A regulatory and financial stability perspective on global stablecoins

A regulatory and financial stability perspective on global stablecoins

Macroprudential Bulletin 10, May 2020.

Stablecoins with the potential for global reach (“global stablecoins”) could help to address unmet consumer demand for payment services that are fast, cheap and easy to use and can operate across borders. However, while there is indeed the potential for such benefits, global stablecoins also pose challenges and risks. This article focuses on the asset management function of global stablecoins, assessing their regulatory and financial stability implications. We start by looking at how global stablecoins could be classified under the current financial regulations, arguing that regulatory gaps may exist with certain design features. We also discuss the financial stability risks posed by global stablecoins and estimate the potential size of a global stablecoin arrangement, using the Libra initiative as an example. We conclude that the malfunctioning of a global stablecoin’s asset management function could pose risks to financial stability given its potential size and interlinkages with the financial system. In order to reap the potential benefits of global stablecoins, a robust regulatory framework needs to be put in place in order to address these risks before such arrangements are allowed to operate.

Introduction

Financial innovation has the potential to improve the efficiency of financial services and spread access to such services to all corners of the globe. While payment services have changed considerably in recent years, driven by new technology and shifts in consumer preferences, traditional financial service providers have struggled to develop faster and cheaper payment services that can operate across borders. Stablecoins promise to help cater for such unmet demand for payment services.[2]

While potential benefits exist, stablecoins could also bring about challenges and pose risks to the financial system. There are many different types of stablecoin,[3] and analysis of their individual features is crucial in order to understand their possible implications from a risk perspective and a regulatory point of view.

Stablecoins seek to provide a stable means of payment and a store of value. Stablecoins were initially developed for use in the trading of crypto-assets, but today’s initiatives often have a much broader scope. This article focuses on stablecoins which have the potential to achieve global reach.

Stablecoins may be backed by funds, traditional asset classes or crypto‑assets, or they may be reliant on expectations. Issuers of stablecoins may or may not be responsible for satisfying any associated claims by end users; and the value of a stablecoin and its stability relative to the currency (or currencies) of reference may or may not be fixed. For a detailed description and taxonomy of stablecoin arrangements, see Bullmann et al. (2019).

The system of entities behind a stablecoin arrangement can vary greatly. Stablecoins are characterised by their integration into a wider arrangement that fulfils various different functions, including issuance, reserve asset management, transfers and an interface with end customers. Taking a holistic view, a stablecoin arrangement represents a complex ecosystem that can be structured entirely around a single provider or distributed across several different entities.

Since they combine several different functions, stablecoin arrangements may fall under different regulatory, oversight and supervisory regimes. Of particular importance to the ECB is the asset management function, which has the potential to be a significant source of risks to financial stability. Another important area is the transfer function, with the relevant components of a global stablecoin arrangement potentially falling under the Eurosystem’s oversight regime for payment systems or the oversight framework for payment schemes or instruments as part of the ECB’s mandate to foster the smooth operation of payment systems.

This article focuses on the asset management function of global stablecoins and the attendant risks to financial stability. To this end, we first provide a general description of stablecoin arrangements, before looking at how certain asset management functions might potentially be classified under current financial legislation. We argue that, as things stand, depending on their specific design features regulatory gaps may exist. We then discuss the financial stability risks that are posed if a stablecoin arrangement reaches a global scale. And finally, we quantify potential financial stability risks by estimating the potential size of a global stablecoin arrangement, using the Libra initiative as an example.

1 Functionalities in a stablecoin ecosystem

Stablecoins aim to provide an alternative to volatile crypto-assets by reducing price volatility, potentially acting as a means of payment and a store of value. First-generation crypto-assets such as Bitcoin have suffered from severe price volatility and limited scalability. Consequently, they have served more as a risky asset class than a means of making payments. A typical stablecoin arrangement (made up of the coin itself and the associated transfer platform and ancillary functions) seeks to reduce price volatility by anchoring the coin to a “safe” low‑volatility reference asset or basket of assets.

A stablecoin arrangement will typically involve several interconnected and interdependent functions. It will feature three key functions: (i) payments, (ii) asset management, and (iii) a user interface. The first encompasses the crucial transfer functionality, whereby stablecoins are used as a means of making payments and transferring value. The asset management function (which is the focus of this article) invests the proceeds from the issuance of stablecoins in safe low-volatility assets. And the final function provides the interface that is needed to link end users with other functionalities (e.g. wallet providers).

2 Regulatory considerations

Given the complexity of its structure, a stablecoin arrangement could, depending on its specific design features, fall under one of a number of different regulatory frameworks – or, potentially, none of them. The payment and customer interface functions of a stablecoin arrangement are similar to those of a traditional payment system, scheme or instrument. As a result, the entities responsible for providing those functions could fall under the Eurosystem’s oversight framework.

The asset management function could qualify as an issuer of e‑money, an investment fund or even a bank. If the issuer of the coin does not grant credit and guarantees redeemability at par, and end users have a claim on the issuer, the coin will fall within the definition of e-money under EU legislation, with both the coin and its issuer being subject to the Electronic Money Directive (EMD).[4] In this case, the proceeds from coin issuance will be held at a custodian bank. In contrast, if the stablecoin arrangement guarantees redeemability at par but also provides credit, it will be classed as a deposit-taking institution and will need to obtain a banking licence from the ECB.[5]

A stablecoin’s asset management function may also qualify as an investment fund. An asset management function may be regarded as a collective investment undertaking (i.e. an investment fund) if (i) coin holders have a claim on the assets of the issuer, (ii) proceeds are invested in non-zero risk financial assets, and (iii) coin holders are entitled to a pro rata share of the value of the issuer’s assets. If the fund is based in the EU and/or marketed to EU investors, it will fall under the standard EU regulatory framework established by the UCITS Directive[6] or the AIFMD.[7] If the fund invests only in instruments with less than two years of residual maturity, it will qualify as a money market fund (MMF), in which case the requirements envisaged by the MMF Regulation[8] (e.g. liquidity limits) will apply on top of those envisaged by the UCITS Directive or the AIFMD.

Depending on its design, the stablecoin’s asset management function may, however, also fall outside of the EU’s existing regulatory framework, implying a potential regulatory gap for certain stablecoin arrangements. The question of whether a coin holder has a claim on the issuer or the assets backing the stablecoin arrangement plays an important role in the characterisation of such an arrangement. Under the EMD, a holder of e-money must have a claim on the issuer for the funds that were exchanged for the e-money. Similarly, under the regulations governing funds, a holder of a share in a fund must have a claim on that fund’s assets. Consequently, if a stablecoin arrangement does not give users a claim on the issuer or the assets backing the stablecoin, that arrangement may not qualify as an issuer of e-money or an investment fund, even though it performs similar functions and takes similar risks. A key question in this regard is whether, in the absence of a formal promise of a claim, a statement indicating that coins are fully backed creates a legitimate expectation that coin holders will have a claim on the underlying assets or a legal right to such a claim.

Furthermore, there is a risk that end users will regard the stablecoin as being equivalent to a deposit, given the promise of “stable” value and the possibility of converting coin holdings back into fiat currency at any time. The value of a stablecoin will depend crucially on its governance and risk management, as well as on the value of the underlying assets or fund portfolio. In this respect, the term “stablecoin” is a misnomer.[9] In order to minimise confidence shocks, stablecoin users should be informed that losses could occur and that they will not be covered by traditional safety nets such as deposit guarantee schemes and central banks’ lender of last resort functions.

3 Financial stability risks

If a stablecoin arrangement reaches a global scale (becoming a “global stablecoin”), any malfunctioning could pose a risk to financial stability. The G7 Working Group on Stablecoins has analysed and identified a vast array of risks to and from global stablecoin arrangements.[10] Without prejudice to issues and risks that may arise in other parts of a stablecoin ecosystem, we focus our discussion on the two most prominent issues for the asset management function: the risk of a liquidity run impairing the functioning of the stablecoin arrangement; and the risk of contagion spreading to the wider financial system as a result of an impaired stablecoin arrangement. The former represents a risk to the smooth functioning of the stablecoin arrangement itself (i.e. vulnerability of the arrangement), while the latter represents a risk to the wider financial system and the rest of the economy as a result of the arrangement’s distress (i.e. risk transmission to the broader economy).

If proceeds from coin sales are not held in a depository, but rather invested in non-zero risk financial assets, the value of the coin will be exposed to the risks that are inherent in such investment. For example, if the stablecoin arrangement invests those proceeds in bank deposits and government debt, it will be exposed to the credit and liquidity risks of the banks where the deposits are held, in addition to credit, liquidity, market and foreign exchange risks associated with the government bonds held.[11]

An important question when assessing risks to stablecoin arrangements is who ultimately bears investment risks. If the stablecoin arrangement does not guarantee a fixed value for the coin, the value of the coin will move in tandem with the value of the underlying assets. In this case, the end user bears all risks and the coin is equivalent in substance to a fund share, with its value equal to the fund’s net asset value. There is no solvency risk for such an arrangement, as it is akin to a “pass-through” structure.

A run on a stablecoin arrangement could occur if end users lose confidence in the issuer or its network. This could happen, for example, if an adverse event occurs (such as a cyberattack on the system or a large-scale theft from a wallet), or if end users realise that the assets backing the coin are losing value, thereby casting doubt on the value of the coin. A loss of confidence could trigger substantial redemptions of coin holdings, which could be amplified if end users have misinterpreted such holdings as a substitute for bank deposits. Unlike stablecoins, bank deposits are covered by the bank’s guarantee of redeemability at par and, should that fail, the appropriate deposit guarantee scheme. One can imagine such a situation arising if, for example, the stablecoin in question has been advertised on established social networks as a cost-efficient alternative to current payment and money transfer services.

The ultimate bearer of investment risks may be the stablecoin issuer if the stablecoin arrangement guarantees a fixed value for the coin. In this case, any losses stemming from its reserve assets are borne by the stablecoin issuer (or whoever provides such guarantees), including losses from exchange rate fluctuations if the value of the coin is fixed relative to a given fiat currency. Confidence in the coin and its arrangement then depends critically on the loss absorption capacity of the guarantor, and doubts in that regard may trigger a run on the coin. In the event of such a run, elements of the stablecoin arrangement (e.g. designated dealers) may stop functioning, potentially in a manner similar to the suspension of securitisation vehicles’ redemptions in 2007 in the context of the global financial crisis.

In the event of a run on a global stablecoin, the liquidation of assets to cover redemptions could have negative contagion effects on the financial system. The size of the stablecoin arrangement and its interconnectedness with the financial system and the wider economy will ultimately determine the severity of the financial stability impact. It should be noted in this regard that different components of the stablecoin arrangement are likely to be located in different jurisdictions. This means that a shock to the stablecoin arrangement that occurs in an emerging market (e.g. a loss of confidence triggered by an operational risk event in a weak institutional setting) could potentially spill over to the advanced economies where most of the pool of assets underlying the stablecoin are invested. As the next section shows, global stablecoin arrangements could conceivably reach a size where they are large enough to destabilise such markets.

Short-term government debt markets could be affected. If a stablecoin arrangement plays a dominant role in short-term government debt markets, a run on that arrangement could translate into price volatility and illiquidity spikes in the markets in question. This could pose a challenge for debt management offices. Insofar as interest rates on credit to the real economy are anchored to rates on short-term bills, this could also have an impact on the transmission of monetary policy.

The stability of bank funding could also be weakened by the advent of a global stablecoin arrangement. If retail users transfer funds from bank deposits to global stablecoins, that could result in generally stable retail deposits[12] being replaced, at least partially, with much more fluid institutional deposits stemming from the stablecoin arrangement in question. In particular, countries with fragile domestic banking systems could see deposit holders preferring to exchange their deposits for stablecoins, resulting in a loss of funding for domestic banks. The situation may be reversed if there is a loss of confidence in the stablecoin arrangement, but banks’ funding could still be affected through other channels, such as the redistribution of deposits across banking institutions following a sudden withdrawal of deposits, associated market volatility, and reputational damage impacting banks involved in the stablecoin ecosystem as actors (authorised resellers, third-party trading platforms, etc.).

4 Size and contagion simulations

This section seeks to quantify the potential size of global stablecoin arrangements, using the Libra initiative as an example. Libra has been chosen as an example as it has the potential to grow quickly, due to network effects stemming from its global user base and the fact that Facebook and the other Libra sponsors are able to make significant resources available in order to support the launch of the stablecoin.

In order to quantify the potential size of the Libra ecosystem, we need to ascertain both the potential number of users and the average holdings per user. For the purposes of this analysis, the potential user base is considered to be the 2.4 billion users in the Facebook ecosystem (which also includes Instagram and WhatsApp, in addition to Facebook itself). Approximately 10% of those users (240 million) are located in the euro area.

In order to approximate the average holdings per Libra account, three different scenarios are considered. The first scenario represents a situation where Libra becomes a widespread means of payment. That scenario uses data on PayPal, as a well-established widely used electronic payment service provider. The PayPal user base currently consists of around 286 million active accounts with average holdings per account of €64.[13]

The two other scenarios aim to reflect a situation where Libra is also used as a store of value. These scenarios are based on data for Yu’E Bao (the MMF operated by Chinese company Ant Financial, which is part of the Alibaba Group), which had 588 million users in China in December 2018. According to Bloomberg (2019), assets under management in Yu’E Bao totalled CNY 1,030 billion in the first half of 2019, corresponding to €135 billion at market exchange rates and making Yu’E Bao one of the world’s largest MMFs.[14] This results in average holdings per capita of around €231, which is the second scenario under consideration (hereafter referred to as the “store of value A” scenario). In order to construct an extreme-case scenario, the peak value for Yu’E Bao’s assets under management (€254 billion in March 2018) is used. To take account of the difference between the income levels seen in China and Europe, purchasing power parity‑adjusted exchange rates are used. This produces average per capita holdings of around €1,220, which forms the basis for the third scenario under consideration (hereafter referred to as the “store of value B” scenario). Bloomberg (2019) notes that one important driver of the strong outflows from Yu’E Bao over the last two years has been increased regulatory pressure and scrutiny. The “store of value B” scenario may therefore be regarded as reflecting a situation where a global stablecoin arrangement remains largely unregulated. It is worth noting, in this regard, that Yu’E Bao has grown rapidly, taking just five years to establish its sizeable user base.

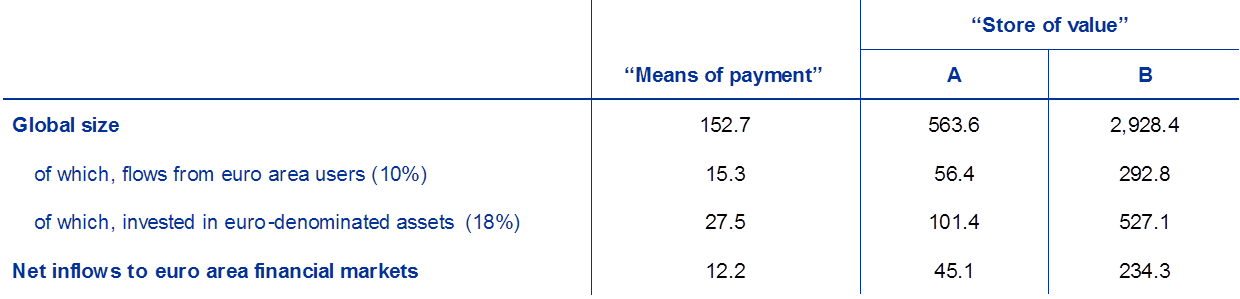

In the extreme-case scenario, the global size of the Libra Reserve could reach almost €3 trillion of assets under management. Table 1 shows the estimated global size of the Libra Reserve in each of the three scenarios. As the table indicates, the Libra Reserve’s total assets under management could range from €152.7 billion in the “means of payment” scenario to around €3 trillion if the currency becomes a widely adopted store of value. On the basis of the number of Facebook users in the euro area, around 10% of these total assets could stem from users in the euro area.

Table 1

The Libra Association’s potential global size and importance for the euro area

(EUR billions)

Source: ECB calculations.

The currency composition of the Libra Reserve could result in inflows to euro area short-term funding markets. The Libra Association has announced that funds collected will be invested in a currency basket comprising US dollars (50%), euro (18%), yen (14%), pounds sterling (11%) and Singapore dollars (7%). The euro’s share of Libra’s currency basket is thus larger than the euro area’s share of total Facebook users (18% versus 10%). Assuming that the average holdings per user are distributed roughly equally across geographical areas, this implies a currency mismatch between flows from European users to the Libra Reserve in euro and euro‑denominated assets held by the Reserve. In the three scenarios under consideration, this would result in additional inflows to euro area short-term funding markets from the rest of the world totalling €12.2 billion, €45.1 billion and €234.3 billion respectively (see Table 1). Depending on the scale and speed of adoption, these inflows could potentially have a limited impact on euro exchange rates. If there are additional versions of Libra, each backed by only one fiat currency (EUR-Libra backed by euro only, USD-Libra backed by US dollars only, etc.), flows between euro area short-term funding markets and the rest of the world would be determined by the relative usage of the different versions of Libra inside and outside the euro area.[15]

Libra could potentially become one of Europe’s largest MMFs. According to the Libra Association, assets under management will be invested in high‑quality highly liquid assets, such as top-rated short-term government bonds, bank deposits and cash. Thus, there are a number of similarities with MMFs. Euro area MMFs held euro‑denominated assets totalling around €600 billion in the third quarter of 2019. The Libra Reserve has the potential, therefore, to become one of the largest MMFs in the euro area. Chart 1 looks at the size of the Libra Reserve in the three scenarios under consideration, comparing it with Europe’s three largest MMFs.

Chart 1

Potential size of the Libra Reserve relative to the largest European MMFs in terms of euro-denominated assets

(EUR billions)

Sources: Fitch (2019) and ECB calculations.

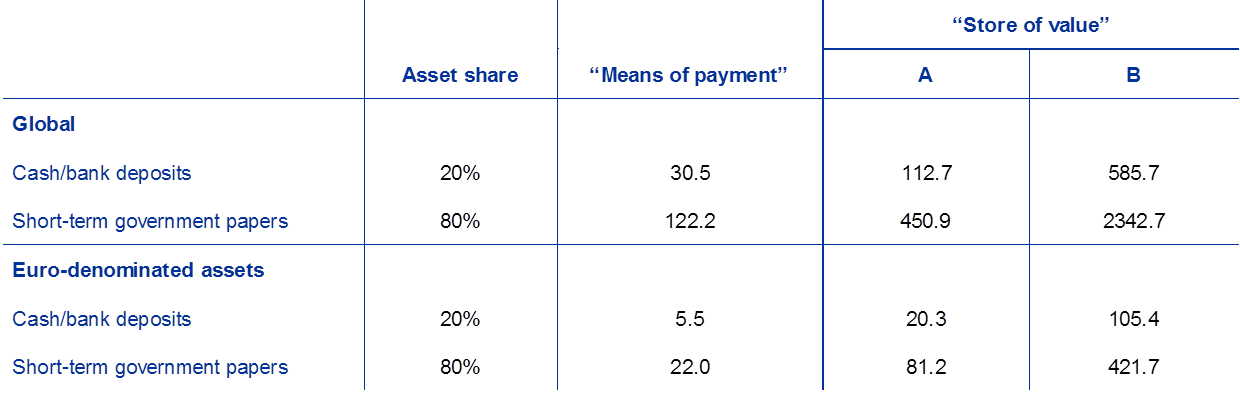

The Libra Reserve could become an important investor in highly rated short-term government papers, thereby potentially contributing to the scarcity of safe assets in the euro area. The Libra Association (2020) declared that at least 80% of the Libra Reserve shall be invested in short-term government debt securities with a residual maturity of less than three months and high credit ratings. The latter was defined as a rating equal to or above A+ from S&P. The remaining up to 20% of the reserve were announced to be held in cash or invested in money market funds. Table 2 shows the size of the Libra Reserve’s investment into the different asset classes for the three scenarios. At year-end 2019, the total value of general government debt of euro area countries rated A+ or above with a maturity of less than three months stood at €268.8 billion. In the “store of value A” scenario, the Libra Reserve would, accordingly, hold around 30% of these short-term government papers by value, while the total amount invested under the “store of value B” scenario would exceed the total value of the entire market segment. Consequently, the scarcity of safe assets (e.g. for collateral purposes) could increase significantly in the euro area.[16] Depending on the growth of the Libra Reserve, the credit quality requirements may need to be weakened. Alternatively, the asset composition may need to be shifted towards other asset classes, typically to be found in the portfolios of constant net asset value (CNAV) money market funds, such as commercial papers, term deposits or certificates of deposits.

Table 2

Potential composition of the Libra Reserve’s asset holdings

(EUR billions)

Notes: Asset composition as proposed by Libra Association (2020).

Sources: ECB and ECB calculations.

The investment policy of the Libra Association could lead to some stable retail deposits being transformed to less stable wholesale financing in the euro area banking system. Up to 20% of the reserve will be held in cash or invested in money market funds according to the Libra Association. In this way, these reserves are likely to provide financing for the banking system. Total bank deposits held with euro area monetary financial institutions stood at €13.2 trillion in November 2019. Of that, €7.7 trillion stemmed from the household sector, and €4.3 trillion was held in current accounts or took the form of overnight deposits. Most inflows to the Libra Reserve are expected to stem from retail depositors, who can be approximated by the household sector. Compared to these numbers, the impact of Libra is likely to remain limited, though. Under the extreme-case “store of value B” scenario in Table 2, 2.4% of euro area households’ current account and overnight bank deposits would be replaced with wholesale funding. This number could be seen as a lower bound given the considerations above that short-term government debt markets may not be able to absorb 80% of the Libra Reserve under this scenario. As retail deposits are considered to be the most stable form of bank financing, this could affect the stability of the funding profiles of individual banks. It could also result in a redistribution of deposits across the euro area banking system. While outflows of retail deposits could affect all banks relatively equally, higher-rated banks could profit more strongly, as the Libra Association has announced that it will only invest in assets of highly rated institutions.

Table 3

Potential Libra outflows under historical bank deposit, MMF and investment fund run scenarios

(EUR billions)

Notes: All bank run-off rates were realised over a period of one month. The sample average for bank runs relates to a sample of ten recent deposit runs in Europe and North America. All investment fund runs took place in the first half of 2019.

Sources: HM Treasury (2009), McCabe (2010), FCA, Bloomberg, Morningstar and ECB calculations.

The implications that abrupt outflows from the Libra Reserve would have for euro area short-term funding markets can be assessed on the basis of historical bank and fund runs. Table 3 shows potential outflows from the Libra Reserve under various shock scenarios, which are based on bank deposit, MMF and investment fund runs observed in the recent past. In order to gauge the potential financial stability implications of widespread use of Libra, these possible outflows need to be considered in the context of the size of short-term funding markets and potential regulatory requirements.

The significant amounts of highly liquid assets that the Libra Reserve would have to hold if it was subject to European regulation on MMFs would increase its resilience in stressed outflow scenarios. Rules on CNAV funds require European MMFs to hold significant liquidity reserves for the case of abrupt outflow shocks. Specifically, MMFs’ liquidity reserves must be sufficient to cater for overnight outflows totalling 10% of their assets and outflows totalling 30% of their assets over the course of a week. Eligible reserves include cash holdings, reverse repo transactions, and sovereign, supranational and agency debt with a residual maturity of up to 190 days. Such liquidity buffers would place restrictions on the types of asset that the Libra Reserve could hold. At the same time, these buffers would allow the Libra Reserve to withstand the majority of the outflow scenarios shown in Table 3, showing the added value that MMF regulation have for global stablecoins in such scenarios.

An outflow shock affecting the Libra Reserve could pose challenges and risks to global and euro area financial markets. The results in Table 3 show that outflows from the Libra Reserve could be significant in the presence of the kinds of run scenarios that have been seen in the banking and fund sectors. If it was governed by the MMF Regulation (MMFR), the Libra Reserve might be able to cover all redemptions by liquidating its most liquid assets. The sudden offloading of such large amounts of assets would, however, have ramifications that could affect market liquidity and asset prices, potentially resulting in funding difficulties for governments and banks that the Libra Reserve had invested in. The Libra Reserve could also react by suspending redemptions of Libra coins.[17] The consequences of a global fund and payment system adopting such a course of action fall outside the scope of this article, but will need to be investigated carefully.

Conclusion

Stablecoins are complex arrangements comprising many interdependent functions and legal entities. Stablecoins could help to address unmet consumer demand for payment services, but detailed analysis of their complex ecosystems, individual features and specific functions is important in order to understand the possible implications in terms of risk and regulatory approaches. Depending on their specific design features, stablecoins’ asset management function could be covered by existing regulations governing e-money, banks or investment funds. However, the technological, legal and operational specificities of stablecoins also allow for design options whereby the asset management function would not be covered by the current regulatory framework. A key issue in this respect is the question of whether end users have a formal claim on the assets backing the stablecoin.

If a stablecoin arrangement reaches a global scale, its malfunctioning could pose risks to the financial system. The asset management function of a global stablecoin arrangement could be similar in substance to a global money market fund whose shares are held by retail users. With stablecoins promising stability, such retail clients could assume that their coin holdings are as safe as bank deposits and can be transferred and spent just as easily and safely. Such a perception would underestimate the risks that are involved in what is effectively an investment in financial assets with payment and transfer functions attached. A sudden realisation of these risks could trigger systemic consequences, the severity and impact of which would depend on the size and interconnectedness of the stablecoin arrangement in question. As the simulation in this article shows, a global stablecoin could, in certain circumstances, grow to such a size as to become systemically relevant.

To reap their potential benefits without undermining financial stability, we must ensure that stablecoin arrangements do not operate in a regulatory vacuum. As our analysis shows, vulnerabilities in the asset management function could trigger a run on a stablecoin which could result in significant risks to financial stability. In order to reduce such risks, promoters of stablecoins should design their arrangement in such a way that they comply with existing regulations (such as the EMD, the UCITS Directive, the AIFMD or the MMF Regulation). Alternatively, a new regulatory framework must be put in place to address risks and ensure that confidence in such arrangements can be sustained even in the presence of stress. Looking beyond the asset management function, the global and complex nature of stablecoin arrangements means that such a framework must be (i) comprehensive (i.e. it must cover the asset management, payment and customer interface functions), (ii) holistic (i.e. it must recognise the role played by interaction between the arrangement’s various entities and functions in terms of amplifying and compounding risks) and (iii) coordinated at international level (i.e. regulatory action in one jurisdiction may not be effective unless it is accompanied by coordinated actions elsewhere, which may entail a need for cooperative arrangements).

References

Bloomberg (2019), “World’s no. 1 money-market fund shrinks by $120 billion in China”, 6 September.

Bullmann, D., Klemm, J. and Pinna, A. (2019), “In search for stability in crypto‑assets: are stablecoins the solution?”, Occasional Paper Series, No 230, ECB, August.

De Guindos, L. (2019), “Financial innovation for inclusive growth: a European approach”, speech in Madrid on 13 December.

EBA (2019), “Report with advice for the European Commission on crypto-assets”, 9 January.

Fitch (2017), “Comparing the World’s Two Largest Money Funds (More Risk for World’s Biggest, China’s Yu’E Bao, than JPM USG MMF)”, December.

Fitch (2019), “European Money Market Fund Compare”, September.

G7 Working Group on Stablecoins (2019), “Investigating the impact of global stablecoins”, October.

HM Treasury (2009), “The nationalisation of Northern Rock”, report by the Comptroller and Auditor General, HC 298 Session 2008-09, March.

Libra Association (2020), “White Paper v2.0”, published online: https://libra.org/en-US/white-paper; last accessed 22 April 2020.

McCabe, P. (2010), “The cross section of money market fund risks and financial crises”, Finance and Economics Discussion Series, No 2010-51, Federal Reserve Board, September.

Wall Street Journal (2016), “PayPal Isn’t a Bank, But It May Be the New Face of Banking”, 1 June.

Valuable comments and suggestions were also made by Peter Kerstens, Florian Denis and Philippe Molitor, as well as several colleagues at the European Central Bank.

See De Guindos (2019).

The most commonly used stablecoin is issued by Tether. By March 2020, Tether’s market capitalisation was more than USD 4.6 billion, but its use is almost entirely limited to the crypto-asset market. Other examples include Fnality and JPM Coin. Facebook recently announced that it was launching a new stablecoin named Libra in cooperation with a group of multinational corporations, with the currency being operated by an umbrella organisation called the Libra Association.

See EBA (2019) for an assessment of EU law’s applicability to crypto-assets.

Under Article 4(1)(1) of the Capital Requirements Regulation, a credit institution is defined as “an undertaking the business of which is to take deposits or other repayable funds from the public and to grant credits for its own account”.

See Directive 2009/65/EC of the European Parliament and of the Council of 13 July 2009.

See Directive 2011/61/EU of the European Parliament and of the Council of 8 June 2011.

See Regulation (EU) 2017/1131 of the European Parliament and of the Council of 14 June 2017 on money market funds.

See also Letter from the ECB President to Mr Paul Tang, Mr Joachim Schuster, Mr Jonás Fernández, Ms Neena Gill, Ms Aurora Lalucq, Mr Eero Heinäluoma, Members of the European Parliament, dated 19 December 2019.

See G7 Working Group on Stablecoins (2019).

Crucially, a stablecoin arrangement where reserve assets are invested in multiple fiat currencies (i.e. a basket of currencies) will find it hard to guarantee the coin’s value in a given local currency. Thus, end users will be exposed to the foreign exchange risks that are involved in buying a stablecoin using local currency and exchanging it back into local currency at a later stage, on top of any foreign exchange risk that may be embedded in the assets backing the coin. In contrast, a stablecoin arrangement that is backed one-to-one by a single fiat currency will guarantee the coin’s value in the backing currency. Even then, though, end users who do not earn income in that currency will still be exposed to foreign exchange risk. Furthermore, if a global arrangement has a substantial number of users from countries with a currency other than the backing currency, that could lead to significant flows into and out of the backing currency, resulting in volatility.

That stability is due in part to the existence of deposit guarantee schemes for retail deposits.

See Wall Street Journal (2016) for a discussion of PayPal’s role in the financial system.

See Fitch (2017) for a detailed description of the Yu’E Bao money market fund.

The second version of Libra’s white paper (see the Libra Association, 2020) proposes the introduction of single-currency Libra stablecoins in addition to the multi-currency stablecoin that was announced previously. It is proposed that the multi-currency coins shall constitute an aggregation of separate single-currency coins with fixed nominal weights of, among others, 50% for a USD-backed coin and 18% of a euro-backed coin.

A significant share of this sovereign debt market segment currently trades at negative yields, making it challenging to maintain a full backing of all outstanding Libra coins by the reserve without the collection of further revenues, for example in the form of fees from users.

In fact, in response to its interactions with central banks and supervisory authorities, the Libra Association (2020) proposed policy tools that are commonly used to contain runs on investment funds, such as redemption notice periods and early redemption haircuts.