Key Findings

The ECB Listens Portal

- On 24 February 2020 the ECB launched its “ECB Listens Portal” as part of the framework for its strategy review, encouraging the general public to express their views on a range of issues.

- Those who participated were invited to answer 13 open-ended questions grouped into four themes: “price stability”, “economic issues”, “other issues” and “communication”. This report analyses the 3,960 partial and complete responses submitted.

Overview of respondents

- The sample over-represents men and older age groups: 76% of respondents were male and 40% were above the age of 55.

- Northern-western and central European countries accounted for the vast majority of contributions: 27% of respondents came from the Netherlands, 25% from Germany and 10% from France.

- Around 15% of respondents answered using standard answers provided by civil society organisations, such as Greenpeace. These respondents were much younger than the rest of the sample and the majority were women.

Price Stability

- When asked to think about changes in the general price level, almost all respondents considered an increase. This suggests that rising prices are of greater importance to them. They highlighted the negative effects of excessive inflation on different aspects of their economic and financial situation (e.g. declining purchasing power, deterioration of savings and inaccessibility of the housing market). Many respondents pointed out that the issue is not inflation per se, but the fact that wages and pensions were not indexed.

- On the issue of excessive inflation and/or deflation, the largest share of respondents claimed to be concerned about both, emphasising the importance of price stability. Concern about inflation alone was expressed by the second largest share of respondents.

- The issue of unaffordable housing was a recurring theme. The vast majority of respondents considered these costs to be relevant to inflation and many stated that they should be more adequately included in the Harmonised Index of Consumer Prices (HICP). Younger respondents and those from northern EU Member States appeared to be particularly concerned about this issue.

- The impact of increasing grocery and daily expenses was mentioned by the majority of respondents. This was especially a concern for women and respondents from southern EU Member States. Another 50% of contributions via the Portal referred to housing costs, while one-fifth mentioned utility and transportation costs.

Economic expectations and concerns

- The worsening economic outlook and employment conditions were prominent concerns, especially for women and respondents from southern EU Member States. Older respondents and those from northern EU Member States were more likely to worry about the deterioration of savings and pensions as a result of low interest rates.

- According to nearly 60% of respondents, changing economic conditions had had a negative impact on their situation over the last decade. Employment conditions were often the discriminant factor, with people struggling to find or to keep a job; in more recent months, this situation was also due to the coronavirus (COVID-19) pandemic.

- At least half of the contributions received were critical of the ECB’s low interest rate policy. One reason often mentioned was the low return on savings, which pushed investors to take on excessive risks and created distortions in the financial and real estate market. Even some of the more positive responses pointed out that there were usually structural factors, for example job precariousness and excessive taxation, preventing them from fully benefiting from the favourable lending conditions.

Themes other than price stability

- A significant number of respondents stated that the ECB should take a more active role in sustaining economic growth, promoting employment, tackling climate change, fostering European integration (also in matters for which the ECB was not responsible, such as taxation), and fighting poverty and inequality.

- At the same time, a sizeable minority would like the ECB to focus exclusively on price stability, leaving other issues to democratically elected bodies, and to reassess the impact of negative interest rates and to improve monitoring of rising house prices.

- Most respondents believed that climate change already affected – or would soon affect – the economy, nature, everyday life and personal finances for the worse.

Communicating with the public

- Even among the sizeable share of respondents who claimed to be adequately informed about the ECB and the Eurosystem, many pointed to a lack of knowledge among the general public and the complexity of monetary policy topics, the use of economic jargon and the lack of accessible communication.

- Simple language and concrete examples were often suggested as ways to improve the ECB’s communication. More two-way engagement and listening activities with the public at large, e.g. via national events, were also often recommended.

- Many respondents indicated they would like to see more transparent explanations of the ECB’s decisions, together with the reasoning behind them and the impact of its policies, including the benefits, risks and negative effects.

- A lack of financial education among the public at large was seen as an impediment to a sound understanding of the ECB’s policies. Many respondents stated they would like to see the institution take an active role in improving this situation.

We wish to thank all the people who have taken their time to share their views with us.

1 Introduction

On 24 February 2020 the ECB launched its “ECB Listens Portal” as part of the framework for its strategy review, encouraging the general public to express their views on a range of issues. Those who participated were invited to answer 13 open-ended questions[1] grouped into four themes: “price stability”, “economic issues”, “other issues” and “communication”. The Portal was available in all euro area languages.

The Portal closed on 31 October 2020. The following document analyses the 3,960 partial and complete responses submitted.

A mix of qualitative and quantitative analysis – specifically text mining and natural language processing – was used to gain insight into participants’ text responses. Each question was analysed in a different way, depending on the nature of the responses. Methodological details are included in the appendix.

It is important to keep in mind that data gathered through public consultation do not provide a representative view of the population, as respondents are self-selecting. In line with the European Commission’s recommendation and best practices,[2] we do not apply weighting techniques but rather provide an analysis by socio-demographic groups.

2 Overview of respondents

The ECB Listens Portal received 3,960[3] responses. At a glance, the age-gender group with the largest number of responses is made up of men above the age of 55, accounting for 33% of total responses. This is in fact greater than the total number of responses from women, which amounted to 22% of total responses.[4]

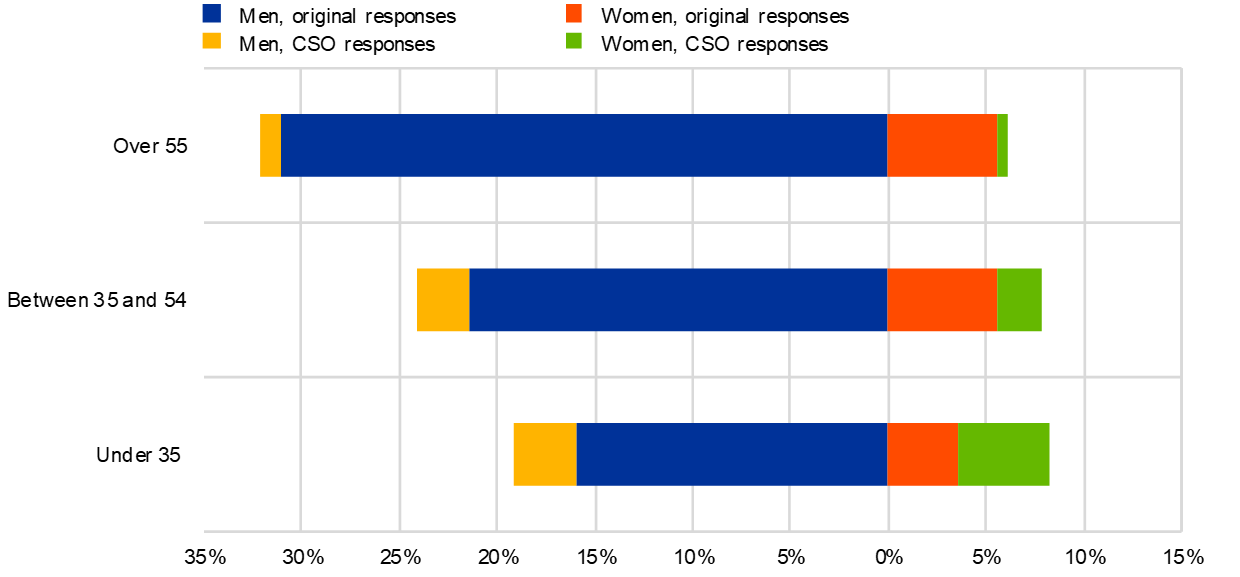

Overall, the number of contributions increases with age: 28% of them come from respondents below 35 years old and nearly 40% of respondents are above 55. However, as shown in Chart 1, this trend is only present for men. In the case of women, the most represented age group is the group of those below 35 years old.

Civil society organisations (CSOs) drew attention to the ECB’s strategy review. Some of these organisations, most notably Greenpeace, called on the public to submit contributions to the ECB Listens Portal, offering standard answers that could be copied into the survey. Overall, around 14% of all responses were copy-paste answers provided by Greenpeace. Another 1% came from other CSOs. As such, original answers amounted to 85% of the sample.

The CSO initiative boosted the number of responses from women and younger people. Around 52% of responses that referred to CSOs’ proposals came from women; in contrast, contributions from women only accounted for 18% of original contributions. In particular, the inflow of “CSO answers” more than doubled the number of responses from women below the age of 35. Overall, nearly 55% of CSO responses come from people under 35, while this share falls to 24% for original responses. The share of respondents in the 35-54 age bracket is around 33%, for both original and CSO answers.

Chart 1

Share of respondents by gender, age group and type of response

Notes: “CSO responses” refers to responses that were copy-pasted from contributions offered by organisations such as Greenpeace. “Original responses” refers to the remaining responses.

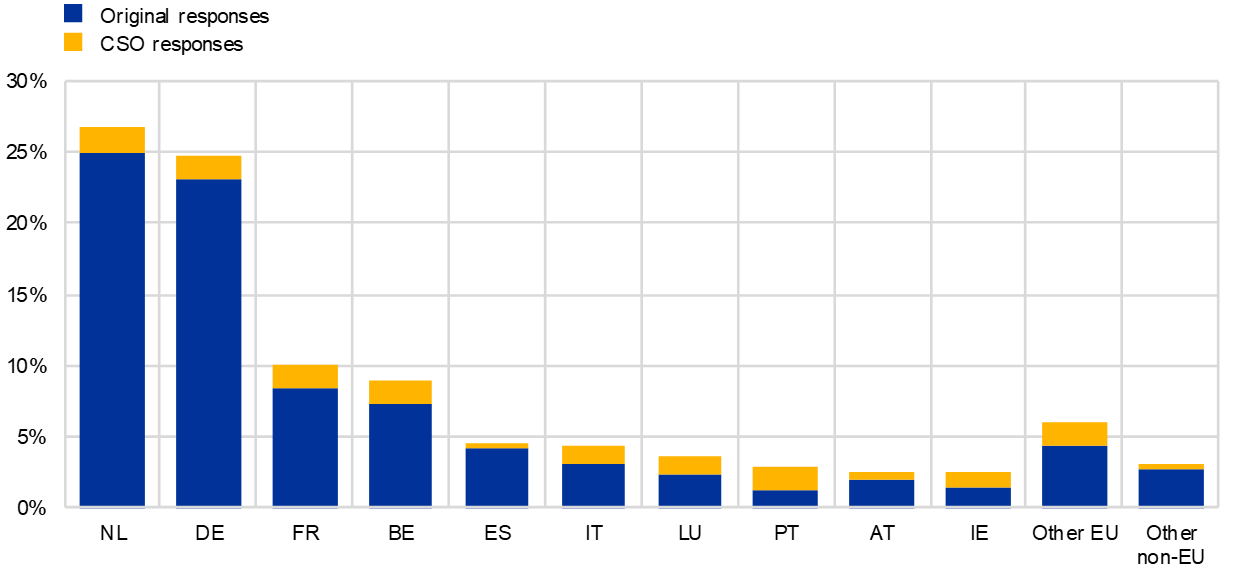

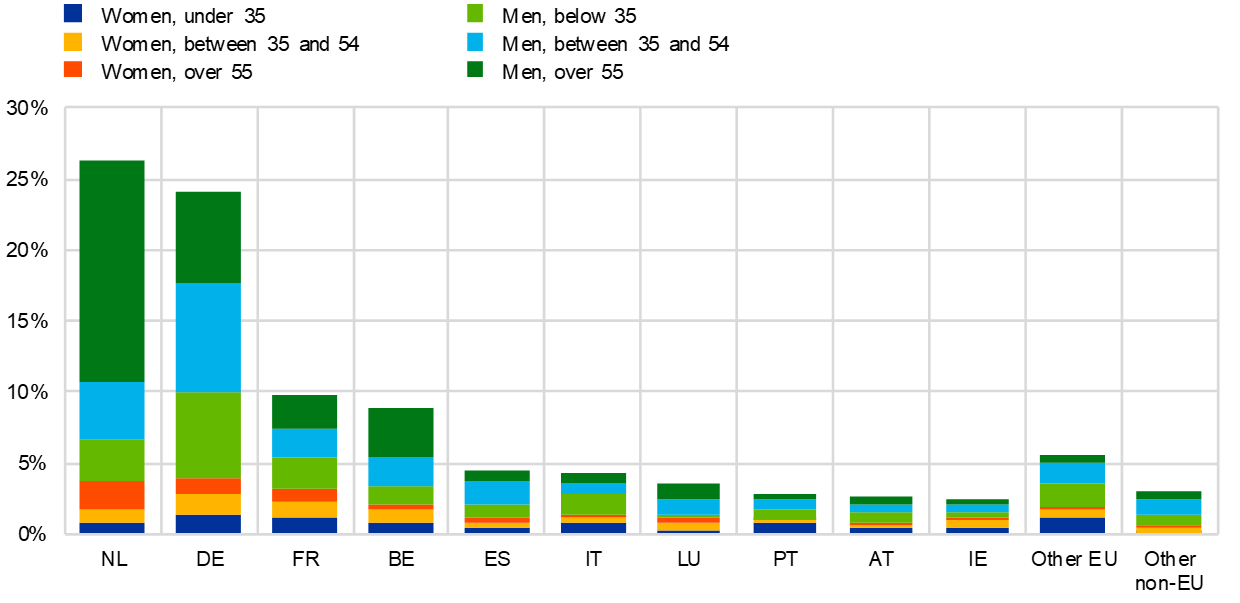

In geographical terms, responses from central and north-western Europe account for the vast majority (see Chart 2, Panel a). The Netherlands is the largest contributor with a 27% share; this is partially due to a Dutch language magazine that covered the launch of the Portal in February and provided a direct link to it in an article. The Netherlands is followed by Germany (25%), France (10%) and Belgium (9%). Spain and Italy each account for 4%. Eastern European countries have a marginal share of responses (less than 2%). In Portugal, Ireland, Luxembourg and Italy, the share of CSO responses range from one-quarter of the responses to more than half.

In terms of differences in socio-demographic characteristics across countries, what stands out is that 67% of respondents from the Netherlands are people over the age of 55 (59% men; 8% women). The share of older people is also significant in Belgium (43%) and Luxembourg (37%). Countries with the highest share of contributions from women are those with the highest share of CSO responses: Ireland, Portugal, Italy and Luxembourg (see Chart 2, Panel b).

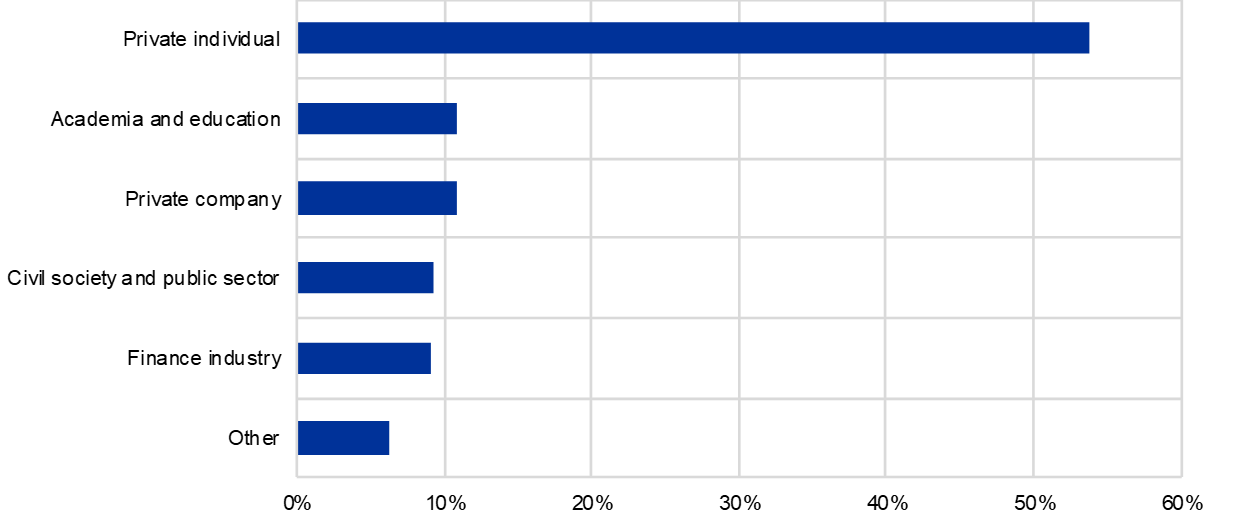

Looking at sector distribution, private individuals are the most represented, with 54%, followed by private companies (11%), members of academia and education (11%), and respondents from the finance industry (9%) (see Chart 3).

Chart 2

Share of respondents for the ten most represented countries

Panel a: By type of contribution

Panel b: By age and gender group

Notes: “CSO responses” refers to responses that were copy-pasted from contributions offered by organisations such as Greenpeace. “Original responses” refers to the remaining responses.

Chart 3

Share of respondents by sector

Some notes on the analysis

Respondents could answer all or only some of the questions. As the questionnaire progressed, the number of blank responses increased. In other words, the sample size varies according to the questions for which responses are given. For this reason, the percentages indicated in the analysis of each question always refer to the percentage share of the total respondents to that specific question. Details on response patterns can be found in the appendix.

Respondents did not always provide pertinent responses in answering specific questions or fully address the main point of the question. When relevant, we report the estimated share of these “off-topic” answers alongside the most frequent points made in this category.

A socio-demographic analysis is carried out to highlight which opinions tend to be more prevalent or which concerns are more pressing for different categories of respondent. This step of the analysis focuses exclusively on original contributions to highlight possible heterogeneities across groups better. Dimensions taken into account are respondents’ gender, age category (under 35, between 35 and 54, and over 55), country group (northern, southern and eastern EU Member States and non-EU countries) and sector (academia and education, public sector and civil society, finance industry, private sector, and others).

3 Price stability

What does price stability mean for you?

The main contribution central banks can make to improving people’s welfare is to maintain price stability. If the rate of inflation (the rate at which consumer prices increase on average from one year to the next) is low and stable, this situation is consistent with price stability. We currently aim for an inflation rate below, but close to, 2% over the medium term.

3.1 Effect of changes in general price levels

How do changes in general price levels affect you/your organisation and your members?

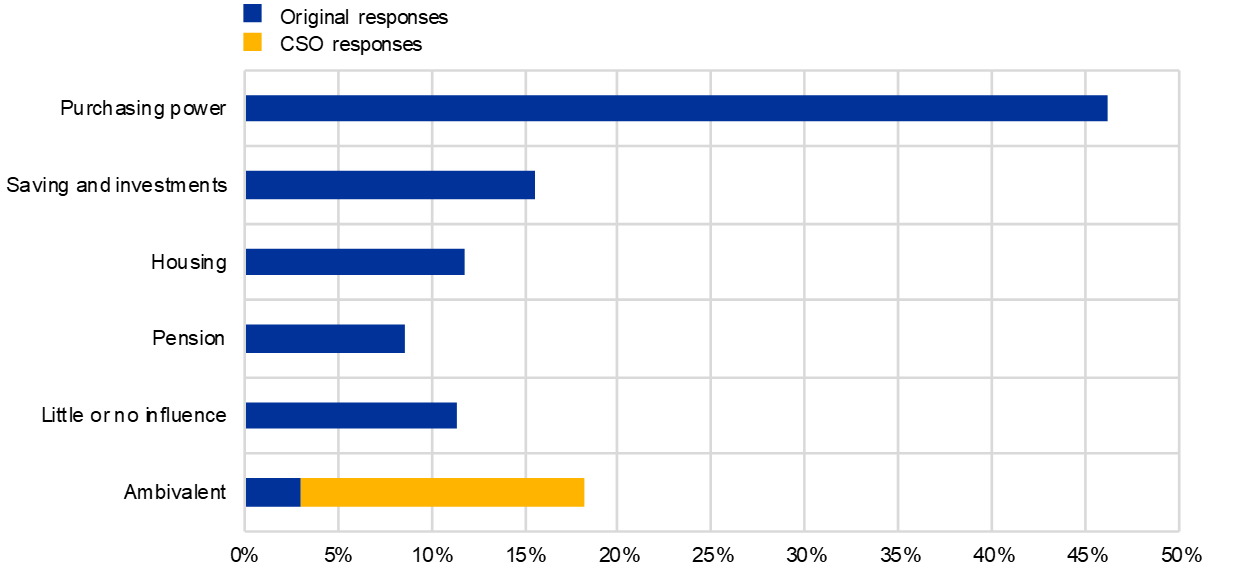

When asked to think about changes in general price levels, even though the question did not explicitly state the direction of the change, the vast majority of respondents referred to an increase in prices. This suggests that rising prices are of greater importance to them. Respondents pointed to the negative effects of rising prices on different aspects of their economic and financial situation, either theoretically or referring to their current situation.

Over 45% of respondents mentioned declining purchasing power (see Chart 4). Many were keen to emphasise that it was not necessarily an increase in the price level that was harmful, but rather that wages and pensions were not adjusted accordingly. Women and respondents under 55 years old were more likely to report this issue than their respective counterparts.

Just over 15% of contributions focused on reduced savings and frequently mentioned the harmful impact of low interest rates. Men, respondents from northern EU Member States and members of the finance industry appeared particularly concerned about this aspect. “Our customers are increasingly less motivated to save money for retirement,” one respondent working in the insurance sector writes. “This, combined with low interest rates, is a twofold attack against our business model”.

Another non-negligible share of respondents, especially among respondents under 55, highlighted the rising price of housing. “Prices in general are OK. […] However, rent (which is my biggest expense) has increased dramatically,” an Austrian respondent writes. Less than 10% of respondents specifically mentioned the devaluation of pensions.

One in ten respondents felt little or no impact at all from price changes, primarily because their salary is adjusted yearly or because their level of consumption is low. In this group, certain respondents recognised that, while changes in prices were not an issue for them, others might be in a very different situation. Moreover, respondents from the private sector recognised that they would be able to pass moderate price increases on to their customers.

Finally, according to the standard Greenpeace responses, while a change in the prices of basic necessities and housing could have a major social impact, increases in the costs of polluting activities and goods might promote a healthier, greener lifestyle and be used to combat climate change.

To conclude, it is worth mentioning that some respondents asked why the ECB wants to promote price stability by aiming for 2% instead of 0%: “2% a year for 20 years means more than a 40% price increase given a stable income,” one respondent notes.

Chart 4

Aspects of economic/financial situation affected by price changes

Estimated share of respondents in the main categories, total = 3,887

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

3.2 Concerns about excessive inflation and deflation

Are you concerned about either deflation or inflation being too high?

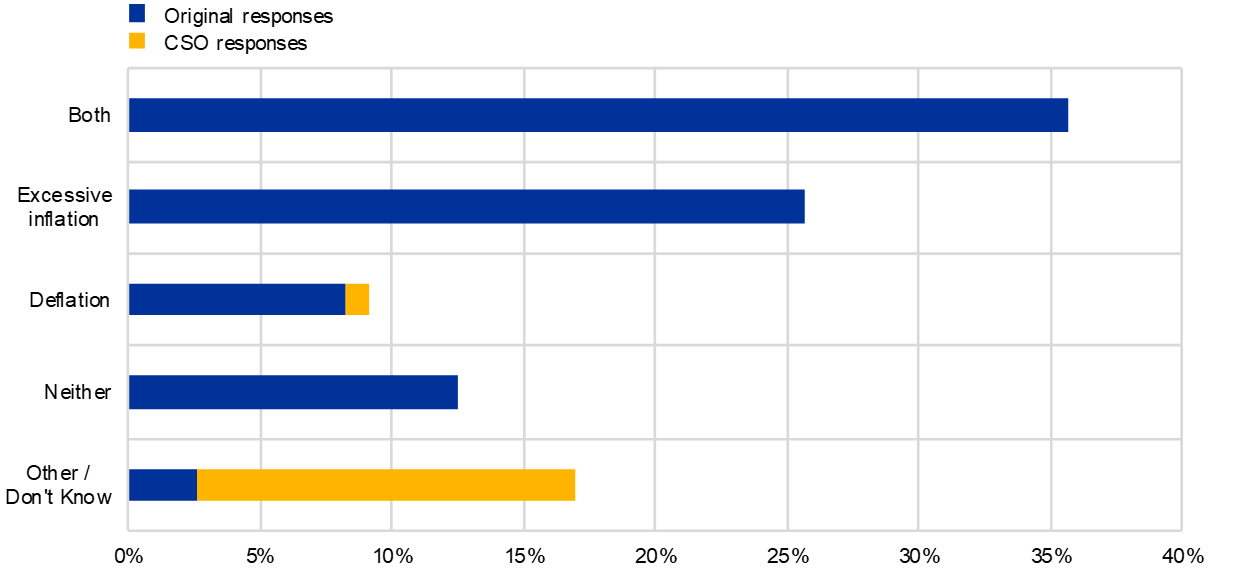

In the previous section we saw that, when thinking about changes in prices, respondents mainly focused on inflation. However, to the question on whether they were concerned about too high a level of inflation or deflation, a sizeable share of respondents stated they were worried about both (see Chart 5). “Stability is important,” a German respondent writes. “Either my savings will be lower or my income will be lower [in case of excessive inflation/deflation].” Women and respondents from southern EU Member States were more likely to indicate both risks at the same time, while their counterparts tended to worry about them individually.

Inflation alone was mentioned by one-quarter of respondents. “In [the] case of deflation I can still afford food and clothes (up to a point),” one respondent explains, and “In [the] case of inflation, the value of money is decreasing”. Hyperinflation emerges as a concern especially as prices actually increase by more than the level of inflation. Indeed, many respondents thought that inflation was systematically underestimated or otherwise poorly measured, especially owing to the way housing costs are treated.

Most respondents focused on the discrepancy between earnings and purchasing power, strongly emphasising the importance of having indexed wages and pensions. Other stressed that high inflation eroded savings deposits, which was the safest form of saving for many. Together with low or negative interest rates, they saw it as a devastating combination for their future. “Considering that my savings are meant to cover my pension, I would be afraid to see these savings being devalued,” one respondent noted. The increasing inaccessibility of the housing market and housing bubbles were also often mentioned, especially by younger respondents.[5]

More broadly, respondents worried about asset price inflation without growth in the real economy (a phenomenon often seen as the result of the ECB’s monetary policy). Respondents who worked in financial markets seemed to be more likely to recognise that large public debts can be reduced through an artificial rise in inflation.

Chart 5

Concerns about excessive inflation and deflation

Estimated share of respondents in each category, total = 3,885

Notes: Results using a dictionary-based approach. The categories are mutually exclusive.

Less than 10% of respondents were worried about deflation and its “devastating effect on the economy”: a lack of economic growth, the depreciation of savings and no viable investment alternatives, wage cuts and higher unemployment. Some respondents expressed their concern that purchasing power would decrease as property price bubbles formed. In general, there was fear of a deflationary spiral and stagnation in Europe that would paralyse the economy, with many people mentioning Japan. Some respondents voiced their concern that monetary policy would lack the instruments to tackle deflation.

Around 10-15% of respondents were not concerned (at least not for the time being). The remainder of the sample did not know (“I don't know economy so well to be able to answer this”, “I must confess I do not know the difference, even if I consider myself an educated professional”) or was concerned about other issues. Some respondents, for example, mentioned low interest rates, unemployment rates and climate change. This group included Greenpeace responses, which stated that, although both excessive inflation and deflation are potentially a problem, they are not nearly as important as the protection of the environment.

3.3 Effects of price changes on goods and services

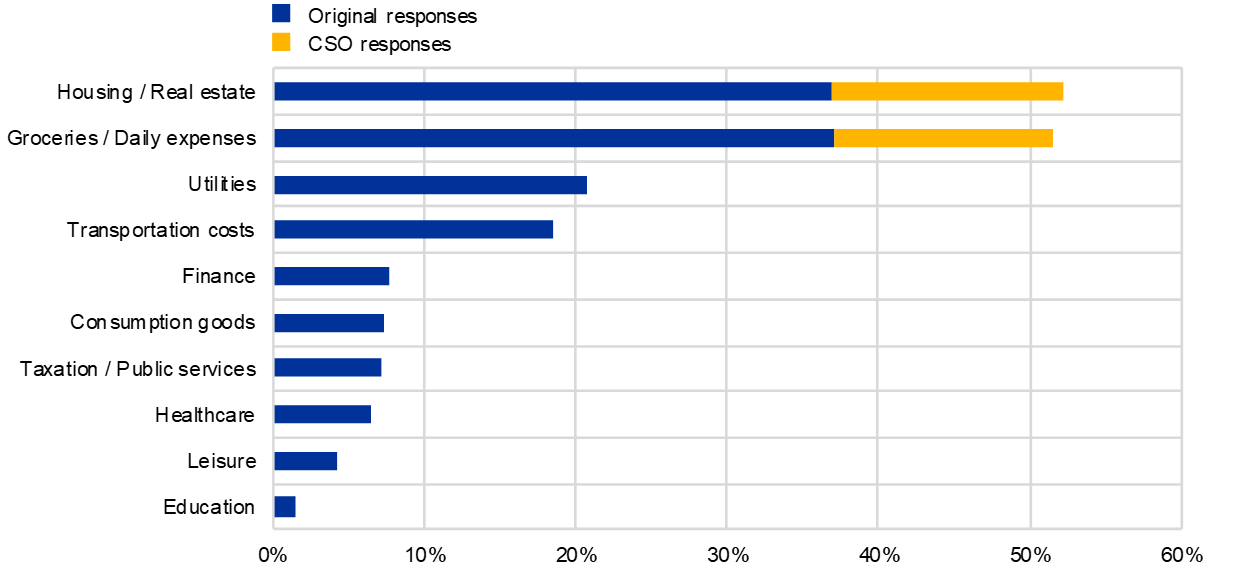

For which types of goods and services do you feel the effects of price changes most?

In response to this question, most respondents noted an increase in the cost of housing: purchase prices, accommodation costs and rent.[6] As shown in Chart 6, this percentage includes CSO contributions. “I noticed general costs, e.g. for housing, are rising beyond the point to be actually affordable for private individuals,” a German respondent writes. Indeed, respondents from northern EU Member States were significantly more likely to mention housing costs than those from southern ones.

Another category of respondent that appeared to be very aware of developments in the housing market – perhaps because they are particularly exposed to it – are those under 55 years old. “Rent prices have been increasing steadily in my region and this is a major burden for my family budget,” a young Italian says.

The few times the ECB was mentioned it was in relation to housing and real estate. Respondents, mostly from northern EU Member States, blame the ECB’s policies for housing becoming inaccessible on account of high prices. In the words of one respondent, “The ECB’s continued low interest rate policy has led to asset inflation. […] Investors urgently look for alternatives to government bonds and therefore invest more in real estate. This in turn means that the purchase prices in the metropolitan areas have become unaffordable.”

Chart 6

Categories of goods and services for which a perceived change in price has the greatest impact

Estimated share of respondents in the main categories, total = 3,879

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

Groceries and daily expenses were also mentioned by nearly 51% of contributions, with women and respondents in southern EU Member States appearing to be very sensitive to changes in prices in this category.

The third most prominent category, mentioned in one-fifth of responses, was utilities; the most frequently listed items were energy, gas, heating and electricity. Utility prices were referred to much more by respondents over 35 years old, possibly because they are more directly affected by them than younger respondents.

Changes in transportation costs – mostly fuel prices, but also public transportation and the cost of buying and owning a car – were mentioned by nearly 20% of respondents. This percentage was significantly higher for respondents in southern EU Member States and those respondents under the age of 55.

The remaining categories were mentioned in less than 10% of contributions. The categories covered services related to finance, such as bank costs[7] (mentioned slightly more often by men than by women), consumption goods, taxation and the cost of public services (with older respondents feeling particularly affected), and lastly health-related expenses, such as health insurance, medical bills and dental expenses (women and older respondents were especially concerned). Only a few respondents mentioned leisure activities (such as travel, restaurants, cinemas and sports), education or childcare. Even fewer mentioned supply-side costs, such as the cost of labour and raw materials.

3.4 Relevance of housing prices

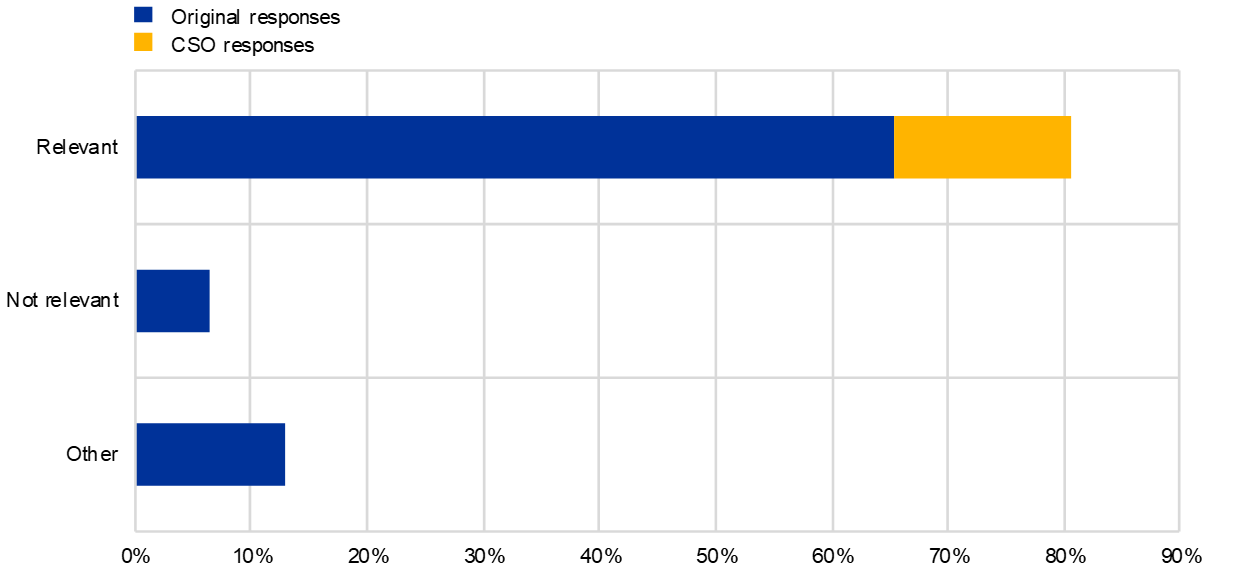

When you think about inflation, how relevant do you find the increase in the cost of housing?

The relevance of housing costs for inflation was confirmed by an overwhelming majority of respondents when asked directly about it (see Chart 7). In line with the results for the previous question, younger respondents and those from northern EU Member States tended to confirm the importance of these costs more frequently than other respondents.

“This cost now represents half of the income of many European citizens,” a French woman explained. On a similar, more personal note, a young man stated “I don’t consider half of my wage [as mine] because each month I have to pay rent”. Comments emphasising that housing costs accounted for a very significant portion of a household’s budget were frequent. Some respondents noted that these costs were growing disproportionately, to the point that housing was no longer affordable, especially when also taking indirect costs – mainly energy costs and local taxes – into account.

Similar concerns were raised in the standard Greenpeace responses. These responses also pointed to housing as being necessary for social integration and suggested that the ECB should create preferential rate refinancing operations (similar to its TLTROs) for banks to finance energy efficiency or decentralised renewable energy systems with interest-free loans for households.

Chart 7

Relevance of housing costs for inflation

Estimated percentage of respondents in each category, total = 3,880

Notes: Results using a dictionary-based approach. The categories are mutually exclusive.

Even among the minority of respondents who did not feel the burden of housing costs (in most cases homeowners), many recognised that high housing prices were a relevant issue for younger generations and less prosperous social groups: “For me personally [housing costs are] not important, but for society, this increase is a cause for concern.”

In short, respondents were of the opinion that housing costs could not be ignored. Indeed, a non-negligible share of respondents used the occasion to call for the inclusion of housing costs in the HICP: “The ECB and the national central banks give too little attention to this factor and too little weight [to it] in the HICP” and “[The rising cost] needs to be taken into account […] as housing is an essential part of people’s lives”. Some respondents argued that a failure in adequately accounting for such costs implied the failure of the ECB in fulfilling its price stability mandate.

The link between rising house prices and central bank policies, in particular low interest rates, was also criticised: “The central banks themselves, through their easing programmes, are an important driver of housing costs, whether it concerns the purchase of real estate or rents".

4 Economic expectations and concerns

What are your economic expectations and concerns?

We conduct monetary policy to make sure that the euro holds its value over time. To make our monetary policy as effective as possible, we want to better understand your expectations, as well as your economic concerns.

4.1 Economic concerns

What economic concerns are you/your organisation and your members facing?

Regarding the main economic issues that concerned respondents, contributions touched on a large number of topics ranging from inequality to financial crises.

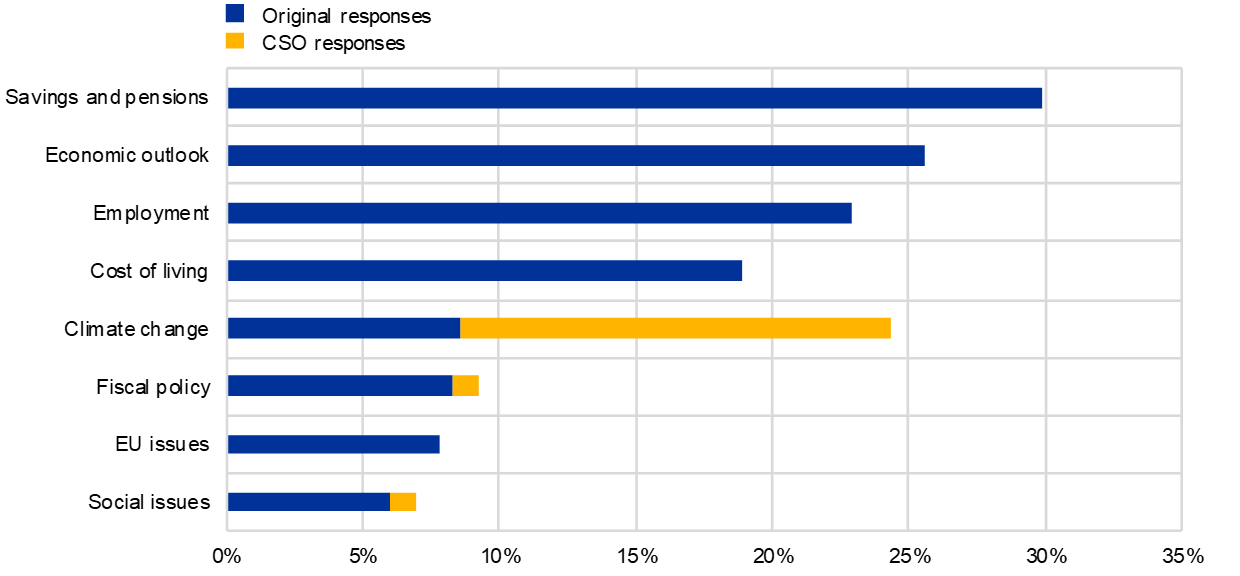

The most common response related to the deterioration of savings and pensions as a result of low interest rates, which was mentioned by about one-third of respondents (see Chart 8). Respondents above the age of 55 from northern EU Member States and members of the financial industry appeared to have very serious concerns. For example, one pensioner writes, “I have paid all of my salary taxes and saved […]. Now, my savings are quickly eroded because I have to pay wealth taxes while the bank charges a negative interest rate”.

The economic outlook was the next most widely cited concern. Weak growth, the current economic crisis caused by COVID-19 and the possibility of further crises in the not too distant future accounted for one-quarter of contributions. “We barely came out of the last crisis on this continent and now we are back again [facing] years of hard recovery,” one respondent wrote. Younger respondents and those from northern EU Member States appeared to be more concerned than their respective counterparts, as were respondents from the private sector by contrast with private citizens.

Chart 8

Main economic concerns

Estimated percentage of respondents in the main categories, total = 3,709

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

Unemployment and job precariousness were mentioned as significant sources of distress by one-quarter of respondents, especially women, young people and respondents from southern EU countries.

Around 20% of respondents, in particular young respondents, expressed their concerns about the decline in their standard of living or, in the words of a Portuguese respondent, “Finding the right balance between living and saving money, which can be difficult when your salary just covers your expenses and leaves only a small room for extras”. As in previous sections, many respondents pointed to wages and pensions not being indexed as a very significant issue.

Climate change was mentioned by around one-quarter of respondents, especially women. “As the COVID-19 crisis has shown, our economic activities are not ready to withstand the global shocks that will become more and more frequent in the coming years as a consequence of the climate crisis,” stated the Greenpeace contributions, which accounted for the largest share of this category. Respondents feared the long-term impact of climate change and complained about the muted response of EU governments and institutions. Climate shocks are also linked to the potentially increasing difficulty for the ECB to maintain price stability.

Around 10% of respondents expressed concerns about fiscal policy issues (e.g. taxation, public debt and austerity), while a slightly smaller percentage were worried about the situation at the EU level (in particular the contrast between northern and southern EU Member States), and about social issues (e.g. poverty and inequality).

4.2 Changes in economic conditions

How have changing economic conditions affected you in the last decade (for example, how have they affected your prospects of finding a job)?

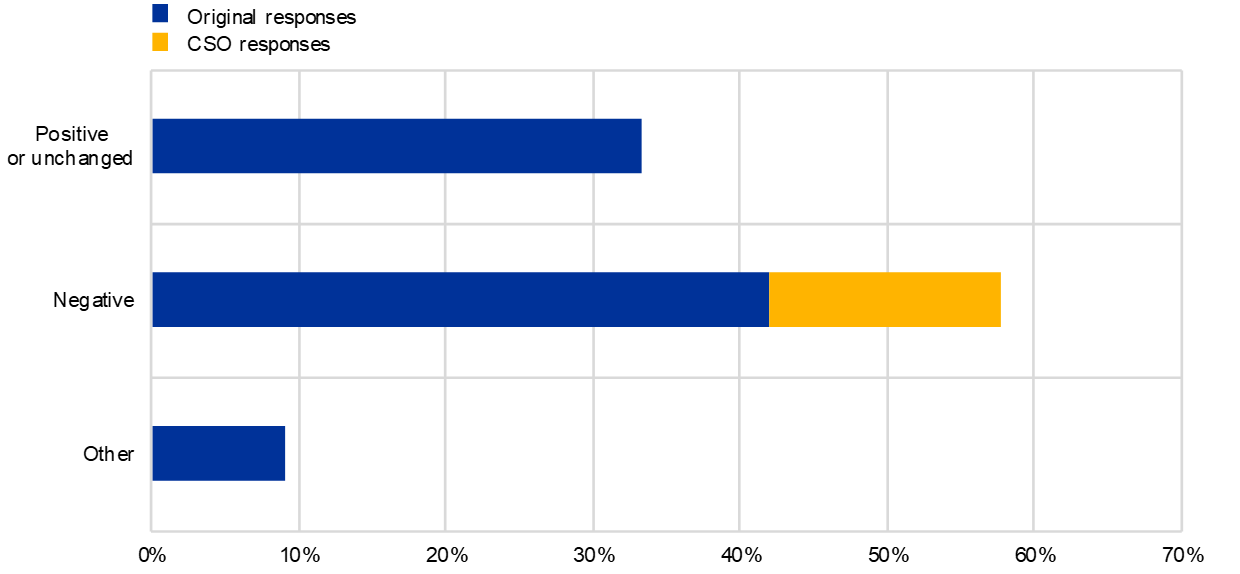

According to nearly 60% of respondents, changing economic conditions had had a negative impact on their situation over the last decade (see Chart 9).

Employment conditions were often the discriminant factor. One Spanish respondent summarised the situation as follows: “Irregular revenues and general instability. Extended periods without work. Difficulties in finding employment or stable contracts”. Rising unemployment and precarity were major concerns not only for younger generations (“As an older person, finding a job is virtually impossible”) and hinder the possibility to “buy a home or set up a family”. Some respondents mentioned that the search for a job was made even harder by the current pandemic, while others were still feeling the consequences of the previous financial crisis.

Other respondents, despite being employed, held that “wages are lagging behind price developments” or, in a similar vein, “real income stagnates or falls”. “I became poorer,” multiple respondents wrote. Similar concerns were shared by pensioners: “I have been retired for 10 years and I have lost 30% of my purchasing power”. Low interest rates that penalise savings and the difficulty finding accommodation were other recurring themes.

Around one-third of respondents wrote that changing conditions had not affected them or that they were better off. Many of these contributions revolved around the question of employment, with some respondents acknowledging they were pensioners, who no longer needed to look for a job and therefore found themselves in a “secure” position. Others highlighted the fact that they had a job in sectors that were not affected by the latest crises and by mounting competition.

Respondents in southern EU Member States and those working in the private sector were much more likely to state that their conditions had worsened. Younger people instead tended to give a more positive or neutral assessment of the last decade; one of the reasons for this, as some of them noted, was that many had been too young to work.

Chart 9

Impact of changing economic conditions in the last decade

Estimated percentage of respondents in each category, total = 3,700

Notes: Results using a dictionary-based approach. The categories are mutually exclusive.

4.3 Impact of low interest rates

How do low interest rates and monetary policy in general affect you/your organisation, your members and the overall economy?

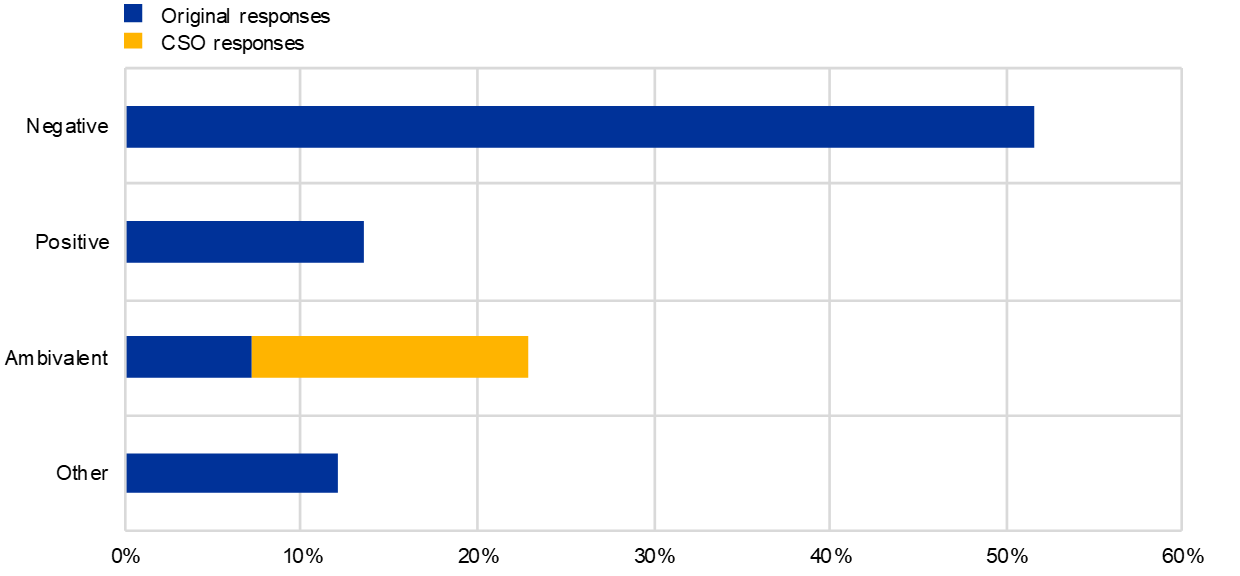

When asked how low interest rates and monetary policy affected them and the economy, most respondents tended to discuss the effect of low interest rates but not to mention monetary policy more in general.

At least half of the contributions received were critical of the ECB’s low interest rate policy (see Chart 10). One frequently cited reason was the low return on savings: “What to do with savings when taxation is higher than the interest rate?” one respondent asked. Unsurprisingly given the age composition of the sample, many respondents referred, in particular, to the negative impact of low interest rates on pensions, which have not been adjusted in recent years.

Respondents described how low rates of return were requiring them to take on greater risk and to invest, for example, in the stock market: “[Low interest rates] force me to invest in a riskier way than would be responsible at this stage in my life”. This practice, they explained, created distortions in the financial and real estate markets, making the financial system less sound. The fear of bubbles that could eventually lead to an economic crisis was mentioned by many. Another side effect cited was the “zombification” of the economy, which could eventually drive healthy firms out of the market: “Monetary policy created a real estate bubble and kept zombie enterprises and banks alive”.

Respondents also highlighted that low interest rates fuelled inequality through asset prices, “by filling the pockets of those who already have financial wealth”, or rising house prices. A few respondents also expressed great concern about excessive general indebtedness, stating that “There is a significant increase in borrowing by people who are simply unable to afford it” and “Saving is not encouraged, which goes against the principle of prudence”.

Turning to the small number of responses that regarded low interest rates as positive, the most frequently given reason concerned the contribution of expansionary monetary policy to financial and economic stability in the euro area and to the increase in employment: “[…] Low interest rates have been beneficial for the economy in general. But even more importantly, quantitative easing has stabilised the economy”.

Chart 10

Perceived impact of low interest rates and expansionary monetary policy

Estimated percentage of respondents in each category, total = 3,700

Notes: Results using a dictionary-based approach. The categories are mutually exclusive.

Other respondents stated that low interest rates had allowed them to purchase a house under more favourable conditions or to start up a business. However, others pointed to structural elements preventing them from fully benefiting from the favourable lending conditions, for example job precariousness: “[…] I would like to take out a mortgage to buy a house, but I have no job guarantees, so I can't”, “EU monetary policies allow young people like me to be very proactive in entrepreneurship, however local policies hinder this with extremely high taxes and a lack of supportive policies", and “Even low inflation does not compensate for the lack of access to credit for loans and mortgages”.

Lastly, some respondents cited both the advantages and disadvantages of low interest rates: “We can buy a house, which would not have been possible before (so positive), but at the same time we do not receive interest on savings” and “As long as I am a borrower, I guess it is fine […]. But it is a disaster for funded pensions […]”.

CSOs were also ambivalent concerning the ECB’s monetary policy. The standard Greenpeace contributions noted that low interest rates meant cheap money was accessible to all firms, both those that contributed to the ecological transition and those that hampered it, and called for the adoption of green quantitative easing and the inclusion of climate criteria in the ECB’s refinancing operations. Positive Money contributions stressed that, while quantitative easing had helped the euro area economy recover from the last financial crisis, it had also widened inequalities by raising the value of assets already owned by wealthy people. They advocated the use of instruments, such as helicopter money, that did not have these side effects.

In terms of socio-demographics, respondents from northern EU Member States adopted a much more unfavourable stance on low interest rates and expansionary monetary policy in general than southern respondents. Criticism appeared to increase also with age. Finally, respondents from the finance industry appeared to be less enthusiastic about these policies than private citizens.

5 Themes other than price stability

What other topics matter to you?

The ECB’s main task, its “primary objective”, is to maintain price stability in the euro area. However, once price stability is guaranteed, it is the ECB’s task to support the general economic policies of the European Union. These include, for example, the sustainable development of Europe based on balanced economic growth, a highly competitive social market economy aiming for full employment and social progress, and a high level of protection and improvement of the quality of the environment.

5.1 Other concerns and considerations

Do you think the ECB should give more or less attention to these other considerations and why?

Are there other issues not mentioned above that you think the ECB should be concerned with when setting its policies?[8]

Beyond price stability, there was an abundance of topics that respondents indicated they would like the ECB to consider when deciding on its policies. Some of them are shown in Chart 11. Many of these topics were the same as the secondary objectives listed in the introduction to this theme.

Among those who thought that the ECB should go beyond a narrow approach to inflation, environmental protection was the most frequently recurring theme. Nearly half of all contributions refer to it: “Price stability is no longer the main contribution central banks can make to improving people's welfare. Limiting global warming is”. Women and respondents from southern EU Member States were more likely than their counterparts to call on the ECB to play an active role in addressing climate change.

While some responses were vague about how exactly the ECB could contribute to a shift towards a greener economy, others provided more concrete proposals. Such proposals ranged from facilitating green investment and supporting the fiscal policies needed for the transition, through reducing investment in polluting activities and taking climate criteria into account in the ECB’s refinancing operations, to integrating climate-related risks in models and steering banks’ behaviour to fund environmentally friendly companies. “Climate change is a systemic risk,” wrote a representative of academia. “If the ECB's monetary policy disregards the longer-term effects of climate change […], it can have a considerable impact in economic and social terms, which, in turn, will affect price stability.”

Besides sustainability issues, a sizeable share of respondents would like the ECB to promote employment and economic growth, with ad hoc investment to improve European competitiveness vis-a-vis other economies, and to support digitalisation. Women and respondents from southern EU Member States were more likely to advocate this than their counterparts, as were respondents under the age of 55. Contributions often emphasised the virtuous circle of growth and employment. At the same time, some respondents were sceptical that full employment could be achieved or that it was even desirable.

Nearly 20% of respondents mentioned EU matters, with a share of them calling for a stronger union and closure of the gap between northern and southern EU Member States. At the same time, others pointed out that certain governments were not implementing the necessary reforms to make the European Union work, and that costs and benefits were not distributed equally. Comments such as “The more productive countries are slowed down” and “The northern countries pay the debt of the southern ones” summarise these positions well. Many respondents called on the ECB to implement a uniform tax regime, which would help prevent tax competition between EU Member States, or for a minimum wage policy at the EU level (even though the ECB has no jurisdiction over these matters).

Chart 11

Other issues, beyond price stability, that the ECB should consider

Estimated percentage of respondents in the main categories, total = 3,614

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

Around 15% of respondents, especially those over 55 and those coming from northern EU Member States, called on the ECB to pay more attention to the effect of low interest rates and to take into account price developments in the housing market because “low interest rates combined with the high prices of other assets make it increasingly difficult for people to build up wealth”.

Growing inequality and poverty were identified as issues that the ECB should also take into account, by a sizeable minority, especially women and respondents from southern EU Member States. “A society that does not pull up the weakest among them is rotten to the core,” wrote a Belgian respondent. “How can one speak of economic growth while in Flanders 680,000 people are dependent on the food bank?”. Some respondents stressed that poverty and inequality undermined social and democratic cohesion in the euro area, and that they also weakened the effectiveness of the ECB’s monetary policy. In this context, the ECB was also encouraged to promote financial inclusion, for example by providing a bank account, free of charge, for all euro area citizens. Others advocated the use of helicopter money.

Alongside the majority of respondents who would like the ECB to give more attention to issues beyond price stability, around one-quarter of respondents said they would prefer the ECB to stick to its mandate and stay out of political issues. A German respondent summarised as follows: “Consistent monetary policy and not economic policy”. Such respondents argued that issues other than price stability should be left to other competent national or EU institutions, as “elected politicians are supposed to take care of those”. Men and respondents in northern EU Member States were more likely to have this view than their counterparts.

Some respondents noted that “supplementing [the price stability mandate] with other objectives will inevitably lead to conflicts of interest”. This concern was also raised by respondents in favour of a broader interpretation of the ECB’s mandate. The ECB’s involvement in environmental issues was especially criticised: “Climate change and environmental protection are undoubtedly very important, but this is not the task of a central bank!”

5.2 Impact of climate change

How will climate change have an impact on you/your organisation, your members and the economy?

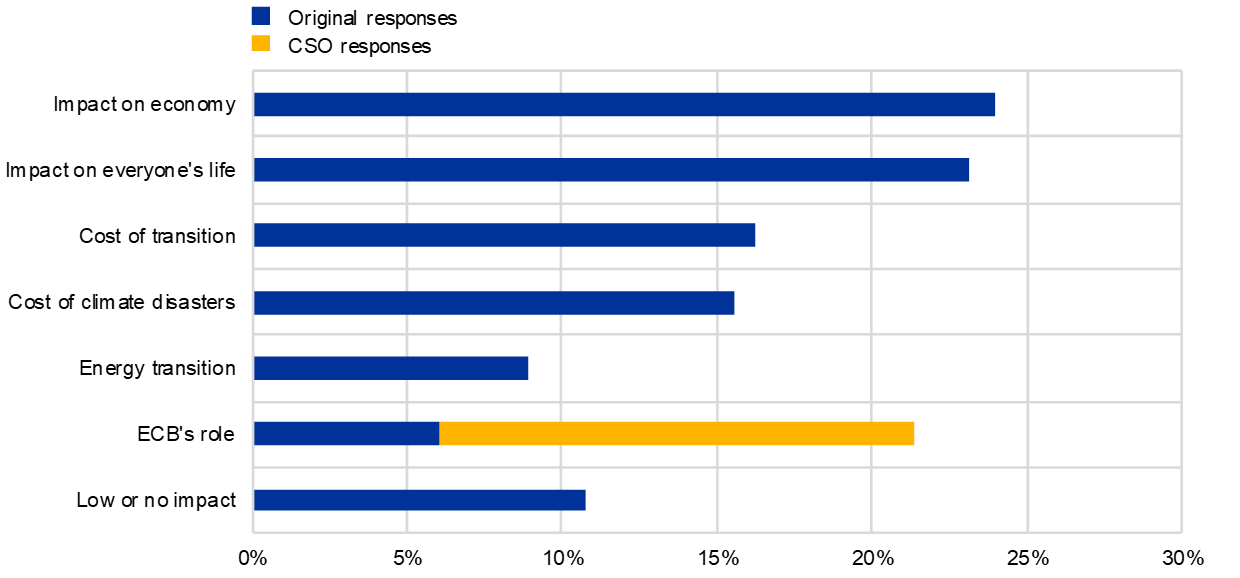

Around 80-85% of respondents acknowledged that climate change would have some sort of impact and described the ways in which it would shape the future (see Chart 12).

Around one-quarter of respondents wrote that the economic and financial system would be affected by climate change: “the economy will have to adapt and will have no other choice”, and “[climate change] will change the risks faced in finance – including credit risk”. Indeed, private and finance sector respondents were more likely than private citizens to consider these effects. The impact of climate change on the economic system was also discussed from a European perspective, with many stressing that the European Union should be quick to adapt: “The European economy must be prepared for a different world, with a competitive advantage to green alternatives”.

Another quarter of respondents pointed out that climate change affected everyone in their daily lives and would penalise future generations even more. “Our children are going to live on a planet unfit for life” was one of the bleak scenarios painted by respondents, who also predicted mass migration, wars for water and finally the extinction of many species, including the human race. A switch to a more sustainable way of life was thus considered necessary and urgent because, in the words of a Belgian respondent, “the impact of climate change will be much more important than any economic crisis”.

Chart 12

Impact of climate change

Estimated percentage of respondents in the main categories, total = 3,615

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

Around 15% of respondents, especially those over 55 and those coming from EU northern countries, remarked that climate change would entail additional costs, not just those stemming directly from natural disasters. There would also be costs linked to energy transition and, in general, to addressing the core issue, including taxes (“the measures are now radical and costly for citizens”). A generalised increase in prices was also foreseen with considerable concern: “I believe that climate change will create enormous strains on prices for some goods or services”. It should be noted that some of the respondents in this category expressed scepticism about the threat of climate change and stated that actions taken to address it were more costly than the actual harm it brought about: “Climate change is less threatening than EU activism, which harms economically and environmentally more than it benefits”. A few respondents disputed humans being responsible, while others claimed that EU actions cannot do much to tackle climate change and that, in the meantime, other economies would benefit from not adhering to the rules.

Another prominent perspective concerned the impact of climate change on nature, with many respondents pointing out that the negative effects were already visible. “I have to say that your question is a little naive because it is expressed in the future tense,” a young respondent from France pointed out. “[We are already] experiencing severe droughts and forest fires during the summer,” a man from Portugal wrote, while a respondent from the Netherlands observed: “Rising sea levels are a significant concern [here]”. Many noted the extreme weather. This perspective was mentioned in just over 15% of contributions, especially those submitted by women, younger people and respondents from southern EU Member States.

Less than 10% of respondents, particularly those over 55, elaborated on the subject of energy transition, with considerable investment foreseen or called for: “Climate change needs to be mitigated. This can only happen if the energy transition to sustainability is carried out as a matter of urgency”.

CSO contributions and around 6% of original ones focused on the role of the ECB in tackling climate change with rather divergent opinions. In line with the reasons presented in the previous section, many of the original contributions warned that climate change “is not an area for the ECB”. “[Climate change] will probably impact at some point but it is not the role of the ECB to address this – at the same time it should not make things worse either,” wrote one of the mildest critics of the ECB’s potential involvement. Some respondents recommended that the ECB should not play a leading role (this should be left to democratically elected bodies) but should act more as a facilitator. Other contributions, most notably from CSOs, instead called on the ECB to act decisively, to “set an example” and to contribute to European objectives in line with its secondary mandate.

Lastly, around 10% of respondents claimed that climate change would have little or no impact, or stated that there were more pressing issues: “Who cares if you can’t pay for rent?”. A few respondents admitted that it was difficult to say what the impact of climate change would be and preferred not to give an opinion.

6 Communicating with the public

How can we best communicate with you?

We know that understanding how monetary policy works helps people make decisions about how to spend, save, invest or borrow money. We would like to find out how successful we have been in explaining what we do and why we do it.

6.1 Perceived knowledge of the ECB and national central banks

To what extent do you feel well informed about the ECB/your national central bank?

When asked whether they felt well informed about the ECB and their national central bank (NCB), almost 50% of respondents affirmed they were inadequately informed or not informed at all, or responded solely in general terms about the public’s lack of knowledge and awareness. In contrast, a slightly smaller share of respondents claimed to be informed. In addition to these two groups, around 6% of respondents gave unrelated answers to the question, instead complaining mainly about the ECB’s monetary policy (see Chart 13).

Among those who did not feel well informed, some pointed to the complexity of monetary policy topics, the use of economic jargon and the lack of communication with the general public: “Communication focused on the financial market and on the technical aspects of the policy. There was little communication (to my knowledge) to citizens” and “Understanding [ECB-related] information is a real challenge for non-economists”. Some respondents blamed the media for not covering monetary policy topics more broadly or the Eurosystem’s communications for mixed, uncoordinated messages.

Chart 13

Perceived knowledge of the ECB and NCBs

Estimated percentage of respondents in each category, total = 3,552

Notes: Results using a dictionary-based approach. The categories are mutually exclusive.

It should be noted that many of those respondents who were confident about their knowledge also pointed out that the rest of the public was not well informed (“[I am] very [informed]. But I am probably an outlier”). Respondents often explained that they were familiar with the ECB because of their interest in economic issues, or through their jobs or academic background, and not because of the ECB’s communication efforts: “I think I am well informed, as I am interested in monetary policy for my studies. But normal people do not have any knowledge about how the institution works”, “I am well informed, but only because of my job as a journalist. I do not think the general public knows a lot” and “I am in the financial sector, so I follow enough but the majority of people know nothing”.

Unsurprisingly, respondents working in the financial sector were considerably more likely to admit to having sound knowledge of the ECB and NCBs than private citizens. Additionally, men claimed to be well informed much more often than women. The share of informed respondents was similar across EU country groups, while it increased significantly among respondents from outside the European Union. This reflects the fact that the latter group of respondents took interest in the ECB Listens Portal even though the ECB was unlikely to be their own central bank.

The word “interest” cropped up frequently. Many agreed that there was plenty of information available to those who were interested and actively searched, offering comments as follows: “Since I am interested, I follow the ECB on social media and think that it is doing a great job in communicating in simple terms what it is doing – yet I think it may only be reaching people like me, who are already interested in economic matters” and “Not everyone is going to be interested in these topics, but I think everyone should have a basic understanding of what is happening at an economic level in the euro zone and how the ECB's policy decisions affect them". At the same time the Greenpeace responses highlighted that, even for people interested in the ECB, “it is not easy to assess the consequences of its actions. While the ECB publishes information on monetary operations, it fails to link them to concrete social and environmental effects”.

Many respondents focused on the media channels through which they got information about the ECB, with some expressing the wish for direct communication from the central bank. However, as expected, some respondents blamed national media for not providing enough coverage of monetary policy and EU issues, or for painting a distorted picture.

6.2 Improving explanation and understanding

How could the ECB/the Eurosystem improve the way it explains the benefits of price stability and the risks of inflation being too high or too low?

What could we do to improve your understanding of the decisions we take and how they affect you?[9]

When asked about ways to improve communication with the public, either to explain better the benefits of price stability or the motivations behind and impact of monetary policy decisions, nearly 40% of respondents suggested explaining in simple language and with relatable, concrete examples (see Chart 14). This percentage was remarkably constant across different socio-demographic groups. As one respondent wrote, “If your findings are solid, you should be able to explain them in plain language, in a convincing manner to everyone with common sense. Some of your research seems like hiding behind numbers and stopping everyone without an economics degree from understanding and being able to criticise them”. Some respondents called, in particular, for information to be provided in their own national language, as “monetary policy is a demanding issue even in one’s own mother tongue”.

The importance of transparency and accountability was highlighted in one-fifth of contributions, with CSOs accounting for around half of this share. Such concerns are especially relevant for respondents from northern EU Member States.

Proponents of enhanced transparency called for more information about market operations, inflation calculations and decision-making processes. Others wanted an honest assessment of the benefits, risks and side effects of the ECB’s decisions, for example information on the effects of monetary policy broken down at the country level[10] and the publication of impact studies on the consequences of its operations on climate and other social aspects. Some respondents called for Governing Council voting to be made public or for the views of the various national central banks to be clarified.

Chart 14

Ways to improve the explanation and understanding of the ECB’s policies and decisions

Estimated percentage of respondents in the main categories, total = 3,550

Notes: Results using a dictionary-based approach. The categories are not mutually exclusive.

Less than 20% of respondents recommended engaging more with the public at large and not just with the financial sector or “bureaucrats” (e.g. by means of road shows or similar events to connect directly with people, possibly in different European countries). Respondents under the age of 55 were somewhat more likely to recommend this. Some respondents emphasised the role of the national central banks as “a key channel for disseminating and explaining your decisions”.

Among suggestions on how to engage more directly with the public, the ECB Listens Portal initiative was mentioned frequently and received positive comments: “I think this survey is already a great start, excellent job”, “a welcome additional means of communication” and “Conduct more surveys like this one, set up a permanent feedback page on your website”. Of course, respondents also expected the ECB to indeed listen and take action based on the input received. However, some also voiced concern about the risks of “a lot of self-selection in the people filling out the survey”. “A large part of this survey is already too complicated,” one respondent noted.

Around 10% of responses recommended a more gradual approach to building up the public’s knowledge and included the following suggestions: “Start from zero and explain to the population how the policy rate works, how the [decision-making] bodies are composed […]”, and “Get closer to average people that might not have great knowledge of economics but are concerned about it”.

The key role of financial education, as well as the general public’s current lack of it, was often highlighted, especially by younger respondents and those from southern EU Member States: “Financial literacy should be improved at school. Too many people don't understand basic economic and financial notions, including interest rates”. Some respondents even called for the ECB and the Eurosystem to play an active role in this respect, for example by investing in financial education, supporting national education systems in improving economic culture and by providing material to schools. The reason put forward, in the words of one respondent, was that “the citizens’ lack of economic and financial literacy can […] hamper the understanding of the [ECB’s] decisions, even though the willingness to explain exists”.

Some contributions focused more on the channel and formats through which the ECB and the Eurosystem could better reach their audiences. The share of respondents who mentioned traditional media was just over 15%, with respondents from southern EU Member States expressing a slightly stronger preference than respondents from northern ones. Television was the most favoured media channel. Respondents suggested interviews focusing on specific themes or questions (e.g. “Why is inflation also crucial for your wages?”), documentaries (e.g. on Netflix) and even advertisements.

In contrast to traditional media, digital media were mentioned by a slightly smaller share of respondents, with younger respondents and women expressing a strong preference. An accessible website and widely used social media channels allowing direct communication with the institution were frequently cited. Respondents proposed the use of digital media to promote explanatory videos and infographics, with material naturally being available in plain terms and in European national languages. Some respondents seemed unaware that content was usually available on the ECB’s website in all languages and that videos were also subtitled in languages other than English.

Around 7% of contributions mentioned other forms of communication, for example regular newsletters (like those sent by commercial banks to their customers), which summarised the main events and decisions, once again, “in simple language, of course!”

Finally, some respondents sceptically suggested changing the policies instead of trying to explain them. In particular, they criticised the low interest rate environment and the current inflation measurement: “First, calculate the actual inflation rate correctly. When property prices explode, it is difficult to explain to young families what benefits [price stability] will bring” and “2% inflation is not price stability and negative interest rates are harmful. This does not need to be better explained but changed”. A few other respondents stated they were already informed and saw no need for change in the Eurosystem’s communication.

7 Appendix

Methodological note

Response languages were identified using RStudio statistical software. Next, text answers in each language were fed into eTranslation, a machine translation tool provided by the European Commission.

The unstructured nature of the core data of this analysis – i.e. open questions – necessitated a text analysis approach. A quantitative analysis was conducted on the English language texts (both translated and original) and a qualitative analysis was run in parallel to validate the results.

Each question required a different type of analysis and, to a lesser extent, different standard pre-processing operations, such as transforming all words to lower case, removing punctuation marks, numbers, separators and stop words ( “the”, “and”, “of”, “for”, etc.), and stemming (the process of reducing inflected words to their root form, e.g. “policy” to “polici”). In some instances, the correction of wrongly translated words was needed.

We used dictionary approaches, frequency analysis, structural topic models and support-vector machine classifiers, and complemented and validated the classification with human coding. (In the charts, we usually display the results obtained using a dictionary approach so they are easier to interpret.)

After responses were classified, a regression analysis (logit or multinomial logit) was run on the original contributions to understand the link between socio-demographic characteristics and the probability of being in one category or another. All regressions include gender, age category (below 35, between 35 and 54, above 55), country group (northern EU Member States, southern EU Member States, eastern EU Member States and non-EU countries) and sector (academia and education, public sector and civil society, finance industry, private sector, and other).

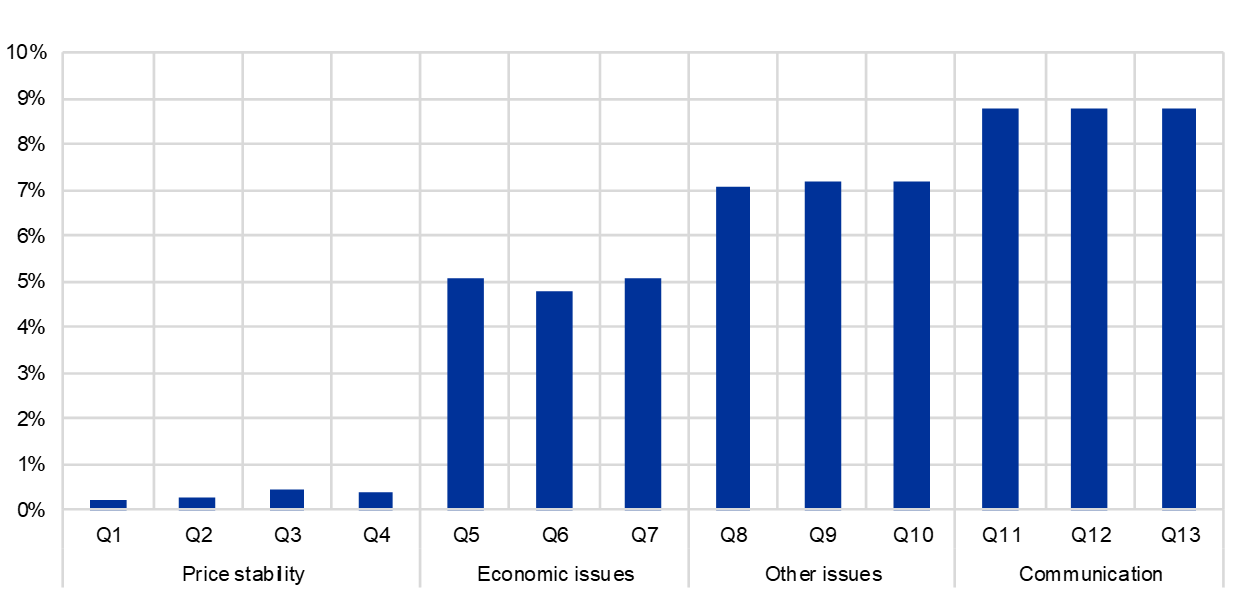

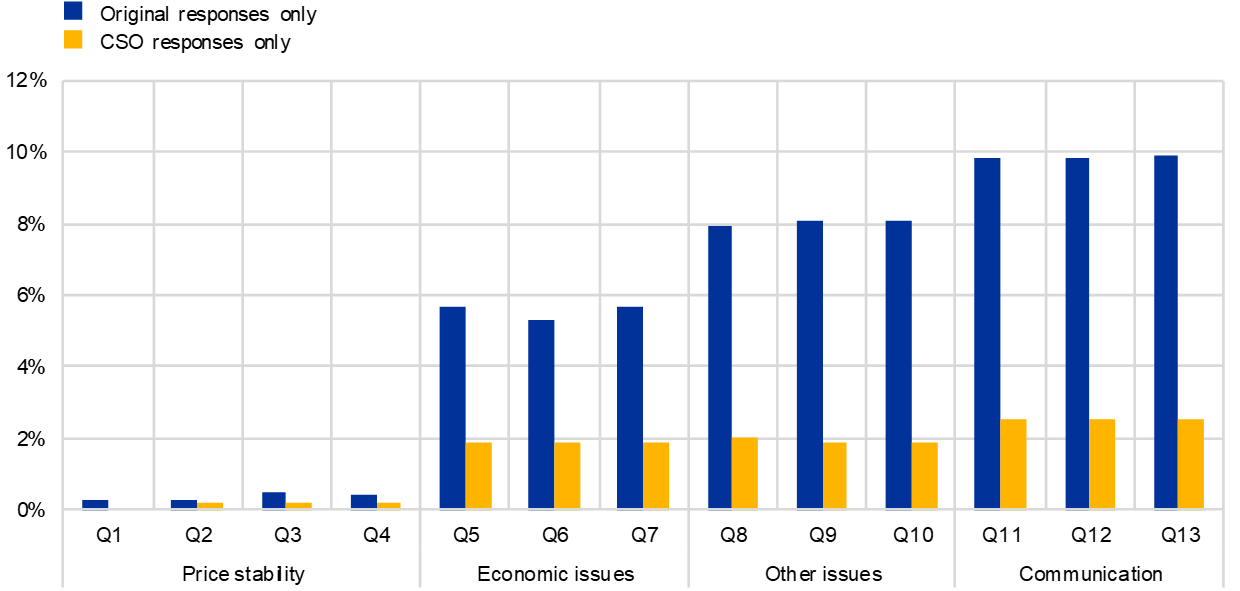

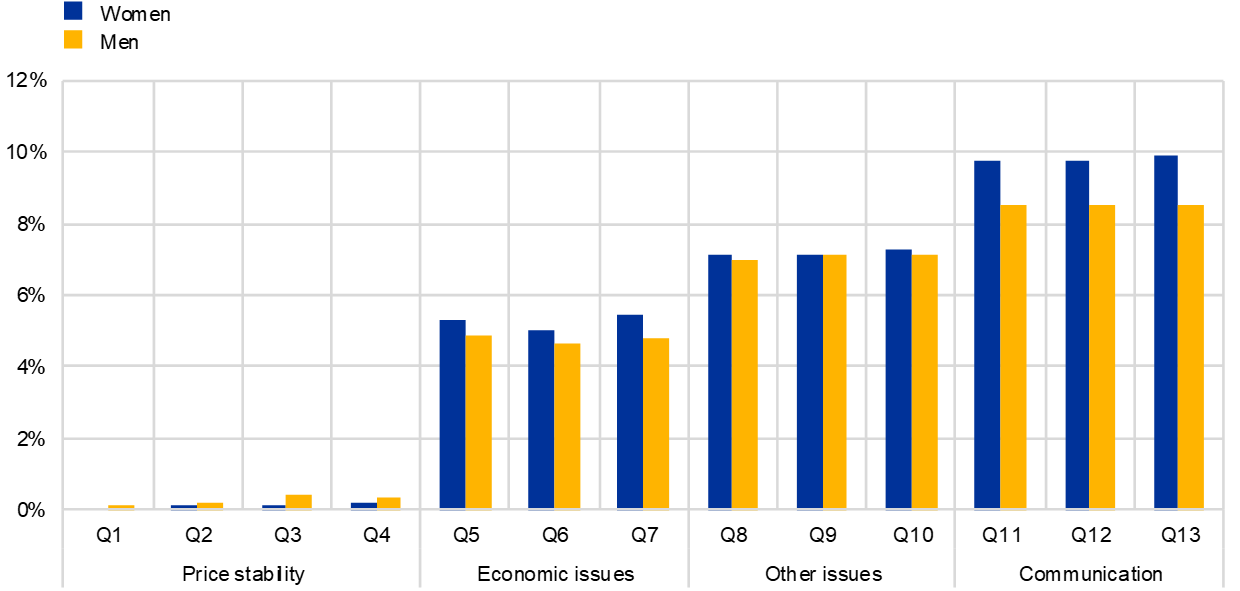

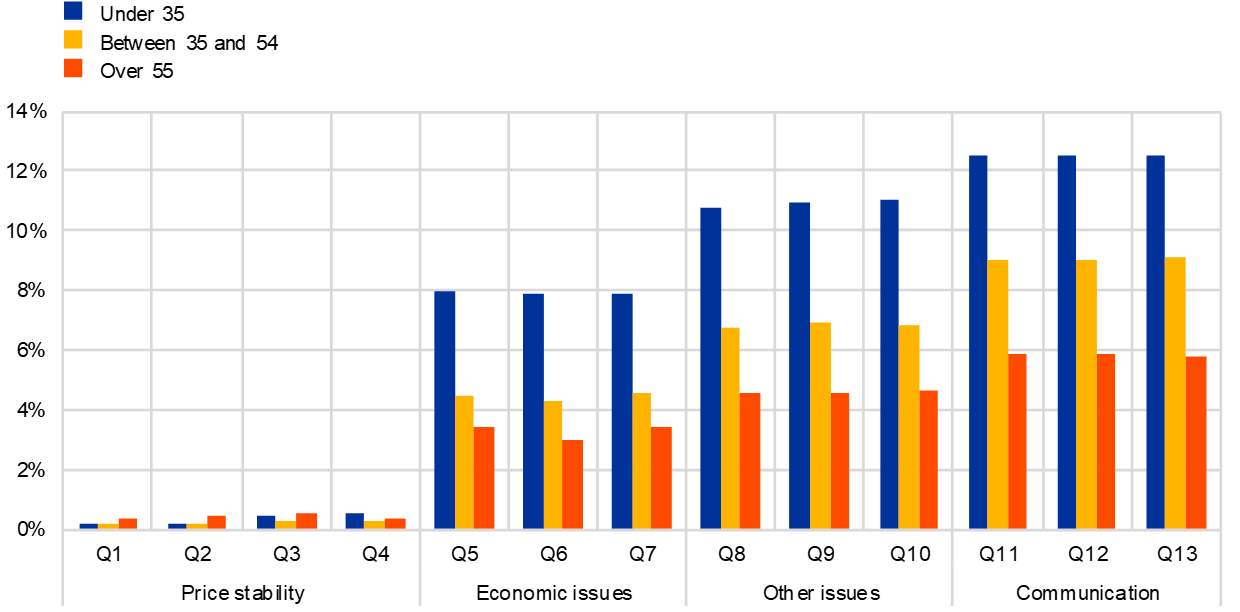

Response patterns

On the ECB Listens Portal, the thirteen questions for respondents were presented over four pages, each page covering one specific theme. As the questionnaire progressed, the percentage of blank responses increased, as shown in Chart 15, Panel a. For the questions on the first theme of “price stability”, the percentage was less than 1%, while for the questions on the last theme of “communication”, the percentage rose to nearly 9%. The most drastic increase occurred between the first theme and the second theme of “economic expectations and concerns”. As the percentage of blank responses is similar for questions under each theme, no question seems to stand out as either harder or less interesting.

In line with expectations, the non-response rate for those who used the standard CSO input is very low – never exceeding 3% – and is consistently lower than the non-response rate for respondents submitting original contributions, as shown in Chart 15, Panel b.

Turning to socio-demographic groups, while there was not a great difference in response patterns for men and women (see Chart 15, Panel c), younger people tended to leave more responses blank than older respondents (see Chart 15, Panel d).

Chart 15

Non-response rate

Panel a: All respondents

Panel b: By type of contribution

Panel c: By gender

Panel d: By age group

© European Central Bank, 2021

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary (available in English only).

- The questions were approved by the strategy review Project Office and the Executive Board, and benefited from comments from the Monetary Policy Committee and the Eurosystem Communications Committee.

- See the European Commission’s Better Regulation toolbox, TOOL #54, “Conducting the consultation activities and data analysis”.

- This figure excludes empty questionnaires and meaningless responses. However, it does include incomplete answers, i.e. where at least some meaningful answer was provided.

- Approximately 2% of the sample (90 respondents) did not reveal their gender. Only 0.3% (12 respondents) did not reveal their age category.

- These points will be expanded in Section 3.4

- In most of the cases, respondents did not explicitly say whether they meant house prices or accommodation costs more generally. It is therefore advisable to interpret this category in a broad sense.

- “Banks, with their very high commissions, are eating savings.”

- As respondents tended to provide similar answers to the two questions, we have analysed them together.

- As respondents tended to provide similar answers to the two questions, we analysed them together.

- A few respondents called for a breakdown by different types of economic agent (consumers, workers, investors, etc.).