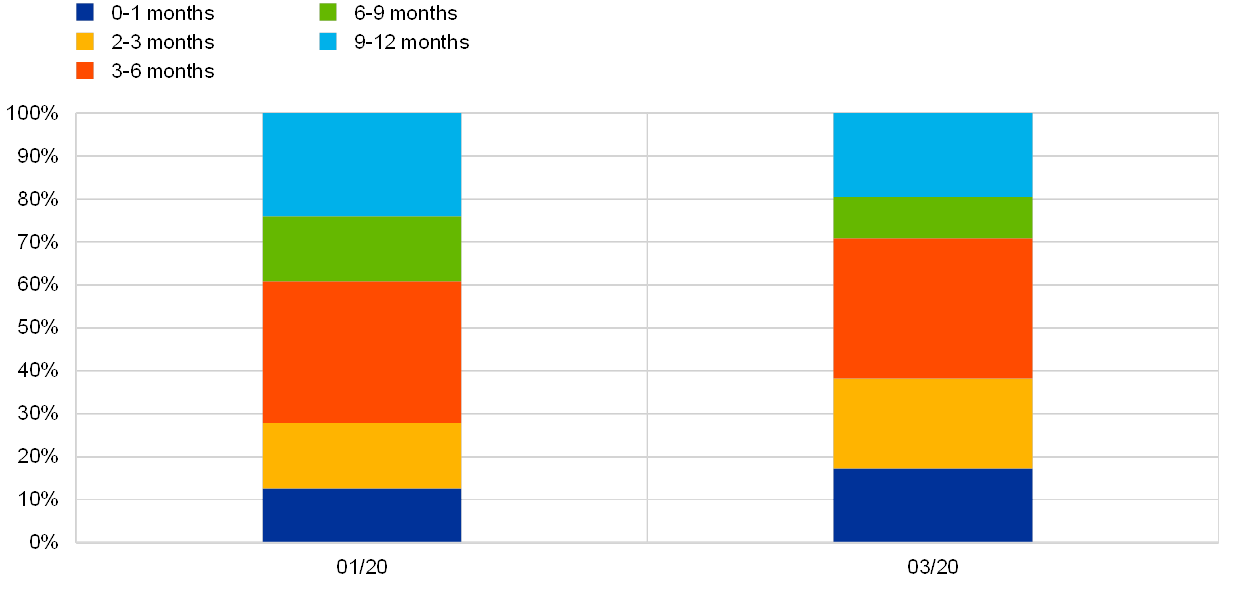

Reduced demand for commercial paper, in turn, may affect the real economy by depriving NFCs of their access to short-term funding through the commercial paper market. In general, the high degree of uncertainty in financial markets has led to a shift towards shorter-term and thus more liquid debt instruments. As a result, the average maturity of recent commercial paper issuances has decreased markedly since January 2020 (Chart 4). This preference for short-dated tenors creates roll-over risk for firms and can result in sudden funding constraints that could exacerbate the effects of the current crisis.

Chart 4. Recent changes in the maturity at issuance of NFC commercial paper

Source: ECB calculations, EADB.

Note: Maturity profile represents a snapshot of NFC commercial paper outstanding at the beginning of January 2020 and in mid-March 2020, directly prior to the PEPP announcement.

The role of commercial paper purchases in the transmission of monetary policy

The expansion of the ECB’s asset purchases to corporate securities with shorter maturities can benefit the smooth transmission of monetary policy in at least three ways.

First, short-term interest rates are the first step in the transmission of our policy. Commercial paper purchases directly ease the financing conditions for non-financial companies at very short tenors.

Second, purchases of commercial paper improve the access of private sector firms to liquidity. Through its presence in the market, the ECB provides an important backstop to solvent euro area companies that encounter temporary cash flow constraints. Our presence in the market fosters confidence, thereby also contributing to restoring demand for commercial paper by private sector counterparties.

Finally, our purchases provide an incentive for companies to issue commercial paper, thereby reducing their dependence on bank-based finance. This aspect is particularly important at times when banks may be reluctant to expand their short-term lending to corporates, or when their balance sheet capacity is constrained. At the same time, a greater reliance on market-based funding by some firms may free up lending capacities of banks, thereby benefiting other firms that fully rely on bank-based funding.

Preliminary evidence suggests that the Governing Council’s recent decisions – including the announcement of expanded non-financial commercial paper purchases – have contributed to a stabilisation in risk sentiment and market conditions.

Following the initial announcement, activity in the primary market for non-financial commercial paper has picked up. On the first day of purchases alone, the Eurosystem was able to buy EUR 1.5 bn of non-financial commercial paper. It appears that these purchases have had the desired effect as many dormant commercial paper programmes have been reactivated by new issuance. This is encouraging for the overall functioning of the market. Furthermore, the average tenor of new non-financial commercial paper issuances has increased relative to the levels observed in the weeks preceding the announcement. After a period of substantial outflows, assets under management held by MMFs and other investment funds also show tentative signs of stabilisation (Chart 5), supporting financial stability.

Chart 5. Cumulated flows in euro area domiciled funds

(% of assets under management)

Source: EPFR.

Note: Latest observation on 1 April 2020.

However, some European corporate commercial paper programmes are currently not fully compliant with the CSPP eligibility requirements (e.g., regarding listing, custodian, common safe keeper, format of the securities, and guarantee in case of issuance via an SPV). Requirements also comprise what the Eurosystem considers as an investment grade rating, which can be satisfied with both short-term and long-term ratings included in the Eurosystem’s credit quality steps 1 to 3. Unrated issuers are thus encouraged to get rated. More generally, issuers should update the legal documentation of commercial paper programmes in order to enlarge the size of CSPP-eligible securities.

Conclusion

Private sector asset purchases are an important and targeted element of the ECB’s policy response to the economic disruptions caused by the COVID-19 health crisis.

The decision to expand the eligibility of non-financial commercial paper under the CSPP serves three purposes. First, it improves the transmission of the ECB’s monetary policy measures to the real economy by easing funding conditions. Second, it supports the provision of liquidity through capital markets, helping companies manage their short-term funding needs. Third, purchases of commercial paper provide additional incentives for companies to access capital markets.

A shift towards more market-based financing is likely to have benefits that go well beyond mitigating the fallout from the current crisis. Deep and broad capital markets bring many benefits to the real economy, allowing euro area firms to diversify their funding sources and reduce their exposure to funding shocks. Sustainable and resilient capital market financing would strengthen the European capital markets union. The launch of the CSPP has already had a catalytic effect on primary market corporate bond issuance: since the launch of the programme in 2016, the outstanding amount of CSPP-eligible bonds has increased by more than 40%.

At the current juncture, many companies may be reluctant to shift to new modes of funding, and financial market participants in some member states may lack the relevant market infrastructure and experience. More cross-border issuance activity in the commercial paper market could help leverage the effectiveness of our monetary policy measures. In the long run, a greater reliance on capital markets can be expected to boost corporate investment, create jobs, support economic growth and ultimately facilitate the smooth transmission of the ECB’s monetary policy.

- 12 March: https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.mp200312~8d3aec3ff2.en.html; 18 March: https://www.ecb.europa.eu/press/pr/date/2020/html/ecb.pr200318_1~3949d6f266.en.html.

- Non-financial commercial papers also include securities by certain non-bank financial corporates, such as insurance companies.

- ECB Economic Bulletin, Issue 3 / 2018, “The impact of the corporate sector purchase programmeon corporate bond markets and the financing of euro area non-financial corporations”.

- According to statistics maintained by Banque de France, 80% of corporate commercial paper that is eligible under the CSPP is issued by French issuer groups while 10% is attributable to Belgian issuer groups.