Introduction

The results reported in the April 2020 bank lending survey (BLS) relate to changes observed during the first quarter of 2020 and expectations for the second quarter of 2020. The survey was conducted between 19 March and 3 April 2020. A total of 144 banks were surveyed in this round, with a response rate of 99%. In addition to results for the euro area as a whole, this report also contains results for the four largest euro area countries.[1]

A number of ad hoc questions were included in the April 2020 survey. They look at the impact that the situation in financial markets has had on banks’ access to retail and wholesale funding, the impact of the ECB’s asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP), the impact of the ECB’s negative deposit facility rate and the ECB’s two-tier system for remunerating excess liquidity holdings, as well as the impact of the ECB’s third series of targeted longer‑term refinancing operations (TLTRO III).

1 Overview of results

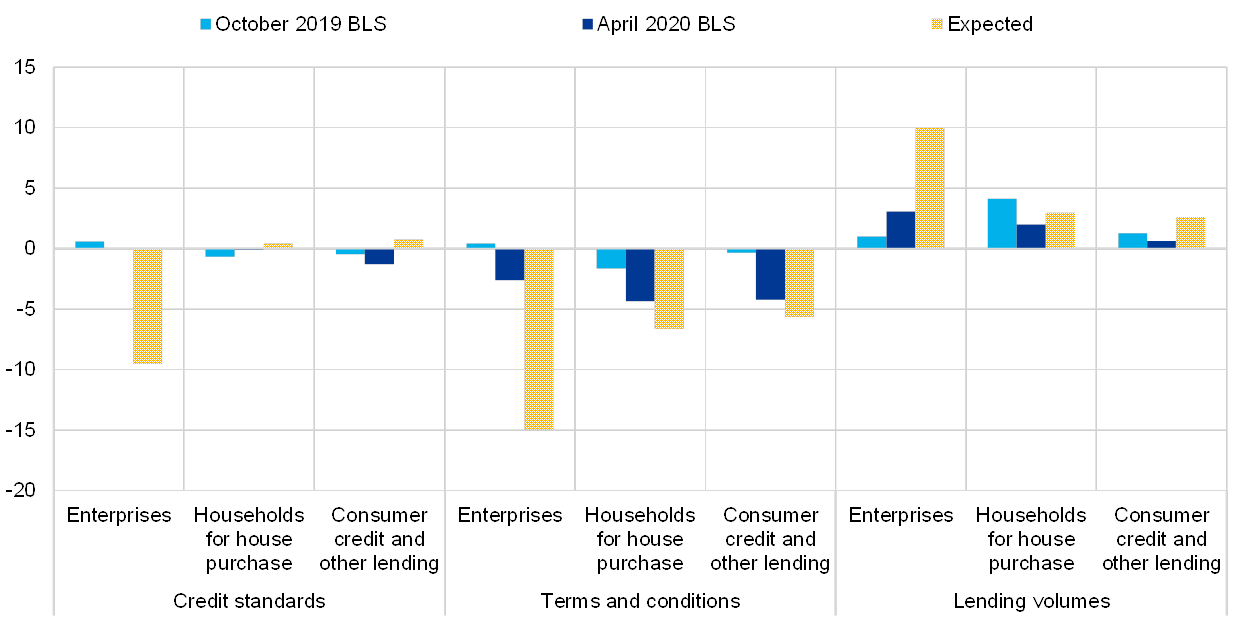

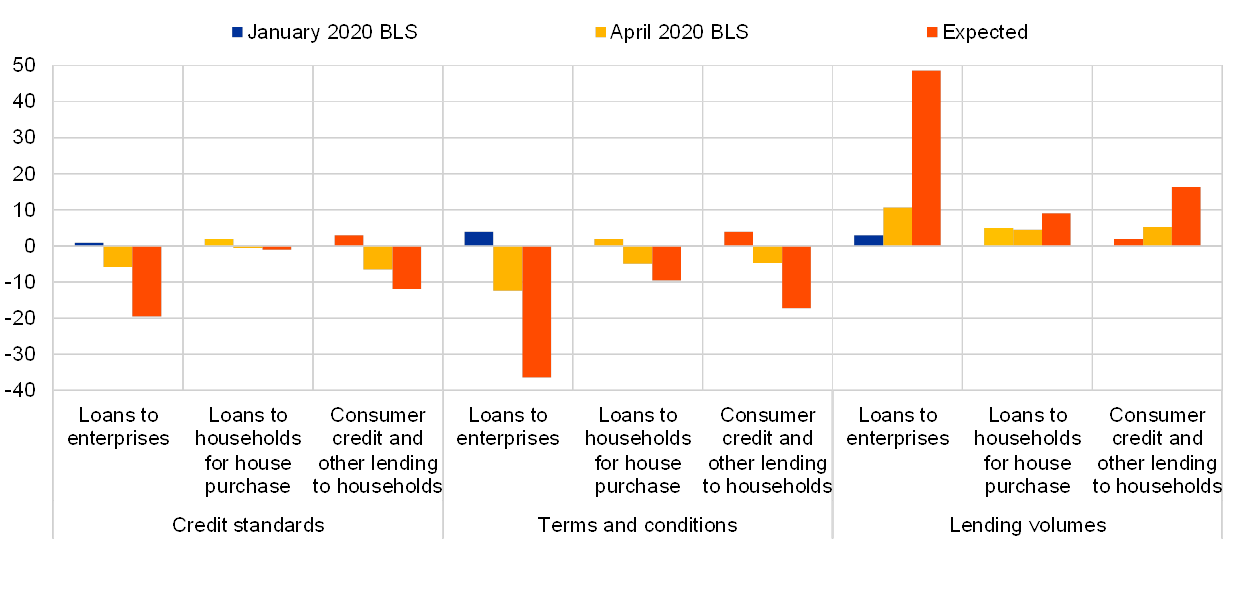

The results of the April 2020 euro area bank lending survey (BLS) show a clear upward impact of the coronavirus (COVID-19) pandemic on firms’ loan demand, largely driven by emergency liquidity needs. The impact on credit standards was however contained in the first quarter of 2020 and the net percentage of banks reporting a tightening of credit standards for loans or credit lines to firms was small compared with the financial and sovereign debt crises. This is related to the size and timeliness of policy measures and the higher resilience of euro area banks. In the second quarter, banks expect credit standards to ease considerably for firms, probably on account of the support measures introduced by governments. At the same time, the dispersion in banks’ responses highlights the high uncertainty with respect to the likely impact of the coronavirus pandemic and banks’ different views concerning the impact on bank lending conditions.

Firms’ demand for loans or drawing of credit lines surged in the first quarter of 2020, on account of firms’ emergency liquidity needs. In the second quarter, firms’ loan demand is expected to increase further, to the highest net balance since the start of the survey in 2003.

Credit standards for loans to households tightened somewhat more strongly than for enterprises in the first quarter of 2020, related to the deterioration of the economic outlook, a worsening of the creditworthiness of households and a lower risk tolerance of banks. The worsening of the outlook is also reflected in a lower net increase in demand for housing loans and lower net demand for consumer credit in the first quarter. A continued net tightening of credit standards and a strongly negative net balance for household loan demand are expected by banks in the second quarter of 2020.

Regarding the impact of the ECB’s monetary policy measures, its asset purchase programmes (APP and PEPP) and the TLTRO III operations have had a positive impact on banks’ liquidity positions and market financing conditions. In addition, these measures and the negative deposit facility rate (DFR) have had an easing impact on bank lending conditions and a positive impact on lending volumes. At the same time, the ECB’s asset purchases and the negative DFR are assessed by banks as having a negative impact on their profitability through a negative impact on their net interest income, while a large percentage of banks report that the ECB’s two-tier system for remunerating excess liquidity holdings supports bank profitability.

In more detail, credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans to enterprises tightened in the first quarter of 2020 (a net percentage of reporting banks at 4%, after 1% in the fourth quarter of 2019; see Overview table), compared with expectations of unchanged credit standards in the previous survey round. Compared with the financial and sovereign debt crises, where net percentages of more than 60% and around 30% respectively were reached at the euro area level, the tightening was small. The current results are influenced by the size and timeliness of policy measures and the stronger capital position of euro area banks. In addition, banks indicated that they were not yet able to fully evaluate the effects of the coronavirus pandemic. The net tightening of credit standards was broadly similar for loans to small and medium-sized enterprises (SMEs) and large firms according to the banks; for long-term loans it was somewhat stronger, while credit standards on short-term loans remained broadly unchanged. Banks referred mainly to the deterioration of the general economic outlook and firms’ increased credit risk as relevant factors for the tightening of their credit standards. In line with financial market developments, some banks also referred to a tightening impact of market financing conditions and of their balance sheet situation, but overall banks showed a much higher resilience compared with previous crises. Moreover, they indicated a somewhat lower risk tolerance as a tightening factor for loans to enterprises.

In the second quarter, banks expect a considerable net easing of credit standards on loans to firms (a net percentage of -11%). While liquidity support measures and loan guarantees by governments only had a limited impact in the first quarter of 2020, as measures were still evolving and could not yet be fully assessed by banks, banks expect a substantial easing impact in the second quarter, which should support the extension of credit to firms. Still, the dispersion among banks is high, showing high uncertainty.

Credit standards on loans to households for house purchase (a net percentage of 9%, after 1% in the previous quarter) and for consumer credit and other lending to households (10%, after 3%) tightened somewhat more strongly than for enterprises in the first quarter of 2020. Banks referred to the deterioration of the economic outlook, a worsening of households’ creditworthiness and lower risk tolerance as relevant factors for the tightening. By contrast, banks’ cost of funds and balance sheet situation had a broadly neutral impact. In the second quarter, banks expect a continued net tightening of credit standards both for housing loans (12%) and for consumer credit (5%), likely reflecting the deteriorating income and employment outlook.

Banks tightened their overall terms and conditions (i.e. banks’ actual terms and conditions agreed in the loan contract) for new loans to enterprises in the first quarter of 2020 (a net percentage of 9%, after 0%). Margins on average loans to non-financial corporations (NFCs) (defined as the spread over relevant market reference rates), and especially margins on riskier NFC loans, widened. In addition, all other terms and conditions, such as collateral requirements, non-interest rate charges and loan maturity, also tightened. Nevertheless, the tightening was moderate. Banks’ overall terms and conditions tightened slightly for housing loans (2%, unchanged from the previous quarter) and for consumer credit and other lending to households (a net percentage of 2%, after -6%).

The rejection rate for loan applications increased across all loan categories. The net percentage of banks reporting an increase remained at 9% for loans to enterprises (unchanged from the previous quarter) and increased for housing loans (6%, after 3%) and, in particular, for consumer credit and other lending to households (12%, after 2%).

Firms’ demand for loans or drawing of credit lines surged in the first quarter of 2020, on account of firms’ emergency liquidity needs in the context of the coronavirus pandemic and the lockdown of large parts of the economy (a net percentage of banks reporting an increase in loan demand at 26%, after -7% in the previous quarter; see Overview table). Banks expect that net demand for loans to firms will increase further in the second quarter of 2020 (a net percentage of 77%), to the highest euro area net balance since the start of the euro area BLS in 2003. Loan demand was higher for large firms (a net percentage of 27%) than for SMEs (19%) and significantly higher in the case of short-term loans (a net percentage of 29%) than long-term loans (5%). This reflects firms’ need to maintain liquidity and ensure ongoing payment needs during the lockdown period. Consistently, the main factor underlying firms’ loan demand in the first quarter was financing needs for inventories and working capital, whereas financing needs for fixed investment and for mergers and acquisitions declined in net terms, related to high uncertainty with respect to the impact of the coronavirus pandemic.

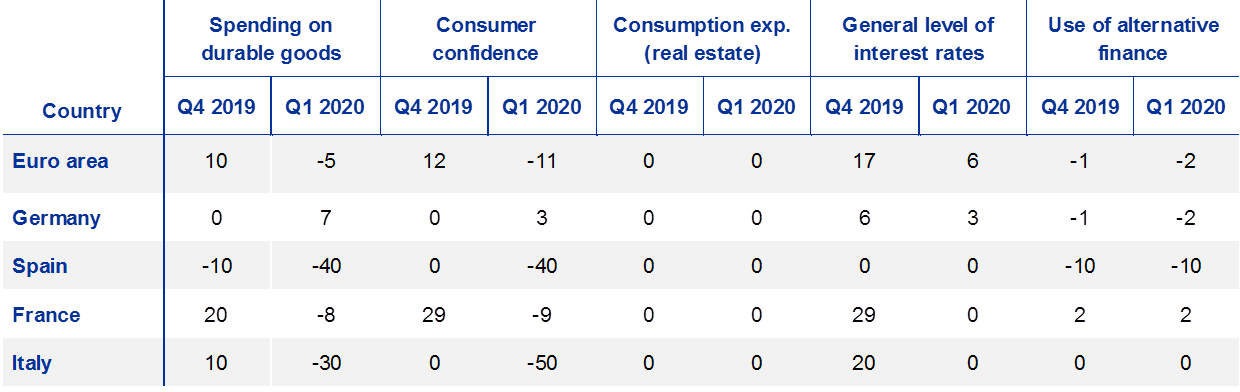

By contrast, net demand for housing loans increased less in the first quarter (a net percentage of banks at 12%, after 25% in the previous quarter) and the net percentage for demand for consumer credit and other lending to households turned negative (-4%, after 10%). A strongly negative net balance for loan demand is expected by banks for housing loans (a net percentage of banks at -67%) and consumer credit (-30%) in the second quarter of 2020. For housing loans, this level would be similar to the realised level in the second half of 2008, when Lehman Brothers collapsed. Net demand for housing loans and consumer credit was supported by the low general level of interest rates but dampened by weak consumer confidence in the first quarter of 2020. For housing loans, the so far positive impact of housing market prospects dropped considerably. For consumer credit, spending on durable consumer goods dampened loan demand, in line with short-term work arrangements and uncertainties about the longer-term employment situation of many households.

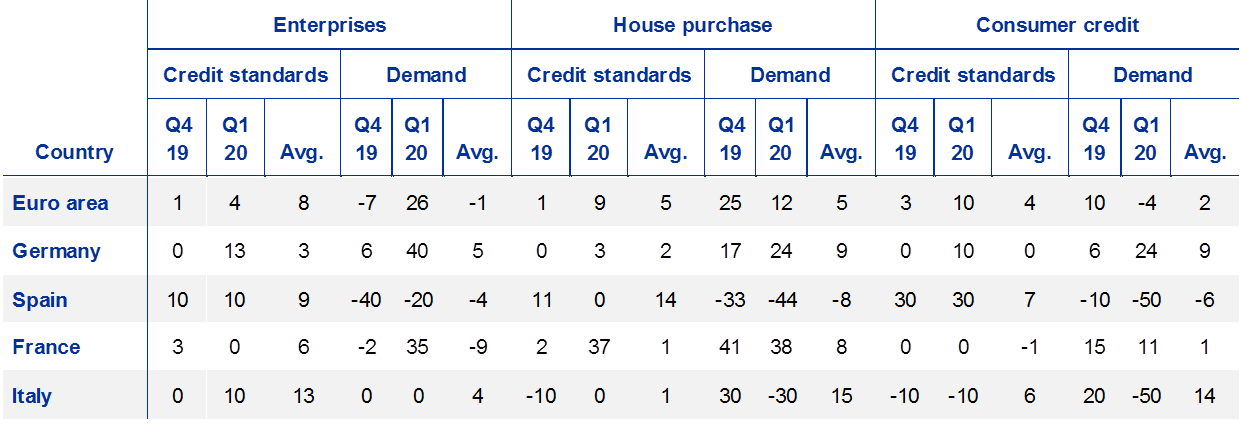

Looking at the four largest euro area countries, credit standards on loans to enterprises tightened in Germany, Spain and Italy in the first quarter of 2020, while they remained unchanged in France (see Overview table). For housing loans, credit standards tightened in Germany and particularly in France (partly related to macroprudential recommendations), but remained unchanged in Spain and Italy. Overall, the tightening was contained compared with the financial and sovereign debt crises in all large countries.

Loan demand developments were heterogeneous across euro area countries. According to the banks, while net demand for loans to enterprises increased considerably in Germany and France in the first quarter of 2020, it declined in Spain and remained unchanged in Italy. For housing loans, net demand continued to increase in Germany and France, while it decreased in Spain and Italy.

Overview table

Latest BLS results for the largest euro area countries

(net percentages of banks reporting a tightening of credit standards or an increase in loan demand)

Notes: The “Avg.” columns contain historical averages, which are calculated over the period since the beginning of the survey, excluding the most recent round. For France, net percentages are weighted on the basis of outstanding loan amounts for individual banks in the respective national samples. Owing to different sample sizes across countries, which broadly reflect the differences in the national shares in lending to the euro area non-financial private sector, the size and volatility of the net percentages cannot be directly compared across countries.

The April 2020 BLS also included a number of ad hoc questions. Regarding euro area banks’ access to retail and wholesale funding, banks reported in net terms that access generally deteriorated in the first quarter of 2020, especially for debt securities and money markets, while the reported deterioration was less severe, in net terms, for retail funding and securitisation.

With respect to the impact of the ECB’s asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP), euro area banks reported a positive impact on their liquidity positions and market financing conditions and a negative impact on their profitability over the past six months. The impact is expected to become more favourable over the next six months, which may be ascribed in particular to the large volume of the ECB’s asset purchases via the PEPP. In addition, banks signalled an easing impact of the APP and PEPP on their credit terms and conditions and a positive impact on their lending volumes across most loan categories, which are expected to continue mainly for loans to enterprises.

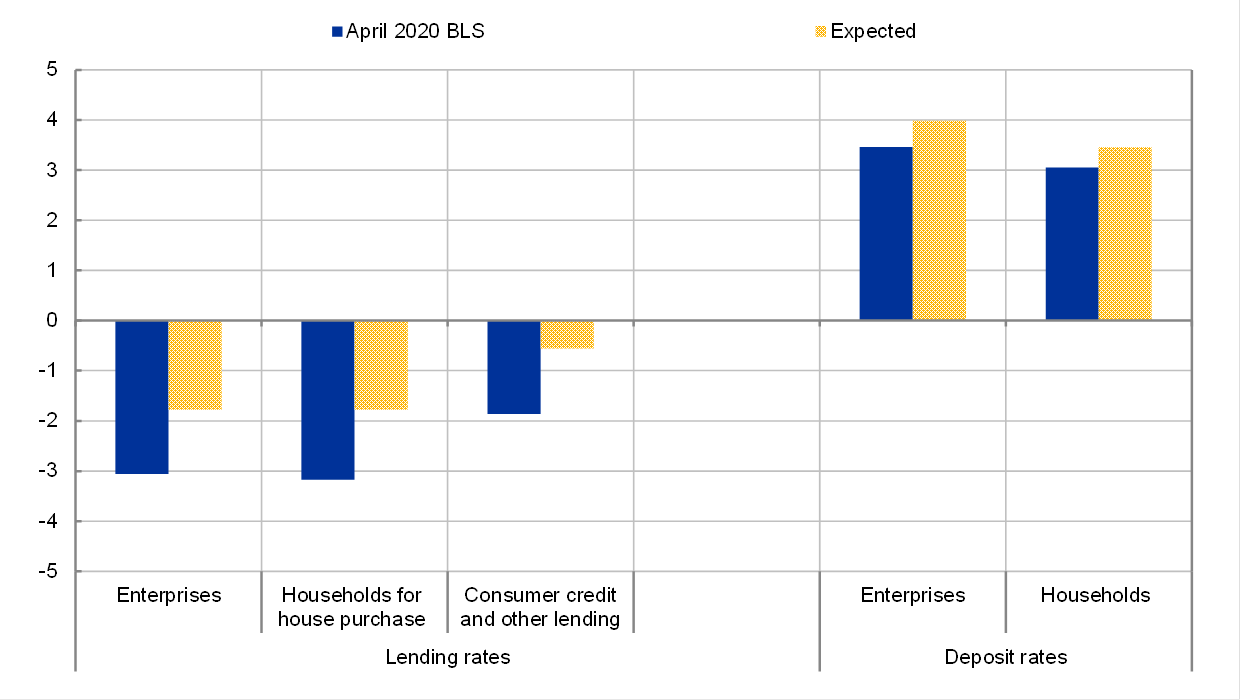

Euro area banks reported that the ECB’s negative DFR, including the ECB’s two-tier system for remunerating excess liquidity holdings, continued to contribute to an increase in lending volumes and a decrease in lending rates across all loan categories. Banks also indicated that the DFR has had a downward impact on their profitability, while the two-tier system has supported bank profitability. In addition, euro area banks indicated, in net terms, a stronger negative impact of the DFR on deposit rates for enterprises than on deposit rates for households over the past six months. To a limited extent, banks also tried to compensate negative rates with higher non-interest rate charges on deposits.

On the impact of the TLTRO III operations, while the profitability motive is the most important reason for banks to participate in the TLTRO III, a considerably increased percentage of euro area banks mentioned the precautionary motive for their expected participation in future TLTROs, likely reflecting the impact of the coronavirus pandemic on banks’ liquidity positions. In addition, banks have indicated that they use, to a large extent, the TLTRO III liquidity for granting loans to the non-financial private sector and for refinancing TLTRO II funding. Banks have also reported an overall positive impact of the TLTRO III on their financial situation, especially on their liquidity positions. With respect to their lending policy, banks have indicated a net easing impact of the TLTRO III on their terms and conditions, more than for credit standards, and a positive net impact on their lending volumes.

Box 1

General notes

The bank lending survey (BLS) is addressed to senior loan officers at a representative sample of euro area banks. In the current round, 144 banks were surveyed, representing all euro area countries and reflecting the characteristics of their respective national banking structures. The main purpose of the BLS is to enhance the Eurosystem’s knowledge of bank lending conditions in the euro area.[2]

BLS questionnaire

The BLS questionnaire contains 22 standard questions on past and expected future developments: 18 backward-looking questions and four forward-looking questions. In addition, it contains one open-ended question. Those questions focus on developments in loans to euro area residents (i.e. domestic and euro area cross-border loans) and distinguish between three loan categories: loans or credit lines to enterprises; loans to households for house purchase; and consumer credit and other lending to households. For all three categories, questions are asked about the credit standards applied to the approval of loans, the terms and conditions of new loans, loan demand, the factors affecting loan supply and demand conditions, and the percentage of loan applications that are rejected. Survey questions are generally phrased in terms of changes over the past three months or expected changes over the next three months. Survey participants are asked to indicate in a qualitative way the strength of any tightening or easing or the strength of any decrease or increase, reporting changes using the following five-point scale: (1) tightened/decreased considerably, (2) tightened/decreased somewhat, (3) basically no change, (4) eased/increased somewhat or (5) eased/increased considerably.

In addition to the standard questions, the BLS questionnaire may contain ad hoc questions on specific topics of interest. Whereas the standard questions cover a three-month time period, the ad hoc questions tend to refer to changes over a longer time period (e.g. over the past and next six months).

Aggregation of banks’ replies to national and euro area BLS results

The responses of the individual banks participating in the BLS are aggregated in two steps. In the first step, the responses of individual banks are aggregated to form national results for euro area countries. And in the second step, those national BLS results are aggregated to form euro area BLS results.

In the first step, banks’ replies can be aggregated to form national BLS results by applying equal weights to all banks in the sample[3] or, alternatively, by applying a weighting scheme based on outstanding loans to non-financial corporations and households for the individual banks in the respective national samples. Specifically, for France, Malta, the Netherlands and Slovakia, an explicit weighting scheme is applied.

In the second step, since the numbers of banks in the national samples differ considerably and do not always reflect those countries’ respective shares of lending to euro area non-financial corporations and households, the national survey results are aggregated to form euro area BLS results by applying a weighting scheme based on national shares of outstanding loans to euro area non-financial corporations and households.

BLS indicators

Responses to questions relating to credit standards are analysed in this report by looking at the difference (the “net percentage”) between the percentage of banks reporting that credit standards applied in the approval of loans have been tightened and the percentage of banks reporting that they have been eased. For all questions, the net percentage is determined on the basis of all participating banks that have business in or exposure to the respective loan categories (i.e. they are all included in the denominator when calculating the net percentage). This means that banks that specialise in certain loan categories (e.g. banks that only grant loans to enterprises) are only included in the aggregation for those categories. All other participating banks are included in the aggregation of all questions, even if a bank replies that a question is “not applicable” (“NA”). This harmonised aggregation method was introduced by the Eurosystem in the April 2018 BLS. It has been applied to all euro area and national BLS results in the current BLS questionnaire, including backdata.[4] The resulting revisions for the standard BLS questions have generally been small, but revisions for some ad hoc questions have been larger owing to a higher number of “not applicable” replies by banks.

A positive net percentage indicates that a larger proportion of banks have tightened credit standards (“net tightening”), whereas a negative net percentage indicates that a larger proportion of banks have eased credit standards (“net easing”).

Likewise, the term “net demand” refers to the difference between the percentage of banks reporting an increase in loan demand (i.e. an increase in bank loan financing needs) and the percentage of banks reporting a decline. Net demand will therefore be positive if a larger proportion of banks have reported an increase in loan demand, whereas negative net demand indicates that a larger proportion of banks have reported a decline in loan demand.

In the assessment of survey balances for the euro area, net percentages between -1 and +1 are generally referred to as “broadly unchanged”. For country results, net percentage changes are reported in a factual manner, as differing sample sizes across countries mean that the answers of individual banks have differing impacts on the magnitude of net percentage changes.

In addition to the “net percentage” indicator, the ECB also publishes an alternative measure of banks’ responses to questions relating to changes in credit standards and net demand. This measure is the weighted difference (“diffusion index”) between the percentage of banks reporting that credit standards have been tightened and the percentage of banks reporting that they have been eased. Likewise, as regards demand for loans, the diffusion index refers to the weighted difference between the percentage of banks reporting an increase in loan demand and the percentage of banks reporting a decline. The diffusion index is constructed in the following way: lenders who have answered “considerably” are given a weight (score of 1) which is twice as large as that given to lenders who have answered “somewhat” (score of 0.5). The interpretation of the diffusion indices follows the same logic as the interpretation of net percentages.

Detailed tables and charts based on the responses provided can be found in Annex 1 for the standard questions and Annex 2 for the ad hoc questions. In addition, BLS time series data are available on the ECB’s website via the Statistical Data Warehouse.

A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can all be found at: https://www.ecb.europa.eu/stats/ecb_surveys/bank_lending_survey/html/index.en.html

2 Developments in credit standards, terms and conditions, and net demand for loans in the euro area

2.1 Loans to enterprises

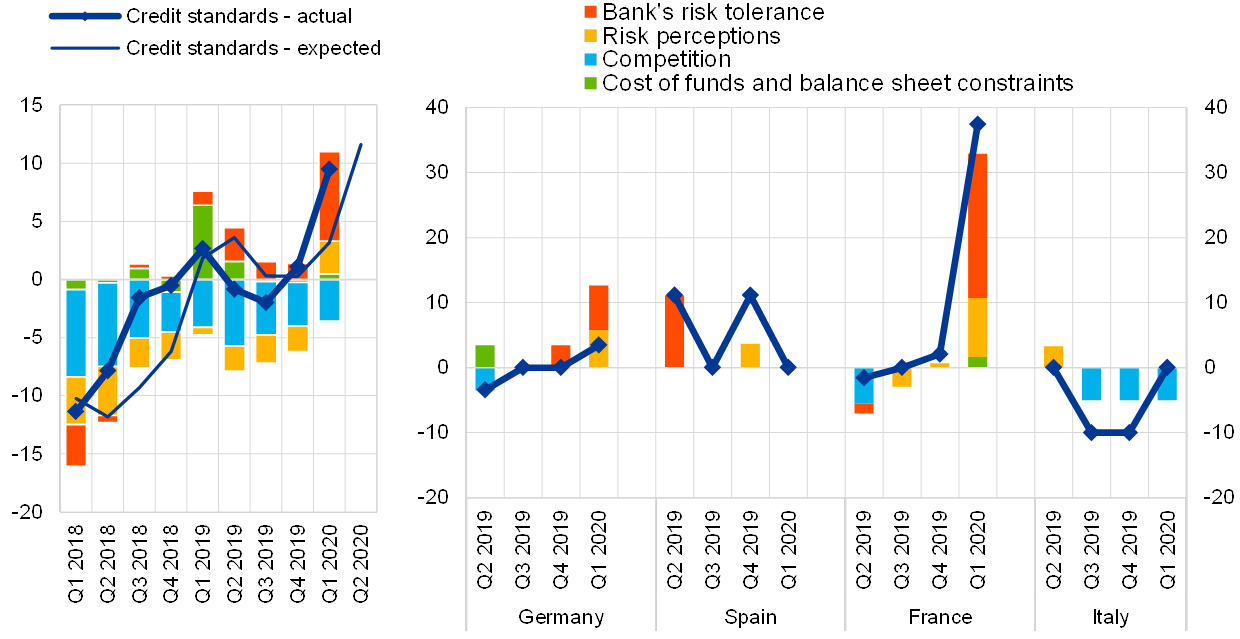

Credit standards for loans to enterprises tightened

Credit standards (i.e. banks’ internal guidelines or loan approval criteria) for loans to enterprises tightened in the first quarter of 2020 (a net percentage at 4%, after 1% in the fourth quarter of 2019; see Chart 1 and Overview table). At the same time, the dispersion of banks’ answers increased considerably, highlighting the significant uncertainty surrounding the effects of the coronavirus pandemic and banks’ different views on the impact on bank lending conditions. The net percentage remained below the historical average since 2003. Compared with the financial and sovereign debt crises, where net percentages of more than 60% and around 30% respectively were reached at the euro area level, the tightening was small. These results are influenced by the size and timeliness of policy measures and the stronger capital position of euro area banks. In addition, banks indicated that they were not yet able to fully evaluate the effects of the coronavirus pandemic.

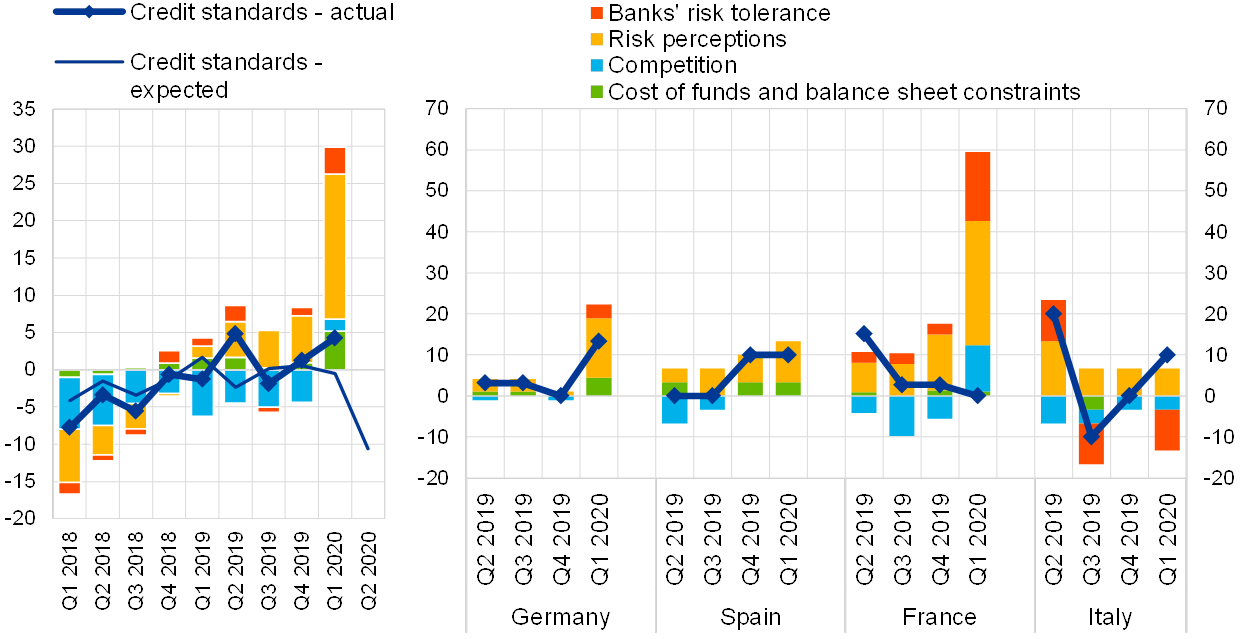

Chart 1

Changes in credit standards applied to the approval of loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for responses to questions related to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing. “Cost of funds and balance sheet constraints” is the unweighted average of “costs related to capital position”, “access to market financing” and “liquidity position”; “risk perceptions” is the unweighted average of “general economic situation and outlook”, “industry or firm-specific situation and outlook/borrower’s creditworthiness” and “risk related to the collateral demanded”; “competition” is the unweighted average of “competition from other banks”, “competition from non-banks” and “competition from market financing”.

The net tightening of credit standards was broadly similar for loans to SMEs (4%) and large firms (3%); it was somewhat stronger for long-term loans (5%), while credit standards on short-term loans remained broadly unchanged (1%).

Banks referred mainly to the deterioration of the general economic outlook and firms’ increased credit risk as relevant factors for the tightening of their credit standards (see Chart 1 and Table 1). In line with financial market developments, some banks also referred to a tightening impact of market financing conditions and their balance sheet situation, but overall banks showed a much higher resilience compared with previous crises. Moreover, they indicated a somewhat lower risk tolerance as a tightening factor for their credit standards on loans to enterprises.

Among the largest euro area countries, credit standards on loans to enterprises tightened in Germany, Spain and Italy in the first quarter of 2020, while they remained unchanged in France. Liquidity support measures and loan guarantees by governments only had a limited impact in the first quarter, as measures were still evolving and could not yet be fully assessed by banks.

Euro area banks expect a considerable net easing of credit standards for firms (a net percentage at -11%) in the second quarter of 2020, probably on account of the liquidity support measures and loan guarantees introduced by governments. At the same time, there has been a substantial increase in the dispersion of banks’ responses to higher levels than during previous crises. This signals high uncertainty about the likely impact of the coronavirus pandemic and the different views of banks on the impact on bank lending conditions.

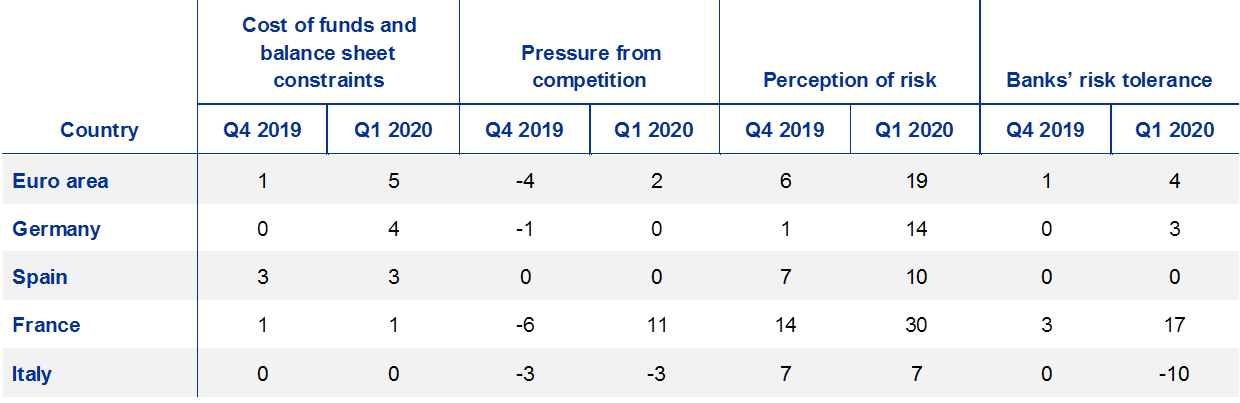

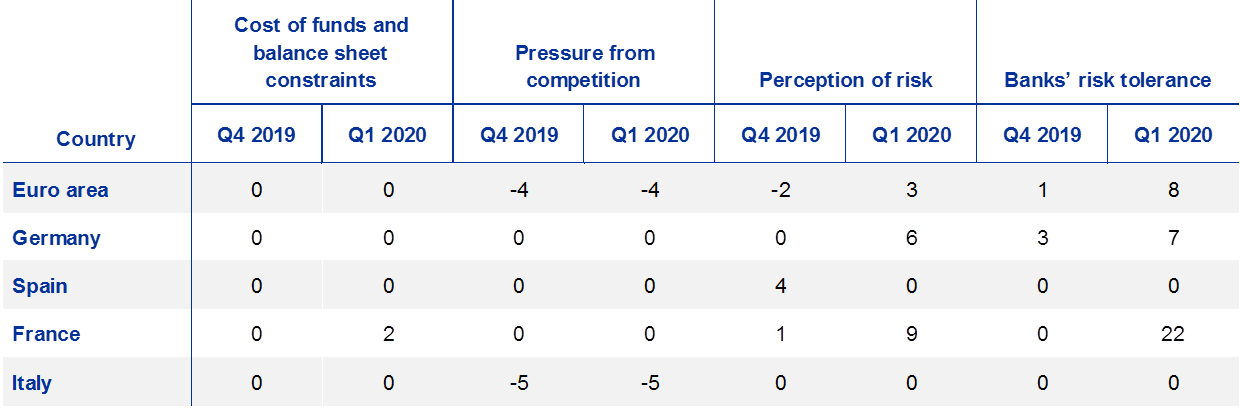

Table 1

Factors contributing to changes in credit standards for loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 1.

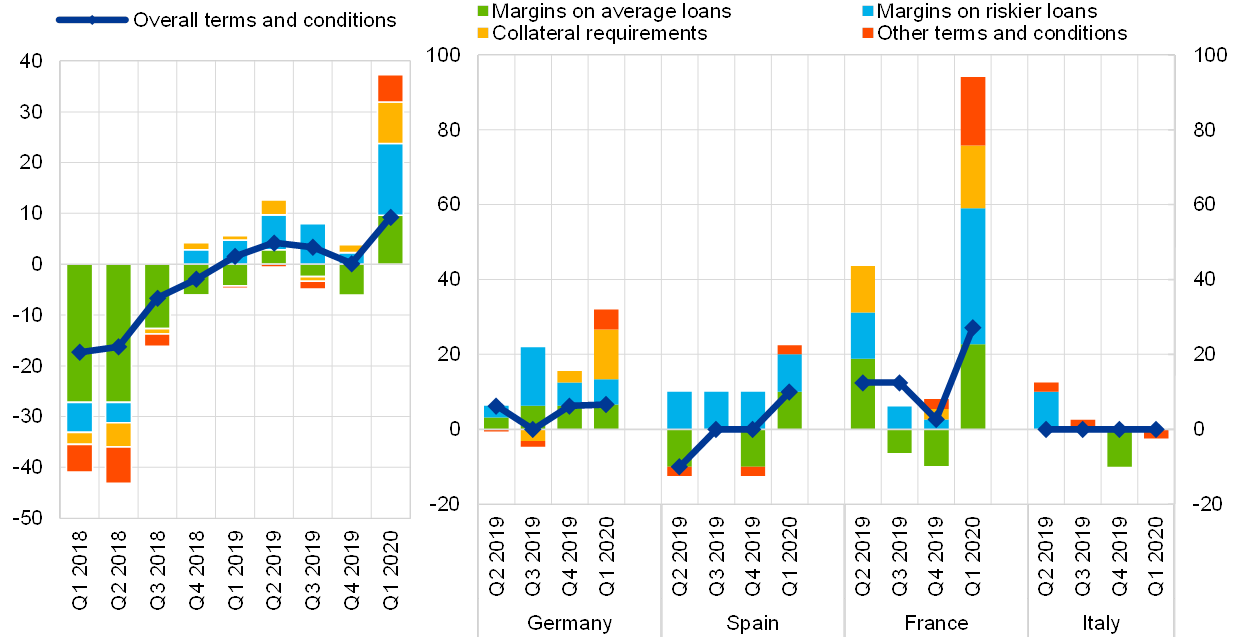

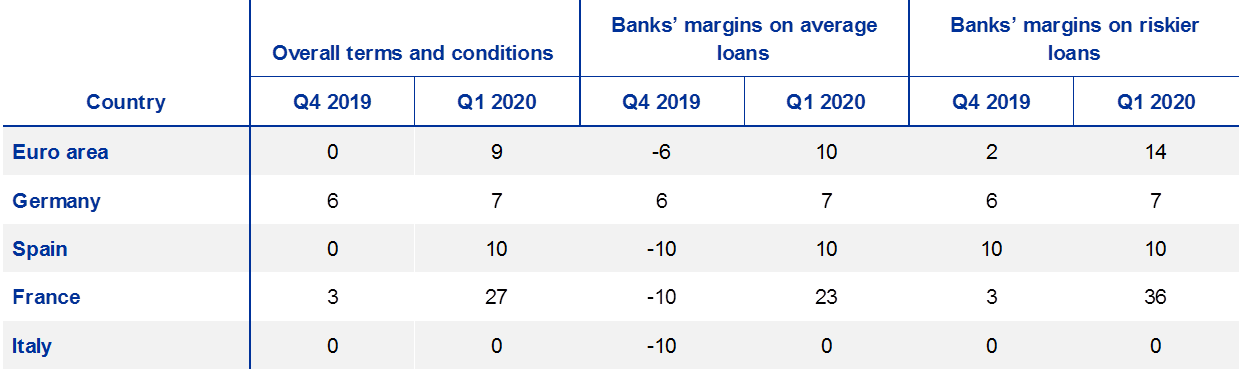

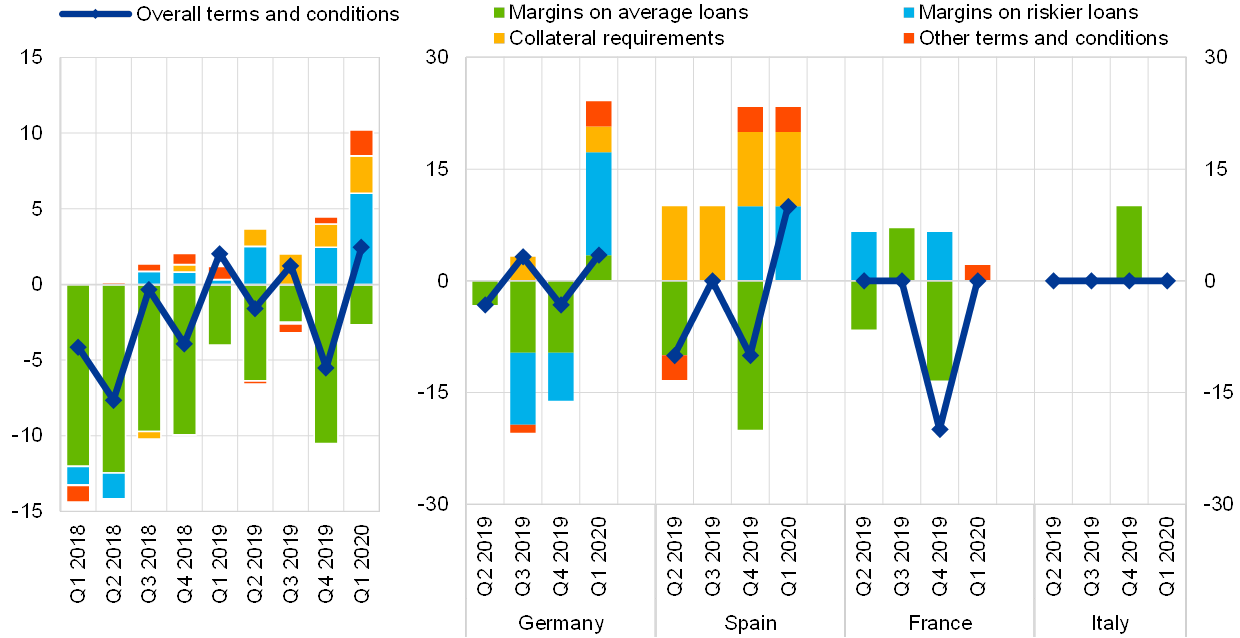

Terms and conditions on loans to enterprises tightened

In the first quarter of 2020, banks tightened their overall terms and conditions (i.e. banks’ actual terms and conditions agreed in the loan contract) for new loans to enterprises (a net percentage of 9%, after 0%; (see Chart 2 and Table 2). Margins on average loans to firms (defined as the spread over relevant market reference rates), and especially margins on riskier loans to firms, widened. In addition, all other terms and conditions, such as collateral requirements, non-interest rate charges and loan maturity, also tightened. Nevertheless, the tightening was moderate.

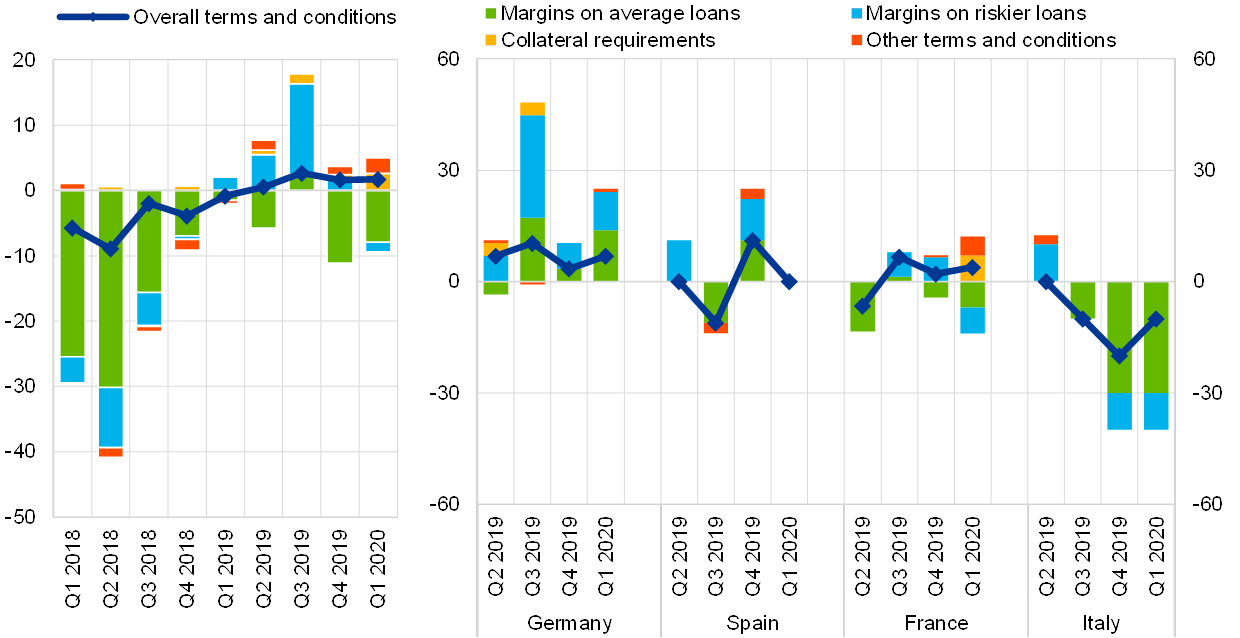

Chart 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “non-interest rate charges”, “size of the loan or credit line”, “loan covenants” and “maturity”.

Risk perceptions were the main contributor to the net tightening of overall terms and conditions (see Table 3). To a smaller extent, banks’ cost of funds and balance sheet constraints also contributed to the tightening, while competitive pressures continued to have an easing impact on overall terms and conditions. Banks’ risk tolerance contributed slightly to the tightening of terms and conditions.

Across the largest euro area countries, overall terms and conditions on new loans or credit lines to enterprises tightened in Germany, Spain and France, while they remained unchanged in Italy. The tightening was related to a widening of margins on average and riskier loans. In Germany and France, collateral requirements and other terms and conditions, for instance loan covenants, also contributed to the tightening of terms and conditions.

Table 2

Changes in terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 2.

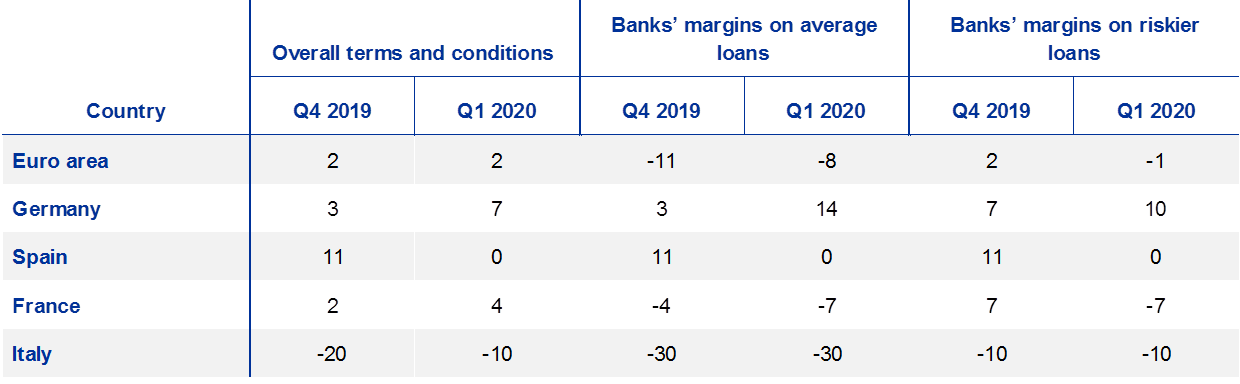

Table 3

Factors contributing to changes in overall terms and conditions on loans or credit lines to enterprises

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

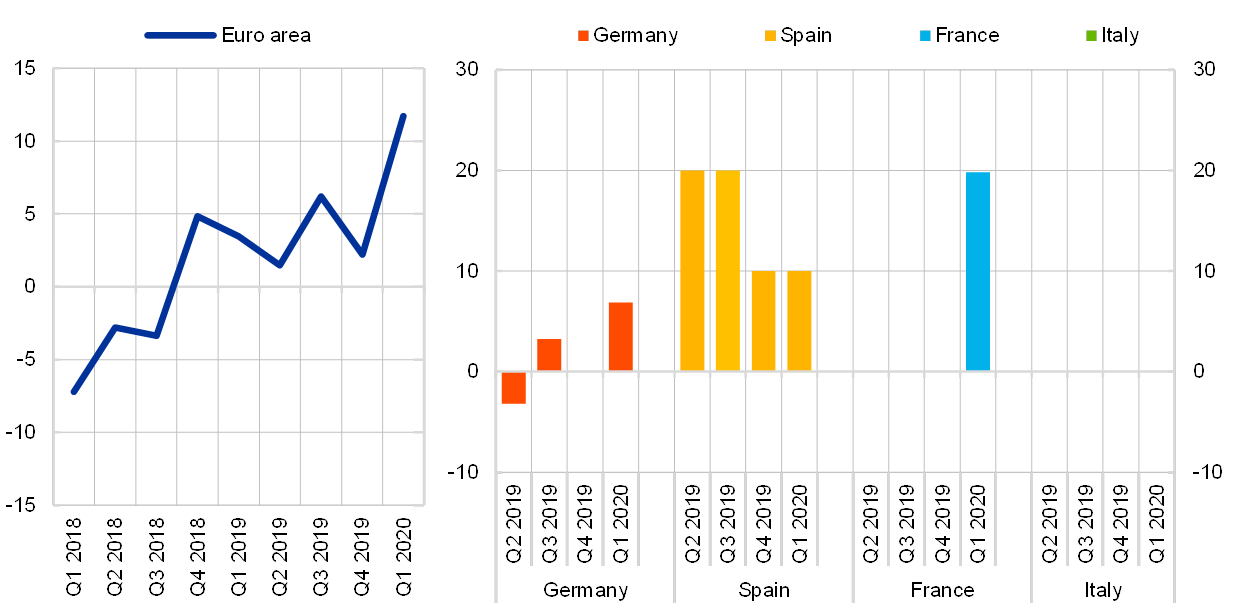

Rejection rate for loans to enterprises increased

In the first quarter of 2020, the rejection rate for loans to euro area enterprises continued to increase (i.e. a higher percentage of banks indicated an increase in the share of rejected loan applications than a decrease). The net percentage stood at 9% (broadly unchanged from the previous quarter; see Chart 3).

Chart 3

Changes in the rejection rate for loans to enterprises

(net percentages of banks reporting an increase in the share of rejections)

Note: Net percentages of rejected loan applications are defined as the difference between the percentages of banks reporting an increase in the share of loan rejections and the percentages of banks reporting a decline. Banks‘ responses refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

The combination of tighter credit standards, a steep net increase in firms’ loan demand and the same net increase in the rejection rate as in the previous quarter suggests that banks were still evaluating firms’ loan requests. This would be in line with anecdotal information about large numbers of incoming loan requests from firms, which banks need to evaluate with respect to the overall or, in case of state loan guarantees, residual credit risk. In addition, rejection rates may not have increased further, as firms were drawing previously committed credit lines for which no new approval was needed.

Across the largest euro area countries, the net rejection rate increased in Germany and Spain, while it remained unchanged in France and declined in Italy.

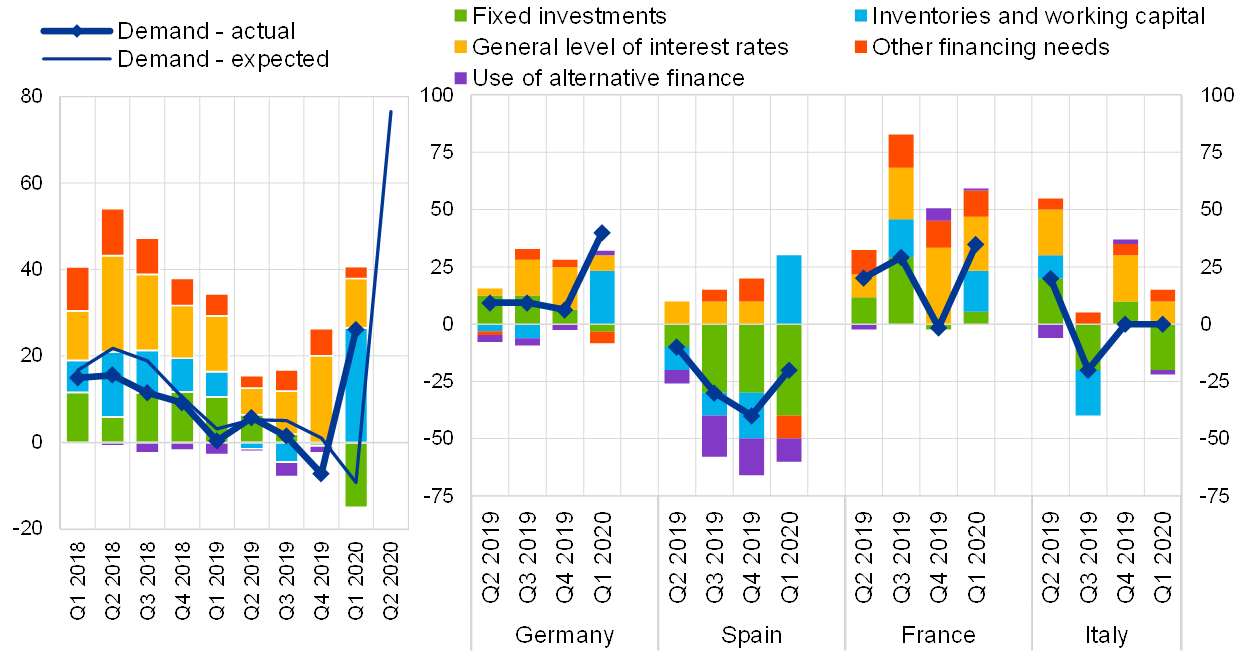

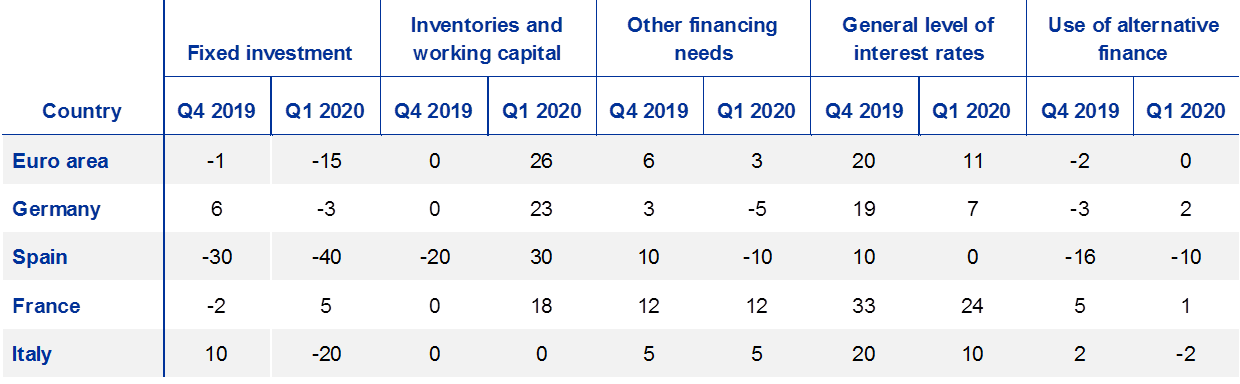

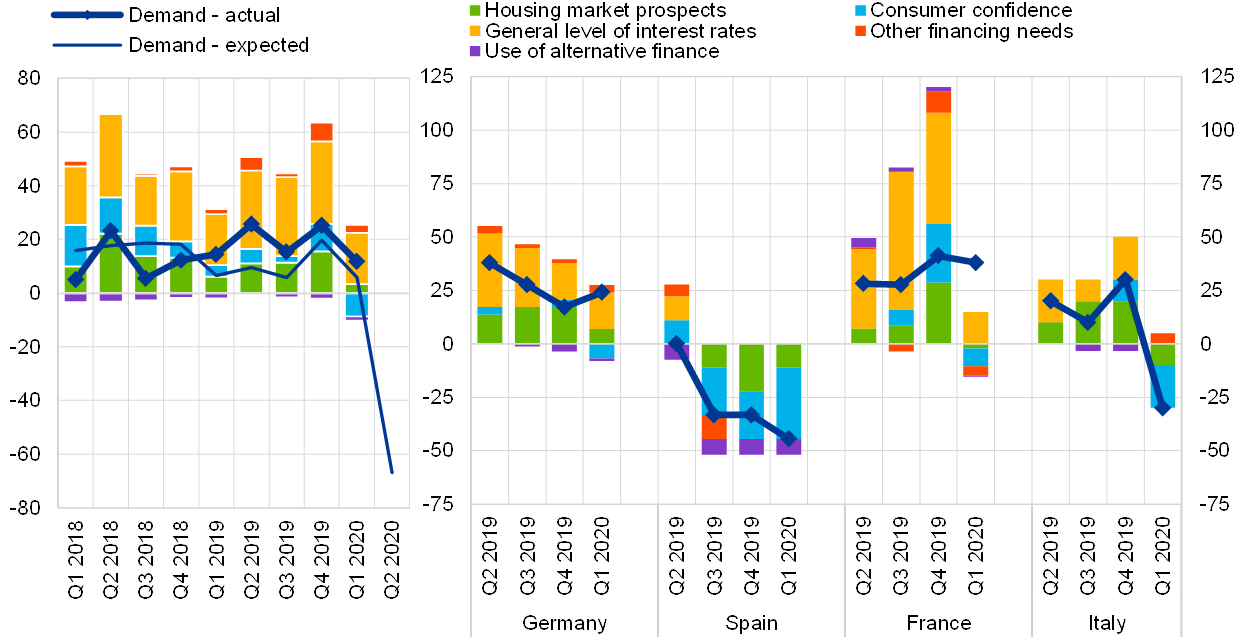

Net demand for loans to enterprises surged

The impact of the coronavirus pandemic is particularly evident in banks’ indications on firms’ demand for loans or credit lines, the net percentage of which surged to 26% in the first quarter (after -7% in the fourth quarter of 2019; see Chart 4 and Overview table). This reflects firms’ emergency liquidity needs to cover ongoing payment needs (e.g. for rents or employees) during the lockdown period. It also indicates that firms are drawing previously committed credit lines. In addition, given the opposite impact of the coronavirus pandemic on financing needs for short-term emergency liquidity and long-term investment, the dispersion in banks’ responses increased to levels which were last seen in 2009.

Chart 4

Changes in demand for loans or credit lines to enterprises and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: “Actual” values are changes that have occurred, while “expected” values are changes anticipated by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”. The net percentages for responses to questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to increasing demand and the percentage reporting that it contributed to decreasing demand. “Other financing needs” is the unweighted average of “mergers/acquisitions and corporate restructuring” and “debt refinancing/restructuring and renegotiation”; “use of alternative finance” is the unweighted average of “internal financing”, “loans from other banks”, “loans from non-banks”, “issuance/redemption of debt securities” and “issuance/redemption of equity”.

Loan demand was higher for large firms (a net percentage of 27%) than for SMEs (19%) and significantly higher for short-term loans (29%) than for long-term loans (5%). In line with this, the main factor underlying firms’ loan demand in the first quarter were financing needs for inventories and working capital, whereas financing needs for fixed investment and for mergers and acquisitions declined in net terms (see Chart 4 and Table 4).[5] This reflects firms’ acute liquidity needs and firms’ uncertainty with respect to the impact of the coronavirus, leading to lower financing needs for fixed investment.

Table 4

Factors contributing to changes in demand for loans or credit lines to enterprises

(net percentages of banks)

Note: See the notes to Chart 4.

Loan demand developments were heterogeneous for firms across euro area countries. According to the banks, while net demand for loans to enterprises increased considerably in Germany and France, it declined in Spain and remained unchanged in Italy in the first quarter of 2020.

In the second quarter of 2020, banks expect that net demand for loans to firms will increase further (a net percentage of 77%), resulting in the highest euro area net balance since the start of the BLS in 2003.

2.2 Loans to households for house purchase

Credit standards for loans to households for house purchase tightened

Credit standards for loans to households for house purchase tightened in the first quarter of 2020, after standards had remained broadly unchanged in the previous quarter (9%, after 1%; see Chart 5 and Overview table). The net percentage has been above the historical average since 2003. Still, it remained overall moderate compared with the financial crisis.

Banks referred to a lower risk tolerance and a worsening creditworthiness of households as relevant factors for the tightening. By contrast, banks’ cost of funds and balance sheet situation had a neutral impact (see Chart 5 and Table 5).

Chart 5

Changes in credit standards applied to the approval of loans to households for house purchase, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: See the notes to Chart 1. “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “housing market prospects, including expected house price developments” and “borrower’s creditworthiness”; “competition” is the unweighted average of “competition from other banks” and “competition from non-banks”.

Across the largest euro area countries, credit standards tightened in Germany and particularly in France, but remained unchanged in Spain and Italy. Banks in Germany and, in particular, in France referred to a lower risk tolerance of banks for granting housing loans, as well as to higher risk perceptions related to the general economic outlook, housing market prospects and borrowers’ creditworthiness. For France, banks also referred to the macroprudential recommendations by the French High Council for Financial Stability in December 2019 as an important tightening factor. By contrast, banks in Spain and Italy did not indicate any changes in credit standards on housing loans in the first quarter of 2020. This may be related to an earlier coronavirus pandemic effect on firms than on households.

Table 5

Factors contributing to changes in credit standards for loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 5.

Looking ahead, euro area banks expect that credit standards for housing loans will tighten further (a net percentage of 12%) in the second quarter of 2020.

Terms and conditions on loans to households for house purchase tightened slightly

Banks’ overall terms and conditions tightened slightly for housing loans (a net percentage of 2%, unchanged from the previous quarter). The net tightening was mainly related to a tightening impact of loan-to-value ratios and collateral requirements, while margins on average loans continued to narrow and margins on riskier loans remained broadly unchanged (see Chart 6 and Table 6).

Chart 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “loan-to-value ratio”, “other loan size limits”, “non-interest rate charges” and “maturity”.

Competitive pressures had an easing impact on overall terms and conditions on housing loans at the euro area level. At the same time, higher risk perceptions and a lower risk tolerance of banks had a tightening impact (see Table 7).

Across the largest euro area countries, banks in Germany and France reported a net tightening of overall terms and conditions on housing loans, while banks in Italy reported an easing and banks in Spain unchanged overall terms and conditions. While wider loan margins were the main contributor to the tightening for German banks, other terms and conditions, such as collateral requirements and loan-to-value ratios, were reported by French banks, partly related to the macroprudential recommendations of the French High Council for Financial Stability.

Table 6

Changes in terms and conditions on loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 6.

Table 7

Factors contributing to changes in overall terms and conditions on loans to households for house purchase

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

Rejection rate for housing loans increased

In the first quarter of 2020, a higher net percentage of banks reported an increase in the share of rejected loan applications for housing loans than in the previous quarter (6%, after 3% in the previous survey round; see Chart 7).

Across the largest euro area countries, the rejection rate for housing loans increased in France, while it remained unchanged in Germany and Italy and declined in Spain. The increase of the net rejection rate in France corresponded with tighter credit standards of French banks following macroprudential recommendations, as explained above.

Chart 7

Changes in the rejection rate for loans to households for house purchase

(net percentages of banks reporting an increase in the share of rejections)

Note: Net percentages of rejected loan applications are defined as the difference between the percentages of banks reporting an increase in the share of loan rejections and the percentages of banks reporting a decline. Banks‘ responses refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

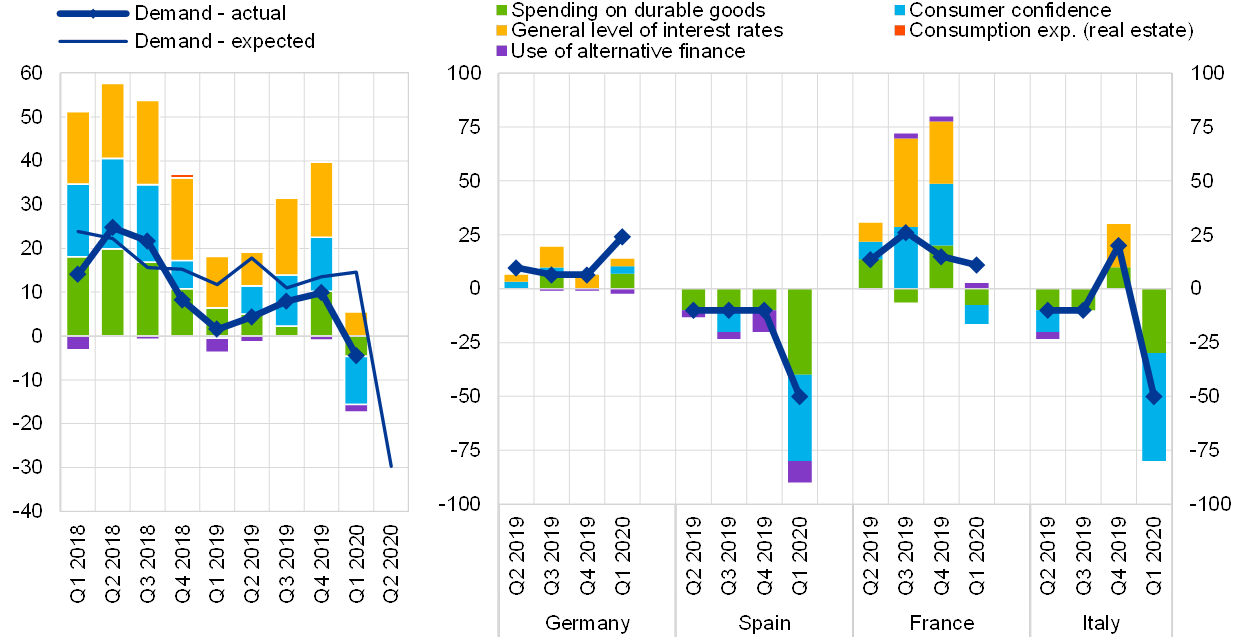

Lower net increase in demand for housing loans

In the first quarter of 2020, banks reported a lower net increase in demand for housing loans (12%, after 25% in the previous quarter; see Chart 8 and Overview table), i.e. the share of banks indicating an increase in loan demand compared with the share of banks reporting a decline in loan demand was lower than in the previous quarter. Still, the net percentage remained above the historical average for housing loan demand.

Chart 8

Changes in demand for loans to households for house purchase, and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: See the notes to Chart 4. “Other financing needs” is the unweighted average of “debt refinancing/restructuring and renegotiation” and “regulatory and fiscal regime of housing markets”; “use of alternative finance” is the unweighted average of “internal finance of house purchase out of savings/down payment”, “loans from other banks” and “other sources of external finance”.

Housing loan demand continued to be driven mainly by the low general level of interest rates, but was dampened by weak consumer confidence in the first quarter of 2020. In addition, the so far positive impact of housing market prospects dropped considerably. Other financing needs, such as debt refinancing/restructuring, supported housing loan demand. The use of alternative sources of finance continued to have a slightly negative effect on demand, mainly on account of internal financing from household savings (see Chart 8 and Table 8).

Across the largest euro area countries, net demand for housing loans increased in Germany and France, mainly on account of the low level of interest rates, but declined in Spain and Italy. The impact of housing market prospects was mostly negative, except in the case of Germany, where it became considerably smaller but remained positive. Consumer confidence dampened housing loan demand in all countries, likely related to the impact of the coronavirus pandemic on households’ income and employment situation.

In the second quarter of 2020, banks expect a strongly negative net balance for housing loan demand (a net percentage of -67%). This net percentage would be similar to that in the second half of 2008, when Lehman Brothers collapsed.

Table 8

Factors contributing to changes in demand for loans to households for house purchase

(net percentages of banks)

Note: See the notes to Chart 8.

2.3 Consumer credit and other lending to households

Credit standards for consumer credit and other lending to households tightened further

In the first quarter of 2020, credit standards for consumer credit and other lending to households tightened further (10%, after 3% in the previous quarter; see Chart 9 and Overview table). This has been the strongest net tightening since the first quarter of 2013 and was above the historical average since 2003.

Chart 9

Changes in credit standards applied to the approval of consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting a tightening of credit standards and contributing factors)

Notes: See the notes to Chart 1. “Risk perceptions” is the unweighted average of “general economic situation and outlook”, “creditworthiness of consumers” and “risk on the collateral demanded”; “competition” is the unweighted average of “competition from other banks” and “competition from non-banks”.

Higher risk perceptions related to the general economic outlook and a lower risk tolerance of banks were the most important factors contributing to the net tightening of credit standards on consumer credit in the first quarter of 2020 (see Chart 9 and Table 9).

Across the largest euro area countries, credit standards for consumer credit and other lending to households tightened in Germany and Spain, while they remained unchanged in France and eased in Italy. The reported tightening in Germany and Spain was mainly related to higher risk perceptions and banks’ lower risk tolerance.

Looking ahead to the second quarter of 2020, euro area banks expect a continued net tightening of credit standards on consumer credit and other lending to households (5%).

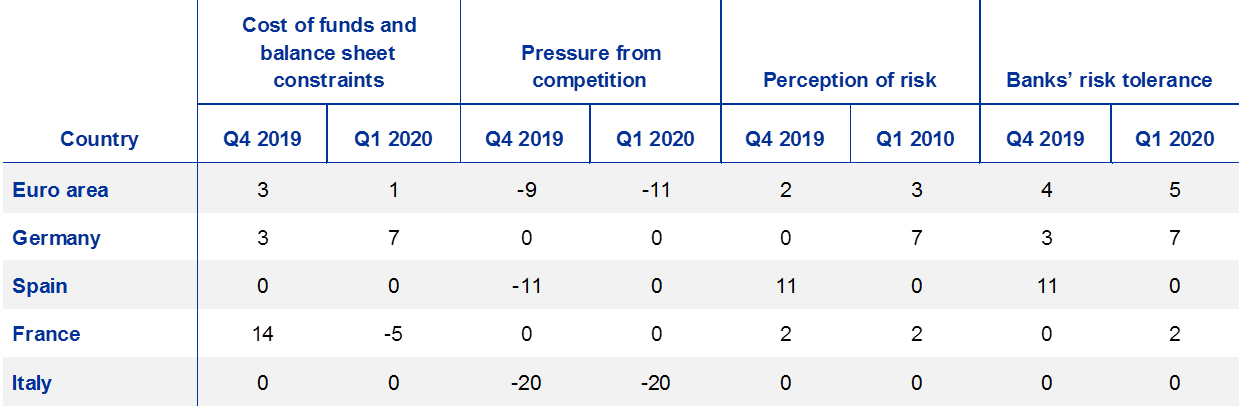

Table 9

Factors contributing to changes in credit standards for consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 9.

Terms and conditions on consumer credit and other lending to households tightened slightly

In the first quarter of 2020, banks’ overall terms and conditions applied when granting new consumer credit and other lending to households tightened slightly (a net percentage of 2%, after -6% in the previous quarter), mainly due to a widening of margins on riskier loans. In addition, collateral requirements and loan size (included in other terms and conditions) also contributed to the tightening of banks’ overall terms and conditions. Margins on average loans continued to narrow, but less than in the previous quarter (see Chart 10 and Table 10).

Chart 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks reporting a tightening of terms and conditions)

Notes: “Margins” are defined as the spread over a relevant market reference rate. “Other terms and conditions” is the unweighted average of “size of the loan”, “non-interest rate charges” and “maturity”.

Table 10

Changes in terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 10.

The main factor underlying the net tightening of overall terms and conditions was a lower risk tolerance of banks (see Table 11).

Across the largest euro area countries, overall terms and conditions on consumer credit and other lending to households tightened in Germany and Spain, while they remained unchanged in France and Italy. Wider loan margins, higher collateral requirements and loan size were the main factors contributing to the tightening in Germany and Spain.

Table 11

Factors contributing to changes in overall terms and conditions on consumer credit and other lending to households

(net percentages of banks)

Note: The net percentages for these questions relating to contributing factors are defined as the difference between the percentage of banks reporting that the given factor contributed to a tightening and the percentage reporting that it contributed to an easing.

Rejection rate for consumer credit and other lending to households increased

In the first quarter of 2020, a considerably higher net percentage of banks indicated an increase in the share of rejected loan applications for consumer credit and other lending to households (12%, after 2% in the previous survey round; see Chart 11). This was the highest share reached since the introduction of this indicator in 2015 and may point to the deteriorated income and employment outlook.

Across the largest euro area countries, the rejection rate increased for banks in Germany, Spain and France, while it remained unchanged in Italy.

Chart 11

Changes in the rejection rate for consumer credit and other lending to households

(net percentages of banks reporting an increase in the share of rejections)

Note: Net percentages of rejected loan applications are defined as the difference between the percentage of banks reporting an increase in the share of loan rejections and the percentage of banks reporting a decline. Banks‘ responses refer to the share of rejected loan applications relative to the total volume of applications in that loan category.

Net demand for consumer credit and other lending to households declined

In the first quarter of 2020, the percentage of banks indicating a decline in demand for consumer credit and other lending to households outweighed the percentage of banks reporting an increase (a net percentage at -4%, after 10% in the previous quarter; see Chart 12 and Overview table). The percentage has been below its historical average since 2003.

Considerably weaker consumer confidence and lower spending on durable goods dampened consumer credit demand (see Chart 12 and Table 12). By contrast, the low general level of interest rates continued to support demand for consumer credit, but less than before.

Across the largest euro area countries, net demand for consumer credit and other lending to households increased in Germany and France, while it declined in Spain and Italy. Weaker consumer confidence and lower spending on durable goods dampened consumer credit demand in all large countries, except Germany.

In the second quarter of 2020, euro area banks expect net demand for consumer credit and other lending to households to decrease further (a net percentage of banks at -30%), which would be the lowest net percentage (based on realised values) since the second quarter of 2012.

Chart 12

Changes in demand for consumer credit and other lending to households, and contributing factors

(net percentages of banks reporting an increase in demand and contributing factors)

Notes: See the notes to Chart 4. “Use of alternative finance” is the unweighted average of “internal financing out of savings”, “loans from other banks” and “other sources of external finance”. “Consumption exp. (real estate)” denotes “consumption expenditure financed through real estate-guaranteed loans”.

Table 12

Factors contributing to changes in demand for consumer credit and other lending to households

(net percentages of banks)

Note: See the notes to Chart 12.

3 Ad hoc questions

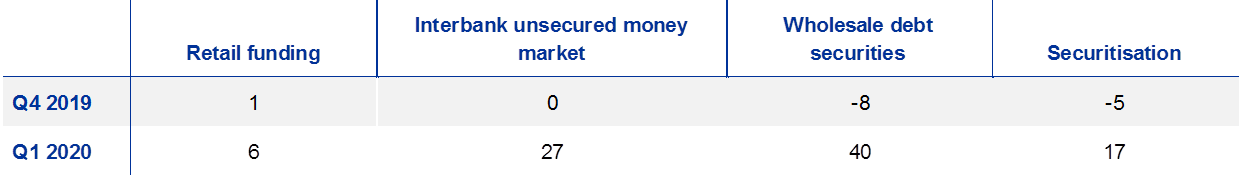

3.1 Banks’ access to retail and wholesale funding

The April 2020 survey included a question assessing the extent to which the situation in financial markets had affected banks’ access to retail and wholesale funding. Banks were asked whether their access to funding had deteriorated or eased over the past three months, as well as about their expectations for the next three months. Here, negative net percentages indicate an improvement, while positive figures indicate a deterioration in net terms.

For the first quarter of 2020, euro area banks reported in net terms that their access to retail and wholesale funding has deteriorated overall (see Chart 13 and Table 13). In particular, banks reported a strong deterioration in access to funding via short-term and long-term debt securities and to money markets. This reflected the overall increase in bank bond yields, notwithstanding some recent recovery, and developments in money markets in the first quarter of 2020. Access to securitisation was also indicated to have deteriorated.[6] As regards retail funding, access to long-term deposit funding was reported to have deteriorated, which may be related to firms’ liquidity needs.

Chart 13

Banks’ assessment of funding conditions and the ability to transfer credit risk off the balance sheet

(net percentages of banks reporting a deterioration in market access)

Note: These net percentages are defined as the difference between the sum of the percentages for “deteriorated considerably” and “deteriorated somewhat” and the sum of the percentages for “eased somewhat” and “eased considerably”.

Looking ahead to the second quarter of 2020, euro area banks expect a continued deterioration in their access to funding. This may reflect expectations by banks of a negative impact of the coronavirus pandemic on bond prices, partly related to an expected dampening impact of the crisis on bank profitability.

Table 13

Banks’ assessment of funding conditions and the ability to transfer credit risk off the balance sheet

(net percentages of banks reporting a deterioration in market access)

Note: See the notes to Chart 13.

3.2 The impact of the ECB’s asset purchase programmes

The April 2020 survey questionnaire included two bi-annual ad hoc questions gauging the impact of the ECB’s asset purchase programme (APP) and the pandemic emergency purchase programme (PEPP). When answering the questions on the impact over the past and next six months, banks were asked to take into account the impact of the ECB’s net asset purchases and the reinvestment of the principal payments from maturing securities purchased. Banks were also asked to consider both direct and indirect effects of the APP and PEPP, as there may be indirect effects on banks’ financial situation and asset allocation.

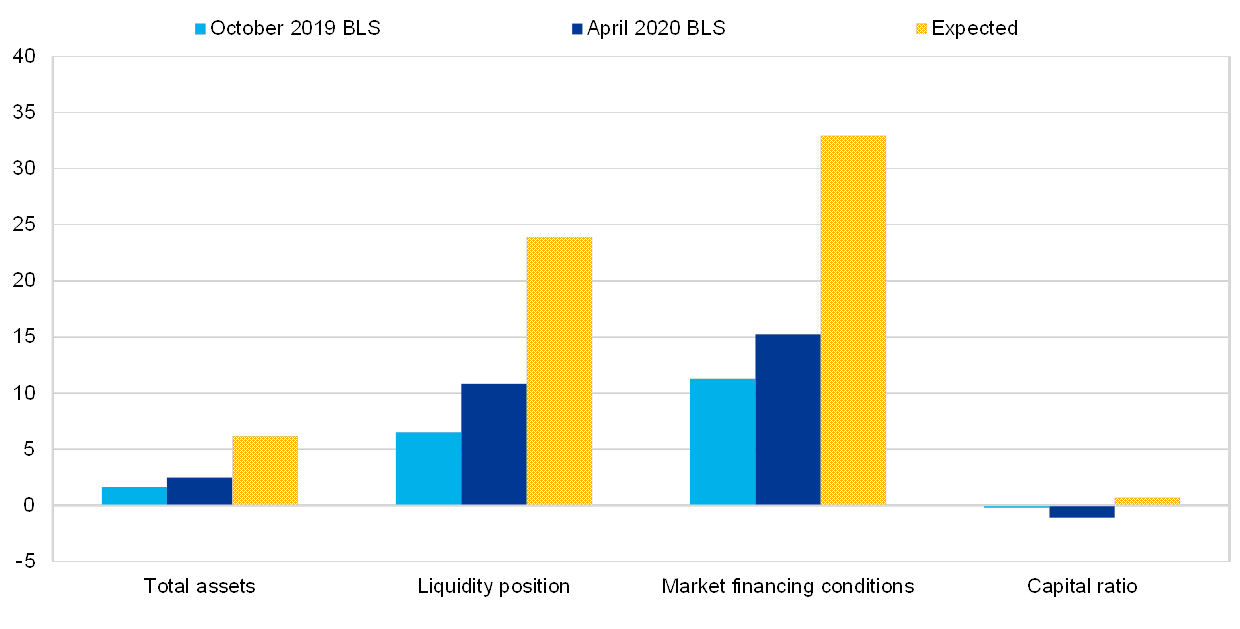

Impact of the ECB’s asset purchase programmes on banks’ financial situation

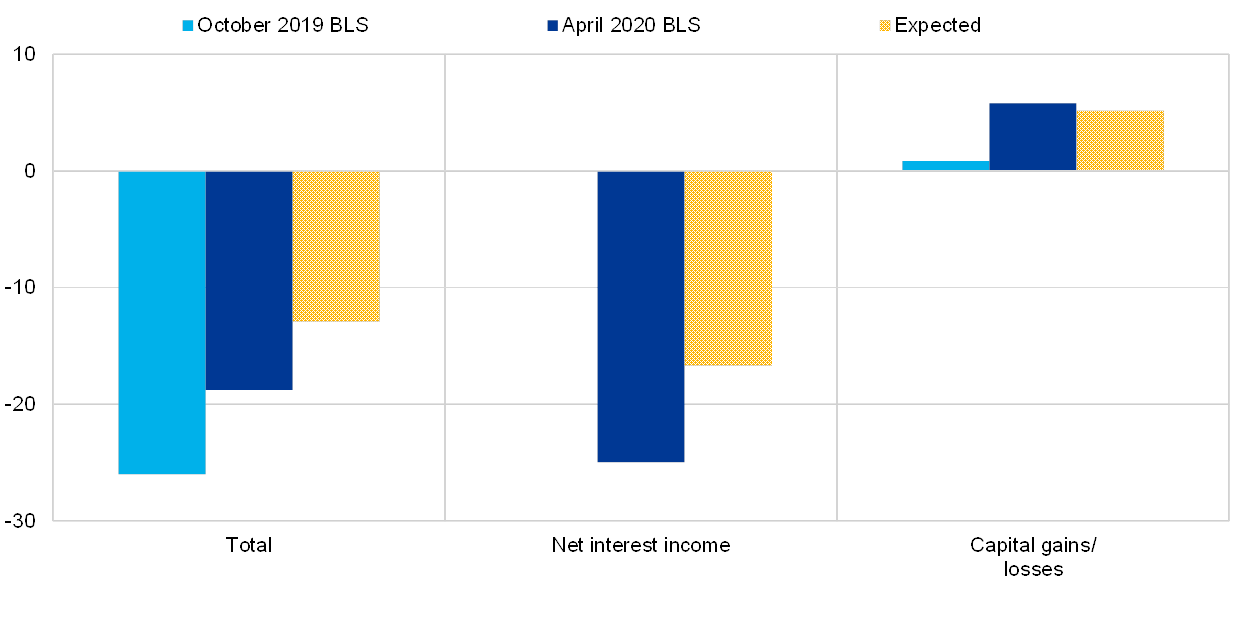

Euro area banks reported that the ECB’s asset purchase programmes (APP and PEPP) have, over the past six months, contributed to an improvement in their liquidity positions and their market financing conditions, but to a deterioration in their profitability (see Chart 14). In net terms, 11% (after 7% in the October 2019 survey round) of the euro area banks reported a positive impact on their liquidity positions and 15% (after 11%) a positive impact on their market financing conditions. In addition, banks’ reported a small positive impact on their total assets (a net percentage at 3%, after 2%). At the same time, a net percentage of -19% (after

-26%) of the euro area banks indicated that the APP and the PEPP have had a negative impact on their profitability, mainly owing to a dampening impact on their net interest income (see Chart 15).

Over the next six months, euro area banks expect a stronger positive impact on their liquidity positions and their market financing conditions (a net percentage of banks: 24% and 33% respectively) owing to the APP and PEPP. In particular, the large volume of asset purchases through the PEPP (announced by the ECB in March 2020) to support financing conditions in the euro area economy has probably supported these more favourable expectations. Banks also expect a more positive impact on their total assets (a net percentage of 6%). In addition, the net percentage of euro area banks expecting a negative impact of the APP and PEPP on their profitability declined for the next six months.

Chart 14

Overview of the impact of the ECB’s asset purchase programmes on euro area banks’ financial situation

(net percentages of banks, over the past and next six months)

Notes: The net percentages are defined as the difference between the sum of the percentages for “increased/improved considerably” and “increased/improved somewhat” and the sum of the percentages for “decreased/deteriorated somewhat” and “decreased/deteriorated considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

Chart 15

Impact of the ECB’s asset purchase programmes on bank profitability

(net percentages of banks, over the past and next six months)

Note: See the notes to Chart 14. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round. The impact on “Net interest income” was introduced in the April 2020 BLS.

Impact of the ECB’s asset purchase programmes on banks’ lending conditions and lending volumes

Euro area banks indicated that the APP and the PEPP have had an easing impact on their terms and conditions and a broadly neutral impact on their credit standards across all loan categories over the past six months (see Chart 16). In more detail, according to euro area banks the ECB’s asset purchases have had a net easing impact on banks’ terms and conditions for new loans to enterprises (a net percentage of -3%, after 0% in the October 2019 survey round), housing loans (-4%, after -2%) and consumer credit and other lending to households (-4%, after 0%). By contrast, according to euro area banks the impact on credit standards was broadly neutral across all loan categories.

Chart 16

Impact of the ECB’s asset purchase programmes on bank lending

(net percentages of banks, over the past and next six months)

Notes: The net percentages are defined as the difference between the sum of the percentages for “tightened/increased considerably” and “tightened/increased somewhat” and the sum of the percentages for “eased/decreased somewhat” and “eased/decreased considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

Over the next six months, banks expect the APP and the PEPP to have a stronger easing impact on their terms and conditions across all loan categories, in particular for loans to enterprises (a net percentage for loans to enterprises at -15%, for housing loans at -7% and for consumer credit at -6%). A net easing impact is also expected by euro area banks for credit standards on loans to enterprises (-10%).

Euro area banks reported a positive impact on their lending volumes across most loan categories over the past six months (see Chart 16). In more detail, euro area banks indicated a positive impact on lending to enterprises (a net percentage at 3%, after 1%), for housing loans (2%, after 4%) and for consumer credit (1%, unchanged from the previous quarter).

For the next six months, euro area banks expect a positive impact on their lending volumes across all loan categories but especially for loans to enterprises (a net percentage of 10% for loans to enterprises, 3% for housing loans and 3% for consumer credit).

3.3 The impact of the ECB’s negative deposit facility rate and the ECB’s two-tier system

The April 2020 survey questionnaire included a bi-annual ad hoc question aimed at gauging the impact of the ECB’s negative deposit facility rate (DFR) and the ECB’s two-tier system for remunerating excess liquidity holdings. In the first part of the question, banks were asked to indicate the overall impact of the DFR (including the impact of the ECB’s two-tier system). In the second part of the question, banks were asked to indicate exclusively the impact of the ECB’s two tier system, compared with the situation if the two-tier system did not exist. For both parts of the question, banks were asked to consider both direct and indirect effects over the past and next six months.

Impact of the ECB’s negative deposit facility rate

Euro area banks reported a negative impact of the ECB’s negative DFR (including the impact of the ECB’s two-tier system) on bank profitability over the past six months (a net percentage of banks at -59%), mainly via the impact on banks’ net interest income[7] (a net percentage of -60%, after -74%; see Chart 17). A broadly identical impact is expected over the coming six months.

Chart 17

Impact of the negative DFR on bank profitability

(net percentages of banks, over the past and next six months)

Notes: Including the impact of the ECB’s two-tier system for remunerating excess liquidity holdings. “Profitability” was introduced in April 2020. The net percentages are defined as the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

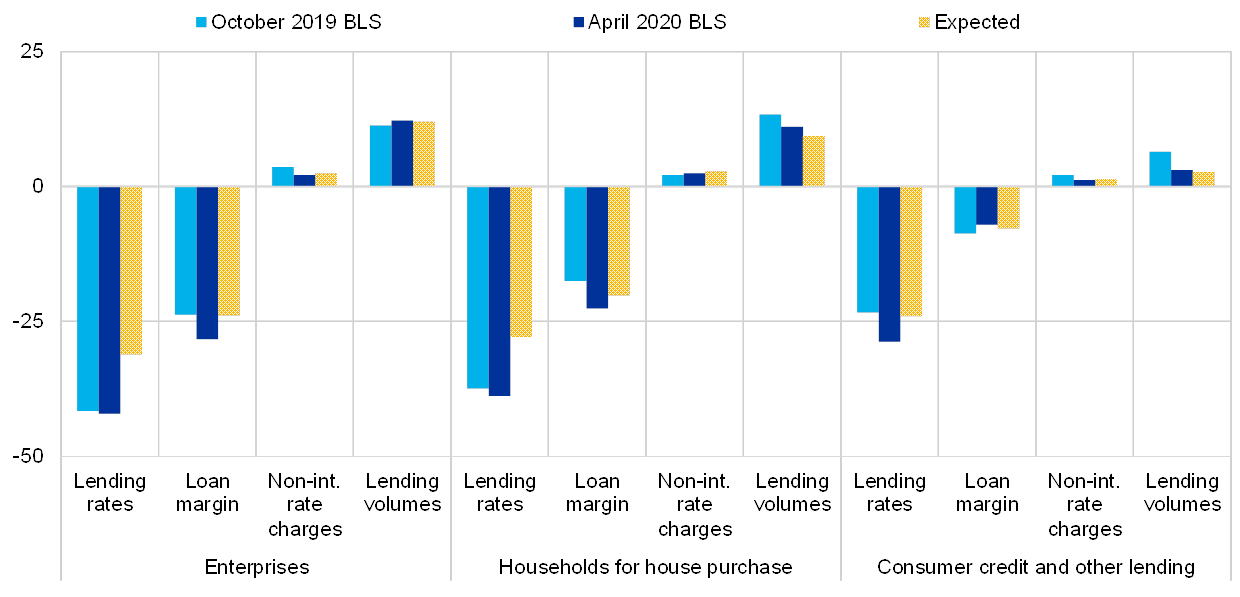

Regarding the DFR impact on lending, euro area banks continued to report a negative impact on bank lending rates across loan categories. In more detail, in net terms, 42% of the banks reported a decline in lending rates for loans to firms, 39% for housing loans and 29% for consumer credit over the past six months (see Chart 18). In addition, in net terms, euro area banks also reported a decline in loan margins and a slight increase in non-interest rate charges. The decline in lending rates and loan margins is expected by banks to continue over the next six months.

Chart 18

Impact of the negative DFR on bank lending

(net percentages of banks, over the past and next six months)

Notes: Including the impact of the ECB’s two-tier system for remunerating excess liquidity holdings. The net percentages are defined as the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

Euro area banks reported an ongoing positive DFR impact on lending volumes (see Chart 18). A net percentage of 12% of the euro area banks indicated a positive impact for lending to enterprises (after 11% in the October 2019 survey round), 11% for housing loans (after 13%) and 3% for consumer credit (after 6%) over the past six months. In the coming six months, a broadly similar positive DFR impact on lending volumes is expected by euro area banks.

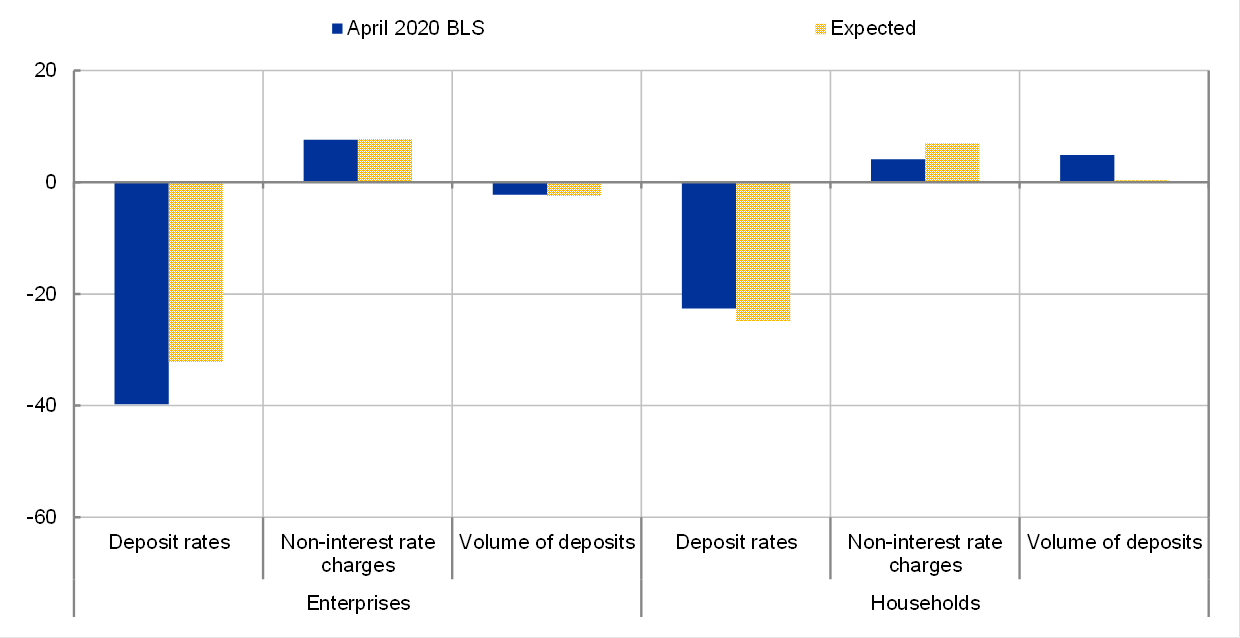

In addition to the impact on lending, euro area banks were asked for the first time in the April 2020 BLS to indicate the DFR impact on deposits (see Chart 19). Euro area banks indicated, in net terms, a stronger negative impact of the DFR on deposit rates for enterprises than on deposit rates for households over the past six months. In more detail, a net percentage of -40% of the euro area banks reported a negative impact on interest rates for deposits held by firms over the past six months, while the corresponding net percentage was lower for household deposits (-23%). This corresponds with the actual interest rate developments, according to which banks tend to pass through negative rates more often to corporate deposits than to household deposits. In the coming six months, a somewhat smaller net percentage of banks expects a negative impact on firms’ deposit rates (-32%) but still higher than for household deposit rates (-25%).

Chart 19

Impact of the negative DFR on bank deposits

(net percentages of banks, over the past and next six months)

Notes: Including the impact of the ECB’s two-tier system for remunerating excess liquidity holdings. The net percentages are defined as the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

To a limited extent, banks tried to compensate negative rates with higher non-interest rate charges on deposits (a net percentage of banks at 8% for firms’ deposits and 4% for household deposits) and plan to continue to do so in the coming six months. In addition, a small net percentage of banks perceives the DFR as having a negative impact on firms’ deposit volumes (a net percentage of -2%) but not for household deposits (a net percentage of 5%), and expects that this will continue to be the case in the next six months.

Impact of the ECB’s two-tier system for remunerating excess liquidity holdings

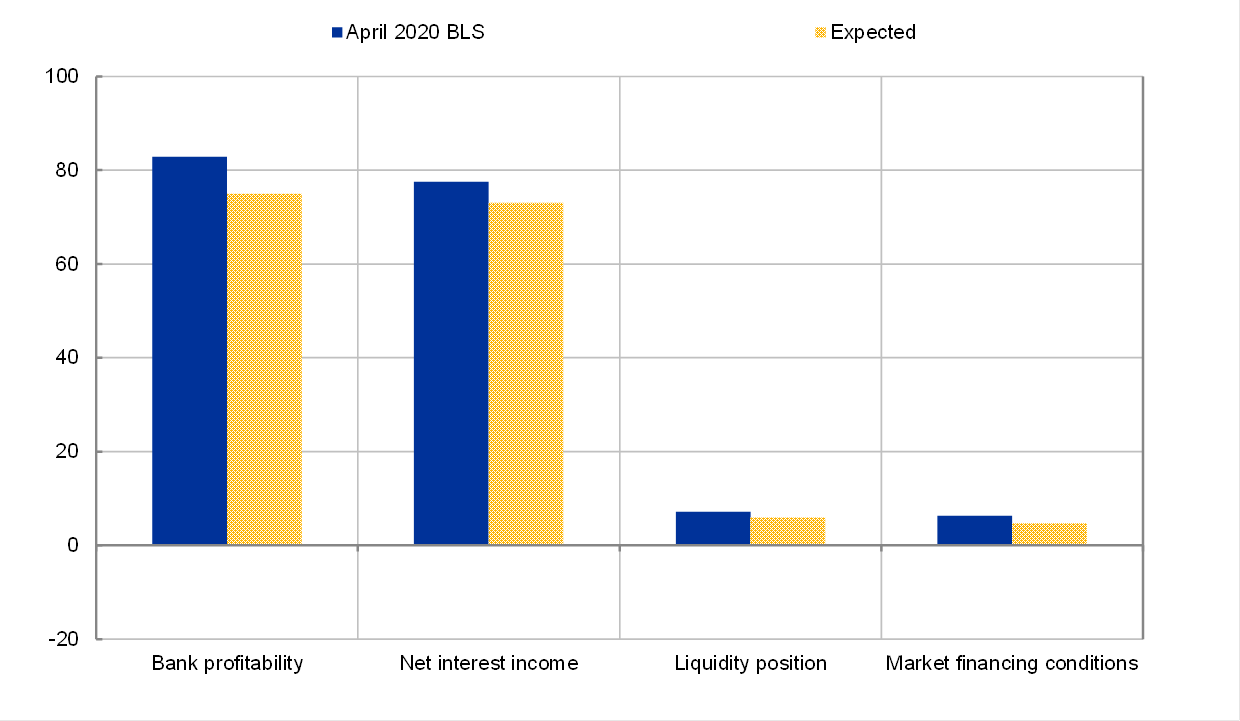

Euro area banks were asked for the first time in the April 2020 BLS to assess the impact of the ECB’s two-tier system for remunerating excess liquidity holdings on their financial situation, lending and deposits, compared with the situation if the two-tier system did not exist.

Compared with the non-existence of the ECB’s two-tier system, a net percentage of 83% of the euro area banks agrees on its supporting impact on their profitability, as it exempts banks from remunerating at the negative deposit facility rates part of their excess reserve holdings (see Chart 20). In addition, a limited net percentage of banks reported a positive impact of the two-tier system on their liquidity positions and market financing conditions (a net percentage of 7% and 6% respectively).

With respect to the impact of the two-tier system on bank lending and deposit rates, banks attributed only a small impact (see Chart 21). Compared with no two-tier system, a net percentage of -2% to -3% (across loan categories) of the euro area banks reported that lending rates had declined somewhat more strongly over the past six months. For interest rates on deposits held by enterprises and households, a net percentage of 3% mentioned that deposit rates are higher now compared with the absence of a two-tier system. This may suggest that a small percentage of banks assess the pressure to lower deposit rates to be somewhat less with the two-tier system.

Chart 20

Impact of the ECB’s two-tier system on banks’ financial situation

(net percentages of banks, over the past and next six months)

Notes: The net percentages are defined as the difference between the sum of the percentages for “improved considerably” and “improved somewhat” and the sum of the percentages for “deteriorated somewhat” and “deteriorated considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

Chart 21

Impact of the ECB’s two-tier system on bank interest rates

(net percentages of banks, over the past and next six months)

Notes: The net percentages are defined as the difference between the sum of the percentages for “increased considerably” and “increased somewhat” and the sum of the percentages for “decreased somewhat” and “decreased considerably”. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

3.4 The impact of TLTRO III on banks and their lending policies

The April 2020 survey questionnaire included some ad hoc questions on the impact of the Eurosystem’s third series of targeted longer-term refinancing operations.[8] Banks were asked about their participation in that series of operations and their reasons for doing so, as well as about their use of TLTRO III liquidity. In addition, they were asked about the impact of the TLTRO III operations on their financial situation, as well as on their lending conditions and lending volumes over the past six months and the next six months.

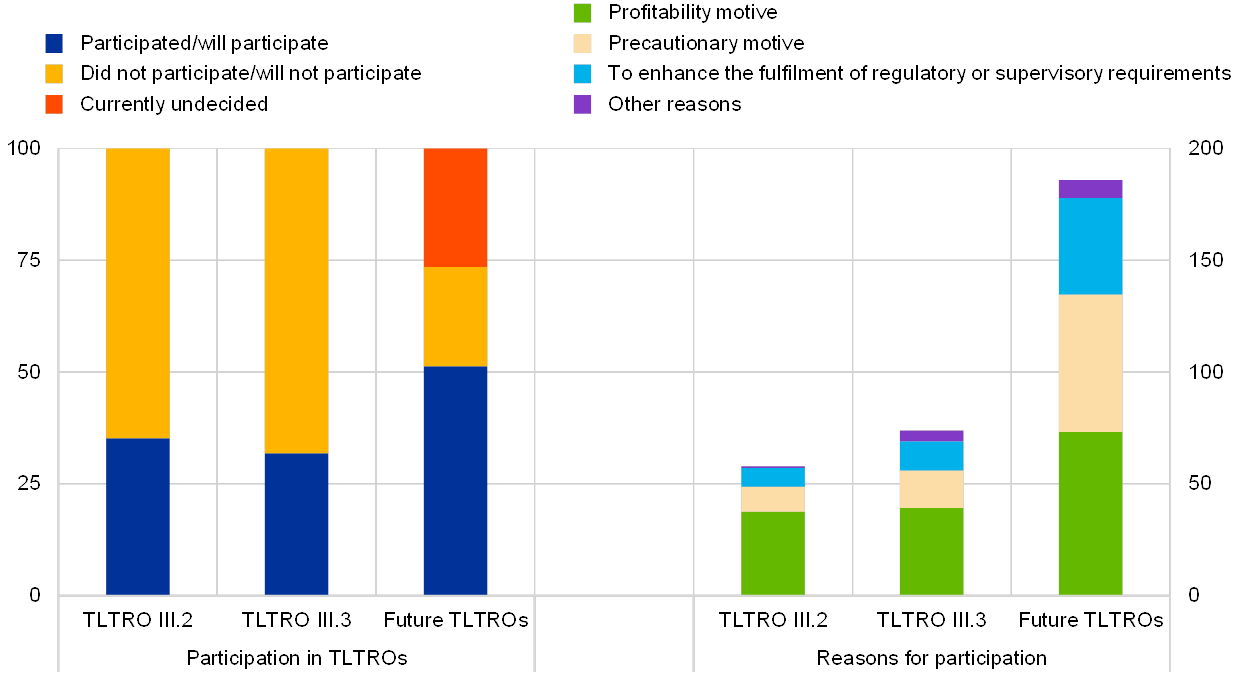

In the TLTRO III.3 operation in March 2020, 32% of euro area BLS banks participated, compared with a participation rate of 35% of BLS banks in the TLTRO III.2 operation in December 2019 (see Chart 22). About half of euro area BLS banks (51%) intend to participate in future TLTRO III operations.

Chart 22

Banks’ participation in TLTRO III operations and their reasons for participation

(percentages of banks)

Notes: The participation rate excludes missing observations. Banks were asked to rate all reasons in terms of the extent to which they have contributed to their participation in TLTRO III operations. “Other reasons” are specific reasons cited by banks that were not included in the questionnaire.

Given the attractive TLTRO III conditions, the profitability motive remained the most important reason for banks to participate in the TLTRO III.3 operation (the percentage of banks stating that this reason contributed to their participation was 39%, after 38% for the TLTRO III.2 operation). At the same time, the precautionary motive, i.e. the avoidance or reduction of funding difficulties, gained importance, with 17% (after 11%) of banks mentioning it as a contributing factor in their TLTRO III participation. Euro area banks also referred to the fulfilment of regulatory or supervisory requirements (13%, after 8%) as a reason for their participation as well as to other reasons (5%, after 1%), such as the diversification of their funding and the optimisation of their liquidity management.

For future TLTRO III operations, a considerably higher percentage of euro area banks mentioned a precautionary motive for their expected participation (62%, up from 25% as a reason for future participation reported by banks in the previous survey round), likely reflecting the impact of the coronavirus pandemic on banks’ liquidity position. The profitability motive (73%, from 66%) and the fulfilment of regulatory or supervisory requirements (43%, after 18%) are expected to gain importance as reasons for participation, likely reflecting the more favourable TLTRO III terms, which will be applied from the June 2020 to June 2021 operations announced by the ECB on 12 March 2020.

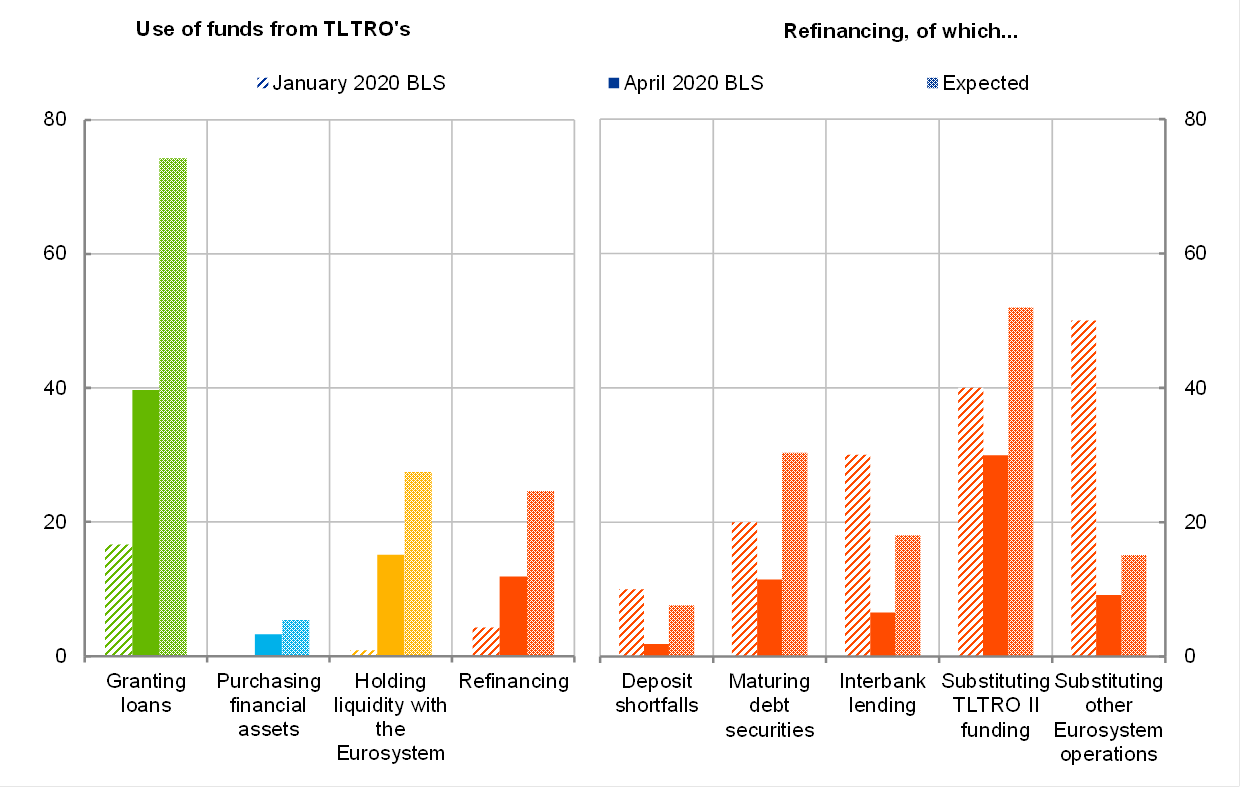

Chart 23

Use of TLTRO III liquidity by banks

(percentages of banks, over the past and next six months)

Notes: Banks were asked to indicate the relevance of all purposes. "Purchasing financial assets" is the sum of “purchasing domestic sovereign bonds” and “purchasing other financial assets”. “Granting loans” refers to loans to the non-financial private sector. The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

40% of banks indicated that they had used TLTRO III liquidity for granting loans to the non-financial private sector over the past six months (see Chart 23; see below for the information across loan categories). The higher percentage compared with banks’ indication in the January 2020 survey round (17%) corresponds to banks’ previous statements that they had not yet fully decided how to use the funds. In addition, 15% (after 1%) of banks indicated that they had used TLTRO III liquidity over the past six months to hold liquidity with the Eurosystem and 12% (after 4%) had used it for refinancing purposes. With respect to the latter, the main refinancing purpose was the substitution of TLTRO II funding, referred to by 30% of banks. Other refinancing purposes, such as the substitution of maturing debt securities (12%), the substitution of other Eurosystem liquidity operations (9%) and the substitution of interbank lending (7%) were mentioned by smaller percentages of banks. Over the next six months, granting loans remains the most important purpose, mentioned by 74% of banks, while 27% referred to holding liquidity with the Eurosystem and 25% to refinancing purposes, among which the substitution of TLTRO II funding (mentioned by 52% of banks) and the substitution of maturing debt securities (30%) were most important.

Chart 24

Impact of the TLTRO III operations on banks’ financial situation

(net improvement reported by banks, over the past and next six months)

Notes: The signs for these net percentages have been inverted to show net improvements. Net percentages are defined as the difference between the sum of the percentages for “contributed considerably to a deterioration” and “contributed somewhat to a deterioration” and the sum of the percentages for “contributed somewhat to an improvement” and “contributed considerably to an improvement". The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

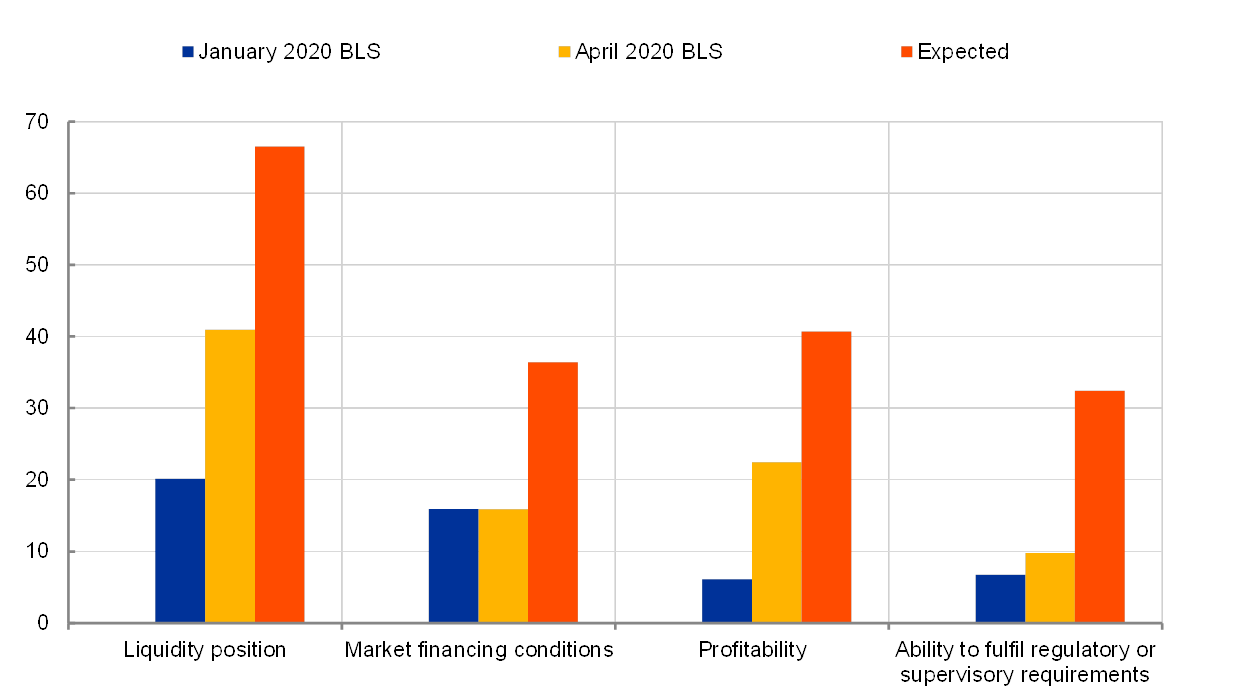

Banks indicated an overall positive impact of TLTRO III on their financial situation, in particular their liquidity positions (see Chart 24). A net percentage of 41% (after 20% in the previous survey round) of banks mentioned a positive TLTRO III impact on their liquidity positions over the past six months. In addition, in net terms, 16% (unchanged from the previous round) indicated a positive impact on their market financing conditions and 22% (after 6%) a positive impact on their profitability. The positive TLTRO III impact is expected to increase over the coming six months.

Banks reported a net easing impact of TLTRO III on their terms and conditions, more than for credit standards, and a positive net impact on their lending volumes (see Chart 25). Euro area banks pointed to a net easing impact of TLTRO III on their terms and conditions for all loans categories over the past six months (net percentages of -12% for loans to enterprises, -5% for housing loans and -5% for consumer credit). The net easing impact on credit standards was limited to loans to enterprises and consumer credit over the past six months (net percentages of -6% and -7% respectively), while the impact on credit standards for housing loans was broadly neutral (-1%). In addition, a net percentage of 11% of banks indicated a positive impact on their lending volumes for loans to enterprises. The positive impact was somewhat smaller for housing loans (a net percentage of 4%) and consumer credit (5%) over the past six months.

Chart 25

Impact of the TLTRO III series on bank lending conditions and lending volumes

(net percentages of banks, over the past and next six months)

Notes: Net percentages are defined as the difference between the sum of the percentages for “contributed considerably to a tightening or decrease” and “contributed somewhat to a tightening or decrease” and the sum of the percentages for “contributed somewhat to an easing or increase” and “contributed considerably to an easing or increase". The periods in the legend refer to the respective BLS survey rounds. “Expected” denotes expectations indicated by banks in the current round.

Over the coming six months, banks expect a larger net easing impact of TLTRO III on their bank lending conditions and a considerably more positive impact on their lending volumes. With respect to terms and conditions on new loans to enterprises, a net percentage of -36% of banks expects an easing impact (housing loans: -10% and consumer credit: -17%). For credit standards, the easing impact is also expected to increase, especially for loans to enterprises (a net percentage of banks at -19%) and less for consumer credit (a net percentage of -12%), while the impact on credit standards for housing loans is expect to be broadly neutral (a net percentage at

-1%). For lending volumes, the positive impact on loans to enterprises is expected to increase strongly (a net percentage of euro area banks at 49%) over the next six months. The net percentages of banks are smaller for housing loans (9%) and consumer credit (16%), but the positive impact on lending volumes is also expected to increase.

Annexes

See more.

© European Central Bank, 2020

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted, provided that the source is acknowledged.

For specific terminology please refer to the ECB glossary.

PDF ISSN 1830-5989, QB-BA-20-002-EN-N

HTML ISSN 1830-5989, QB-BA-20-002-EN-Q

- The four largest euro area countries in terms of GDP are Germany, France, Italy and Spain.

- For more detailed information on the bank lending survey, see the article entitled “A bank lending survey for the euro area”, Monthly Bulletin, ECB, April 2003; Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016; and Burlon, L., Dimou, M., Drahonsky, A. and Köhler-Ulbrich, P., “What does the bank lending survey tell us about credit conditions for euro area firms?”, Economic Bulletin, Issue 8, ECB, December 2019.

- In this case, the selected sample banks are generally of similar size or their lending behaviour is typical of a larger group of banks.

- The non-harmonised historical data differ from the harmonised data mainly as a result of heterogeneous treatment of “NA” replies and specialised banks across questions and countries. Non‑harmonised historical BLS data are published for discontinued BLS questions and ad hoc questions.

- The calculation of a simple average when combining factors in broader categories assumes that all factors have the same importance for banks. This helps to explain some inconsistencies between developments in demand for loans and developments in the main underlying factor categories.

- Considerable percentages of banks indicated that questions on securitisation were “not applicable”, as that source of funding was not relevant to them (between 46% and 57% of banks in the first quarter of 2020, depending on the type of securitisation).

- The net interest income is defined as the difference between the interest earned and interest paid on the outstanding amount of interest-bearing assets and liabilities by the bank.

- The additional longer-term refinancing operations (LTROs) that were announced by the ECB on 12 March 2020, whose operations will mature on 24 June 2020, are not part of the TLTRO ad hoc questions. These LTROs were introduced to bridge the period until the TLTRO III operation in June 2020.

- 28 April 2020