- SPEECH

- Los Angeles, 30 September 2019

Globalisation and monetary policy

Speech by Philip R. Lane, Member of the Executive Board of the ECB, at the University of California

It is a pleasure to contribute to UCLA’s Master of Applied Economics Distinguished Speaker Series. [1] Los Angeles is a good setting for me to reflect upon the importance of globalisation: around USD 300 billion of US imports and exports pass through the port here every year – around half of which are to or from China – while Californian firms are at the forefront of many global industries.[2] Globalisation has fundamentally reshaped how the major advanced economies operate (including both the euro area and the United States). The rest of the world is a major destination for the goods and services these design and produce, while providing a broad choice of imports for domestic producers and consumers.[3] Alongside this, the financial systems of the advanced economies have been transformed through global financial flows, while the technological frontier is driven by the global pace of innovation.

It directly follows that central banks must take into account the impact of globalisation on both macro-financial dynamics and the transmission mechanisms through which monetary policy operates. Accordingly, my aim in this lecture is to analyse some dimensions of how globalisation affects the monetary policy of the ECB. To set the scene, I will first review some key indicators of globalisation. I will then outline how globalisation can be incorporated into the conceptual frameworks that we employ to think about monetary policy. And finally, in order to make a direct link between the topic of globalisation and the current conduct of monetary policy, I will discuss the role of external factors in the current slowdown in the euro area.

The evolution of financial and economic globalisation

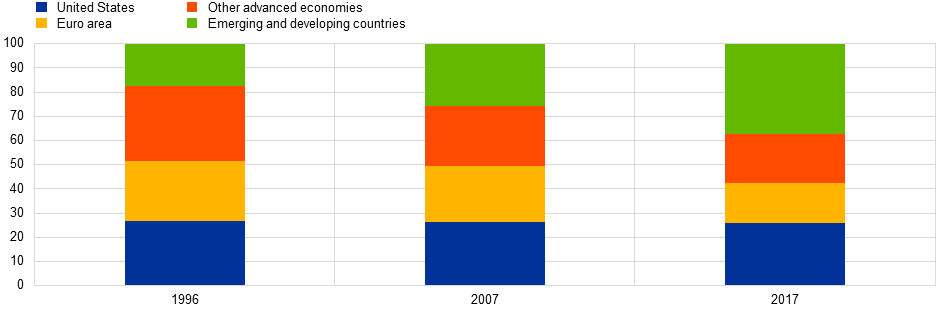

A fundamental shift in the global economy has been the increasing share of emerging and developing countries in world GDP, which has characterised the past two decades (Chart 1). Mechanically, it reflects the higher growth potential of economies that are catching up with advanced economies by closing the technology gap, improving institutional capacity and fostering the accumulation of physical and human capital.[4] And, in the aggregate, faster population growth has also played an important role. Emerging and developing countries were also somewhat less exposed to the excessive leverage and risk-taking that was at the root of the 2008-09 global financial crisis, and their resilience during that period (which also reflected countercyclical fiscal and monetary policy) resulted in a further upward shift in their relative share in global output and gave the momentum of the world economy a crucial boost.

Evolution of distribution of world GDP in USD

(percentage shares of world GDP)

Sources: IMF World Development Indicators and Haver Analytics.

The growing contribution of emerging market economies to global GDP is mirrored in their rising contribution to global trade, as you can see in Chart 2.

Evolution of distribution of world nominal imports in USD

(percentage shares of total imports)

Sources: IMF World Development Indicators, IMF World Economic Outlook and Haver Analytics. Note: For the euro area, the data shown reflect imports of goods and services from outside the euro area.

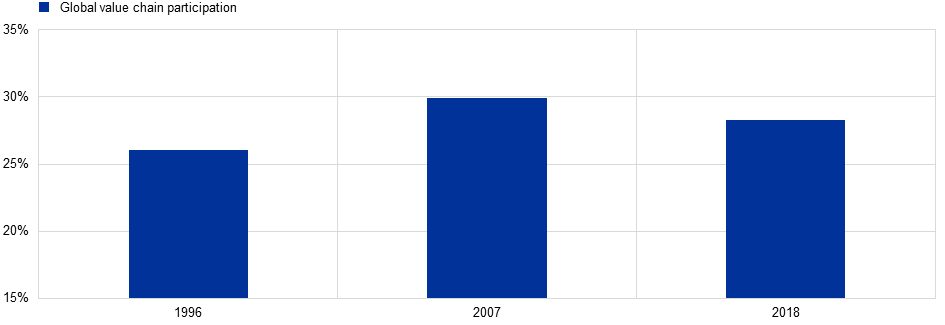

The expansion in international trade has been accompanied by the integration of production activities across borders, both through the expansion of multinational firms and the complex production chains that link firms specialising in different production stages across countries (Chart 3).

Global value chain participation

(foreign value added as a percentage of gross exports)

Sources: UNCTAED EORA database and ECB staff calculations.Notes: The global value chain participation figure for 2018 is based on now-casting. The sample includes 190 countries.

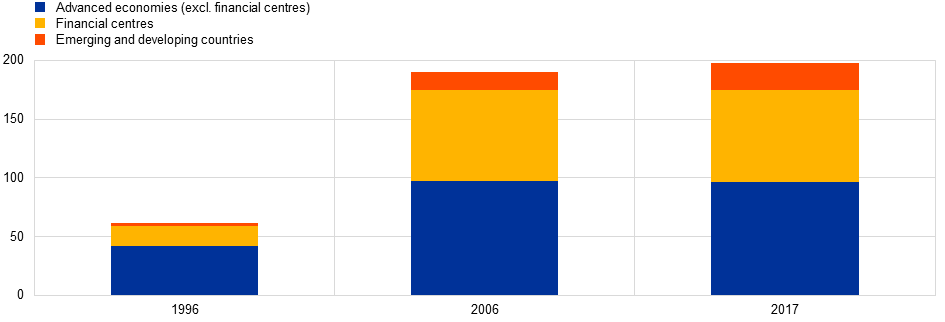

Turning to financial globalisation, indicators of international financial trade increased from the early 1990s until the global financial crisis and have essentially moved in proportion to global output growth since then (Chart 4).

Evolution of external assets

(percentage shares of world GDP)

Sources: External Wealth of Nations database (Lane and Milesi-Ferretti) and ECB staff calculations. Note: Aggregates for advanced economies, financial centres and emerging and developing countries are defined as in Lane, P. R. and Milesi-Ferretti, G.-M. (2018), “The External Wealth of Nations Revisited: International Financial Integration in the Aftermath of the Global Financial Crisis”, IMF Economic Review, 66(1), 189-222.

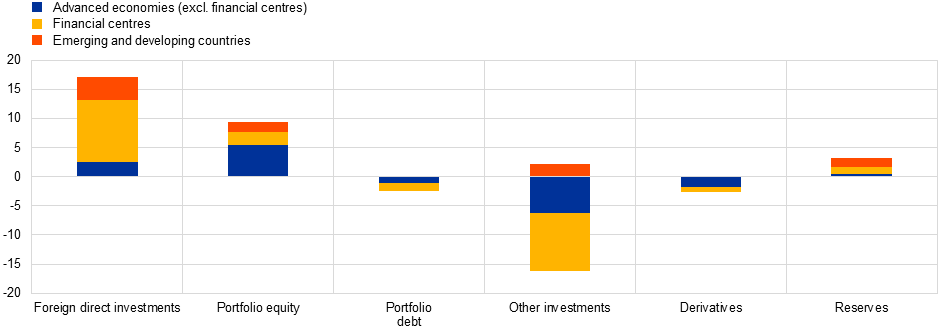

One explanation for the pause in the rise in cross-border asset holdings is a composition effect. While emerging economies account for an increasing share of global GDP, these remain less financially integrated than advanced economies. Another reason is the contraction in debt instruments as a percentage of world output, which has been partially counterbalanced by a rise in direct investment and, to a lesser extent, in portfolio equity positions (Chart 5).

In a recent collaboration with Gian Maria Milesi-Ferretti, we have documented that this expansion of foreign direct investment primarily reflects positions vis-à-vis international financial centres.[5] This phenomenon is, in turn, related to the corporate structure of large multinational corporations. The decline in foreign ownership of debt instruments, by contrast, is partly the legacy of the euro debt crisis.[6]

Change in ratio of external assets to world GDP, 2007-17

(percentage shares of world GDP)

Sources: External Wealth of Nations database (Lane and Milesi-Ferretti) and ECB staff calculations.

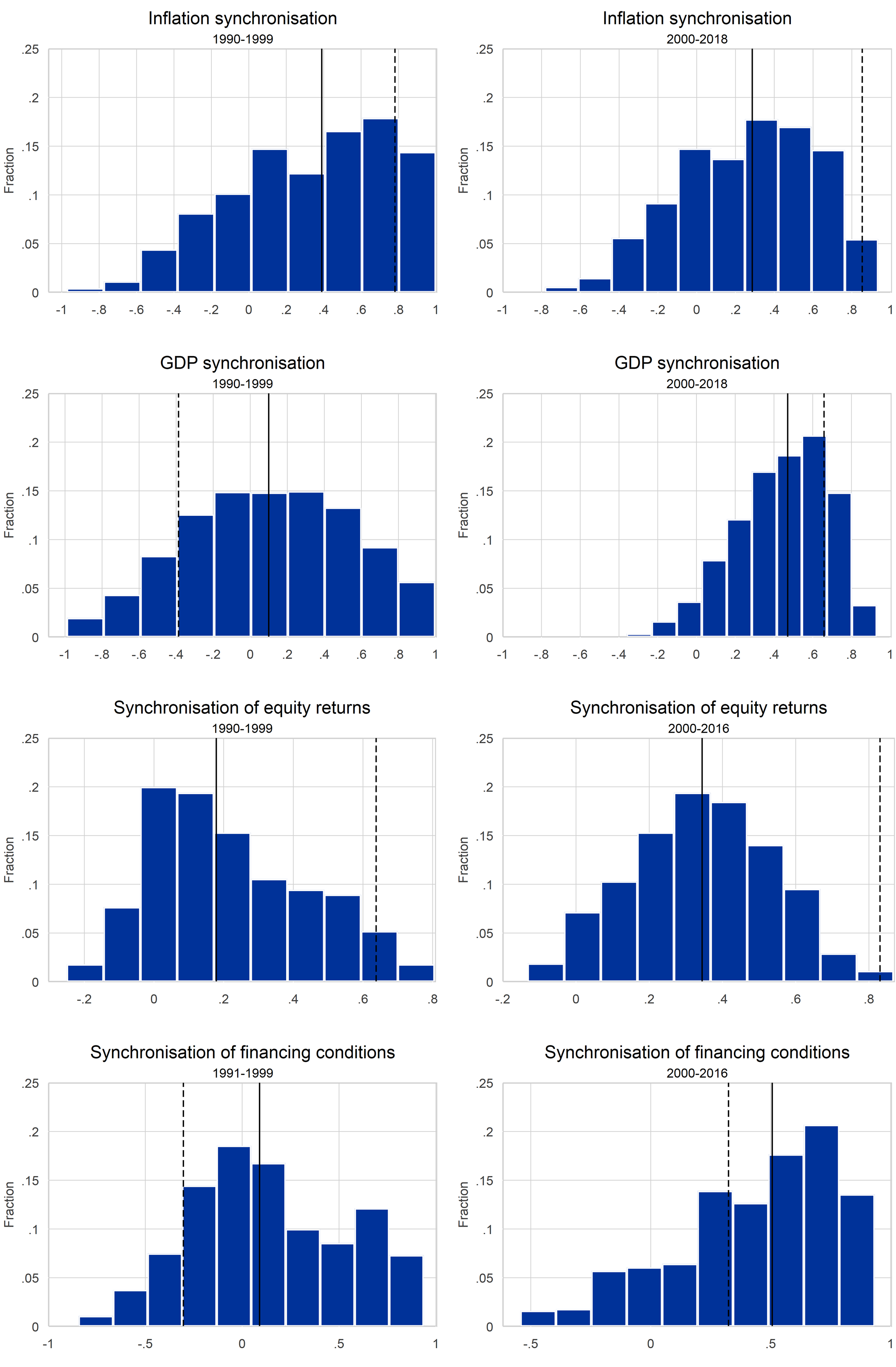

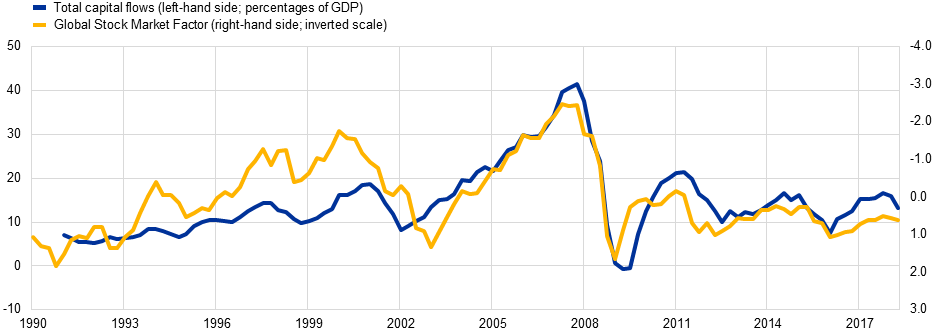

Over time there has also been a substantial increase in the degree of correlation across countries and across a range of macroeconomic and financial indicators (Chart 6).[7] While common shocks undoubtedly play a central role in explaining these high correlations, it seems plausible that the increase in the extent of real and financial linkages may also have contributed to this pattern. To take just one example, Chart 7 shows the striking correlation between global capital flows and a global factor of equity returns.[8]

The role of common international factors in the determination of yield curves has also been widely documented. I will return to the interlinkages between the US dollar and euro-denominated bond yield curves later on but, at a global level, the demand from emerging and developing economies for safe assets has been a contributing factor to the compression of term premia both in the United States and in Europe.[9]

From a central banking perspective, there is much interest in the active research debate on whether and how globalisation may influence inflation outcomes, with the recent paper by Kristin Forbes just the latest contribution to this debate.[10] At the same time, it is worth keeping in mind that the average correlation of inflation across countries has actually slightly decreased compared with the 1990s. Moreover, while commodity price fluctuations are an important common factor influencing headline inflation around the world, core inflation is less correlated across countries than headline inflation. Recent research has also emphasised that cross-country correlations of inflation tend to be smaller at longer horizons.[11]

Distribution of pairwise cross-country correlations of selected real and financial variables

(y-axis: fraction; x-axis: correlation coefficient)

Sources: Ca’ Zorzi, M. et al. (2019) op. cit., IMF World Development Indicators, Bloomberg and IMF Global Financial Stability Report. Notes: The data cover 53 advanced and emerging economies at annual frequency. The solid line indicates the median and the dashed line indicates the correlation between the United States and the euro area.

Capital flows and Global Stock Market Factor since the 1990s

Sources: Habib, M. and F. Venditti (2019), op. cit. Notes: Capital flows are a four-quarters moving average of total “gross capital inflows” aggregated over 50 economies and reported as a percentage of total GDP. The global stock market factor is constructed from a dynamic factor model for stock returns in 63 countries.Latest observation: Q2 2018.

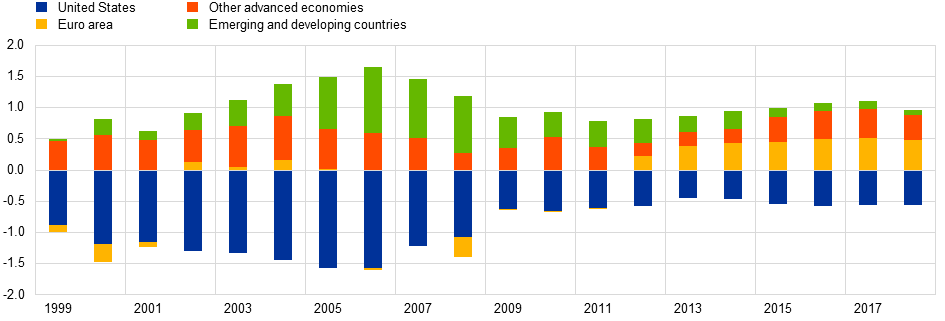

The increase in international financial integration in recent decades has also been accompanied by the emergence of larger and more persistent external imbalances. This stands in contrast to the limited external imbalances observed in the 1960s and 1970s.[12] While current account imbalances largely narrowed after the global financial crisis, a striking feature of the current configuration is that the euro area is running a substantial surplus, while the largest external deficit is run by the United States (Chart 8).

Evolution of current account balances

(percentage shares of world GDP)

Sources: IMF World Economic Outlook and ECB staff calculations.

Evolution of net international investment positions

(percentage shares of world GDP)

Sources: IMF International Financial Statistics and ECB staff calculations.

In terms of external stock imbalances (the difference between external assets and external liabilities), net international investment positions remain substantial and have even widened in recent years (Chart 9).

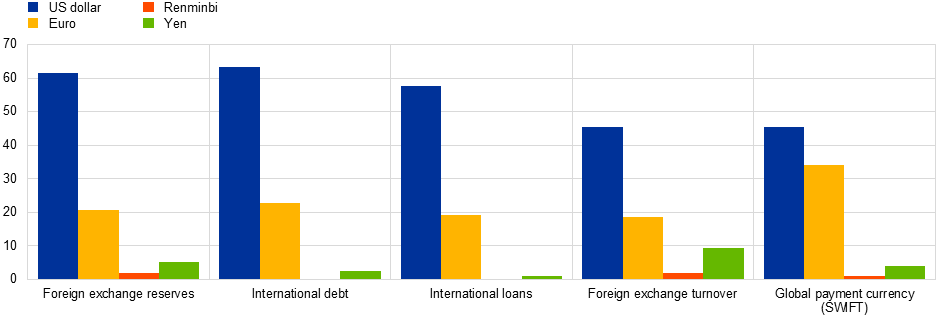

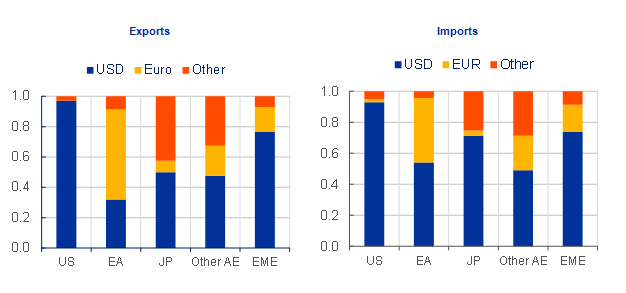

Finally, the denomination of international trade in goods and assets is heavily concentrated in a small set of currencies: the US dollar has a predominant global role, with the euro the second-ranked global currency and especially important at the regional level (Chart 10). I will return to the some of the implications later, but a wider discussion of the international monetary system is beyond the scope of this lecture.[13]

Snapshot of the international monetary system

(percentages)

Sources: BIS, CLS Bank International, IMF, SWIFT and ECB calculations. See also ECB (2019). Note: The latest data are for the fourth quarter of 2018 or the latest available.

Globalisation and monetary policy: conceptual issues

There are several reasons why globalisation has important implications both for the transmission of shocks and the conduct of monetary policy.

Globalisation and domestic shocks

While enhanced international risk-sharing should dampen the national impact of economic and financial shocks, the international mobility of factors of capital, labour, finance, firms and technologies can either amplify or dampen shocks.[14],[15] For instance, in relation to amplification, a boost to the domestic business environment can trigger a larger output response than in a closed economy, since the prospect of higher investment returns and higher wages draws in capital and labour from abroad. Conversely, a negative shock may be amplified by capital outflows and net emigration. In terms of cross-border financial integration, a domestic boom-bust cycle can be amplified if domestic residents take on extra foreign leverage during the upswing that then requires additional deleveraging during the downturn.

Similarly, in relation to dampening, firms can opt to extend overseas production or switch to imported inputs if a boom triggers rising domestic cost pressures. In the other direction, if a recession is associated with a decline in domestic costs, the end of the recession can be brought forward by the entry of foreign firms and capital that are attracted by the improvement in the cost base. The dampening of the cycle is also facilitated by international financial risk-sharing, with domestic risks partly transferred to foreign investors through direct ownership and portfolio equity claims, and domestic residents holding diversified portfolios that include foreign assets.[16]

A shock to export demand

In a globalised economy, external shocks can be a significant driver of the domestic economy. To illustrate the importance of the external sector for the performance of the euro area economy, Chart 8 shows results from a simulation of a negative foreign shock in the ECB’s in-house model for the euro area economy, the New Area-Wide Model II.[17] In the absence of a monetary policy response, the shock to foreign demand induces substantial declines in exports, output and inflation. However, a reactive monetary policy dampens the shock, since a reduction of the policy interest rate improves financial conditions and stimulates domestic consumption and investment. Chart 11 shows both the potential damage caused by a foreign shock and the pivotal role of monetary policy in determining the ultimate net impact.[18]

Effects of an export demand shock on euro area GDP

(percentage deviation from trend/steady state)

Sources: New Area-Wide Model II and ECB calculations.Note: An export preference shock is considered to reflect a drop in exports peaking at 4% deviation from their steady state value. Under exogenous monetary policy the central bank here is assumed not to change its short-term interest rate for six quarter in response to the shock, which is akin to policy being constrained by a lower bound on the short-term interest rate. Under endogenous monetary policy the central bank adjusts its short-term policy rate (a Taylor-rule estimated for the euro area), while the exercise abstracts from other policy instruments. The model is solved under perfect foresight, see for the technical implementation Adjemian, S. and Juillard, M. (2014), “Assessing long run risk in a DSGE model under ZLB with the stochastic extended path approach”, mimeo.

A shock to tariffs

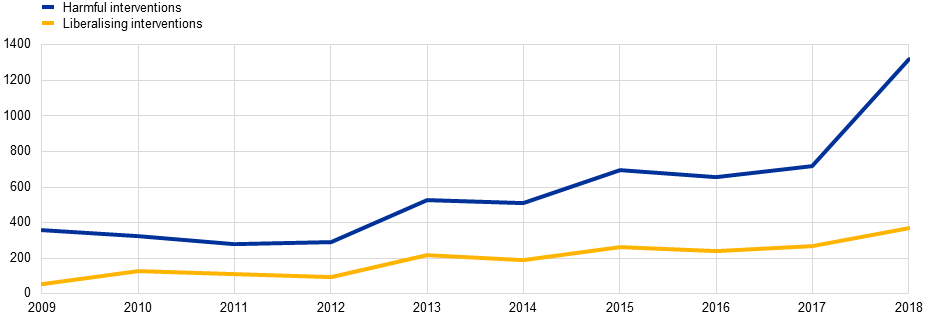

A further illustration of sensitivity to the external environment can be seen in the impact of a “de-globalisation” shock that raises trade costs. In recent years, we have observed a surge in protectionist measures, with a simple metric indicating that the number of harmful interventions has outpaced that of liberalising interventions, especially since mid-2018 (Chart 12).

Evolution of the number of newly implemented trade policy measures

(number of trade interventions)

Source: Global Trade Alert.Note: Data adjusted for reporting lags.Latest observation: 2018.

Recent trade tensions and existing and prospective threats (including the risk of a hard Brexit) have the potential to disrupt prices and activity globally.[19] From a macroeconomic perspective, protectionism can be interpreted as a negative supply shock.[20]

More generally, protectionism can influence prices and activity via several channels. First, the increase in trade costs may alter the prices and volumes of internationally traded products (the trade channel). To the extent that producers and distributors pass through the increases in tariff and non-tariff barriers, there will be upward pressure on the prices of imported inputs and final products. These cost pressures work not only via directly imported products, but also via complex international production chains that magnify the effect of any increase in trade costs. Since products cross the border several times during the various stages of production, tariff costs accumulate due to a cascading effect.[21]

In the short run, firms may absorb cost increases through lower markups, but the increase in costs should eventually pass through into higher prices. Of course, the way trade cost effects are passed through crucially depends on the margin adjustment of both exporting and importing firms, which in turn hinges on several factors, such as the degree of competitiveness in the specific sector, product quality and the currency of invoicing of trade flows. In addition, the higher prices of imported products can also induce domestic customers to switch from imported to domestically produced products.

This switch can give rise to allocative distortions along supply chains and affect competitiveness and productivity as well as, in turn, prices and potential output (the productivity channel). Trade barriers impede the efficient allocation of production factors across borders and protect domestic industries against foreign competition. However, these cost-push effects on price dynamics might be counterbalanced to some extent by an overall decrease in aggregate demand, which has deflationary consequences.

In addition, higher trade costs and rising uncertainty over future trade policies, coupled with financial stress, could also amplify the impact of rising protectionism on economic activity in the short run. For example, households and firms may delay spending and investment as prospects become more uncertain.[22] In response to uncertainty shocks, firms can also adjust their inventory policies by disproportionately cutting their foreign orders of intermediate goods, with a disproportionate impact on international trade flows.[23] Financial risk premia could increase as a result of the re-evaluation of multinational firms and associated revisions in cross-border financial flows.

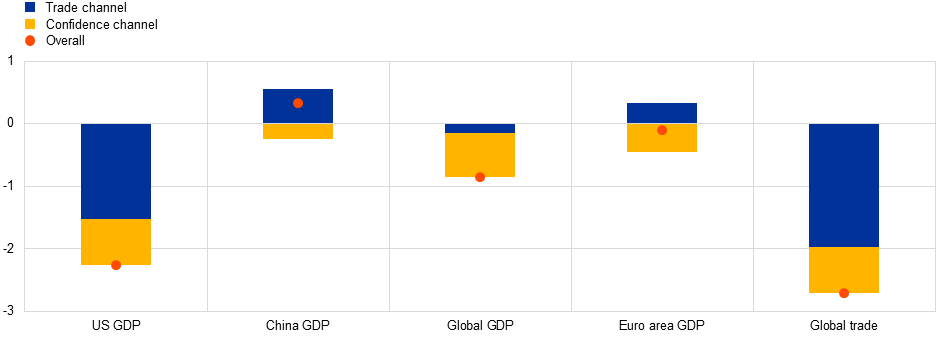

Model-based results of a scenario simulating an increase in trade costs illustrate how various transmission channels operate (Chart 13).[24] For illustrative purposes, consider a hypothetical case in which the United States raise tariffs and non-tariff barriers by 10 percent on imports from all trading partners and other countries raise tariffs and non-tariff barriers by 10 percent on imports from the United States. The results show that the increase in trade costs would induce domestic consumers and firms in the United States to replace foreign suppliers with domestic alternatives. However, these positive effects on activity are more than offset by the increase in prices of imported intermediate and final products and by the reduction in US exports caused by retaliatory measures. In addition, there could be negative confidence effects, which would further depress US GDP. Other countries may also gain competitiveness vis-à-vis US producers in third markets. It follows that the trade effects on activity can be positive for some countries (China and the euro area in this specific scenario). However, negative confidence effects may outweigh these outcomes. Overall, global trade and activity could fall substantially as a result of the combined effects via the trade and confidence channels.

Estimated impact of a hypothetical scenario of a mutual increase in tariffs on GDP – first-year effects

(GDP response, deviation from baseline levels; percentages)

Source: “The economic implications of rising protectionism: a euro area and global perspective”, Economic Bulletin, Issue 3, ECB, April 2019.Note: The scenario assumes that the United States increases tariff and non-tariff barriers on imports from all countries by 10% and US trade partners respond symmetrically.

The international dimension of monetary policy transmission

So far, I have focused on how globalisation affects the propagation of domestic and external shocks. However, globalisation also shapes the transmission of monetary policy. From a conceptual perspective, monetary policy spillovers propagate via three channels: (i) an aggregate demand channel; (ii) a multi-faceted financial channel; and (iii) an exchange-rate competitiveness channel. Recent research has highlighted the importance of understanding all three channels – the second and third channels in particular may not be as straightforward as presented in textbooks.

First, the aggregate demand channel is simply based on changes in import demand. Since contractionary monetary policy action curbs consumption and investment, it also entails lower demand for imports. This constitutes a negative demand shock for the rest of the world and is contractionary for trading partners.

Second, the financial channel works through the effect of domestic policy on foreign financial conditions. One dimension of the financial channel is based on the effect of the exchange rate on the local-currency valuation of foreign-currency denominated assets and liabilities. A country that is a net borrower on international financial markets in US dollars will experience a negative wealth effect when US monetary policy is tightened. This means that an exchange rate valuation wealth effect implies a contractionary monetary policy spillover. Such valuation effects can be particularly powerful when exchange rate fluctuations change the value of collateral denominated in foreign currency, and thereby affect borrowing and leverage.[25] Again, given the dominance of the US dollar in global financial markets, spillovers from US monetary policy through this channel may be particularly sizeable.[26] This channel is especially important for emerging and developing economies, as these rely more on foreign-currency funding.

Another dimension of the financial channel operates through portfolio rebalancing.[27] In particular, cross-border portfolio balance effects arise from imperfect substitutability between short and long-term bond portfolios, as well as between domestic and foreign bonds within investors’ portfolios.[28] Suppose that agents in each country can hold domestic and foreign short and long-term government bonds, but they cannot perfectly substitute among these four types of bonds. In this set-up, portfolio balance effects arise as yields react to changes in the relative supply of bonds. For example, a reduction in the relative supply of euro area long-term bonds due to asset purchases by the ECB leads to a decrease in long-term yields in the euro area. Since bond supplies directly affect the term premium, this occurs even when short-term rates are unchanged. In turn, the international portfolio re-balancing channel leads to a reduction in term premia and long-term yields in the rest of the world, as the ECB’s asset purchases increase through portfolio rebalancing the demand for rest-of-the-world long-term bonds.

Of course, the degree of substitutability across bonds of different maturities and origins is crucial for the magnitude of spillovers from central bank asset purchases through the portfolio re-balancing channel. For example, a relatively low elasticity of substitution between short- and long-term bonds implies a sizeable domestic effect of the ECB’s asset purchases on term premia, whereas a relatively high elasticity of substitution between domestic and rest-of–the-world bonds is key for generating large spillovers from to rest-of-the-world term premia. In fact, there is empirical evidence suggesting that portfolio re-balancing is an important conduit for spillovers from central bank asset purchases in large economies.[29] The financial channel of exchange rates and cross-border portfolio re-balancing are just two dimensions of a more complex of the more broadly defined financial channel of monetary policy spillovers, and quite some research – including at the ECB – is under way to shed more light on how monetary policy in systemic economies affects the rest of the world.

Third, the traditional exchange rate channel of monetary policy spillovers operates through changes in the relative prices of domestic and foreign goods. A monetary policy tightening generally causes the exchange rate to appreciate. To the extent that the relative prices of domestic and foreign goods are affected by the exchange rate appreciation, a monetary policy tightening at home elicits expenditure switching at home and abroad. Expenditure switching under the exchange rate channel of monetary policy spillovers thus rotates demand at home and abroad, but where and in which direction the rotation takes place depends on a string of factors.

Two factors that have received some attention recently are the invoicing currency of exports.[30] If export prices are sticky in domestic currency, an exchange rate appreciation makes domestic goods less competitive in world markets, shifting expenditure abroad and at home away from domestic goods. This traditional analysis is based on the Mundellian assumption of “producer currency pricing” (PCP).[31] Discussions about the external effects of policy actions in politics and the media are typically implicitly based on this assumption.

In contrast, if export prices are sticky in a foreign currency, the relative price of imports and domestically produced goods in terms of the currency of the importer is not affected by the exchange rate appreciation and exchange rate pass-through is incomplete. In this case, monetary policy spillovers through expenditure switching are muted. This latter case traditionally corresponds to the setting in which export prices are sticky in the currency of the importer, referred to as “local currency pricing” (LCP). More recently, emphasis has shifted to an alternative setting, namely one in which export prices are sticky in a dominant currency regardless of the trading partners involved, in particular the US dollar. This setting of “dominant currency pricing” (DCP) has particularly important implications for the global spillovers from US monetary policy.

The differences in monetary spillovers through expenditure switching under the exchange rate channel across these different invoicing settings can be illustrated by a scenario analysis using the structural model for the global economy used at the ECB.[32] For example, a tightening in US monetary policy that is followed by a multilateral appreciation of the US dollar elicits a much stronger slowdown in global trade under DCP than under PCP (Chart 14).

The reason is that a larger share of global trade prices is sticky in US dollars under DCP, even if the related trade does not involve the United States. As a result, a larger share of global imports becomes more expensive in local currency terms in response to the appreciation of the US dollar, which elicits expenditure switching from imports to domestically produced goods.

Model simulations of the impact of a US monetary policy shock in ECB-Global

(average effect over one year)

Sources: Georgiadis, G. and S. Mösle, “Introducing dominant currency pricing in the ECB’s global macroeconomic model”, International Finance, forthcoming and ECB (2019), “The international role of the euro”.

The emphasis on the importance of the currency in which export prices are sticky is not just an academic curiosity. In fact, as mentioned before, the US dollar is the dominant currency in global trade, notably also for transactions that do not involve the United States (Chart 15). Emerging economies, in particular, invoice the bulk of their imports and exports in US dollars. In Europe, the euro assumes a similar role for trade within the region.

Currency invoicing patterns

(percentages)

Sources: Gopinath, G. (2016), “The International Price System.” Jackson Hole Symposium Proceedings, Eurostat and ECB staff calculations.Note: The data generally cover the time period from 1995 to 2012. AE = advanced economies; EME = emerging market economies.

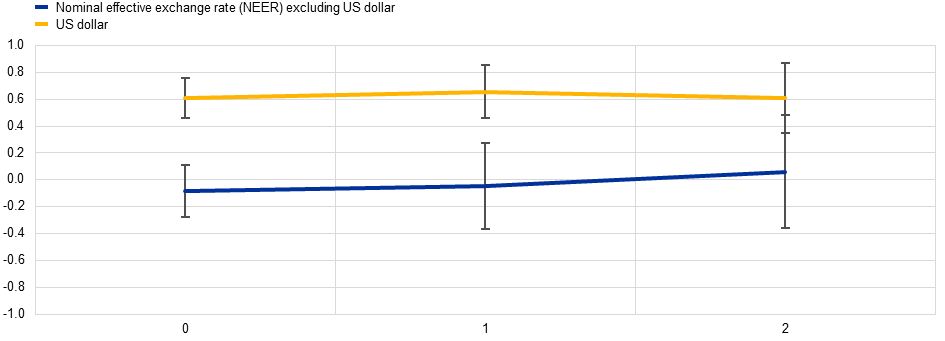

There is some support for the model predictions of the importance of US dollar invoicing for monetary policy spillovers. The degree of exchange rate pass-through to import prices from bilateral changes in the US dollar is high, while movements of effective exchange rates excluding the US dollar are muted (Chart 16).[33]

Exchange rate pass-through to import prices

(y-axis coefficient estimates with 90% confidence bands; x-axis: years)

Sources: BIS, OECD and ECB staff calculations. Notes: The chart is based on coefficients estimated in a regression of the changes in import prices on the changes in exchange rates and other controls using quarterly data and including country and time fixed effects. All variables are in logs. Import and export prices are calculated as unit value indices and include trade in both goods and services. Exchange rates are defined such that an increase implies a depreciation of the domestic currency (in effective terms or against the US dollar). The NEER excluding the US dollar is obtained as the residual from a country-by-country regression of the NEER on the bilateral exchange rate with the US dollar.

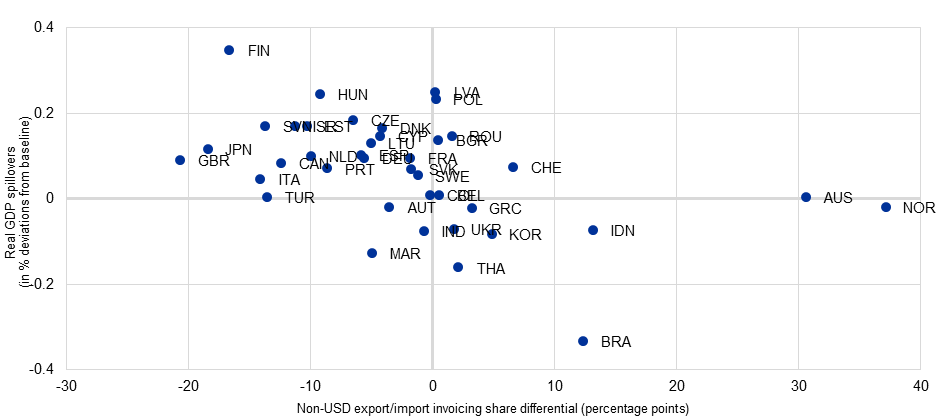

Furthermore, ECB research suggests that the output effects from a US dollar appreciation are larger for an economy receiving spillovers that features a higher export-import US dollar invoicing share differential: that is, a higher share of exports but a lower share of imports invoiced in US dollars (Chart 17). The mechanism at play is that net exports suffer more from a US dollar appreciation if a large share of the exports of the economy receiving the spillovers is invoiced in US dollars, since it implies stronger expenditure switching in its trading partners away from imports from the economy towards domestically produced goods in the rest of the world. In turn, net exports suffer less from US dollar appreciation if a large share of the imports of the economy receiving the spillovers is invoiced in US dollars, since it implies stronger expenditure switching away from imports from the rest of the world towards domestically produced goods.

VAR estimates of the global real GDP spillovers from US dollar appreciation and export-import US dollar invoicing share differentials

Source: Georgiadis, G and Schumann, B. (2019), “Dominant-currency pricing and the global output spillovers from US dollar appreciation”, ECB Working Paper, No 2308.Note: The US dollar appreciation is induced by a positive demand shock in the United States in VAR models generally estimated for the time period from 1995 to 2018.

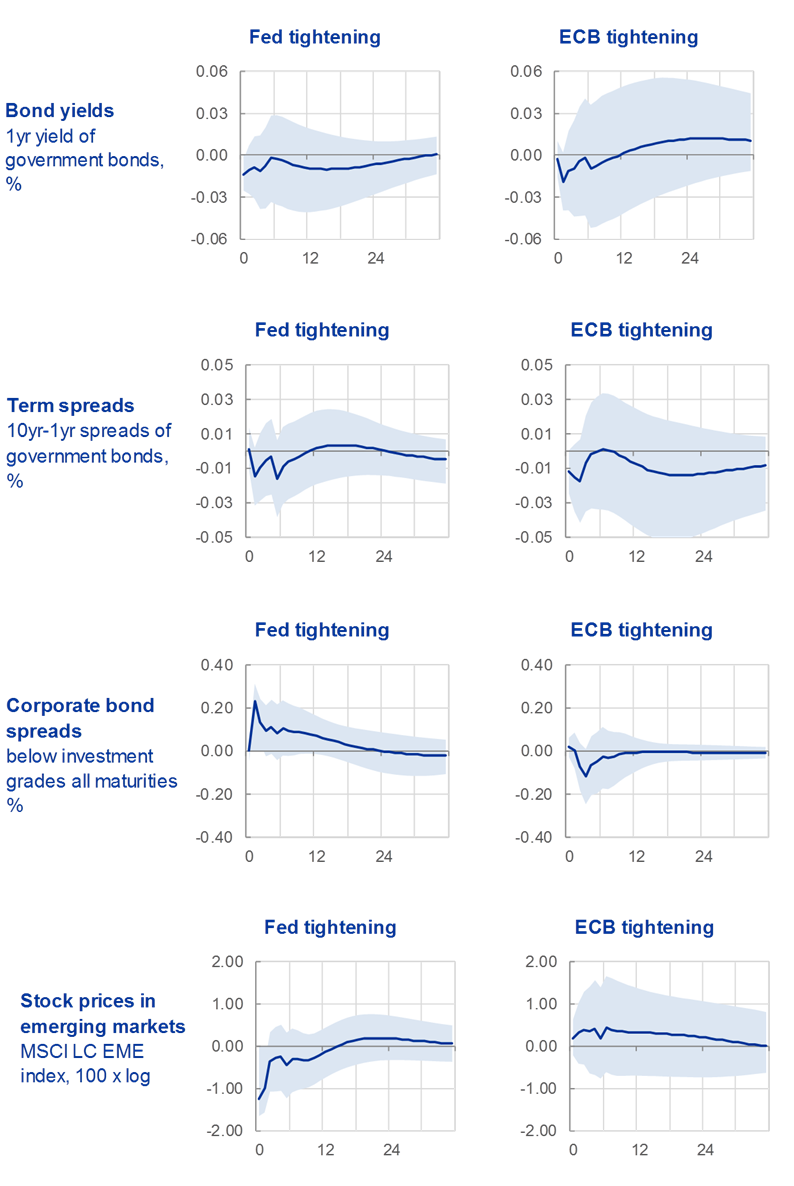

Against this conceptual background, let me focus on a policy-relevant empirical question: to what extent does monetary policy spill over between large economic areas, such as the United States and the euro area? Recent ECB research addresses this question, finding that US monetary policy has a larger effect on euro area financial markets than vice-versa (Chart 18).[34]

Estimated spillovers to euro area and US financial markets from Fed and ECB monetary policy tightening

Source: Ca’ Zorzi, M. et al (2019), op. cit. Notes: The solid line shows the median spillover with 68% confidence bands. The left column shows the responses of euro area variables; the right column shows the responses of US variables. The corporate bond spread is defined as the option-adjusted spread between a corporate bond with BBB or lower investment grade rating and a government bond. The government bonds displayed are the German Bund for the euro area and the Treasury bonds for the United States. The stock index shown for the euro area is the EuroStoxx 50; the index for the United States is the S&P500.

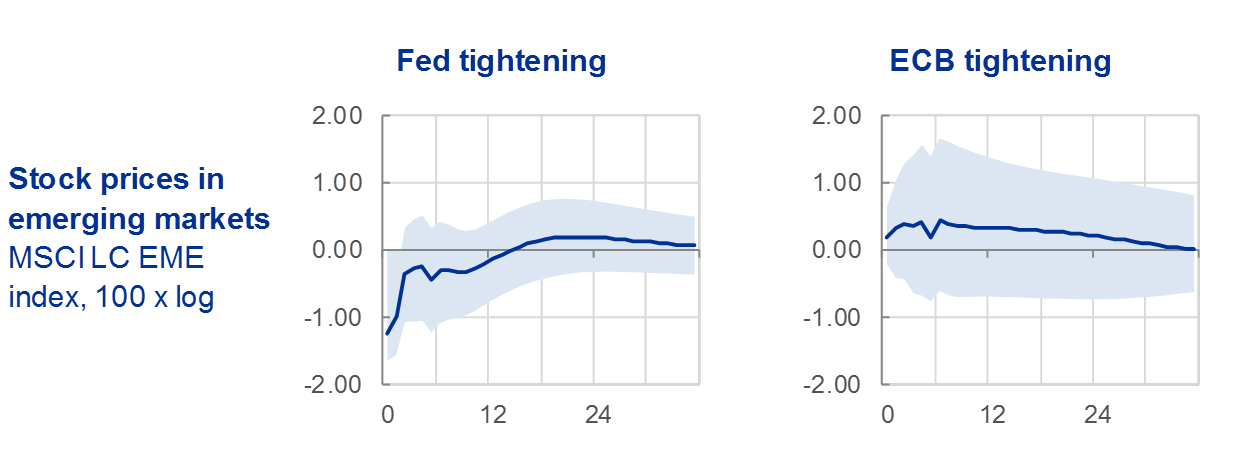

A similar picture emerges for monetary policy spillovers to emerging economies. Here, the estimates again indicate that only US monetary policy affects financial markets in emerging economies (Chart 19). As shown by Şebnem Kalemli-Özcan at the latest Jackson Hole conference, the evidence suggests that emerging economies are more vulnerable to spillovers from US monetary policy than advanced economies, since capital flows to the former group are more risk-sensitive.[35] In particular, she shows that a tightening of US monetary policy is associated with an increase in risk premia in asset prices in emerging economies, while those in advanced economies are essentially unaffected.

Estimated spillovers to global equity markets from Fed and ECB monetary policy tightening

Source: Ca’ Zorzi, M. et al (2019), op. cit.Notes: The solid line shows the median impulse response with 68% bands.

While it may be that risk premia in advanced economies are not very sensitive to US monetary policy in general, these may nevertheless be affected by macro-financial conditions in emerging economies. The extent to which developments in emerging market economies reverberate in advanced economies depends on the extent to which policymakers in emerging economies employ countercyclical monetary and fiscal policies. A positive recent development is that the scope for countercyclical policies in many emerging economies has increased on the back of the development of local currency financial markets, the accumulation of substantial foreign reserves and a reduction in their net foreign-currency debt exposures.[36]

Finally, globalisation not only implies a greater potential for spillovers from shocks in one economy to the rest of the world, but also a greater potential for these spillovers to spill back to their origin. This is particularly important for those economies that generate the largest spillovers to the rest of the world. For example, and as discussed above, US monetary policy emits large spillovers to the rest of the world. If such large spillovers were accompanied by substantial spillbacks, the calibration of US monetary policy could incorporate these feedback loops. Similarly, the ECB also has to assess the quantitative significance of spillback mechanisms in setting monetary policy, which is the subject of ongoing research by ECB staff.[37] Of course, the strength of these spillover-spillback loops also depends on the monetary policy reaction functions in emerging economies: the interdependencies in monetary policy run in both directions.[38]

The role of external factors in the current euro area slowdown

Finally, let me illustrate the importance of globalisation for monetary policy by discussing how external factors have made a significant contribution to the current slowdown in the euro area economy and, as a result, to the downward adjustment in the projected path of inflation. In turn, the deterioration in the inflation outlook prompted the further accommodative measures that we adopted in our recent monetary policy meeting.

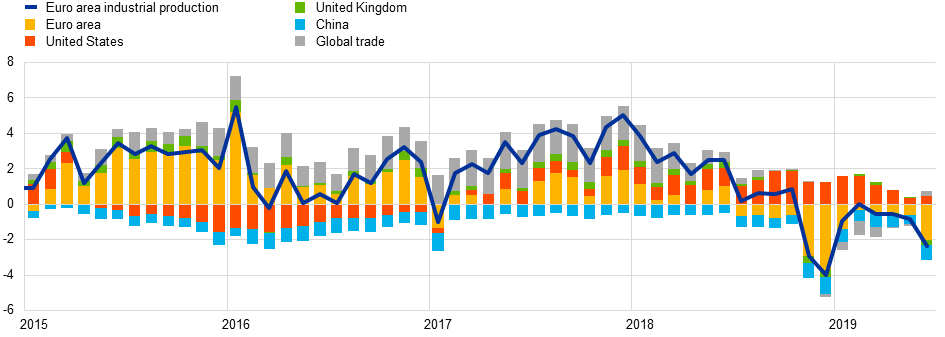

For several quarters now, we have been facing a slowdown that can, in part, be ascribed to external factors (Chart 20). While uncertainty about the future of the international trading system is doubtless a key contributor, other factors are also contributing to weak international trade, such as the rebalancing of the Chinese economy away from export-oriented manufacturing towards domestically-oriented services sectors, and a maturing tech cycle which has affected key Asian economies through closely integrated supply chains.[39]

Euro area goods exports to countries outside the euro area

(volumes; 3-month moving averages, annual percentage changes; percentage point contribution)

Sources: Eurostat, ECB staff calculations. Note: July 2019 for the United States, China and Turkey and June 2019 for all other countries/regions.Latest observation: July 2019.

The international trade shock is especially relevant for the euro area manufacturing sector, given the high tradability of capital, intermediate and durable consumption goods. A geographical decomposition of the drivers of industrial production confirms this point, with external fluctuations playing a significant role in determining output in the euro area in the last eighteen months (Chart 21).

Shock decomposition of euro area industrial production excluding construction

(year-on-year percentage changes)

Sources: Eurostat, Markit and ECB calculations. Notes: Shocks to industrial production are identified using the absolute magnitude restriction method (see De Santis, R.A. and Zimic, S. (2018), “Spillovers among sovereign debt markets: Identification by absolute magnitude restrictions”, Journal of Applied Econometrics, Vol. 33, pp. 727-747), which assumes that the effect of the shock on the domestic economy at the time of impact is larger in absolute value than the magnitude of the foreign spillover. The PMI for world new export orders, which is a proxy for global trade, is assumed to react to countries’ industrial production shocks with one lag. The overall sample period is from January 2007 to June 2019.

In contrast, the services sector has proved more resilient to recent global headwinds (Chart 22). The resilience of domestically-oriented services sectors points to continued robust domestic demand in the euro area. Still, potential risks of spillovers from weak manufacturing activity to the services sector need to be carefully monitored.

Purchasing managers’ index of manufacturing and services output

(diffusion index, 50 = no change)

Source: Markit.Latest observation: August 2019.

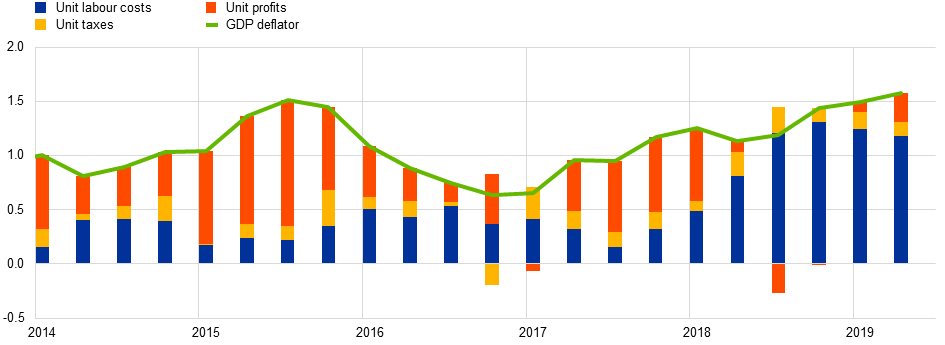

The adjustment for the growth outlook has been accompanied by a downward revision in projected inflation over our forecast horizon. Since the end of last year, we have seen successive and significant downward revisions to the inflation outlook, bringing down the 2021 inflation projection from 1.8 percent to 1.5 percent. Although wage growth has picked up, firms are currently absorbing cost increases in lower profit margins (Chart 23). Especially in the manufacturing sector, it is plausible that the reluctance to raise prices may in part be attributed to the weak level of external demand. Taking a longer-term perspective, the persistent current account surplus of the euro area in recent years may also have acted to dampen inflationary pressures, in view of the importance of domestic demand in price dynamics.[40]

GDP deflator and contributions

(annual percentage changes; percentage points)

Sources: Eurostat and ECB staff calculations.Latest observation: Q2 2019.

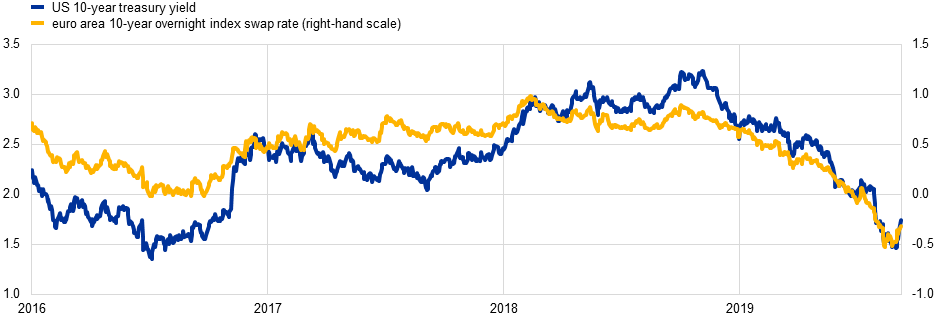

External factors have also been influential in determining financial conditions in the euro area, which are crucial when deciding on the appropriate monetary stance. For instance, Chart 24 shows the joint movement in ten-year bond yields for the United States and Germany. Both markets have seen a considerable decline in yields during 2019. A possible interpretation of this joint movement is that investors have downgraded estimates of trend global growth prospects, which feeds into lower estimates of equilibrium real rates and a reduction in expected inflation rates. In turn, investors expect central banks to react (both now and in the future) to lower growth and downside inflation risks through accommodative policy rates and balance sheet policies. Finally, as discussed earlier, the common factor in bond yields is reinforced by international arbitrage, by which lower yields in one currency area also put downward pressure on yields in other currency areas.

Taken together, the combination of weakness in the externally-oriented manufacturing sector but resilience in the services sector means that we expect the euro area economy to continue growing, albeit at a slower pace. In parallel, the inflation momentum from strong domestic demand and an improving labour market is being partly offset by the downward revision to manufacturing and aggregate output. In view of this disruption to the inflation path, the ECB Governing Council decided to strengthen its accommodative policy stance in its September meeting.

Euro area and US long-term yields

(percentages)

Sources: Bloomberg and ECB.Latest observation: 20 September 2019.

Conclusion

In summary, the current economic situation vividly illustrates how global macroeconomic and financial developments can play a central role in influencing monetary policy decisions, even for major central banks. Simply put, global developments cannot be ignored, to the extent that external factors filter through to the outlook for domestic growth and inflation. Accordingly, globalisation requires central banks to pay increased attention to how foreign factors spill over to the domestic economy and financial system. At the same time, in the other direction, it is also necessary to incorporate the feedback loops by which domestic monetary policy decisions affect the global economy and global financial conditions, which in turn spill back to the domestic macro-financial configuration.

Finally, the international interdependencies in monetary policy decisions have been extensively studied in the context of the potential gains from international policy coordination and recently re-assessed in the light of the strength of the forces of globalisation and the low real interest rate environment.[41] While formal arrangements for routine international coordination in monetary policy are difficult to reconcile with the domestic mandates of central banks, they have shown their capacity for joint action during crisis periods. In addition, the quality of monetary policy decisions is enhanced by the extensive sharing of information and analysis throughout the global central banking community, through international fora such as the regular Basel meetings of the Bank for International Settlements and other multilateral organisations.

- [1]I would like to thank Michele Ca’ Zorzi, Georgios Georgiadis and Ine Van Robays for their contributions to this speech.

- [2]USD 300 billion corresponds to around 7% of total US imports and exports, including oil-related shipments.

- [3]My focus today is on the interlinkages between the euro area and the rest of the world. Of course, cross-border integration is extensive within the euro area, in relation to both trade and financial integration. Indeed, the economic motivation for the creation of the euro was closely intertwined with the broader project to develop close economic and financial ties among the member countries. For recent discussions of this point, see Lane, P. R., (2019), “Globalisation: A Macro-Financial Perspective”, Geary Lecture 2019, The Economic and Social Review, vol. 50(2), pp. 249-263 and Lane, P. R., (2019), “Macrofinancial Stability and the Euro”, IMF Economic Review, vol. 67(3), pp. 424-442.

- [4]Of course, the convergence process is heavily influenced by globalisation through the specialisation gains from international trade and international knowledge spillovers, among many other mechanisms. It is beyond the scope of this lecture to analyse the implications of globalisation for the development process.

- [5]Lane, P. R. and Milesi-Ferretti, G.-M. (2018), “The External Wealth of Nations Revisited: International Financial Integration in the Aftermath of the Global Financial Crisis”, IMF Economic Review, vol. 66(1), International Monetary Fund, March, pp. 189-222.

- [6]McCauley, R. N., Bénétrix, Agustín S., McGuire, P. and von Peter, G., 2019. "Financial deglobalisation in banking?," Journal of International Money and Finance, Elsevier, vol. 94(C), pp. 116-131.

- [7]Ca’ Zorzi, M., Dedola, L., Georgiadis, G., Jarociński, M., Stracca, L. and Strasser, G. (forthcoming), “Monetary Policy and its Transmission in a Globalised World”, ECB discussion paper.

- [8]Habib, M. and Venditti, F. (2019), “The global capital flows cycle: structural drivers and transmission channels”, Working Paper Series, No 2280, ECB. See also the research programme of Helene Rey that has documented how international financial flows and international financial intermediaries contribute to a global common component in the financial cycle.

- [9]On the global savings glut hypothesis, see Bernanke, B. (2005), “The global saving glut and the U.S. current account deficit”, speech delivered at the Sandridge Lecture, Virginia Association of Economists, Richmond. For the impact of foreign inflows of international capital flows on US yields, see Warnock, F. E. and Warnock, V. C. (2009), “International capital flows and US interest rates”, Journal of International Money and Finance, Vol. 28, pp. 903-19. For the impact of increased holdings of euro area debt securities yields, see Carvalho, D. and Fidora, M. (2015), “Capital inflows and euro area long-term interest rates”, Journal of International Money and Finance, vol. 54, pp. 186-204.

- [10]Forbes, K. (2019), "Has globalization changed the inflation process?", BIS Working Papers, No 791, Bank for International Settlements.

- [11]Kamber, G. and Wong, B. (2018), ”Global factors and trend inflation," BIS Working Papers, No 688, Bank for International Settlements.

- [12]Feldstein, M. and Horioka, C. (1980), "Domestic Saving and International Capital Flows.", The Economic Journal, Vol. 90, pp. 314-329 and Summers, L. H. (1988), "Tax Policy and International Competitiveness", in Frankel, J. (ed.), International Aspects of Fiscal Policies, University of Chicago Press, pp. 349-386.

- [13]For an interesting discussion, see the speech by Mark Carney at this year’s Jackson Hole symposium, “The growing challenges for monetary policy in the current international monetary and financial system”.

- [14]See Lane, P. R., (2019), IMF Economic Review, op. cit.

- [15]See Lane, P. R., (2019), The Economic and Social Review, op. cit.

- [16]See Lane, P. R. (2019), The Economic and Social Review, op. cit.

- [17]A shock is introduced that reduces the demand for domestic exports by foreigners. Of course, the external sector can also play a stabilising role in the event of an asymmetric domestic shock. This was the case during the global financial crisis, with the domestic shocks in advanced economies counter-balanced by the greater resilience of emerging and developing economies (especially China).

- [18]In these simulations, reactive monetary policy follows a policy rule for the short-term interest rate and does not consider unconventional tools such as the use of forward guidance on interest rates or net asset purchases that have proven effective in the pursuit of the central bank’s objective when approaching the effective lower bound.

- [19]See Carney, M. (2017), “[De]Globalisation and inflation”, 2017 IMF Michel Camdessus Central Banking Lecture; and Carney, M. (2018), “From Protectionism to Prosperity,” speech held at Northern Powerhouse Business Summit – Great Exhibition of the North.

- [20]See Barattieri, A., Cacciatore, M. and Ghironi, F. (2018), “Protectionism and the Business Cycle”, NBER Working Paper, No 24353, National Bureau of Economic Research, February; and Furceri, D. et al. (2018), “Macroeconomic Consequences of Tariffs”, NBER Working Paper, No 25402. Of course, shocks to supply also induce demand shocks, since firms and households adjust expenditure plans to the downgraded outlook for incomes and production.

- [21]See Cappariello, R., Franco-Bedoya, S., Gunnella, V. and Ottaviano, G. I. P. (forthcoming). In the context of a multi-country, multi-sector general equilibrium model, they show that, as global value chain relations intensify, the effects of trade cost shocks are amplified. The amplification effects crucially depend on global value chain-related components of trade.

- [22]See Bloom, N. (2009), “The Impact of Uncertainty Shocks”, Econometrica, Vol. 77, No 3, May; and Handley, K. and Limão, N. (2015), “Trade and Investment under Policy Uncertainty: Theory and Firm Evidence”, American Economic Journal: Economic Policy, vol. 7(4), pp.189-222.

- [23]See Novy, D. and Taylor, A. M. (2014), “Trade and Uncertainty”, CEPR Discussion Papers, No 1266, Centre for Economic Performance, The London School of Economics and Political Science, May; and Handley, K. and Limão, N. (2015), ibid.

- [24]The IMF’s Global Integrated Monetary and Fiscal Model, in combination with ECB-Global, are employed to investigate effects over the medium-term horizon. See Cœuré, B., “The consequences of protectionism”, panel contribution at the 29th edition of the workshop “The Outlook for the Economy and Finance”, “Villa d’Este”, Cernobbio, 6 April 2018, and Gunnella, V. and Quaglietti, L. (2019), “The economic implications of rising protectionism: a euro area and global perspective”, Economic Bulletin, Issue 3, ECB; and Dizioli, A. G. and van Roye, B. (2018), “Macroeconomic implications of increasing protectionism”, Economic Bulletin, Issue 6, ECB.

- [25]Bruno, V. and Shin, H. S. (2015), “Cross-border Banking and Global Liquidity”, Review of Economic Studies, vol. 82(2), pp. 535-564 describe the consequences of the correlation between US dollar exchange rates and the leverage of global banks. They refer to this relationship between domestic and global financial conditions as the “risk-taking channel of [local] currency appreciation”. For empirical evidence, see: Kearns, J. and Patel, N. (2016), "Does the Financial Channel of Exchange Rates Offset the Trade Channel? ", BIS Quarterly Review; Hofmann, B. and Peersman, G. (2017), “Monetary Policy Transmission and Trade-offs in the United States: Old and New”, BIS Working Paper, No 649; and Avdjiev, S., Koch, C., McGuire, P. and von Peter, G. (2018), “Transmission of monetary policy through global banks: whose policy matters?,” Journal of International Money and Finance, vol. 89, pp. 67-82.

- [26]A number of studies explore the emergence of international, dominant and reserve currencies. See, for example: Maggiori, M. (2017), “Financial intermediation, international risk sharing, and reserve currencies”, American Economic Review, 107(10), pp. 3038-71; Eren, E. and Malamud, S. (2018), “Dominant Currency Debt”, Swiss Finance Institute Research Paper, No 18-55; Gopinath, G. and Stein, J. C. (2018), “Banking, Trade, and the making of a Dominant Currency”, NBER Working paper, No. 24485; Mukhin, D. (2018), "An equilibrium model of the International Price System.", 2018 Meeting Papers, No. 89, Society for Economic Dynamics.

- [27]See Alpanda, S. and Kabaca S. (2019), “International Spillovers of Large-Scale Asset Purchases,” Journal of the European Economic Association, in press; Kolasa, M. and Wesolowski G. (2018), “International spillovers of quantitative easing,” ECB Working Paper, No 2172.

- [28]See Vayanos, D. and J.L. Vila (2009), “A Preferred-Habitat Model of the Term Structure of Interest Rates,” NBER Working Paper, No 15487 for a model treatment of how the presence of preferred-habitat investors gives rise to bond-supply effects on term premia. Consistent with this theory Eser, F., W. Lemke, K. Nyholm, S. Radde and A. Vladu (2019), “Tracing the impact of the ECB’s asset purchase programme on the yield curve,” ECB Working Paper, No 2293, quantify term premia effects of the ECB’s asset purchases programme for the euro area, in line with Li, C. and M. Wei (2013), "Term Structure Modeling with Supply Factors and the Federal Reserve's Large-Scale Asset Purchase Programs," International Journal of Central Banking, vol. 9(1), pp. 3-39, and Ihrig, J., Klee, E., Li, C., Wei, M. and J. Kachovec (2018), "Expectations about the Federal Reserve’s Balance Sheet and the Term Structure of Interest Rates," International Journal of Central Banking, vol. 14(2), pp. 341-391, for the US.

- [29]Cœuré B. (2018), “The international dimension of the ECB’s asset purchase programme: an update,” speech held at a conference on “Exiting Unconventional Monetary Policies”, organised by the Euro 50 Group, the CF40 forum and CIGI, Paris, 26 October 2018; Koijen, R., Koulischer, F., Nguyen, B. and M. Yogo (2017), “Euro-Area Quantitative Easing and Portfolio Rebalancing,” American Economic Review Papers & Proceedings, vol. 107(5); Koijen, R., Koulischer, F., Nguyen, B. and M. Yogo (2019), “Inspecting the Mechanism of Quantitative Easing in the Euro Area,” NBER Working Paper, No. 26152; Bergant, K., Fidora, M. and M. Schmitz (2018), “International capital flows at the security level – evidence from the ECB’s asset purchase programme," ECMI Paper, No 13926; Bauer, M. and Neely C. (2014), “International Channels of the Fed’s Unconventional Monetary Policy”, Journal of International Money and Finance, vol. 44, pp. 24-46; Fratzscher, M, Lo Duca, M., and Straub R. (2016), “On the International Spillovers of US Quantitative Easing,” The Economic Journal, vol. 128, pp. 330–377; Rogers, J., Scotti, C..and Wright J. (2014), “Evaluating Asset-Market Effects of Unconventional Monetary Policy: A Cross-Country Comparison,” Economic Policy, vol. 29(80), pp. 749-799.

- [30]See, for example, Burstein, A. and Gopinath, G. (2014), “International Prices and Exchange Rates“, in Gopinath, G., Helpman, E. and Rogoff, K. (eds.), Handbook of International Economics, vol. 4, pp. 391-451.

- [31]See Gopinath, G., C. Casas, F. Diez, P.-O. Gourinchas and M. Plagborg-Moller (forthcoming), “Dominant Currency Paradigm,” American Economic Review.

- [32]See Dieppe, A., Georgiadis, G., Ricci, M., Van Robays, I. and van Roye, B. (2017), “ECB-Global: introducing ECB's global macroeconomic model for spillover analysis,” Working Paper Series, No 2045, ECB.

- [33]See also Gopinath et al. (2019), op. cit.

- [34]On the asymmetry in the international impact of US monetary policy and its implications for the euro area economy, see also de Guindos, L. (2019), “International spillovers of monetary policy and financial stability concerns,” speech held at the ECB and Its Watchers XX Conference, Frankfurt am Main, 27 March 2019.

- [35]See Kalemli-Özcan, S. (2019), “U.S. Monetary Policy and International Risk Spillovers,” Jackson Hole Economic Policy Symposium.

- [36]See Lane, P. R., and Shambaugh, J. C. (2010), "Financial exchange rates and international currency exposures," American Economic Review, vol. 100(1), pp. 518-40; Lane, P. R., and Shambaugh, J. C. (2010), "The long or short of it: determinants of foreign currency exposure in external balance sheets," Journal of International Economics, vol. 80(1), pp. 33-44; and Benetrix, A., Lane, P. R. and Shambaugh, J. C. (2015) “International Currency Exposures, Valuation Effects and the Global Financial Crisis,” Journal of International Economics, vol. 96, pp. 98-109.

- [37]For some evidence on the magnitude of spillbacks see Georgiadis, G. (2017) “To bi, or not to bi? Differences between spillover estimates from bilateral and multilateral multi-country models”, Journal of International Economics, vol. 107(C), pp. 1-18; Dees, S. and Galesi, A. (2019), “The Global Financial Cycle and US Monetary Policy in an Interconnected World,” forthcoming; as well as Box 4 in IMF (2014), “IMF Spillover Report”.

- [38] Furthermore, the proximity of the effective lower bound may affect the size of spillovers, as suggested e.g. by the analyses of Taylor, J. (2013), "International monetary policy coordination: past, present and future," BIS Working paper, No 437, Bank for International Settlements and Caballero, R., Farhi, E. and Gourinchas, P.-O. (2015), "Global Imbalances and Currency Wars at the ZLB,” NBER Working Paper, No 21670.

- [39]See Tirpák, M. (2019), “What the maturing tech cycle signals for the global economy”, Economic Bulletin, Issue 3, ECB.

- [40]See Galstyan, V. (2019), “Inflation and the Current Account in the Euro Area,” Economic Letters, No 4, Central Bank of Ireland.

- [41]See also Draghi, M. “The International Dimension of Monetary Policy, Introductory speech at the ECB Forum on Central Banking, Sintra, 28 June 2016. See also Cœuré, B. (2016), “The internationalisation of monetary policy,” Journal of International Money and Finance, vol. 67, pp. 8-12, as well as Claessens S., Stracca L. and Warnock, F. E. (2016), “International dimensions of conventional and unconventional monetary policy,” Journal of International Money and Finance, vol. 320, pp. 1-7.

Europeiska centralbanken

Generaldirektorat Kommunikation och språktjänster

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Texten får återges om källan anges.

Kontakt för media