Potential impact of government loan guarantee schemes on bank losses

Published as part of Financial Stability Review, May 2020.

Many euro area countries have made loan guarantee schemes a central element of their support packages in response to the coronavirus shock (see Chapter 1). In the face of acute revenue and income losses, these temporary schemes can support the flow of credit to the real economy and thereby help stabilise the banking system. This box sets out an illustrative assessment of how the announced schemes are intended to operate, and how they might affect the scale of losses that banks may face in the quarters ahead.

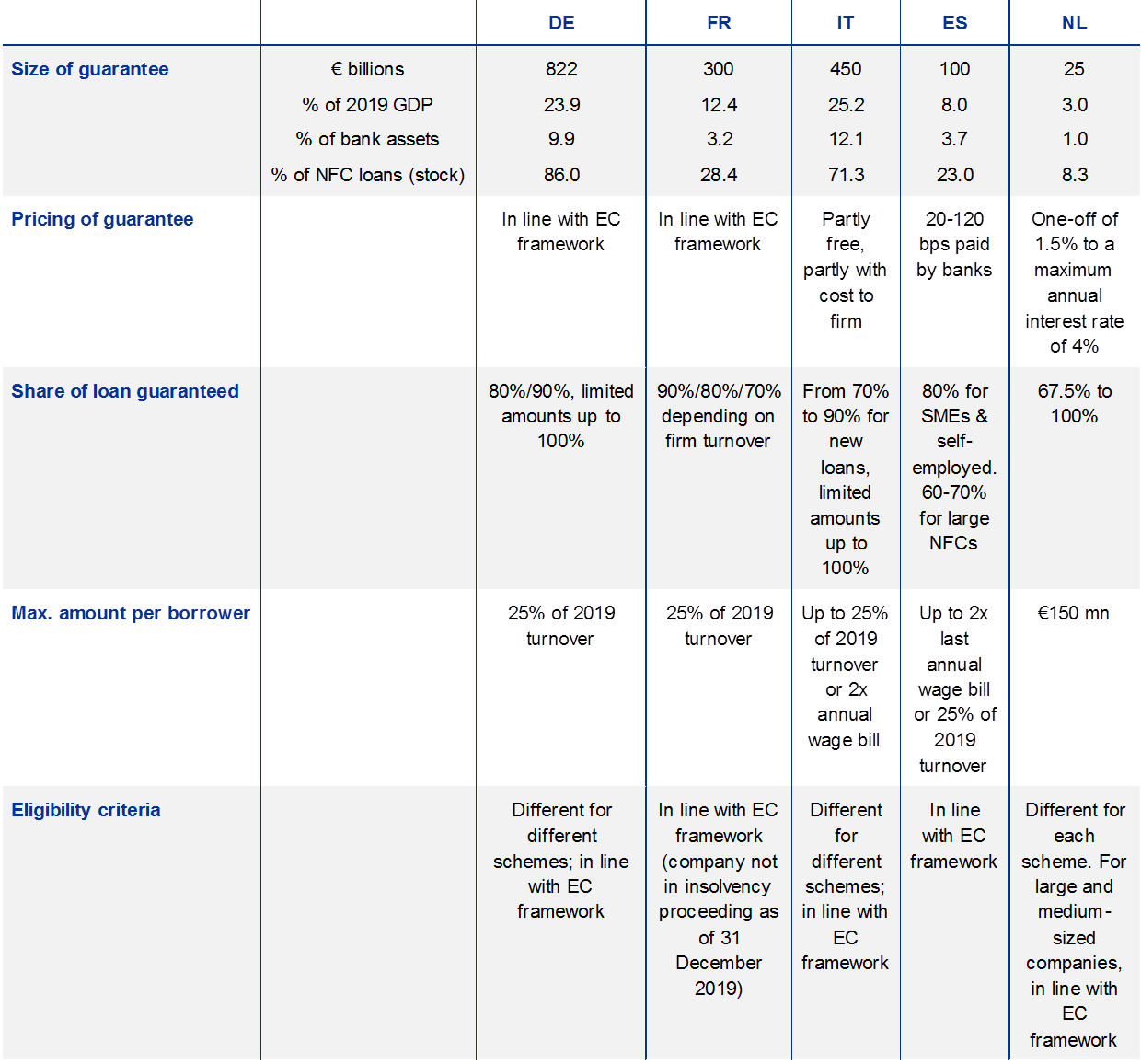

As the schemes are determined at national level, their features, including their size and eligibility criteria, vary across countries. The key parameters of the schemes are the overall size of the guarantee scheme, the pricing of the guarantees, the share of the loan that is guaranteed, the maximum amount per borrower and the eligibility criteria for companies to qualify (see Table A). The European Commission’s temporary framework for coronavirus support measures sets out standards for State guarantees that would remain compatible with the Internal Market.[1] Schemes are aimed at supporting small and medium-sized enterprises (SMEs) and the self-employed, with larger companies also eligible for new lending that can be used as a business lifeline to continue paying suppliers and employees. Loan guarantees are generally short-term (one year), but can rise to up to six years. Pricing generally starts at 25 basis points (bps) for one-year SME guarantees and 50 bps for one-year corporate guarantees. This rises to 100 bps and 200 bps respectively for four and six-year maturity. Loss absorption is generally limited to a maximum of 90% of the loan principal, although in a few countries a limited amount of credit is available with a 100% guarantee.

Parameters of loan schemes vary significantly across countries

Sources: ECB staff and national authorities.Notes: Given the large number of support schemes and the variety in their specific conditions as well as different institutional environments across countries, not all features of guarantee schemes are directly comparable. Bank assets comprise both domestic and foreign assets. The NFC loan stock refers to domestic loans. For DE, the overall size of the guarantees is indicative (unlimited pledge). Pricing in line with the EU framework is staggered according to maturity.

In principle, the schemes can reduce losses incurred by banks on corporate loans and transfer some of the remaining credit risk to governments. Eligible companies can use the guarantees to obtain bridge financing that increases their cash buffers and extends the horizon over which these firms will continue servicing their liabilities, even with limited operating cash flows. Information on the size and eligibility criteria of national schemes can be combined with firm-level data on euro area corporate cash buffers and short-term liabilities to estimate how much of the corporate loan stock can be covered by the guarantees and how additional corporate borrowing under the schemes might reduce the firm’s probability of default . Based on the eligibility criteria outlined in the European Commission’s framework, this sensitivity analysis assumes full deployment of the schemes along the lines of the maximum loan amount per borrower, restricted by the country-specific schemes in Table A. Illustrative estimates considering four scenarios for economic growth and corporate cash flows indicate that full deployment of loan schemes might reduce loan losses by between 15% and 20% for the euro area on aggregate compared with losses without the schemes. About one-third of the losses that would still arise could be transferred to governments via the activation of guarantees (see Chart A).[2]

Illustrative analysis suggests schemes could transfer a significant share of losses to governments

Estimated share of bank loan losses covered by government guarantee schemes under alternative macroeconomic and cash-flow scenarios, assuming full take-up

(range, percentage of total estimated losses)

Sources: ECB, national authorities, Bureau van Dijk and ECB calculations.Notes: The ranges are constructed based on four stylised scenarios. Two of these assume a reduction of each NFC’s cash flows by either 50% or 100% for a period of three months. The other two assume that euro area GDP declines in 2020 by either 8% or 12%. The impact does not take into account the possible benefits from using lower risk weights on guaranteed loans. Full deployment of the available schemes to eligible firms is assumed. The potential utilisation of guarantee schemes is estimated using corporate balance sheet micro data, taking into account the eligibility criteria of the national schemes.

A combination of the starting position of the corporate sector and the design of the scheme will determine the impact in different countries. The larger the overall size of the scheme relative to the economy, the greater the benefit in general in terms of avoiding loan losses. Beyond the overall size of the scheme, the initial cash position and solvency of the corporate sector determines the potential extent to which the additional credit supply may avoid losses arising on corporate debt by bridging liquidity shortages. The corresponding extent to which remaining losses are transferred to the State will depend on the share of firms failing to meet eligibility requirements, for example because they faced pre-existing solvency concerns (see Chart A).[3] In addition, banks would also benefit from a reduction in risk weights as guaranteed loans move to lower sovereign risk weights.[4]

But in reality, the effectiveness of the guarantee schemes hinges on their take-up and the ability of borrowers to access loans quickly. The demand for guarantees is likely to be particularly high in those countries facing larger economic contractions, where SMEs play a more prominent role, where companies rely more on short-term bank financing and where the corporate sector is more indebted. However, actual take-up could be significantly lower than the announced envelopes, as many firms may feel they can manage their cash-flow needs without resorting to guarantees, while other firms may not be eligible, as guarantees are conceived to be provided to companies that were not in financial difficulty before the pandemic. Operational challenges for banks may arise from the need to assess the creditworthiness of a potentially large number of applications in a challenging economic environment, and where applications may also coincide with numerous applications for debt moratoria. For example, if only firms in the most adversely affected sectors[5] take up loans, rather than all eligible firms, the uptake might be about 60% of its maximum potential amount. That said, the share of losses averted and covered by the governments might remain relatively high, as the loans would go to the firms which benefit most from extra bridge financing. Although the take-up of guaranteed loans has so far been limited in some countries, uptake is expected to increase over time.

- [1]See the European Commission’s Temporary Framework to support the economy in the context of the coronavirus outbreak, first announced on 19 March.

- [2]The figures presented only capture effects from loan guarantee schemes and do not take into account other government-sponsored support programmes.

- [3]The results should be interpreted as indicative, as the impact varies by country depending on the assumptions about the design of the scheme and also the estimated shape of the corporate sectors. The vulnerability of the corporate sector is estimated through a representative sample of firm-level data, which is aggregated up to match country-level corporate loan amounts.

- [4]In the case of an exposure being secured by unfunded credit protection, such as a guarantee, the secured part is assigned to the exposure class of the protection provider.

- [5]See the box entitled “Alternative scenarios for the impact of the COVID-19 pandemic on economic activity in the euro area”, Economic Bulletin, Issue 3, ECB, 2020.