Climate change and financial stability

Published as part of the Financial Stability Review May 2019.

This special feature discusses the channels through which climate change can affect financial stability and illustrates the exposure of euro area financial institutions to risks from climate change with the help of granular data. Notwithstanding currently limited data availability, the analysis shows that climate change-related risks have the potential to become systemic for the euro area, in particular if markets are not pricing the risks correctly. A deeper understanding of the relevance of climate change-related risks for the euro area financial system at large is therefore needed. Better data availability and comparability and the development of a forward-looking framework for risk assessments are important aspects of this work going forward.

1 Introduction

With evidence of rising global temperatures, awareness of climate change risks has been growing, leading to enhanced international action. The Intergovernmental Panel on Climate Change (IPCC) has estimated human activities to have led to around 1°C of global warming compared with pre-industrial times.[2] In most scenarios previously developed by the IPCC, without additional efforts to reduce carbon emissions, global warming is “more likely than not to exceed 4°C above pre-industrial levels by 2100”, although there is substantial uncertainty about the precise estimates.[3] Against this backdrop, the Paris Agreement, signed in December 2015, aims to limit the rise in global average temperatures to well below 2°C above pre-industrial levels and to pursue efforts to limit the rise to 1.5°C.[4]

Climate change may have significant impacts on the economy, both directly and indirectly through the actions taken to address it. Rising temperatures and changing patterns of precipitation would be expected to have direct impacts on agriculture and fisheries but they may also affect other sectors such as energy, tourism, construction and insurance.[5] While significant macroeconomic impacts from climate change may occur in the more distant future, some impacts are already beginning to be felt.[6] Policies implemented to try to prevent or moderate climate change (climate change mitigation) may also have wide-ranging sectoral impacts, potentially affecting the energy, transport, manufacturing and construction sectors in particular.[7] On the other hand, if the mitigating action is too timid, this will increase the magnitude and the pace of the necessary adjustment in the future, creating the potential for a sudden and general market correction or even an economic recession.[8]

While the need for financial sector adjustment as part of the climate challenge is widely acknowledged, key gaps remain in terms of measurement. Within Europe, discussions on the financial aspects of climate change have ranged from ongoing work at the European Commission to devise taxonomies that aim to support transparency and thereby market-based adjustment, to the establishment of a Network for Greening the Financial System (NGFS), where central banks and financial supervisors from five continents have joined forces to support the transition to a low-carbon economy and manage climate change risks. Foremost among the measurement gaps is the understanding of exposures of financial institutions to climate change-related risks. Partly, this relates to a dearth of sufficiently granular public data detailing complex and evolving exposures both within as well as across economic sectors. Notably, while country-level data can be used for tracking the implementation of political commitments, monitoring financial exposures to the global effects of climate change requires reliable and comparable data at the level of economic sectors or individual exposures. Limited empirical measurement has, in turn, constrained both market development and informed policy initiatives.

This special feature discusses general financial stability issues pertaining to climate change, examines potential financial exposures to it, and outlines policy considerations.[9] The first section briefly introduces the transmission channels of climate change risk to the financial sector. The second section explores the exposures of euro area financial institutions to climate risk-sensitive assets using sectoral and exposure-level data. The final section gives an overview of the ECB’s involvement in policy initiatives in the field of climate risk and financial stability and outlines priorities for further work.

2 Physical risks directly impair financial stability, while transition requires adjustment

The transmission channels of climate change risk to the financial sector are by now commonly understood to comprise two main aspects. First, climate change can affect financial stability directly through the impact of more frequent and severe disasters and through gradual developments in the economy, of which financial markets constitute an important part. Second, financial markets can be adversely affected by the uncertainties related to the timing and speed of the process of adjustment towards a low-carbon economy, including the impact of the related policy action and potentially disruptive technological progress on the asset prices of carbon-intensive sectors. In the literature, these risks are typically referred to as physical and transition risks, respectively.[10]

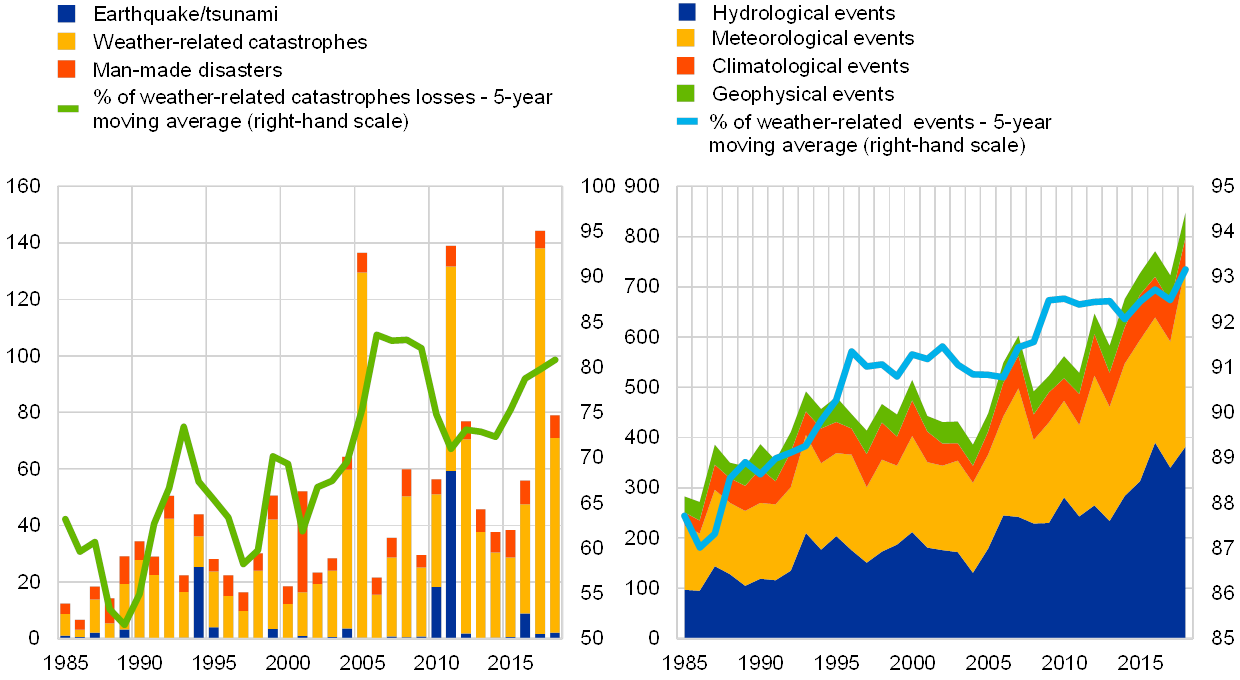

Physical risks, when they materialise, can significantly erode collateral and asset values and have an impact on insurance liabilities in particular. As climate change advances, the risk of abrupt value losses in climate risk-sensitive geographical areas increases. This can lead to the erosion of collateral and asset values for a large number of financial institutions. Insurance liabilities are particularly exposed to an increased frequency and severity of climate and weather-related events that damage property or disrupt trade. Chart A.1 (left panel) shows that the share of weather-related catastrophe losses has increased steadily to account for over 80% of insured catastrophe losses in 2018. The upward trend is accompanied by a growing frequency of weather-related loss events, the number of which hit a record in 2018 (see Chart A.1, right panel).

Physical risk: weather-related insured losses and the number of natural loss events are increasing

Global insured catastrophe losses (left panel) and number of relevant natural loss events worldwide (right panel)

(1985-2018; left panel: left-hand scale: USD billions; right-hand scale: percentages; right panel: left-hand scale: number of events; right-hand scale: percentages)

Sources: Swiss Re Institute, Munich Re NatCatService and ECB calculations.

Adaptation can reduce exposures of insurers to physical risk, but can also increasingly shift them to other economic agents. New models have improved forecasting capabilities and risk management related to insurance coverage and pricing. From a social welfare point of view, there is a risk that certain losses may become uninsurable. For example, properties in areas vulnerable to floods, fires or hurricanes are becoming harder and more expensive to insure. This could increase costs to households and non-financial corporations (NFCs), as well as governments in the cases where they act as ultimate insurers of last resort.

Transition risk materialises when mitigation policies, technological advances or changes in public sentiment lead to value reassessments by financial market participants, possibly in an abrupt manner. Reaching the goals of the Paris Agreement will require policy action that provides incentives to economic agents to reduce emissions.[11] An unanticipated introduction of policy measures or a rapid change in consumer preferences could trigger abrupt asset price decreases for the affected firms and sectors. A lack of reliable and comparable information on climate-sensitive exposures of financial institutions could create uncertainty and cause procyclical market dynamics, including fire sales of carbon-intensive assets, and potentially also liquidity problems.[12] In addition to market risk, credit risk could also increase if policies, market reactions or the accelerating impact of new technologies on the transition lead to lower profitability and higher default risks for carbon-intensive firms, and ultimately to higher capital charges and risk weights for bank exposures. Furthermore, sovereign risks could increase for countries with carbon-intensive industries.

Market pricing of transition risk is complicated by its long-term nature and the lack of data. Correct pricing of climate risk reduces the risk of a sudden reassessment and thus the costs related to the transition, which in such a case is likely to be more orderly. Evidence in the literature is mixed, suggesting that pricing transition risk is not straightforward.[13] A potential underpricing of transition risk could emerge if the strategic horizon of investors is shorter than the horizon over which they expect the transition to occur.[14] At the same time, market pricing is hampered by the lack of granular and comparable information on climate change-related risks. For example, although there are some widely accepted market initiatives to certify and register green instruments, no universal classification as to what is to be considered sustainable exists to date.[15] Box A discusses the state of play of the European Commission’s initiative to establish an EU classification system, or taxonomy, for sustainable activities.[16]

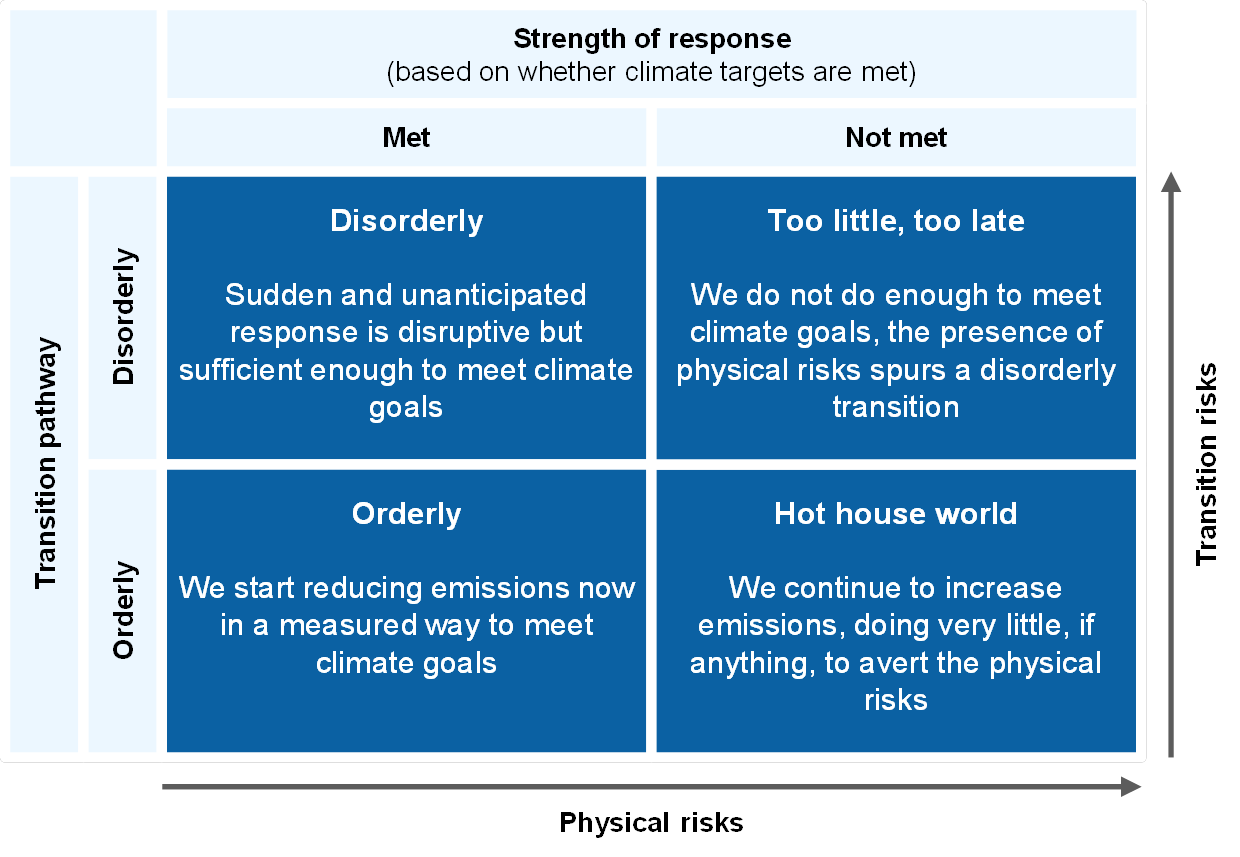

The costs associated with physical and transition risks vary depending on the trajectory chosen for reducing carbon emissions. Chart A.2 depicts the relationships between the climate change scenarios and the transmission channels in a stylised manner.[17] As the costs related to physical risk increase when emissions accumulate, a delay in action will increase the magnitude of the necessary reaction and adjustment costs in the future.[18] In contrast, an orderly transition would allow a gradual repricing of assets, while early action would minimise damage caused by physical risk.[19] Stress tests and scenario analyses can be used to gauge the quantitative impacts of the various scenarios. Compared with traditional stress testing, however, the quantification is complicated by the long time horizon of the expected impact, and in particular by the choice of the appropriate discount rate and the timing of policy and technological development-related events.[20]

Physical versus transition risks: temperature scenarios and the cost of climate change

Source: NGFS (2019), op. cit.

Box AA taxonomy for sustainable financial activities

Prepared by Anouk Levels and Ana Sofia Melo

No universal taxonomy exists for defining which activities or financial instruments could be considered environmentally sustainable (green) or harmful (brown). A universal labelling of green activities would help investors to direct capital towards sustainable investments and provide a basis for the issuance of green instruments, such as bonds or loans. A brown taxonomy would facilitate the assessment of transition risk in the balance sheets of financial institutions.

An effective taxonomy would need to be activity-based and harmonised. A taxonomy at the sectoral or firm level would be too limited. The oil industry, for example, would not be classified as sustainable, even though there may be firms that invest in renewable energy. Not recognising these activities as green may hamper the transition to more sustainable production technologies. Harmonisation is needed to achieve transparency for investors who want to invest in sustainable assets or avoid polluting assets, and to limit firms’ or financial institutions’ incentives to “green-wash” assets in order to benefit from any potential preferential (regulatory) treatment.

Creating a harmonised classification of environmentally sustainable activities is a priority for the European Commission. The Action Plan on Financing Sustainable Growth notes that redirecting capital towards sustainable economic activities has to be based on a common understanding of sustainability.[21] Establishing an EU classification system (“taxonomy”) for sustainable activities is therefore a priority. The taxonomy is expected to screen sectors and activities on the basis of criteria, thresholds and metrics and will be crucial for supporting the flow of capital to sustainable activities. The taxonomy aims to provide transparency on environmental sustainability to investors and enable informed decision-making with a view to fostering sustainable finance.

Due to the complexity of the task, the implementation of the taxonomy will be gradual. Initially, the taxonomy will be voluntary and it will be integrated into EU legislation in a phased manner at a later stage. In terms of coverage, the first version of the taxonomy is expected to pertain to climate change mitigation and adaptation. In a later stage, the taxonomy is expected to be extended to cover a full set of environmental and social activities.[22]

The taxonomy will only cover activities that contribute substantially to environmental objectives. Activities that are not classified as green are not automatically brown. They could contribute marginally to environmental objectives, be neutral, or be polluting (brown). From a financial stability and prudential perspective, it would be relevant to develop a brown taxonomy for the purpose of assessing climate risks. Any consideration of climate risk in banks’ capital requirements framework would require evidence of the potential risk differential between green and brown assets.

3 Euro area financial institutions’ exposures to transition risk

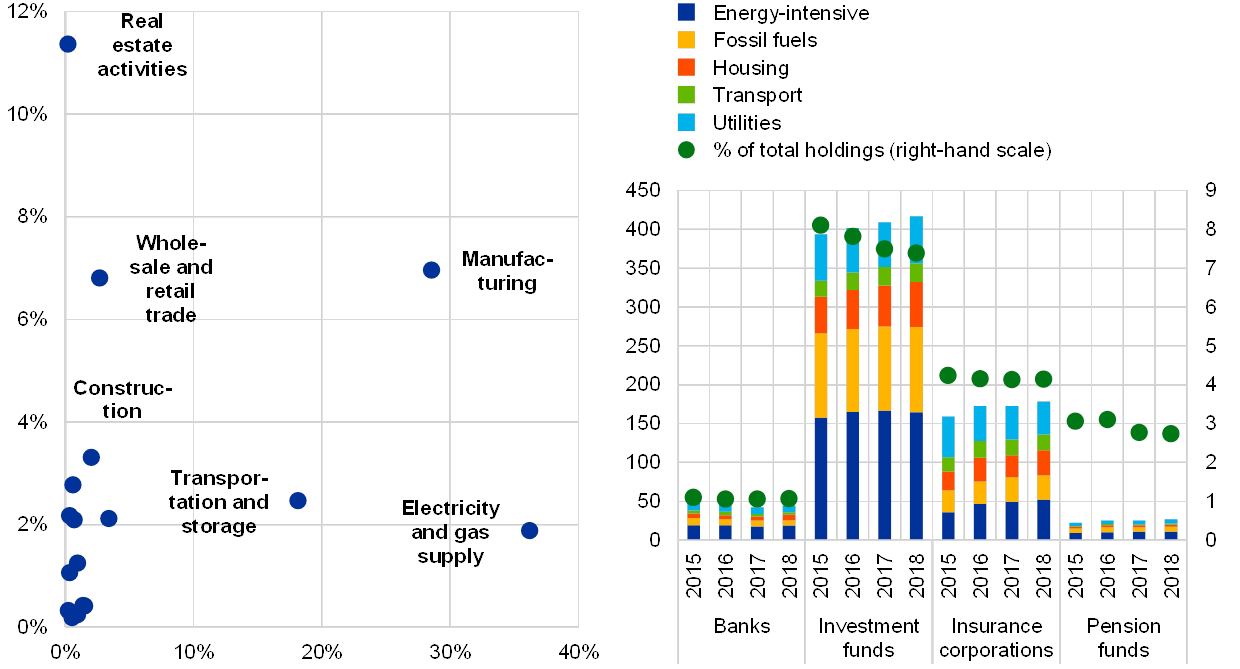

Efforts to gauge financial institutions’ exposures to transition risk have so far mostly concerned investments in certain industrial sectors. Typically, the most climate-sensitive sectors are selected in the NACE classification on the basis of an aggregate environmental metric, such as a measure of carbon emissions for the sector.[23] Battiston et al. (2017) remap all the sectors at NACE2 4-digit level into new climate policy-sensitive sectors, combining criteria including carbon emissions, the role of the sector in the supply chain, and the existence of traditional policy institutions for the sectors.[24] The left panel of Chart A.3 paints a broad picture of euro area banks’ exposures and the contribution of various sectors to carbon emissions. The right panel of Chart A.3 applies the approach by Battiston et al. (2017) to the ECB’s Securities Holdings Statistics by Sector (SHSS). The evolution of portfolio investments shows that investment and pension funds have reduced their relative exposures to securities issued by climate policy-relevant sectors in recent years.[25] By contrast, banks and insurance corporations kept their exposures relatively constant.[26] However, the analysis of the banking sector suffers from the fact that loans are not included in the SHSS.[27]

Sectoral exposure statistics can provide a first comprehensive approximation of transition risk

Euro area banks’ exposures and sectoral contributions to carbon emissions (left panel); evolution of investment exposures to climate-sensitive sectors (by issuer sector) (right panel)

(left panel: percentages; x-axis: sectoral contributions to total carbon emissions; y-axis: bank exposures (as a share of total exposures); right panel: Dec. 2015-Dec. 2018; left-hand scale: € billions; right-hand scale: percentage of total holdings)

Sources: ECB supervisory statistics, European Commission EDGAR dataset, Eurostat, ECB SHSS, ECB CSDB and ECB calculations.Notes: Left panel: the share of carbon emissions is calculated from Eurostat data on air emissions accounts by NACE activity, which cover the EU28, Turkey and Serbia. Electricity and gas supply also includes steam and air conditioning supply. Right panel: the classification of climate-sensitive assets follows the approach of Battiston et al. (2017). Sectoral holdings are classified according to the NACE categorisation in the ECB’s Centralised Securities Database (CSDB).

Sectoral analysis can be useful for a first approximation of exposures of financial institutions to transition risk, but at the same time it abstracts from important differences within sectors. Sectoral classification allows for a more comprehensive aggregate view, as more data are available for sectors than for individual firms. This is important for the feasibility of top-down scenario analyses, for example. Sectoral data, however, abstract from the large differences in production processes and technologies, and consequently from pollution propensities of firms within sectors (see Box A). Furthermore, sectoral classification importantly ignores any dynamics within firms over time. In particular, investments in carbon-intensive firms could in fact be aimed at introducing cleaner technologies, in which case labelling an investment as carbon-intensive would be highly misleading.[28]

While data availability does not allow for a comprehensive analysis, large exposures of euro area banks can be used to learn more about their exposures to climate-sensitive assets. Looking at individual exposures in particular allows for the use of borrower-specific metrics of carbon intensity. At the same time, caution should be exercised when interpreting the results. By their nature, large exposure data only allow for a partial and potentially biased view into bank portfolios, and the overall exposures in a given market may be affected by the market structure.[29] Data cleaning and matching with the available carbon data furthermore reduce the sample to 40% of the reported exposures. The remaining €720 billion constitute 5.6% of the total exposures to NFCs and 3% of the total assets of the banks in the sample. Furthermore, firm-level reporting on carbon emissions is currently voluntary, and therefore may not be fully representative. At the same time, large exposures provide a first illustration of the potentially most important exposures in terms of concentration and potential systemic impact.[30]

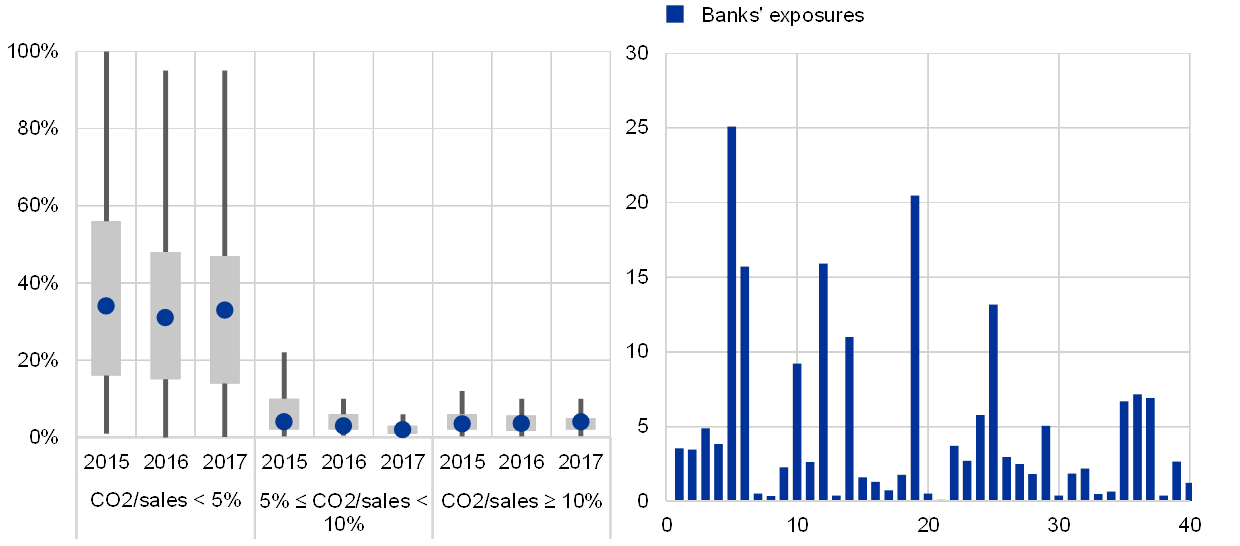

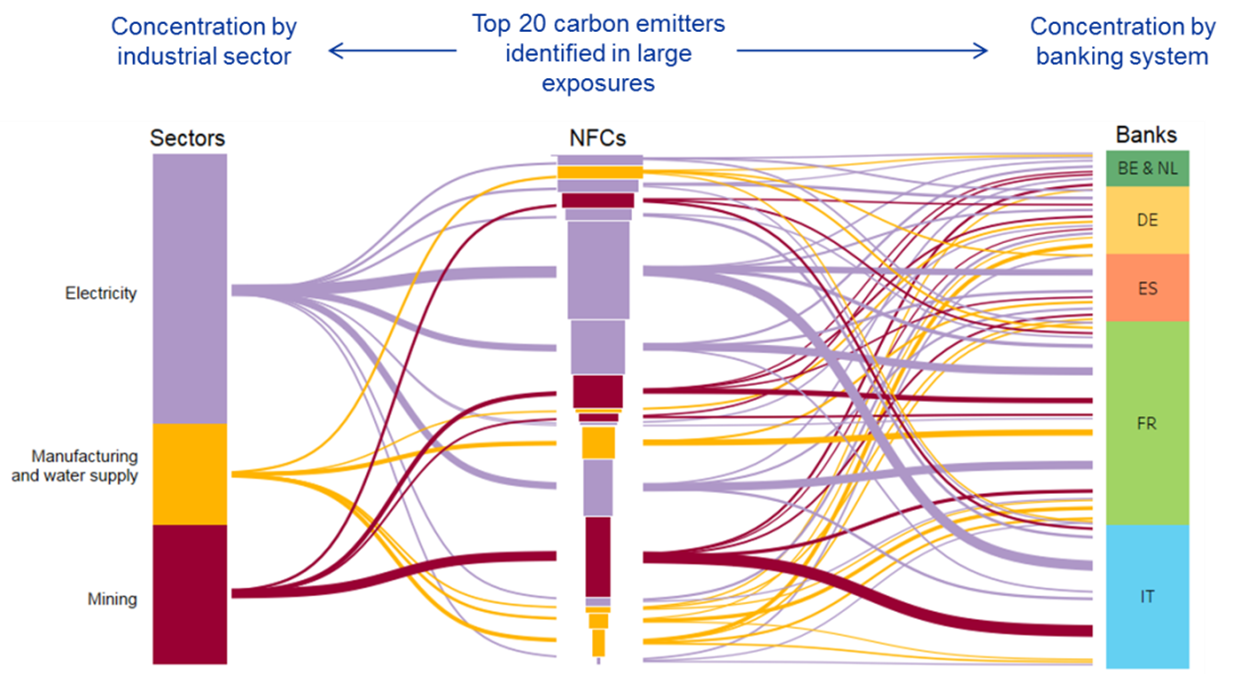

Data show that exposures to transition risk, although quite contained in relative terms, may be significant for some banks in absolute values. Chart A.4 (left panel) divides the exposures according to the reported carbon intensity of the borrower firm. From this perspective, exposures to carbon-intensive firms look relatively contained. Looking at absolute carbon emission amounts – which are obviously larger for big firms and are a relevant perspective from the point of view of political commitments to reduce overall emissions – changes the picture somewhat. Chart A.4 (right panel) lists the firms starting from the highest contributor to the overall emissions in the sample and shows that banks’ exposures to these firms are rather significant. Overall, the exposures to the twenty largest emitters capture 20% of total large exposures, or 1.8% of the total assets of the banks in the sample.[31] Chart A.5 provides an illustration of how the top 20 carbon-emitting firms identified in the large exposures dataset map into concentration at the level of both economic sectors and banking systems. This illustration suggests that such exposures could be quite concentrated in a few banking sectors. At the same time, any firm conclusions would need to be tempered given the caveats noted in the preceding paragraph.

Although the relative carbon intensity of exposures appears moderate for the sample, absolute exposures to large emitters could still be significant

Distribution of large exposures of banks in the sample to firms with different carbon intensities (as a share of total large exposures) (left panel); banks’ exposures to the reporting 40 firms with the highest carbon emissions (right panel)

(left panel: median, quartiles and 10th and 90th percentiles; right panel: € billions)

Sources: Thomson Reuters, ECB supervisory statistics (large exposures) and ECB calculations.Notes: Carbon intensity is calculated as the ratio of a firm’s total carbon emissions to its total sales. Altogether, 76% of the firms in the sample belong to the most carbon-efficient group (carbon emissions/sales <5%), 9% to the mid-range, and 15% to the most carbon-intensive group. The carbon emissions refer to Scope 2 emissions (emissions arising from purchased energy, heat or steam consumed by the firm). The carbon accounting standard has been developed and made available by the Greenhouse Gas Protocol and the Carbon Disclosure Project.

While this preliminary assessment suggests that a disorderly transition to a low-carbon economy could be systemically relevant, it also demonstrates the limitations related to the lack of comprehensive and comparable climate risk-related data. A monitoring framework for climate change-related risks in the financial sector would require more comprehensive information on carbon emissions and the exposures of banks and other financial institutions. In addition, scenario analyses and/or stress tests need to be developed to cater for transition risk in a forward-looking manner.

Large exposures to reporting firms with the highest emissions

Euro area banks’ large exposures to reporting firms with the highest carbon emissions

(share of total loans)

Sources: Thomson Reuters, ECB supervisory statistics (large exposures) and ECB calculations.Notes: The top 20 carbon-emitting companies reported in the large exposures dataset. The companies are ranked in descending order according to their total carbon emissions over the last four years (middle bar); the height of the NFCs’ rectangles represents total loans extended to the respective company, whereas the width of the rectangles represents the carbon emissions of the company. The NFCs are classified according to the NACE categorisation (left bar). The banking systems column includes 29 banks (right bar).

4 Policy initiatives related to climate risk and financial stability

Increased awareness of the potential impact of climate risk on the financial sector has brought together central banks and supervisors to share best practices regarding climate risk monitoring and management. In 2017 the Financial Stability Board’s Task Force on Climate-related Financial Disclosures (the FSB TCFD) highlighted the need for comparable and consistent disclosures about the risks and opportunities of climate change, and issued recommendations to this effect.[32] In addition, under the auspices of the NGFS, a group of central banks, supervisors and international organisations agreed in October 2018 that it is within the mandates of central banks and supervisors to ensure that the financial system is resilient to climate-related risks.[33]

The NGFS recently published recommendations on: (i) monitoring climate risks; (ii) developing taxonomies; (iii) promoting disclosures; and (iv) incorporating climate-related risks into prudential frameworks.[34] Table A.2 provides an overview of these recommendations and links them to ongoing policy and regulatory initiatives at the European level by the European Commission and the European Systemic Risk Board (ESRB).[35]

Recommendations by the NGFS and European initiatives with a focus on financial stability

At the European level, the ESRB is taking important steps towards developing a monitoring framework for climate-related risks. The NGFS encourages monitoring of climate risks by central banks and supervisors. The ESRB’s Advisory Scientific Committee in 2016 highlighted the potential impacts of physical and transition risks on the European financial system and recommended that authorities consider developing climate stress-test methodologies.[36] The European Supervisory Authorities could also include climate risks in their regular stress-testing exercises. To facilitate the incorporation of climate risks into stress analysis by authorities, the ESRB is conducting analytical work on data and methodologies.

The European Commission is developing a taxonomy which will feed into several initiatives that aim to help investors direct their capital towards sustainable activities. The legislative proposal for the taxonomy lays down criteria for the identification of activities that actively contribute to sustainability and environmental objectives (see Box A). The taxonomy will facilitate the development of standards and labels for green financial products such as green bonds. Green bonds allow bond issuers – such as companies, banks and governmental organisations – to borrow money from investors in order to finance sustainable investments.[37]

The green taxonomy is intended to complement the Commission’s proposals on improved disclosures on sustainable investments and risks and low-carbon and positive carbon impact benchmarks. The proposed disclosure regulation provides guidance to companies on how to provide climate-related information in line with the FSB TCFD recommendations[38] and the green taxonomy. The benchmark regulation sets out a harmonised framework for the development of low-carbon and positive carbon impact benchmarks, which aims to improve transparency for investors regarding their impact on climate change and the energy transition.

In its Action Plan, the Commission also proposed to explore the feasibility of the inclusion of climate-related risks in banks’ capital requirements framework. The idea of a “green supporting factor” – a risk-weight reduction in the prudential framework for banks’ exposures to green assets – has been mooted in this context.[39] While the Commission recognises that a reflection of climate risks should not jeopardise the credibility and effectiveness of the prudential framework, the proposal to introduce climate-related concerns into the prudential requirements for banks is based on the premise that green assets are less risky than non-green or brown assets. However, at this stage, it is not clear that the former are less risky than the latter. The European Banking Authority (EBA) will carry out further analysis in this regard.[40] For the integrity of financial institutions and financial stability, it is important that prudential frameworks remain risk-based.

The ECB is working with the members of the European System of Central Banks and the ESRB to contribute to the analysis and management of climate-related risks at the global and European levels. As a member of the NGFS, the ECB is contributing to the development of an analytical framework for climate risk assessment. In line with the guidance provided by the NGFS, the ECB will continue developing indicators for a climate risk monitoring framework for the European financial sector and methodologies for climate stress tests or sensitivity analyses, and will explore possibilities to fill identified data gaps. The ECB also contributes to the development of the EU green taxonomy through its membership of the European Commission’s Technical Expert Group on Sustainable Finance (see Box A). In doing so, the ECB aims to raise the awareness and understanding of climate-related risks in order to help financial institutions build resilience against potential climate-related risks.

The analysis presented in this special feature has overall shown that climate risk may adversely affect the balance sheets of financial institutions and therefore may be relevant for financial stability, in particular if markets are not pricing the related risks correctly. A deeper understanding and better communication of such risks and their relevance for the euro area financial system at large are therefore needed. Increased information should feed into a clear framework that helps market participants assess the related financial risks and reorient financial flows in an orderly manner. Macroprudential policies should be considered for any material systemic risks, including climate-related ones. Besides its efforts to increase quantitative information on climate-related risks in European financial markets, the ECB will continue to be actively involved in several global and European fora to support these aims.

- [1]Also based on contributions by Spyridon Alogoskoufis, Nicola Benatti, Linda Faché Rousova, Morgane Hoffmann, Urszula Kochanska and Gabriele Torri. Comments from Julian Morgan are gratefully acknowledged.

- [2]With a “likely” range between 0.8°C and 1.2°C. Taken from “Global Warming of 1.5°C”, IPCC, Geneva, Switzerland, p. 6.

- [3]Climate Change 2014 Synthesis Report – Summary for Policymakers, IPCC, Geneva, Switzerland, pp. 18-19.

- [4]See the Paris Agreement homepage.

- [5]See the analysis by the European Commission on this issue.

- [6]For instance, it is estimated that, ceteris paribus, the 20cm rise in the sea level since the 1950s may have raised the surge losses associated with Superstorm Sandy by 30% in New York. See Catastrophe Modelling and Climate Change, Lloyds, London, 2014.

- [7]See, for instance, the “In-depth analysis in support of the Commission communication COM (2018) 773” from the European Commission on this issue.

- [8]See Lane, P. R., “Climate Change and the Irish Financial System”, Central Bank of Ireland Economic Letters, Vol. 2019, No 1.

- [9]The focus of the special feature is on the financial stability consequences of climate change. For a discussion on monetary policy, see Cœuré, B., “Monetary policy and climate change”, speech at the conference on “Scaling up Green Finance: The Role of Central Banks”, organised by the Network for Greening the Financial System, the Deutsche Bundesbank and the Council on Economic Policies, Berlin, 8 November 2018.

- [10]See, for example, G20 Green Finance Synthesis Report, G20 Green Finance Study Group, September 2016; First Progress Report, NGFS, October 2018; and First comprehensive report, NGFS, April 2019. In addition, some designate (legal) liability risk as a separate category. The risk is likely to have an impact on individual institutions that are active in the liability insurance market rather than the system as a whole (see e.g. Batten, S., Sowerbutts, R. and Tanaka, M., “Let’s talk about the weather: the impact of climate change on central banks”, Staff Working Paper No 603, Bank of England, May 2016).

- [11]An example of such policy action is the introduction of carbon taxes.

- [12]See, for example, “Transition in thinking: The impact of climate change on the UK banking sector”, Bank of England, September 2018; and “Too late, too sudden: Transition to a low-carbon economy and systemic risk”, Reports of the ESRB Advisory Scientific Committee, No 6, February 2016.

- [13]See, for example, Delis, M. D., de Greiff, K. and Ongena, S., “Being Stranded on the Carbon Bubble? Climate Policy Risk and the Pricing of Bank Loans”, mimeo, 2018; and Friede, G., Busch, T. and Bassen, A., “ESG and financial performance: aggregated evidence from more than 2000 empirical studies”, Journal of Sustainable Finance & Investment, Vol. 5(4), 2015.

- [14]See NGFS (2018), op. cit., and Carney, M., “Breaking the tragedy of the horizon – climate change and financial stability”, speech at Lloyd’s of London, 29 September 2015.

- [15]See, for example, Green Bond Principles, International Capital Market Association (updated as of June 2018). For an overview of the most-used certification mechanisms for green bonds, see Ehlers, T. and Packer, F., “Green bond finance and certification”, BIS Quarterly Review, September 2017.

- [16]See Action Plan: Financing Sustainable Growth, European Commission, March 2018.

- [17]In reality, there is a continuum of different outcomes and transition pathways across the two dimensions. The four high-level scenarios are to be taken as representative for the sake of simplicity.

- [18]See Carney, M., (2015), op. cit., ESRB Advisory Scientific Committee (2016), op. cit., and Lane, P. R. (2019), op. cit.

- [19]It should be noted that the transition paths and the associated costs will vary from country to country and depend on the different political, technological and socioeconomic conditions and the policy and consumer choices made in the future. See NGFS (2019), op. cit.

- [20]See NGFS (2018), op. cit.

- [21]See European Commission (March 2018), op. cit.

- [22]The Commission is empowered to adopt delegated acts to specify technical screening criteria for what qualifies as a substantial contribution to a given environmental objective for a given economic activity and what is considered to cause significant harm to other objectives. See the Proposal for a Regulation of the European Parliament and the Council on the establishment of a framework to facilitate sustainable investment, European Commission, May 2018.

- [23]See, for example, “Evaluating climate change risks in the banking sector – Report required under Article 173 V of the Energy Transition and Green Growth Act No. 2015-992 of 17 August 2015”, DG Trésor, Banque de France and ACPR, 2017; and Vermeulen, R., Schets, E., Lohuis, M., Kölbl, B., Jansen, D.-J. and Heeringa, W., “An energy transition risk stress test for the financial system of the Netherlands”, Occasional Studies, Vol. 16-7, De Nederlandsche Bank (DNB), 2018. For earlier work on exposures to oil, gas and mining firms, see Weyzig, F., Kupper, B., van Gelder, J. W. and van Tilburg, R., “The Price of Doing Too Little Too Late – The impact of the carbon bubble on the EU financial system”, report prepared for the Greens/EFA Group, European Parliament, February 2014. For information on the NACE classification, see the European Commission’s website.

- [24]See Battiston, S., Mandel, A., Monasterolo, I., Schuetze, F. and Visentin, G., “A climate stress-test of the EU financial system”, Nature Climate Change, Vol. 7, 2017, pp. 283-288.

- [25]For institutional investors, policy guidelines may have a large impact on their asset allocations. For example, Norway’s government recommended that its USD 1 trillion wealth fund, one of the largest funds globally, divest from upstream oil and gas producers in March 2019.

- [26]For a more comprehensive analysis on climate-related asset exposures of euro area insurers, see Financial Stability Report, European Insurance and Occupational Pensions Authority, December 2018.

- [27]The stress test by DNB (2018) op. cit. uses a survey on corporate loans. Combining this information with the SHSS resulted in 10-13% of the assets of Dutch banks being estimated as climate-sensitive.

- [28]In fact, green bond issuance is heavily concentrated in carbon-intensive sectors. See De Santis, R. A., Hettler, K., Roos, M. and Tamburrini, F., “Purchases of green bonds under the Eurosystem’s asset purchase programme”, Economic Bulletin, Issue 7, ECB, 2018.

- [29]The Capital Requirements Regulation (CRR) requires that banks report exposures to clients (or groups of connected clients) totalling at least 10% of the eligible capital of the bank as large exposures. Additionally, exposures larger than or equal to €300 million also need to be reported. The fact that only large exposures are observable may in addition understate the exposures in a fragmented banking system or overstate those in a concentrated system.

- [30]An earlier contribution has justified a partial approach of looking at syndicated loans to estimate bank exposures to oil, gas and coal mining firms, with the argument that large fossil fuel companies would not typically request bilateral bank loans owing to their much smaller size. See Weyzig et al. (2014), op. cit.

- [31]Altogether these 20 firms are responsible for more than half of the reported aggregate carbon footprint in large exposures of euro area banks.

- [32]Recommendations of the Task Force on Climate-related Financial Disclosures, June 2017.

- [33]NGFS (2018), op. cit. The ECB is a member of the NGFS. To date, the NGFS comprises 36 members. Other global initiatives include the launch of the Sustainable Insurance Forum (SIF) in 2016 and the activities of the International Association of Insurance Supervisors related to climate risk.

- [34]The NGFS also published recommendations on integrating sustainability factors into portfolio management and bridging data gaps.

- [35]NGFS (2019), op. cit.

- [36]ESRB Advisory Scientific Committee (2016), op. cit.

- [37]The European Commission is developing an EU Green Bond Standard, which builds on the proposed EU taxonomy regulation to clarify green definitions and puts in place a verification and accreditation process to enhance credibility.

- [38]The FSB TCFD recommendations cover: (i) the governance around climate risks and opportunities; (ii) the potential impact on the strategy and business model; (iii) risk management; and (iv) metrics and targets used to assess climate risks.

- [39]See Actions 1 and 8 of the Commission’s Action Plan.

- [40]See Article 501c of the Presidency compromise on the Proposal for a Regulation amending the CRR. The EBA shall be entrusted with the task of assessing whether a dedicated prudential treatment of exposures related to assets or activities associated substantially with environmental and/or social objectives would be justified to safeguard the coherence and effectiveness of the prudential framework and financial stability.