Given the significant increase in the role of market-based finance over recent years, it is important that stress-testing models include amplification effects emerging from market interactions between banks and non-banks. This focus report presents a system-wide stress simulation model and its application to the euro area aimed at capturing two shocks akin to some of those observed at the onset of the COVID-19 pandemic in early 2020. These shocks are a broad-based deterioration in the corporate outlook and a possible credit rating downgrade of some investment-grade (IG) corporate bonds. Within an equilibrium framework, the model simulates interactions among banks, insurers, pension funds, investment funds and hedge funds in asset, funding and derivatives markets, against a backdrop of solvency and liquidity regulatory constraints. The main findings suggest that forced sales by open-ended funds would be by far the most important driver of market dislocation and balance sheet losses.

Since the 2008 global financial crisis, the footprint of non-bank financial intermediaries has increased substantially (Chart A, panel a). Non-banks are an integral part of the financial ecosystem, with insurance companies, pension funds and investment funds being key investors in capital markets (Chart A, panel b) and playing an increasingly important role in financing the real economy.[1] This structural transformation, with markets playing a larger role, comes with new vulnerabilities that may affect financial stability. Above all, investment funds may exhibit procyclical behaviour, i.e. buying assets as prices rise and selling them as they fall. Such behaviour might amplify financial cycles and structurally increase the demand for market liquidity. The March 2020 market turmoil confirmed some of these concerns.

Chart A

Increase in importance of market-based finance over time and model calibration

Sources: European Central Bank (ECB) and ECB calculations.

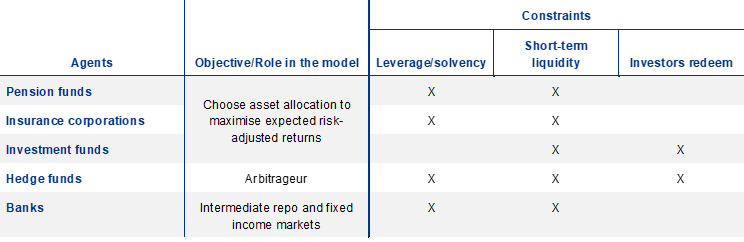

The model used in this article aims to capture and quantify short-term market amplifications in a parsimonious way, while relying on an equilibrium approach where both buyers and sellers of assets are modelled.[2] It uses a set of representative agents corresponding to key sectors of the financial system: banks, insurance companies, pension funds, investment funds and hedge funds. These sectors interact in asset, funding and derivatives markets. A central bank is the ultimate liquidity provider in the repo market. Traded assets are equities, government bonds and corporate bonds. Agents face a range of solvency and liquidity constraints (see Table A), have specific net demand functions for assets, derived from fundamentals and calibrated on real data, and react to exogenous shocks. For each shock, demand function and constraint, the model computes new equilibrium prices for financial assets that clear the markets.

Table A

Agents have different objectives and face different constraints

Agent objectives and constraints

Source: ECB.

The model captures the amplification of initial shocks driven by the behaviour and constraints of the agents concerned. A series of factors, such as large shocks or weak capital or liquidity ratios may generate adverse feedback loops whereby low asset prices can lead to binding solvency and/or liquidity constraints. Agents, such as insurance companies, pension funds and investment funds, endogenously react and reallocate their portfolios based on the investment horizons and assumed behaviours of those portfolios. This leads to banks pulling funding in stress scenarios, which creates greater forced deleveraging, pushing asset prices down further.

The model is run by simulating two shocks akin to some of those anticipated and observed at the onset of the pandemic. The first shock (Shock 1) reflects the deterioration in corporate fundamentals following lockdown measures and the higher economic uncertainty, while the second (Shock 2) aims to capture the large-scale rating downgrade of corporate bonds that was forecast in the early stages of the pandemic. Shock 1 implies that the probability of default of euro area non-financial corporations (NFCs) increases by 30 basis points, reflecting the change in Moody’s one-year-ahead expected default frequencies during the second and third week of March 2020. It also includes a symmetric drop of 30 basis points in the expected dividends of euro area equities issued by NFCs. In the final equilibrium allocation, equity prices drop by almost 20%, while yields on IG bonds issued by euro area non-financial firms increase by 265 basis points (see Chart B, panel a).[3]

Chart B

Price effects and asset flows under the stress scenarios

Source: di Iasio et al. (2022).

Notes: In panel a, the values for fixed income securities are represented as basis points and for losses in equities as percentages. Positive values for equities represent a drop in prices. Shock 1 is the initial shock that corresponds to the deterioration in the corporate outlook, while Shock 2 comes on top of Shock 1 and also incorporates credit rating agency downgrades.

These price dynamics reflect investors’ heterogeneous reactions to the shocks, based on their different speeds of portfolio rebalancing and their risk aversion. Mixed investment funds (mIFs), pension funds (PFs) and insurers (ICs) all pursue target allocations established for risk-return portfolio optimisation. However, amid adverse shocks, mIFs adjust to their new targets faster than ICs and PFs, akin to having ‘shorter investment horizons’, and sell risky assets more aggressively. Selling by mIFs is also amplified by endogenous investor redemptions. Overall, this puts downward pressure on corporate bond prices and reduces sovereign yields. By contrast, both ICs and PFs are longer-term investors and converge to their new targets more slowly. The drop in risky asset prices translates into ICs having below-target allocations of corporate bonds and equities (the opposite holds true for government bonds whose prices tends to appreciate). As a result, insurers rotate from government bonds into IG corporate bonds and equities (see Chart B, panel b). PFs behave similarly to ICs but, owing to higher risk aversion, sell IG bonds under Shock 1.[4] Government bond funds experience inflows, contributing to lower sovereign yields.

The rating downgrade shock puts additional pressure on corporate bond markets, leading to an even stronger drop in prices. According to ECB estimates in Spring 2020 (see ECB, 2020), potential ‘fallen angel’ downgrades of euro area NFC BBB-rated bonds to high yield (HY) in an adverse scenario amounted to €110 billion, and this figure is used to calibrate Shock 2.[5] Almost two-thirds of those bonds are held by the model's private agents, while the remaining are held by the Eurosystem. Holders of fallen angels are hit by mark-to-market losses that affect their portfolio decisions. Furthermore, insurers and pension funds operating under rating mandate restrictions shed fallen angels on the market. In addition, portfolio rotation into IG corporate bonds becomes dominant for PFs when Shock 2 adds to Shock 1 and prices change more strongly. Investment funds face stronger outflows following higher asset valuation losses. Overall, in the new equilibrium, IG corporate bond yields increase by an additional 165 basis points relative to the first shock, while the impact on equities and sovereign bonds remains relatively similar.

Investment and hedge funds bear the largest losses in these scenarios, while other sectors are less affected. The combination of adverse price developments in risky asset markets and endogenous investor redemptions generates a €360 billion decline in the value of assets under management (AuM) for the fund industry (i.e. investment and hedge funds), or 5.3% of their total initial assets (see Chart C, panel a). The rating downgrade shock imposes a further loss of €160 billion, or 2.4% of total initial assets. This is caused by investor sensitivity to negative performance and endogenous outflows. Other investors bear the remaining €330 billion and additional €35 billion total system-wide losses following a deterioration in the corporate outlook and a rating downgrade shock respectively. In relative terms, total losses from both shocks represent 0.8%, 4% and 2.8% of initial total assets for banks, pension funds and insurance companies respectively. Overall, banks, as well as insurance corporations and pension funds (ICPFs) appear to be more stable and resilient under these scenarios, as none of the regulatory constraints embedded in the model kick in.

Chart C

Model sensitivity

Source: di Iasio et al. (2022)

Higher cash buffers at investment funds decrease forced sales and thereby price pressures. In an extension of the simulation, investment funds are assumed to hold 1 percentage point higher cash buffers than under the benchmark calibration and Shock 1 is then re-applied. The increased cash buffers lessen the pressure to sell bonds in the event of outflows and thereby imply a lower drop in corporate bond prices. This effect is mostly relevant for single asset corporate bond funds given that mixed funds can rotate into other assets (see Chart C, panel b).

The losses and dynamics predicted by the model may differ from those that actually materialised for two main reasons. First and foremost, the simulations do not consider the broad-based effects of the various fiscal, monetary, supervisory and regulatory measures that supported the economy and financial system, both directly and indirectly. In addition, the actual rating downgrade shock was much milder than had been expected in the early estimates produced in Spring 2020. Indeed, credit rating agencies took a very gradual approach to rating downgrades, due in part to the swift and major official sector support measures.

The model presented in this special focus is relevant for financial stability surveillance. It provides a parsimonious framework that captures how agents’ interactions and various regulatory/market constraints could amplify shocks, resulting in asset flows, price dislocation and balance sheet losses. Additionally, the model can be used flexibly to test and simulate the effects of regulatory requirements on various market participants during episodes of market stress.

References

Aikman, D., Chichkanov, P., Douglas, G., Georgiev, Y., Howat, J. and King, B. (2019), “System wide stress simulation”, Staff Working Paper, No 809, Bank of England, London, July.

di Iasio, G., Alogoskoufis, S., Kördel, S., Kryczka, D., Nicoletti, G. and Vause, N. (2022), Working Paper Series, European Central Bank, Frankfurt am Main, forthcoming.

European Central Bank (2020), Financial Stability Review, Frankfurt am Main, May.

“Measuring market-based and non-bank financing of non-financial corporations in the euro area”, Financial Integration and Structure in the Euro Area, ECB, April 2022.

See di Iasio et al. (2022) for further details on the model. This model expands the original contribution by Aikman et al. (2019).

In March 2020, firms’ bond yields actually rose by less than 100 basis points, due to central banks’ interventions. The exercise here is illustrative and does not aim at providing a rigorous counterfactual exercise of how spreads would have moved without such interventions.

Portfolio parameters (e.g. risk aversion) are calibrated so that the initial targets reproduce the holdings observed in the data prior to the COVID-19 pandemic.

These estimates were revised downwards later in 2020, as various support measures were introduced by public authorities and credit rating agencies took a very gradual approach in their rating decisions.