Global production and supply chain risks: insights from a survey of leading companies

Published as part of the ECB Economic Bulletin, Issue 7/2023.

Although geopolitical risks and their effects on global production and trade are much debated, little empirical evidence has emerged of increased fragmentation in global value chains. Disruption caused by the coronavirus (COVID-19) pandemic, the Russian war against Ukraine and increased geopolitical tensions across the board raise questions about whether we are witnessing a trend towards deglobalisation. Most analysis to date does not find evidence of significant changes in aggregate European trade patterns. Nonetheless, the ways that firms are adjusting their trading relations and supply chain management may take time to unfold, given the challenges and costs involved in modifying business models, supply chains and contracts.[1] Survey evidence is therefore helpful to identify new trends. To this end, the European Bank for Reconstruction and Development (EBRD), the Banca d’Italia, the Deutsche Bundesbank and others have recently conducted surveys asking firms about supply chain risks.[2]

This box summarises the findings from a recent ECB survey of leading firms operating in the euro area, focusing on their production-location and input-sourcing decisions, particularly in response to supply chain risks.[3] The firms surveyed are mostly multinationals with significant operations in the EU, while most also have a large share of their activity outside the EU. Table A at the end of this box summarises the sample in terms of extra-EU activity. The questionnaire had three parts, covering questions related to (i) trends in the location of production/operations and their main drivers; (ii) trends in input sourcing, dependency and supply chain risks; and (iii) the implications of these trends for activity, employment and prices.

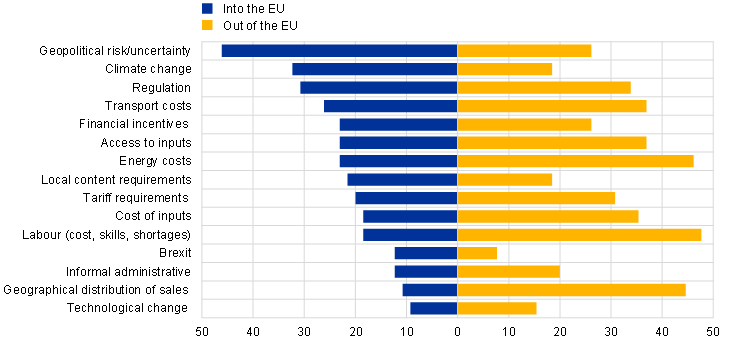

These large firms expect to become more active in (re)locating operations over the next five years to make their businesses more resilient (Chart A). Companies were asked how the location of their production/operations had changed over the last five years and how they expected it to evolve over the next five years. The replies indicate higher shares of firms expecting to (re)locate more production both into and out of the EU in the next five years than in the previous five years.[4] But there is still a higher proportion of companies expecting to move production out of the EU than into the EU. A higher share of firms also said that they expected a tendency to (i) relocate more production geographically closer to the final production site or country of sales (“near-shoring”), (ii) diversify operations to a greater extent across countries, and/or (iii) (re)locate more production within/into countries politically closer to the main country of sales (“friend-shoring”) in the next five years than in the last five years.[5] The near-shoring of production (or producing “local for local”) was already a fairly common trend which is now expected to intensify.[6] The friend-shoring of production, by contrast, had not been so evident in the past but was expected to become much more commonplace – 42% of firms envisage pursuing such a strategy, up from just 11% in the previous five years. Looking at the findings in detail, it is primarily the firms that were already near-shoring or expecting to near-shore that now also anticipate diversifying and friend-shoring some of their operations. Furthermore, these actions are broadly equally associated with firms saying they envisage moving more production into and those saying they envisage moving more production out of the EU.

Chart A

Past and future trends in location of production/operations

(percentages of responses)

Source: ECB.

Notes: Responses to the question “How has the location of your company’s production/operations changed in the last five years and how do you expect it to evolve in the next five years?” Respondents could choose one or more of the following replies: Tendency to (i) move more production/operations into the EU, (ii) move more production/operations out of the EU, (iii) (re)locate more production/operations geographically closer to the final production location or country of sales (“near-shoring”), (iv) diversify production/operations to a greater extent across countries, (v) (re)locate more production/operations to countries politically closer to the main country of sales (“friend-shoring”). The category “Neither into nor out of the EU” captures the responses of firms which did not signal a tendency to move production either into or out of the EU.

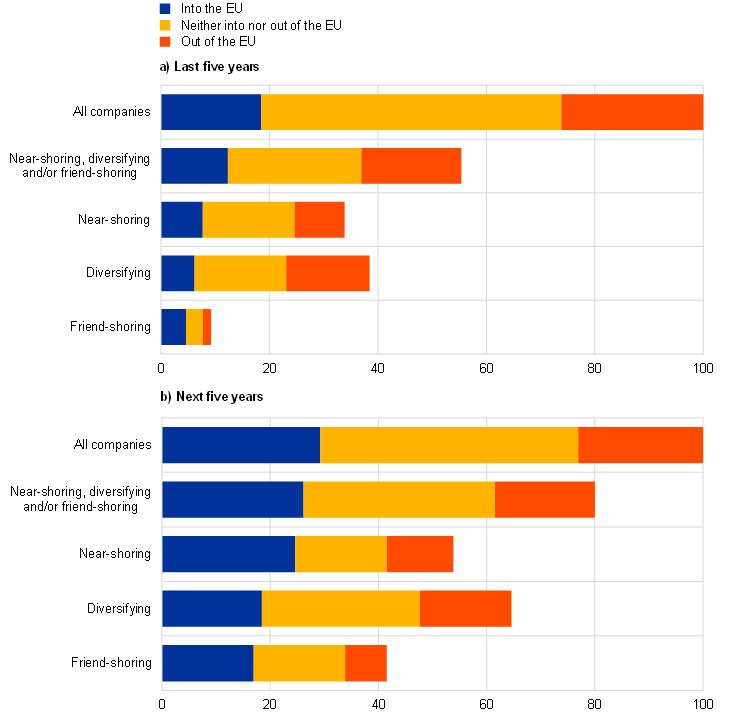

Geopolitical risk was the most frequently cited factor behind decisions to (re)locate production into the EU, while demand and cost factors motivate moves out of the EU (Chart B). Firms were given a list of factors and asked which of these were important for them in relation to recent or planned future moves of production/operations into or out of the EU. Almost half cited geopolitical risk/uncertainty as an important factor relating to recent or planned future moves into the EU. This highlights a shift in firms’ priorities from simply focusing on cutting costs or improving efficiency to also factoring resilience into their decisions. The next most important factor for moving into the EU was climate change (transition to net zero). Regulation, financial incentives and local content requirements were, broadly speaking, equally likely to be factors relevant for moves into or out of the EU. At the same time, labour (cost/shortages/skills), energy costs and the changing geographical distribution of sales were the main factors for moving production out of the EU.

Chart B

Importance of factors for moving production/operations into or out of the EU

(percentages of responses)

Source: ECB.

Notes: Responses to the question “Which of the following factors do you consider particularly important in relation to recent or planned future moves of production/operations into or out of the EU?” Respondents could choose any of the above replies that applied to their company. Responses are ranked according to the net score (“into the EU” less “out of the EU”).

As regards input sourcing, firms expect to increasingly near-shore, diversify and/or friend-shore their supply chains in the next five years, with some increase in the share of sourcing from inside the EU (Chart C). Companies were asked how the geographical distribution of their cross-border sourcing of inputs had changed in the last five years and how they expected it to evolve in the next five years. The replies indicate that a higher share of firms expect to increasingly source inputs from inside the EU in the next five years than in the last five years, while there was no increase in the share of companies saying they expected to source more inputs from outside the EU.[7] A higher share of firms said they expected to increasingly source inputs (i) geographically closer to the country of production (“near-shoring”), (ii) from a more diverse range of suppliers in different countries, and/or (iii) from countries politically closer to the country of sales (“friend-shoring”) in the next five years than they had in the last five years (up from 55% to 80%). Diversifying and near-shoring the sourcing of inputs were already fairly common and were expected to become more so in the coming years. By contrast, the friend-shoring of input sourcing had, as was the case with the location of production, not been typical in the past but was expected to become much more so (with 42% of responding firms expecting to pursue such a strategy compared with just 9% having done so in the past). The increase in the share of firms expecting to pursue any or all of these strategies was negligible among firms who also said they envisaged sourcing more inputs from outside the EU, but it was significant for firms who also said they expected to source more inputs from inside the EU. Accordingly, an expected increase in the near-shoring, diversification and/or friend-shoring of input sourcing appears to be tilting these firms, on average, towards greater use of EU suppliers.

Chart C

Past and future trends in input sourcing

(percentages of responses)

Source: ECB.

Notes: Responses to the question “How has the geographical distribution of your company’s cross-border sourcing of inputs changed in the last five years and how do you expect it to evolve in the next five years?” Respondents could choose one or more of the following replies: Tendency to increasingly source inputs (i) from inside the EU, (ii) from outside the EU, (iii) geographically closer to the country of production (“near-shoring”), (iv) from a more diverse range of suppliers in different countries, and (v) from countries politically closer to the country of sales (“friend-shoring”). The category “Neither into nor out of the EU” captures the responses of firms which did not signal a tendency to source a higher share of inputs from within or outside the EU.

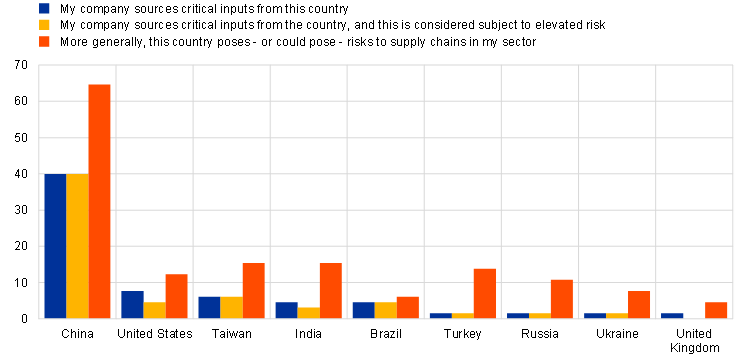

China was the dominant source of critical inputs and also the country most frequently mentioned in terms of perceived risks, either to the company’s own supply chain or that of its sector (Chart D). In total, 55% of respondents said that their company sourced critical inputs (fully or heavily) from a specific country or countries.[8] Of these, almost all (52% of all respondents) said that the supply of critical inputs from at least one of those countries was subject to elevated risk.[9] In turn, a large majority of these identified China as that country (or one of those countries), with all of them considering this an elevated risk. Coming a distant second, only 8% of respondents said that their company sourced critical inputs from the United States, and only 5% flagged this as a particular risk. As to those countries which posed – or could pose – a risk to supply chains in their sector more generally, two-thirds of all respondents cited China, while the United States, Taiwan, India, Turkey and Russia were also each cited by more than 10% of respondents.

Chart D

Supply chain dependency and risks, by country

(percentages of responses)

Source: ECB.

Notes: Responses to the questions (i) “Does your company presently source critical inputs which depend (fully or heavily) on supply from a specific country; and if so, which one(s)?”, (ii) “Do you consider the supply of critical inputs from this country or any of these countries to be subject to elevated risk?”, and (iii) “More generally, which countries (if any) pose – or could pose – risks to supply chains in your sector?” Countries mentioned by three or more respondents are included in the chart. Many more countries were mentioned by just one or two respondents.

Most firms said that it would be very hard for them to substitute critical inputs originating from countries deemed to be an elevated risk. Among the respondents who said that their company sourced critical inputs (heavily or fully) from a specific country they considered an elevated risk, almost two-thirds said that if those critical inputs were suddenly no longer available, replacing them with inputs originating from elsewhere would be “very hard”, while nearly a third said it would be “hard” (Chart E, panel a). In this context, two-thirds said that their company mainly sourced these critical inputs directly from firms located in the country concerned, and one-sixth said that they mainly sourced them directly from their own facilities in the country concerned, with the remainder sourcing them mainly via distributors.

Most companies were, however, implementing strategies to reduce their exposure to the country or countries concerned (Chart E, panel b). Among the same respondents who said that their company sourced critical inputs (heavily or fully) from a specific country they considered an elevated risk, only three said that they had neither adopted, nor intended to adopt, a strategy to reduce their exposure. Almost 40% said that they were pursuing a strategy to mostly source the same inputs from other countries outside the EU, 20% that they were pursuing a strategy to mostly source the same inputs from other countries inside the EU, while 15% said that they were pursuing other strategies, such as holding more inventory, diversifying their input sources, monitoring risk more closely, changing the composition of their product(s) or closing down some production capacity. Just under 20% had not yet adopted a strategy but were considering doing so in the near future.

Chart E

Ease of substitution of inputs and strategies to reduce country exposure

(percentages of responses)

Source: ECB.

Notes: Responses to the questions (i) “In case these inputs were suddenly no longer available, how easy would it be to substitute them with inputs originating elsewhere?” and (ii) “Is your firm implementing or is it planning to implement a strategy to reduce exposure to the country – or countries – concerned?” The percentages of responses refer only to those who said that their company presently sourced critical inputs which depended (fully or heavily) on supply from a specific country and that they considered to be subject to elevated risk. A small number of respondents gave more than one response to question (ii) and these responses have been weighted accordingly.

On balance, the impact of changes in production location and cross-border sourcing of inputs on EU activity was perceived to be limited, while the impact on employment located in the EU was considered significant. Companies were asked to assess the impact of changes in production location and cross-border input sourcing on their company’s activity, employment and selling prices in the EU in the last five years (Chart F, panel a) and what they expected in the next five years (Chart F, panel b). In terms of activity, a large share of respondents said that these changes were likely to influence the share of their company’s value added generated in the EU in the next five years compared with the last five years. That said, those anticipating higher and lower shares broadly balanced out. Respondents did, however, see the impact of these changes as increasingly negative for the share of their company’s employment located in the EU. This would be consistent with companies citing the cost of – and access to – labour and skills as the most important factor in their recent or planned future decisions to move production or operations out of the EU.

Chart F

Overall impact of production location and input sourcing decisions on activity, employment and prices

(percentages of responses)

Source: ECB.

Note: Responses to the question “What has been/will be the impact of changes in production location and/or cross-border input sourcing on your company’s activity, employment and selling prices in the EU?”

Changes in production location and cross-border sourcing of inputs led to higher prices, but this impact was expected to ease slightly in the next five years. 60% of contacts said that changes in production location and/or cross-border input sourcing had pushed up their average prices in the last five years, compared with just 5% who said that their prices had fallen as a result. Looking ahead to the next five years, the share of firms expecting upward pressure on prices was still high (45%) but lower than when looking back at the last five years. One interpretation would be that moves to make business operations and supply chains more resilient are costly per se, but the impact on costs, and therefore prices, can be mitigated if these changes are carefully planned. In this regard, past moves may to a greater extent have been unplanned and sudden (e.g. in response to the pandemic or Russia’s invasion of Ukraine) and therefore more costly than intended future moves to respond to production and supply chain risks.

Table A

Share of company sales, production and input sourcing outside the EU across the survey sample

Less than 20% | 20-50% | More than 50% | |

|---|---|---|---|

Sales | 16 | 27 | 20 |

Production | 20 | 24 | 18 |

Input sourcing | 18 | 22 | 22 |

Source: ECB.

Note: The numbers in the table refer to the number of responding companies in each category.

See the blog posts by Di Sano, M., Gunnella, V. and Lebastard, L., “Deglobalisation: risk or reality?”, ECB, 12 July 2023, and Koh, S.-H., MacLeod, C. and Rusticelli, E., “Shifting sands: trade partner patterns since 2018”, OECD, 12 July 2023.

The EBRD survey focuses on 15 EBRD countries; see “Global supply chains in turbulence”, Transition report 2022-23, EBRD, 2022. The Banca d’Italia survey focuses on Italian firms; see Bottone, M., Mancini, M. and Padellini, T., “Navigating Fragmentation Risks: China Exposure and Supply Chains Reorganization among Italian Firms”, Banca d’Italia, 2023. The Deutsche Bundesbank survey focuses on German firms (data collection completed and analysis forthcoming).

The survey was sent to companies with which the ECB maintains regular contact as part of its gathering of information on current business trends. A total of 65 responses were received during July-August 2023. This is a relatively small sample in terms of the overall number of firms, but the aggregate value added of these firms generated globally is equivalent to around 5% of euro area GDP.

With regard to Brexit, respondents were asked to ignore changes brought about solely by the reclassification of the UK from an EU to a non-EU country if there had been no physical change in the location of production or input sourcing.

42% of firms said they had near-shored, diversified and/or friend-shored production in the last five years, while 74% said they expected to do so in the next five years.

28% of firms said they had near-shored production in the last five years, while 49% said they expected to do so in the next five years. It is striking that this first number is identical to the share that, in a similar ECB survey in 2016, replied that it had become more common in the past five years for companies in their sector to produce/operate in the local markets where goods and services are sold. See the box entitled “Global production patterns from a European perspective: insights from a survey of large euro area firms”, Economic Bulletin, Issue 6, ECB, 2016.

This result is driven mainly by companies that are truly global (with more than 50% of their sales, production and input sourcing presently outside the EU) and by companies that import (either intermediate or final) products into the EU.

In the questionnaire, it was clarified that “By ‘critical’ inputs we mean goods without which a significant part of your business activity could not be completed or would suffer significant delays or the quality of the good or service produced by your firm would significantly decrease.” Respondents were asked to indicate up to five countries, but most named just one or two.

In the questionnaire, it was stated that “Such risks could include the risk of sudden escalation of economic or political tensions between countries (e.g. China and the US) resulting in bans on the import or export of specific products, a tightening of local content requirements (e.g. in the context of the EU/UK trade agreement), sourcing from countries at (risk of) conflict, risks stemming from climate change…etc.”