24 March 2023

The ECB is for the first time disclosing the carbon footprint of its own investment portfolios and the Eurosystem’s corporate sector holdings. Executive Board members Frank Elderson and Isabel Schnabel explain the progress made and the next steps needed to decarbonise the portfolios of the ECB and the Eurosystem.

Climate change is upon us and we are running out of time to stop the worst of its consequences.[1] Central banks don’t make climate policy, but we do have a clear role to play. Climate change affects the core of our mandate – price stability – through its effect on the economy and inflation. It also has implications for the stability of our financial system. That’s why in 2021 we presented our first action plan to include climate change considerations in our monetary policy strategy. That’s why in 2022 we took significant steps within our mandate to incorporate climate change considerations in our monetary policy operations. And that’s why we committed to regularly review our actions to ensure that we reduce the carbon footprint of the financial assets that we hold for our monetary policy operations in line with the goals of the Paris Agreement and EU climate neutrality objectives.[2] In addition, we want to reduce the carbon footprint of our non-monetary policy portfolios (NMPPs), that is, other financial assets that we hold for instance for the purposes of the ECB’s pension funds or our own funds portfolio[3], in order to achieve our target of carbon neutrality by 2050.

To stay the course on our climate commitments we need a clear view of where we have come from, where we are now and how far we still need to go. For that, we need comprehensive, reliable and relevant information.

Therefore we have collected, and are now publishing, for the first time, climate-related information about the carbon footprint of the Eurosystem’s corporate sector holdings under the corporate sector purchase programme (CSPP) and the pandemic emergency purchase programme (PEPP).[4] We have also released disclosures about our NMPPs.[5] These disclosures are part of a collective effort by all central banks within the Eurosystem, and they give us a first picture of where we stand in the decarbonisation of these portfolios.

Moving towards a lower carbon footprint

So how are we progressing in decarbonising our portfolios?

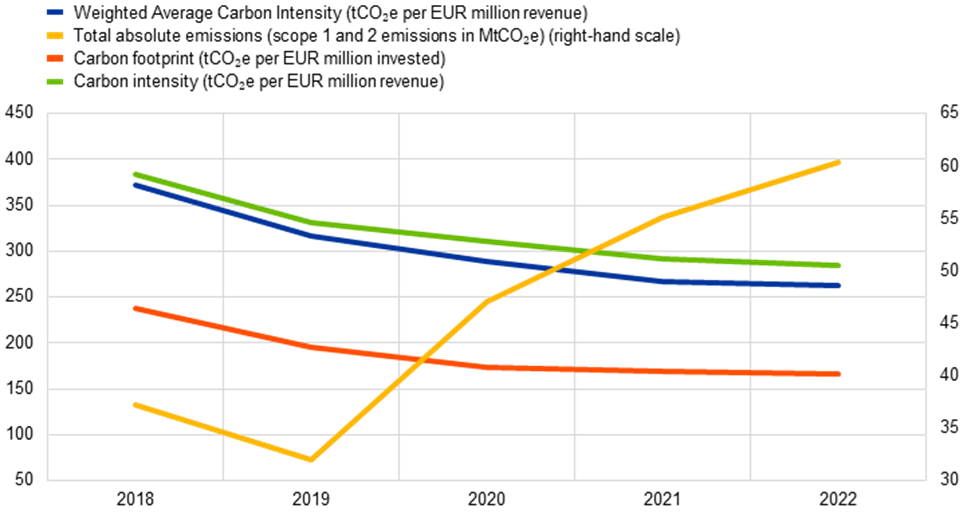

Between 2018 and 2022, as part of our accommodative monetary policy, the Eurosystem purchased significant amounts of corporate bonds under its CSPP and PEPP programmes. However, the data show that despite these corporate sector holdings growing by 123% from 2018 to 2022, the total carbon emissions[6] increased by much less, namely by 62% in the same period (Chart 1). This means that the portfolios became less emissions-intensive in relative terms, as their growth was almost double the growth of the associated emissions.

The total emissions of our corporate sector portfolio have increased because the portfolio itself has grown. To assess how the carbon footprint has evolved relative to the greater size of the portfolio, we need to look beyond absolute emissions and consider normalised metrics like carbon intensity.[7] Overall, the portfolios’ carbon intensity gradually decreased by about 26% from 2018 to 2022 (Chart 1), mainly because of companies’ own efforts to reduce their emissions. This shows that although they still need to do more to become Paris-aligned, the efforts of the companies in our portfolios to cut their emissions and become more carbon-efficient are already yielding positive results.

Chart 1

Evolution of climate-related metrics for the Eurosystem’s corporate sector portfolios from 2018 to 2022

(left-hand scale: tonnes of CO₂ equivalent (tCO₂e)/EUR million, right-hand scale: megatonnes of CO₂ equivalent (MtCO₂e)

Sources: ISS, Bloomberg and ECB calculations.

Note: Climate data for 2022 were not available by the cut-off date for this report. Therefore, 2022 figures only account for changes in holdings and are expected to be revised in subsequent reports in the light of updated climate data. WACI stands for weighted average carbon intensity.

The disclosures also show that our own efforts are bearing fruit. In October 2022 the Eurosystem started tilting its corporate sector bond holdings towards issuers with a better climate performance to manage climate-related financial risk and support the transition to a sustainable economy in line with its mandate. Taking a closer look at the carbon intensity of the reinvestments made after this period – in comparison with the carbon intensity of the entire portfolio – we can see that purchases made in the fourth quarter of 2022 were more than 65% less carbon-intensive than those made in the first three quarters of the year. Future disclosures, which we will publish each year, will give us a better idea of how this trend evolves over time.

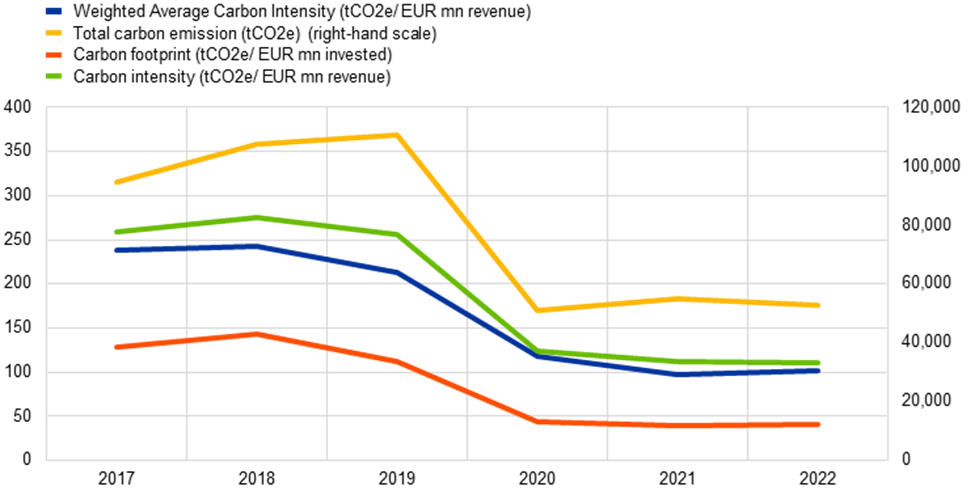

We have also already cut in half the total carbon emissions of our equity and corporate bond investments since 2019 (Chart 2), which make up most of the ECB’s staff pension fund. This suggests that our efforts have to date been effective and have contributed to keeping our decarbonisation path aligned with the goals of the Paris Agreement.

Chart 2

Evolution of key metrics for corporate investments in the staff pension fund

(left-hand scale: tonnes of CO₂ equivalent (tCO₂e)/EUR million, right-hand scale: tCO₂e)

Sources: ISS, Carbon4 Finance, World Bank, Bloomberg and ECB calculations.

Notes: The chart shows historic values of the key metrics for the pension fund’s corporate investments (equity + corporate bonds) based on issuers’ scope 1 + 2 emissions. Metrics are calculated using market values for equities and nominal values for bonds. Emissions normalisation in the weighted average carbon intensity and the carbon intensity is based on revenue in EUR millions; and in the carbon footprint based on investment amount in EUR millions.

The road ahead: staying the course to Paris

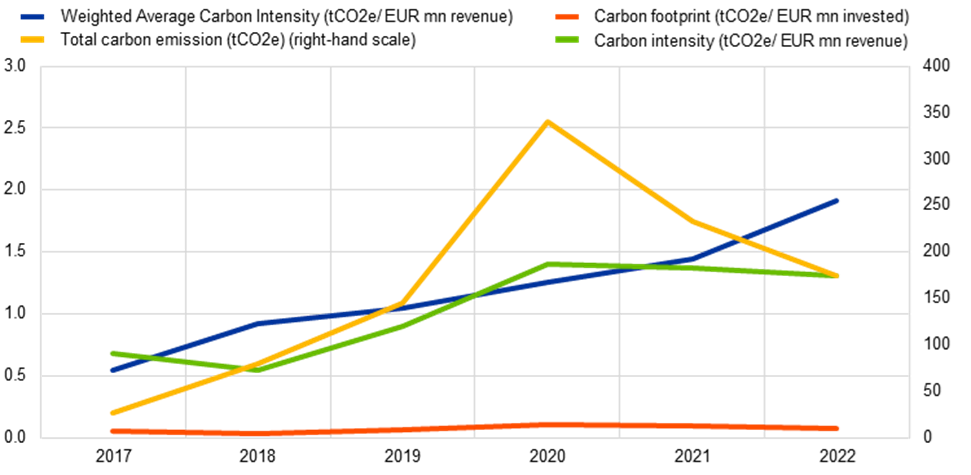

Despite this progress, the disclosures reveal that we still have a lot of ground to cover to keep decarbonising our portfolios in line with the objectives of the Paris Agreement. This is true, in particular, for our own funds portfolio, which is mainly invested in bonds issued by euro area governments. How much these decarbonise depends largely on the efforts of those governments to stick to their commitments, given that they have signed the Paris Agreement and are bound by the European Climate Law.

Chart 3

Evolution of key metrics for supranational, agency and covered bond investments in the own funds portfolio

(EUR billions)

Sources: ISS, Carbon4 Finance, World Bank, Bloomberg, ECB calculations

Notes: The chart shows historic values of the four key metrics for the own funds supranational-, agency and covered bond investments based on issuers’ scope 1 + 2 emissions. Metrics are calculated using bonds’ nominal values.

The current landscape is evolving quickly, including the outlook for the economy, our monetary policy stance, and the ever more tangible impact of the climate crisis. This calls on us to regularly revisit our approach to deliver on the climate-related goals that follow from our mandate.

For instance, as we tighten our monetary policy, the absolute amount of emissions associated with our holdings will decline as our holdings become smaller. But since we are purchasing fewer bonds in total as part of our reinvestment strategy, we have fewer opportunities to tilt our Eurosystem corporate sector reinvestments towards companies with a better climate performance. In February, we announced that the remaining reinvestments would be tilted more strongly to mitigate this effect.[8] Going forward, we may need to rethink and adjust the overall approach more fundamentally.

Moreover, while our tilting approach supports issuers to be more climate-conscious, they in fact need to act more quickly and decisively to reduce the carbon footprint of their business activities for our portfolios to decarbonise in time. This means we need to continuously rethink our climate-related measures to further strengthen the incentives for companies to reduce their emissions further, in line with our mandate. As part of this continuous adaptation of our approach, we may need to be more ambitious in other areas: our collateral framework, our lending operations, or our holdings of public sector bonds. The latter currently account for around half of our balance sheet and most of our own funds portfolio.[9]

Precisely for this purpose, our disclosures are useful. They are an annual data-based “check-up”, allowing us to assess the performance of our tilting framework and, if necessary, recalibrate it. We will improve the quality of our disclosures and broaden their scope to include further portfolios. This will enhance transparency and set an example for other institutions. And, since we know that interim decarbonisation targets will be crucial for keeping us on track to meet our climate goals, we will set quantitative, portfolio-specific interim targets for our NMPPs, up to the point of reaching our long-term target of climate neutrality by 2050 at the latest. We will also consider setting interim targets for Eurosystem corporate sector portfolios. Over time, our disclosures will help us to steer the reduction of the emissions of our asset holdings and keep us on track towards our ultimate goal: to align everything we do with the goals of the Paris Agreement.

Paving the path towards a green economy together

The necessary transformation of the economy and financial system can only be achieved by proactive and swift action across borders and sectors. Central banks can and should be part of this concerted effort.

Most of all, governments need to be more ambitious in delivering on their climate commitments and create a regulatory and economic landscape that provides the right incentives for net zero emissions. In concrete terms, they should, for example, introduce comprehensive carbon pricing and support innovation in areas like renewable energies. Crucially, this must be a joint effort at the European and global levels. In this respect, mandatory and globally comparable rules on climate-related disclosures, including clear and timely transition paths to net zero, would be very helpful. We want to use our disclosures to lead by example and help accelerate these political efforts.

This knowledge is the basis for concrete action. Once countries, businesses and banks have access to better data on how they contribute to climate change and the risks they face because of it, they can make more accurate plans to support a Paris-aligned decarbonisation path. At the same time, better and more reliable information will allow investors to confidently direct funding towards the green transition. Importantly, this would also foster the realisation of a green capital markets union in Europe.

With war raging in Europe and a challenging macroeconomic and financial landscape, it is easy to lose sight of the climate and environmental crises that are unfolding.[10] We will not allow this to happen. By becoming more transparent about the climate impact of our investments and holdings, we can and will contribute to paving a clearer pathway towards the goals of the Paris Agreement.

Subscribe to the ECB blogIntergovernmental Panel on Climate Change (2023), “AR6 Synthesis Report: Climate Change 2023”, 20 March.

See ECB (2022), “ECB takes further steps to incorporate climate change into its monetary policy operations”, 4 July.

The objective of the ECB’s own funds portfolio is to generate income to help fund the operating expenses of the ECB that are not related to the delivery of its supervisory tasks. The own funds portfolio predominantly invests the ECB’s financial resources, namely the ECB’s paid-up capital, the amounts set aside in general reserves and the general provision for financial risks.

See ECB (2023) “ECB starts disclosing climate impact of portfolios on road to Paris-alignment”, 23 March.

Nominal Eurosystem corporate bond holdings under CSPP and PEPP stand at €385.2 billion as at year-end 2022. The value of the ECB own funds portfolio and the ECB staff pension fund at year-end 2022 stood at €21 billion and €1.83 billion respectively.

The total carbon emissions metric measures the absolute emissions (Scope 1 and Scope 2 and in mega tonnes of CO2e) associated with a portfolio and serves as a proxy for a portfolio’s financed contribution to global warming.

Carbon intensity is measured in tonnes of CO2 emissions for every million euros of issuers’ revenue and it allows us to make comparisons over time and across portfolios.

See ECB (2023), “Monetary policy decisions”, 2 February.

Schnabel, I. (2023), “Monetary policy tightening and the green transition”, speech at the International Symposium on Central Bank Independence, Sveriges Riksbank, Stockholm, 10 January.

See Lagarde, C. (2022), “Painting the bigger picture: keeping climate change on the agenda”, ECB Blog post, 7 November.