Some way to go in the transition to the €STR

Published as part of the Financial Stability Review, November 2020.

Market participants have been slow in making the transition to the euro short-term rate (€STR) as the new reference rate in short-term interest rate derivatives markets. Overnight index swaps (OISs) – the main product in this market segment with a notional outstanding amount of about €8.7 trillion – are essential for managing interest rate risk, and therefore helping to support the stability of the financial system. The industry also views the OIS market segment as a potential source of alternative risk-free interest rates to serve as a fall-back for the euro interbank offered rate (EURIBOR), the benchmark term rate underlying loan and debt security pricing for euro area households and corporates.

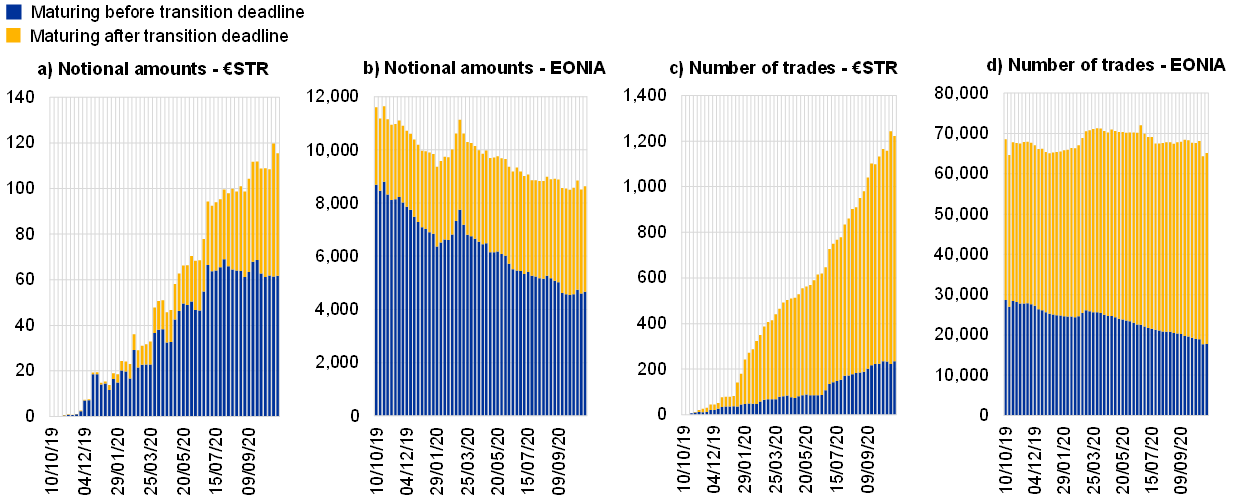

The €STR has been published daily since October 2019, with publication of the euro overnight index average (EONIA) rate – calculated using a revised methodology as the €STR plus a spread of 8.5 basis points ‒ due to cease in January 2022. But trading activity in €STR-referencing OISs, although constantly growing, has remained at very low levels compared with EONIA-referencing OISs (see Chart A for €STR to EONIA comparisons in notional amounts and number of trades). Median weekly trading activity in EONIA OISs has been approximately 200 times larger in terms of the aggregate notional amount and 50 times larger in terms of the number of trades than the activity in €STR OISs.

Chart A

The amount and number of EONIA OISs maturing after the transition deadline increased sharply

Amount and number of OIS contracts by reference rate and by maturity

(10 Oct. 2019-28 Oct. 2020; weekly data; € billions in panels (a) and (b), number of trades in panels (c) and (d))

Source: ECB (European Market Infrastructure Regulation data).

Note: Data preparation was strongly based on the methodology developed in Boneva, L., Böninghausen, B., Fache Rousová, L. and Letizia, E., “Derivatives transactions data and their use in central bank analysis”, Economic Bulletin, Issue 6, ECB, 2019.

Of particular concern is that EONIA OIS trades that mature after the transition deadline have continued to rise. Since October 2019, the aggregate notional amount and the number of outstanding EONIA OISs with a maturity beyond the 3 January 2022 deadline have increased by 36% and 19% respectively (see Chart A, panels (b) and (d)). In the absence of robust fall-back provisions in EONIA-referencing OIS contracts, such trades will have to be amended or cancelled by the end of 2021, posing both a significant risk to contract continuity and operational challenges.

Client preferences and habits, coupled with the postponed switch from EONIA to €STR discounting by central counterparties (CCPs)[1] and the impact of the pandemic, explain the low level of activity up to summer 2020. CCPs and counterparties use the published near risk-free overnight rates to discount derivatives and to calculate the loss of interest on the posted collateral. Three large CCPs switched to €STR discounting on 27 July 2020, a move that is expected to increase liquidity in the €STR OIS segment.

Nonetheless, market participants are encouraged to increase their use of the €STR ahead of the discontinuation of EONIA.[2] In addition to switching to the €STR in new contracts and amending contracts that mature after 31 December 2021, market participants are encouraged to redouble their efforts to ensure sufficient technical preparedness to trade, price and account for €STR-based products and manage risk related to usage of the €STR.

- See “EACH statement on the transition from EONIA to €STR discounting regime”, European Association of CCP Clearing Houses (EACH), press release, 17 April 2020.

- See “Recommendations on the EONIA to €STR Legal Action Plan”, Working group on euro risk-free rates, 16 July 2019.