On the importance of institutions as provider of stability and protection in an uncertain world

Speech by Peter Praet, Member of the Executive Board of the ECB, Steptoe Brussels Open Conference Series, Brussels, 15 May 2019

Uncertainty and economic developments[1]

The economic literature – both theoretical and empirical – finds a link between heightened uncertainty and lower economic activity in the short run. There are usually fixed costs involved with investment, from creating new capital such as building a factory to hiring new staff, which cannot be recovered if the investment decision is reversed. So faced with an increase in uncertainty, businesses pare back investment plans. Similarly, if households fear unemployment or lower income from employment in the future they may reduce consumption today.[2]

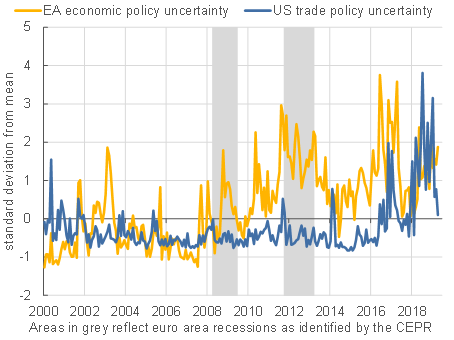

Chart 1: Measures of euro-area uncertainty

Sources: Baker, Bloom and Davis, and ECB calculations. CEPR for recession periods. Last observation refers to: April 2019.

The literature uses a number of different measures of uncertainty. Such measures usually move with each other, and generally peak in recessions. The indicator for euro area economic policy uncertainty still appears relatively elevated.[3] This measure counts how frequently newspaper articles cite “uncertainty”, “economy” or similar, and particular policy words, such as “deficit” or “regulation”. A number of recent events have sparked this rise in uncertainty. World trade policy uncertainty resulting from the negotiations initiated by the US with its trading partners as illustrated by the indicator for US trade policy uncertainty, the protracted process of withdrawal of the United Kingdom from the EU, and the policy uncertainty resulting from the rise of populism show how pervasive uncertainty is in today’s world.

These recent bouts of political and policy uncertainty have come on top of the existing and more enduring sources of “structural” uncertainty about the economic outlook in advanced economies. What do we really know about the impact of new technologies and innovation on tomorrow’s economic landscape? Will secular stagnation be the new economic reality? Various authors have suggested that recent innovations have had only limited effect on productivity and growth in advanced economies. Others have expressed concern that these innovations may polarise societies still further and may even have negative effects on employment. Technology optimists meanwhile predict the advent of a bright future, with the diffusion of innovation bringing about significant productivity increases and high levels of well-being. It is important for us economists to be humble when forecasting the future. Debating concepts such as ‘secular stagnation’ may be fashionable now, but we should remember only a decade ago it was fashionable to debate the ‘Great Moderation’.

Uncertainty about the future has always been with us. The incidence of natural disasters such as droughts, floods and earthquakes, the doubt of whether contractual promises will be honoured and the fear of your possessions being taken by force are all factors that can affect economic activity. Humankind, over the millennia, has put in place various mechanisms to help cope with uncertainty. For example, putting in place narratives to filter and process the vast array of information available and arrange it in order to guide people’s expectations about an uncertain future, thereby making it possible for societies to coordinate their efforts towards the common good. In this respect, building institutions has been key to providing economic stability, as they can best create an environment of trust in the future by implementing policies reducing the impact of uncertainty on economic developments.

The importance of economic narratives

Following financial crises, political uncertainty is often elevated. According to a recent study,[4] votes for extreme parties can increase by on average 30%, while government majorities shrink, parliaments end up with a larger number of parties and become more fractionalised. Thus the political landscape becomes more gridlocked at precisely the moment when decisiveness is typically required.

This can delay necessary policy responses, such as cleaning up the financial sector, which prolongs the post-crisis recovery. And such uncertainty, reflected in the media, can gradually build a narrative of doom and gloom around the economy or around the existing institutions – a seeping pessimism, which over time alters investors’ and consumers’ expectations, and thereby their behaviour.

Robert Schiller[5] has elaborated on the epidemiology of narratives relevant to economic fluctuations, ranging from the Great Depression of the 1930s, to the Great Recession of 2007-2009 and today’s climate of political uncertainty. Popular narratives can drive economic developments. For example, when people hear stories of declining prices and then postpone their purchases: talking about deflation feeds deflation. But the relationship is more than just one way: actual events play some role in the development of popular narratives. Overall, popular narratives act as a potent multiplier of economic shocks – the “animal spirits” of Keynes.

Today’s information and communication technologies have opened up a vast field of research into the role of narratives as determinants of economic developments. These technologies have also greatly accelerated the diffusion of narratives in our societies; it is surprising how easily fake news can flourish nowadays.

This is a serious matter. The outcome of the UK referendum can be partly attributed to the decades-long development and spread of negative popular narratives about European integration. More generally, the events I mentioned earlier are the culmination of a broader narrative against free trade that has gained traction in advanced economies. As narratives often are key determinants of economic and political outcomes, it is important to be wary of them.

The stabilising role of institutions

Institutions contribute to stability, especially in times of uncertainty, and help anchor expectations. In times of political gridlock, effective institutions are vital since they can deliver their mandates decisively and outside of the push-and-pull of the political process. This in turn foreshortens the crisis and the self-fulfilling cycle of weak economic performance and gloom-and-doom narratives.

For example, while bank failures are always possible, the existence of appropriate institutions can mitigate their impact. A sound supervisory framework makes failures less likely, while resolution plans contribute to seamless unwinding of failed institutions.

The move over recent decades to grant independence to central banks owes much to the problem of time consistency. When monetary policy was under the control of governments, there was always an incentive to “cheat” and deliver higher than expected inflation to temporarily increase output. The existence of this incentive, and the inability of governments to credibly commit to the right policy, gave rise to de-anchored inflation expectations.

Independent central banks with a clear mandate to maintain price stability have been successful in anchoring inflation expectations. Having an explicit price stability objective provides its own stabilising narrative – people can trust the central bank to deliver an inflation rate in line with their mandate, and can therefore base their economic decisions on that expected inflation rate. In recent years, the ECB has been an anchor of stability, creating an effective bulwark against deflationary narratives when they appeared in the euro area.

But institutions need to be strong in order to deliver in the face of shocks. To put this in perspective, consider how two periods of global economic integration have fared under different institutions. Global economic integration has fluctuated over time and is now higher than at any time in the past. Another period of high integration, in the decades prior to World War I, ended abruptly as a financial crisis of global proportions, accompanied by a credit crunch, broke apart bilateral arrangements and paved the way for several rounds of retaliatory tariff increases.

Multilateralism has been a cornerstone of economic expansion since World War II. The current legal framework for world trade, embodied in the multilateral World Trade Organization, has proven much more robust to the recent global financial crisis. It has played a key role in preventing the re-emergence of protectionism in the aftermath of the Great Recession.

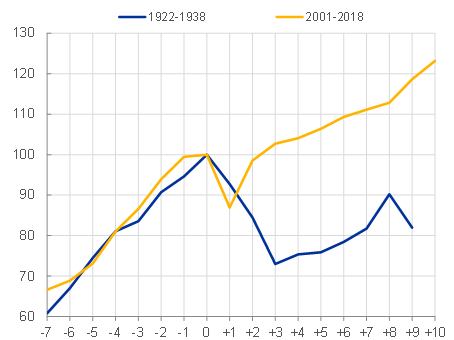

Three stylised facts emerge from comparing the evolution of world trade in goods in the periods 1922-38 and 2001-16. First, the pre-crisis expansion was very similar in both eras. Second, world trade collapsed in 1930 and 2009, immediately after the two shocks, but the decline was sharper in 2009, even though the total decline in the 1930s was larger. Third, the subsequent recovery has been noticeably stronger in the most recent episode.

Chart 2. The evolution of world trade in goods during the Great Depression and the Great Recession

(volumes; 1929 and 2008=100, respectively)

Sources: ECB staff calculations based on data in Federico and Tena-Junguito (2016)[6] and CPB Trade Monitor data.

Notes: The year 0 on the horizontal axis is 1929 in the case of the Great Depression (blue line) and 2008 in the case of the Great Recession (yellow line). 1922-1938 trade flows are constructed using current country borders.

On both occasions, falling output was the main driver of the trade collapse, but protectionism after the Great Depression was largely due to the emergence of a new political constituency opposed to free trade which, in many cases, was able to develop convincing narratives for the continuation of protectionism even when the crisis was over. The current multilateral framework has so far shielded us against the adverse consequences of protectionist pressures for economic prosperity

Institutions provide stability by their very nature of being hard to change. But that inertia can lead them to lack the agility to deal with new challenges. It is therefore essential for modern institutions to evaluate the impact of their policies and the effectiveness of their strategy on an ongoing basis. There is also a chance for new institutions to be founded to improve on previous arrangements. The Federal Deposit Insurance Corporation was created in the United States in 1933 to reduce the effect of failed banks on depositors. Following the recent financial crisis, the international institutional architecture was strengthened with the inauguration of the G20 summits and the creation of the Financial Stability Board. In the euro area, the establishment of the Single Supervisory Mechanism and the Single Resolution Mechanism has strengthened the financial system and made it more resilient to future shocks.

While the current multilateral framework has so far shielded us against protectionist headwinds, this has not been acknowledged by a significant share of the population. This can be attributed to the fact that the benefits of globalisation have not always been fairly shared, which risks triggering a setback in economic integration. This calls for further improvements in our institutions and our policy frameworks to manage and share the benefits of integration. In particular, progress towards a better European Union is both necessary and welcome, and being constructively critical of our actions and policies is certainly part of this process. Yet it is important to acknowledge the progress made so far, to keep a sense of direction. Let me therefore take a few moments, then, to remind you of the successes of the post-war institutions in Europe.

The European Union as provider of stability and protection

The European Union and the Single Market have successfully delivered decades of peace and growing prosperity throughout Europe. There has been a steady process of strengthening trade and economic links, based on the foundations of democracy, a strong social model and the rule of law. These institutions are Europe’s answer to the questions posed by globalisation, a democratic way to reap the benefits of economic integration while still protecting consumers and workers.

The Single Market is more than just a customs union or a dense network of free trade agreements between countries. It is in fact an innovative forward step in economic evolution. It provides the legal framework for trade between Member States, underpinned by the four fundamental freedoms – free movement of goods, services, labour and capital.

This framework is vital to give companies confidence to invest and integrate across national borders. For trade to flourish, businesses need to be certain that contracts will be honoured, competition rules will be fairly enforced, property rights respected and standards adhered to. In ensuring the rule of law, the Single Market reduces barriers to trade, labour mobility and competition and increases technological diffusion between countries.

This is not to say that the European Union is perfect. Strong institutions should always strive to improve, evaluate their strategies and make sure their policies bring more value to citizens. We should also be clear about what European institutions are and what they are not. There is a widespread narrative according to which Brussels imposes its decisions on Member States. Yet all regulations and directives adopted in Brussels are decided according to a political process involving the governments of all Member States, which are all represented in the Council, and elected representatives of all European citizens. The Union has built over time a set of strong institutions for Member States to decide together matters of common interest.

But it is important to recognise the tensions that exist between the individual priorities of nation states and the pooling of national sovereignty for mutual gain[7]. The regulations for the Single Market need to be strong enough to promote innovation, but not so tight that they stifle it. By the same token, countries have to be able to pursue their own social agendas where these do not clearly clash with the principles of the Single Market. The principle of subsidiarity is important.

Conclusion

The successful development of a strong rules-based international order in the aftermath of World War II and the existence of strong institutions at both national and international level should not lead to complacency. History has proven that accidents are possible, that protectionism can follow periods of free trade. Brexit proves that there is a possibility for European integration to go into reverse. A more widespread reversal of European economic integration would durably jeopardise economic prosperity.

In times of global political and policy uncertainty, when the foundations of multilateralism are being challenged and global economic powers are flexing their muscles, it is indispensable for us to take European integration forward. A stronger Union is important to retain influence on global economic developments and to provide security to citizens. It is therefore essential to debunk the narratives of the critics of the European Union, and to speak up loudly for the EU and its institutions.

- [1]These remarks build on the speech ‘Creating stability in an uncertain world’ I delivered at a SUERF Conference, in London on 23 February 2017

- [2]For a more detailed discussion of the economic impact of uncertainty, see “The impact of uncertainty on activity in the euro area”, Economic Bulletin, Issue 8/2016, ECB and “Uncertainty about Uncertainty”, speech by Kristin Forbes, External MPC member, Bank of England, 23 November 2016.

- [3]This measure is derived from a method proposed by Baker, S., Bloom, N., and Davis, S. (2015), “Measuring economic policy uncertainty”, NBER Working Paper Series No 21633.

- [4]Funke, M., Schularick, M., and Trebesch, C. (2016), “Going to extremes: Politics after financial crises, 1870-2014,” European Economic Review, 88(C): 227-260.

- [5]Robert Schiller (2017) Narrative Economics, National Bureau of Economic Research Working Paper 23075

- [6]Federico, G. and Tena-Junguito, A. (2016), “A new series of world trade, 1800-1938”, EHES Working Paper, No. 93.

- [7]On the notion of sovereignty in a globalised world, see Mario Draghi (2019)

Europska središnja banka

glavna uprava Odnosi s javnošću

- Sonnemannstrasse 20

- 60314 Frankfurt na Majni, Njemačka

- +49 69 1344 7455

- media@ecb.europa.eu

Reprodukcija se dopušta uz navođenje izvora.

Kontaktni podatci za medije