ECB publishes Consolidated Banking Data for end of 2015

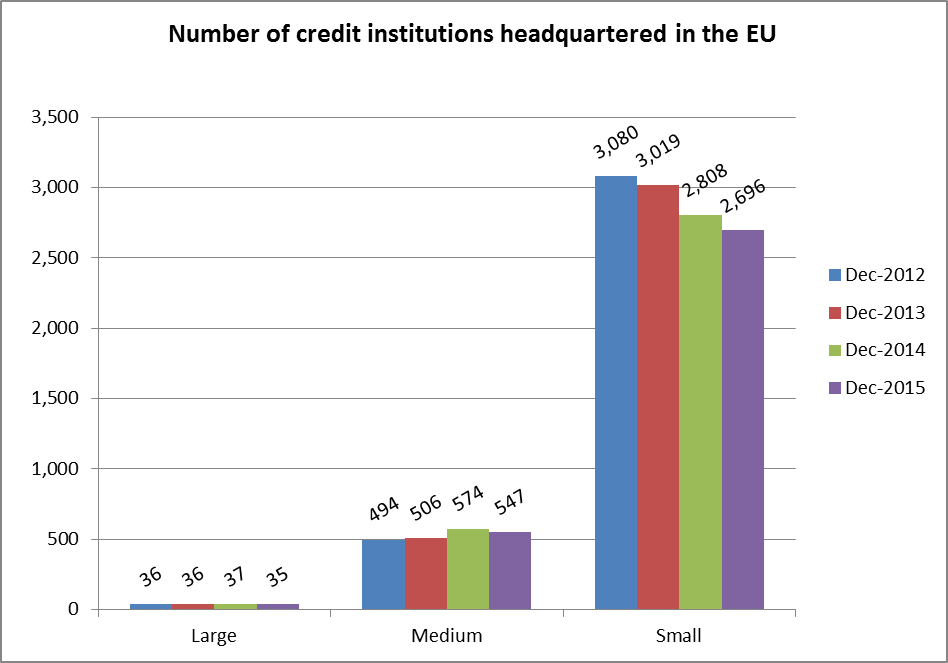

- The number of credit institutions headquartered in the EU continued to decrease from 3,419 in 2014 to 3,278 in 2015.

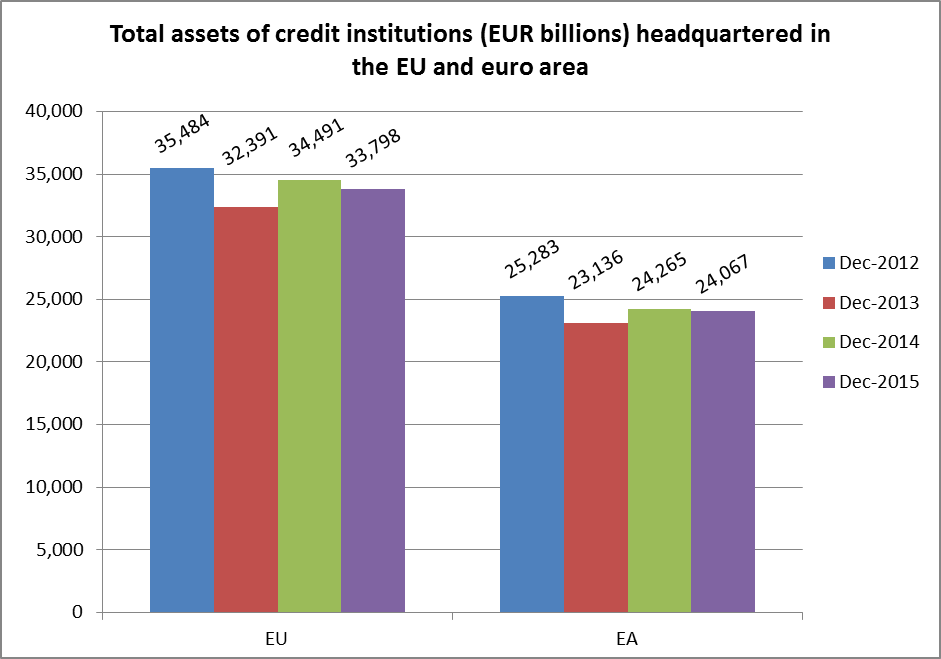

- Total assets of these credit institutions also decreased in the last year from € 34,491bn to € 33,798 bn. The decrease was to a large extent driven by non-euro area countries.

- The end-year data are comprehensive, covering an even broader set of variables and indicators relevant for the analysis of the banking sector than the quarterly data.

The European Central Bank (ECB) has published the December 2015 Consolidated Banking Data (CBD), a data set of the EU banking system on a group consolidated basis.

The CBD include statistics on individual EU Member States and on the European Union and Euro Area as a whole. The end-2015 data refer to 342 banking groups together with 3,229 stand-alone credit institutions, and include data for 972 foreign-controlled branches and subsidiaries operating in the EU, covering nearly 100% of the EU banking sector balance sheet. This dataset includes an extensive range of indicators on profitability and efficiency, balance sheets, liquidity and funding, asset encumbrance, non-performing loans developments and capital adequacy and solvency.

Aggregates and indicators are published for the full sample of the banking industry. While large reporters apply International Financial Reporting Standards and the EBA Implementing Technical Standards on supervisory reporting, in other cases reporters may apply national accounting standards, jointly with the EBA standards or not. Accordingly, aggregates and indicators are published also for data based on national accounting standards, depending on the availability of the underlying items.

The CBD series for EU banking groups are calculated on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” to affiliates of banking groups that can be classified as other financial institutions. Insurance companies are not included within the consolidation perimeter.

CBD data are also separately reported for domestic banking groups (broken down into small, medium-sized and large groups) and foreign-controlled institutions active in EU countries.

Together with end-2015 data, also few revisions to past data are shown.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- The Consolidated Banking Data are available in the ECB Statistical Data Warehouse: Economic Concepts > Monetary and financial statistics > Consolidated banking data current

- More information about the methodology behind the data compilation is available on the ECB’s website: Statistics › Monetary and financial statistics › Consolidated banking data

Európska centrálna banka

Generálne riaditeľstvo pre komunikáciu

- Sonnemannstrasse 20

- 60314 Frankfurt nad Mohanom, Nemecko

- +49 69 1344 7455

- media@ecb.europa.eu

Šírenie je dovolené len s uvedením zdroja.

Kontakty pre médiá