- Speech

Challenges to monetary policy normalisation

Speech by Peter Praet[1], Member of the Executive Board of the ECB, at the SUERF conference “Sustainable Policy Responses: EU and US Perspectives”, New York, 20 September 2018

Introduction

The euro area economy continues to expand at a rate that is above potential, despite a slow-down relative to the exceptional growth rates observed in the second half of last year. The underlying strength of the economy supports our confidence that the sustained convergence of inflation to our aim will proceed and will be maintained even after a gradual winding-down of our net asset purchases. At the same time, uncertainties relating to rising protectionism, vulnerabilities in emerging markets and financial market volatility have gained more prominence recently. Significant monetary policy stimulus is still needed to support the further build-up of domestic price pressures and headline inflation developments over the medium term.

At our June monetary policy meeting, we initiated a rotation of our policy instruments from our asset purchase programme (APP) towards our conventional instruments of monetary policy – the policy interest rates and forward guidance on their likely future evolution. This had two main elements. First, we said that we anticipated that we would gradually wind down our net asset purchases, subject to incoming data confirming our outlook for inflation. Our projections currently foresee that inflation will rise gradually but consistently towards levels below, but close to, 2% over the medium term. Second, we updated and enhanced our forward guidance on the path for interest rates, which is now expressed in terms of the expectation that our key ECB interest rates will remain at their present levels “at least through the summer of 2019, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”. Finally, we maintained our intention to reinvest principal payments from maturing securities purchased under the APP “for an extended period of time after the end of our net asset purchases, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation”.

At our September meeting last week, and in line with the conditional plan announced in June, we decided to reduce the monthly pace of our net asset purchases, from €30 billion to €15 billion a month, for the period from October to December. In addition, we reiterated the forward guidance on the path of all our monetary policy instruments, as mapped out in June.

Against this background, I would like to focus today on two questions. The first is why we anticipate that it is likely to be appropriate to terminate net asset purchases by the end of December this year. The second is why we need to maintain an ample degree of monetary accommodation.

The rotation from the asset purchase programme to rate forward guidance

The ECB’s APP has been a central component of the comprehensive package of measures which the Governing Council has deployed since June 2014 to safeguard price stability. In addition to the APP and forward guidance on our key interest rates, a negative deposit facility rate and targeted longer-term refinancing operations (TLTROs) make important contributions to monetary accommodation. This combination of instruments allows for complementary and mutually reinforcing interactions in providing monetary accommodation, including possibilities to compensate for one another.

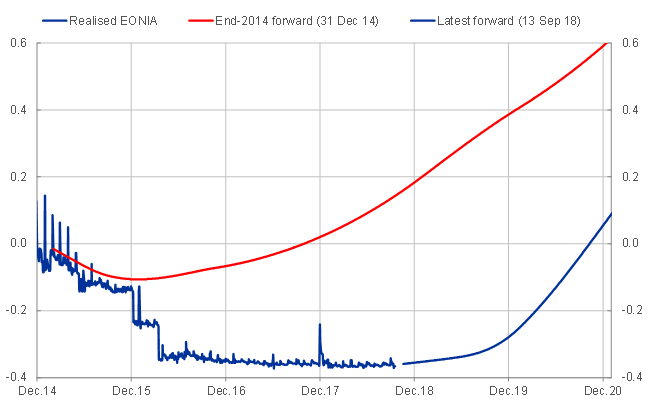

Taken together, the measures we have adopted since June 2014 have had a substantial financial market impact, which has manifested itself in two ways. First, risk-free interest rates have been compressed at all maturities, thus reducing the basis that banks and the capital markets adopt for determining the conditions at which credit is made available to borrowers (Chart 1). Second, the policies have resulted in a liquidity creation effect, which is often considered a side-show relative to yield compression, but which was in fact critical to restoring intermediation in the strained financial conditions we faced when the policies were launched. In the euro area, we can see this effect quite clearly in the development of broad money, specifically M3, over recent times. In 2013 M3 growth had fallen close to zero, as banks in large parts of the euro area sought to deleverage their balance sheets by severely curtailing credit and engaging in other contractionary actions. Loan extinction became a powerful drag on money creation. The APP broke that vicious circle by forcing fresh liquidity into the system, as the Eurosystem started paying for the purchased securities by creating reserves and deposits.

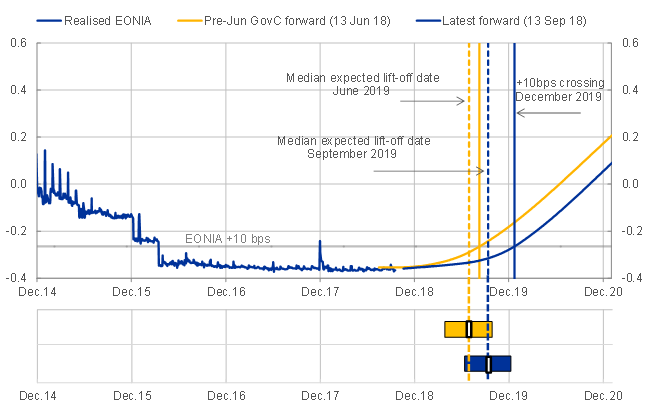

EONIA forward curves estimated from OIS

(percentage per annum)

Source: ECB. Notes: Latest observation: 17 September 2018 for realised EONIA.

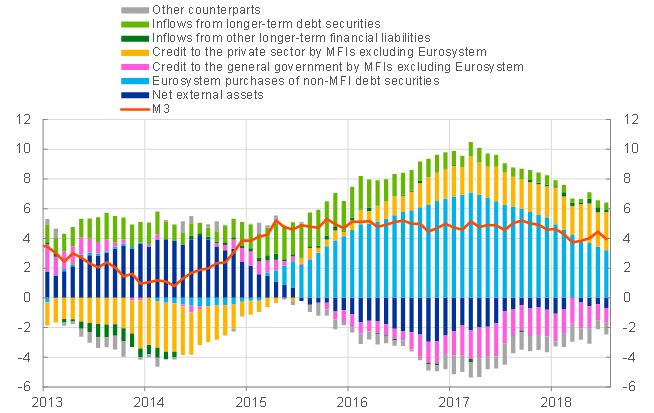

Initially, growth in M3 was supported primarily by APP-induced liquidity injections. However, almost as soon as our net asset purchases started, bank credit to the economy began to be a source of money creation. More recently, as we embarked on reducing the pace of monthly purchases, we have observed a gradual shift in the growth momentum of M3 from the exogenous source of money creation through the APP to a rising contribution from endogenous deposit creation by banks due to a sustained pick-up in credit (Chart 2). The APP has allowed banks to rebalance their portfolios and use their renewed balance sheet capacity to extend credit to the real economy. Together the expansionary effects of our policies spurred a substantial recovery, which gradually morphed into an expansion, and which is now in its fifth year.

Counterparts to M3 growth

(annual percentage changes; percentage point contributions)

Source: ECB.Notes: Latest observation: July 2018.

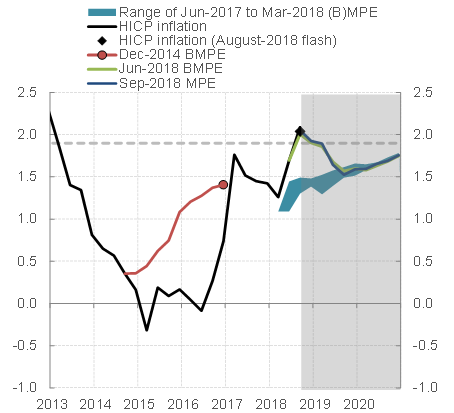

Since the start of the APP in 2015, the Governing Council has made net asset purchases under the APP conditional on progress towards a sustained adjustment in the path of inflation to levels below, but close to, 2% over the medium term. To measure progress towards a sustained adjustment in the path of inflation, we have applied three criteria: first, convergence of projected headline inflation to our medium-term aim; second, confidence in the realisation of this projected convergence path; and third, the resilience of inflation convergence even after the end of our net asset purchases.

In terms of convergence, the June 2018 Eurosystem staff projections foresaw inflation at a level of 1.7% in 2018, 2019 and 2020. These projections confirmed the pattern of convergence to levels closer to 2% that had become increasingly evident over a series of projections exercises (Chart 3). This was subsequently confirmed by the September 2018 ECB staff projections.

September 2018 MPE: Actual, projected HICP inflation and projected HICP inflation from previous (B)MPE vintages

(year-on-year percentage change)

Source: ECB staff projections.

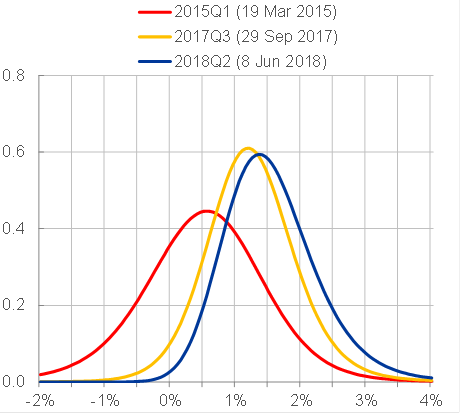

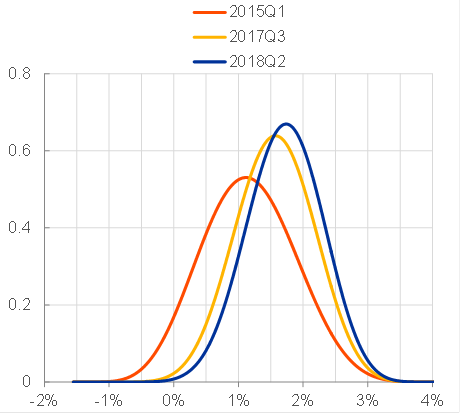

Second, on confidence, the uncertainty around the inflation outlook has been receding significantly and the risk of deflation has vanished. Inflation expectations – both survey and market-based – have been gradually improving and are increasingly consistent with our inflation aim. The dispersion of the predictive distribution of market- and survey-based measures of inflation expectations has been compressed considerably since 2014 (Charts 4 and 5). Moreover, domestic cost pressures are strengthening amid high levels of capacity utilisation, tightening labour markets and rising wages.

Option-implied probability density function of euro area inflation over the next two years

Sources: Bloomberg, Reuters, ECB calculations.Notes: The chart shows the risk-neutral probability distribution function implied by two-year zero-coupon inflation options. These risk-neutral probabilities may differ significantly from physical, or true, probabilities. They are estimated on the basis of call (“caplets”) and put options (“floorlets”) with different strike rates on the (three-month lagged) euro area HICPxT (ex tobacco) index, assuming Black-Scholes option pricing and implied volatilities that vary across strike rates (“volatility smile”).

Survey-implied probability density function of euro area inflation in two years time

Source: ECB Survey of Professional Forecasters.

The last criterion, resilience, has been pivotal to our decisions relating to net asset purchases. Why did we judge inflation and the economy to have become sufficiently robust as to allow a gradual end to net purchases? Let me go back to the mechanics of securities purchases. The fundamental mechanism that has justified our outright interventions works through the market price of duration risk, which is the interest rate risk borne by price-sensitive investors in long-term bonds. Investors in long-term bonds require higher premia to bear the extra risk. This pushes up the long-term interest rate. If the central bank wants to exert downward pressure on long-term interest rates, then it can absorb extra duration risk from the market by purchasing securities with a relatively longer maturity. This frees up more risk-bearing capacity for investors, which they can re-deploy towards different types of risk, including investment in the real economy, which is a key channel of transmission to business investment and durable consumption. It is worth remembering here that, for a central bank to set this mechanism in motion, it is the fact of holding a large portfolio of long-dated securities embodying duration risk that matters. These effects are complemented by the signalling channel that asset purchases imply for the path of interest rates.

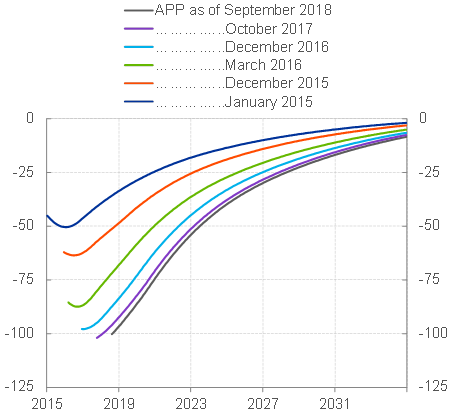

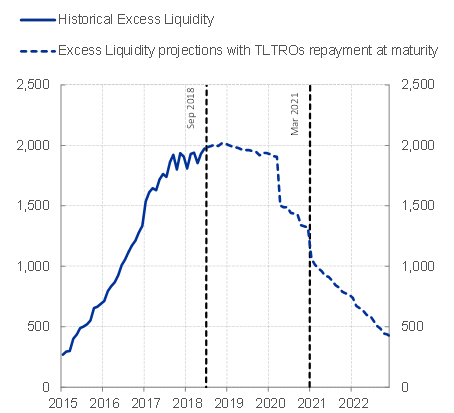

The bonds we have purchased will remain on our balance sheet for an extended period of time after the end of our net asset purchases. As a result, a substantial stock effect will continue to extract a sizeable amount of duration risk, even as the portfolio is set to increase at a much reduced pace until the end of December and is anticipated to remain constant thereafter. The roll-over of the portfolio will also continue to preserve adequate liquidity conditions, despite the decline in the volume of banks’ excess reserves that we anticipate will follow the expiration of our outstanding TLTROs. You can see this in the following charts, which show the term-premium compression that our portfolio is estimated to bring about across time (Chart 6) and the estimated evolution of excess liquidity over the period stretching beyond the maturity of the TLTROs (Chart 7).

Estimated effect of APP re-calibration vintages on euro area 10-year term premium

(basis points)

Source: Eser, Lemke, Nyholm, Radde, Vladu (2018).Notes: Euro area yields are proxied by the GDP-weighted long-term yield of the four largest euro area jurisdictions. The 10-year yield impacts are obtained from a Li-Wei model. Impacts are shown for different recalibration vintages. The marginal impact of each recalibration is given by the distance between the line referring to that vintage and the line referring to the vintage earlier in time. In constructing the curves, the arbitrary assumption was made that reinvestments will be carried out until December 2020 and securities will be rolled over into a mix of securities in line with market neutrality. Latest observation: August 2018.

Evolution of excess liquidity

(€ bn)

Sources: ECB.Notes: The projected excess liquidity is based on a comprehensive simulation of the evolution of the Eurosystem balance sheet. In constructing the projection, the arbitrary assumption was made that reinvestments will be carried out until December 2020 and securities will be rolled over into a mix of securities in line with market neutrality. Last observation: August 2018.

In June we judged that the withdrawal of duration risk was approaching levels at which, subject to underlying and external conditions evolving in line with our projections, a gradual slowing and an eventual end of net purchases would not hamper the return of inflation to our aim.

However, announcing that we anticipated a gradual winding-down of our net purchases could have left expectations of our rate path unanchored. The signalling that comes together with a quantitative easing programme was reinforced in our case by the Governing Council’s decision to tie the expected path of the policy rates to the end of the net asset purchases. From March 2016 until June 2018, we provided guidance on the likely timing of a rate lift-off by saying that we expected the key ECB interest rates “to remain at their present levels for an extended period of time, and well past the horizon of our net asset purchases”. The adoption of this sequenced form of guidance turned out to be an important factor behind the reduction of uncertainty around the policy path that we have observed since March 2016 (Charts 8 and 9). Predicting at the June meeting what market participants would infer about future policy from the Governing Council’s announcements concerning its asset purchase plans – in other words, how investors would process the signalling implicit in such purchases – was particularly challenging. Had market participants drawn wrong inferences from the anticipated end to net asset purchases regarding the Governing Council’s rate expectations, this could have implied a more rapid increase in short-term interest rates than the Governing Council judged to be consistent with continued progress towards the policy objective. This, in turn, could have had significant financial market repercussions. The announcement could have destabilised expectations and sent shock waves through the financial system. The attendant tightening in financial conditions could have driven the path of inflation convergence off course. Assessing “resilience” was therefore of the essence.

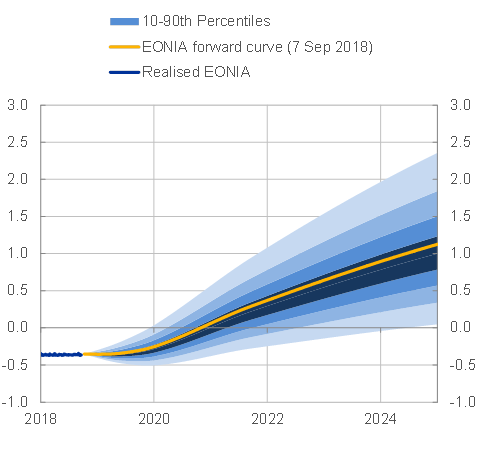

EONIA forward curve estimated from OIS and its risk-neutral distribution

(percentage per annum)

Sources: Bloomberg and ECB calculations.Notes: The charts combine two sources of information for deriving the risk-neutral distribution of EONIA: (1) prices of options on exchange-traded Euribor futures; (2) prices of interest rate caps on plain Euribor. Latest observation: 7 September 2018.

Standard deviation of risk-neutral 1-year ahead EONIA distribution

(basis points)

To minimise this risk, we decided to re-anchor our policy interest rates through a new conditionality formulation that – by and large – mirrored the one we had used for steering securities purchase expectations right from the beginning of the APP. Given our favourable experience with the two-leg conditionality of guidance regarding the APP, we have expressed our rate guidance as a two-pronged statement. There is the date-based element that interest rates are expected to remain at their present levels “at least through the summer of 2019”. In addition, there is a state-contingent element that rates will remain unchanged “in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term”.

As it turned out, our enhanced guidance on the rate path successfully kept the signalling channel of the APP communication under control (Chart 10). The financial market reaction to the announcement was well aligned with the Governing Council’s rate guidance. The latest surveys of market participants’ expectations regarding the most likely date for a lift-off indicate that the “at least through the summer” of 2019 formulation has been solidly internalised in markets’ risk-neutral expectations, although interest rate swap contracts price in the possibility that the first rate hike might be postponed somewhat beyond the summer of 2019, due to potential risks to the global economy. We do not see this disagreement between economists – who participate as panellists in the surveys on rate expectations – and rank-and-file traders – who make the investment decisions underpinning the interest rate swap curve – as necessarily puzzling. After all, our rate forward guidance has a time-based and a state-based element to it. The rate guidance is thus framed in terms of an expected path of action, which is inherently probabilistic in nature. Accordingly, given our data-dependent approach to monetary policy, that path may change in line with the evolving investors’ assessment of the economy and the inflation outlook (Chart 11).

Market reaction to communicating (anticipated) phasing out of net purchases

(basis points)

Sources: Bloomberg, ECB, and Kim and Wright (2005). Notes: The chart displays one-day changes of 10-year yields and premia for both the euro area and the US around policy meeting announcements.

The intention to reinvest for an extended period after the end of our purchases, and in any case for as long as needed, ensures a certain degree of duration extraction from bond markets also in the period ahead. Of course, we are well aware that our portfolio, even if kept constant in euro amounts, will tend to lose duration over time, as the securities held in the portfolio will gradually mature. At some point in the future, this passive loss of duration in our securities holdings will begin to exert increasing upward pressure on the term premium. But this will happen only slowly. And, in the more distant future, when the associated impact on long-term rates does eventually become significant, the measured tightening in financial conditions will be justified by the advanced phase of economic expansion which the economy will be enjoying at that point in time.

EONIA forward curve estimated from OIS and survey-based expected lift-off

(basis points)

Sources: Bloomberg, Thomson Reuters and ECB calculations.Notes: The box-plot shows the median, as well as the 25th and 75th percentiles of expected DFR lift-off dates as indicated in the pre-June and pre-September GovC Bloomberg surveys. Latest observation: 17 September 2018 for realised EONIA.

Why is an ample degree of monetary accommodation needed?

The ongoing economic expansion gives us confidence that inflation dynamics will strengthen in the period ahead. However, underlying price pressures are building up only gradually. So, the process of inflation convergence is expected to take time – meaning we have to be patient – and it remains contingent on a very substantial degree of monetary policy accommodation – meaning we have to be persistent in our monetary policy. Prudence also remains paramount, as we need to ensure that our stimulus preserves the economic expansion amid the lingering uncertainties.

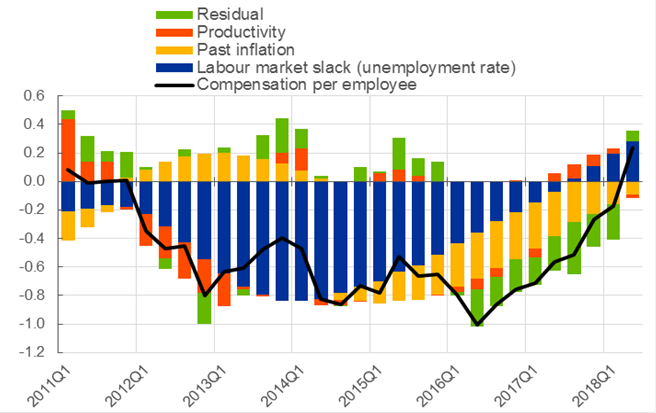

We see the need for patience analysing the principal intersection between growth and inflation formation that is the labour market. On the back of the economic expansion, which has been underpinned by our monetary policy, all of the job losses recorded during the crisis have been recovered and the unemployment rate is at its lowest level for nearly nine years. At the same time, the degree of slack in the economy remains uncertain. One reason for this is that productive capacities may have been positively affected by labour market reforms. In this context, non-accelerating inflation rate of unemployment (NAIRU) estimates have been continuously revised downwards. Moreover, narrow unemployment measures are likely to understate the prevailing degree of underemployment. Some employees would still like to work more hours, or move from temporary jobs to more permanent ones. There also appears to be a considerable backward-looking component in wage-setting, as it is only now that the considerable negative contribution of past inflation developments to compensation per employee growth has started to wane, aided by the gradual pick-up in inflation expectations and the higher headline inflation numbers (Chart 12).[2] Overall, while there is growing evidence that labour market tightness is finally translating into a pick-up in wage growth, we have to remain patient for a more durable rise in wage growth to materialise.

Moreover, higher wage growth does not mechanically translate into higher inflation. There is evidence that the degree to which firms pass on rising costs in the form of higher prices depends on whether they perceive cost pressures to be persistent.[3] A more lasting increase in wages, fostered by persistent monetary policy accommodation, should gradually strengthen the transmission of rising wages to price inflation, thereby supporting the projected trajectory of inflation convergence.

Euro area Phillips curve decomposition based on unemployment rate as measure of labour market slack

(deviations from mean in year-on-year growth terms; percentage point contributions)

Sources: Eurostat, ECB staff calculations.Notes: Contributions are calculated based on an equation in which the annualised quarterly growth of compensation per employee is regressed against its own lag, the lagged unemployment rate, productivity growth, the four-quarter moving average of headline inflation and a constant. Estimation sample: 1999Q1 until 2018Q2. Contributions are derived as in Yellen, J.L. (2015), “Inflation Dynamics and Monetary Policy”, Speech at the Philip Gamble Memorial Lecture, University of Massachusetts, Amherst, 24 September 2015.

Conclusion

The strength of the economy supports our confidence that the sustained convergence of inflation to our aim will proceed and will be maintained even after a gradual winding-down of our net asset purchases. At the same time, uncertainties relating to rising protectionism, vulnerabilities in emerging markets and financial market volatility have gained more prominence recently, and an ample degree of monetary accommodation remains necessary to underpin the further build-up of domestic price pressures and headline inflation developments over the medium term.

Today’s term structure of money market interest rates, which is a key ingredient underpinning our projections of a gradual but consistent return of inflation to our aim in the medium term, embodies a very moderate pace of rate rises beyond the expected date of lift-off. As we move forward beyond year-end, that segment of the term structure will become the focus of market scrutiny. In order for that segment to remain consistent with a continued gradual inflation convergence, our communication on policy adjustments beyond the first rate hike will become increasingly important.

Prudence, patience and persistence remain the guiding principles for our monetary policy in order to provide the necessary degree of monetary accommodation and to support the gradual build-up of inflationary pressures to return inflation to levels below, but close to, 2% in the medium term in a durable fashion.

- [1]I would like to thank Fabian Eser for his support in preparing this speech.

- [2]See, for instance, Dornbusch (1987) and Bergin and Feenstra (2001).

- [3]Bobeica, Ciccarelli and Vansteenkiste (2018), “The link between wage and price inflation in the euro area”, mimeo.

Europeiska centralbanken

Generaldirektorat Kommunikation och språktjänster

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Tyskland

- +49 69 1344 7455

- media@ecb.europa.eu

Texten får återges om källan anges.

Kontakt för media