ECB publishes quarterly Consolidated Banking Data for September 2015 and revisions

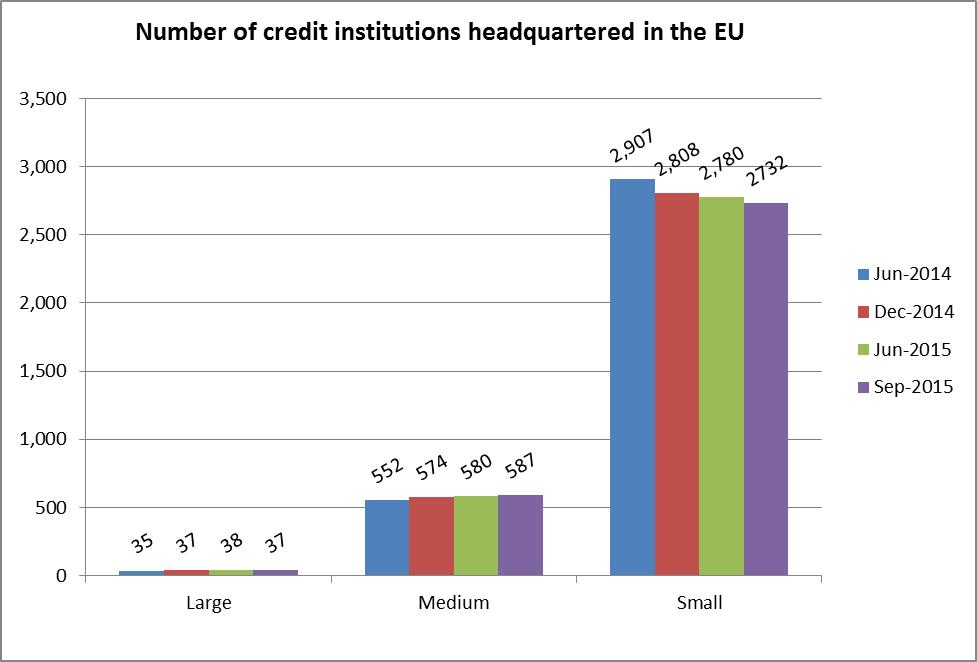

- The number of credit institutions headquartered in the EU continued to decrease from 3,398 in June to 3,356 in September. This is mainly due to the decrease of small ones.

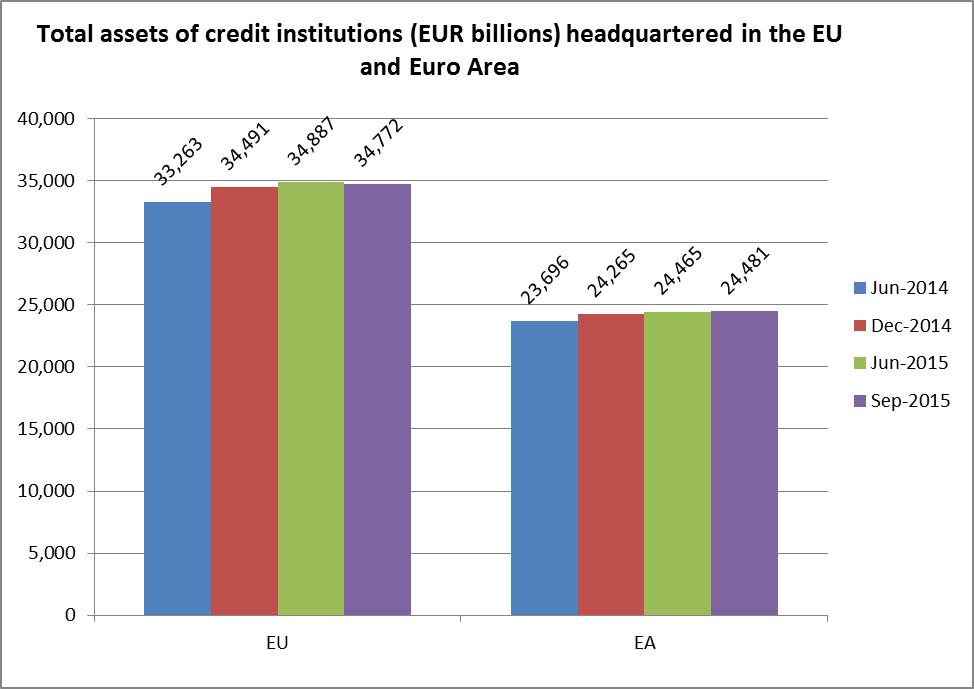

- Total assets of these credit institutions were almost stable at €34,772bn in September (€34,887bn in June).

- Quarterly data are a subset of the corresponding annual data, covering relevant information for the analysis of the banking sector.

The European Central Bank (ECB) has published the September 2015 Consolidated Banking Data (CBD), a data set of the EU banking system on a group consolidated basis.

The quarterly CBD cover relevant information required for the analysis of the EU banking sector, although a lean subset of the end-year data. CBD include statistics on individual EU Member States and on the European Union and Euro Area as a whole. This dataset includes an extensive range of indicators on profitability and efficiency, balance sheets, liquidity and funding, asset encumbrance, non-performing exposures developments and capital adequacy and solvency.

Disclosed aggregates and indicators are published for the full sample of the banking industry, based on accounting reports. While large reporters (data sources) apply International Financial Reporting Standards and the EBA Implementing Technical Standards on supervisory reporting, other reporters apply national accounting standards, jointly with the EBA standards or not. Aggregates and indicators are published also for reports based on supervisory and national accounting standards, depending on the availability of the underlying items.

The CBD series for EU banking groups are available on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” to affiliates of banking groups that can be classified as other financial institutions. Insurance companies are not included within the consolidation perimeter.

The CBD data are separately reported for domestic banking groups (broken down into small, medium-sized and large groups). Information is also provided on foreign-controlled institutions active in EU countries.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- The Consolidated Banking Data are available in the ECB Statistical Data Warehouse: [ http://sdw.ecb.europa.eu/browse.do?node=9689600].

- More information about the methodology behind the data compilation is available on the ECB’s website: http://www.ecb.int/stats/money/consolidated/html/index.en.html.

Európska centrálna banka

Generálne riaditeľstvo pre komunikáciu

- Sonnemannstrasse 20

- 60314 Frankfurt nad Mohanom, Nemecko

- +49 69 1344 7455

- media@ecb.europa.eu

Šírenie je dovolené len s uvedením zdroja.

Kontakty pre médiá