- THE ECB BLOG

- 13 March 2020

The Monetary Policy Package: An Analytical Framework

by Philip R. Lane, Member of the Executive Board of the ECB

In this blog post, I will explain the analytical framework underlying the comprehensive package of monetary policy measures that the Governing Council decided yesterday. The spreading of the coronavirus is a severe economic shock to the world and euro area economies. In addition to the much-discussed potential interruption of supply chains, the necessary containment measures that are being introduced in many countries imply both a temporary decline in production and the cancellation or postponement of many expenditure plans. In overall terms, this situation has an immediate adverse impact on the economy.

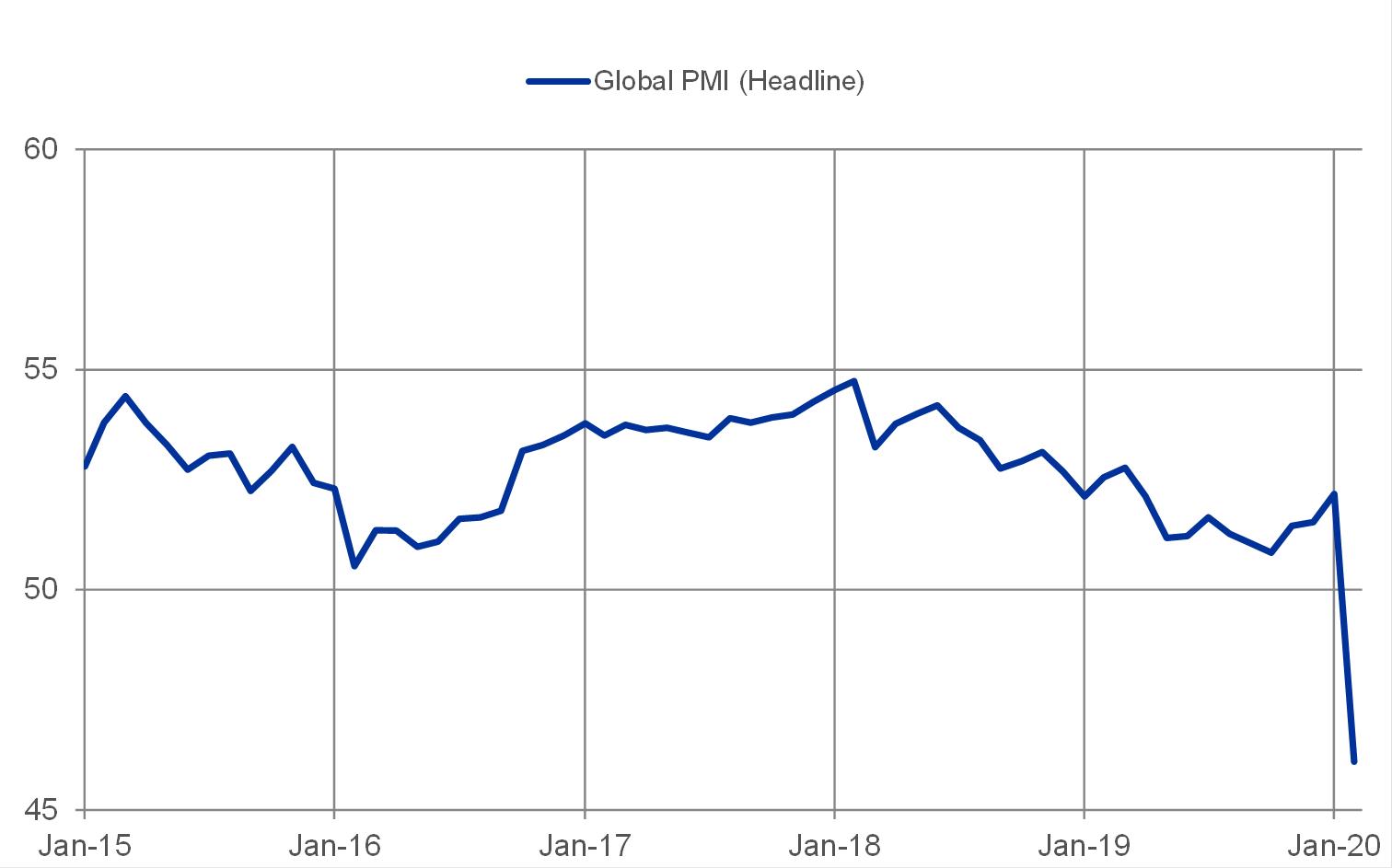

In fact, the latest survey data measuring current global activity have nosedived (see Chart 1). Moreover, as lockdown measures are implemented more broadly and for a longer duration, a more substantial and longer lasting downturn is likely. At the same time, success in containing the virus - notably through an appropriate policy response - will ultimately allow a return to more normal economic conditions.

Chart 1: Global PMI

Sources: Markit.

Last observation: February 2020.

The clear aim for policymakers should be to mitigate the impact of the shock, by countering pro-cyclical amplification dynamics and muting propagation forces that might convert a temporary shock into a decline in long-run economic performance. For governments, in addition to meeting the immediate public health challenges that are needed in order to containing the spread of the coronavirus, an ambitious and coordinated fiscal policy response is required to support firms and workers at risk due to the economic fallout from this shock. This should include measures such as credit guarantees that limit the threat that a temporary shortfall in revenue would constrain the subsequent recovery of firms that were in good shape before this shock occurred. It should also include support for workers that face temporary declines in wages. More broadly, the overall macroeconomic orientation of fiscal policy should ensure that the decline in aggregate private-sector expenditure is not amplified in a pro-cyclical manner. Accordingly, the Governing Council strongly supports the commitment of euro area governments and the European Institutions to joint and coordinated policy action.

Monetary policy also has a vital role to play. The initial supply side shock from the coronavirus outbreak has clearly morphed into a demand shock that deeply affects activity across all sectors of the economy. Moreover, the economic ramifications of the coronavirus have already been amplified by a tightening in financial conditions, especially through the decline in stock prices, rising yields in some asset classes, together with the appreciation of the euro (Chart 2). This risks triggering a material deterioration in financing conditions in the euro area.

Chart 2: Financial conditions in the euro area

Source: ECB.

Notes: The FCI is constructed as a weighted average of the 1-year OIS, the 10-year OIS, the EA NEER vis-à-vis 38 trading partners and the EuroStoxx Broad Stock Exchange Index. All variables are in deviation from their long-term average. The FCI is an average of two alternative FCIs, one in which the weights are derived from the impulse response of HICP inflation to a shock in each of the four financial variables from an estimated VAR model, and the other where the weights are derived from the elasticities drawn from a set of projection models used in the (B)MPE.

Last observation: 11 March 2020.

Our monetary policy response to this severe (yet ultimately temporary) shock has three key elements: first, safeguarding liquidity conditions in the banking system through a series of favourably-priced LTROs; second, protecting the continued flow of credit to the real economy through a fundamental recalibration of the TLTROs; and third, via an increase in the asset purchase programme, preventing that financing conditions for the economy tighten in a pro-cyclical way.

Let me explain the rationale for each of the measures in more detail.

It is essential to ensure that liquidity is provided on generous terms to the financial system, in order to avoid the well-understood spiral effects if an adverse economic shock is amplified by liquidity shortages: in addition to our existing regular liquidity operations, the new long-term refinancing operations (LTROs) provide new lines of funding at a low rate (the deposit facility rate) ) of -50 basis points. Such liquidity measures are especially important under conditions of heightened uncertainty and when the coronavirus shock also poses operational risk challenges for many participants in the financial system.

Especially given the revenue shortfall that is facing small and medium-sized enterprises (SMEs) and the income shortfall that is facing households, supporting credit supply can avoid the credit-crunch dynamic by which banks pull back from lending at the same time as the demand for credit is increasing. Under the new terms for TLTRO III, we have increased the volume of funds that banks can borrow from us in order to provide credit to firms and households by more than EUR 1 trillion. This raises the total possible borrowing volume under this programme to almost EUR 3 trillion. Banks can borrow at the most favourable rates we have ever offered, provided that they continue to do their job of extending credit to the private sector. An important innovation is that, by setting the minimum borrowing rate at 25 basis points below the average interest rate on the deposit facility, we are effectively lowering the funding costs in the economy without a generalised reduction in the main traditional policy rates.

Overall, the new conditions on the TLTRO help to significantly ease the funding conditions that determine the supply of credit provided by banks to firms and households. In particular, this will support bank lending to those affected most by the spread of the coronavirus, and especially SMEs. In order to ensure that banks will be able to make full use of our funding support, we will also investigate further collateral easing measures. Also, as demonstrated by this revision, it should be clear that adjustments to the parameters of the TLTRO programme provides an agile instrument in our monetary policy toolbox, if the circumstances so warrant.

In this context, the measures taken by the ECB’s Supervisory Board also provide welcome temporary capital and operational relief to euro area banks. These decisions show that the improvements in the regulatory framework achieved over the past years, allow relaxing requirements on banks in a counter-cyclical way, thereby, complementing well our monetary policy decisions.

It is essential to ensure a sufficiently-accommodative monetary stance, especially in an environment of high uncertainty and elevated financial volatility. The addition of an envelope of an extra EUR 120 billion to our asset purchase programme (APP) over the rest of 2020 helps to ensure that the euro area risk-free yield curve – as captured by the overnight index swap (OIS) curve – supports favourable financial conditions for the real economy. The role of the APP – both the private-sector purchase programmes and the public sector securities programme – is especially helpful during a “flight to safety” episode when investors switch across assets on the basis of the correlation patterns by which some assets are classified as “safe havens” that gain value during risk-off episodes. Under such conditions, there are deviations from the typical co-movement patterns between the GDP-weighted average sovereign bond yield curve and the respective OIS rates, which call for flexibility in the implementation of our asset purchase programme.

The addition of this extra envelope in the asset purchase programme demonstrates that it is a priority for the Eurosystem to show a more robust presence in the bond market during phases of heightened volatility. Moreover, we are committed to use the full flexibility embedded in the APP to respond to current market conditions. This means that there can be temporary fluctuations in the distribution of purchase flows both across asset classes and across countries in response to “flight to safety” shocks and liquidity shocks. Such deviations from the steady-state cross-country allocation are within the remit of the programme, so long as the capital key continues to anchor the total stock of our holdings in the long run.

We will not tolerate any risks to the smooth transmission of our monetary policy in all jurisdictions of the euro area. We clearly stand ready to do more and adjust all of our instruments, if needed to ensure that the elevated spreads that we see in response to the acceleration of the spreading of the coronavirus do not undermine transmission.[1]

Let me touch on a final aspect. You may wonder why, unlike many other central banks in recent weeks, the ECB did not lower its key policy rates. Decisions about the short-term policy rate should be understood in the context of the nature and expected duration of the shocks facing the economy, as well as the transmission lag of the different monetary policy instruments. For instance, a move in the short-term rate is typically most powerful if it is expected to be persistent, given the importance of the expectations channel in determining the influence of the short-term policy rate on the overall yield curve. This persistence channel is less relevant in the context of the spreading of the coronavirus. While this major shock is hitting us at high speed, our baseline scenario is that it will be ultimately temporary in duration. Accordingly, we concluded that an easing of the monetary stance through the additional asset purchases and the considerable support for credit supply through the revised TLTRO programme is the more appropriate response. However, it should also be clear that, although the deposit facility rate (the main short-term policy rate) was maintained in yesterday’s decision at its current value of minus 50 basis points, the Governing Council retains the option of future cuts in the policy rate, if warranted by a tightening in financial conditions or a threat to our medium-term inflation aim.

- [1]The European Court of Justice has confirmed that, within its mandate, the ECB has discretion when calibrating its monetary policy tools, provided that these are necessary and proportionate to achieving the ECB’s objective.