- SPEECH

Monetary policy and the money market

Opening remarks by Philip R. Lane, Member of the Executive Board of the ECB, Meeting of the Money Market Contact Group

14 September 2022

It is a pleasure to open this meeting of the ECB’s Money Market Contact Group (MMCG).[1] While the money market is always central to the transmission of monetary policy, its role is especially prominent when the set of policy interest rates is the main active monetary policy instrument. After an extended period in which policy rates were stable near the lower bound and asset purchasing was the marginal monetary policy instrument, the money market is now back to centre stage in the transmission of monetary policy and the MMCG is an excellent forum to collect feedback from you, the money market practitioners. In these opening remarks, I will first explain the monetary policy decisions we took last week, before turning to the transmission of our recent interest rate moves in the money market.

The September monetary policy decisions

The Governing Council last week decided to raise the three key ECB interest rates by 75 basis points. This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to our two per cent medium-term target. Based on our current assessment, we expect that this transition will require us to continue to raise interest rates over the next several meetings. This policy path will dampen demand and guard against the risk of a persistent upward shift in inflation expectations. We will regularly re-evaluate our policy path in light of incoming information and the evolving inflation outlook. Our future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.[2]

We took last week’s decision, and expect to raise interest rates further, because inflation remains far too high and is likely to stay above our target for an extended period. The new staff projections foresee inflation to average 8.1 per cent in 2022, 5.5 per cent in 2023 and 2.3 per cent in 2024. This is a substantial revision relative to the June staff projections: 2022 inflation has been revised up by 1.3 percentage points, 2023 inflation by 2.0 percentage points and 2024 inflation by 0.2 percentage points.

The most important driver of these upward revisions is the exceptional increases in the assumptions for wholesale prices for gas and electricity over the coming months. In addition, faster growth in nominal wages – reflecting some catch up to the price level increases that have already occurred and also the improvement in the labour market – is also a significant contributor to higher and more persistent inflation, while exchange rate depreciation has also added to price pressures.

At the same time, the staff projections continue to see a steep reduction in inflation over the projection horizon. While core inflation is expected to remain at elevated levels until the middle of 2023, it is expected to decline thereafter as re-opening effects subside and as supply bottlenecks and energy input cost pressures ease. The projected decline in inflation is also supported by the indicators that suggest that most measures of longer-term inflation expectations currently stand at around two per cent, although recent above-target revisions to some indicators warrant continued monitoring.

In terms of the risk assessment, the risks to the inflation outlook are primarily on the upside. The major risk in the short term is a further disruption of energy supplies. Over the medium term, inflation may turn out to be higher than expected because of a persistent worsening of the production capacity of the euro area economy, further increases in energy and food prices, a rise in inflation expectations above our target, or higher than anticipated wage rises. However, if energy costs were to decline or demand were to weaken over the medium term, it would lower pressures on prices.

This inflation outlook forms the context for the setting of monetary policy. Last week’s decision is closely linked to our monetary policy strategy, which stipulates that the appropriate monetary policy response to a deviation of inflation from the symmetric two per cent target is context-specific and depends on the origin, magnitude and persistence of the deviation. In the context of a long projected period with inflation far above target, the net upside risks to inflation and taking into account that the current setting of the key policy rates is still highly accommodative, it was appropriate to take a major step that frontloads the transition from the prevailing highly-accommodative level of policy rates towards levels that will support a timely return of inflation to our target. Moreover, all else being equal, in calibrating a multi-step transition path, the appropriate size of an individual increment will be larger, the wider the gap to the terminal rate and the more skewed the risks to the inflation target.

At the same time, it is crystal clear that the appropriate monetary policy for the euro area should continue to take into account that the energy shock remains a dominant driving force of inflation dynamics and the general economic outlook, including through the impact of the very significant terms of trade deterioration. In particular, the inflation dynamics associated with the energy shock component, to which the euro area is particularly exposed, are of a different nature compared to demand-driven overheating dynamics.

The transmission of interest rate changes in the money market

The money market is key for the implementation and transmission of monetary policy: it acts as a seismograph for liquidity conditions and market expectations of future policy, while money market rates are central to the transmission of monetary policy through their impact on economy-wide financing conditions. It follows that it is important that money market rates adjust in line with changes in key ECB interest rates. This applies in particular to changes in the deposit facility rate (DFR), which represents the relevant policy rate in conditions of excess liquidity.

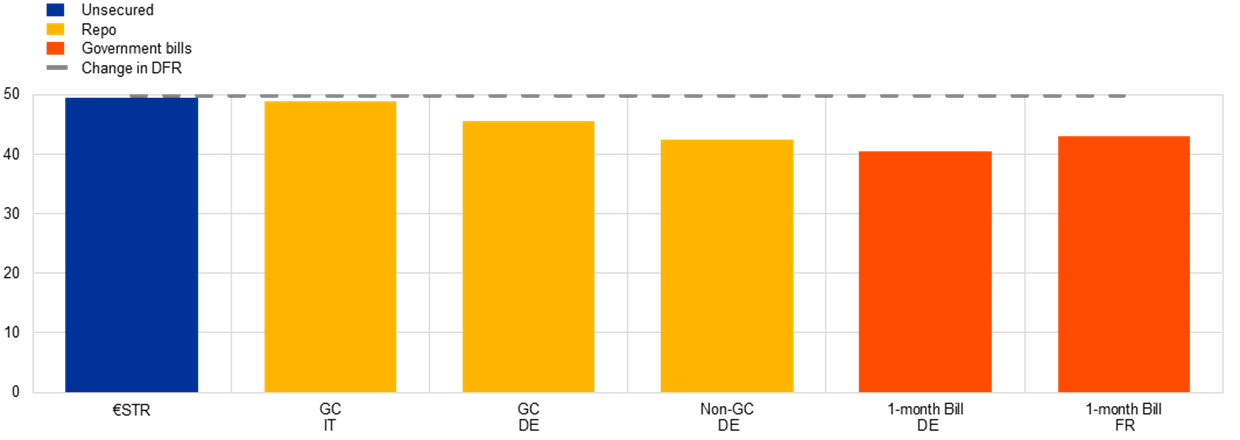

The available evidence suggests that our July rate hike of 50 basis points, which increased the DFR from -0.5 per cent to zero, has been well transmitted to money market rates overall. In particular, the euro short-term rate (€STR) moved up by the full size of the change in policy rates (Chart 1). This is especially important, since the €STR is the basis for the overnight interest rate swap curve, along which the market prices expectations of future policy. The reaction was similar across deposits by banks and by the different types of non-bank financial institutions that are active in the money market. The near-complete adjustment of repo rates for transactions based on a broad collateral pool – which are predominantly driven by a motivation to borrow or lend cash – was immediate.

Chart 1

The July 2022 rate hike by 50 basis points and rate changes across money market rates segments

(basis points)

Sources: Bloomberg, MMSR, BrokerTec/MTS and ECB calculations.

Notes: General collateral (GC) and refers to cash-driven repo transactions and non-general (non-GC) refers to collateral-driven repo transactions. The bars show the difference between the average rate of the period 1-26 July (before the hike) and the period 27 July-19 August (after the hike). For 1-month government bills, the bars show the difference in the respective rate between the average rate of the period 10 – 27 June (before the hike) and the period 27 July – 11 August (after the hike).

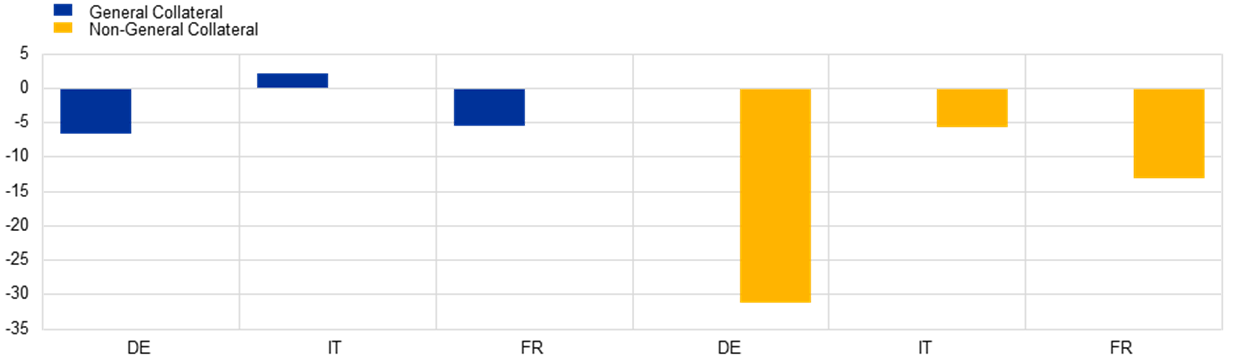

At the same time, repo rates for transactions using specific collateral – which are driven by the need to source a specific security – have increased by slightly less than 50 basis points as collateral scarcity has implied some downward pressure on these rates. This collateral scarcity is reflected in persistent negative spreads of some short-term repo rates to €STR, which is particularly pronounced for the non-general collateral (non-GC) rates (Chart 2).[3]

Chart 2

Average spread of short-term repo rates to €STR over 2022

(basis points)

Sources: BrokerTec/MTS and ECB calculations.

Notes: GC refers to general collateral and cash-driven repo transactions. Non-GC refers to non-general collateral and collateral-driven repo transactions. The chart displays the average spread of the respective repo rate to the €STR since the beginning of 2022. The latest observations are for 13 September 2022.

Moreover, there has been a widening of the spread between short-term government bill rates and swaps with the same maturity (Chart 1). This can be mainly attributed to demand/supply imbalances in the market for short-term government bills, which is partially driven by the level of excess liquidity and increased demand for short-term high-quality assets. This increased demand is also motivated by the current interest rate uncertainty and high level of volatility. These demand/supply imbalances of high-quality collateral with short-term maturities can also be observed in other jurisdictions of major central banks for similar reasons.[4]

The increase of the DFR by 75 basis points to 0.75 per cent that we decided last week will only become effective with the start of the new maintenance period today.

To preserve the effective transmission of last week’s rate hike by 75 basis points and safeguard the orderly functioning of money markets, the Governing Council also decided last week to temporarily remove the zero per cent interest rate ceiling for remunerating government deposits held with the Eurosystem. Until 30 April 2023, the remuneration ceiling government deposits will remain at the €STR or the DFR, whichever is lower. This temporary adjustment was in recognition that the faster than initially expected pace of monetary policy normalisation gave only little time for government deposit holders to adjust and plan for alternative arrangements. The temporary adjustment allows the remuneration of government deposits to follow money market rates, which reduces the risk of an abrupt outflow of these deposits held on the Eurosystem balance sheet into the market — likely into repos or short-term government securities. This, in turn, could have created additional demand for highly-rated euro collateral, at a time when some segments of money markets, in particular the market for euro area repo and short-term government securities, are showing signs of collateral scarcity (Chart 2).

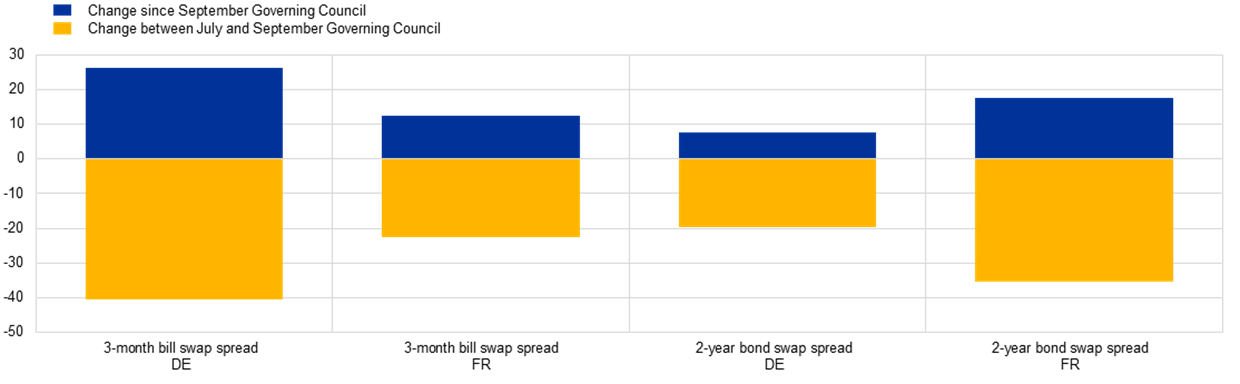

The early indications are that the decision on the remuneration of government deposits has been effective. Following the announcement of the change in the remuneration of non-monetary policy deposits, the recent increase in the spread between the yield for short-term euro government securities and interest rate swaps has been partially reversed. (Chart 3). At the same time, as the change in the ceiling for the remuneration of governments will only come into effect today, the full effects of the measure may only become visible over time, and we remain attentive to the spread between different money market rates as well as collateral scarcity concerns.

The temporary change in the remuneration ceiling for government deposits gives government deposit holders extra time to undertake a smooth and gradual return of their deposits to the market. From the ECB’s perspective, it remains the case that encouraging market intermediation of these deposits remains desirable in the long term. In the meantime, the temporary change will allow us to assess the adjustments of money markets across market segments to the return to positive interest rates and thereby also reduce uncertainty about the pass-through of the changes in the ECB interest rates to money markets.

Chart 3

Change in 3-month bill to OIS spread DE and FR (left side); change in 2-year bond to OIS spread DE and FR (right side)

Sources: Bloomberg and ECB calculations.

Notes: The charts display the change in 3-month bill to overnight indexed swap (OIS) spread and 2-year bond to OIS spread for Germany and France between the July and September Governing Council meetings (blue bar) and the change since the September Governing Council meeting (yellow bar). The latest observations are for 13 September 2022.

I am grateful to Pamina Karl for her contribution to this speech.

For more general considerations on this new phase of euro area monetary policy, see also Lane, P.R. (2022), “Monetary policy in the euro area: the next phase”, remarks to the policy panel at the annual meeting of the Central Bank Research Association on 29 August.

Non-general collateral (Non-GC) refers to specific securities that are subject to particularly high demand in the repo market compared to similar securities (general collateral, GC). Due to the high demand for these securities potential buyers in the repo market tend to offer a lower rate for cash in exchange, so that non-GC repo rates are usually below GC repo rates.

Also in the United States and the United Kingdom, the spread between overnight unsecured rates and collateral-driven repo transactions (non-GC) and short-term bill rates has widened since the start of the hiking cycle.

Európska centrálna banka

Generálne riaditeľstvo pre komunikáciu

- Sonnemannstrasse 20

- 60314 Frankfurt nad Mohanom, Nemecko

- +49 69 1344 7455

- media@ecb.europa.eu

Šírenie je dovolené len s uvedením zdroja.

Kontakty pre médiá