Globalisation and its implications for inflation in advanced economies

Published as part of the ECB Economic Bulletin, Issue 4/2021.

1 Introduction

The globalisation of inflation hypothesis argues that the factors influencing inflation dynamics are becoming increasingly global. In recent years, economists have started to reassess the predictive power of standard inflation models (e.g. the Phillips curve) and to increasingly look at global factors, including globalisation, as a possible explanation behind the reduced sensitivity of inflation to domestic determinants (the so-called globalisation of inflation hypothesis).[1] Accordingly, in addition to domestic measures of slack, standard models of inflation should account for the role of global factors over and beyond their impact via import prices.

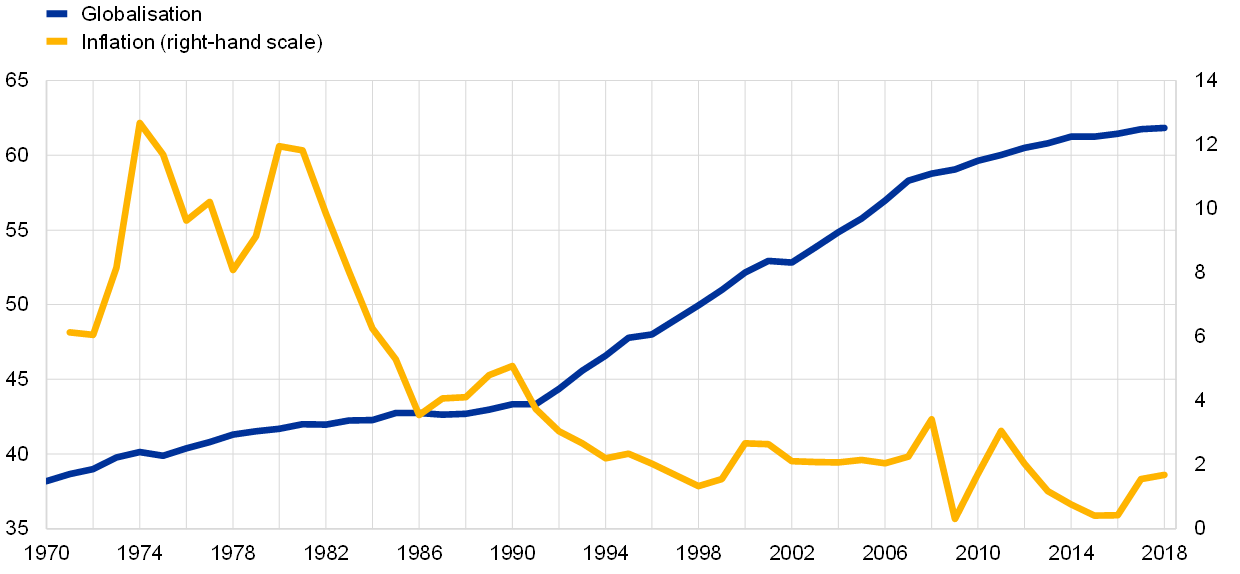

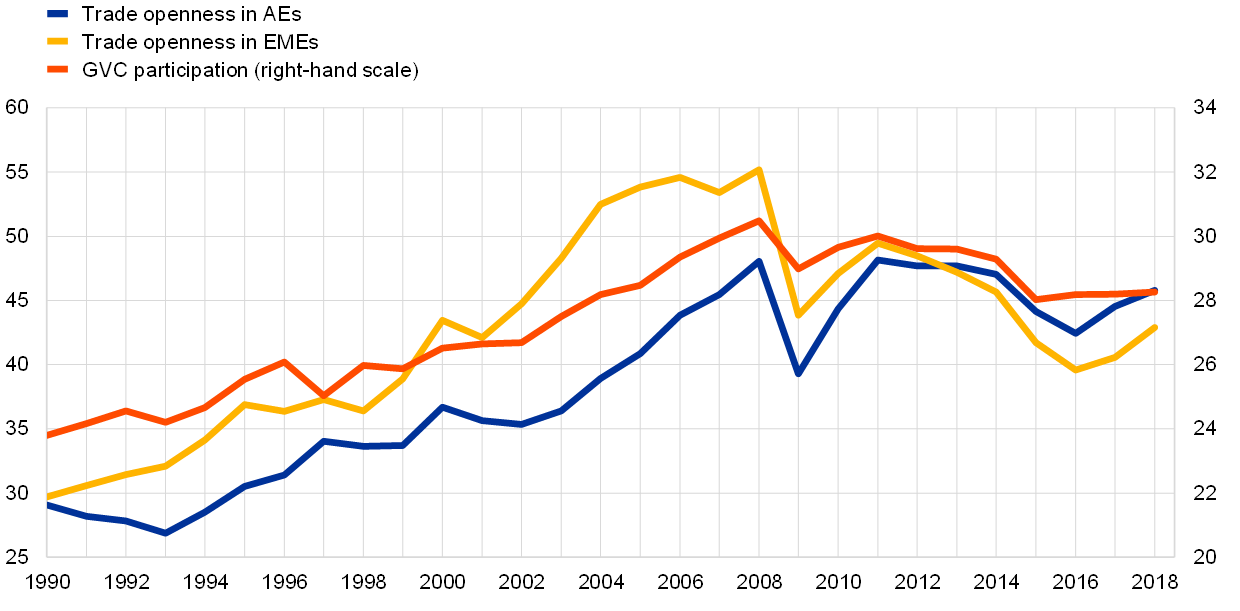

The interest in the global determinants of inflation stems from the observed co-movement of inflation rates across advanced economies (AEs) amid the growing internationalisation of goods, services and financial markets. Average headline inflation rates in AEs have declined from around 10% in the 1970s to rates below 2% since 2014. However, the pace of globalisation has accelerated significantly since the early 1990s (Chart 1) with profound implications for the structure of the global economy. While the role of external factors (e.g. commodity prices) on inflation outcomes has been widely documented, it could also be argued that globalisation, by increasing the interconnectedness of the world economies, entails the propagation of shocks in one economy to other countries, thus influencing domestic macroeconomic outcomes. In this regard researchers have looked at the possibility that globalisation might affect inflation in a more fundamental way rather than just causing temporary shifts in the level of inflation.[2] More specifically, by changing the structure of the world economy, globalisation could alter the inflation formation process thus affecting the more persistent component of inflation across AEs.

Chart 1

Median inflation rates in advanced economies and the KOF Globalisation Index

(left-hand scale: index; right-hand scale: annual percentage changes)

Sources: ECB staff calculations, KOF Swiss Economic Institute and national sources.

Note: Headline median inflation of 22 OECD countries and the KOF Globalisation Index.

This article reviews recent inflation developments across AEs and the channels through which globalisation can feed into the more persistent component of inflation. The question is relevant from a monetary policy perspective. If the impact of globalisation on inflation is found to be only transitory, then the monetary authority should “look through” it. If, instead, globalisation entails a change in price and wage-setting behaviour, it would feed into the more persistent component of inflation, with direct implications for the conduct of monetary policy. The focus of this article is on medium-term inflation developments, measured as a smoothed average of core inflation in order to exclude the more volatile sub-components (such as oil and food prices) and referred to as the more persistent component of inflation. The article finds that three elements of globalisation appear to be linked to a lower persistent inflation: trade integration, informational globalisation and global value chain participation. However, available estimates suggest that this effect is economically small, and the article concludes that globalisation does not appear to be a key determinant of the synchronisation and decline in inflation rates observed across AEs. Looking ahead a reversal (or further slowdown) of globalisation trends could provide only limited tailwinds for inflation trends.

2 Inflation in advanced economies: historical developments and common drivers

Cyclical shocks may cause temporary deviations of inflation from the central bank’s objective. In the pursuit of their price stability mandate, central banks aim at a low and stable rate of inflation over the medium to long term. This amounts to setting a quantitative target (or objective) for the annual rate of change in the price level, which usually corresponds to 2%.[3] As headline inflation comprises a broad-based basket of goods and services, movements in the more volatile inflation components, such as commodity and food prices, influence inflation temporarily. These short-term changes are usually looked through by the monetary authority,[4] which relies on measures of underlying inflation to have a more accurate signal of medium-term inflationary pressures.[5]

Inflation outcomes may also be influenced by structural forces reflecting, for example, changes in the structure of the economy stemming from both domestic and external factors (e.g. increasing trade integration). Given their gradual and persistent character, these changes could feed into the more persistent component of inflation thus potentially interfering with the medium-term price stability objective. Central banks would then tend to react in order to insulate inflation outcomes from this type of perturbation. However, since in recent years interest rates have been nearing the lower bound in many countries, a fundamental consideration, which is outside the scope of this article, is whether the monetary policy space available to neutralise the persistent influence of structural forces on inflation is diminished.

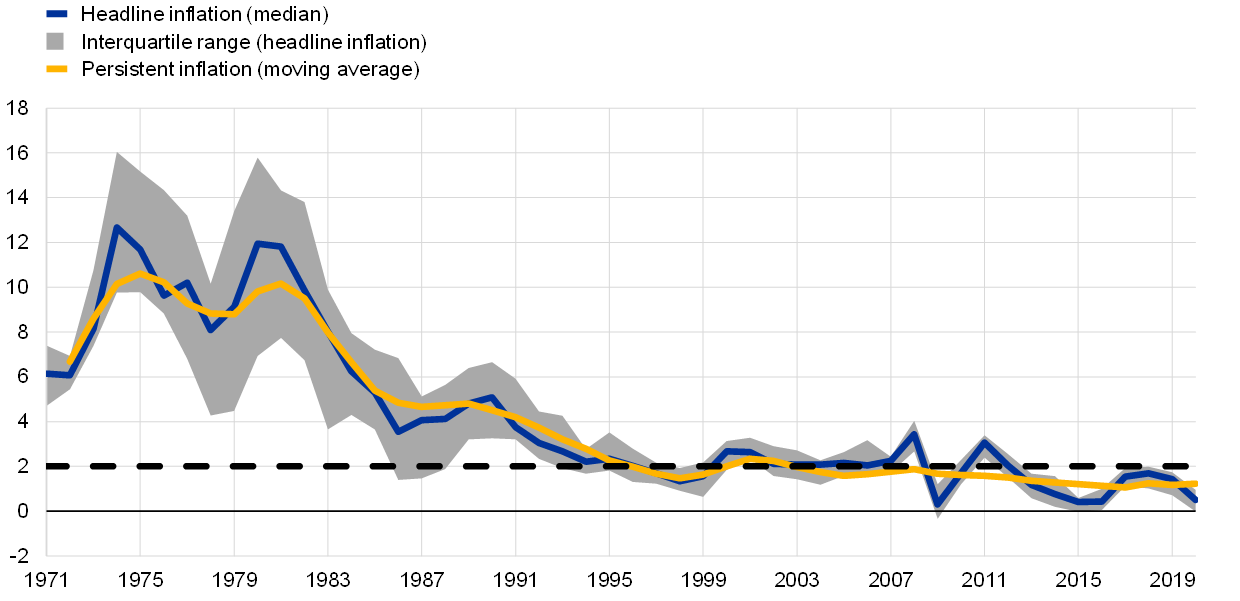

Over the past half-century, average inflation rates across AEs have displayed increasing co-movement amid declining volatility. Since the early 1970s and until the mid-1980s, inflation rates in several AEs rose to levels exceeding 10% (Chart 2), with the exception of Germany and Switzerland.[6] Inflation rates started to decline and to stabilise at lower levels in the late 1980s amid a shift in several central banks towards a more aggressive monetary policy stance. Since the early 1990s both the headline and the more persistent component of inflation started to decline gradually, along with reduced dispersion across AEs (Chart 2). In the decade after the global financial crisis (GFC), inflation rates have been trending further down along with a marked decline in volatility. During this period, characterised by low inflation and low interest rates, economists and policymakers have been confronted with a “missing inflation” puzzle.

Chart 2

Headline and persistent inflation in advanced economies

(annual percentage changes)

Sources: national sources and ECB staff calculations.

Notes: The chart consists of data for a panel of 22 OECD countries. Persistent inflation is computed as a three-year centred moving average of median core inflation rates. The latest observation is for 2020.

The increasing synchronisation of inflation rates across countries reflects the influence of common factors, as widely documented in the literature. Ciccarelli and Mojon[7] document the large co-movement in headline inflation rates in OECD countries and show that global inflation accounts for about 70% of the cross-country variance of inflation. The authors find that the inclusion of global inflation consistently improves domestic inflation forecasts. In a similar vein, Mumtaz and Surico[8] find that the importance of the global factor was more prominent until the mid-1970s, while it declined thereafter.[9]

International inflation co-movements may be explained by factors such as common shocks, the evolution of the monetary policy regime and structural changes. These factors affect inflation outcomes in different ways with different implications from a monetary policy perspective.

First, common shocks, of which fluctuations in oil and non-oil commodity prices are a typical example, are a global source of headline inflation volatility. As argued by Lane,[10] since central banks tend to stabilise medium-term inflation without fully insulating inflation outcomes from the impact of these (largely temporary) shocks, the latter may account for strong co-movements in the deviation of national inflation rates from their medium-term target (or objective). Chart 3 depicts the evolution of the estimated (unobserved) common factor in headline inflation across countries and the estimated contribution of oil prices since the early 1970s. The chart illustrates that fluctuations in oil prices played a significant role in explaining the international co-movement in inflation during the 1970s, but since the late 1980s their importance started to diminish thus pointing to a role also for other factors.[11]

Chart 3

Global inflation and commodities

(standardised annual percentage changes; percentage point contributions)

Sources: national sources and ECB staff calculations.

Notes: The common factor is demeaned. The estimation sample runs from January 1971 to December 2019. The blue line reflects the zero mean common factor in global inflation as derived by replicating the principal component approach of Ciccarelli and Mojon (op. cit.) for a sample of 34 advanced and emerging economies. The yellow bars reflect the contributions of oil prices derived as in Yellen, J.L., “Inflation Dynamics and Monetary Policy”, speech delivered at the Philip Gamble Memorial Lecture, University of Massachusetts, Amherst, 24 September 2015. The coefficients are estimated by a linear regression of the common factor on oil prices. The red bars are the residual contributions.

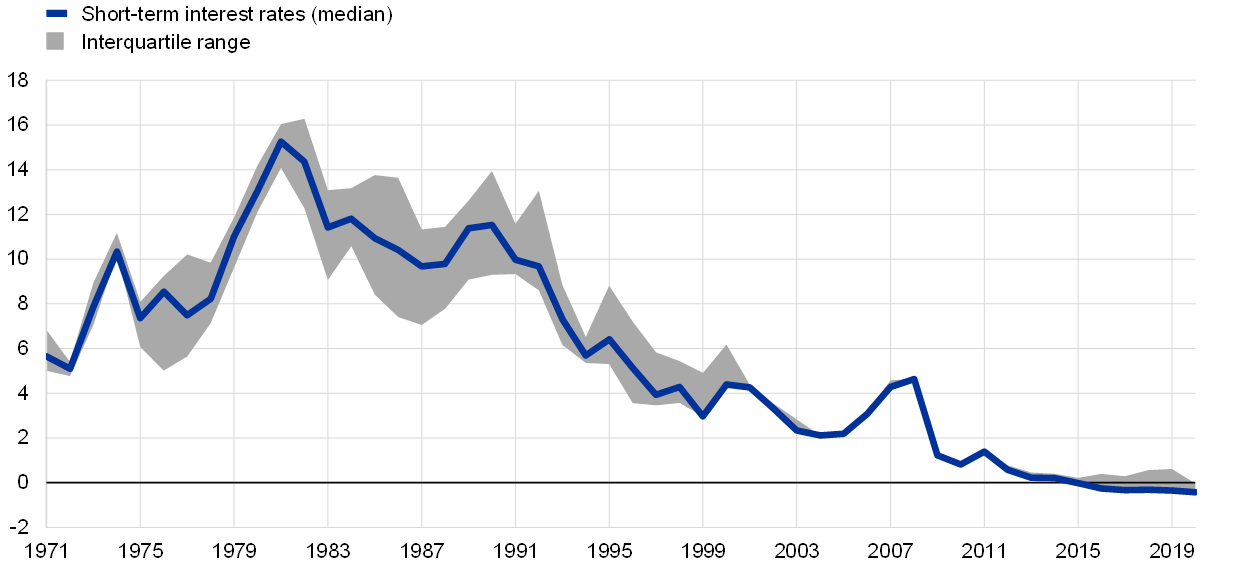

Second, the shift to inflation-targeting regimes played an important role in the convergence of inflation outcomes towards low and stable levels across AEs. The early 1990s marked a shift in the monetary policy conduct of several AE central banks towards an inflation-targeting regime aimed at taming persistently high inflation rates and anchoring inflation expectations (Table 1).[12] The pursuit of low and stable inflation benefited from a higher level of central bank independence as the consensus around a reduction of political pressure in the conduct of monetary policy emerged.[13] The successful taming of inflation under inflation-targeting frameworks until 2007 was tested by the GFC.[14] Inflation rates remained subdued and interest rates approached the effective lower bound (Chart 4) thereby constraining the available monetary policy space to bring inflation back to target.

Table 1

Monetary policy frameworks in advanced economies

Sources: Balatti, M., “Inflation volatility in small and large advanced open economies”, Working Paper Series, No 2448, ECB, 2020 and Annual Report on Exchange Arrangements and Exchange Restrictions 2019, International Monetary Fund, August, 2020.

Notes: Adapted from Balatti and IMF, the table includes 11 advanced economies with explicit inflation or price stability objectives. CPI is the Consumer Price Index, HICP is the Harmonised Index of Consumer Prices and PCE is the Personal Consumption Expenditures Price Index.

Chart 4

Interest rates in advanced economies

(percentages)

Sources: national sources and ECB staff calculations.

Notes: The chart consists of data for a panel of 22 OECD countries. Interest rates on three-month maturity contracts are used as proxies of the short-term rates. In the period after the creation of the euro area, the interquartile range of interest rates is mechanically affected by the fact that some countries within the sample share the same monetary policy.

Third, structural changes in the economy can influence inflation dynamics by feeding into the more persistent component of inflation. The structure of the economy matters for inflation outcomes because it determines price and wage-setting dynamics. Changes in the structure of the economy fall broadly into two main categories.[15] First, changes that are domestic in nature but affect national economies in similar ways, thus resulting in a common inflation pattern across countries. Demographic changes are one example of this type of structural change and may influence inflation through multiple channels.[16] Second, changes of a global nature that increase the interdependence of the world economies, of which the economic and financial globalisation that has taken hold since the 1990s is certainly the most notable example.

The influence of globalisation on inflation outcomes has been widely debated by policymakers and academics alike. In a standard Phillips curve framework,[17] external forces (e.g. foreign demand, foreign prices) feed on inflation via pressures on domestic slack and/or via import prices of final goods or intermediate goods. Moreover, as trade integration mainly influences the price of tradable goods relative to non-tradable goods the impact on average inflation rates over the medium term is thought to be limited. Arguments in support of a more direct role of foreign factors in explaining inflation fluctuations have been growing,[18] calling to augment traditional Phillips curve models with measures of global slack. At the same time, the transformational role of globalisation for the world economy has been increasingly acknowledged. Global economic integration in its various dimensions (e.g. labour, trade in final and intermediate products) may act as a persistent and positive supply shock leading to sustained disinflationary pressures, thus shifting the Phillips curve downwards. But it may also affect the market structure by increasing competition within many markets, thus causing structural changes that would influence the inflation process, possibly flattening the Phillips curve.[19]

3 Globalisation: main features and transmission channels to inflation

Globalisation, in its multidimensional character, has shaped the world economy in a fundamental way. Albeit on an upward trend since the 1970s, globalisation gathered speed in the 1990s, entering a period of “hyper-globalisation”[20] which led to the progressive reduction of (cross-border) frictions to the flow of people, capital, goods, services, information and knowledge. Globalisation stalled after the GFC owing to a slowdown in the speed of economic integration. This slowdown reflected compositional effects stemming from the increasing weight of emerging market economies (EMEs) in global economic activity, as these economies have a lower trade intensity; a moderation in global value chain (GVC) expansion which partly pre-dated the GFC; and diminishing support from trade finance.[21]

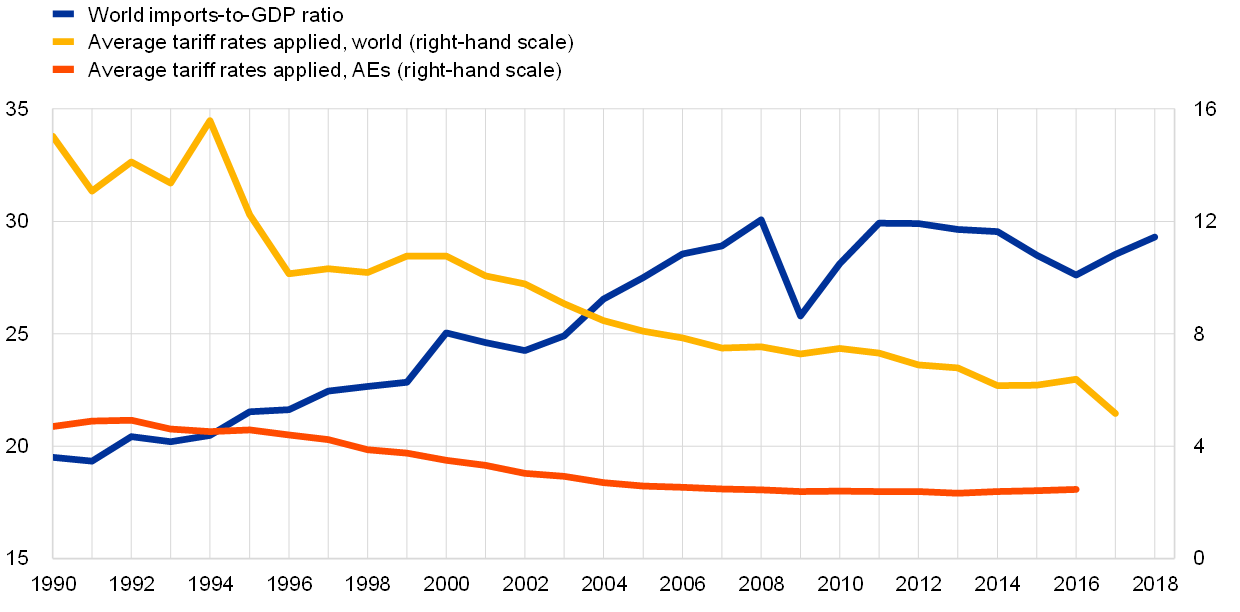

Trade integration and the increasing fragmentation of production in vertically integrated supply chains have been a landmark feature of globalisation. Trade intensity, measured as the share of world imports of goods and services to GDP, has increased from 30% in 1980 to more than 50% in 2008 and has broadly stabilised around this level since. Trade integration was spurred by the trade liberalisation efforts (i.e. bilateral and multilateral free trade agreements) which resulted in an unprecedented decline in average tariff rates (Chart 5, panel a)) as well as lower taxes and regulations. At the same time, advances in information and transportation technologies and falling trade barriers enabled the fragmentation of production processes along supply chains (GVCs) located in different countries. GVC integration resulted in a sharp increase in trade in intermediate goods which are used as inputs of production. From 1995 to 2007, GVC-related trade rose from around 25% to 40% of global exports and plateaued since the GFC (Chart 5, panel b), red line).[22] The increase in GVC participation is closely linked to the growing integration of EMEs in global production processes, particularly the unprecedented rise of China whose share in global GDP has increased from about 5% in 1993 to 19% in 2019.

Chart 5

Trade globalisation

a) Trade intensity and tariff rates

(left-hand scale: ratio; right-hand scale: percentages)

b) Trade openness and global value chain participation

(ratio)

Sources: OECD TiVA, IMF, World Bank (World Development Indicators) and ECB staff calculations.

Notes: Ratio of nominal imports to GDP. The average tariff rate applied is the unweighted average of effectively applied rates for all products subject to tariffs calculated for all traded goods in percentage terms. Trade openness is calculated as the sum of imports and exports relative to GDP. GVC participation is calculated as the ratio of GVC-related trade to gross exports. GVC-related trade is defined as the value added that has crossed at least two national borders (Borin and Mancini, op. cit.). Values between 2016 and 2018 are based on ECB estimates.

Trade globalisation may affect inflation in AEs by influencing the price and wage-setting mechanism. Increasing trade integration and greater participation of low-cost producers in global production has a direct disinflationary effect. This effect works via lower imported inflation,[23] but also via decreasing the average mark-ups of domestic firms in the face of tougher foreign competition.[24] As a result, less productive firms could exit the market, further lowering cost pressures.[25] Participation in GVCs can further contribute to the disinflationary effects, and it is associated with more synchronised inflation dynamics across AEs.[26] Andrews et al.[27] find that for AEs the rise in GVC participation has pushed producer price index (PPI) inflation down by 0.15 percentage points on average. GVC participation contributes to lower inflation by exerting downward pressures on unit labour costs (by raising productivity and reducing wage growth) in the importing country, especially when low-wage countries are integrated in supply chains.

Globalisation has also had pervasive effects on labour markets ‒ eroding the bargaining power of workers in AEs and further moderating production costs. On the one hand, increased trade integration has enabled a geographical shift of the centres of production towards large EMEs characterised by an abundance of low-cost labour for manufacturing goods. In this regard notable examples are the re-integration of central, eastern and south-eastern European countries into the market economy after 1990 and the integration of China in the world economy in the early 2000s, which both constituted an unprecedented increase in global labour supply. Many workers moved within countries from rural areas to cities. In China, for example, the trend in rural to urban migration is closely linked to this integration and has allowed for a decades-long expansion of export capacity without a concomitant increase in the cost of production.[28] On the other hand, by facilitating international migration flows towards AEs, globalisation has influenced the relationship between unemployment and the wage-setting behaviour of the hosting country. In the presence of a strong rise in migration inflows, heterogeneous labour supply elasticities between native and immigrant workers lower the marginal labour costs and put downward pressure on inflation.[29]

Informational globalisation and digitalisation are two other dimensions of global integration which have been increasing across AEs since 1990. The technological advancements of the last decades have led to a sharp increase in the flow of information and communication across AEs. While these flows are very difficult to measure, the KOF Swiss Economic Institute produces some indicators.[30] The KOF Informational Globalisation (de jure) Index[31] refers to the ability to share information across countries and is measured by internet access and press freedom. While this measure has been trending upward since 1970, the de facto dimension of the KOF Informational Globalisation Index, measured by used internet bandwidth, international patents and technology export increased strikingly after the GFC. Both measures have plateaued in the last few years.

Digitalisation-driven integration has changed the pricing behaviour of large retailers at a global scale. The advent of algorithmic pricing technologies, easily transferable across countries and firms, and the transparency of the internet have enlarged geographical horizons for consumers, and reinforced globalisation trends via lower search costs for consumers and improved efficiency and productivity for producers. The enhanced competitive behaviour of firms increases the geographical correlation of price changes and tends to dampen price increases.[32] Firms in some industries update their prices more frequently than in previous decades, although the extent to which dynamic pricing affects the flexibility of reference prices, hence the slope of the Phillips curve, remains unclear. For the United States there is evidence that goods prices have become significantly more uniform across retailers, suggesting higher strategic complementarities in the price-setting behaviour of firms (i.e. a high sensitivity to competitors’ prices)[33] whereas for some euro area countries early evidence points to less uniform pricing than in the United States.

The rise of “superstar firms”, many of which operate in the technology sector, has an ambiguous impact on price setting. Highly productive “superstar firms” have rapidly increased their market share, allowing firms with superior quality products, lower marginal costs or greater innovation ability to reap disproportionate rewards relative to previous eras.[34] This trend is likely to have influenced the evolution of prices over time, but the direction of the impact remains ambiguous. On the one hand, such firms can leverage the higher productivity to lower prices and maximise their market share. So long as this results in an increasing degree of competition, mark-ups and prices would be dampened further, flattening underlying inflation. On the other hand, if globalisation channels sales towards the most productive firms in each industry, product market concentration would rise, and competition would fall. Depending on the contestability of the market, monopolistic and oligopolistic market power would allow firms to increase mark-ups with a consequent impact on price setting.

4 The impact of globalisation on inflation in advanced economies

Empirical evidence on how global slack influences the response of inflation to domestic cyclical conditions is mixed. The early literature on the disinflationary effects of globalisation mostly focused on measures of global slack. Borio and Filardo[35] find that the inclusion of global slack (i.e. a weighted average of international output gaps) adds considerable explanatory power to traditional benchmark inflation rate equations, thus explaining cyclical fluctuations in inflation across AEs. Lodge and Mikolajun[36] augment a Phillips curve for a panel of AEs with measures of both global slack and global inflation and find little evidence that global slack drives domestic inflation.[37] Global inflation is found to have had a more prominent role during the 1970s and 1980s (i.e. the Great Inflation period) but lost significance during periods of more stable inflation rates. Bianchi and Civelli[38] find that global slack affects inflation dynamics and that globalisation, measured in terms of trade and financial openness, is positively related to the effects of global slack on inflation. However, the authors conclude that “… the effects of globalization require substantially large changes in the degree of openness in order to be economically significant”. The analysis presented in Box 1 confirms that in the case of central and eastern European EU countries their increasing integration in the world economy since the early 2000s has weakened the responsiveness of consumer price inflation to domestic conditions, though the effect is quantitatively small. This impact is more pronounced in the manufacturing sector given a higher GVC integration, hence higher exposure to international competition and strategic complementarities. Certain aspects of digitalisation (e.g. the use of internet for e-commerce) are also found to weaken the correlation between inflation and domestic cyclical conditions.

Evidence on the impact of globalisation on persistent inflation is limited and points, at best, to an economically small impact. Forbes[39] analyses the impact of global variables on inflation dynamics and finds that while there is a positive correlation between measures of global slack and cyclical inflation, the impact on the more persistent component of inflation is not significant. Likewise, Kamber and Wong[40] study the role of foreign shocks in driving inflation outcomes and find evidence of a sizeable influence on inflation gaps, while the impact on the permanent component is small. The negative but relatively small correlation between globalisation and the persistent component of inflation is confirmed in the analysis presented in Box 2.

Three elements of globalisation are found to be inversely related to the persistent component of inflation across AEs: trade integration, informational globalisation and GVC participation. The broad perspective on globalisation presented in this article and employed in the empirical analysis in Box 2 allows a comprehensive investigation of how globalisation can influence inflation dynamics. The findings point to the presence of compositional effects as globalisation, in its various dimensions, appears to act as a disinflationary force in the case of goods inflation, but not for services inflation. This suggests that the sharpest movements in overall inflation, which took place in the 1990s and then again after the GFC, are possibly linked to other factors, such as shifts in monetary policy regimes, falling inflation expectations and lower wage indexation. The findings are in line with the literature and hold for the cross-section of AEs analysed as well as for the euro area. Therefore this article concurs with Forbes,[41] who finds that “global variables … have limited ability to improve our understanding of the dynamics of the underlying slow-moving trend in inflation, and they do not appear to have become more important over the last decade”. A direct implication is that while standard inflation frameworks can be augmented to account for the role of global factors, they should not be fully replaced. This is consistent with the evidence that the major plunge in inflation rates across AEs and its persistent component started in the 1980s, when globalisation was still latent and digitalisation was low, and it came to a halt around the mid-1990s, when China had not yet joined the World Trade Organization (WTO) (see Chart 2). The analysis in Box 2 further shows that the fall in inflation rates that occurred in the 1990s was synchronised across goods and services. As the latter are expected to have been relatively unaffected by cross-border integration, it can be concluded that while globalisation likely pushed down a little further the persistent component of inflation it seems unlikely to have been the main force behind its decline.

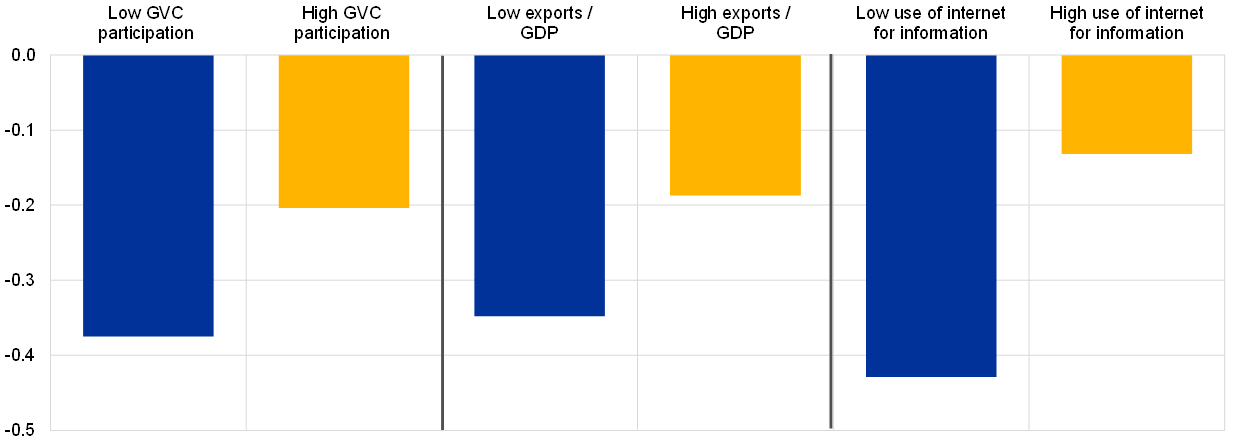

Box 1

Globalisation and the Phillips curve in central and eastern European EU countries

This box examines the responsiveness of consumer prices to domestic conditions in central and eastern European EU countries and whether their correlation is affected by two measures of globalisation: trade openness and participation in global value chains (GVCs). In the homogeneous group of 11 central and eastern European (CEE) EU countries, which includes five euro area countries (Estonia, Latvia, Lithuania, Slovenia and Slovakia) and six other EU Member States (Bulgaria, the Czech Republic, Croatia, Hungary, Poland and Romania), a standard representation of a hybrid new Keynesian Phillips curve is estimated, proxying marginal costs with economic slack and using quarterly data over 2001-2019. During this period, the CEE EU countries maintained a high level of openness and were relatively more integrated in global production chains than the euro area as well as most advanced economies (AEs).[42] The estimations are carried out by regressing the quarter-on-quarter change of the HICP excluding energy and food on the unemployment gap, past inflation and the two lags of the import deflator.[43] To investigate whether globalisation affects the slope of the Phillips curve, the coefficient of the unemployment gap is interacted with measures of trade openness and integration in cross-border supply chains.[44]

Globalisation may not only affect inflation levels but also change the price-setting behaviour of firms and thus the way inflation responds to domestic conditions, though its overall effect is a priori ambiguous. Rising exposure to global competition may limit the scope for firms to pass domestic costs on to consumers in order not to lose competitiveness or market share. However, greater integration and openness to trade can affect market concentration and favour larger and more productive players that are relatively more protective of mark-ups. The findings of this box, while not making causal statements, support the argument that rising exposure to global competition may overall limit the scope for firms to pass their costs on to consumers.

For the panel of CEE EU countries, a high dependence on export markets and high GVC participation are associated with a lower correlation of inflation with the domestic business cycle (Chart A, left-hand and middle panels). The estimated coefficients turn out significantly lower for observations with relatively higher GVC participation and trade openness (Chart A, yellow bars). However, as the country-specific time-variation in GVC participation is smaller than the cross-country variation (which drives the estimated coefficients shown in Chart A), it is likely that the contribution of GVC participation in lowering the correlation between activity and prices for individual countries is plausibly small.[45]

Chart A

Global factors affecting the slope of price Phillips curves in CEE EU countries

(estimated coefficients of the unemployment gap)

Sources: Eurostat, ECB, World Input-Output Database, and authors’ calculations.

Notes: Results from a reduced form-estimation of a Phillips curve in a panel of 11 countries over 2001-2019, where the lagged unemployment gap is interacted with a dummy equal to 1 if the underlying value of GVC participation, exports of goods and services as a percentage of GDP, or the percentage of individuals finding information about goods and services online is higher than that of the panel long-term median. The dependent variable is the annualised quarter-on-quarter growth rate of underlying inflation. Other controls include lagged inflation, the two lags of the import deflator, as well as country-period and year fixed effects. Coefficients of interaction terms are statistically significant. GVC participation is computed as the share of GVC-related trade in total gross exports (Borin and Mancini, op. cit.), where GVC-related trade is defined as the sum of exported domestic value added that is re-exported by a direct importer (forward GVC trade) and foreign value added embedded in own exports (backward GVC trade). The sample for GVC participation ends in 2016, with values for 2015 and 2016 based on authors’ estimates. Digitalisation data are broadly available from 2004.

Certain aspects of digitalisation that enhance global integration are also found to weaken the correlation between underlying inflation and domestic conditions in CEE EU countries. Adapting the previous analysis, similar results are obtained using measures of informational globalisation (e.g. the use of internet for e-commerce or for finding information about goods and services; Chart A, right-hand panel). These variables capture technological developments fostering the cross-border flow of information or lowering entry costs into global markets that may affect business dynamism, competition and price transparency.[46]

A similar analysis at the sectoral level suggests that GVC integration channels are particularly relevant for manufacturing industries. The aggregate approach described above is complemented by the estimation of a sectoral Phillips curve panel where sectoral labour costs drive sectoral output price inflation.[47] By interacting sectoral labour costs with the change in GVC participation at the sectoral level, we find that the exposure to global competition lowers the correlation between sectoral wages and producer prices and particularly so for manufacturing industries (relative to the rest of the business economy), which are the most integrated in GVCs, generally sell highly tradable goods and are less local in nature. This increases strategic complementarities and the dependence of producer price inflation on global economic conditions. Thus, the industrial composition of an economy is an important aspect in assessing how global factors may influence the responsiveness of inflation to the business cycle, as GVCs are a sectoral phenomenon.

Overall, for a panel of CEE EU countries there is evidence that growing global economic integration has reduced the sensitivity of inflation to domestic slack, hence the slope of the Phillips curve in the last two decades. Global economic integration appears to have affected firms’ price-setting behaviour, though the small quantitative estimates also imply that even if future structural transformations, like how production processes will be organised, will keep shaping price setting, these would have limited implications for the aggregate inflation of individual countries.

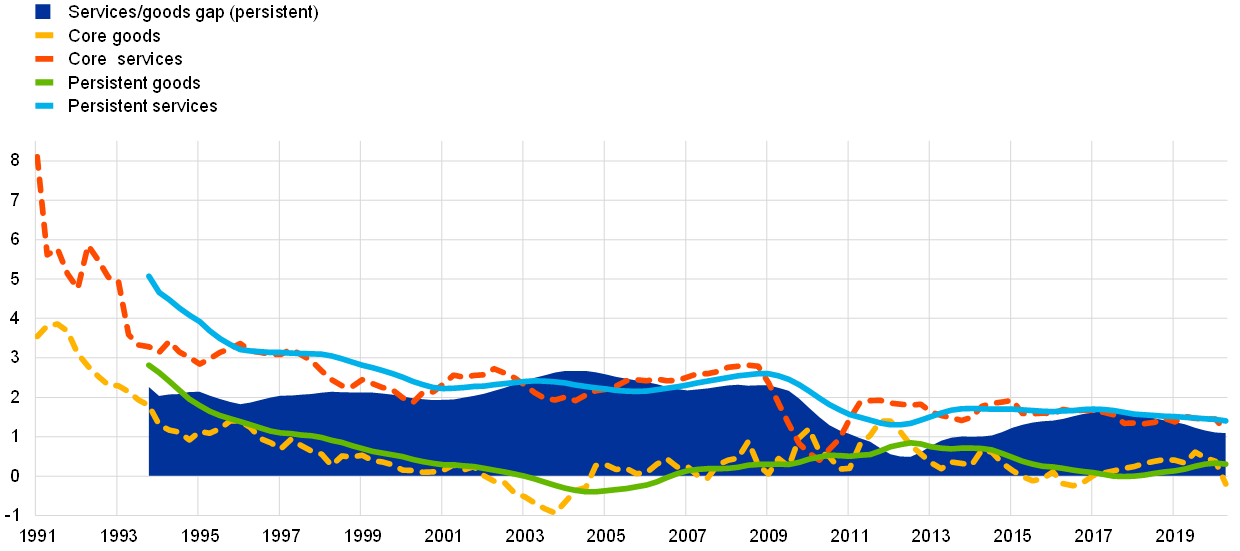

Box 2

The impact of globalisation on inflation and its components in advanced economies: empirical evidence

This box investigates empirically the globalisation of inflation hypothesis and finds limited supporting evidence. Understanding the effect of the external environment on domestic conditions is important in the conduct of monetary policy. Econometric analysis for a panel of advanced economies (AEs) finds that over the last three decades the persistent component of inflation, measured as a 12-quarter moving average of core inflation, has been sensitive to some measures of globalisation. Yet the economic importance of these factors is limited and leaves scope for domestic determinants.

In contrast to a large part of the literature, this analysis takes an encompassing view of globalisation which is not limited to goods trade linkages and prices of traded goods. On the back of the rise of financial and informational integration, services have become more tradable and their share in consumption baskets has grown. Assessing the role of globalisation on services prices can shed some light on the future role of foreign and domestic factors for inflation dynamics. As the role of services in high-income economies increases, the question of whether this will strengthen the link between persistent inflation and domestic economic developments also arises, given that changes in services prices are commonly attributed to domestic rather than to foreign factors.[48] Breaking down overall inflation into goods and services inflation helps to understand overall inflation dynamics.[49] Their unique characteristics also imply a different exposure to globalisation factors (e.g. trade integration owing to the higher tradability) and are exploited in the analysis to test the validity of the predictions of the globalisation of inflation hypothesis.

The persistent component of inflation in goods and services has fallen sharply in AEs since the early 1990s (Chart B). In particular, for goods it has dropped from around 3% to around 0.5% in 2019, whereas for services it declined from around 5% to around 1.5%. As a result, the wedge between services and goods persistent inflation has remained positive throughout the last 25 years but has narrowed significantly in the aftermath of the GFC.[50] One tenet of the globalisation of inflation hypothesis is that prices of more tradable products are affected by economic integration to a greater extent. However, the fact that the largest inflation swings during the period of analysis took place in the early 1990s, when globalisation was still in the early stages, and were synchronised across goods and services, casts doubts over the assumption of a prominent influence of globalisation on inflation.[51]

Chart B

Inflation in goods and services in advanced economies

(Percentages; percentage points)

Sources: national sources and ECB staff calculations.

Notes: persistent inflation rates are computed based on 12-quarter moving averages of core goods and services, calculated as the weighted average (GDP purchasing power parity (PPP) weights) of six advanced economies (Australia, Canada, the euro area, Japan, the United Kingdom and the United States). The latest observation is for Q2 2020.

Estimates of a dynamic panel model provide empirical evidence on the role of globalisation in price dynamics. The specification is inspired by Forbes[52] in which persistent inflation, computed as a 12-quarter moving average of core inflation rates, is determined by real exchange rate movements and is augmented by various indicators of globalisation including trade integration, financial globalisation and informational globalisation. While we do not aim at a causal interpretation, the exercise can reveal linkages between the different dimensions of integration and persistent inflation and inform on possible differences between goods and services. The equation is estimated using a generalised method of moments (GMM) approach to allow for the inclusion of a lagged dependent variable and a lag of the independent variables. The estimation follows an Arellano-Bond procedure, also using lags in the difference equation and additionally includes the consensus forecast of inflation expectations in the level equation for the instrumented variable. The equation is estimated over the period Q4 1996 to Q1 2018 using quarterly data for six AEs (Australia, Canada, the euro area, Japan, the United Kingdom and the United States) and the panel is strongly balanced. Persistent inflation estimates are employed as independent variables.[53]

Table A

Panel estimates – summary of impact of globalisation indicators on persistent inflation

Source: ECB staff calculations.

Notes: The table reports the sign of the coefficient of the dynamic panel equation estimated using GMM. Trade integration is proxied by the KOF Trade Globalisation (de jure) Index, the informational globalisation measure is taken from the KOF Informational Globalisation (de facto) Index and GVC participation is computed as the ratio of GVC-related trade to gross exports. GVC-related trade is defined as the value added that has crossed at least two national borders à la Borin and Mancini, op. cit. with values between 2016 and 2018 based on internal ECB estimates.

Indicators of globalisation are significantly correlated with overall persistent inflation mainly through the goods component. As shown in Table A, three elements of globalisation appear to contribute to a decline in the persistent component of overall as well as goods inflation in AEs: trade integration (lower trade barriers), informational globalisation (digitalisation-driven integration) and global value chain participation. By contrast, the results suggest that different globalisation measures have had an offsetting impact on services inflation, thereby reducing the total effect.[54] At the same time, estimates of specifications including domestic variables (e.g. output gap and labour cost) suggest that these indicators are robustly significant and domestic factors continue to play an important role in driving price dynamics.

The panel estimates do not point to a large difference in the effects of globalisation before or after the financial crisis, or between the euro area economies and other AEs. A number of robustness tests of the main results are implemented which also explore specifically whether the effects of globalisation indicators vary noticeably in sub-periods or across economies. These tests point to qualitatively similar results after the global financial crisis and do not present evidence of a different effect for euro area economies. Our conclusions are also robust to a supplementary set of tests spanning different specifications where we employ alternative proxies for explanatory variables, additional controls and a different number of instrumental variables.

A quantification of the overall impact finds that the effect of globalisation on persistent inflation has been small. Using the estimated coefficients and the developments of the globalisation metrics discussed above, we compute the contribution of a higher interconnectedness to the variations in persistent inflation. Albeit subject to uncertainty, the results indicate that, among the analysed economies, globalisation provided limited headwinds to overall and goods inflation over the last three decades. The findings echo earlier empirical evidence presented in the literature.[55]

5 Conclusion

This article discussed the disinflationary role of globalisation in AEs, with a focus on the more persistent component of inflation. Drawing from the existing literature, this article reviewed three sets of factors that can explain the international co-movement of inflation and its declining path observed in the past decades. First, there are common shocks (e.g. fluctuations in commodity prices), which affect the most volatile component of headline inflation. Second, the shift in the monetary policy of several AEs towards an inflation-targeting regime and the anchoring of inflation expectations succeeded in keeping inflation steadily close to target over the past three decades and until the GFC. Third, changes in the structure of the economy that affect the wage and price-setting mechanisms can influence the more persistent component of inflation.

Evidence presented in this article shows that the disinflationary role of globalisation has been economically small. Most of the economic literature focuses on augmenting an otherwise standard Phillips curve framework with measures of global slack and shows that when controlling for such factors, the sensitivity of domestic inflation to domestic slack is diminished. While evidence of the impact on the persistent component of inflation is more limited, typically the impact is found to be smaller. This article concludes that globalisation does not appear to be a major force behind the disinflationary trends of the past decades, and any headwinds stemming from globalisation were too small to be economically meaningful. This conclusion hinges on three main elements. First, the major plunge in inflation and its persistent component started in the 1980s, when globalisation was still latent, and came to a halt around the mid-1990s, when China had not yet joined the WTO. Furthermore, the fall in inflation was synchronised across goods and services and, because of their different tradability, they should not respond homogeneously to cross-border integration. Second, and related to the latter point, evidence presented in this article suggests that globalisation has a heterogeneous impact on the sectors of the economy, with the manufacturing sector being more exposed to disinflationary forces than the services sector. This lends support to the view that globalisation leads to relative price changes but not necessarily to a decline in overall inflation. Finally, even when globalisation acts as a disinflationary force, the estimated impact is economically small. In view of this, and given that in recent years interest rates have been nearing the lower bound in many countries, a possible reason behind the persistently low inflation observed over the past decades is the limited space available to monetary policy to neutralise the influence of structural forces on inflation (either of a domestic or foreign origin).

Looking ahead, globalisation is at a crossroads. While rising protectionism seems to be threatening globalisation, growing digitalisation and services trade are also providing new impetus, shifting and re-shaping the future path of globalisation. Moreover, while global integration growth may be waning, regional trade integration appears to have been deepening both for economic and geo-political reasons. The coronavirus (COVID-19) might accelerate some of these trends, though it appears premature to draw firm conclusions about the consequences for globalisation and inflation.

- See Auer, R., Borio, C. and Filardo, A., “The globalisation of inflation: the growing importance of global value chains”, BIS Working Papers, No 602, Bank for International Settlements, January 2017.

- See Forbes, K., “Has globalization changed the inflation process?”, BIS Working Papers, No 791, Bank for International Settlements, June 2019.

- The ECB Governing Council has adopted a quantitative definition of price stability according to which it aims to maintain inflation rates below, but close to, 2% over the medium term. The inflation rate is measured as the year-on-year change in the Harmonised Index of Consumer Prices (HICP). For the United States, the Federal Open Market Committee (FOMC) judges that an inflation rate of 2% over the longer term, as measured by the annual change in the price index for personal consumption expenditures, is most consistent with the Federal Reserve’s mandate to maintain price stability.

- However, movements in oil and commodity prices can have a more lasting impact on inflation, thus becoming relevant for monetary policy if they feed into core inflation over the medium term. In this regard it is always necessary to conduct a careful analysis of the underlying factors driving commodity prices in order to assess the implications for medium-term price stability and to determine the appropriate monetary policy response to changes in commodity prices. See also the article entitled “Commodity prices and their role in assessing euro area growth and inflation”, Monthly Bulletin, ECB, October 2013.

- Measures of underlying inflation aim to remove the “noise” and to capture the (unobservable) persistent component of inflation. See the article entitled “Measures of underlying inflation for the euro area”, Economic Bulletin, Issue 4, ECB, 2018. The article discusses three categories of underlying inflation measures: i) permanent exclusion measures, which permanently remove certain volatile sub-components (e.g. oil prices) that have little relevance for medium-term inflation as they are less persistent; ii) temporary exclusion measures, which rely on trimmed means or weighted medians of inflation; and iii) frequency exclusion measures, which aim to filter out the transitory component of all HICP sub-items and retain only the persistent ones. The measure of persistent inflation used in this article is a hybrid of category one and three.

- See the article entitled “The ‘Great Inflation’: Lessons for monetary policy”, Monthly Bulletin, ECB, May 2010.

- Ciccarelli, M. and Mojon, B., “Global Inflation”, The Review of Economics and Statistics, Vol. 92, No 3, August 2010, pp. 524-535. The authors develop three alternative measures of global inflation: a cross-country average of inflation rates, the aggregate OECD inflation and a measure based on static factor analysis.

- Mumtaz, H. and Surico, P., “Evolving International Inflation Dynamics: World and Country-specific Factors”, Journal of the European Economic Association, Vol. 10, No 4, August 2012, pp. 716-734.

- Taking a longer historical perspective, Gerlach and Stuart analyse data from the 1850s and argue that the role of international inflation on domestic prices, excluding the “Great Inflation” period, has remained remarkably stable over time. See Gerlach, S. and Stuart, R., “International Co-Movements of Inflation, 1851-1913”, CEPR Discussion Paper, No DP15914, March 2021.

- Lane, P. R., “International inflation co-movements”, speech delivered at the Inflation: Drivers and Dynamics 2020 Online Conference, Federal Reserve Bank of Cleveland/European Central Bank, 22 May 2020.

- The relatively diminished contribution of oil prices to the common inflation component is confirmed also when the relationship is estimated starting from the early 1990s, or when including food prices or when month-on-month changes are employed. Lane, ibid., points out that the transmission of fluctuations in commodity prices to domestic inflation is, however, neither automatic nor uniform across countries. With an independent monetary policy regime, hence flexible exchange rates, there is no deterministic relationship between international relative price movements and overall inflation rates. For example, while the oil price is globally quoted in US dollars, the pattern of movements in the USD/EUR exchange rate has meant that the oil price in euro has been much less volatile than the oil price in US dollars.

- During this period many monetary authorities shifted towards an inflation-targeting regime, either explicitly or implicitly, in a trend that has been referred to as the “globalisation of central banking”. See Arrigoni, S., Beck, R., Ca' Zorzi, M. and Stracca, L., “Globalisation: What’s at stake for central banks”, VoxEU, February 2020.

- In this context, the adoption of explicit inflation targets, promoted accountability and constrained discretionary policy thus counterbalancing the flexibility stemming from greater independence. See Dall’Orto Mas, R. et al., “The case for central bank independence”, Occasional Paper Series, No 248, ECB, 2020.

- Rogoff, K., “Globalization and global disinflation”, Economic Review, Vol. 88, Issue Q IV, 2003, pp. 45-78; Williams, J.C., “Inflation Targeting and the Global Financial Crisis: Successes and Challenges”, Federal Reserve Bank of San Francisco, October 2014.

- Lane, op. cit.

- See Lis, E., Nickel, C. and Papetti, A., “Demographics and inflation in the euro area: a two-sector new Keynesian perspective”, Working Paper Series, No 2382, ECB, March 2020. Population ageing may affect inflation via shrinking labour force participation and productivity, but also by contributing to the trend decline in the equilibrium interest rate. However, a full assessment of the channels of domestic changes in the structure of the economy is beyond the scope of this article.

- Inflation dynamics are typically modelled in terms of a Phillips curve ‒ formulated as an inverse relationship over the short to medium term between the rate of inflation and the cyclical position of the domestic economy. During periods of economic expansion, declining economic slack (e.g. low unemployment) puts upward pressure on prices via rising wages, as they are passed on by businesses to consumers. Empirical estimates of the Phillips curve rely on measures of labour market slack, and control, among other variables, for the role of inflation expectations, oil prices and the exchange rate. Given its good empirical properties, the Phillips curve has become the workhorse model used in many central banks to analyse and forecast developments in both headline and core inflation.

- See Borio, C. and Filardo, A., “Globalisation and inflation: New cross-country evidence on the global determinants of domestic inflation”, BIS Working Papers, No 227, Bank for International Settlements, May 2007. For a more recent analysis see Auer, Borio and Filardo, op. cit. who have also focused on the global and domestic drivers of inflation. See Section 4 of this article for a more in-depth review.

- Carney, M., “Inflation in a globalised world”, remarks at the Federal Reserve Bank of Kansas City Economic Symposium, Jackson Hole, Wyoming, 29 August 2015; and Carney, M., “[De]Globalisation and inflation”, speech delivered at the IMF Michel Camdessus Central Banking Lecture, September 2017.

- Rodrik, D., The Globalization Paradox: Democracy and the Future of the World Economy, WW Norton, 2011.

- IRC Trade Task Force, “Understanding the weakness in global trade ‒ What is the new normal?”, Occasional Paper Series, No 178, ECB, September 2016.

- GVC-related trade is measured as the share of traded intermediate goods in total global exports that cross at least two national borders (see Borin, A. and Mancini, M., “Follow the value added: tracking bilateral relations in global value chains”, MPRA Paper, No 82692, University Library of Munich, November 2017).

- This direct effect is usually captured via import prices, and it may result in a lasting disinflationary effect only to the extent that foreign prices are systematically lower than domestic prices. For the case of France, Carluccio et al. show that the differential between France export prices (which proxy for the price level of domestically produced goods) and the import prices of low wage countries (e.g. China and the countries that joined the EU in or after 2004) was large over the period 1994-2014 and it has only slightly declined over time. See Carluccio, J., Gautier, E. and Guilloux-Nefussi, S., “Dissecting the Impact of Imports from Low-Wage Countries on French Consumer Prices”, Banque de France Working Papers, No 672, April 2018.

- Melitz, M. and Ottaviano, G., “Market size, Trade, and Productivity”, Review of Economic Studies, Vol. 75, Issue 1, 2008, pp. 295-316.

- Guerrieri, L., Gust, C. and López-Salido, J.D., “International competition and inflation: a New Keynesian perspective”, American Economic Journal: Macroeconomics, Vol. 2, No 4, 2010, pp. 247-80; Amiti, M., Itskhoki, O. and Konings, J., “International Shocks, Variable Markups and Domestic Prices”, Review of Economic Studies, Vol. 86(6), November 2019, pp. 2356-2402.

- See de Soyres, F. and Franco, S., “Inflation Dynamics and Global Value Chains”, Policy Research Working Paper, No 9090, World Bank, 2019.

- Andrews, D., Gal, P. and Witheridge, W., “A genie in a bottle? Globalisation, Competition and Inflation?”, OECD Economics Department Working Papers, No 1462, 2018.

- For an extensive analysis on the role of China for inflation dynamics in advanced economies, see Gern, K.-J. et al., “Higher inflation in China: Risks for Inflation and Output in Advanced Economies”, Kiel Policy Briefs, No 36, Kiel Institute for the World Economy, October 2011.

- Bentolila, S., Dolado, J.J. and Jimeno, J.F., “Does immigration affect the Phillips curve? Some evidence for Spain”, European Economic Review, Vol. 52, No 8, 2008, pp. 1398-1423.

- Gygli, S., Haelg, F., Potrafke, N. and Sturm, J.-E, “The KOF Globalisation Index – revisited”, The Review of International Organizations, Vol. 14(3), 2019, pp. 543-574.

- Dreher, A., “Does Globalization Affect Growth? Evidence from a new Index of Globalization”, Applied Economics, Vol. 38(10), 2006, pp. 1091-1110.

- Cavallo, A., “Scraped Data and Sticky Prices”, The Review of Economics and Statistics, Vol. 100, No 1, 2018, pp. 105-119.

- Belz, S., Wessel, D. and Yellen, J., “What’s (Not) Up With Inflation?”, The Brookings Institution, January 2020.

- Autor, D., Dorn, D., Katz, L.F., Patterson, C. and Van Reenen, J., “The Fall of the Labor Share and the Rise of Superstar Firms”, The Quarterly Journal of Economics, Vol. 135, Issue 2, 2020, pp. 645-709.

- Borio, C. and Filardo, A., op. cit.

- Mikolajun, I. and Lodge, D., “Advanced economy inflation: the role of global factors”, Working Paper Series, No 1948, ECB, August 2016.

- See the article entitled “Domestic and global drivers of inflation in the euro area”, Economic Bulletin, Issue 4, ECB, 2017, which finds only limited support for including measures of global slack and measures of integration in GVCs in Phillips curve analyses when studying inflation in the euro area.

- Bianchi, F. and Civelli, A., “Globalization and inflation: Evidence from a time-varying VAR”, Review of Economic Dynamics, Vol. 18, Issue 2, 2015, pp. 406-433.

- See Forbes, K., “Has globalization changed the inflation process?”, op. cit.

- Kamber, G. and Wong, B., “Global factors and trend inflation”, Journal of International Economics, Vol. 122, 2020.

- Forbes, K., “Inflation Dynamics: Dead, Dormant, or Determined Abroad?”, Brookings Papers on Economic Activity, Fall 2019, pp. 257-338.

- See, for example, the article entitled “The impact of global value chains on the macroeconomic analysis of the euro area”, Economic Bulletin, Issue 8, ECB, 2017.

- The dependent variable is the annualised quarter-on-quarter growth rate of underlying inflation, while the import deflator is taken in year-on-year growth rates. Regressions also include a rich set of fixed effects accounting for a country’s macroeconomic cycle and idiosyncratic shocks affecting all countries.

- Trade openness is computed as gross exports of goods and services as a percentage of GDP. GVC participation is measured as the share of GVC-related trade in total gross exports (Borin and Mancini, op. cit.), where GVC-related trade is defined as the sum of exported domestic value added that is re-exported by a direct importer (forward GVC trade) and foreign value added embedded in own exports (backward GVC trade). For a better interpretation of interaction terms, levels of GVC participation and openness are expressed as dummies equal to 1 if the underlying observation is higher than that of the panel long-term median.

- This resonates with the cross-sectional analysis in Bianchi and Civelli, op. cit.

- See, for example, the article entitled “The digital economy and the euro area”, Economic Bulletin, Issue 8, ECB, 2020.

- We regress growth of sectoral gross output deflator on growth of sectoral labour costs per worker, growth of sectoral deflator of import of intermediates and growth of sectoral mean labour productivity. Data are sourced from CompNet (7th Vintage dataset), where annual information is available for seven CEE countries and 56 two-digit sectors (according to the NACE Rev. 2 classification) of the business economy, from 2005 to 2015.

- See Lane, Philip R., Member of the Executive Board of the ECB, interview with The Financial Times, published 2 February 2020.

- Peach, R., Rich, R.W. and Linder, M., “The parts are more than the whole: separating goods and services to predict core inflation”, Current Issues in Economics and Finance, Federal Reserve Bank of New York, Vol. 19, No 7, 2013.

- See the box entitled “What is behind the change in the gap between services price inflation and goods price inflation?”, Economic Bulletin, Issue 5, ECB, 2019 for an analysis of the goods and services gap in the euro area.

- In addition, in the spirit of Reis and Watson, co-movements in inflation rates of goods and services can be labelled as “pure” inflation, while diverging developments can be interpreted as relative price changes. Reis, R. and Watson, M.W., “Relative Goods' Prices, Pure Inflation, and the Phillips Correlation”, American Economic Journal: Macroeconomics, Vol. 2, No 3, 2010, pp. 128-57.

- See Forbes, K., “Has globalization changed the inflation process?”, op. cit.

- As we are focused on the slow-moving part of inflation, we compute 12-quarter moving averages of core inflation. These are estimated individually for each country and each of the three consumer price indexes (CPI) considered: overall CPI, goods CPI and services CPI, taken from national sources. Core measures are chosen to minimise the influence of highly volatile components such as oil, whose price is also determined in international markets.

- The heterogeneity between some of the parameters in goods and services calls for future research to improve the understanding behind the driving forces. Nonetheless, the difference in the response of prices to a higher informational globalisation in the goods market compared with the services market might be due to different reasons. These can include the fact that a higher transparency of the internet lowers search costs and accentuates competition in the goods market where products are more comparable and homogeneous in contrast to the services sector. With respect to GVC participation, albeit elusive and thus harder to measure, services are considered as the “glue” and catalyst of complex supply chains (Low). It is therefore plausible that the value added and mark-ups of the services sector are positively correlated to a more extensive use of GVCs. Low, P., “The role of services in global value chains”, in Elms, D. and Low, P. (eds.), Global value chains in a changing world, 2013, pp. 61-81.

- See Bianchi and Civelli, op. cit.; Forbes, K., “Has globalization changed the inflation process?”, op. cit.; and Eo, Y., Uzeda, L. and Wong, B., “Understanding Trend Inflation Through the Lens of the Goods and Services Sectors”, Staff Working Paper, No 2020-45, Bank of Canada, November 2020.