Taking stock of the Eurosystem’s asset purchase programme after the end of net asset purchases

Following the Governing Council’s decision in December 2018 to end net asset purchases under the Eurosystem’s asset purchase programme (APP), this article reviews the implementation and effects of the asset purchases. The APP has proved to be an adaptable and effective instrument to ease monetary and financial conditions, foster economic recovery, counteract disinflationary pressures and anchor inflation expectations, thereby supporting a sustained adjustment in the path of inflation towards price stability. The APP has been part of a package of policy measures together with negative interest rates on the deposit facility, forward guidance and targeted longer-term refinancing operations (TLTROs), jointly creating synergies that have enhanced the effectiveness of each of the package’s individual components. From an implementation viewpoint, the Eurosystem ensured that asset purchases were conducted smoothly and flexibly by striving for market neutrality and mitigating unintended side effects for market functioning.

Whereas net asset purchases have come to an end, principal payments from maturing securities purchased under the APP will continue to be reinvested as this, together with enhanced forward guidance, provides the monetary accommodation that the Governing Council judges to be required for the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term.

1 Introduction

The APP is part of a package of policy measures that was initiated in mid-2014 to support the monetary policy transmission mechanism and provide the amount of policy accommodation needed to ensure price stability. The room for further interest rate cuts had become very limited after monetary conditions were eased in the wake of the financial and sovereign debt crises by cutting key interest rates and deploying unprecedented measures to support monetary policy transmission. The APP, in combination with negative interest rates on the deposit facility, forward guidance and TLTROs, has helped the ECB meet its price stability objective. The APP comprises the third covered bond purchase programme (CBPP3, launched on 20 October 2014), the asset-backed securities purchase programme (ABSPP, launched on 21 November 2014), the public sector purchase programme (PSPP, launched on 9 March 2015) and the corporate sector purchase programme (CSPP, launched on 8 June 2016). APP net asset purchases were conducted until the end of December 2018, involving a total amount of €2.6 trillion. A snapshot of the APP portfolio in December 2018 shows the PSPP contributing the largest share, accounting for 82% of the total net purchases, followed by the CBPP3 (10%), the CSPP (7%) and the ABSPP (1%). The size of the APP portfolio is currently being kept stable by reinvesting principal payments from maturing securities.

2 The monetary policy rationale for launching the APP

Following a double-dip recession in the wake of the financial and sovereign debt crises, the euro area experienced a prolonged period of deleveraging, an atypically shallow recovery and persistently weak inflation. Bank lending conditions started to deteriorate and loan volumes (in particular those involving non-financial corporations) to contract at the end of 2011. Persistent weakness in the underlying growth momentum perpetuated capacity underutilisation, as also visible in high levels of unemployment. Inflation rates exhibited a protracted downward trend: in the core components, this was due to the general economic weakness, while declines in energy and food prices influenced the headline readings. Euro area inflation was generally projected to remain weak and fall over time, as reflected in successive downward adjustments in macroeconomic projections by most international organisations and the ECB (see Chart 1). Euro area annual HICP inflation fell to -0.2% in December 2014, and Eurosystem staff macroeconomic projections entailed further substantive downward revisions of inflation forecasts, from 1.1% to 0.7% in 2015 and from 1.4% to 1.3% in 2016.

Chart 1

Actual and projected HICP inflation with revisions

(percentages, year-on-year)

Sources: Eurosystem staff macroeconomic projections and ECB calculations.

Notes: The grey lines in the chart refer to projected HICP inflation underpinning the (Broad) Macroeconomic Projection Exercise ((B)MPE) projection vintages in 2014 and 2018.

Persistently weak inflation in 2013-2014 contributed to a downtrend in inflation expectations and an increasing risk of those expectations becoming unmoored from the ECB’s price stability objective. Market-based measures of inflation expectations drifted to extraordinarily low levels. At the end of December 2014 the option-implied probability density function of euro area inflation indicated that markets assigned a probability of almost 50% to deflation and saw only a marginal probability of annual inflation reaching a level close to 2% or above (see Chart 9 below). These developments indicated risks that too prolonged a period of low inflation could become entrenched in inflation expectations, with adverse consequences for price stability.

To reverse the downtrend in inflation and forestall a disanchoring of inflation expectations, the APP was designed to expand and complement existing monetary policy measures. With the APP, announced in January 2015, the PSPP, an additional programme consisting of purchases of debt securities issued by public entities, was launched to complement the two ongoing asset purchase programmes, the CBPP3 and the ABSPP.

During the period 2015-2018 net asset purchases under the APP were the principal instrument of monetary policy and their size and duration were linked to achieving a sustained adjustment in the path of inflation towards price stability. In January 2015, following the APP announcement, net asset purchases were made the principal policy instrument and the Governing Council adopted a structured forward guidance. The first building block of this guidance pertained to the principal instrument itself and featured a combination of a time-dependent and state-dependent formulation. The time-dependent leg stated that the net asset purchases were intended to run at a certain monthly pace at least until a specific date (see Figure 1). The state-dependent leg established an explicit link to the price stability objective (“or beyond, if necessary, and in any case until the Governing Council sees a sustained adjustment in the path of inflation consistent with its inflation aim”). As shown in Figure 1, following the first announcement in January 2015 the Governing Council extended the programme through a series of recalibrations, in which the minimum horizon for the monthly purchases was pushed back sequentially and the pace of purchases was adjusted as necessary to advance progress towards the sustained adjustment. The second building block of the forward guidance pertained to the period over which the Governing Council expected that it would not be appropriate to raise the key ECB interest rates. In March 2016 the length of that period was linked to the end of the net asset purchases.

Figure 1

Summary of the APP and other policy measures between June 2014 and December 2018

Source: ECB.

Notes: MRO indicates the interest rate on main refinancing operations, MLF the interest rate on the marginal lending facility and DFR the interest rate on the deposit facility.

The Governing Council adopted APP modalities in accordance with the primary objective of price stability. APP design features were geared to provide the degree of policy accommodation necessary to deliver on the price stability mandate when it was hardly possible to lower key interest rates any further. In line with the prohibition on monetary financing laid down in Article 123 of the Treaty on the Functioning of the European Union, purchases of public sector securities were limited to the secondary market.

The APP was designed to take into account both market structures and the institutional set-up of the euro area. Purchases of public debt instruments were guided by the ECB capital key, which specifies the share of the ECB’s capital attributable to each of the national central banks. At the same time, private sector programmes were based on the market capitalisation of the eligible bonds included in the purchases.

3 Implementation issues

Market neutrality

When implementing the APP, the Eurosystem aimed to ensure market neutrality in order to minimise the impact on relative prices within the eligible universe and unintended side effects on market functioning. For instance, while aimed at affecting bond prices, the APP purchases were conducted with a view to preserving the price discovery mechanism and limiting distortions in market liquidity. Key features designed to ensure market neutrality in APP implementation are detailed below.

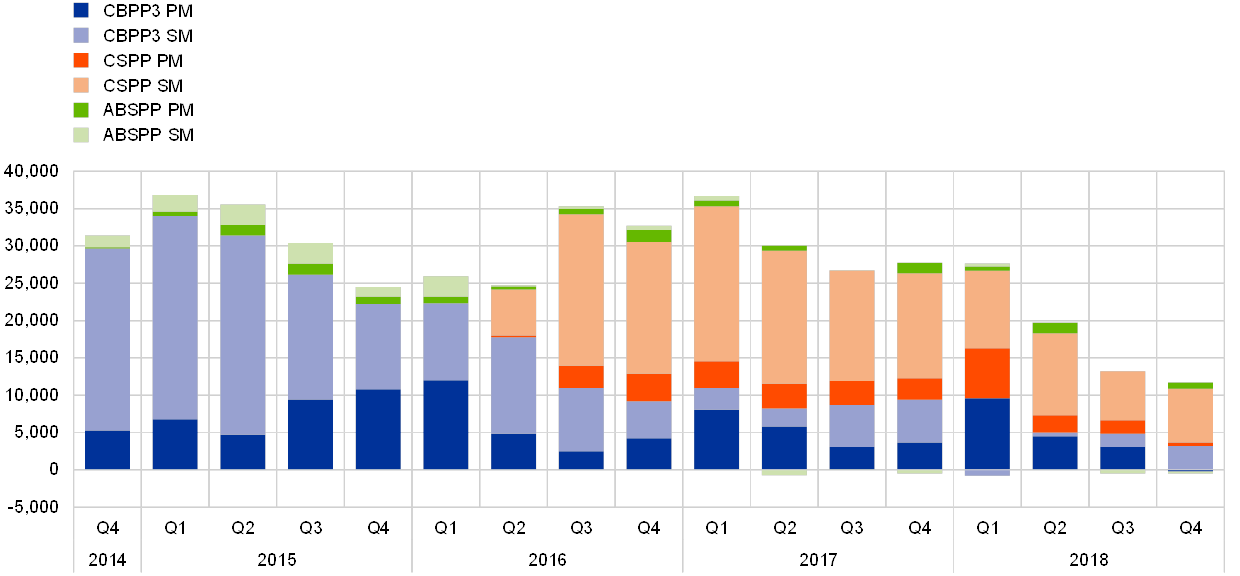

Clear and observable monthly APP targets were defined, with seasonal patterns in market liquidity also being taken into account. The average monthly APP target set ex ante by the Governing Council was decomposed internally into monthly purchase guidance per programme. The programme operating in the most liquid market, the PSPP, acted as a buffer to ensure the precise fulfilment of the overall monthly purchase target. In addition, the Eurosystem took into account seasonal patterns in fixed income market activity, such as the decline in market liquidity from mid-July to late August and in December. Purchase activity was front and back-loaded around these periods (see Chart 2). In all months, the purchase guidance was expressed in monthly totals, rather than strict daily volumes, providing flexibility in the day-to-day execution of purchases.

Chart 2

Pace and composition of net APP purchases

(EUR billions)

Source: ECB.

Note: The average monthly APP targets were first set by the ECB Governing Council at the beginning of the PSPP in March 2015.

Comprehensive ex ante communication on the operational parameters of the APP supported the price discovery mechanism. The parameters defined the operational scope of the APP through (i) stringent eligibility criteria aligned with the procedures in place for the Eurosystem collateral framework[1] and using the expertise of Eurosystem collateral management experts, (ii) maturity restrictions,[2] (iii) the exclusion of certain issuers,[3] (iv) pricing frameworks to ensure that purchases were conducted taking into account available market prices, and (v) different limit systems.[4]

The Eurosystem took a rule-based approach to the composition of purchases with a view to maintaining adequate diversification across issuers and counterparties. APP purchases were broad-based across jurisdictions, maturity segments, issuers and types of eligible bond in terms of different coupon types or different collateral types, for instance. For the PSPP, the ECB’s capital key provided a straightforward, stable guideline for the composition of purchases across jurisdictions.

The Eurosystem geared its monthly purchase allocation to align a jurisdiction’s share in the stock of PSPP purchases as closely as possible with the respective share of the ECB capital key by the end of the net asset purchase phase. Chart 3 illustrates the deviation of the share of cumulative net purchases at the end of 2018 relative to the ECB capital key for each jurisdiction. For instance, the Eurosystem’s stock of German securities at the end of 2018 was 4.5% above the German share of the ECB capital key. This surplus equates to €22.3 billion.

Chart 3

Deviation in the share of net cumulative purchases relative to the ECB capital key at the end of 2018

(percent)

Source: ECB.

A relative share of the PSPP stock above the ECB capital key in a jurisdiction resulted mechanically from the need to offset downward deviations in other jurisdictions. These downward deviations arose for two reasons. First, Greek government bonds were ineligible for the PSPP over the entire net asset purchase phase. Second, limitations were experienced in the availability of bonds for purchase, which arose, for instance, as bonds were held by hold-to-maturity investors or because of the overall size of the eligible universe in some jurisdictions.

APP purchases were executed regularly, while some flexibility was maintained to adapt to prevailing market conditions (see Box 1). The Eurosystem aimed to maintain a continuous market presence throughout the day, thereby avoiding temporary market dominance. Depending on a central bank’s operational modalities, flexibility can relate inter alia to the selection of securities to purchase, the timing of operations and the overall purchase amount for the day. Moreover, spreading purchases flexibly across the different asset classes included in a programme also helped to preserve market neutrality. As an example of this flexibility, the share of regional government purchases as a proportion of total PSPP purchases fluctuated significantly in 2018 (see Chart 4).

Chart 4

Central government, agency and regional government purchases

(percentage shares of PSPP purchases)

Source: ECB.

Box 1Purchase methods

The Eurosystem executed close to 225,000 transactions under the APP between 2014 and 2018. These transactions were conducted in accordance with the conventions of the respective fixed income market and alongside other market participants. Over time, the Eurosystem fine-tuned its purchase methods to reflect evolving market conditions. This box describes the main purchase elements of the APP.

All Eurosystem NCBs and the ECB executed APP purchases, with the ECB also coordinating the implementation of the programmes. PSPP purchases were conducted by the entire Eurosystem. The CBPP3 was executed by a large number of NCBs and the ECB, while six specialised NCBs[5] bought assets under the CSPP. As of April 2017, ABSPP purchases have been conducted exclusively by six NCBs acting as internal asset managers.[6] Prior to that, external asset managers and some NCBs had conducted the ABSPP purchases together.

Purchases under the private sector programmes were conducted alongside other market participants in both the primary and the secondary market, with the proportional shares varying over time as a reflection of issuance patterns and secondary market liquidity (see Chart A). The standard Eurosystem primary market bid size was set with a view to striking a balance between supporting individual issuances and drawing on the flexibility offered by secondary market purchases.

Chart A

Private programme purchases broken down by primary and secondary market

(EUR millions)

Source: ECB.

Notes: Purchases approximated from change in holdings. Negative values for a subcategory indicate that redemptions were greater than gross purchases for that period.

The majority of APP purchases were executed by bilateral trades with counterparties. These trades were conducted via major electronic platforms and by voice. Bilateral trading entails responding flexibly to market participants’ offers, requesting prices from several counterparties for the same security and then trading at the best price. Bilateral trades are particularly well suited to the liquidity and heterogeneity of euro area bond markets as they can be tailored to market conditions in order to avoid market distortions. For instance, the PSPP purchased securities of 110 issuers,[7] while other major central banks generally purchased only a single sovereign issuer when implementing their large-scale asset purchase programmes.

The Deutsche Bundesbank, the Banque de France, Lietuvos Bankas and De Nederlandsche Bank conducted regular auctions in specific market segments when implementing the PSPP. The decision to use auctions reflected the intention to achieve certain volumes while also taking account of transparency considerations. In the days before each auction, market participants were provided with a list of securities that each NCB was considering buying at prevailing market prices. This gave counterparties a well identified “liquidity window” every week to communicate their interest in selling specific securities while being guaranteed equal pricing. Some NCBs focussed their auctions on illiquid bonds, which were difficult to source bilaterally, while others used auctions for liquid bonds to foster price transparency for other market participants. The Eurosystem applied the same trading rules to align the purchase price in bilateral trading and reverse auctions with the prevailing market offer price.

Bid wanted in competition (BWIC) is a transaction method specific to the ABS market. BWICs are organised by dealers on behalf of investors to sell ABS holdings while ensuring best execution by inviting a large range of potential buyers. The ABSPP regularly participated in BWICs for both liquid and less liquid jurisdictions and across all ABS collateral types. The share of ABSPP purchases executed through BWICs was relatively low, however, as the Eurosystem aimed to purchase at market prices without pushing prices to artificially high levels. The ECB set up a governance structure to assess all securities purchased and provide guidance on appropriate market pricing.

Fixed income market liquidity and its interaction with APP implementation

The APP purchases were executed in a way that aimed to safeguard the liquidity of euro area fixed income markets. Eurosystem staff regularly assessed bond market liquidity indicators. Taken together with market intelligence, these assessments indicate that the design of the APP has been successful in mitigating potential detrimental effects on market functioning and that the impact of the APP on market liquidity has been at most transitory.[8]

Daily purchase modalities, and in particular the day-to-day selection of securities to be purchased, were applied with a view to preserving market liquidity conditions. The Eurosystem actively incorporated the offers from a broad range of counterparties in the daily bond selection. In addition, significant efforts were undertaken to avoid buying securities that were scarce, as measured by such metrics as relative value indicators, pricing in the repo market and trading volumes.

The size of individual transactions was responsive to the observed offer sizes. For APP transactions, the average secondary market transaction ranged from €4 million in the CSPP to €14 million in the PSPP. These averages mask compositional heterogeneity, with transaction sizes increasing for more liquid securities and declining for illiquid bonds.

Using a broad set of counterparties facilitated the smooth implementation of purchases and fostered competition, with the Eurosystem trading with more than 350 counterparties. A very large majority of APP purchases involve counterparties located in a different country from the purchasing central bank, which also impacted the distribution of Target 2 balances across jurisdictions.[9] Individual central banks expanded their set of counterparties in order to reach all relevant segments of the fixed income market. APP implementation thus avoided persistent effects in the micro-structure of bond market segments through the competitive use of counterparties. Against this background, the Eurosystem adopted a wide range of transparency tools to minimise the informational advantages for eligible counterparties. These initiatives helped to level the playing field among financial market participants while preserving the timely execution of operations (see Box 2).

Box 2Providing additional transparency on aggregate APP holdings

Transparency has played a central role in the APP by allowing market participants to better understand how the programmes are implemented. The regular disclosure of information on APP purchases and holdings on the ECB website was complemented by additional information on the CSPP in a box in the June 2017 issue of the Economic Bulletin.[10] Similar data on the aggregate holdings of the CBPP3 and the ABSPP are presented below. In addition, the box provides a comparison of the weighted average maturity of PSPP net cumulative purchases with the relevant eligible universe.

CBPP3 purchases were broadly oriented towards a market capitalisation-based benchmark of eligible securities, with due consideration being given to market liquidity conditions. This allowed purchases to be conducted across a broad range of countries on an ongoing basis. The Eurosystem was responsive to the availability of individual bonds in day-to-day implementation.

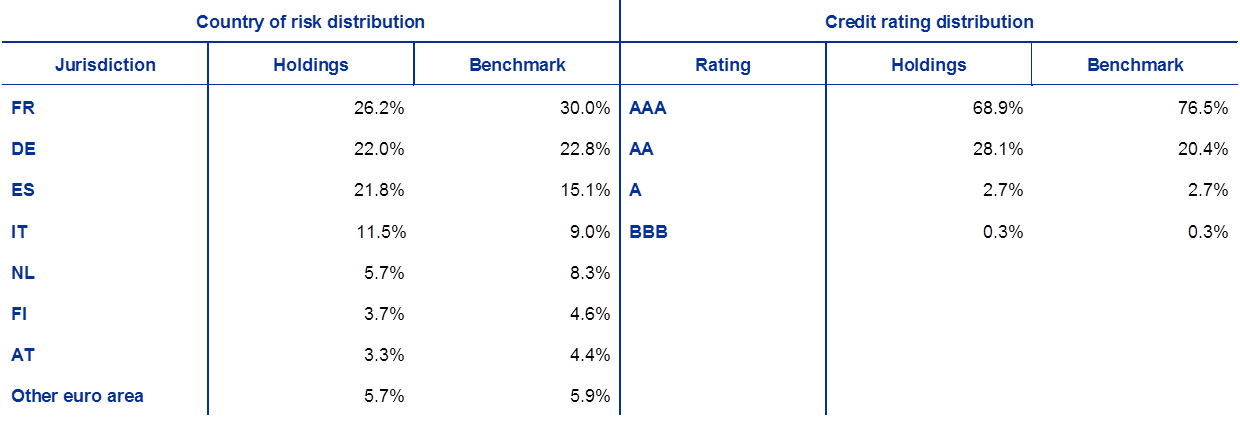

Table A

Country and rating distributions of CBPP3 holdings and benchmark at the end of 2018

Sources: ECB and ECB calculations.

Notes: The benchmark is constructed using the universe of eligible securities pertaining at the end of 2018. The weights of certain covered bond classes have been adjusted lower to reflect their lack of availability and illiquidity. Only bonds with an asset rating are included in the data for the credit rating distribution. The ratings are first-best asset ratings. The distributions are by nominal value.

The market capitalisation approach evolved over time, with the benchmark weights attached to certain securities decreasing as some covered bond categories were found to be increasingly hard to purchase. For example, the launch of TLTRO-II increased the attractiveness of retaining covered bonds as collateral rather than placing them in the market. To account for this, the relative weight of retained covered bonds was reduced in the eligible CBPP3 benchmark.

To accommodate the dynamic nature of the CBPP3-eligible universe, with its variable issuance patterns and liquidity conditions across jurisdictions, the market capitalisation-based benchmark was updated regularly so as to guide future purchases. This evolutionary approach is the main explanation for the differences evident in Table A, where, for example, CBPP3 holdings in Spanish covered bonds are considerably higher than the current benchmark would imply. At the same time, the share of French covered bonds in the holdings has increased over time, guided by an increase in their benchmark weight. The deviations in the rating distribution between CBPP3 holdings and the current benchmark also reflect the outcome of the evolutionary approach.

Turning to the ABSPP, the cumulative gross purchases have been added to the presentation of holdings to provide a more accurate illustration of implementation across the Eurosystem (see Table B). This additional information is needed to reflect the faster repayment of ABSs compared to other fixed income asset classes, with cumulative gross purchases of €51.6 billion set against holdings of only €27.5 billion at end-2018.

Table B

Country, collateral and rating distribution of ABSPP holdings and universe at the end of 2018

Sources: ECB, Bloomberg, company publications.

Notes: The universe is a theoretical measure of the purchasable senior tranche securities eligible as Eurosystem collateral outstanding at the end of 2018. Credit rating distribution based on second-best rating consistent with collateral eligibility. The distributions are by outstanding amount.

Gross ABSPP purchases were more broadly distributed across jurisdictions than the holdings at the end of 2018 would indicate, reflecting the prevalence of different asset types in each country. For example, auto ABSs dominate the German ABS market. These securities have a much lower weighted average life than residential mortgage backed securities (RMBS), which are more common in the Netherlands. Furthermore, the portfolio composition also reflected market capitalisation and market liquidity. Core markets with lower yielding securities generally had a higher number of actively offered securities, which has led to some over-representation of Dutch RMBS in the portfolio, for example. At the same time, non-core and higher yielding securities were largely held by hold-to-maturity investors and were not offered to the Eurosystem to the same extent. Moreover, there was a higher concentration in securities issued since the start of the ABSPP, given the ability of the ABSPP to make primary market purchases and hence purchase larger volumes in these issues. This resulted in a lower presence in jurisdictions with less issuance since October 2014, such as Spain and Portugal.

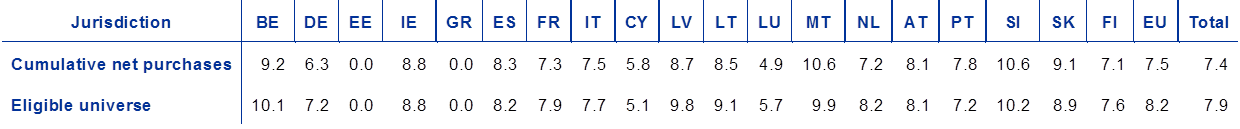

With regard to the PSPP, a comparison of the weighted average maturity (WAM) of cumulative net purchases with the WAM of the eligible universe shows that they were broadly in line with each other at the end of 2018 (see Table C). The dispersion of WAMs of the eligible universe across jurisdictions reflects the past issuance patterns of PSPP-eligible issuers. The WAM measure for cumulative net purchases includes the contribution of bonds which are no longer eligible owing to a maturity of less than one year and broadly reflects the availability of individual bonds for purchase across time. Moreover, securities with short to medium-term maturities at the start of the PSPP were already extensively held by the Eurosystem as a result of the securities markets programme. These holdings limited the ability to purchase such bonds under the PSPP in certain jurisdictions. Therefore, the WAM measure for cumulative net purchases in these jurisdictions is higher than would have otherwise been the case.

Table C

Weighted average maturities by jurisdiction for the PSPP at the end of 2018

(years)

Notes: The WAM measure for cumulative net purchases in jurisdictions which were purchased under the ECB’s securities markets programme (SMP) is higher than would have been the case if many short to medium-term maturity securities had not already been extensively purchased under the SMP.

Securities lending

APP securities lending facilities addressed challenging repo market conditions. Combined with the gradual expansion of PSPP holdings, increasing demand for high quality liquid assets in line with regulatory requirements contributed to challenging repo market conditions through 2016. The Eurosystem purchases reduced the effective availability of securities for market participants, which could have resulted in a shortage of bonds to be used as collateral[11] and lower market liquidity, while possibly impairing the price discovery mechanism. The Eurosystem’s securities lending approach served to minimise such unintended consequences of the APP.[12]

The Eurosystem conducts securities lending activities, which continue in the reinvestment phase of the APP, in a decentralised manner on the basis of common principles. The Eurosystem acts as a backstop without curtailing normal repo market activity.[13] The institutional set-up of the Eurosystem means that securities lending implementation is decentralised and various lending channels are used (e.g. bilateral lending or through custodians). As illustrated in the upper panel of Chart 5, the share of German government bonds trading “special” – that is trading at a premium to general collateral in the repo market – increased markedly in 2016. The Eurosystem responded by introducing a number of modifications to the securities lending facilities, such as the option to borrow bonds against cash collateral. This was introduced in December 2016, effectively increasing the supply of bonds available in the repo market and reducing the share of bonds trading special.[14] Several other beneficiary owners also enhanced their securities lending facilities during this period.

Chart 5

Repo market developments for German government bonds – the share of special trades in total volume and the evolution of the repo rate

(percentages)

Sources: ECB calculations, NEX Data and MTS Markets.

Notes: Special trades are defined as volume traded at least 25 basis points lower than the cheapest specific German bond on a given day. They are expressed as a share of total volume on any given day.

The PSPP on-loan balance fluctuated, with peaks occurring at quarter-ends and ahead of futures delivery dates. At the end of 2017, the market value of bonds lent out peaked at €87 billion, €33 billion of which was lent against cash collateral (see Chart 6, right panel). The average monthly on-loan balance however stabilised between €50 billion and €60 billion since mid-2018, representing 2.4-2.8% of the respective monthly PSPP holdings (see Chart 6, left panel).

Chart 6

PSPP on-loan balance divided into loans against securities collateral and cash collateral

(EUR billions)

Sources: ECB calculations.

Notes: Amounts are in market value terms. Starting 15 December 2016, the Eurosystem introduced the option of also accepting cash as collateral in its PSPP securities lending facilities.

4 Transmission and impact on the macroeconomy

Main transmission channels

The APP has provided a substantial improvement in financing conditions via several transmission channels, and each individual policy measure, being part of a package of policy measures, has benefitted from reinforcing synergies. Evidence based on event studies shows that yields fell significantly across all financial market segments following the APP announcement.[15] Over the course of APP implementation, declining bank lending rates and credit expansion helped to ease financing conditions, support a firming of the economic recovery and counter disinflationary forces. As documented by a large body of literature, the APP operates through three main channels: the signalling channel, the portfolio rebalancing channel and the direct pass-through channel.[16] The package of policy measures of which the APP was part has created mutually reinforcing synergies across the individual measures.

Via the signalling channel, the APP has underscored the ECB’s intention to provide sufficient monetary stimulus for an extended period of time, thereby also contributing to anchor policy rate expectations. The APP has enhanced the signal that key policy rates would remain low for long. The signalling aspect of central banks’ large-scale asset purchases has always been found to be an important component of transmission for such policy programmes. This component was reinforced in March 2016, when the Governing Council’s communication of the expected future rate path was made conditional on the end of net asset purchases.

Via the portfolio rebalancing channel, the APP has compressed yields across a wide range of asset classes, with negative rates on reserves providing additional incentives to the rebalancing process. With the price of the purchased assets being bid up, their yields decrease. The lower yields induce investors to sell these securities, earning the associated capital gain. As sellers may not view holding the liquidity received as being a perfect substitute for the assets sold, they reinvest and rebalance their portfolios towards other assets, such as securities and loans (see also Box 4). This process is reinforced by the negative rates charged on reserves.[17] Consequently, yields also decreased in other market segments not targeted by the central bank purchases, including a rebalancing in non-euro denominated debt and equity markets.[18]

Within the portfolio rebalancing channel, the extraction of duration risk has been a particularly relevant mechanism affecting the term premium component of medium and long-term yields (Box 3). Asset purchases decrease the duration risk borne by private investors, thus increasing their risk-bearing capacity and incentivising them to restore the desired overall risk profile of their portfolio by investing in different assets. Therefore, duration extraction affects the pricing of maturities and asset classes beyond securities purchased.

Via the direct pass-through channel, which comes into play for the ABSPP and the CBPP3 in particular, the APP has directly improved credit conditions for the private non-financial sector. At the same time, the CBPP3 and TLTROs have interacted to foster lending to small and medium-size enterprises (SMEs) as well.[19] More generally, TLTROs have alleviated the funding costs for participant banks, thus mitigating possible negative effects on bank lending stemming from negative rates on reserves. Central bank purchases have raised the price of ABS and covered bonds, lowered the market interest rate paid by the originators and encouraged banks to create more loans with a view to repackaging them and selling them on. Through this mechanism, bond purchases have supported borrowing conditions in the private non-financial sector. Similarly, the CSPP has reduced funding costs for firms accessing financial markets directly and supported a switch from bank funding to market funding for large firms, thereby freeing up capacity on bank balance sheets to finance loans to SMEs.[20]

Box 3The impact of the APP on the term structure of euro area bond yields – a model-based assessment

The term premium component of yields reflects the aggregate duration risk borne by investors. Risk-free long-term bond yields have two components: average expectations of short-term interest rates over the life of the bond and a term premium. The latter comprises the current and future expected risk exposure of individual bonds (their bond-specific duration risk), as well as the compensation per unit of risk exposure. This compensation – the “price of risk” – depends in turn on the aggregate duration risk to be borne by the market.

Central bank asset purchases decrease the overall duration risk to be absorbed by private investors, thus reducing the price of risk and, in turn, the term premium. Importantly, the effect of asset purchases on the term premium depends on the entire path of the duration-weighted bond portfolio acquired. For a ten-year bond, lower aggregate duration risk in, say, five years decreases the required risk compensation in the future and hence also the term premium today.

The APP’s impact on the term premium can be estimated using an arbitrage-free term structure model.[21] The drivers of bond rates are summarised by three factors, one of which reflects the “free float of duration risk” in the hands of those market participants who are deemed willing to rebalance their bond portfolio when bond prices change.[22] The model links current and future changes in the free-float to changes in current term premia and can thereby explain how current and expected future APP volumes affect the yield curve.[23]

The compression in sovereign yields due to the APP-induced reduction in current and expected bond free float is estimated to stand at around 100 basis points for the ten-year maturity (Chart A, left panel). The chart illustrates the impact of the APP on term premia across the term structure at the time when the PSPP was announced and at the end of net asset purchases in December 2018. The term premium impact is larger for longer maturities.

Looking ahead, the substantial stock of acquired assets and the forthcoming reinvestments mean that a sizeable amount of duration risk will continue to be extracted, even after net purchases have ceased (Chart A, right panel). The chart plots the evolution of the ten-year term premium compression, based on the projected free float as at the end of net asset purchases. The term premium impact gradually fades over time, which reflects the ageing of the portfolio i.e. its gradual loss of duration as the securities held in the portfolio mature as well as the run-down of the portfolio that market participants anticipate will eventually follow the end of the expected horizon of reinvestments.

Chart A

Estimated impact of the APP on euro area sovereign yields

Source: Based on Eser, Lemke, Nyholm, Radde and Vladu (2019).

Notes: The left panel shows by how much the term premium component of sovereign euro area yields with maturities of one year to ten years are estimated to be compressed due to the APP, at the time of the launch of the APP (Q1 2015), as well as at the end of the net purchase phase in December 2018. The right panel shows point estimates of the ten-year yield term premia compression over time. The confidence band reflects parameter uncertainty around these point estimates, constructed using bootstrap/Monte Carlo resampling techniques. Euro area yields are proxied by the GDP-weighted zero-coupon yields of the four largest euro area jurisdictions.

Quantifying the impact of the APP on the yield curve is subject to several layers of uncertainty. Accounting for parameter uncertainty in the model estimation suggests that the impact of the APP on ten-year term premia currently lies in a range of 70 to 130 basis points.[24] Additional sources of uncertainty relate to model specification, the estimation window and the quantification of the free float measure.

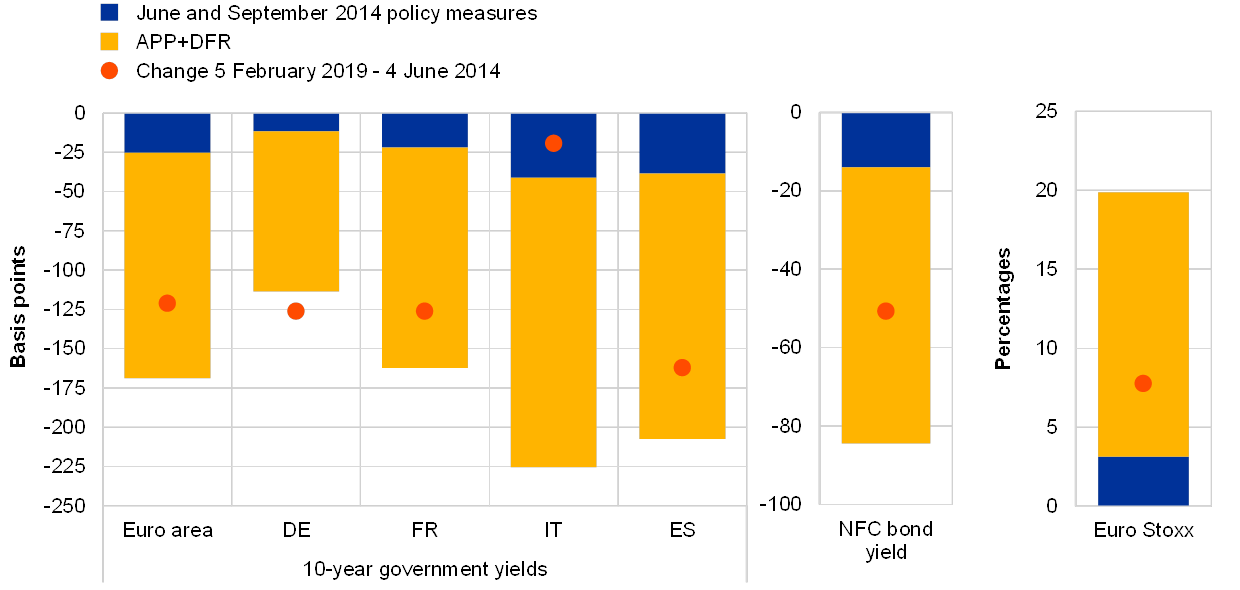

The APP has eased financing conditions across asset classes. Liquidity injected by the APP has tied up short-term money market interest rates at levels close to the ECB’s deposit facility rate and, together with negative rates and forward guidance, anchored the expected path of money market rates in line with the intended policy stance. Chart 7 shows the estimated accumulated easing impact of the APP across asset classes – alongside that from other easing measures – relative to actual asset price changes recorded since 2014.[25] The APP is estimated to have decreased sovereign yields and pushed down yields of bonds issued by non-financial corporations (NFCs), and to have contributed to an increase in share prices.

Chart 7

Impact of policy measures on financial prices and yields

Source: ECB calculations.

Notes: The chart shows the impact of the June and September 2014 policy measures, the APP and cuts in the deposit facility rate (DFR) on financial prices and yields. The impact of the June and September 2014 policy measures is estimated on the basis of an event-study methodology which focuses on the announcement effects of these measures; see the ECB Economic Bulletin article entitled “The transmission of the ECB’s recent non-standard monetary policy measures” (Issue 7/2015). The impact of the cuts of the deposit facility rate (DFR) rests on the announcement effects of the September 2014 DFR cut, while the impact of the subsequent DFR cuts is difficult to disentangle from the simultaneous APP adjustments. Both effects are therefore shown jointly. APP encompasses the effects of the asset purchase measures adopted at the Governing Council meetings in January and December 2015, March and December 2016, and October 2017. The January 2015 APP impact is estimated on the basis of two event-study exercises considering a broad set of events that, starting from September 2014, have affected market expectations about the programme; see Altavilla, C., Carboni, G. and Motto, R., op. cit., and De Santis, R., op. cit. The quantification of the impact of the December 2015 policy package on asset prices rests on a broad-based assessment comprising event studies and model-based counterfactual exercises. The impact of the March 2016 and December 2016 policy packages is assessed using model-based counterfactual exercises. The impact of the October 2017 policy package is assessed using two models: a term structure modelling framework similar to the one used in Box 3, and an ISIN-by-ISIN regression framework akin to D’Amico, S. and King, T.B., “Flow and stock effects of large-scale treasury purchases: Evidence on the importance of local supply”, Journal of Financial Economics, Vol. 108, Issue 2, 2013, pp. 425-448.

Banks have played a crucial role in the transmission of net asset purchases to financing conditions. Bank-based financial intermediation remains very important, notwithstanding a trend towards market funding in the financing structure of euro area NFCs over the last decade. The APP, acting in conjunction with negative interest rates on the deposit facility and TLTROs, has incentivised banks to reinvest the proceeds from asset sales into loan creation (see Box 4).

As a result, bank lending rates have steadily declined and converged across euro area countries since mid-2014. Composite lending rates to NFCs currently stand close to record lows (see Chart 8, left panel). Model-based results indicate that the APP and DFR cuts have led to a reduction of around 50 basis points in bank lending rates to NFCs since June 2014 due to their impact on the yield curve.[26] Previously large dispersions in borrowing costs across euro area countries have progressively narrowed to the point of being almost fully reabsorbed.

Chart 8

Cost of borrowing for new NFC loans and MFI loans to NFCs

Source: ECB.

Notes: The indicator for the total cost of borrowing is calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. Loans are adjusted for sales, securitisation and notional cash pooling. MFI stands for monetary financial institutions. The latest observations are for November 2018.

The APP is also found to have contributed significantly to the recovery in loan growth. NFC loan volumes started growing again with positive rates in mid-2015. Model-based simulations suggest that almost half of the annual growth in NFC loan volumes in the third quarter of 2018 (4.3%, see Chart 8, right panel) can be attributed to the effects of the APP.[27] Box 4 provides further details on the bank-based transmission of the APP to lending.

Box 4 Impact of the APP on lending to enterprises

All monetary policy measures taken since mid-2014 have helped to support lending conditions, which makes it difficult to separate out the impact of each individual measure. This identification problem can be addressed by using granular data. It is possible to identify the contribution of the APP to lending to enterprises by matching bank-level qualitative information from the Bank Lending Survey (BLS) with individual bank balance sheet characteristics and lending flows.

Granular data show that banks had diverse liquidity inflows associated with the APP.[28] Asset purchases increase bank liquidity directly through sales of bonds by banks and indirectly through an increase in deposits stemming from their customers’ bond sales. Linking the BLS with balance sheet data confirms that, on average, banks with higher holdings of sovereign bonds just before the APP was launched reported a stronger impact on liquidity from the programme (Chart A, left panel). On average, just over 20% of banks reported a positive impact on liquidity from the programme in net percentage terms, while for the banks with relatively high holdings of sovereign bonds at the end of 2014, the net percentage reporting a positive impact increases by 10 percentage points to over 30%. The banks that experienced an increase in liquidity owing to the APP could then adjust towards other assets, such as loans.

Banks with larger liquidity inflows associated with the APP are found to have recorded stronger loan growth to enterprises following the implementation of the programme. Using BLS data on liquidity inflows to identify banks that were more exposed to the policy, the right panel of Chart A indicates that this group of banks had higher cumulative loan growth than other banks following the introduction of the APP. While Chart A implies that the policy was effective, the trend may be driven by other confounding factors such as the macroeconomic environment, bank business models and the demand conditions faced by the banks that were more exposed to the policy. To make a causal statement regarding the impact of the programme on credit supply, it is necessary to control for these factors. Model-based analysis shows that, even after controlling for bank characteristics (both time-varying and fixed unobservable features), demand conditions and macroeconomic variation, the APP continues to be found a strong driver of higher credit supply for the banks that were more exposed to liquidity inflows associated with the APP.[29]

Chart A

Impact of the APP on bank liquidity and lending

Sources: ECB and ECB calculations; Altavilla, Boucinha, Holton and Ongena (2018).

Notes: The chart on the left hand side shows net percentages, i.e. the difference between the percentage of banks reporting a positive and a negative impact. Banks with high sovereign holdings are those that are in the 75th percentile in terms of their holdings of sovereign bonds relative to main assets in December 2014. Other banks are the remainder. The chart on the right shows the cumulative differences in quarterly growth rates between banks which on average reported that the APP impact on their liquidity position was more positive and other banks. The red line indicates the start of APP purchases in March 2015.

Impact on the euro area economy and inflation, and progress towards a sustained adjustment in the path of inflation

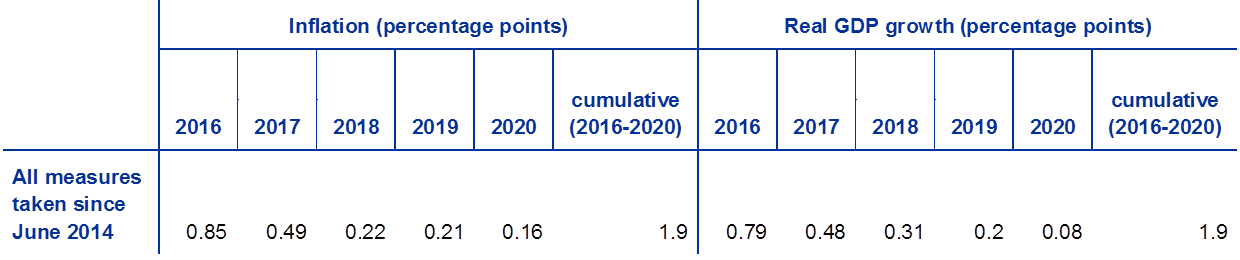

The APP, in conjunction with the other monetary policy measures, has provided a substantial contribution to the economic recovery and the formation of inflation expectations. According to calculations by Eurosystem staff, the overall impact of the policy measures adopted since mid-2014 on the euro area inflation rate is estimated to be around 1.9 percentage points cumulatively between 2016 and 2020, with the strongest impact being felt in 2016 and 2017 (see Table 1). The impact on real GDP growth is of a similar size.

Table 1

Impact of non-standard policy measures on euro area inflation and real GDP growth

Sources: Eurosystem staff calculations and NCB country-based models.

Notes: The table reports the estimated impact of all policy measures adopted since mid-2014. The assessment takes as reference the December 2018 BMPE information set. The estimates are derived on the basis of various modelling frameworks, comprising the suite of models developed by staff of the ECB and NCBs, as well as the NCBs’ country-based models. Totals may not add up due to rounding.

In June 2018 the Governing Council signalled that it expected to end the net purchases by the end of the year, and in December 2018 the decision to terminate the net purchases was confirmed. The decisions taken by the Governing Council at different stages of the asset purchase programme to extend, expand, scale back and finally end net asset purchases have consistently been informed by its assessment of the progress made towards achieving a sustained adjustment in the path of inflation. Upon a review of the progress made, in June 2018 the Governing Council signalled its anticipation that, subject to incoming data confirming the Governing Council’s medium-term inflation outlook, net asset purchases would end in December 2018. The end of net asset purchases was indeed confirmed in December 2018.

The assessment that the progress was substantial was based on a comprehensive review that took into account, among other elements, Eurosystem staff macroeconomic projections, measures of price and wage pressure, and uncertainties surrounding the inflation outlook. The Governing Council’s positive assessment of the progress towards a sustained adjustment of inflation that was carried out in June and December 2018 was underpinned by the stronger anchoring of longer-term inflation expectations, the underlying strength of domestic demand and the continuing ample degree of monetary accommodation, which provided grounds for confidence that sustained convergence would continue and be maintained even after the end of net asset purchases.

Over the course of 2018, the medium-term projections for headline inflation had moved closer to 2% (see Chart 1). Furthermore, uncertainty surrounding the inflation outlook had receded significantly, with the risk of deflation virtually vanishing. Inflation expectations as measured using different sources had been gradually improving, and had moved to levels closer to the ECB’s inflation aim. The predictive distribution derived from model-based assessments, market-based measures of inflation compensation (see Chart 9), and survey-based measures of inflation expectations had shown that substantial progress had been achieved. Moreover, while measures of underlying inflation remained generally muted, labour cost pressures had continued to strengthen amid high levels of capacity utilisation and tightening labour markets, thereby providing additional supporting evidence that the return of headline inflation towards the ECB’s target was sustainable.

Chart 9

Option-implied probability density function of euro area inflation compensation over the next two years

(annual percentage changes, density)

Source: ECB.

Notes: The chart shows the option-implied probability density function based on two-year zero-coupon inflation options. These risk-neutral probabilities may differ significantly from physical, or true, probabilities. They are estimated on the basis of call (“caplets”) and put options (“floorlets”) with different strike rates on the (three-month lagged) euro area HICPxT (ex tobacco) index, assuming Black-Scholes option pricing and implied volatilities that vary across strike rates (“volatility smile”).

Finally, the path of future inflation was judged to have become more resilient over time, making it less reliant on net asset purchases. Consistent with the propagation patterns that are characteristic for standard and non-standard policy interventions, the estimated profile of the impact of net additions to the APP portfolio had a tendency to diminish progressively over time. Based on this evidence, current and future inflation developments could be assessed to be less reliant on net asset purchases.

5 Outlook

The Governing Council’s decision in December 2018 to end net asset purchases was accompanied by the decision to continue reinvesting the principal payments from maturing securities purchased under the APP and to enhance its forward guidance on policy rates and reinvestment. In December 2018 the Governing Council completed the rotation from net asset purchases to policy rates as the new principal policy instrument. As regards the first building block of its forward guidance, and similarly to the structure adopted during the period of net asset purchases, the rate guidance provided by the Governing Council since December 2018 features a time-dependent leg (i.e. key ECB interest rates are expected to “remain at their present levels at least through the summer of 2019”) and a state-dependent leg linking the evolution of policy rates to the price stability objective (“and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”). The second building block of the guidance links the reinvestment horizon directly to the principal policy instrument in a chained manner. Accordingly, the Governing Council currently states its intention to continue reinvesting, in full, the principal payments from maturing securities purchased under the APP for an extended period of time past the date when key ECB interest rates would be raised, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

During the reinvestment phase, the Eurosystem will continue to adhere to the principle of market neutrality built around smooth and flexible implementation. To this end, the principal redemptions will be reinvested with a view to allow for a regular and balanced market presence. In 2019, APP redemptions will amount to EUR 203 billion, implying average monthly reinvestments of nearly EUR 17 billion. Limited temporary deviations in the overall size and composition of the APP may occur during the reinvestment phase for operational reasons. Any adjustment to the portfolio allocation across jurisdictions will be gradual and calibrated as appropriate to safeguard orderly market conditions.

Overall, the APP has helped the ECB fulfil its price stability mandate, making it an effective instrument in the central bank’s policy toolkit. Alongside other policy measures taken since mid-2014, the APP has proved to be an adaptable and effective monetary policy instrument, helping the ECB to carry out its mandate.

- Assets were thus subject to a minimum credit quality requirement of step 3 on the Eurosystem’s harmonised rating scale, which implied having at least one credit rating provided by an external credit assessment institution accepted under the Eurosystem credit assessment framework. Assets were also required to be euro-denominated and issued and settled within the euro area. For ABSs, the underlying debtors were required to be predominantly located within the euro area.

- At the end of 2018, the minimum remaining maturity for the PSPP was one year and the maximum remaining maturity 30 years. The minimum remaining maturity for the CSPP was six months and the maximum remaining maturity 30 years. No maturity restrictions were defined for the CBPP3 or the ABSPP.

- Securities issued by credit institutions were not eligible for the CSPP. Debt securities of bad banks were not eligible for the PSPP.

- The issue share limit for the private sector purchase programmes was 70%, with lower limits for the CSPP in specific cases. The PSPP issue share limit was 33% of the issued amount outstanding, subject to case-by-case verification that it would not lead to the Eurosystem having a blocking majority for the purpose of collective action clauses (in which case it was set at 25%). The PSPP issuer limit was also 33%.

- The six specialised central banks were the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, the Banco de España, the Banque de France, the Banca d’Italia and Suomen Pankki Finlands Bank.

- Central banks involved in this task were the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, the Banco de España, the Banque de France, the Banca d’Italia and De Nederlandsche Bank.

- In addition to the 17 central government issuers, the PSPP purchased securities of 43 PSPP-eligible agencies and of 43 regional governments and six EU supranational institutions as well as one non-financial corporate.

- See Jurskas et al., “Euro area sovereign bond market liquidity since the start of the PSPP”, Economic Bulletin, Issue 2, ECB, 2018, pp. 41-44.

- See Box 1 entitled “The ECB’s asset purchase programme and TARGET balances: monetary policy implementation and beyond”, Economic Bulletin, Issue 3, ECB 2017, pp. 21-26 and Box 2 entitled “TARGET balances and the asset purchase programme”, Economic Bulletin, Issue 7, ECB, 2016, pp. 20-23.

- See Box 2 entitled “The ECB’s corporate sector purchase programme: its implementation and impact”, Economic Bulletin, Issue 4, ECB, 2017, pp. 40-45.

- Government bonds are the main type of collateral used in the euro repo markets due to their safety and liquidity.

- PSPP securities were made available for lending in April 2015, shortly after the start of the purchases. Lending of CSPP securities by Eurosystem NCBs is also mandatory, while lending of CBPP3 holdings is voluntary. However, holdings from each covered bond jurisdiction are made available for lending by at least one Eurosystem central bank. Lending of ABSPP holdings is possible in principle, but no requests have been received since the start of the programme.

- To ensure this, the lending is conducted at a certain spread against general collateral (for lending against securities), and the cash collateral option (for PSPP only) is offered at a rate equal to the lower of the rate of the deposit facility minus 30 basis points and the prevailing market repo rate.

- The overall limit for securities lending against cash collateral was initially set at €50 billion and was increased to €75 billion in March 2018, also reflecting the increase in the stock of acquired assets in the meantime.

- See Dell’Ariccia, G., Rabanal, P. and Sandri, D., “Unconventional Monetary Policies in the Euro Area, Japan, and the United Kingdom”, Journal of Economic Perspectives, Volume 32, Number 4, Fall 2018, pp. 147-172; Altavilla, C., Carboni, G. and Motto, R., “Asset purchase programmes and financial markets: lessons from the euro area”, Working Paper Series, No 1864, ECB, November 2015; De Santis, R., “Impact of the asset purchase programme on euro area government bond yields using market news”, Working Paper Series, No 1939, ECB, July 2016; and De Santis, R. and Holm-Hadulla, F., “Flow effects of central bank asset purchases on euro area sovereign bond yields: evidence from a natural experiment”, Working Paper Series, No 2052, ECB, May 2017.

- For an overview of the channels and further analyses, please see the article entitled “The transmission of the ECB’s recent non-standard monetary policy measures”, Economic Bulletin, Issue 7, ECB, 2015, and the box entitled “Impact of the ECB’s non-standard measures on financing conditions: taking stock of recent evidence”, Economic Bulletin, Issue 2, ECB, 2017.

- See Ryan, E. and Whelan, K., “Quantitative Easing and the Hot Potato Effect: Evidence from the Euro Area Banks”, Research Technical Paper, Vol. 2019, No. 1, Central Bank of Ireland, 2019.

- See “The international dimension of the ECB’s asset purchase programme”, speech by Benoît Cœuré, Member of the Executive Board of the ECB, at the Foreign Exchange Contact Group meeting, Frankfurt am Main, 11 July 2017.

- See the article entitled “MFI lending rates: pass-through in the time of non-standard monetary policy”, Economic Bulletin, Issue 1, ECB, 2017.

- See the article entitled “The impact of the corporate sector purchase programme on corporate bond markets and the financing of euro area non-financial corporations”, Economic Bulletin, Issue 3, ECB, 2018.

- The model is described in more detail in Eser, F., Lemke, W., Nyholm, K., Radde, S. and Vladu, A., Tracing the impact of the ECB’s asset purchase programme on the yield curve, forthcoming as an ECB Working Paper in 2019. This has a similar framework to Li, C. and Wei, M., “Term Structure Modeling with Supply Factors and the Federal Reserve’s Large-Scale Asset purchase Programs”, International Journal of Central Banking, 9(1), 3-39, 2013, which is used by the Federal Reserve to estimate the yield impact of large-scale sovereign bond purchases.

- Non-financial corporations, households, money market funds and monetary financial institutions (excluding the Eurosystem) are considered to be price-sensitive. By contrast, the Eurosystem in terms of both monetary policy and non-monetary policy portfolios non-euro area official sector holdings (in particular central bank foreign exchange reserves), intra-euro area government bond holdings and holdings by insurance companies and pension funds are considered to be price-insensitive.

- The required free-float projections at each point in time are based on the APP parameters communicated by the Governing Council and on private-sector expectations as proxied by survey information.

- Chart 7 presents further evidence using additional methodological frameworks, together with the impact of other measures taken since June 2014.

- Box 3 presents further evidence on the impact of the APP.

- This estimate compares to an overall decline of 129 basis points in bank lending rates to NFCs between June 2014 and October 2018. The estimation is based on lending rate pass-through mechanisms that operate via the relationship between government bond yields and bank funding costs, including: (i) standard pass-through mechanisms used for the projections, and (ii) pass-through models using granular bank balance sheet information. On (ii), see Altavilla, C., Canova, F. and Ciccarelli, M., “Mending the broken link: heterogeneous bank lending and monetary policy pass-through”, Journal of Monetary Economics, 2019, forthcoming. Additionally, the TLTROs provided further downward pressure on bank lending rates.

- The figure reported corresponds to the average of alternative estimates: (i) DGSE simulations aimed at capturing the impact of the APP based on Darracq Pariès, M. and Kühl, M., “The optimal conduct of central bank asset purchases,” Working Paper Series, No 1973, ECB, 2016; (ii) estimates of the impact of the APP based on a VAR with time-varying parameters and stochastic volatility based on a paper by Gambetti, L. and Musso, A., “The macroeconomic impact of the ECB’s expanded asset purchase programme (APP)”, Working Paper Series, No 2075, ECB, 2017; (iii) country estimates of the impact of unconventional monetary policy shocks based on the multi-country BVAR model from Altavilla, C., Giannone, D. and Lenza, M., “The financial and macroeconomic effects of the OMT announcements,” International Journal of Central Banking, Vol. 12(3), September 2016, pp. 29-57.

- See also Altavilla, C., Canova, F. and Ciccarelli, M., op. cit.; Albertazzi, U., Becker, B. and Boucinha, M., “Portfolio rebalancing and the transmission of large-scale asset programmes: evidence from the euro area”, Working Paper Series, No 2125, ECB, 2018.

- See Altavilla, C., Boucinha, M., Holton, S. and Ongena, S., “Credit supply and demand in unconventional times”, Working Paper Series, No 2202, ECB, 2018.