The role of stress testing in supervision and macroprudential policy

Keynote address by Vítor Constâncio, Vice-President of the ECB, at the London School of Economics Conference on “Stress Testing and Macroprudential Regulation: a Trans-Atlantic Assessment”, London 29 October 2015

Summary

The generalised use of system-wide stress testing was boosted by the financial crisis. However, thus far, system-wide stress tests have been focusing on banks and their solvency and have been used for microprudential purposes.

The macroprudential policy function has added a new dimension to stress testing going well beyond the examination of individual bank results. Enhancements in the macro stress testing framework are underway to integrate more realistic dynamic features in the model-framework, allow for banks’ reactions, add a proper liquidity stress test component, integrate contagion effects as well as a two-way interaction with the real economy. Furthermore, efforts are being made in the direction of going beyond banks and integrating, to the extent possible, the shadow banking sector in the broader framework. These steps are necessary to provide the macro dimension to stress testing exercises and make them fit for macroprudential policy use. This entails accounting for macroeconomic impacts along the horizons of stress testing exercises, as well as alerting for the need for pre-emptive action and assessing the impact of macroprudential policy tools.

The objective is very challenging but is being actively pursued: a new framework for stress testing must serve both the micro- and the macroprudential policy functions in a complementary way.

* * *

Ladies and gentlemen,

It is a great pleasure to be here today at this prestigious school addressing a topic of utmost importance. I thank the organisers at the Systemic Risk Centre for inviting me. Very much in line with the event itself, the topic of my address today is stress testing and macroprudential regulation. These might seem like distinct topics. But in fact, they are in many ways intertwined. Even so, there is a need to further enhance the macroprudential function of stress testing, which is what I am going to elaborate on today.

1. Stress testing: the past and the present

Without the latest crisis that started back in 2007, we would most likely not be here today discussing stress testing nor would the macroprudential policy area be so much under the spot light.

The crisis, especially in Europe, triggered far-reaching structural changes. Decisive steps taken following the crisis include Banking Union in its various dimensions – not least, the establishment of the Single Supervisory Mechanism (SSM) and the corresponding joint approach to micro- and macroprudential policies. This dual approach is reflected, inter alia, on the operational side in the lasting and generalised use of system-wide stress testing.

Stress testing in Europe has changed substantially since the inception of the crisis. Back in 2009, the Committee of European Banking Supervisors (CEBS) initiated the first EU-wide stress test. At the time, with its Supervisory Capital Assessment Program (SCAP), the US had also started with their, by now, regular exercise.

Placed under the aegis of the just established European Banking Authority (EBA) in 2011, the EU co-ordinated exercise grew in size and scope, providing a common macro-financial baseline, adverse scenario and methodological guidance to the designated participating banks. However, contrary to the US case, the estimated capital needs of individual banks were not integrated in centralised supervisory decision processes, as no supervisory powers were attributed to the EBA. Any supervisory follow-up deriving from stress tests results was left to the discretion of national authorities.

With the establishment of the SSM, now about to celebrate its first anniversary, there is, for the countries belonging to the SSM, a move to a new regime. Before its operational start, a financial health check of the banking sector was required. In synchronisation with the EBA EU-wide stress test, this exercise was carried out by the ECB in a much publicised manner. This so-called “Comprehensive Assessment” (CA) was an exercise of unprecedented scale. To recall, the sample covered comprised no less than 130 significant banks in the euro area. An additional and essential element was that it combined a system-wide asset quality review (AQR) with a stress test.

Due to the inclusion of an AQR and to an intense “quality assurance” conducted at the ECB, this exercise was seen as credible by market participants. Evidence of that is, for example that euro area banks’ stock prices reflected the CA results as soon as these were published. Developments pointed to more discrimination between banks, notably regarding their valuation and risk assessment by the market, reflecting the outcome of the tests. Some further disconnect between sovereign and banks’ CDS premia could also be observed at the end of the exercise – a very welcomed outcome. Furthermore, the exercise entailed a data-rich disclosure with comprehensive balance-sheet data and detailed final results, enhancing transparency and facilitating the assessment of banks by observers.

Both the 2014 stress testing exercise, also under the EU-wide exercise co-ordinated by the EBA, as well as the 2016 EU-wide exercise under preparation, have a predominant micro-dimension, even if they are run on a common macro-financial scenario.

Let me highlight some features of these EU-wide stress tests. The exercises can be described as balance-sheet based, forward-looking assessments of bank solvency. They span over a three-year horizon on a macro-financial baseline and adverse scenario. The adverse scenario is designed on the basis of the main systemic risks to the banking sector identified as pertinent, at a specific juncture. This set of risks is mapped into exogenous shocks. The calibrated shock profiles are then input to dynamic macro-econometric models used to project macroeconomic and financial variables which constitute the scenario output.

The framework comprises both exogenous and a form of endogenous, shocks. The exogenous components are shocks to stock and bond markets, house prices, short- and long-term interest rates, sovereign bond yields, and to the structure and cost of funding, which are consistently linked to the macroeconomic scenario. The translation of the scenario into variables affecting the valuation of banks’ balance-sheet elements has an endogenous dimension. It relates to the impact of the scenario on banks’ credit risk (PDs and LGDs), market risk, and other profit components. While the impact of liquidity stress is somehow captured by the funding and liquidity shocks, the exercise remains primarily a solvency assessment.

Exercises have so far been conducted under static balance-sheet assumptions, whereby all balance-sheet elements are kept constant throughout the horizon of the test. This is a simplifying feature, clearly not very realistic. At the same time, this introduces a conservative bias to the exercise because it does not consider mitigating reactions by the banks within the tests’ time span. The main purpose of the exercise is to identify banks with a capital shortfall in relation to a pre-determined hurdle rate. The outcome of the exercise is thus a list of capital needs or surpluses per individual bank, reflecting a predominantly microprudential objective.

With the operational start of the SSM, a co-ordinated supervisory follow-up to the stress test results is in place, since these are relevant input to the SSM Supervisory Review and Evaluation Process (SREP). Following the CA, SSM Joint Supervisory Teams (JSTs) follow-up with banks on their individual results, dig deeper on potential pockets of risks and decide, when necessary, on additional bank-specific measures. The microprudential function of the ECB/SSM thus uses the results of system-wide stress tests for the assessment of individual institutions and their risk management.

This type of stress tests is also relevant from a macroprudential perspective for a number of reasons. First, because the aggregate results are used for a second feedback exercise about their possible macroeconomic impact as assessed by ECB internal models. From this perspective, it may emerge, for instance, that overly stringent capital requirements may be harmful to the economy to the point of being self-defeating. This could stem from the banks’ deleveraging by liquidating assets and reducing credit provision in order to meet higher capital requirements. In particular, when the economy has just entered the recovery phase or languishes in a recession, such an approach could be damaging. Second, because the tests’ results are also used to assess contagion effects using network analysis. Finally, the overall results can be seen as an input to macroprudential analysis used to discuss the relevance of possible macroprudential measures.

Decisions on the follow-up to a stress test need to take into consideration all types of capital requirements deriving from micro- and macroprudential functions in a coordinated way. It is important to avoid overlaps between macroprudential measures and bank-specific Pillar II measures, which use bank-level stress tests as inputs. Similarly, potential cross-border spillovers of these decisions should be handled with care. The ECB has specific co-ordinating competences to address questions of cross-border effects and reciprocity.

Turning to the other side of the Atlantic, allow me a minute to compare the European experience with the US Comprehensive Capital Analysis and Review (CCAR). There are in fact significant methodological and design-related differences. The CCAR covers the largest US banks (ca. 30) and spans through a shorter horizon of just nine quarters. The recent version considered five different scenarios, from which three are generated by the Fed and two are bank-specific and designed by each bank. Six bank holding companies with large trading operations were required to factor in a global market shock, as part of their scenarios, and eight bank holding companies with substantial trading or custodial operations were required to incorporate the assumption that their large counterparty defaults. The exercise follows a dynamic balance-sheet approach. The Fed thus runs a stringent quantitative and qualitative assurance process, uses top-down models and may object to the capital plan of a bank even though it satisfies minimum regulatory ratios throughout the exercise. Results from both the top-down and bottom-up exercises have been published, whereas only the latter is made public by the EBA. CCAR hurdle rates in 2014 were the regulatory ratios, comprising Basel III transitional arrangements (4.5% CET1) GSIBs additional buffers where applicable, and a leverage ratio. The same hurdle rates applied to baseline and stressed scenarios. This was quite different from the EBA stress test where hurdle rates were set at a higher rate than minimum requirements (5.5% CET1), which were tightened for the adverse scenario (8% CET1).

The CCAR is thus mostly a “supervisory exercise”. If a bank fails the test it must submit a new capital plan which may restrict dividend payments, for instance. This is different from the EBA exercises that can be labelled a “capital exercise”. But in both cases, the microprudential dimension prevails.

2. Stress testing methodologies: treatment of sovereign debt

Rules and methodological aspects need to be consistent and make economic sense within a macro-financial environment in which stress testing exercises are conducted. A particular controversial aspect is related to the nexus between banks and sovereigns and the treatment of sovereign exposures. This applies to both exercises conducted in the past and to future exercises.

Banks in the EU, which follow the standardised approach for credit risk, benefit from a zero risk weight on sovereign exposures issued in local currency, as well as the exemption of these exposures from the existing Large Exposure (LE) regime. Banks that are authorised to use the internal risk model approach may also exclude sovereign exposures from risk models and use a zero weight. After the recent experiences, there is wide agreement that this current regulatory treatment needs to be reviewed and the debate is thus underway.

Nevertheless, let me underline that in the context of EBA stress tests and our CA, sovereign exposures were adequately subject to stress. Accordingly to the EBA methodology, fair value positions, i.e. positions classified in the available-for-sale (AFS) category and under the fair-value-option through P&L (FVO), are subject to market risk stress. As such, in the CA banks faced a large impact on capital on account of the revaluation of sovereign portfolios related to significant sovereign bond yield increases. More importantly, banks are requested to estimate default and impairment flows for sovereign positions kept as loans and receivables or held-to-maturity (HTM), subject to a set of stressed default and loss rates for each scenario. In the CA, these losses were very substantial.

This leads me to the broader policy debate underway about the treatment of sovereign debt exposures, proposals have emerged to impose quotas or quantitative caps to the banks’ holdings of the domestic debt of the country where they are domiciled. In this context, it has been proposed to use the large exposures regime and apply a cap of 25% of a bank’s equity on all exposures to the sovereign.

In my personal view, this orientation suffers from serious flaws. First, well-functioning sovereign bond markets are essential for the functioning of financial markets and the pricing of risk. Banks hold sovereign exposures for a number of reasons, including its favourable credit and liquidity characteristics, its use as collateral. An alternative to setting a hard limit for sovereign exposures, is to use the pricing mechanism by introducing risk-weights which should be less intrusive and with less distortion. A price-based regulation would allow more leeway in banks’ portfolio decisions and would also be less disruptive to the sovereign debt markets. Finally, preliminary analysis suggests that hard limits under a large exposure regime of 25% of own funds would imply that to accommodate the present holdings of domestic sovereign debt by EU banks, they would need additional Tier 1 capital needs of over € 6 trillion or potential sales of those securities above € 1.6 trillion. This is illustrative of the likely scale of disruption in sovereign debt markets, banking sector and the economy as a whole that the introduction of such a regime could bring.

Some economists defend that the quantitative limit would generate a nice diversification by creating an active market of asset swaps among banks, with the banks from core countries taking debt from peripheral countries. The functioning of the sovereign debt market in past years raises doubts about whether such a scenario could ever materialise.

The discussion is motivated by the need to put an end to the sovereign-bank nexus. One should recall that the risk transmission between banks and sovereign runs both ways.

It does not take much to conclude that, since the beginning of the crisis, the government support to banks (in the form of capital injections or guarantees) far exceeded total bank losses on sovereign exposures. To date, these relate only to the Greek restructuring of private debt in 2012.

Banks’ losses in the crisis derived primarily from excessive risk and concentration on residential and commercial real estate exposures, including related to US underpriced and toxic assets. Should quantitative limits be also introduced on such exposures? In what concerns the feedback loop with the sovereigns, the overwhelming bulk came from the bailout of banks, amounting in gross terms to €800 billion incurred by sovereigns [1], dwarfing the €50 billion that banks lost from their Greek sovereign holdings. The Bank Recovery and Resolution Directive (BRRD) and the new bail-in regime in force as from 2016 have fully addressed this source of the feedback as bailouts can no longer take place.

Finally, as referred in the recent Five Presidents’ Report about the future of the Monetary Union, any new regulation on sovereign debt risk weights should have a true worldwide agreement in the Basel Committee context. This could point to a reasonable solution along the lines of a price incentive approach by increasing sovereign debt risk weights. This approach should be sufficient in addressing the real concerns surrounding sovereign debt, bearing also in mind that sovereign debt will continue to be appropriately stressed in our tests.

3. Alternative approaches to stress testing

Before moving on to the future of stress testing, let me share my views on alternative approaches to the balance-sheet-based stress tests, conducted by official authorities. The main alternative is the so-called “market-price-based stress tests”, which can be quite appealing given its simplicity, low data-intensity and automaticity. At the same time, it places great emphasis on the wisdom or whims of the market. I will however argue that these exercises are not usable for policy-making purposes, and can create a dangerous false sense of comfort in quiet times.

It relies on market capitalizations and other market-based indicators to measure the safety and soundness of the financial sector. Quantitative analysis based, for instance, on the SRISK measure, [2] among others, was used to challenge the results of the CA in 2014, by comparing them to alternative stress test simulations based on market data. In October 2014, market-based metrics provided substantially higher estimates of capital shortfalls than the SSM CA results. [3]

The SRISK approach determines a bank’s capital shortfall as a function of i) a bank’s market capitalisation, ii) its asset size, and iii) the relationship of the bank’s stock returns with the aggregate market returns.

I confess my scepticism about the relevance of such approaches to inform policy decisions. They are detached from the macroeconomic and financial narrative that helps us lay the foundations for macroprudential policy and macroeconomic scenarios and their specific shocks. Such approaches are thus not comparable with balance sheet-based stress tests exercises as conducted by EBA or CCAR. The estimates vary widely, depending on the definition of the capital ratio, the reference threshold, and the underlying stress assumptions which are not linked to a macroeconomic scenario.

Additionally, the approach is subject to substantial volatility, on account of its market-based dependence. Resulting capital requirements could vary substantially in a matter of months, according to market fluctuations, making the results not usable for either management or authorities’ purposes. At the same time, in periods of relative calm in the financial markets, such measures would provide false comfort – which is precisely what one would need to counteract by using pre-emptive macroprudential policy. On the contrary, during episodes of heightened market uncertainty, such measures are likely going to exacerbate fear and distress, pointing to astonishingly low bank market capitalisation levels and big capital shortfalls. We should view this kind of procyclicality with great concern and avoid taking policy decisions that would further amplify, rather than smoothen the financial cycle.

4. Stress testing: the present methodology limitations

As can be seen from the description I made before it is clear that system-wide stress testing exercises in the EU, conducted under the present methodology, are faced with a number of limitations. This concerns in particular their macro dimension and their use for macroprudential policy purposes.

Featuring prominently among these limitations is the static balance-sheet approach, which is not suited to exercises that run for a horizon of three years. This may turn the tests unduly conservative if the macro scenario is too severe.

A related limitation is the fact that no bank reaction is considered. It would be far more realistic to assume that market participants could react to adverse conditions, rather than assuming passive bank behaviour throughout the entire stress test period. Bank behaviour or reaction could come in the form of deleveraging, straight capital increases or working out of non-performing loans.

While the EBA exercise entails some liquidity stress, in the form of market liquidity (the risk that an asset cannot be sold or used as collateral) or funding liquidity (the risk that a bank is unable to roll-over maturing funding), no thorough liquidity assessment is conducted. Given the strong, two-way interaction between liquidity and solvency stress brought to the fore by the global financial crisis, a proper liquidity stress testing framework should constitute an inherent part of the solvency stress testing framework.

Another limitation relates to the absence of interaction between banks and other specific sectors of the economy, notably the households and non-financial corporate sectors’ balance-sheet and financial positions. In an integrated model framework, these balance-sheets would also be affected and would respond to the various macroeconomic shocks in the stress test scenario. In the same vein, the framework does not capture second-round effects and subsequent feedback effects within the financial sector and with the real economy at large.

All such features can clearly only be present in a top-down stress test framework, centrally conducted, so difficult to adopt in the context of the EBA EU-wide stress tests, where bottom-up results are provided by the banks and covering a large sample. Top-down macro stress tests are therefore a powerful tool that can be employed in a range of exercises from the simplest – aimed at evaluating the direct impact of stress on each bank – to the most complex, when it includes a dynamic set-up and is combined with a macroeconomic model, taking into account second-round effects. These would have the potential to assist macroprudential policy in the design, calibration and assessment of the impact of macroprudential tools.

5. Macro Stress tests: the future of the ECB framework

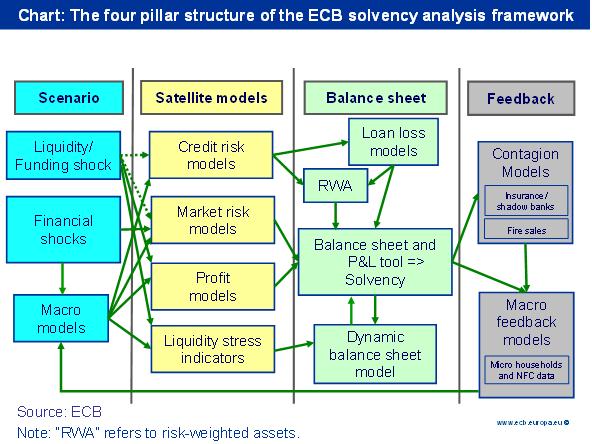

In my view, macro stress tests are an indispensable tool of macroprudential policy. However, to be policy relevant, exercises need to be embedded in a coherent macroeconomic and financial set up and to incorporate a macroprudential perspective. Overcoming the drawbacks highlighted earlier is a first step, and work is underway at the ECB in that direction (see also following chart). After incorporating the dynamic elements and the necessary feedback with the macroeconomy, we need to enlarge the framework to assess the impact of policy tools and expand the range of macroprudential tools used in the models. To develop proper indicators that can measure the system-wide level of systemic risk resulting from the each scenario and shocks considered is even more challenging. These should relate to the various sources of systemic risk: macroeconomic shocks, endogenous financial imbalances, and contagion effects dependent on interconnectedness.

ECB staff has been working on the characterisation of the financial cycle which depends on several variables related to credit, leverage and selected asset prices, notably housing and bond prices. Going forward, the macro and financial variables, as evolving over the stress testing horizon, including feedback effects, could be used in a framework to assess systemic risk levels over the financial cycle. This could provide valuable guidance for pre-emptive macroprudential policy decisions.

In 2013, the ECB published an occasional paper describing the framework and its various modules [4] developed by the ECB to conduct stress tests. These had been used to support the CEBS, and later the EBA exercises. Since then we have added new modules and tools that I will now briefly describe.

Regarding the dynamic treatment of certain variables, quite some progress has been made in accommodating the dynamic balance-sheet approach for macroprudential stress tests, or the capacity to take into account banks’ reactions to the stress. In our framework, the dynamic balance-sheet is implemented by allowing banks to re-optimise their portfolio according to the risk-return optimisation criterion [5]. Reaction functions could also be informed by bank surveys. Typically, under adverse scenarios, reactions generate a negative feedback loop, whereby deleveraging leads to an aggravation of the initial stress. At the same time, bank results tend to be less acute, given the more realistic possibility to react to shocks.

Household sector

Concerning the attempts to assess household sector vulnerabilities, we have developed a framework for stress testing balance-sheets of individual households using the data from the ECB Household Finance and Consumption Survey [6]. This approach, linking micro and macro data, has already allowed us to compute PDs and LGDs for mortgage exposures directly at the household sector level and link them to macroeconomic stress scenarios. This gave us valuable insight into heterogeneity across the euro area countries and non-linearities in responses to various macroeconomic shocks due to different distributions of debt burden across households. We are currently working on extending this framework to account for a consistent stress scenario, as well as allowing for dynamic adjustments of individual households’ balance-sheets in response to shocks, and related second round effects [7].

Liquidity

The global financial crisis revealed major transmission channels from liquidity and funding to bank solvency and vice-versa. Efforts are thus underway to integrate a macro liquidity stress test in the solvency stress testing framework.

Liquidity stress testing should be a tool to assess banks’ capacity to withstand extreme liquidity shocks by looking at bank’s liquidity positions. This goes far beyond compliance with the regulatory liquidity ratios such as the Liquidity Coverage Ratio (LCR). It takes the dimensions of depth, breadth and horizon of a shock, and should also take into account the fact that liquidity stress usually unwinds very quickly and turbulently.

Brunnermeier, Gorton and Krishnamurthy have proposed a new system of measuring risks and liquidity in the financial sector and recommend policymakers to focus on the risk topography for the economy [8]. Their idea is to regularly obtain from financial companies the maturities and liquidity sensitivities of their assets and portfolios and build a total firm specific liquidity indicator. To calculate such an indicator on a regular basis, although very useful, would be demanding on the reporting institutions but I could imagine the implementation of their proposal in the context of point-in-time stress tests.

A proper liquidity stress testing framework should constitute an inherent part of the solvency stress testing framework. Irrespective of the origin of the shock to the financial sector, which can be multiple and largely unpredictable, the major propagation channels between liquidity and solvency are broadly common and could be integrated within a liquidity stress testing framework.

This nexus of solvency and liquidity includes four important propagation channels that we model (or intend to model) in our framework: (i) a fire-sale externality: fire-sales emerge due to incomplete markets during times of stress impacting the solvency of banks via realised losses due to asset disposals at fire sale prices, and mark-to-market losses on liquid assets held at fair value; (ii) margin calls and the closure of funding markets: negative feedback loops are triggered by illiquid banks calling-in interbank facilities with other banks or raising margin requirements in illiquid repo or derivative markets. This may lead to increasing funding costs or even the closure of the funding markets; (iii) credit rating: a deterioration of a bank’s credit rating triggered by a worsened capital position may lead to higher funding costs, which, ceteris paribus, leads to a further deterioration of the solvency position; and (iv) asset quality: a worsening of the credit quality of assets leads to a worsening of the cash-flow, (as Non-Performing Loans do not generate cash-inflows), which in turn leads to an immediate deterioration of the liquidity and funding position.

We are aware that liquidity risk – in particular the fire-sale externality – cannot be assessed in isolation, only within the whole banking sector, but I will come to that.

Contagion

Financial contagion is another important element of a macroprudential stress testing framework. In the 2007/8 financial crisis, contagion via direct and indirect channels was key in propagating the initial, relatively small, subprime shock. In our top-down stress tests, we have been taking account of direct contagion via the interbank channel for many years now. Second round effects of contagion are regularly published as part of our assessment of resilience of financial institutions in the semi-annual ECB Financial Stability Review. However, by taking full account of contagion, we are further enhancing our framework to also consider indirect contagion. In particular, we are modelling the impacts of fire-sales [9] with the ultimate aim of making endogenous the price response within an integrated bank-shadow-bank stress test framework using an agent based modelling framework.

Interaction with the real economy

Macro-feedback analysis, which takes account of interactions with the economy, plays an important role in the macroprudential stress tests. To this end, for the euro area, we have calibrated country versions of a stylised DSGE model [10], which we use to assess post-stress general equilibrium dynamics in each euro area country. Moreover, to take better account of the banking sector and default externalities, a general equilibrium model has been developed with a three layer endogenous default, in the household, corporate and the banking sector (the so-called 3D model) [11]. Country versions of this model will soon be available for the regular policy evaluation. The macro-feedback loop has also been beefed up by econometrically testing banks’ response to capital shocks in time-series models including GVAR [12] and FAVAR [13] models. These tools can also be used for macroprudential policy cost-benefit analyses as well as for capturing cross-border effects. We are also working on integrating the GVAR with the early warning models to take account of the medium-term boom-bust cycles by making endogenous the predictor variables used in the logistic early warning model [14].

6. Stress testing of non-banking sectors

Let me now mention an important aspect that needs to be taken into account for a fully-fledged stress testing framework, namely, the need to have a stress testing framework that integrates banks and the shadow banking sector.

With a steady growth in assets and the potential for substituting financial services from the regulated sector, shadow banks also constitute a challenge to any macroprudential policy-maker. Recent ECB research suggests that the shadow banking sector has a natural tendency to grow until it becomes systemically important for the entire financial system and endangers the stability of the banking sector [15]. To unveil the vulnerabilities in this sector and to identify the pockets of illiquidity and better understand the dynamics of the interactions of the sector with the rest of the financial sector, we need a stress testing framework conducted by the firms themselves but according to guidance by the competent regulators, as recently recommended by the FSB. [16]

Such a framework could start with assessing the resilience of the largest shadow banks to a number of stress factors, in particular to various asset price shocks, but also the resilience against the materialisation of redemption risk. This should include a simulation of fire-sales that would account for the depth and liquidity of various asset markets. Ultimately, the shadow banking stress testing framework should be integrated by accounting for various layers of interconnectedness and by identifying direct and indirect contagion channels.

As a starting point for a financial system stress test also involving firms themselves, “guided” stress tests of non-banking entities, notably large asset management entities, would be important, even if not yet fully integrated with banking sector stress tests.

To complete this picture, let me briefly also mention stress test on Central Clearing Counterparties (CCP). A proper macroprudential stress test of these institutions should not only include solvency and liquidity stress but also account for the interconnectedness via common exposures to clearing members as well as possible knock-on effects on the banking sector that could arise in case the guarantee fund of a CCP is wiped out and clearing members are required to cover the CCP losses. In this vein, the ECB is contributing to the ESMA CCP stress tests by helping with the scenario design and the analysis of the network effects.

7. Conclusion

Let me conclude. The generalised use of system-wide stress tests has been one of the important consequences of the financial crisis. So far, they have focused mainly on banks and their solvency, reflecting mostly a micro supervision perspective. The macroprudential function has added a new dimension to stress testing. It requires going well beyond summing up the individual bank results. Such a step is necessary to properly assess the macroeconomic impact of stress-results. As a by-product, the resulting enhanced stress testing capabilities should enable the assessment of the impact of macroprudential measures. The underlying framework has to embed spillovers – within the banking sector, to other sectors, including the real economy – also allowing for banks’ own reactions that can also spill over to other segments of the economy.

A new framework for stress testing must therefore combine the objectives of the two policy functions, micro and macro supervision in a complementary manner. It is a challenging objective but one the ECB is actively pursuing.

Thank you for your attention.

[1]“The fiscal impact of financial sector support during the crisis” in ECB Economic Bulletin, issue 6/ 2015-Articles.

[2]Acharya, V., R. Engle and M. Richardson (2012), “Capital Shortfall: A New Approach to Ranking and Regulating Systemic Risks”, American Economic Review: Papers & Proceedings, 102(3).

[3]Steffen, S. and V. Acharya (2014), “Making Sense of the Comprehensive Assessment”, October and S. Steffen, (2014), “Robustness, Validity and Significance of the ECB’s Asset Quality Review and Stress Test Exercise”, SAFE Goethe University Frankfurt, White Paper No. 23.

[4]Henry, J. and C. Kok Eds., (2013), “A macro stress testing framework for assessing systemic risk in the banking sector”, ECB Occasional Paper No. 152.

[5]G. Hałaj, (2013), “Optimal asset structure of a bank - bank reactions to stressful market conditions”, ECB Working Paper Series No. 1533.

[6]Ampudia, M., H. van Vlokhoven and D. Żochowski, (2014), “Financial fragility of euro area households”, ECB Working Paper Series No. 1737.

[7]Gross, M. and J. Poblacion, (2015), “The Integrated Dynamic Household Balance Sheet (IDHBS) Model of the Euro Area Household Sector for Stress Testing and Assessing the Efficacy of Macro-Prudential Policy Measures”, mimeo, ECB.

[8]Brunnermeier, M., G. Gorton and A. Krishnamurthy, (2012) “Risk Topography”. NBER Macroeconomics Annual 2011 26 (2012): 149-176.

[9]Along the lines of R. Greenwood, A. Landier and D. Thesmar, “Vulnerable Banks”, Journal of Financial Economics, forthcoming or L. Cappiello and D. Supera 2014, “Fire-sale externalities in the euro area banking sector”, ECB Financial Stability Review, November 2014.

[10]Darracq Paries, M., C. Kok, and D. Rodriguez Palenzuela (2011) “Macroeconomic propagation under different regulatory regimes: evidence from an estimated DSGE model for the euro area” International Journal of Central Banking, December.

[11] Clerc, L., A. Derviz, C. Mendicino, S. Moyen, K. Nikolov, L. Stracca, J. Suarez and A. P. Vardoulakis, (2015) “Capital regulation in a macroeconomic model with three layers of default” International Journal of Central Banking, June.

[12]See: Gross, M., C. Kok and D. Żochowski, (2015), ”The impact of bank capital on economic activity: Evidence from a Mixed-Cross-Section GVAR model”, mimeo, European Central Bank; Gray, D., M. Gross, J. Paredes and M. Sydow, (2013), “Modeling Banking, Sovereign, and Macro Risk in a CCA Global VAR”, IMF Working Paper 13/218; Gross, M. and C. Kok, (2013), “Measuring contagion potential among sovereigns and banks using a mixed-cross-section GVAR”, ECB Working Paper Series No. 1570.

[13]Budnik K., L. Cappiello, H. Kick and G. Nicoletti, (2015), “Financial shocks, bank balance sheet variables and financial spill-overs in the Euro area”, mimeo, European Central Bank.

[14]Behn, M., M. Gross, T. Peltonen, (2015), Assessing capital-based macroprudential policy using an integrated Early Warning GVAR model”, mimeo, European Central Bank.

[15]Ari, A., C. Kok, M. Darracq Paries and D. Żochowski, (2015), “Shadow banking in general equilibrium”, mimeo, European Central Bank.

[16]See http://www.financialstabilityboard.org/2015/09/meeting-of-the-financial-stability-board-in-london-on-25-september/

Európska centrálna banka

Generálne riaditeľstvo pre komunikáciu

- Sonnemannstrasse 20

- 60314 Frankfurt nad Mohanom, Nemecko

- +49 69 1344 7455

- media@ecb.europa.eu

Šírenie je dovolené len s uvedením zdroja.

Kontakty pre médiá