- Press release

EU structural financial indicators: end of 2021

2 June 2022

- Number of offices continued to decline in most EU Member States, by 1.98% on average

- Number of bank employees declined by 0.85% on average

- Degree of banking sector concentration continues to differ widely across countries

The European Central Bank (ECB) has updated its dataset of structural financial indicators for the banking sector in the European Union (EU) for the end of 2021. This annual dataset comprises statistics on the number of offices and employees of EU credit institutions, data on the degree of concentration of the banking sector in each EU Member State and data on foreign-controlled institutions in EU national banking markets.

The structural financial indicators show a further decline in the number of bank offices in the EU, averaging 1.98% across Member States. Falls ranging from -0.2% to -22.93% were observed in 20 of the 27 countries. The total number of offices in the EU at the end of 2021 was 138,294, 82.56% of which were located in the euro area.

In the course of 2021, the number of employees of credit institutions fell in 21 EU Member States, with an average decline of 0.85% across all countries. This decline in the number of bank employees is a trend that has been observed in most countries since 2008.

The data also indicate that the degree of concentration in the banking sector (measured by the share of assets held by the five largest banks) continues to vary considerably between EU Member States. At the national level the share of total assets of the five largest credit institutions ranged from 29.65% to 98.01%, while the EU average at the end of 2021 was 67.71%.

The structural financial indicators are published by the ECB on an annual basis.

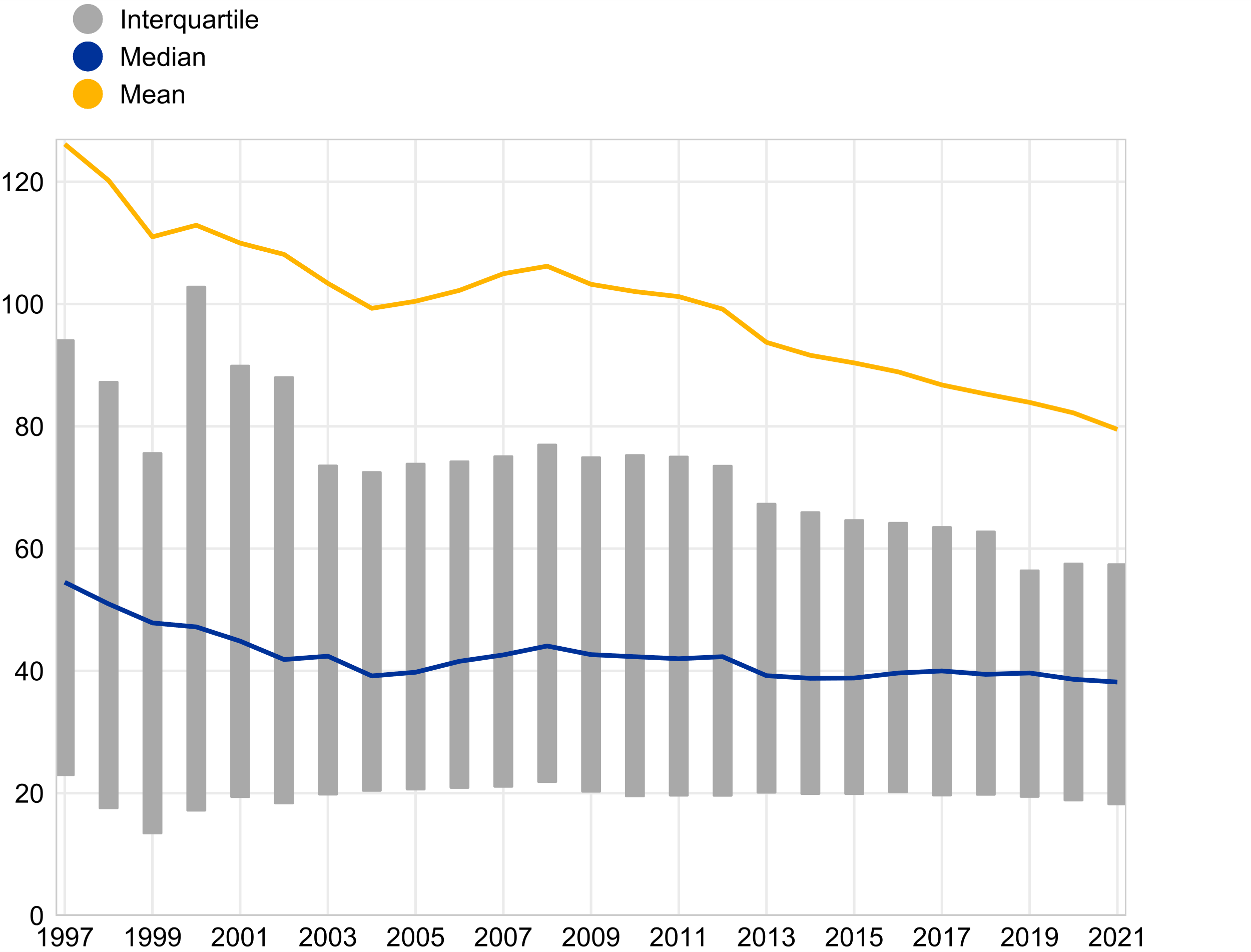

Chart 1

Number of employees of domestic credit institutions

(thousands)

Notes: Interquartile ranges and medians are calculated across average country values. Data are available for all EU27 countries.

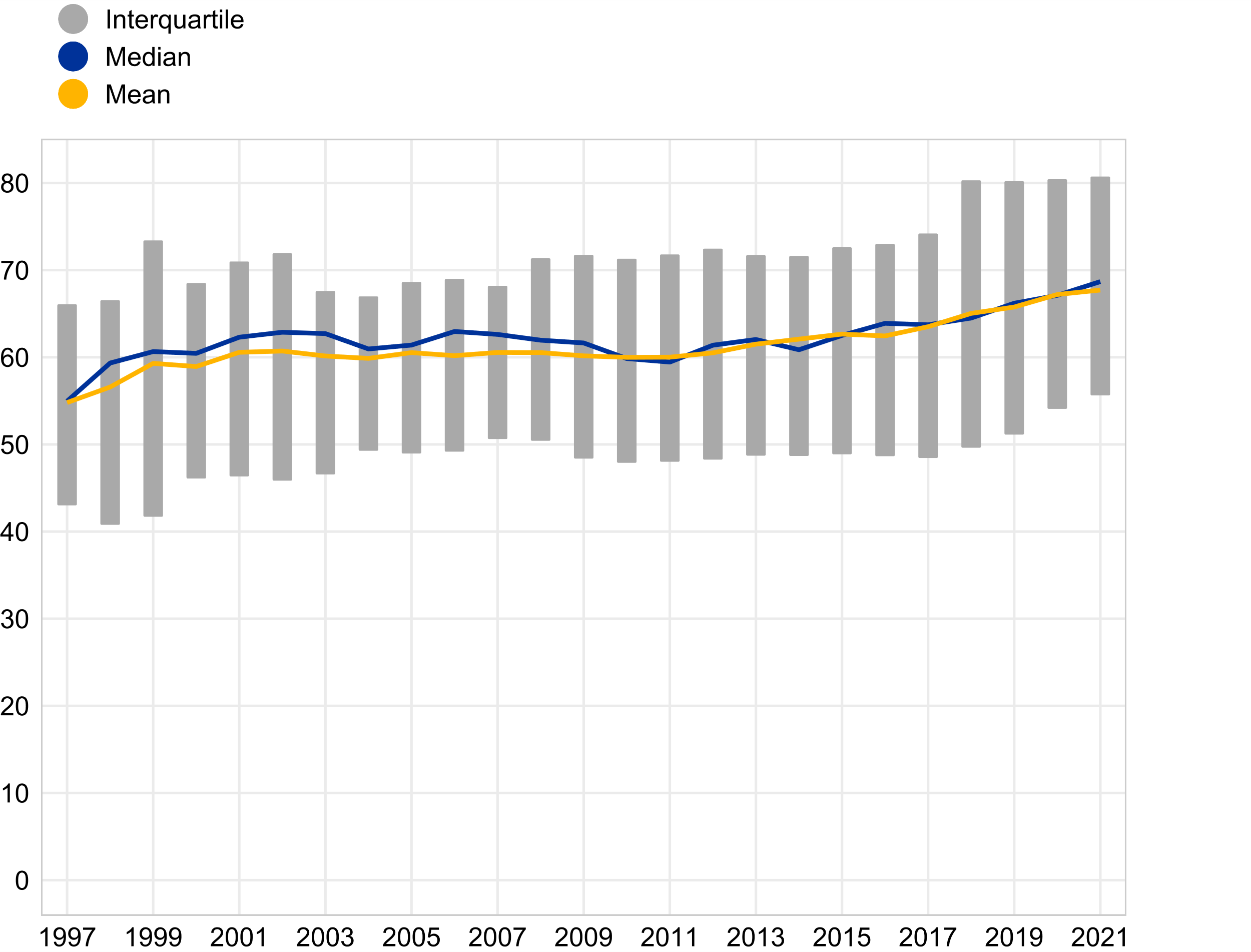

Chart 2

Share of assets held by the five largest banks

(percentages)

Notes: Interquartile ranges and medians are calculated across average country values. Data are available for all EU27 countries.

Annex

The United Kingdom was reclassified as a non-EU country in the structural financial indicators as of 2020, following the country’s withdrawal from the European Union on 31 January 2020. As a result, the business of UK credit institutions, insurance corporations and pension funds is no longer published and is also excluded from the compilation of EU aggregates and indicators.

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes:

- Tables containing further breakdowns of structural financial indicator statistics are available in the ECB Statistical Data Warehouse.

- Structural Financial Indicators data are available in the ECB Statistical Data Warehouse.

- Hyperlinks in the main body of the press release lead to data that may change with subsequent releases as a result of revisions.

Europska središnja banka

glavna uprava Odnosi s javnošću

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Njemačka

- +49 69 1344 7455

- media@ecb.europa.eu

Reprodukcija se dopušta uz navođenje izvora.

Kontaktni podatci za medije