Foreword

This 18th annual review of the international role of the euro published by the ECB presents an overview of developments in the use of the euro by non-euro area residents.

This report covers developments in 2018 and early 2019. This period was characterised by growing concerns about the impact of international trade tensions, a protracted slowdown in global growth, reversals in cross-border capital flows and challenges to multilateralism, including the imposition of unilateral sanctions. On balance, these developments, together with progress towards deepening Economic and Monetary Union (EMU), seem to have had a positive effect on the international use of the euro, which showed tentative signs of recovering from historic lows. In particular, the euro’s share in global foreign exchange reserves, international debt issuance and international deposits increased, as did its share in outstanding amounts of international loans. Its use as an invoicing currency remained broadly stable, as did shipments of euro banknotes to destinations outside the euro area.

The European Commission has launched an initiative to strengthen the international role of the euro and issued a Communication to this effect on 5 December 2018. Like the Commission, the Eurosystem stresses that the international role of the euro is primarily supported by a deeper and more complete EMU, including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU.

The ECB will continue to monitor developments in and publish information on the international role of the euro on a regular basis.

Mario Draghi

President

1 Main findings

In 2018 and early 2019, there were tentative signs of a recovery in the international use of the euro, with a composite index of the euro’s international role increasing in the review period, albeit from historic lows (see Chart 1). The euro remained unchallenged as the second most important currency in the international monetary system (see Chart 2).

The share of the euro in global foreign exchange reserves rose in 2018 by more than 1 percentage point (see Table 1). Several emerging market economies sold foreign exchange reserves to stabilise their domestic currencies amid tighter financial conditions and reversals in capital flows. A large part of those interventions took place in US dollars, mechanically underpinning the share of the euro in global foreign exchange reserves. Tentative evidence suggests that concerns about unilateral sanctions may have been another factor supporting diversification of the reserve portfolios of some central banks, such as the Central Bank of Russia. To some extent, these concerns may also have contributed to a 0.5 percentage point increase in the share of the euro in international deposits.

Additional indicators tracked in this report show the share of the euro as having increased in the review period. One such indicator is international debt issuance. The share of the euro increased by more than 2 percentage points as a stronger US dollar exchange rate, together with higher US interest rates, raised concerns among international borrowers about higher debt servicing costs. Borrowers in emerging market economies markedly scaled back volumes of US dollar-denominated issuance to reduce exposures to US dollar exchange rate movements and risks arising from currency mismatches. By contrast, the role of the euro as an invoicing currency for extra-euro area trade transactions and shipments of euro banknotes to destinations outside the euro area remained broadly stable.

All in all, financial turbulence in some emerging market economies, growing concerns about the impact of international trade tensions and challenges to multilateralism, including the imposition of unilateral sanctions, seem to have lent support to the euro’s global standing over the review period. Moreover, euro area-specific developments, such as progress towards completing banking union and deepening EMU more generally, helped to further strengthen the euro area’s resilience and, in turn, to boost the attractiveness of the euro internationally.

The European Commission launched an initiative to strengthen the international role of the euro and issued a Communication to this effect on 5 December 2018. Like the Commission, the Eurosystem stresses that the international role of the euro is primarily supported by a deeper and more complete EMU, including advancing the capital markets union, in the context of the pursuit of sound economic policies in the euro area. The Eurosystem supports these policies and emphasises the need for further efforts to complete EMU.

This year’s report contains four special features. The first of these looks at developments since the start of Economic and Monetary Union 20 years ago, assessing the economic benefits and costs of the international role of the euro from a central banking perspective. In particular, it shows that the balance between these benefits and costs has shifted, with some of the traditional effects of international currency status having declined in relevance while others have become more apparent. As a result, changes in the global role of the euro may have consequences for the conduct of monetary policy, all of which must be understood and taken into account when designing euro area monetary policy.

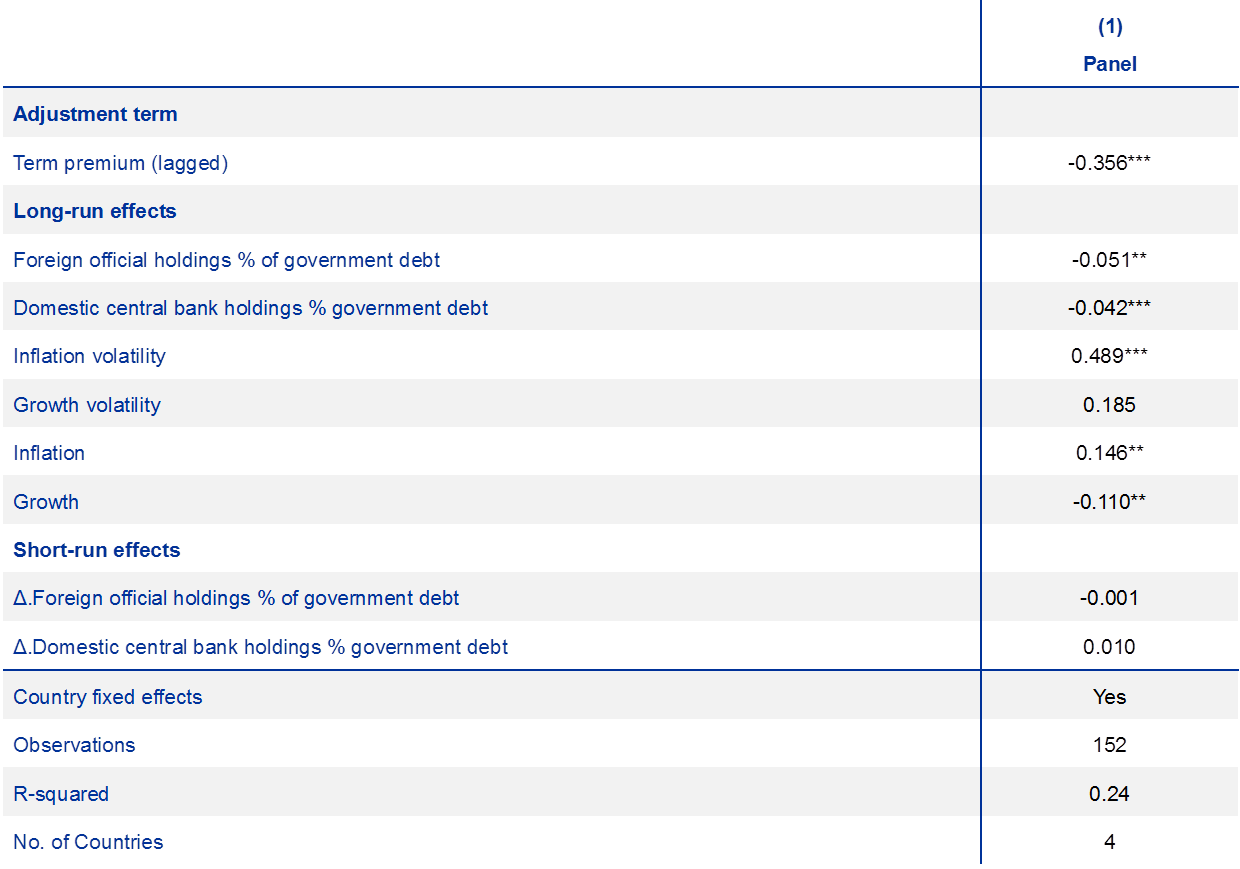

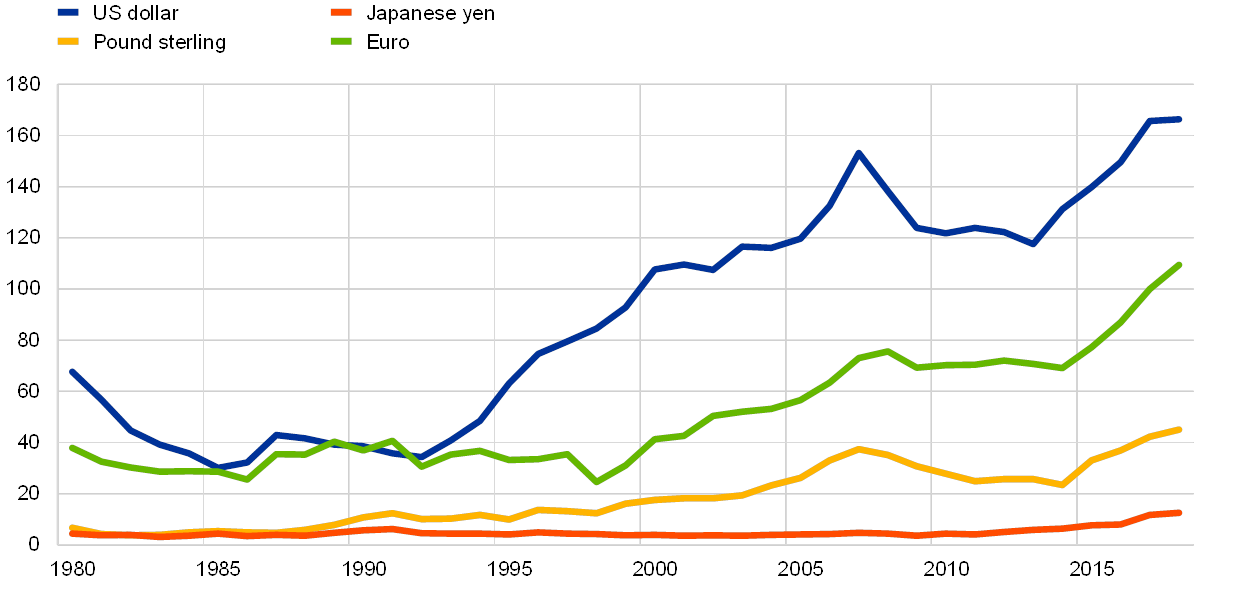

The second special feature aims to quantify the “exorbitant privilege” of international currency status for major currencies. It explains that the relevant metric for this purpose is the share of foreign official holdings in the stock of outstanding highly rated debt – a metric for which the euro is at par with the US dollar. Estimates from a simple error-correction model that aims to disentangle long-run stock effects from short-run flow effects of net purchases of sovereign debt by foreign official reserve holders suggest that the “exorbitant privilege” enjoyed by the euro is economically significant. Foreign official reserve holdings of debt securities have compressed term premia on euro area long-term yields by around 110 basis points, which compares with around 160 basis points for US long-term yields. But foreign official holdings of euro area government debt are concentrated in the few euro area sovereigns issuing highly rated debt securities. Strengthening the credit quality of outstanding debt, notably by pursuing sound and sustainable fiscal policies, would contribute to increasing the supply of safe euro area debt and raising the euro’s global appeal. In the longer term, the creation of a common euro area safe asset, if so decided by Member States, in a way that does not undermine incentives for sound national fiscal policies, could also contribute to this objective. This, in turn, would help the euro’s “exorbitant privilege” to be more widely shared across euro area sovereigns.

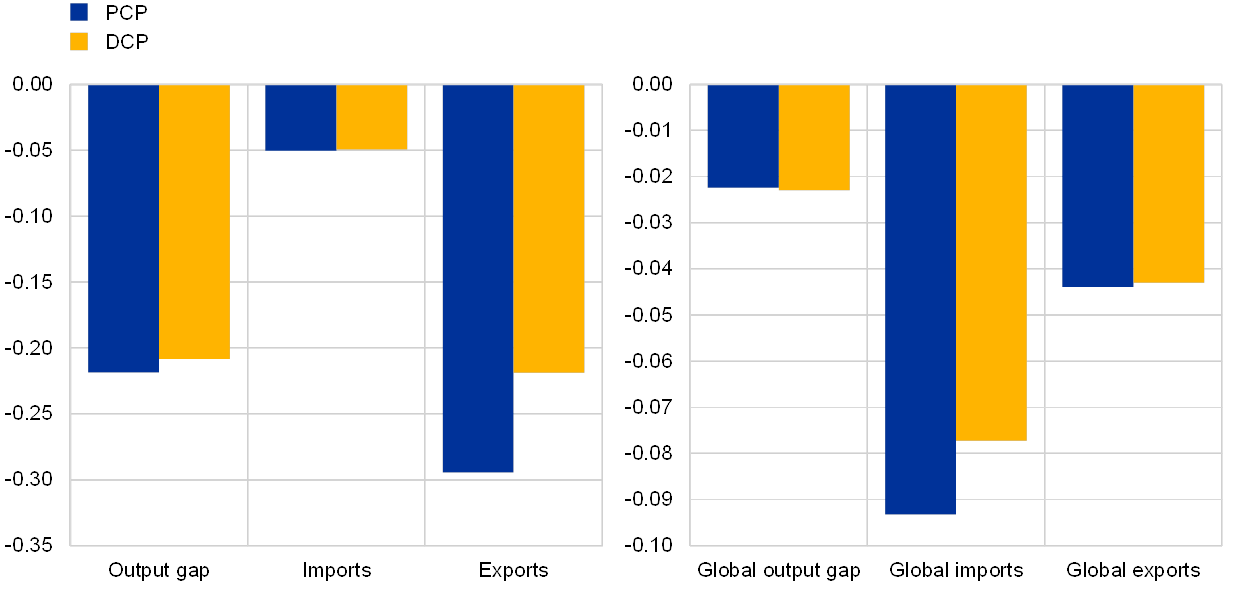

The third special feature assesses the role of the US dollar in trade invoicing for the global transmission of US and euro area monetary policy shocks. It provides evidence on differences in shock transmission from the traditional perspective of producer currency pricing, in which exporters price products in their own currency, and from the dominant currency perspective, in which exporters and importers price products in a third currency, such as the US dollar. It provides simulations using ECB‑Global, the ECB’s main structural macroeconomic model, for the analysis of global spillovers. It shows that dominant currency pricing amplifies the effects of US monetary policy on US and global trade. By contrast, dominant currency pricing does not significantly alter the domestic effects of euro area monetary policy, but it does reduce the effects of euro area monetary policy on global exports.

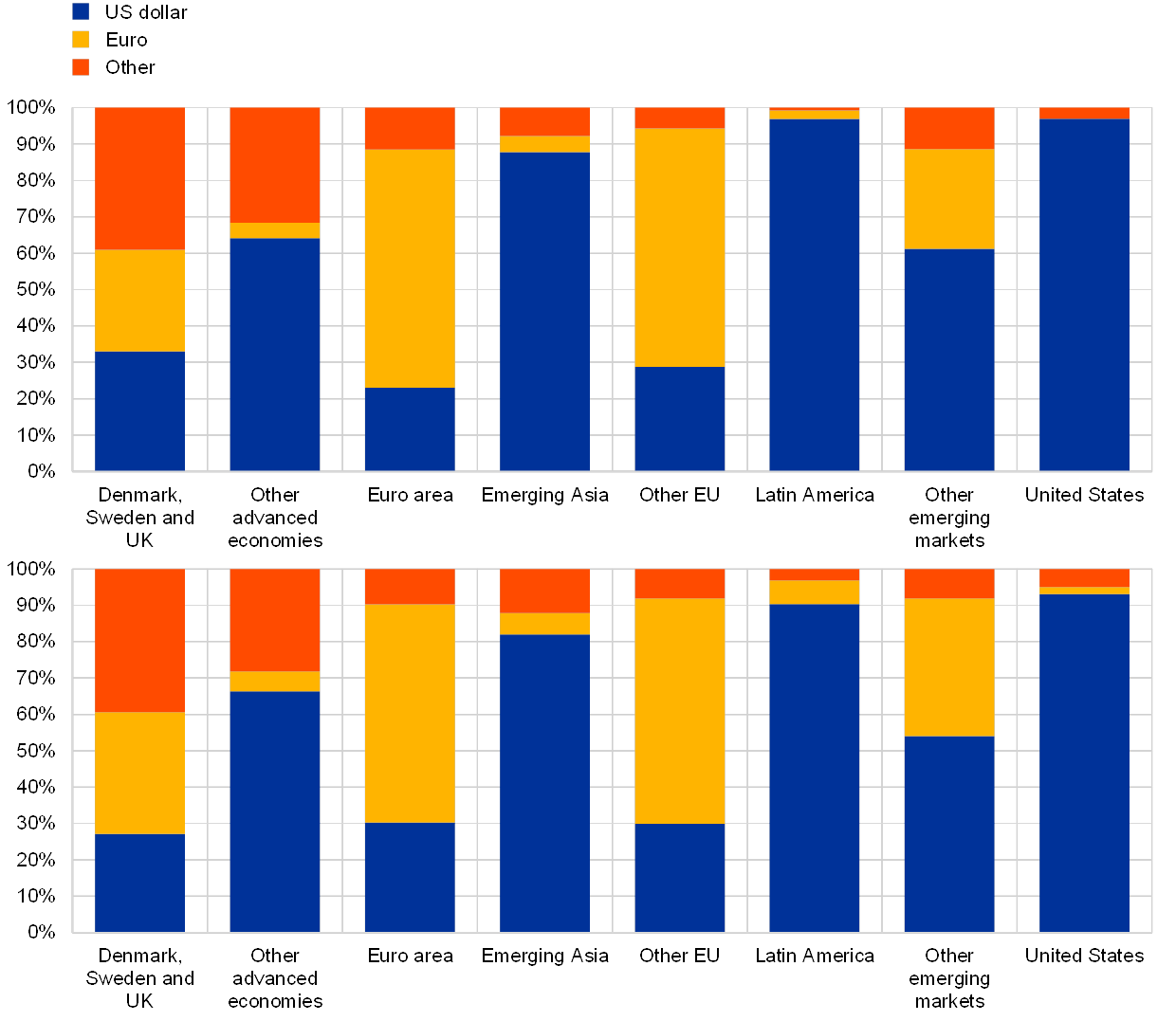

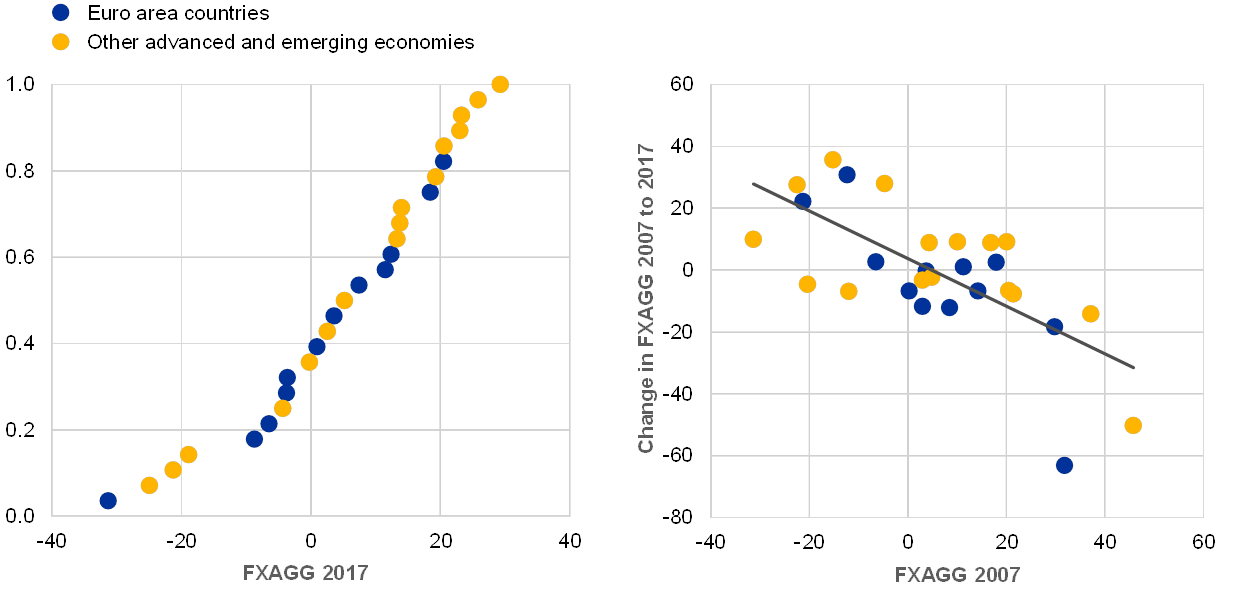

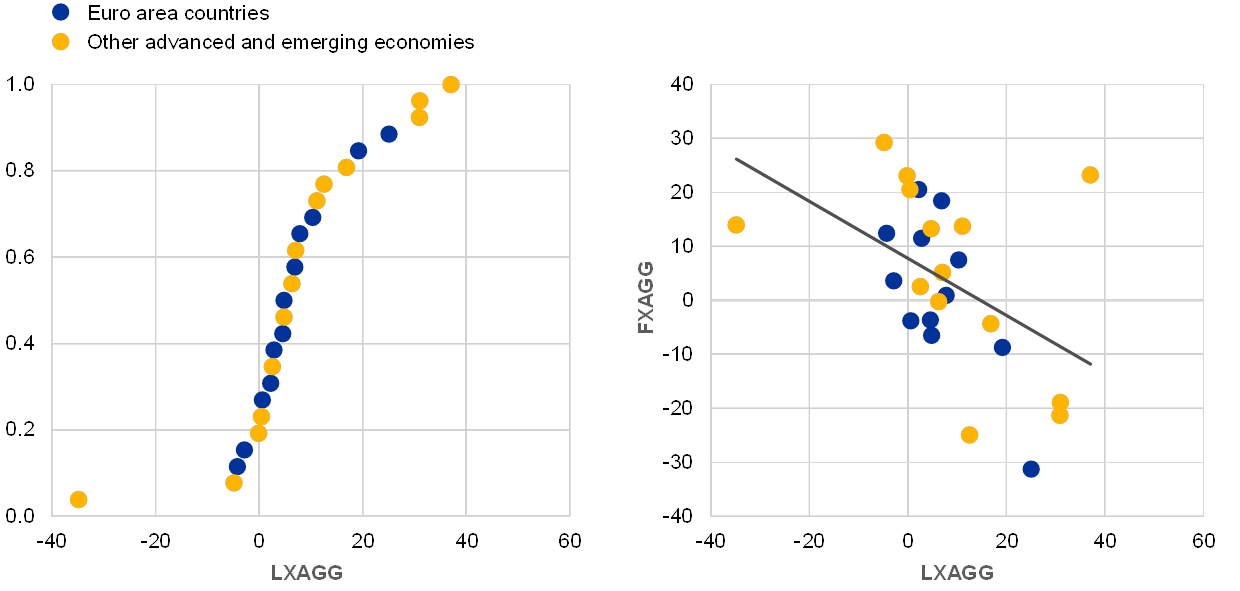

The fourth special feature provides stylised facts on the relative importance of the euro and the US dollar as denomination currencies for cross-border bank positions, which is useful for understanding the international transmission of shocks. It focuses on 28 advanced and emerging market economies to analyse cross-country heterogeneity in the currency mix of banking systems using data from the locational banking statistics of the Bank for International Settlements (BIS). In addition to considering variations across countries and time in currency exposures, it studies their relation to the geography of cross-border banking and to the currency mix of local banking positions. The special feature identifies three main stylised facts, namely that the majority of national banking systems have larger net assets in euro than in US dollars, that dispersion in net currency exposures has declined, and that net cross-border exposures towards the euro and the US dollar are shaped by the geography of cross-border banking positions towards the euro area and partly mirror banks’ currency exposures in local positions.

Chart 1

The international role of the euro rose from historic lows in the review period

Composite index of the international role of the euro

(percentages; at current and Q4 2018 exchange rates; four-quarter moving averages)

Sources: BIS, IMF, CLS Bank International, Ilzetzki, Reinhart and Rogoff (2017) and ECB calculations.

Notes: Arithmetic average of the shares of the euro at constant (current) exchange rates in stocks of international bonds, loans by banks outside the euro area to borrowers outside the euro area, deposits with banks outside the euro area from creditors outside the euro area, foreign exchange settlements, global foreign exchange reserves and share of the euro in exchange rate regimes globally. Data at constant exchange rates were not available for foreign exchange settlements. Data for 2016 are used for 2017 and 2018 observations for the share of the euro in exchange rate regimes globally. The latest observations are for the fourth quarter of 2018.

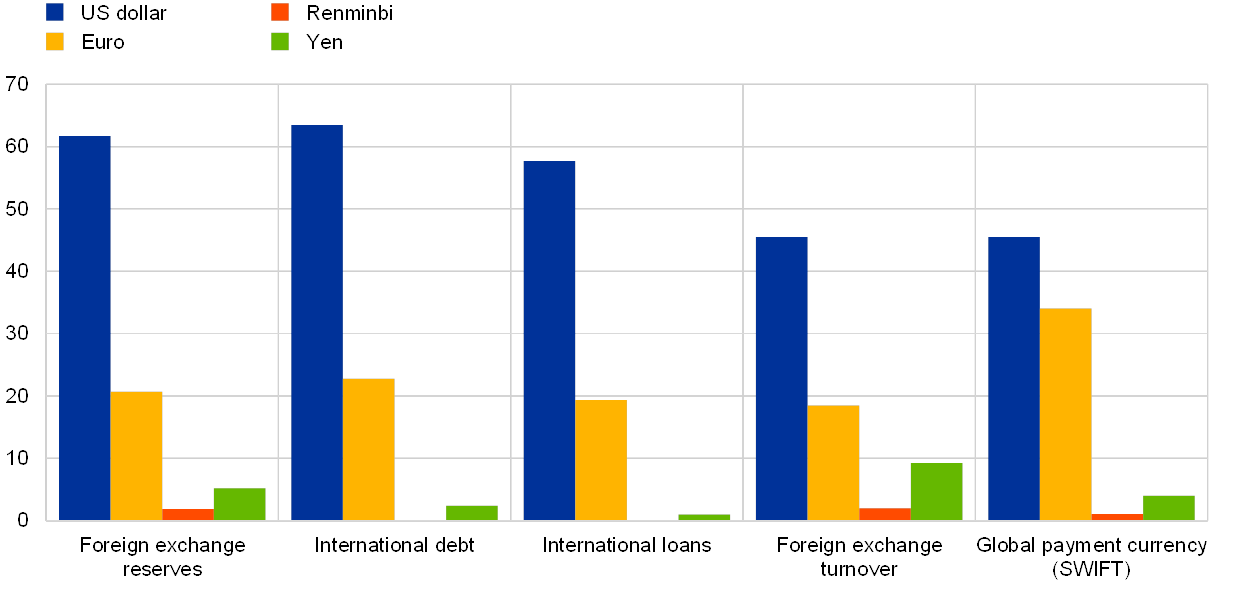

Chart 2

The euro remains the second most important currency in the international monetary system

Snapshot of the international monetary system

(percentages)

Sources: BIS, CLS Bank International, IMF, SWIFT and ECB calculations.

Note: The latest data are for the fourth quarter of 2018 or the latest available.

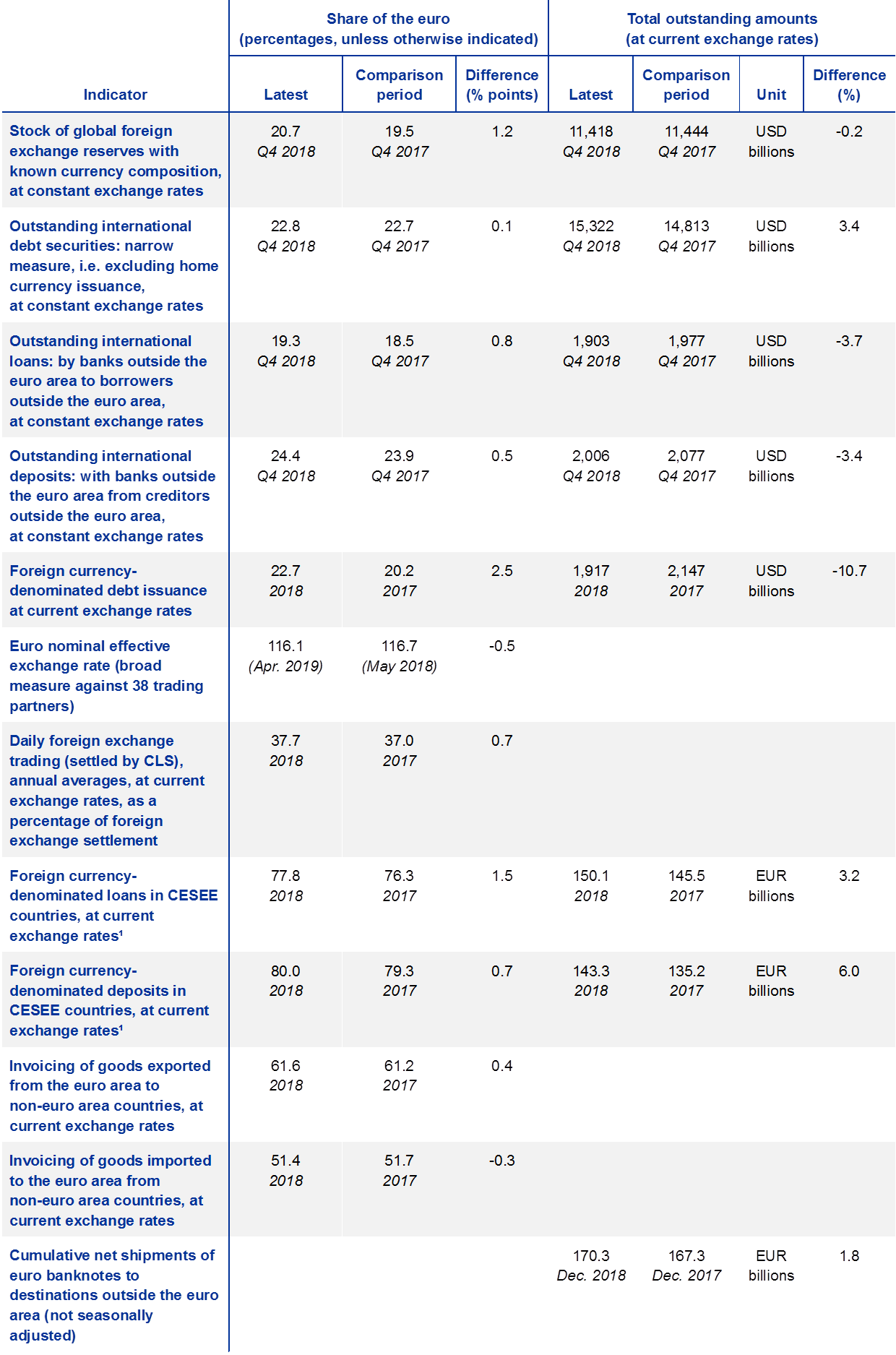

Table 1

The international role of the euro showed signs of a tentative turnaround in 2018

Summary of data in this report

Sources: BIS, CLS Bank International, Dealogic, IMF, national sources and ECB calculations.

Notes: An increase in the euro nominal effective exchange rate indicates an appreciation of the euro.

1) Outstanding amounts figures refer to outstanding amounts of foreign currency total amounts.

2 Key developments

2.1 Use of the euro as an international reserve and investment currency

The share of the euro in global official holdings of foreign exchange reserves increased in 2018, unlike that of the US dollar which continued to decline. At constant exchange rates, the share of the euro in globally disclosed holdings of foreign exchange reserves increased by more than a full percentage point between the end of 2017 and the end of 2018, to 20.7% (see Chart 3).[1] Moreover, the share of the US dollar continued to decline over the review period to 61.7% – an all-time low since the start of Economic and Monetary Union.

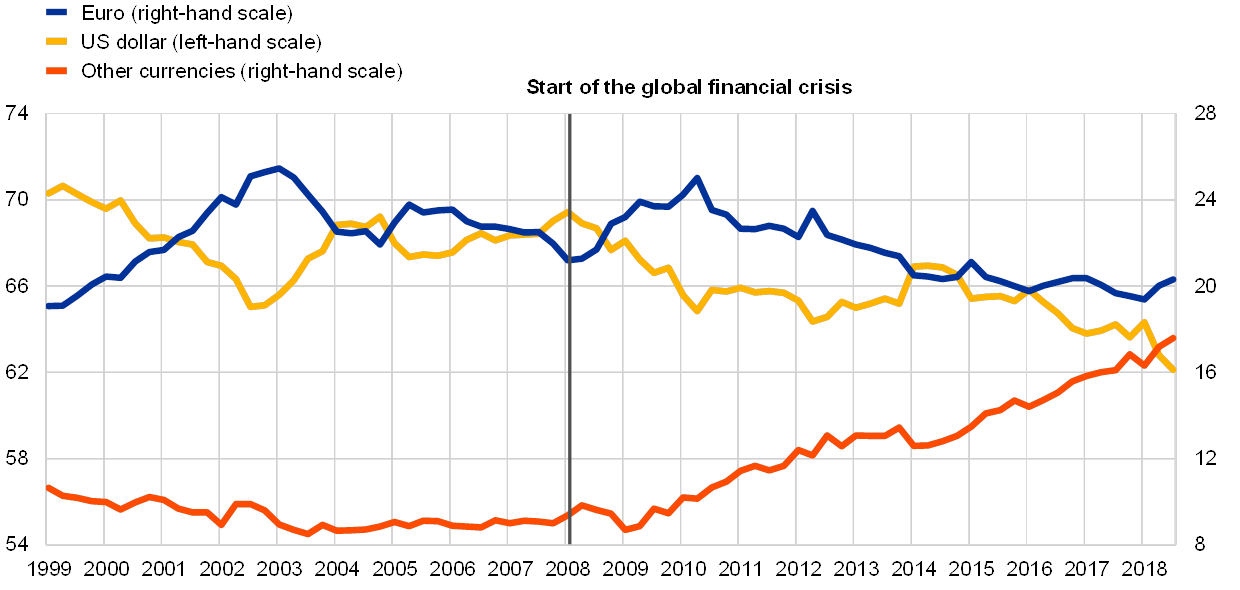

Chart 3

The share of the euro in global foreign exchange reserves increased in 2018

Developments in the shares of the euro, US dollar and other currencies in global official holdings of foreign exchange reserves

(percentages; at constant Q4 2018 exchange rates)

Sources: IMF and ECB calculations.

Note: The latest observation is for the fourth quarter of 2018.

The US dollar remains the leading global reserve currency, but its share has declined by more than 7 percentage points relative to its peak level before the global financial crisis. Although the euro grew temporarily in importance as an international reserve unit in the wake of the global financial crisis, its role declined after the outbreak of the euro area debt crisis in the period 2010‑11. The share of other currencies in official reserve portfolios increased significantly in parallel, pointing to diversification of global reserve portfolios – a trend which continued in the review period.[2]

The increase in the share of the euro in global reserve portfolios in the review period appears partly related to factors that weighed on the use of the US dollar. One such factor is that several emerging market economies – many of which are large reserve holders – sold US dollar-denominated reserves. Heightened financial market volatility and reversals in cross-border capital flows over the summer led these economies to conduct foreign exchange market interventions to stabilise their currencies. Between the end of March and the end of September 2018, they sold about USD 200 billion worth of – mainly US dollar-denominated – foreign exchange reserves (see the left panel of Chart 4).[3]

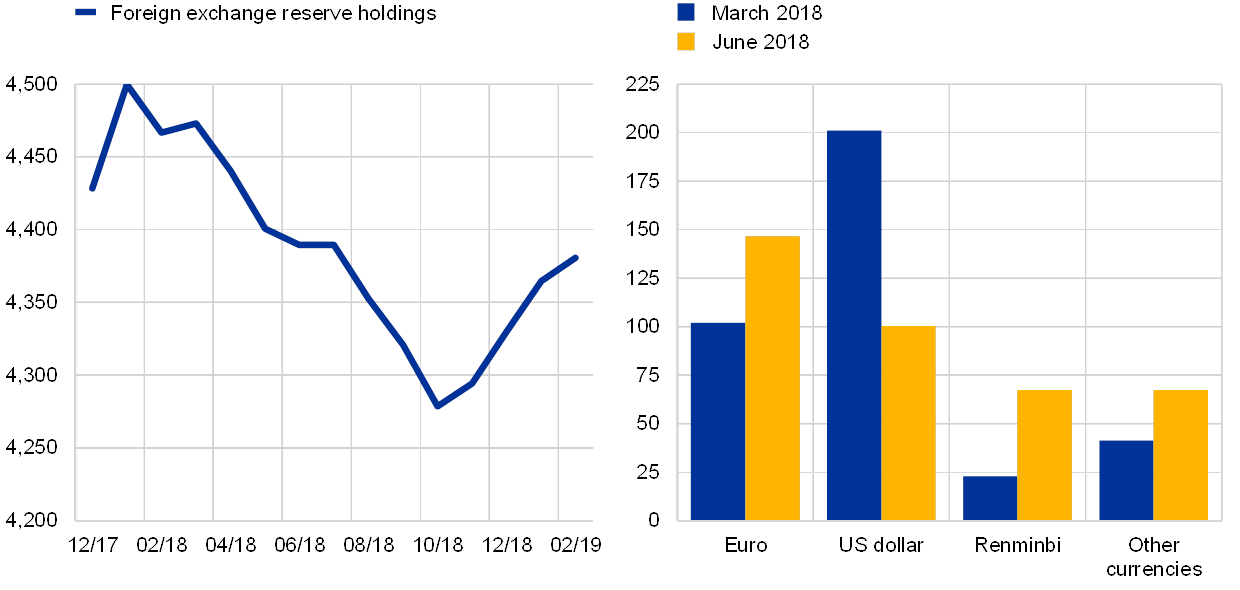

Chart 4

Changes in 2018 in the currency composition of global foreign exchange reserve portfolios reflected factors that weighed on the US dollar

Change in the foreign exchange reserve holdings of selected emerging market economies (left panel) and currency composition of the foreign exchange reserves of the Central Bank of the Russian Federation (right panel)

(amounts in USD billions)

Sources: Haver analytics, Central Bank of the Russian Federation and ECB calculations.

Notes: The latest observation is for February 2019 (left panel) and June 2018 (right panel). The emerging market economies referred to in the left panel chart include Argentina, China, Hong Kong, India, Indonesia, Thailand and Turkey.

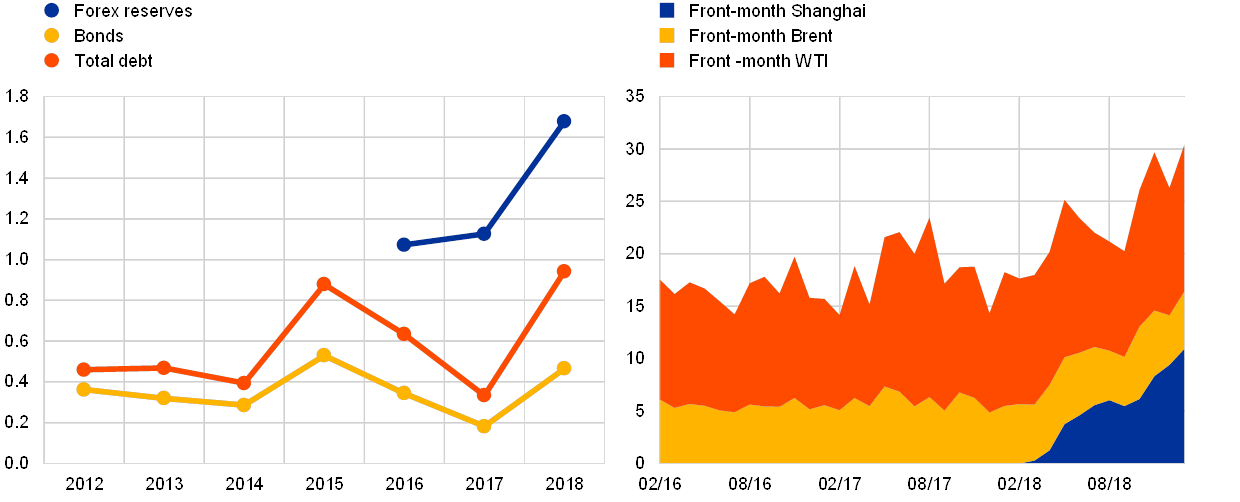

Another factor that weighed on the US dollar is that some central banks might have started to consider reducing their positions in financial assets exposed to the risks of unilateral actions. One example is Russia, one of the world’s largest reserve holders, which sold about USD 100 billion worth of US dollar-denominated reserves in the wake of new rounds of US sanctions, and purchased almost USD 90 billion worth of euro-denominated and renminbi-denominated assets in the second quarter of 2018 (see the right panel of Chart 4). With a share of about 39%, the euro is now the main currency of denomination of Russia’s foreign exchange reserve holdings, ahead of the US dollar and the renminbi, with shares of 27% and 17% respectively.[4] China also reduced its holdings of US Treasury securities in the course of 2018 in an environment of escalating global trade tensions, to the tune of about USD 60 billion (from a total of nearly USD 1.1 trillion).[5] It is difficult to assess whether other official reserve holders have taken – or are contemplating taking – similar steps, not least owing to the limited information available publicly on the currency composition of central banks’ reserve portfolios (see Table A1).[6]

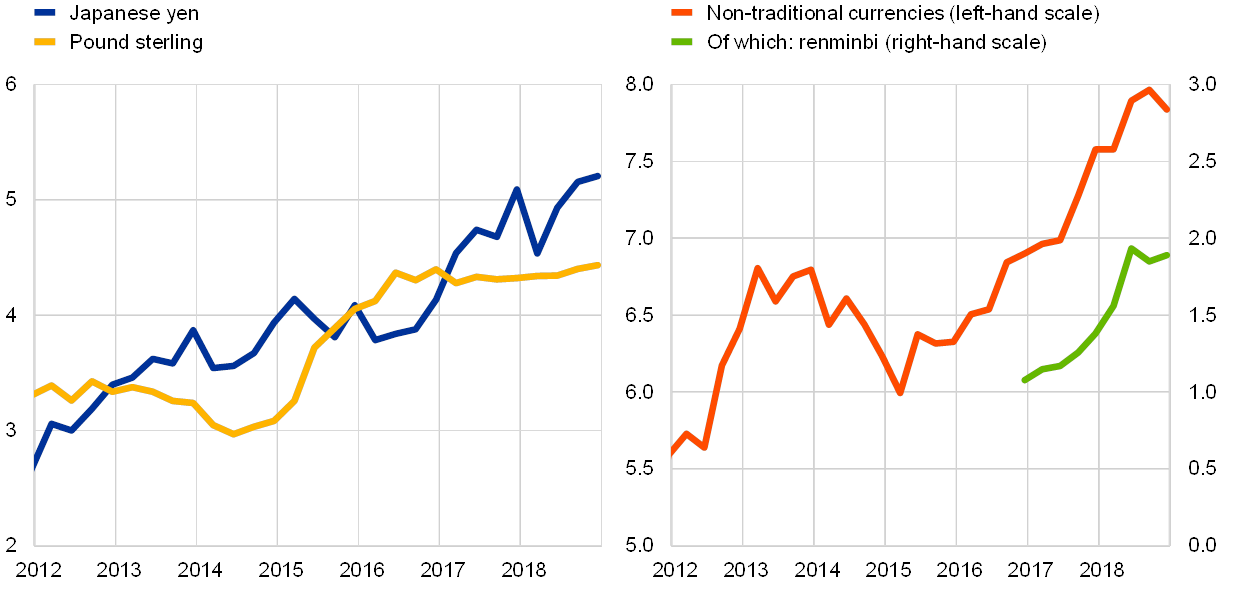

The role of the remaining reserve currencies continued to increase, mainly on account of the Chinese renminbi. Adjusting for valuation effects arising from exchange rate movements, the shares of both the Japanese yen and the pound sterling remained broadly stable (see the left panel of Chart 5). Stability in the share of the pound sterling, in turn, suggests that official reserve holders remained confident, in the review period, that risks associated with an exit of the United Kingdom from the European Union could be mitigated. Non-standard currencies continued to gain in importance (see the right panel of Chart 5). Their share increased by nearly half a percentage point in 2018, mostly due to investments in Chinese renminbi from Russia.[7] The share of the Chinese renminbi reached almost 2% of global foreign exchange reserves in the fourth quarter of 2018, double that of early‑2017 (see also Box 1, which reviews recent developments in the renminbi’s global role).

Chart 5

The stronger role of the other reserve currencies was mainly on account of the renminbi

Shares of the Japanese yen and of the pound sterling in global foreign exchange reserves (left panel) as well as of non-traditional currencies, including the Chinese renminbi (right panel)

(percentages; at constant Q4 2018 exchange rates)

Sources: IMF and ECB calculations.

Notes: The latest observation is for the fourth quarter of 2018. Non-traditional currencies include the Australian dollar, the Canadian dollar, the Chinese renminbi and other currencies not included in the special drawing rights basket.

Developments in portfolio flows to the euro area suggest that weaker euro area growth prospects and the lingering effects of the ECB’s asset purchase programme were important determinants in lowering the attractiveness of the euro as an investment currency. Balance of payments data suggest that net purchases of euro area equities by foreign investors fell to about €60 billion in February 2019 from an all-time high of almost €490 billion in December 2017 (see the left panel of Chart 6).[8] Waning demand for euro area equities in 2018 mainly reflected global factors, particularly lower levels of global investor risk appetite in an environment of slowing global growth, heightened trade tensions and lingering political uncertainty. However, idiosyncratic euro area factors, including concerns of a more severe slowdown in activity in the euro area, weighed additionally on the global attractiveness of euro area equities. Foreign investors continued to retreat from euro area bonds (see the right panel of Chart 6). Against the background of the ECB’s asset purchase programme and low euro area yields, foreign investors remained net sellers of debt securities in 2018, to the tune of €190 billion.

Chart 6

Foreign investors remained net sellers of euro area debt securities in 2018

Net purchases by foreign investors of euro area equities (left panel) and debt securities (right panel)

(cumulated flows over 12 months)

Sources: ECB and ECB calculations.

Notes: The latest observation is for February 2019. Debt securities include bonds, notes and money market instruments.

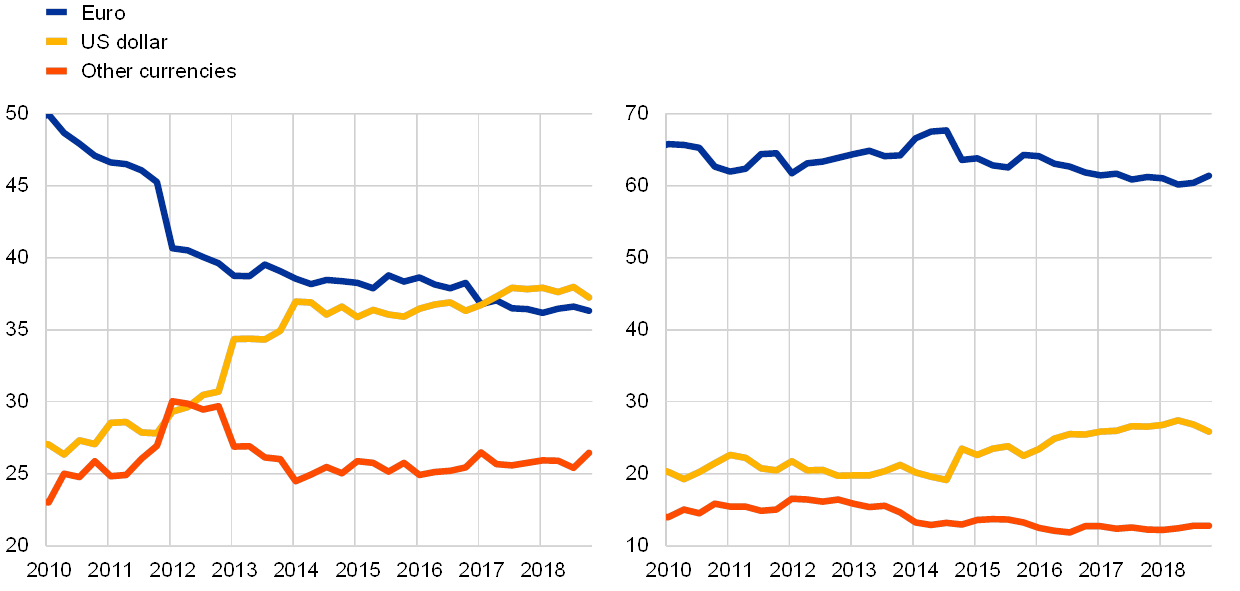

This interpretation is supported by new statistical evidence on the currency composition of euro area portfolio debt assets and liabilities. Holdings by euro area investors of foreign debt securities denominated in US dollars remained higher than those denominated in the euro in the review period (see the left panel of Chart 7). Between 2010 and 2013 euro area investors rebalanced their holdings of foreign debt securities from euro to US dollar-denominated assets, presumably reflecting concerns about risks raised by the euro area debt crisis. However, the share of the euro at constant exchange rates did not recover subsequently. This might have reflected mounting market expectations about – and ultimately the launch of – the ECB’s programme of large-scale purchases of sovereign bonds. Expectations that yields would fall in the euro area, in turn, may have encouraged euro area investors to turn to foreign bonds seen as close substitutes, including US Treasury securities.[9] The currency composition of portfolio debt liabilities vis-à-vis non-euro area residents is also increasingly tilted towards the US dollar (see the right panel of Chart 7). Anecdotal evidence suggests that this reflects issuances by US multinational enterprises and financial institutions via special purpose vehicles set up in some euro area countries, as well the issuance of US dollar debt by euro area banks to hedge US dollar assets.

Chart 7

The currency composition of euro area portfolio debt assets and liabilities is increasingly tilted towards the US dollar

Currency composition of euro area portfolio debt assets (left panel) and liabilities (right panel)

(percentages; at constant Q4 2018 exchange rates)

Sources: ECB and ECB calculations.

Note: The latest observation is for the fourth quarter of 2018.

Box 1

Internationalisation of the Chinese renminbi – state of play

The international use of the Chinese renminbi regained some strength in 2018 after the launch of several initiatives by Chinese authorities to raise its global status. However, international use of the renminbi remains substantially below the peak levels of 2015.

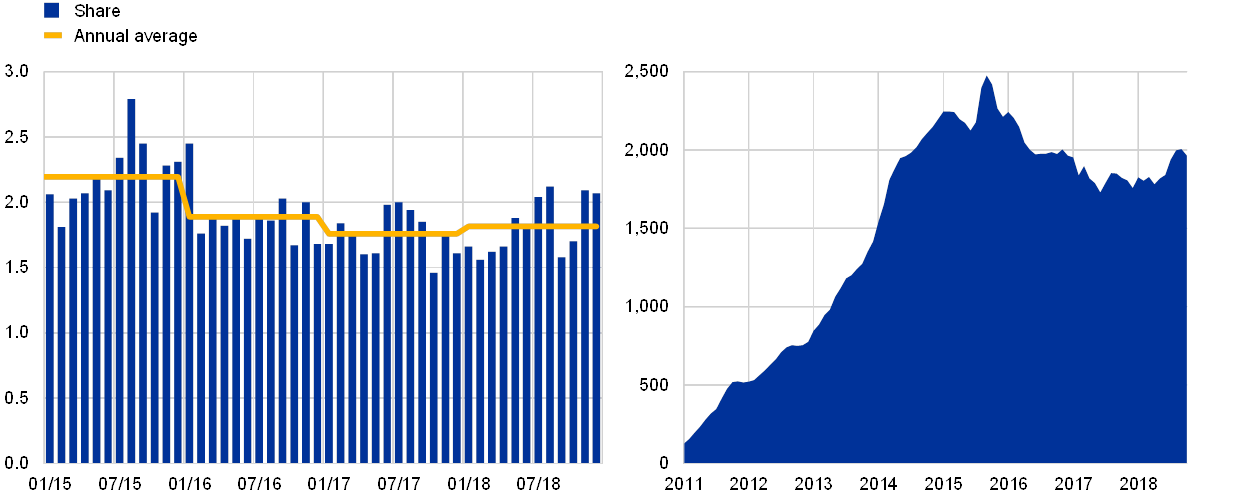

One popular indicator of the internationalisation of the renminbi is its role in international payments (see the left panel of Chart A). SWIFT data show that the average share of the renminbi declined from 2.2% in 2015 to about 1.8% in 2018, although it remains the fifth most used currency in international payments. A composite index of the renminbi’s global role suggests that it is less strong in 2018 than it was in 2015 (see the right panel of Chart A). The currency’s international role actually declined just after it was included in the special drawing rights basket.

By contrast, use of the renminbi as a currency of denomination for international bonds and reserves increased noticeably in 2018. But at less than 2%, the share of the renminbi in global foreign reserve portfolios, outstanding amounts of international bonds and international liabilities remains small overall (see the left panel of Chart B).

The Chinese authorities have taken initiatives to foster the international use of the renminbi. They launched several projects in 2017 and 2018 under the umbrella of the Belt and Road Initiative to support use of the renminbi as an invoicing currency for trade and to create direct trade routes between China and other economies.[10] The Shanghai International Energy Trading Centre launched an oil futures contract denominated in renminbi in 2018, with the goal of elevating it to benchmark status in the Asia-Pacific region. Within the space of a few months, trading volumes in the contract reached levels not too far off those in more established benchmarks, such as WTI or Brent (see the right panel of Chart B). Plans for financial products traded directly in renminbi are also under consideration.[11] The expansion of the Chinese banking sector – which, since 2016, has held total assets larger than those of European banks – notably to developing economies, may also have been another factor underpinning the renminbi’s global appeal, through the financing of international trade in renminbi, for example.

Time will tell whether these measures will succeed in increasing the global attractiveness of the renminbi. Complementary reforms to open China’s capital account and move to market-based exchange rate determination are also likely to be important if the renminbi is to reach its full potential.

Chart A

Indicators pointing to a small increase in the role of the renminbi in 2018

Change in the renminbi’s share as an international payment currency (left panel) and a composite indicator of internationalisation (right panel)

(left panel: percentages; right panel: index)

Sources: SWIFT (left panel); Bloomberg, Standard Chartered (right panel).

Notes: The latest observation is for December 2018 (left panel) and 31 January 2019 (right panel). Inbound plus outbound traffic based on value (left panel). The Renminbi Globalisation Index (RGI) tracks four components with weights inversely proportional to their variance, namely deposits, trade settlement and other international payments, dim sum bonds and certificates of deposit issued, and foreign exchange turnover (all from an offshore perspective and denominated in renminbi) in several countries (Hong Kong, Singapore, Taiwan, the United States, the United Kingdom, Korea, France) (right panel).

Chart B

Indicators pointing to a more significant increase in the role of the renminbi in 2018

Change in the share of the renminbi in total international debt, bonds and official foreign exchange reserves (left panel) and in selected oil future benchmarks (right panel)

(left panel: percentages; right panel: million lots per year, with each lot equalling 1,000 barrels)

Source: Dealogic, Haver Analytics, IMF, People's Bank of China and ECB staff calculations (left panel) and Bloomberg (right panel).

Note: The latest observation is for December 2018 (left panel) and for January 2019 (right panel).

2.2 The euro in global foreign exchange markets

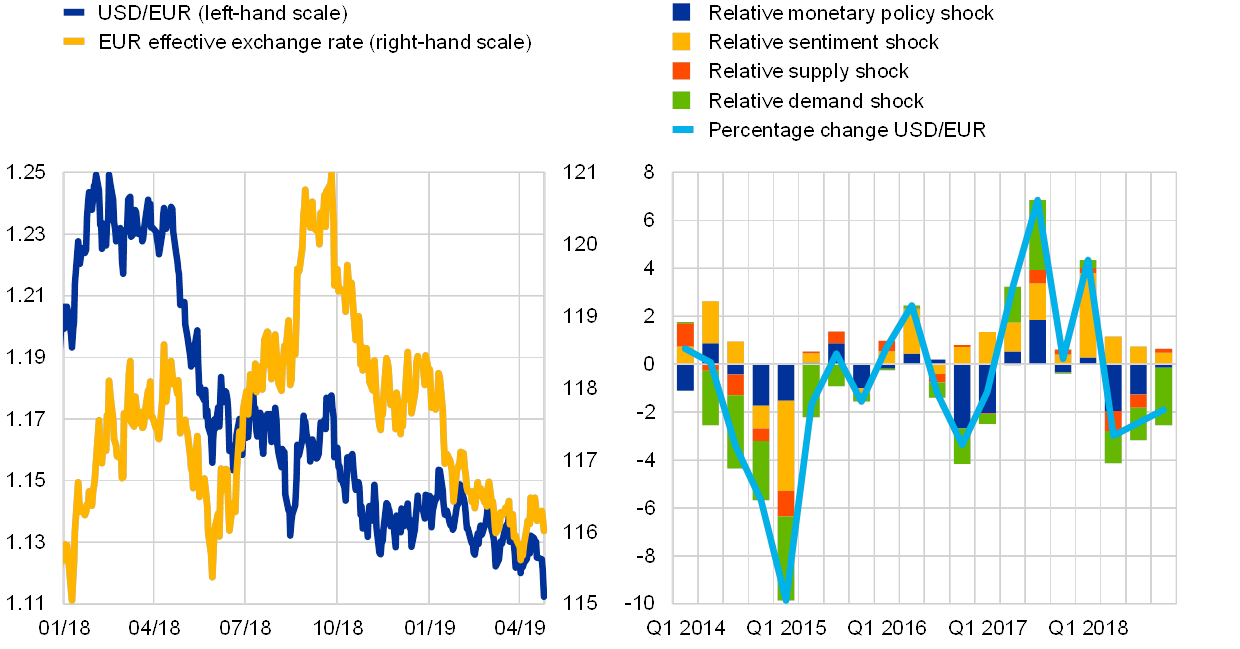

The euro exchange rate weakened in the review period. Between May 2018 and April 2019, the euro depreciated markedly (by about 5.0%) against the US dollar. In nominal effective terms (i.e. against the euro area’s 38 major trading partners), the depreciation of the euro was more contained, at about 0.5% (see the left panel of Chart 8), reflecting, among other things, weakness of several emerging market currencies[12] and the pound sterling.

The depreciation of the euro against the US dollar reflected mainly the stronger growth momentum and a faster pace of monetary policy normalisation in the United States relative to the euro area. Estimates obtained from a Bayesian vector autoregression (BVAR) model, where structural shocks driving the USD/EUR exchange rate are identified via sign restrictions, suggest that the euro’s depreciation against the US dollar over the review period can be largely ascribed to a combination of relatively stronger demand and a tighter monetary policy stance in the United States relative to the euro area (see the right panel of Chart 8). In contrast, market sentiment shocks, which often explain a large share of exchange rate developments, played a smaller role in the review period.

Chart 8

The euro depreciated markedly against the US dollar on the back of a weaker outlook for euro area growth and a faster pace of US monetary policy normalisation

Exchange rate of the euro against the US dollar and in nominal effective terms vis-à-vis the currencies of 38 major trading partners (left panel) and model-based decomposition of the quarterly change in the USD/EUR exchange rate over the past five years (right panel)

(right panel: percentages)

Sources: ECB and ECB calculations.

Note: Estimates based on a quarterly BVAR model of the USD/EUR exchange rate, relative GDP (euro area versus US), relative CPI (euro area versus US) and shadow interest rate differentials (euro area versus US) where shocks are identified via sign restrictions. The latest observation is for 25 April 2019 (left panel) and for the fourth quarter of 2018 (right panel).

Evidence on the role of the euro in the foreign exchange market based on quantities points to a slight decline in the use of the euro. In the absence of updated data from the Triennial Central Bank Survey of Foreign Exchange and Over-The-Counter (OTC) Derivatives Markets conducted by the BIS – which was last released in December 2016 – quantity-based evidence on the role of the euro in the foreign exchange markets can be gleaned from data on foreign exchange transactions settled in the CLS system. CLS is operated by CLS Bank International, a specialised financial institution providing settlement services to its members in the foreign exchange market.[13] The share of the euro in global foreign exchange settlements decreased between January and December 2018, from about 38% to about 36% (see the left panel of Chart 9) amid lighter volumes of euro settlements (see the right panel of Chart 9).[14] Data are volatile, however, and such developments are not unprecedented. Moreover, a comparison of the annual averages between 2017 and 2018 shows that the share of the euro increased by 0.7 percentage points. The US dollar remained the leading currency in the foreign exchange market by a wide margin, being involved in about 91% of all settlements in December 2018, while the euro remained the second most actively settled currency.

The role of the euro as an anchor currency, i.e. as a currency of reference for the exchange rate regime of economies outside the euro area, remained stable in the review period.[15] Box 2 shows evidence of the strong regional dimension of the euro’s role as an exchange rate anchor.

Chart 9

The share of the euro in global foreign exchange turnover decreased in 2018

Share of foreign exchange transactions settled in CLS (left panel) and total value of euro-denominated settlements (right panel)

(left panel: percentages; right panel: EUR billion equivalents per month)

Sources: CLS Bank International and ECB calculations.

Note: The latest observation is for March 2019.

Box 2

Global currency areas

The international role of a currency can be measured based on several indicators, such as liquidity in the exchange rate market, use in international debt markets and denomination of foreign assets. These indicators measure use of a currency beyond national borders. Another important factor to consider is that, when a currency has a dominant role in the international monetary system, shocks to the currency in question propagate to other currencies. One example of this is the US dollar. A large array of bilateral exchange rates co-move strongly with the US dollar’s nominal effective exchange rate. A number of factors drive that finding, including the fact that many trade and debt operations are US-dollar denominated and many countries track US monetary policy closely (see also Box 6). Estimating how much a currency acts as an anchor for the exchange rates of other countries is therefore one way of splitting the global economy into currency areas, i.e. groups of countries with exchange rates co-moving strongly with the US dollar or other major currencies. We use a simple framework to that end in the spirit of McCauley and Ito (2018), which consists of estimating the following model equation on monthly data[16]:

where is the bilateral exchange rate of country i vis-à-vis the US dollar regressed on the nominal effective exchange rate of the euro, the yen and the pound sterling, respectively.[17] The various coefficients measure how much the euro, the yen and the pound sterling co-move with the bilateral exchange rate of country i against the US dollar, which captures their relevance for currency i (this is also in the spirit of the standard Frankel-Wei methodology albeit using nominal effective exchange rates in lieu of bilateral exchange rates expressed in a common numéraire currency).[18] The coefficient for the US dollar is computed as , which can be seen as an upper bound. The coefficient estimates can then be plotted on a map to provide a visual representation of global currency zones. ECB staff estimates using this methodology suggest that the US dollar plays a dominant role as a global anchor currency (see Chart A).

Chart A

The euro currency area is the second most important in the world

Estimated co-movement with the dollar (upper panel) and the euro (lower panel)

(percentages derived from the β coefficient estimates discussed above)

Sources: ECB, BIS and ECB staff calculations.

Notes: The estimates are for December 2018. The boundaries shown on this map do not imply acceptance by the ECB.

The US dollar drives the exchange rates of most countries in the western hemisphere, Asia and the Middle East. The euro is an important anchor currency for non-euro area European countries and for some countries in Africa, which typically share strong economic, historical and institutional links with the euro area. Intuitively, the β coefficient estimate equals 1 on the US dollar exchange rate for Panama (which is a dollarised economy) and 1 on the euro exchange rate for Denmark (which pegs its currency vis-à-vis the euro within tight fluctuation bands). The role of the Japanese yen and the pound sterling is more limited, by contrast.

2.3 Use of the euro in international debt and loan markets

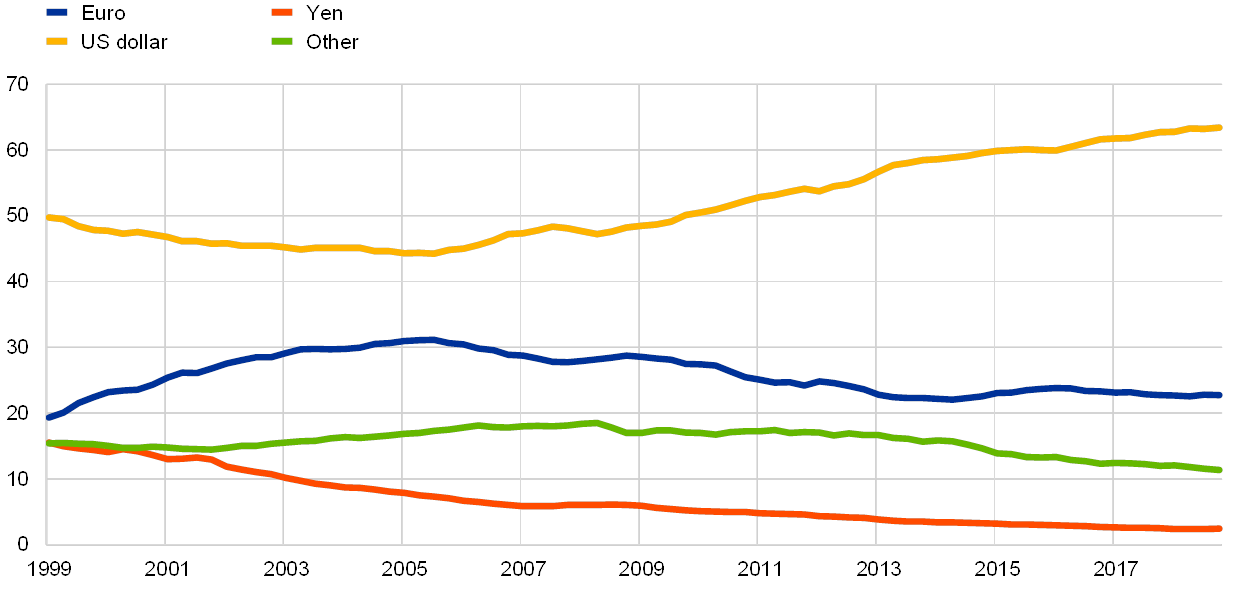

The euro in international debt markets

The share of the euro in the stock of international debt securities remained stable in 2018 (see Chart 10 and Table A4). At constant exchange rates, the share of the euro in outstanding amounts of international debt securities remained stable, at about 23%.[19] The dominant role of the US dollar in international debt markets continued to increase, rising by about half a percentage point, to over 63%. Since the mid‑2000s, the share of the euro has declined by about 8 percentage points, while that of the US dollar has increased by close to 20 percentage points.

Chart 10

The share of the euro in the stock of international debt securities remained stable in 2018

Currency composition of outstanding international debt securities

(percentages; at Q4 2018 exchange rates)

Sources: BIS and ECB calculations.

Notes: Narrow measure. The latest data are for the fourth quarter of 2018.

However, analysis of debt flows provides a different perspective, with an increase in the share of the euro and a notable decline in that of the US dollar. Recent trends in international debt markets are more clearly reflected by developments in issuance than developments in stocks. In 2018 total volumes of foreign currency denominated debt issuance declined by more than 10% to about USD 1,900 billion, the largest decline in a year since the outbreak of the global financial crisis in 2008 (see the left panel of Chart 11). This decline was confined to issuance in US dollars. Debt financing in the euro and other currencies remained stable or increased slightly. As a consequence, the share of euro debt issuance increased by 2.5 percentage points (see the right panel of Chart 11), while the share of the US dollar declined for a second consecutive year, by around 8 percentage points in total, to less than 61%.

Chart 11

The share of the euro in foreign currency-denominated debt issuance increased in 2018 on the back of markedly lower issuance in US dollars

Currency composition of foreign currency-denominated debt issuance

(left panel: USD billions; right panel: percentages)

Sources: Dealogic and ECB calculations.

Note: The latest data are for the fourth quarter of 2018.

The decline in the share of the US dollar mainly reflected a decrease in US dollar issuance by borrowers in emerging market economies in an environment characterised by a stronger US dollar exchange rate and concerns about rising debt servicing costs. The ascent of the US dollar as the main financing vehicle in global debt markets in the past decade mainly reflected dynamic borrowing of emerging market issuers seeking to take advantage of low US interest rates. US dollar-denominated issues by emerging market economies increased almost tenfold in the last decade (see the left panel of Chart 12). However, this trend came to a halt in 2018. In an environment characterised by a stronger US dollar exchange rate, weaker global growth and concerns about rising debt servicing costs, borrowers in emerging market economies cut volumes of US dollar-denominated issuance by about 30%. US dollar debt issuance also declined among borrowers in non-EU advanced economies, also probably because a stronger US dollar exchange rate weighed on its attractiveness as a funding currency.[20]

Interest shown by emerging market borrowers in using the euro as a funding currency increased further, suggesting that they sought to diversify their currency exposures. The volume of euro-denominated debt issuance by emerging market residents increased for the third consecutive year in 2018, although it remains considerably lower than the corresponding dollar volumes (see the right panel of Chart 12). In turn, the share of the euro in total international debt issuance of emerging market economies rose from 7% to 9%, while that of the US dollar declined from 89% to 84%, suggesting that borrowers in emerging market economies sought to diversify their funding base and reduce exposures to US dollar exchange rate movements.

Chart 12

The decline in US dollar-denominated international debt issuance in 2018 was largely driven by borrowers in emerging market economies

Regional breakdown of US dollar-denominated (left panel) and euro-denominated (right panel) international debt issuance

(USD billions)

Sources: Dealogic and ECB calculations.

Note: The latest data are for the fourth quarter of 2018.

Euro-denominated issuance in 2018 was also supported by the gradual decline in the cost of synthetic US dollar borrowing, as measured by the cross-currency swap (CCS) basis. A negative CCS basis is equivalent to paying a premium for borrowing US dollars “synthetically” via another funding currency, such as the euro.[21] The CCS basis across different maturities continued to contract in 2018. For instance, at the ten-year maturity, the basis declined from about 40 to about 20 basis points (see Chart 13); at the one-year maturity, it narrowed from about 40 to about 10 basis points.

Chart 13

The cross-currency swap basis of the euro decreased in 2018, which lowered the cost of using the euro as a funding currency

Cross-currency swap basis against the US dollar at the ten-year maturity

(basis points)

Sources: Bloomberg and ECB calculations.

Note: The latest observation is for 25 April 2019.

However, the share of the euro in stocks of international debt remains limited outside developed European countries. Aside from developed Europe and Canada, the share of the euro in outstanding amounts of international debt remains below 16% (see Chart 14 and Table A6). The dominance of the US dollar in global debt markets is most pronounced in the Middle East and in offshore financial centres, where its share is typically close to 90%, in line with the US dollar’s pre-eminence as an invoicing currency of energy products (see Box 3) and in global financial transactions.

Chart 14

Use of the euro as a financing currency remains limited outside Europe

Currency composition of outstanding international bonds and notes in selected regions

(percentages)

Sources: BIS and ECB calculations.

Notes: Narrow measure. The data are for the fourth quarter of 2018. Non-EU developed Europe refers to Iceland, Norway, Switzerland and European microstates.

Foreign currency debt issuance remains dominated by the private sector. As in previous years, financial institutions were the most active issuers of euro-denominated and US dollar-denominated international bonds, accounting for about two-thirds of total issuance for each (see Chart 15). Sovereigns accounted for around 10% of total international issuance. The relative importance of private versus public issuers has been remarkably stable over the past two decades. Since 1999 the private sector has accounted for around 90% of international bond issuance, both in the euro and US dollars.

Chart 15

Financial institutions remained the main issuers of euro-denominated and US dollar-denominated international debt in 2018

Sector breakdown of euro-denominated (left panel) and US-denominated (right panel) international debt issuance

(percentages)

Sources: Dealogic and ECB calculations.

The euro in international loan and deposit markets

The share of the euro in international loan markets continued to rise in 2018. Between 2006 and 2014 the share of the euro in international loans declined continuously, reflecting among other things deleveraging by euro area banks, as well as regulatory efforts to reduce exposures to foreign loans denominated in the euro.[22] This trend has halted and partly reversed in the past few years. The share of the euro in the stock of international loans stood at 19.3% at the end of the review period, an increase of almost 1 percentage point relative to the end of 2017 (see Chart 16 and Table A6).[23]

Recent evidence suggests that the ECB’s unconventional monetary policy measures, in particular in the form of credit easing programmes, supported cross-border lending of euro area banks.[24] In response to the ECB’s accommodative monetary policy, euro area banks operating internationally reallocated funds abroad within their respective banking organisations, which suggests that internal capital markets may amplify the strength of outward monetary transmission.[25] A greater supply of euro-denominated funds outside the euro area also boosted euro lending from banks outside the euro area.

Chart 16

The share of the euro in outstanding international loans increased notably in 2018

Currency composition of outstanding amounts of international loans

(percentages; at Q4 2018 exchange rates)

Sources: BIS and ECB calculations.

Note: The latest data are for the fourth quarter of 2018.

The share of the euro in outstanding international deposits also increased, mirroring developments in international loan markets. At constant exchange rates, the share of the euro in the stock of international deposits increased by 0.5 percentage points relative to the end of 2017 (see Chart 17 and Table A9).[26] That share now stands around 7 percentage points above its trough at the end of 2015 and close to its previous peak of 2005. The share of the US dollar also increased in the review period by almost 1 percentage point. Relative to 2015, the share of the US dollar is down by about 5 percentage points.

Anecdotal evidence suggests that developments in international deposits in US dollars in the review period reflected concerns about unilateral sanctions, among other factors. In particular, it has been observed that Russian banks were faced with the risk of US sanctions banning them from conducting transactions with US legal entities, including US banks with correspondent accounts that enable the Russian banks to conduct transactions in US dollars. Anecdotal evidence from press reports suggests, for instance, that some Russian clients shifted assets out of US dollar deposits into deposits in local currency or in foreign currencies other than the US dollar.[27]

Chart 17

The share of the euro in outstanding international deposits increased in 2018

Currency composition of outstanding amounts of international deposits

(percentages; at Q4 2018 exchange rates)

Sources: BIS and ECB calculations.

Note: The latest data are for the fourth quarter of 2018.

Lastly, the share of the euro in outstanding loans declined further in central, eastern and south-eastern Europe (see Table A12). As noted in last year’s edition of the report, this may reflect local authorities’ efforts to promote the use of domestic currencies to mitigate financial stability risks raised by unofficial euroisation. The share of the euro in foreign deposits also decreased moderately in some of these countries (see Table A13).

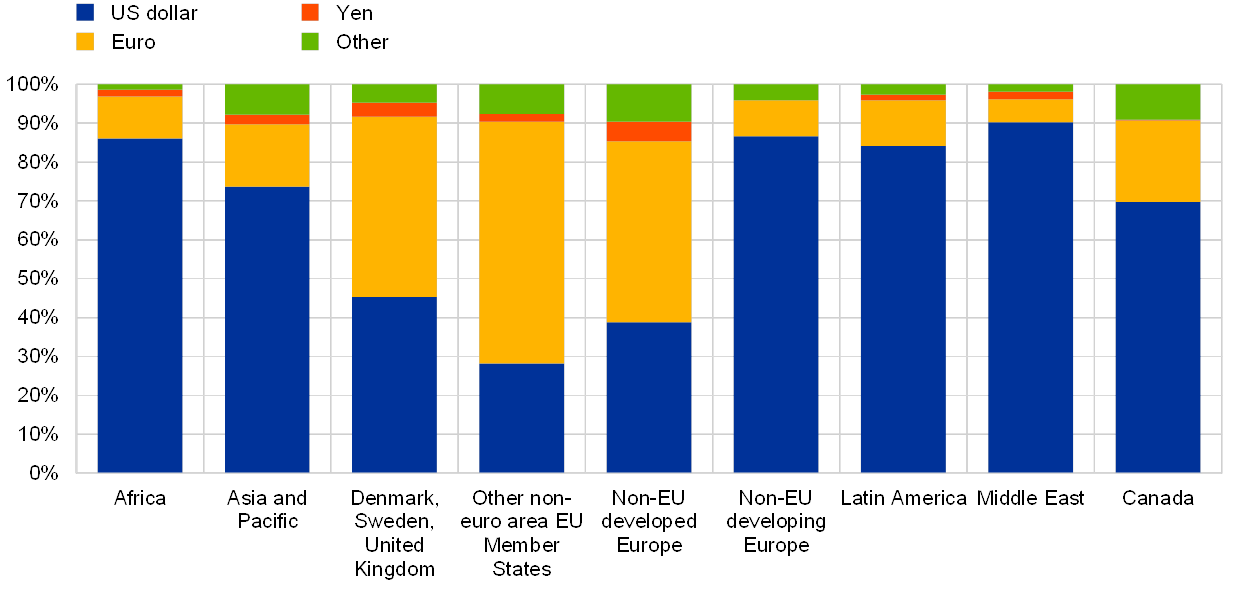

2.4 Use of the euro as an invoicing currency

The share of the euro as an invoicing or settlement currency for extra-euro area trade in goods remained broadly stable. In 2018 over 60% of extra-euro area exports and 50% of extra-euro area imports of goods were invoiced in euro (see the left panel of Chart 18 and Table A10). Patterns were broadly similar for extra-euro area trade in services.

The share of the euro as an invoicing currency has been remarkably stable in the past decade. Unlike other dimensions of the international use of the euro, the share of the euro in the invoicing of euro area international trade transactions in goods has hovered around 50‑60% over the past decade. However, trade invoicing practices vary across euro area trading partners. For instance, the vast majority of euro area trade with the United States is invoiced and settled in US dollars, while the bulk of euro area trade with non-euro area EU countries is invoiced in euro (see Table A11). Stability in the relative importance of the euro area’s trading partners – notwithstanding cyclical and structural developments in global trade – may contribute to explaining the resilience of the role of the euro as an invoicing currency of extra-euro area transactions (see the right panel of Chart 18).

Chart 18

The share of the euro in the invoicing of extra-euro area trade remained broadly stable

Share of the euro in the invoicing of extra-euro area trade in goods (left panel) and composition of the euro area’s trading partners in extra-euro area trade (right panel)

(percentages)

Sources: ECB, IMF DOTS and ECB calculations.

Note: The latest data are for 2018.

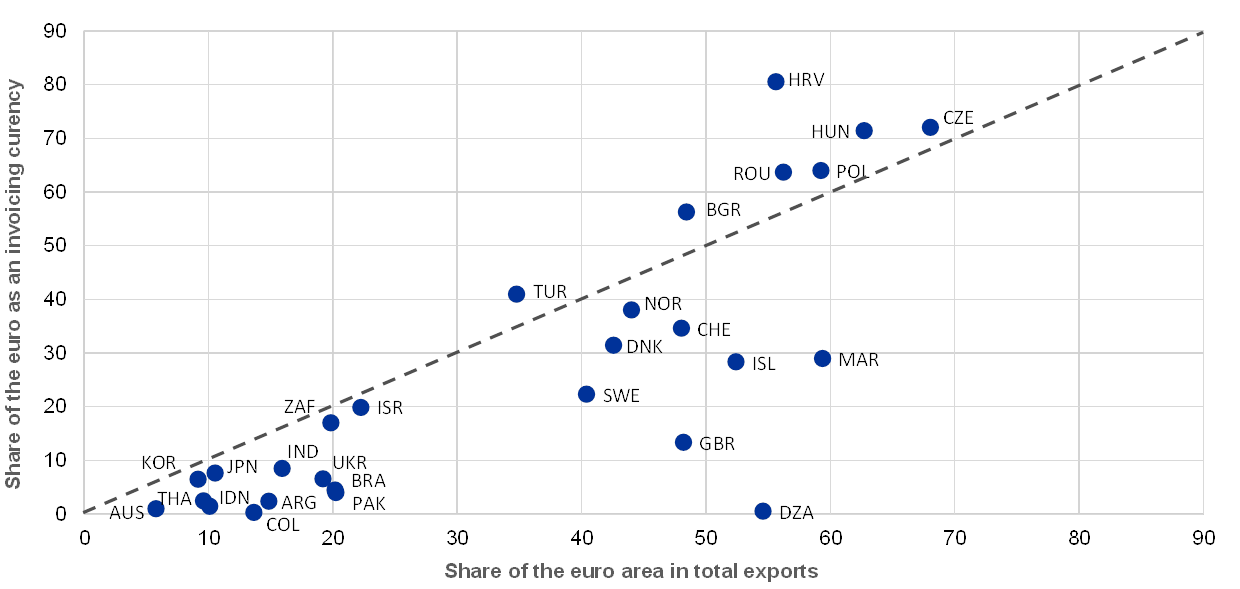

Unlike the US dollar, use of the euro for the invoicing of international transactions between third countries is limited. The euro is used as an invoicing currency in more than 30% of global trade transactions in goods.[28] However, unlike the US dollar, there is limited evidence that the euro is used for invoicing when transactions do not involve the euro area.[29] Plotting the share of the euro as an invoicing currency of goods exports for a sample of countries against the share of the euro area in total trade of the countries in question suggests that virtually no non-European countries use the euro proportionately more than predicted by their exports to the euro area (see Chart 19).[30] A different picture is observed in the EU Member States of central and eastern Europe and Turkey, which would be one indication that they are using the euro as a vehicle currency for international transactions with countries outside the euro area. This might be an indication that countries in this region trade in euro with one another.

Chart 19

There is limited evidence that the euro is used for trade invoicing between third countries

Share of the euro as an invoicing currency versus exports to the euro area relative to total trade

(percentages)

Sources: ECB, Gopinath (2015), IMF DOTS and ECB calculations.

Note: Gopinath, G., "The International Price System", NBER Working Paper, No 21646, 2015.

Box 3

Role of the US dollar as an invoicing currency for oil imports

The US dollar is widely used as the currency for oil trade invoicing in the European Union (EU). This strong role (around 85% of extra-EU oil imports, see the left panel of Chart A) far outweighs the EU’s imports of petroleum products from the United States, which accounted for just 4% of total EU petroleum imports over the period 2010‑16 (see the right panel of Chart A). It is hence used as a vehicle currency, i.e. neither the exporters’ currency nor the local currency. To address this imbalance, the European Commission has published a recommendation on the international role of the euro in the field of energy.[31] For the same reason, outside Europe, China launched oil futures contracts denominated in the renminbi on the Shanghai International Energy Exchange in March 2018 and as part of broader plans to raise the renminbi’s global profile.

Chart A

Evidence on currency invoicing patterns in EU trade of oil products

Currency breakdown of extra-EU oil imports (left panel) and breakdown of petroleum oil imports of EU countries by region of origin (right panel)

(percentages)

Sources: Eurostat, IMF WEO and ECB staff calculations.

Notes: Countries used to define the EU aggregate shown in the left panel include Belgium, Germany, France, Italy, Spain and the United Kingdom; invoicing is expressed as a percentage of total extra-EU imports of oil; weights defined use the shares of oil imports from the United States (US dollar invoicing) and the EU (euro invoicing). In the right panel, real imports (using the commodity price index as deflator) are weighted using real GDP shares and expressed as a percentage of total oil imports from the rest of the world; OPEC exporters include Algeria, Angola, Congo, Ecuador, Equatorial Guinea, Gabon, Iran, Iraq, Kuwait, Libya, Nigeria, Saudi Arabia, United Arab Emirates and Venezuela.

The specific features of oil as a product influence invoicing currency choice. Differentiated goods tend to be invoiced in the exporter’s currency. But more homogeneous goods such as oil are usually priced in a single (or dominant) currency, such as the US dollar.[32] However, an analysis of post-World War II data suggests that European oil imports were invoiced equally in US dollars and other currencies, notably the pound sterling.[33] This suggests that even for homogeneous goods such as oil, multiple invoicing currencies can coexist.

Most commodities are also upstream (i.e. used as inputs) in the production process. Often, firms that use commodities as inputs may want to use the same currency for their exports as for their imports. For example, the importance of crude oil, largely invoiced in dollars, as an input to petroleum products may explain why the US dollar also dominates the invoicing of EU imports of petroleum products. Indeed, research suggests that the use of a vehicle currency is more likely for exporters with a higher share of inputs priced in that vehicle currency.[34]

The limited data available on commodity invoicing currencies confirm a strong role played by the US dollar. Based on survey data, Chart A shows that more than 80% of extra-EU oil imports are invoiced in dollars. Firm-level data for the United Kingdom suggest that almost 90% of mineral fuel imports are invoiced in a vehicle currency. Similarly, data for Japan suggest that about 90% of petroleum, coal and natural gas imports were invoiced in US dollars in 2015.[35]

Conducting an empirical evaluation of oil trade currency invoicing for the euro area is difficult as the above-mentioned data are only available for a few years. Nevertheless, the pass-through of fluctuations in the exchange rate into oil import prices might provide an indirect approximation of the role of the US dollar as a vehicle currency for oil import transactions. Recent empirical findings do in fact show that for international transactions carried out in a vehicle currency such as the US dollar, exchange rate fluctuations against that vehicle currency have much higher pass-through into domestic inflation than those affecting transactions priced in the local or producer (i.e. the partner country) currency.[36] A measure of exchange rate pass-through to oil import prices could therefore give some indication of the use of the US dollar as a vehicle currency. This can be estimated in the following panel regression[37]:

where changes in import prices are regressed on changes in oil prices and the exchange rate. The closer the coefficient estimate is to one, the higher the pass-through of exchange rate changes against the US dollar to oil import prices. This, in turn, could be an indication of a higher share of US dollar invoicing in oil imports than what would be expected through the import share from the United States. As a caveat, it could be that prices adjust flexibly for reasons other than invoicing currency. Moreover, Borio (2019) suggests that the US dollar tends to weaken vis-à-vis the euro when commodity prices rise; as a result, oil price increases in US dollars would not necessarily match those in euro.[38] We apply the exchange rate with its lags in the spirit of the GMM methodology to control for possible endogeneity resulting from this relationship between the oil price and the US dollar exchange rate.

The empirical analysis points to the dominance of the US dollar as an invoicing currency for global oil trade transactions. The results show that pass-through is almost complete, with a coefficient of 0.93 for the full sample (see Table A). As regards advanced economies, the coefficient is almost equal to 1, which could be an indication of almost complete US dollar invoicing of imports. Similar results hold for the EU and the euro area. These estimates differ from the survey results shown in the left panel of Chart A above as the latter draw from evidence gained over the period 2010‑16 for Belgium, Germany, France, Italy, Spain and the United Kingdom. The estimates, in contrast, are for the period 1983‑2018 and for a larger sample of countries than that covered in the survey, some of which most likely use the US dollar as a vehicle currency to a greater extent (for example Australia or Canada). For emerging market economies, the coefficient is statistically smaller than one. Still, it has to be borne in mind that other factors can influence the pass-through of the US dollar so that the estimation results provide only some tentative indication that the US dollar is indeed a vehicle currency for most oil imports.

Table A

Regression results

Robust standard errors in parentheses *** p<0.01, ** p<0.05, * p<0.1.

Box 4

Advances in market infrastructures and implications for the international use of the euro

The Eurosystem promotes the safe and efficient functioning of the euro payment infrastructure. This task is closely interlinked with its responsibilities in the field of monetary policy. All actions taken by the Eurosystem in this field also indirectly support the international standing of the euro by making euro-denominated financial markets more efficient and more attractive to foreign investors.

Since the launch of the euro the Eurosystem has played a major part in reshaping and consolidating the infrastructure for large-value payments, for post-trading services for financial instruments and, most recently, for instant retail payments. The goal is to create a truly single financial market in Europe where payments, securities and collateral can be moved safely and efficiently between participants active in European markets, without friction or restrictions.

The Eurosystem’s market infrastructure services for the settlement of payments and securities in central bank money include TARGET2, TARGET2‑Securities (T2S) and TARGET Instant Payment Settlement (TIPS) – the so-called TARGET Services.

TARGET2 and its predecessor are the longest-standing components of the Eurosystem’s financial market infrastructure. TARGET, the first-generation RTGS system, commenced operations just a few days after the launch of the euro in January 1999. In 2008 it was fully replaced by TARGET2, which offers harmonised services on a single technical platform. Today TARGET2 is one of the largest payment systems in the world, processing 90% of the total value settled by large-value payment systems in euro.

T2S, the integrated technical platform which processes the real-time settlement of securities transactions against central bank money across Europe, was launched in 2015. Full migration took place in waves over the following two years to ensure a smooth transition. T2S provides banks and intermediaries with a single pool of collateral for the entire T2S market comprising 21 central securities depositories from 20 European countries, thereby optimising settlement and triparty procedures.

Last but not least, in November 2018 the Eurosystem delivered TIPS, a market infrastructure for instant payments with settlement in central bank money. TIPS enables payment service providers to offer fund transfers to their customers in less than ten seconds throughout the day, every day of the year.

The upcoming technical and functional convergence of TARGET2 and T2S will further optimise liquidity management and generate new cost efficiencies. The consolidation project, which will run until 2021, will introduce a central liquidity management system that will allow participants to monitor and manage their liquidity for all TARGET Services. It will enable centralised management and control over the payment capacity with a clear allocation of liquidity for the different settlement purposes. This will make the use of central bank money even more efficient for market participants and, in turn, benefit the financial market and its domestic and foreign participants.

In contrast to the major steps taken to overcome the fragmentation in the European payments market and in the securities trade and post-trade area, there is still room for progress at the front end of the securities process chain. The issuance and distribution of securities still hinges on fragmented legacy standards, structural constraints and complex market practices at the national level. Facilitating interactions and procedures between some participants still entails high costs and risks. European issuers and EU institutions in particular need to be able to collect funds from investors across the continent in a fair and well defined manner. Reflection on pan-European issuance would be in line with the endeavour to deepen the single capital market in the EU.

Finally, whilst noting the progress achieved in better integrating the retail payments market through the SEPA project, recent global trends in this field call for capitalizing on European strengths and develop a European strategy for retail payments, taking into account the instant payment infrastructure (TIPS) and instrument (SEPA Instant Credit Transfer).

In summary, through its provision of safe and efficient market infrastructure services, the Eurosystem plays an integral role in strengthening the international role of the euro. The full deployment of TIPS and the consolidation of TARGET2 and T2S will underpin the progress in the RTGS and retail payments market. Simultaneously, discussions on how best to remove the remaining barriers and obstacles that still exist in some segments of the securities market are under way.

2.5 Use of euro cash outside the euro area

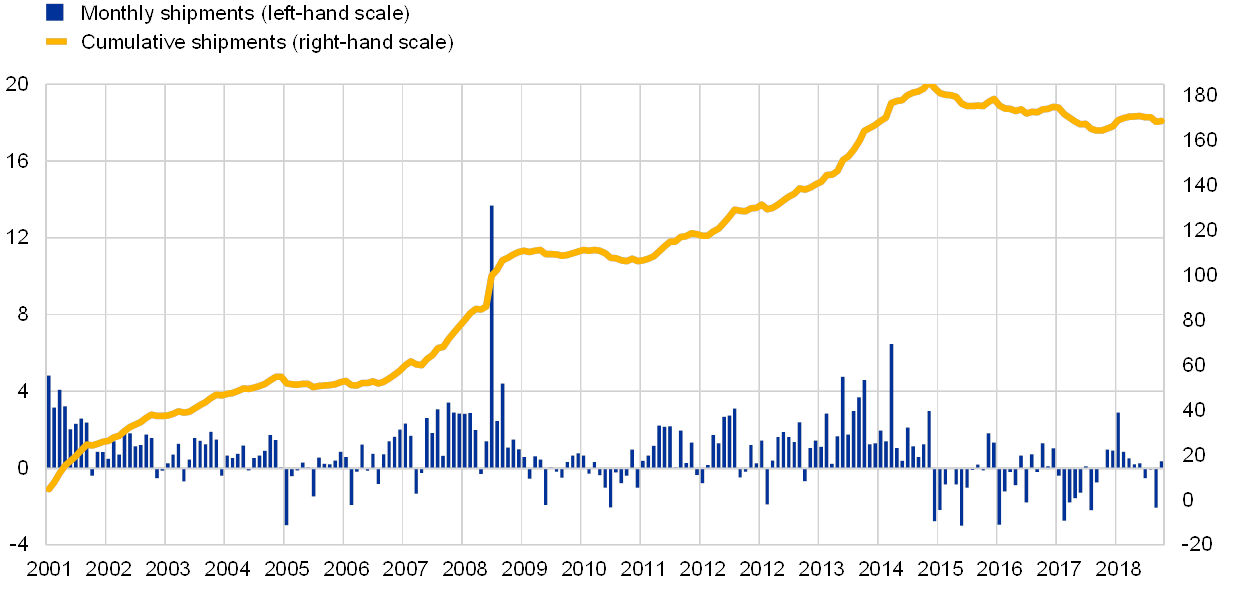

Shipments of euro banknotes to destinations outside the euro area remained broadly stable in the review period. Following a decline in cumulated net shipments of euro banknotes to destinations outside the euro area between the middle of 2015 and early‑2018, the trend reversed, with shipments remaining broadly stable (see Chart 20).[39] Data collected from banknote wholesale banks, which act as intermediaries between the national central banks of the Eurosystem and financial institutions outside the euro area, suggest that stronger demand from Russia largely contributed to support foreign demand for euro banknotes. In terms of destinations, entities in euro area neighbouring countries remained the main purchasers of euro banknotes, including the United Kingdom in the EU, Switzerland in the western Europe region (non-EU) and Russia in the eastern Europe region (non-EU) (see the left panel of Chart 21). Euro banknotes continued to be mainly imported from euro area neighbouring countries too, first and foremost from eastern EU countries and Turkey. Box 5 provides further evidence on the use of euro cash in central, eastern and south-eastern Europe.

Chart 20

Foreign demand for euro banknotes stabilised in 2018

Net monthly shipments of euro banknotes to destinations outside the euro area

(EUR billions; adjusted for seasonal effects)

Source: Eurosystem.

Notes: Net shipments are euro banknotes sent to destinations outside the euro area minus euro banknotes received from outside the euro area. The latest observation is for February 2019.

Chart 21

In 2018 euro banknotes were mainly exported to, and imported from, euro area neighbouring regions

Sales (left panel) and purchases (right panel) of euro banknotes – breakdown by destination

(percentages)

Source: ECB calculations based on data from international banknote wholesalers.

Note: The data are for 2018.

Box 5

Use of euro cash in CESEE countries

A number of countries in the CESEE (central, eastern and south-eastern Europe) region hold significant amounts of euro cash. Euro cash holdings are widespread in Albania, Croatia, the Czech Republic, the Republic of North Macedonia and Serbia. In those five countries, an average of 36% of respondents reported holding euro cash in the OeNB’s Euro Surveys conducted in 2017–2018 (see the left panel of Chart A).[40] The corresponding average for the other five countries surveyed (Bosnia and Herzegovina, Bulgaria, Hungary, Poland and Romania) was 13% of respondents. The recent rebound of euro cash holdings in several CESEE countries that can be noted in Chart A may have been driven by rising incomes or a greater prevalence of remittances.

Individuals in the region hold euro cash for a variety of reasons. One main motive cited by respondents in most countries is that they hold euro cash as a general reserve (Scheiber and Stern, 2016).[41] Stix (2013) observed that a substantial share of people in CESEE countries have a preference for cash over interest-bearing assets – a phenomenon that is mainly related to lack of trust in the local currency and banks.[42] Besides being used for saving purposes, euro cash is also used for domestic payments – for example, real estate and cars are frequently paid for in euro in a number of south-eastern European (SEE) countries (Scheiber and Stern, 2016). By contrast, respondents in Hungary, Poland and particularly the Czech Republic reported that they plan to spend their euro cash mainly abroad. This regional pattern of motives for holding euro cash correlates with self-reported euro cash amounts, which tend to be relatively high in countries where the saving purpose dominates.

One indication of the motives for holding euro area cash is through a currency substitution index (CSI, see the right panel of Chart A). The measure is derived from the OeNB Euro Survey and compares projected per capita euro cash amounts with per capita local currency in circulation outside the banking sector. Compared to SEE, currency substitution clearly has not been an issue in the Czech Republic, Hungary and Poland over the last decade. Currency substitution has also trended downwards in all SEE countries since 2008. Bulgaria and Bosnia and Herzegovina were the first SEE countries in which the ratio declined below 10% – which is regarded as a threshold for low euroisation in the literature. In Albania and Romania, the CSI declined to 10% in 2017‑2018. Medium levels of currency substitution prevail in Croatia and the Republic of North Macedonia, which have both seen a substantial increase in the CSI, to 24% and 45% respectively.[43] Meanwhile, the Serbian CSI declined further, but remained above 50%.[44]

Chart A

Evidence on the use of euro cash

Frequency of euro cash holdings per country (left panel) and currency substitution index (right panel)

(left panel: percentages of respondents; right panel: percentages)

Source: OeNB Euro Survey.

Notes: left panel: weighted percentages based on pooled data from survey waves of two consecutive years as indicated in the legend; respondents answering "Don't know" or who refused to answer were excluded; right panel: the currency substitution index is calculated as the ratio of euro cash to euro cash plus national currency in circulation outside the banking sector; for details, see Scheiber and Stix (2009). BG: Bulgaria; HR: Croatia; CZ: Czech Republic; HU: Hungary; PL: Poland; RO: Romania; AL: Albania: BA: Bosnia and Herzegovina; MK: North Macedonia; RS: Serbia.

Against the background of EU integration, the question arises as to whether individual expectations with respect to future euro adoption have a significant influence on euro cash holdings. Below, we focus on the six CESEE EU Member States. According to the OeNB Euro Survey, a substantial share of respondents did not know how soon the euro might be introduced in their country (see the “don’t know” answers in Chart B). Compared with 2014, respondents in Bulgaria have become slightly more optimistic regarding the introduction of the euro, whereas Czech, Hungarian, Polish and Romanian respondents were more sceptical. In particular, the share of “never” replies increased substantially. The exception is Croatia, which had declining shares of both “don’t know” and “never” answers and the most optimistic replies, namely a median expectation of four years.[45] Empirical analysis confirms that expectations regarding euro adoption prospects affect the propensity for individuals to hold euro cash. Two simple regressions were run using data from 2014, 2017 and 2018. The first regression, a probit model, finds a positive and significant influence of the expected euro adoption periods on the likelihood of individuals to hold euro cash. The average marginal effect of expectations anticipating euro adoption in 2‑3 years or 4‑5 years increases the likelihood by 7 percentage points. The marginal effects decline as the prospects of euro adoption diminish. Nonetheless, the prospects of euro adoption do not seem to affect the amounts of euro cash held. A second regression finds no significant correlation between the amounts of euro cash held (for those holding some euro cash) and expectations regarding euro adoption.[46]

Chart B

Expected adoption of the euro as legal tender

Survey evidence

(percentages of respondents)

Source: OeNB Euro Survey.

Notes: Results are weighted; respondents who refused to answer are excluded.

3 Special features

The benefits and costs of the international role of the euro at 20

This year marks the 20th anniversary of the creation of the euro and of the adoption of the Eurosystem’s position on its international role. It is therefore an appropriate time to take stock of developments in the use of the euro as a global currency and to assess whether, and how, the economic benefits and costs of the international use of the euro have evolved. This assessment takes place amid renewed calls among European policymakers to promote a stronger international role for the currency. In particular, the decision was taken at the Euro Summit of December 2018 to encourage “work to be taken forward to this end”.[47]

This special feature assesses changes in the economic benefits and costs arising from the international role of the euro from a central banking perspective. It provides evidence that the balance of benefits and costs has evolved since 1999, with some of the traditional effects of its status as an international currency having declined in relevance while others have become more apparent.

Taking stock of the ECB’s position on the international role of the euro twenty years on

Since the launch of Economic and Monetary Union, the Eurosystem has advocated a policy of neutrality vis-à-vis the international role of the euro. This was stressed in the first speech of President Duisenberg in January 1999 and in a Monthly Bulletin article published in August 1999, which stated that currency status is market-driven and that the Eurosystem neither hinders nor fosters the internationalisation of the euro.[48]

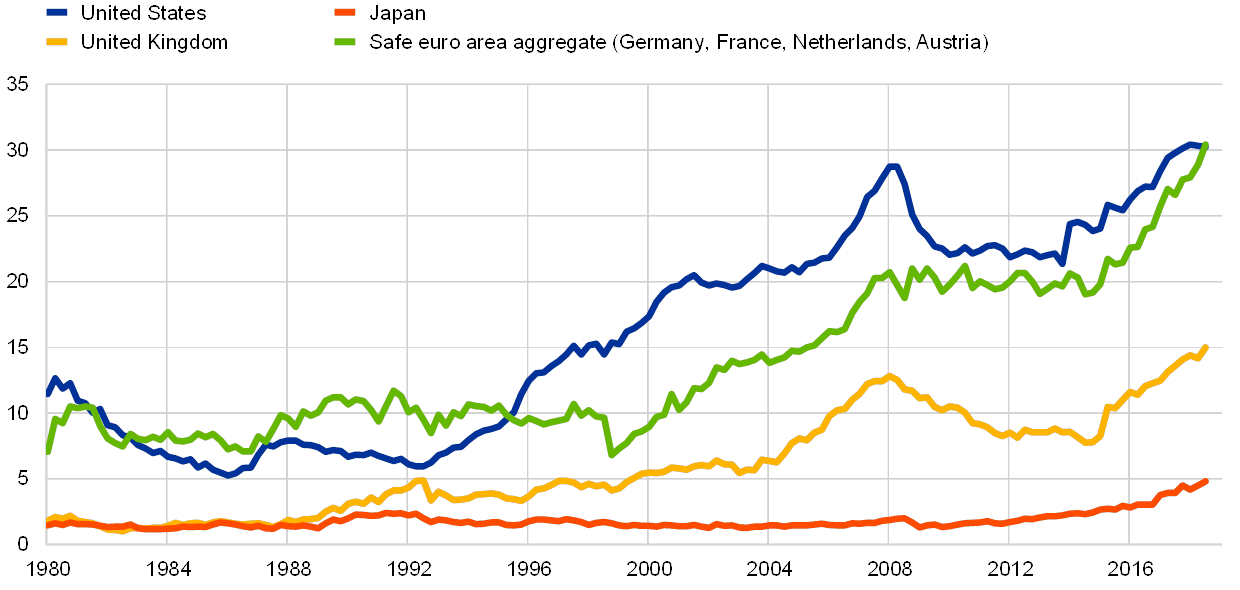

This position was the outcome of two views, one emphasising the economic benefits of international currency status, and the other emphasising the costs. Back in 1999 the main benefits of currency internationalisation discussed included seigniorage, lower transaction and hedging costs, added breadth and efficiency to the euro area financial markets, as well as the “exorbitant privilege” (the fact that international currency issuers have lower external financing costs). In particular, research suggests that the net return earned by the United States on its net international investment position due to the US dollar’s role as the leading international currency is approximately 1‑3% per year.[49] The main costs stressed were volatility in money aggregates and, in turn, in capital flows, which it was believed could complicate the conduct of monetary policy (see Table 1).

Table 1

Benefits and costs of international currency use: assessment in 1999

Source: ECB (1999), op. cit.

Twenty years on, the balance of benefits and costs of international currency status has evolved. With rapid financial globalisation, rising challenges to multilateralism and the adoption of new monetary policy frameworks across major central banks, the relevance of some of the traditional effects of international currency status has declined, while other effects have become more apparent. These developments, which may have a bearing on the conduct and transmission of monetary policy, need to be considered when assessing the balance of economic benefits and costs from a central bank perspective. Specifically, research has highlighted the following factors. First, that international currency status may strengthen the global transmission of domestic monetary policy impulses, with potential reinforcing spillback effects for the domestic economy (see Table 2); and, second, that it lowers exchange rate pass-through, which helps shield inflation from foreign shocks, while it may, at times, attenuate the effects of monetary policy on import prices; and, third, that the “exorbitant duty” of international currency status – the fact that international currencies appreciate in times of global stress and that their central banks of issue are called upon to assume greater responsibility for global financial stability – is the flipside of the traditional “exorbitant privilege” – i.e. of lower external financing costs. Finally, it can be argued that the traditional argument against a stronger international role of currencies, i.e. that it increases the volatility of monetary aggregates, has declined in prominence. The following section reviews these arguments in greater detail.

Table 2

The balance of the benefits and costs of international currency use is changing

Sources: ECB and Coeuré, B., “The euro’s global role in a changing world: a monetary policy perspective”, speech at the Council on Foreign Relations, New York City, 15 February 2019.

Salient developments

In principle, international currency issuers enjoy greater monetary autonomy. Owing to the pre-eminence of the US dollar in the global monetary and financial system, US monetary policy drives – along with global risk appetite – global financial cycles in capital flows and financial asset prices (see Box 6 for evidence in the context of the debate on whether the traditional monetary policy trilemma has morphed into a dilemma).[50] By contrast, central banks in small open economies are typically more heavily exposed to foreign spillovers in setting interest rates than those presiding over an internationally dominant currency.[51] However, foreign factors may still at times influence domestic monetary and financial conditions of international currency issuers. This is suggested by the past experience of the Federal Reserve System. For instance, it is well documented that the large demand for US securities by foreign central banks in the run-up to the global financial crisis contributed to the decline in longer-term US interest rates, thereby partially offsetting the parallel tightening efforts by the Federal Open Market Committee (see Special Feature B for further discussion).[52]

Expected benefits of seigniorage still exist but may have declined. The low interest rate environment has tended to reduce seigniorage benefits that can be expected from the euro’s international role. An additional factor to consider is the impact of increased use of electronic means of payments on the demand for banknotes.

Moreover, concerns about exposure to capital flow volatility as a consequence of international currency status are now less prominent. These concerns featured prominently in discussions about the internationalisation of the Deutschmark in the 1970s, when it was considered that volatile “hot money” flows into financial assets denominated in the Deutsche Mark increased volatility in M3 – the main monetary aggregate monitored by the Bundesbank – thereby complicating the conduct of monetary policy.[53] The enhanced tools for the ECB’s monetary analysis have made these concerns less prominent. Moreover, in a financial globalised economy, the influence of foreign factors on local monetary and financial conditions is not a feature specific to international currency issuers but a feature of any financially open economy.[54]

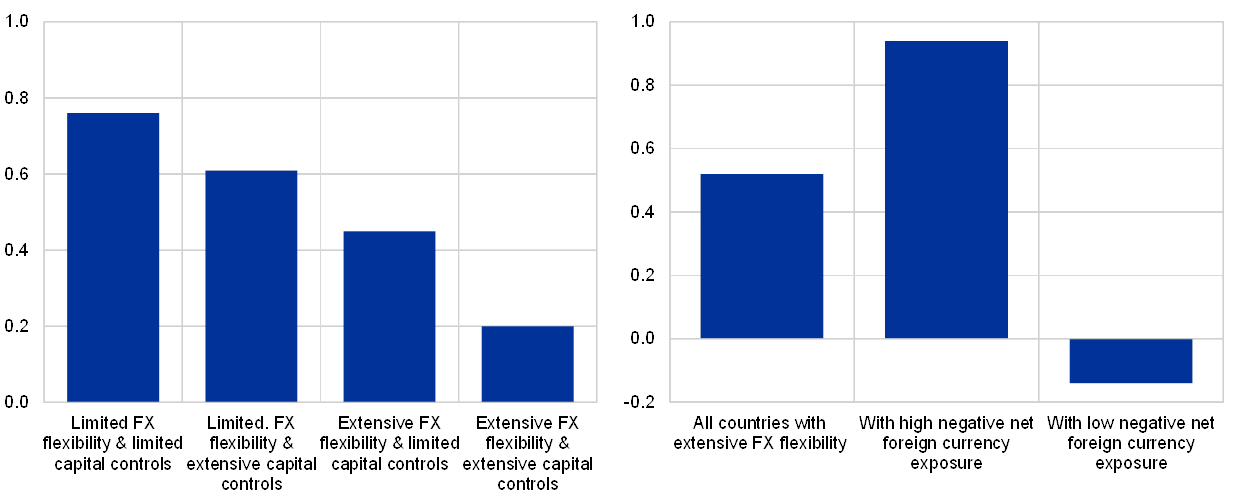

An additional aspect on which more evidence is now available is that international currency status strengthens the global transmission of monetary policy. This reflects the fact that stronger use of a currency as an international funding unit amplifies the international transmission of monetary policy. This channel is well documented for the US dollar and US monetary policy.[55] When US monetary policy eases, the US dollar depreciates; international lending in dollars grows, because the balance sheets of borrowers in emerging market economies, who often borrow in dollars, appear stronger in US dollar terms; this, in turn, encourages global banks to provide the borrowers in question with US dollar-denominated credit (see the left panel of Chart 22).[56] Another channel for greater international transmission of liquidity shocks may reflect the role of international credit markets within global banking groups. Global banks respond to domestic monetary shocks by managing liquidity globally through an internal reallocation of funds, which affects their foreign lending.[57]

Monetary policy impulses may reverberate globally as a consequence, with wider and possibly larger domestic effects owing to spillbacks. For instance, for an issuer of an international currency, a domestic interest rate cut would ease financial conditions globally and feed demand across the world.[58] The domestic economy could benefit from spillback effects, especially in an economy like the euro area, which is more open to trade than other major economies.

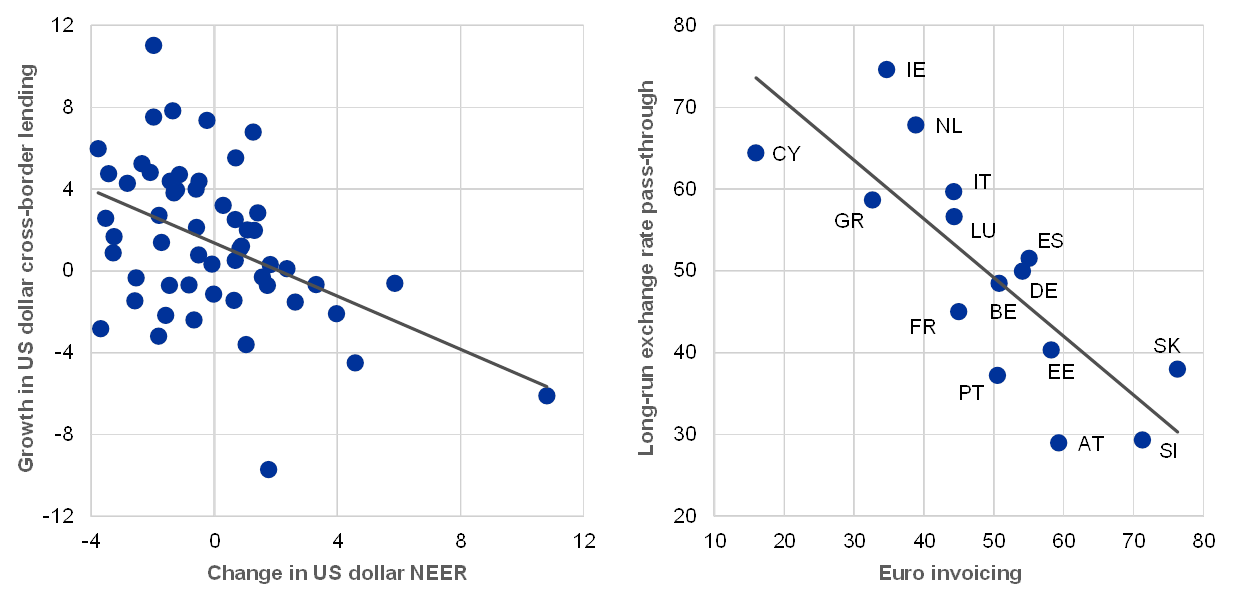

Chart 22

The balance of the benefits and costs of international currency use is changing

Evidence of an international risk-taking channel of monetary policy (left panel) and exchange rate pass-through to import prices versus euro invoicing across euro area countries (right panel)

(left panel: percentages; right panel: percentages and percentages of imports)

Sources: BIS, ECB and ECB staff calculations.

Notes: left panel: growth in US dollar lending refers to quarterly changes in cross-border loans and deposits in US dollars of BIS reporting banks; NEER stands for nominal effective exchange rate (positive changes indicate a US dollar appreciation); the sample period is Q1 2002‑Q3 2015 as in Avdjiev, S., Koch, C. and Shin, H. S., “Exchange rates and the transmission of global liquidity”, paper presented at the 2018 ASSA Annual Meeting; the black line is a fitted regression line. Right panel: long-run exchange rate pass-through is estimated using a standard log-linear regression model of the quarterly log change in import price unit values on the quarterly changes of the standard broad measure of the NEER‑38 of the euro, a quarterly effective measure of inflation in production costs of the euro area’s major trading partners and the quarterly log change in industrial production (excluding construction); the estimation sample spans the time period from the first quarter of 2000 to the last quarter of 2014; the share of euro invoicing reported on the x-axis is the average over the sample period; the black line is a fitted regression line.

On the other hand, the “exorbitant duty” arising from international currency status has become more apparent since the global financial crisis as the flipside of the traditional “exorbitant privilege”. Because debt securities denominated in US dollars are seen as particularly safe and liquid by international investors, the US dollar tends to be seen as a safe haven in times of heightened global financial stress. In turn, the US dollar appreciates in episodes of global stress, as it did immediately after the collapse of Lehman Brothers in autumn 2008.[59] This led to a decline in the US net international investment position and to large negative external wealth effects for the United States.[60]

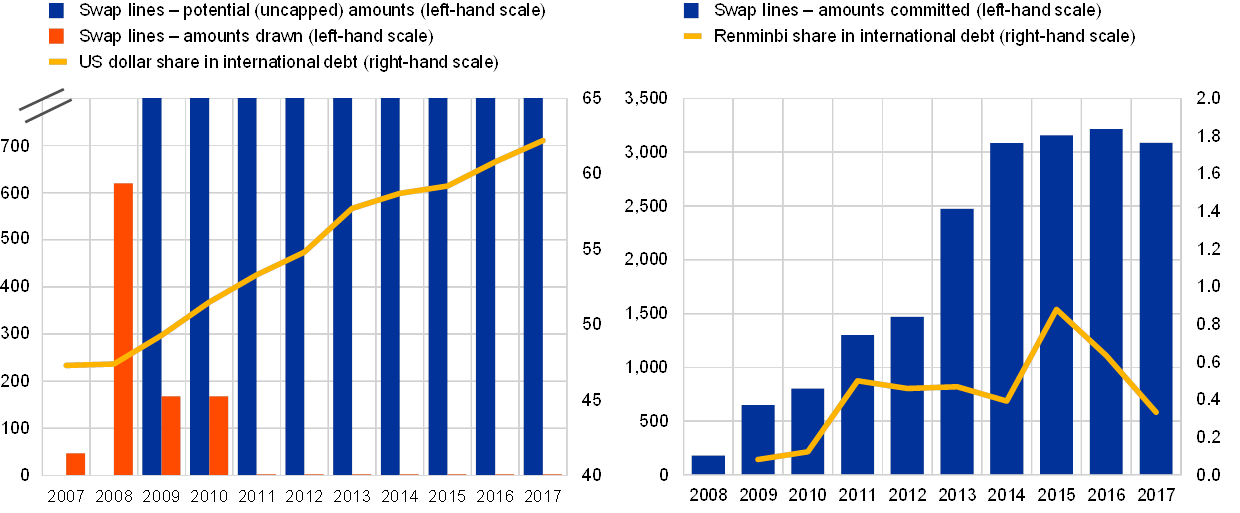

Another consideration is that reserve currency issuers may face requests for currency swap lines when availability of international liquidity dries up. This is suggested by the experience during the global financial crisis, when major central banks were more active in providing swap lines.[61] The provision of currency swap lines has been carried out by all major central banks issuing international currencies, in full independence and in line with their respective mandates. Standing swap networks now exist. The global network of currency swap lines has expanded in the past decade, driven also by China’s policies to support the renminbi (see Box 7 for a review of the debate on the link between currency swap lines and international currency status).

Finally, it is now also more apparent that international currencies have lower exchange rate pass-through. The more the domestic currency is used for invoicing international trade transactions, the lower the pass-through to import prices from exchange rate movements. This holds not only over the short run, when prices are sticky, but also over the long run, when they are adjusted by producers.[62] The close correlation between domestic currency invoicing and exchange rate pass-through is noticeable in the euro area (see the right panel of Chart 22).[63] Lower pass-through has two main implications for the conduct and transmission of monetary policy.

First, the effect of domestic monetary policy on import prices is more limited when pass-through is low. If more trade were invoiced in euro, for instance, import prices would react less to an exchange rate depreciation resulting from an accommodative domestic monetary policy shock, as simulations from calibrated general equilibrium models suggest.[64] At the same time, interest rate changes have larger spillovers and spillbacks. In other words, the relative importance and interaction of the interest rate and exchange rate channels of monetary policy change.

Second, lower pass-through shields the Consumer Price Index (CPI) from foreign disturbances affecting the exchange rate. In a low pass-through environment, import prices, and hence inflation as well as inflation expectations, are better shielded from foreign exchange shocks.[65]

Conclusions

The balance of economic benefits and costs arising from the international role of the euro has evolved since 1999. The relevance of some of the traditional effects of international currency status has declined, while other effects have become more apparent. Changes in the global role of the euro would have consequences for the conduct of monetary policy, all of which need to be understood and taken into account when designing the common monetary policy for the euro area.

Box 6

New evidence on international currencies and the monetary policy trilemma