- SPEECH

- 22 May 2020

International inflation co-movements

Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the Inflation: Drivers and Dynamics 2020 Online Conference, Federal Reserve Bank of Cleveland/European Central Bank, 22 May 2020

In my remarks today, I will discuss some analytical issues in understanding the drivers of international inflation co-movements. In particular, I will examine the individual contributions of common shocks, structural change and the evolution of monetary policy regimes to the observed high correlation of inflation across countries. At the same time, I will caution that correlated inflation paths are not inevitable. Some underlying forces may contribute to divergent inflation outcomes in the years to come.

International inflation patterns

As illustrated in Chart 1, average rates of inflation have generally declined and exhibited lower volatility in recent decades, most notably in advanced economies.[1] A common component accounts for a large share of the remaining variability of national inflation rates: this finding has been confirmed for advanced economies in a range of studies.[2]

Range of inflation in advanced and emerging economies over time

(annual percentage changes)

Source: Haver Analytics.

Note: The interquartile range covers 50% of the sample of 25 advanced and 93 emerging market economies.

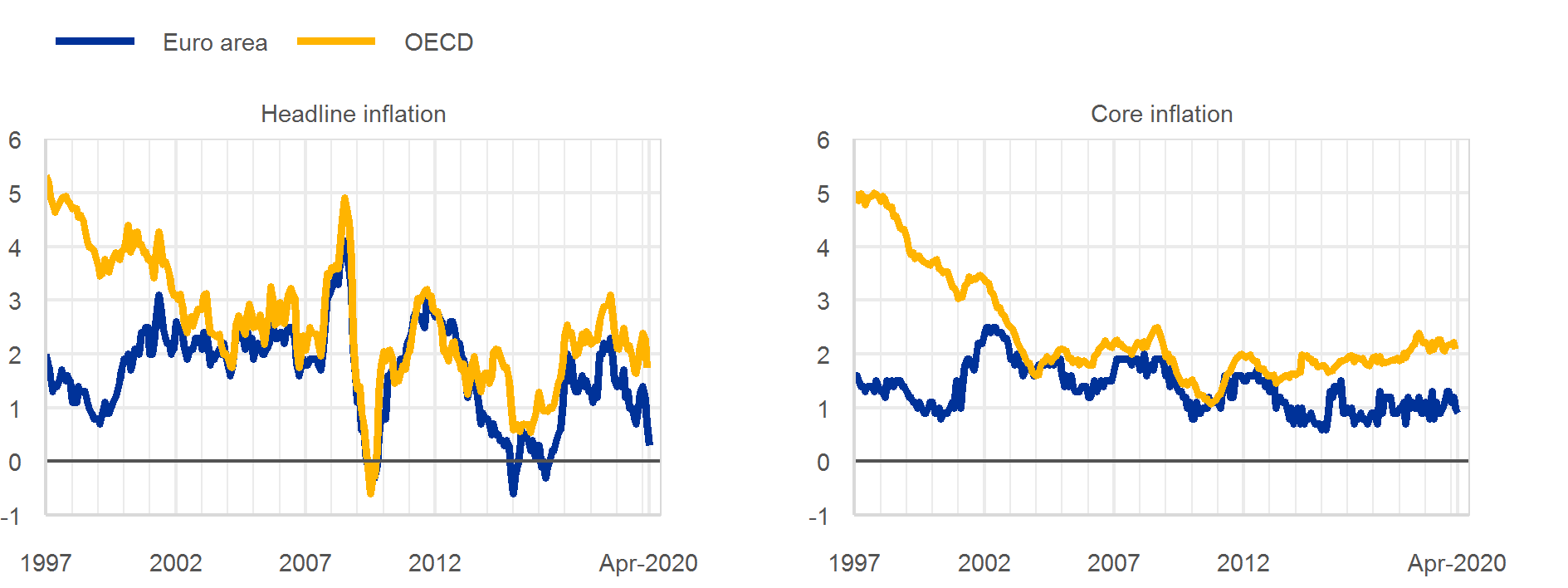

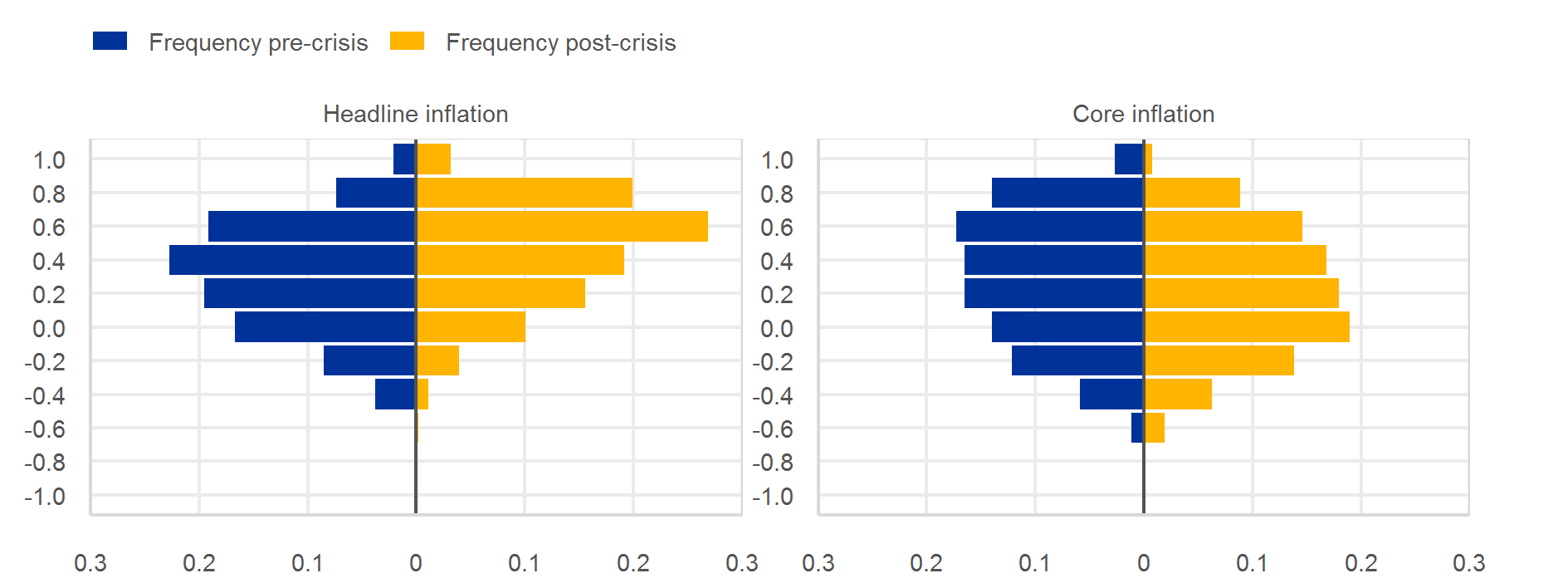

Although Chart 1 shows high cross-country correlations in headline inflation, Chart 2 indicates that the dynamics differ significantly between headline inflation and core inflation measures that are constructed by stripping out the volatile energy and food components. In fact, as shown in Chart 3, there has been an increase in cross-country correlations for headline inflation since the global financial crisis (left panel), but a decrease for core inflation (right panel).[3]

Inflation in the euro area and in the Organisation for Economic Co-operation and Development (OECD)

(annual percentage changes)

Source: Eurostat and Haver Analytics.

Distribution of pairwise cross-country correlations of headline and core inflation

(x-axis: frequency; y-axis: correlation coefficient) Sources: Haver Analytics and national statistical offices. Notes: The data cover 33 advanced and emerging economies at monthly frequency. The pre-crisis sample runs from January 1997 to June 2008 and the post-crisis sample from July 2008 to December 2019.

In the rest of my speech, I will examine the role of a range of factors in these correlated inflation outcomes, including the distribution of underlying shocks, structural changes in the world economy and the role of monetary policy regimes.

Common shocks

One possible explanation for the synchronisation of inflation is that shocks have become more synchronised. Since central banks typically seek to stabilise medium-term inflation and do not neutralise fully the impact of shocks on inflation outcomes, it is plausible that a preponderance of common shocks can account for strong co-movements in the deviations of national inflation rates from their medium-term target levels.

Moreover, in a world of low inflation and low interest rates it is plausible that the impact of negative shocks on observed inflation is likely to be more persistent, since the available policy space to quickly offset negative inflation shocks is more constrained. Under these conditions, there may be prolonged deviations of inflation outcomes away from the inflation aim, with central banks closing inflation gaps over a longer time horizon.

One source of global fluctuations in inflation is the pronounced volatility of commodity prices.[4] That these play a prominent role in global inflation volatility is not only indicated by Chart 3 but also confirmed by studies that analyse the contributions of the underlying components of overall inflation. International co-movements of inflation are largely related to the dynamics of energy prices and, to a lesser extent, food prices (see Chart 4).[5] Food and energy are the components that are the most correlated across countries. For instance, the fall in oil prices by about 60 percent since December 2019 accounts for the bulk of the 0.9 percentage point drop in headline inflation between then and April 2020 in the euro area.

The relation between the common factor in global inflation and commodity price developments

(annual percentage changes)

Sources: Haver Analytics and national statistical offices.Notes: The common factor is demeaned. The estimation sample runs from January 1997 to December 2019. The blue line reflects the zero mean common factor in global inflation as derived by replicating the principal component approach of Ciccarelli, M. and Mojon, B. (op. cit.) for a sample of 33 advanced and emerging economies. The yellow line reflects movements of oil and food prices weighted with the coefficients derived by a linear regression of the common factor on oil and food prices.

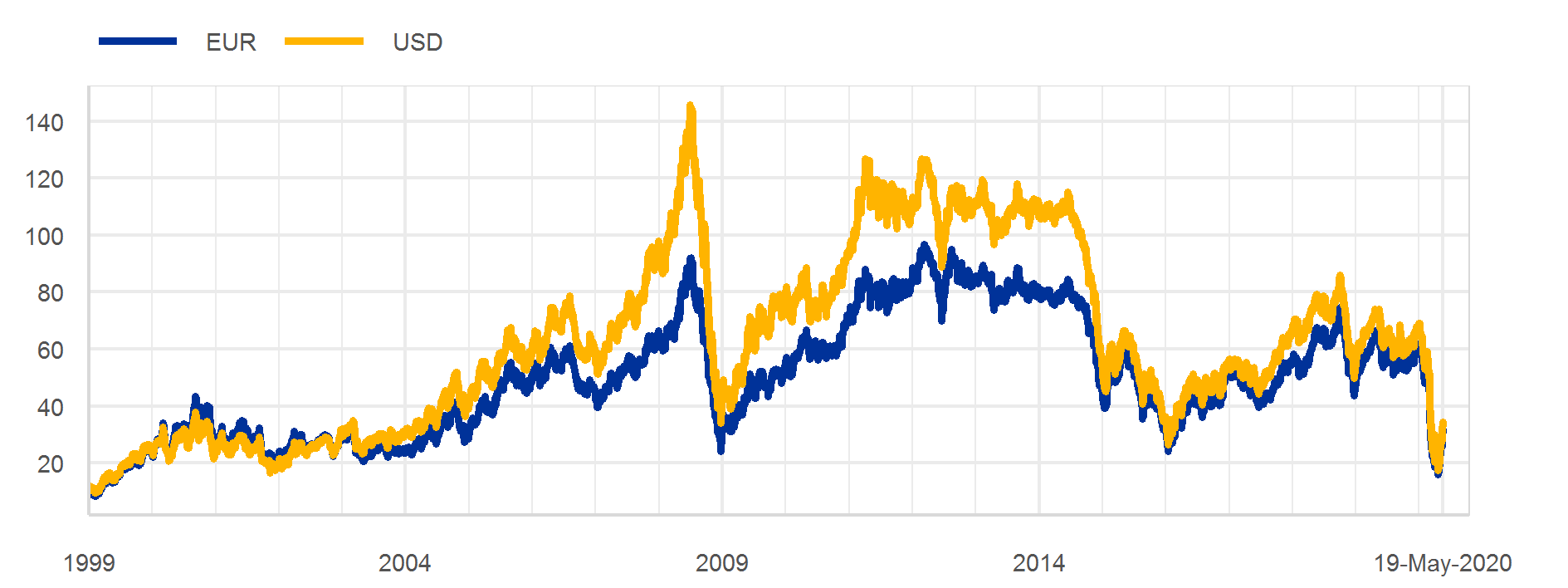

The transmission of commodity prices to domestic inflation is, however, neither automatic nor uniform across countries. At the most basic level, the impact of global shocks on domestic inflation depends on factors such as exchange rate movements and the domestic monetary policy regime. For example, it is sometimes neglected that the path for oil prices in US dollars is not the same as the path for oil prices in euro. While the oil price is globally quoted in US dollars, the pattern of movements in the USD/EUR exchange rate has meant that the oil price in euro has been much less volatile than the oil price in US dollars (see Chart 5).[6] This illustrates a general principle: an independent monetary policy (and, as a corollary, a flexible exchange rate) means that there is no deterministic relationship between international relative price movements and overall inflation rates.[7]

Oil prices in US dollars and in euro

(USD per barrel and EUR per barrel)

Sources: ECB and Bloomberg.

Structural change and inflation outcomes

The structure of the economy matters for wage and price-setting dynamics and the transmission of shocks to the real economy. Two categories of structural change may have contributed to greater co-movement in inflation outcomes. First, structural changes that increase international interdependence mean that a shock in one region may also affect economic performance and inflation outcomes in other regions. Second, structural changes that affect national economies in similar ways mean that there may be a common pattern in observed inflation even if shocks are mainly domestic in origin. In contrast, other types of structural change have the potential to contribute to divergent inflation outcomes across countries.

Economic and financial globalisation influences inflation outcomes through several mechanisms.[8],[9]

First, through enhanced trade linkages and higher cross-border knowledge flows, economic globalisation may contribute to greater similarity in productivity dynamics across countries. Moreover, closer economic integration through global value chains (GVCs) and the operation of multinational firms are mechanisms that transmit local shocks to other countries and generate more synchronised business cycles. For instance, shifts in demand in one economy can affect demand in upstream economies through trade linkages. This mechanism is confirmed by empirical evidence showing that increased GVC participation is associated with more synchronised inflation dynamics.[10] The degree of GVC integration also helps to explain the contribution of global economic slack to the domestic inflation environment.[11] By one estimate, international input-output linkages account for around half of the global component of producer price inflation.[12]

At the same time, it should be recognised that economic globalisation can also be a source of divergent inflationary pressures, especially during adjustment phases. In particular, re-allocation shocks can see some industries expand in some regions, but contract in others, with a particular impact on wage dynamics if there is a shift in the level and composition of labour demand.

The contribution of economic globalisation to higher inflation co-movements may also differ between phases in which globalisation acts as an anti-inflationary force and phases in which globalisation acts as pro-inflationary force. As indicated earlier, shocks that push inflation below the target level are more difficult to neutralise than shocks that push inflation above the target level, in view of the asymmetric policy space (the tools to tighten the monetary stance are more effective than the tools to loosen the monetary stance). Over the last quarter century, the dominant contribution of globalisation for advanced economies may have been as an anti-inflationary force (through increased productivity, increased international factor mobility, the entry of labour-abundant countries into the global trading system). However, especially with rising wages and income levels in emerging economies, globalisation may in the future act as a pro-inflationary force. This would also be reinforced if de-globalisation forces (such as protectionism and increasing transportation costs) served to reverse some of the productivity gains achieved in recent decades.

Second, to the extent that it is associated with a larger common component in the determination of financial conditions, financial globalisation can also contribute to greater similarity in inflation dynamics. This is most visible during global financial crises, as these are typically associated with significant recessions and disinflationary pressures.

However, in the other direction, financial globalisation can also contribute to asymmetric business cycle dynamics. For instance, international financial flows may amplify and prolong the domestic credit cycle, with the banking system obtaining additional leverage on international markets during upswings but suffering more rapid and severe funding outflows during downturns.[13] Moreover, to the extent that financial globalisation facilitates larger and more persistent current account imbalances, this may also contribute to divergent inflation paths between surplus and deficit countries. For instance, there is some suggestive evidence that the persistent current account surplus of the euro area has been a low-frequency contributor to the decline in inflation outcomes over the last decade.[14]

Third, international migration flows also affect inflation dynamics. At a macroeconomic level, a higher sensitivity of migration flows to the business cycle can dampen the wage response to employment shocks, with net migration acting as another adjustment margin.[15] The wage-setting process may also be influenced by differences in bargaining power between immigrant and local workers. Similarly, price-setting behaviour in some sectors may be reshaped by differences in search intensities between different groups.

In relation to the second category of structural changes, trends such as population ageing and digitalisation are broadly similar across advanced economies.[16] In addition to the impact of these trends on aggregate and sectoral economic activity, these forces may also affect price and wage-setting behaviour and alter the monetary policy transmission mechanism.

Population ageing operates through multiple channels. As well as having an impact on aggregate output growth (both through shrinking labour force participation and productivity dynamics), the current phase of population ageing is contributing to the trend decline in the underlying equilibrium real interest rate.[17] In turn, as indicated in the introduction, a low interest rate environment means that negative shocks affect inflation outcomes more persistently. Moreover, demographic patterns influence consumption patterns, altering the composition of the overall price index, and shape the responsiveness of consumption to monetary policy actions.[18]

In addition to the general impact of digitalisation on the structure of the domestic and international economies, it is also re-shaping pricing behaviour in many sectors, through the impact of online distribution channels and the automation of pricing decisions based on the information that is contained in real-time datasets.[19] Such digital pricing algorithms may increase increasing the responsiveness of prices to shocks.[20] This effect is likely to extend beyond actual online sales, since online prices also constrain brick-and-mortar prices.[21] Digitalisation may also give rise to the emergence of “superstar firms” that assume a dominant market position (thanks to the combination of high fixed and low variable costs that is prevalent in many digital markets), which may also have a substantial impact on pricing behaviour. These complement changes in market power and market structures that go beyond digitalisation.[22]

While available estimates point to digitalisation having had only a small impact on aggregate price dynamics, the effects may become larger as digitalisation becomes more pervasive. So far, the steady-state impact of digitalisation on market structures and pricing dynamics remains quite uncertain. For example, while 43 percent of respondents to a survey on price setting in the United Kingdom cited increased competition as a reason for increasing the frequency of price setting over the previous decade, 42 percent cited it as a reason for reducing the frequency.[23],[24]

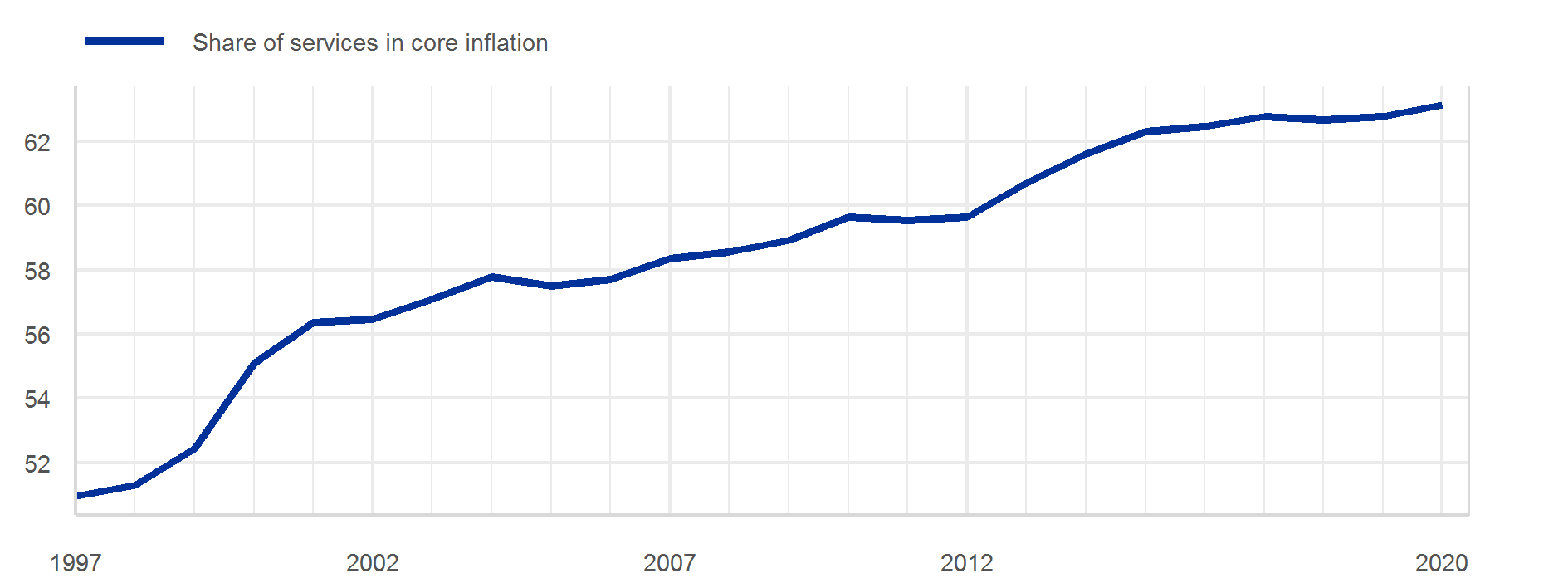

Finally, it is important to recognise that some structural trends can contribute to divergent inflation outcomes. Most obviously, the trend increase in the share of services in economic activity in high-income economies means that core inflation will be increasingly determined by domestic factors, given that services are less tradable than manufacturing (see Chart 6).[25]

Share of services in core inflation in the euro area

(percentages)

Sources: Eurostat.

Note: Core inflation refers to HICP excluding energy and food.

In a similar vein, the declining share of energy in the production functions and consumption baskets of advanced economies means that the importance of common energy shocks for domestic inflation rates is diminishing, both through a lower direct impact of fluctuations in commodity prices on headline inflation and the weakening of second-round effects.[26]

The structure of the international monetary system may also contribute to divergent inflation outcomes. For instance, there is a sharp distinction between the major issuers of international reserve currencies and other countries. For the former, exports and imports are typically priced in domestic currency, so short-term exchange rate volatility has a much more limited impact on inflation outcomes in those countries than in countries in which exports and imports are typically priced in foreign currencies, with a dominant global role for US dollar pricing.[27] In addition, the latter countries are also more exposed to the global financial cycle owing to the limited capacity of such countries to insulate themselves from international funding shocks.

Monetary policy regimes

The convergence in monetary policy regimes across countries has played a central role in the convergence in medium-term inflation outcomes. Almost all major advanced economies now have an inflation aim in the region of two percent, whether formally instituted as a policy target or as a longer-term goal.[28] In turn, lower and less-volatile overall inflation is associated with a higher global component in the short-term inflation volatility that remains, especially for countries with more independent central banks.[29]

The impact of a commodity price shock on inflation provides a good illustration of the difference between the initial impact and the longer-term impact of a shock. As discussed earlier, commodity price volatility is a common source of headline inflation volatility around the world. However, the impact of a commodity price shock on domestic inflation is neutralised over time, with the monetary policy stance adjusted as required to ensure convergence to the medium-term domestic inflation target.[30] In addition, the anchor provided by the medium-term inflation target means that such shocks are less likely to permeate through second-round effects.

The challenge for central banks is to ensure that monetary policy strategies successfully protect the medium-term inflation aim by ensuring that the economic and financial assessments that inform policy decisions successfully diagnose the nature of the underlying shocks driving the inflation outlook. This includes recognising the impact of trend forces such as globalisation, demography and digitalisation (together with climate change and the pandemic) on the underlying structure of the economy and the dynamics of wage and price setting. In making these assessments on an ongoing basis, it is important to avoid the temptation to extrapolate from recent experience; in particular, some of the forces that have contributed to an increase in international inflation co-movement in recent decades may act as sources of divergence in the future.

These strategic challenges are especially acute under conditions of low inflation and low interest rates, since deviations from the medium-term inflation aim are likely to be more persistent under such conditions. Accordingly, our monetary policy strategy review – even if it is unavoidably delayed by the COVID-19 pandemic – remains a high priority for the ECB.

- [1]I am grateful to Chiara Osbat and Miles Parker for their contributions to this speech, as well as to Timo Reinelt, Eduardo Goncalves, Alberto Lentini and Jakob Nordeman for their input.

- [2]For an overview, see Ciccarelli, M. and Mojon, B. (2010), “Global Inflation”, The Review of Economics and Statistics, Vol. 92, No 3, pp. 524-535. The role of global factors for domestic inflation are also discussed, for example, in European Central Bank (2017), “Domestic and global drivers of inflation in the euro area”, Economic Bulletin, Issue 4 and Nickel, C. (2017), “The role of foreign slack in domestic inflation in the Eurozone”, VOX.eu, 28 July 2017.

- [3]See also Forbes, K. (2019), “Inflation Dynamics: Dead, Dormant, or Determined Abroad?,” Brookings Papers on Economic Activity (Fall 2019).

- [4]Climate change and pandemics also constitute major global shocks, but these are outside the scope of this speech.

- [5]See Förster, M. and Tillmann, P. (2014), “Reconsidering the International Comovement of Inflation”, Open Economies Review, Vol. 25, No 5, pp. 841-863; and Parker, M. (2018), “How global is ‘global inflation’?”, Journal of Macroeconomics, Vol. 58, pp. 174-197.

- [6]See Ortega, E. and Osbat, C. (eds.) (2020), “Exchange rate pass-through in the euro area and EU countries”, Occasional Paper Series, No 241, ECB, April.

- [7]See also Geerolf, F. (2020), “The Phillips Curve: A Relation between Real Exchange Rate Growth and Unemployment,” mimeo, UCLA.

- [8]For a discussion of monetary policy transmission in a globalised world, see Lane, P. R. (2019a), “Globalisation and monetary policy”, speech at the University of California, Los Angeles, California, 30 September; Lane, P. R. (2019b), “The international transmission of monetary policy”, speech at the CEPR International Macroeconomics and Finance Programme Meeting, Frankfurt am Main, 14 November; and Ca’ Zorzi, M., Dedola, L, Georgiadis, G., Stracca, L. and Strasser, G. (2020) “Monetary policy and its transmission in a globalised world”, ECB Working Paper Series, No 2407.

- [9]See Bentolila, S., Dolado, J. and Jimeno, J. (2008), “Does immigration affect the Phillips curve? Some evidence for Spain”, European Economic Review, Vol. 52, No 8, pp. 1398-1423; Borio, C. and Filardo, A. (2007), “Globalisation and inflation: New cross-country evidence on the global determinants of domestic inflation”, BIS Working Papers, No 227, Bank for International Settlements; Henriksen, E., Kydland, F. and Šustek, R. (2013), “Globally Correlated Nominal Fluctuations”, Journal of Monetary Economics, Vol. 60, No 6, pp. 613-631; Melitz, M. and Ottaviano, G. (2008), “Market Size, Trade, and Productivity”, The Review of Economic Studies, Vol. 75, No 1, pp. 295-316; and Meier, M. and Reinelt, T. (2020), “Monetary Policy, Markup Dispersion, and Aggregate TFP”, CRC TR 224 Discussion Paper Series, No 161, University of Bonn and University of Mannheim, Germany.

- [10]See de Soyres, F. and Franco, S. (2019), “Inflation Dynamics and Global Value Chains”, Policy Research Working Paper Series, No 9090, World Bank.

- [11]See Auer, R., Borio, C. and Filardo, A. (2017), “The globalisation of inflation: the growing importance of global value chains”, BIS Working Papers, No 602, Bank for International Settlements.

- [12]See Auer, R., Levchenko, A. and Sauré, P. (2019), “International Inflation Spillovers through Input Linkages”, The Review of Economics and Statistics, Vol. 101, No 3, pp. 507-521.

- [13]See Lane, P. R. and McQuade, P. (2014), “Domestic Credit Growth and International Capital Flows”, Scandinavian Journal of Economics, Vol. 116, No 1, pp. 218-252.

- [14]See Galstyan, V. (2019), “Inflation and the Current Account in the Euro Area,” Central Bank of Ireland Economic Letter, No 2019-7, and Eser, F., Karadi, P., Lane, P.R., Moretti, L. and Osbat, C. (2020), “The Phillips Curve at the ECB,” ECB Working Paper Series, No. 2400.

- [15]See Lozej, M. (2019), “Economic Migration and Business Cycles in a Small Open Economy with Matching Frictions”, Economic Modelling, Vol. 81, pp. 604-620.

- [16]Of course, there is no strict separation between the two categories of structural change, since there are many interactions between globalisation and the demographic and digitalisation trends.

- [17]While a large population cohort that is saving for retirement puts upward pressure on the total savings rate, a large elderly cohort may push down aggregate savings by running down accumulated wealth.

- [18]See, among others, Lis, E., Nickel, C. and Papetti, A. (2020), “Demographics and inflation in the euro area: a two-sector New Keynesian perspective”, Working Paper Series, No 2382, ECB; Leahy, J.V. and Thapar, A. (2019), “Demographic Effects on the Impact of Monetary Policy”, NBER Working Paper, No 26324; and Katagiri, M., Konishi, H. and Ueda, K. (2020), “Ageing and Deflation from a Fiscal Perspective”, Journal of Monetary Economics, Vol. 111, pp. 1-15.

- [19]See also Lane, P. R. (2019c), “Welcome address”, welcome remarks at the ECB conference on “Challenges in the digital age”, Frankfurt am Main, 4 July.

- [20]See Cavallo, A. (2018), “More Amazon Effects: Online Competition and Pricing Behaviors”, NBER Working Paper, No 25138.

- [21]Ibid. and Aparicio, D. and Rigobon, R. (2020), “Quantum prices”, NBER Working Paper, No 26646.

- [22]See, for instance, Philippon, T., (2019), “The Great Reversal. How America Gave Up on Free Markets”, Harvard University Press;, Gutierrez, G. and Philippon, T. (2017), "Declining Competition and Investment in the U.S," NBER Working Paper, No 23583; Covarrubias, M, Gutiérrez, G and Philippon, T. (2019), "From Good to Bad Concentration? U.S. Industries over the past 30 years”.

- [23]For the euro area, see Box 3 in Ciccarelli, M. and Osbat, C. (eds.) (2017), “Low inflation in the euro area: Causes and consequences”, Occasional Paper Series, No 181, ECB; for Canada, see Charbonneau, K., Evans, A., Sarker, S. and Suchanek, L. (2017), “Digitalization and Inflation: a Review of the Literature”, Staff Analytical Note, No 2017-20, Bank of Canada; and for Sweden, see Sveriges Riksbank (2015), “Digitisation and inflation”, Monetary Policy Report, February, pp. 55-59.

- [24]See Greenslade, J. and Parker, M. (2010), “New insights into price-setting behaviour in the United Kingdom”, Working Paper Series, No 395, Bank of England.

- [25]For further discussion of this point, see Cœuré, B. (2019), “The rise of services and the transmission of monetary policy”, speech at the 21st Geneva Conference on the World Economy, 16 May.

- [26]See Gelos, G. and Ustyugova, Y. (2017), “Inflation responses to commodity price shocks – How and why do countries differ?”, Journal of International Money and Finance, Vol. 72, pp. 28-47.

- [27]See Ortega, E. and Osbat, C. (eds.) (2020), op. cit. On dominant currency pricing, see Gopinath, G., Boz, E., Casas, C., Díez, F.J., Gourinchas, P.-O. and Plagborg-Møller, M. (2020), “Dominant Currency Paradigm”, American Economic Review, Vol. 110, No 3, pp. 677-719; Georgiadis, G. and Mösle, S. (2019), “Introducing dominant currency pricing in the ECB’s global macroeconomic model”, Working Paper Series, No 2321, ECB; Georgiadis, G. and Schumann, B. (2019), “Dominant-currency pricing and the global output spillovers from US dollar appreciation”, Working Paper Series, No 2308, ECB; and the discussion in Lane, P.R. (2019a), op. cit.

- [28]The commitment to delivering similar inflation aims reduces the relevance of an earlier literature that speculated that the equilibrium inflation rate would be lower in more open economies. See Romer, D. (1993), “Openness and Inflation: Theory and Evidence,” Quarterly Journal of Economics 108(4), 869-903, and Lane, P.R. (1997), “Inflation in Open Economies,” Journal of International Economics 42(3-4), 327-347.

- [29]Parker, M. (2018), op. cit., studies a wide range of economies – 223 countries over the period 1980 to 2012 – and finds that global inflation can explain around 70 percent of national inflation variability in a group of around 20 advanced economies, but only 20 percent for middle-income countries and 13 percent for low-income countries. The model of an independent central bank commited to a clear inflation aim had spread much more widely among advanced economies than among emerging and developing countries. However, more recently, as this model has become more widespread, both average inflation and inflation volatility have declined in a wider range of economies. In a similar vein, Ha, J., Kose, A. and Ohnsorge, F. (2019), “Global Inflation Synchronization”, Policy Research Working Paper Series, No 8768, World Bank, argue that global inflation is becoming more pervasive.

- [30]See Choi, S., Furceri, D., Loungani, P., Mishrah, S. and Poplawski-Ribeiro, M. (2018), “Oil prices and inflation dynamics: Evidence from advanced and developing economies”, Journal of International Money and Finance, Vol. 82, pp. 71-96.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts