Thinking beyond borders: how important are reciprocity arrangements for the use of sectoral capital buffers?

Published as part of the Macroprudential Bulletin 8, September 2019.

The expansion of the EU macroprudential toolkit to also include capital buffers applied at sectoral level may require the cross-border recognition of these instruments. This article explores the relevance of sectoral cross-border credit provided via foreign branches or direct cross-border lending in the SSM area and analyses the effects of the implementation of mandatory reciprocity arrangements. Our findings provide some evidence supporting the introduction of mandatory reciprocity arrangements for sectoral capital buffers where exposures are material in order to ensure a level playing field and pre-empt future leakages. This is important to foster the effectiveness of macroprudential policies because financial services provided via foreign branches or direct cross-border exposures would otherwise not be subject to a macroprudential measure taken in a host Member State.

1 Introduction

The sectoral macroprudential toolkit has been recently expanded with targeted instruments to effectively address risks largely related to specific sectors. Sectoral macroprudential instruments were already introduced into the EU capital rules primarily to counter potential risks in the real estate sector due to the material role played by real estate markets in past financial crises.[2] With the EU banking reform package adopted in spring 2019, the macroprudential toolkit has been expanded to include a sectoral capital buffer in the form of a sectoral systemic risk buffer (SRB). Up until now the SRB was aimed at addressing structural systemic risks for all, or a subset of, banks (Article 133 CRD IV), while in CRD V authorities can activate the SRB also for sectoral exposures. At the national level, Switzerland and Spain have implemented a sectoral countercyclical capital buffer (SCCyB) in their national macroprudential frameworks.[3]

The cross-border recognition of these instruments may be important when it comes to cross-border lending activities in an integrated financial market. For a macroprudential measure applied in a specific Member State, reciprocity is an arrangement ensuring that the measure is applicable to all institutions that carry out activities in that Member State with regard to the risk in question irrespective of the location of the parent institution. This is important because credit provided via foreign branches or direct cross-border bank lending falls within the supervisory scope of the bank’s home country rather than under the macroprudential policy of the host country where the macroprudential measure was enacted. In the absence of mandatory reciprocity arrangements, the effectiveness of macroprudential instruments, including sectoral instruments, could be potentially undermined by leakages and regulatory arbitrage arising from this.

This article explores the merits of extending the framework for mandatory reciprocity arrangements to include sectoral capital buffers and thereby ensure a level playing field for domestic and foreign banks. This study first provides a stocktake of the materiality of sectoral cross-border credit provided via foreign branches or direct cross-border lending in the SSM area. Second, it recalls the rationale for reciprocity arrangements to foster an effective implementation of macroprudential measures in an integrated financial market. Third, a counterfactual scenario analysis on a sectoral capital buffer in the form of a SCCyB is applied to corporate exposures with and without mandatory reciprocation in place.

2 Taking stock of sectoral cross-border bank credit provided via foreign branches or direct cross-border bank lending

We conduct an assessment of the materiality of cross-border exposures via foreign branches or direct cross-border lending for all SSM countries at sectoral level. To the best of our knowledge, this is the first system-wide quantitative analysis of these types of cross-border exposures. The following analysis focuses on non-financial private sector credit provided via foreign branches or direct cross-border bank lending. This is because (i) some macroprudential measures such as a sectoral SRB or SCCyB are applied to specific types of credit and not to total assets and (ii) the stated objectives of macroprudential policy aim primarily to counter risks resulting from exuberant credit developments at either the broad or sectoral level.

Very granular information is needed to assess the materiality of credit provided via foreign branches or direct cross-border bank lending, but these data are not easily accessible. National and supranational authorities have asymmetric information on cross-border lending activities which is not provided via subsidiaries. The authorities of the host country (which potentially implement a macroprudential policy) only have access to some information, e.g. some authorities typically have very limited information about direct cross-border lending. These specific exposures are also not directly available in the supervisory data available via the ECB and must be inferred. For the analysis presented in this article, the cross-border exposures resulting from direct and via-branch bank lending were obtained from the supervisory data for each bank and sector using a newly established so-called residual approach (for more details see Box 1).

Box 1

A “residual approach” to disentangling credit provided via foreign branches or direct cross-border bank lending

The analysis presented in this article is based on a so-called residual approach in order to disentangle the cross-border exposures via direct lending and/or foreign branches from the overall cross-border lending which includes lending via subsidiaries. The cross-border exposures from direct cross-border lending and lending via foreign branches are approximated as the difference between the cross-border exposures toward the host country at the highest level of consolidation (which also include lending via subsidiaries) and the domestic exposures of the subsidiaries located in each host country. All cross-border exposures through subsidiaries in foreign countries at lower levels of consolidation must be excluded in order to avoid double-counting. This requires a precise reconstruction of banks’ corporate structures.

The analysis is based on a subsample of supervisory data which only includes the Significant Institutions, some of their subsidiaries and some Less Significant Institutions, totalling around 1,350 entities overall (representing about 90% of total assets of the SSM area).[4] Given that we are adopting a “residual approach” subtracting exposures via subsidiaries available in the sample from the consolidated-level exposures, this means that the estimated cross-border exposures via foreign branches and direct cross-border lending might be overestimated, as we might count as direct lending cross-border lending via subsidiaries which are not available in our sample. However, the degree of overestimation should be low as the largest subsidiaries are included in our database. For robustness, selected aggregate sectoral exposure shares have been cross-checked and confirmed with relevant national authorities or using other information from commercial databases.[5]

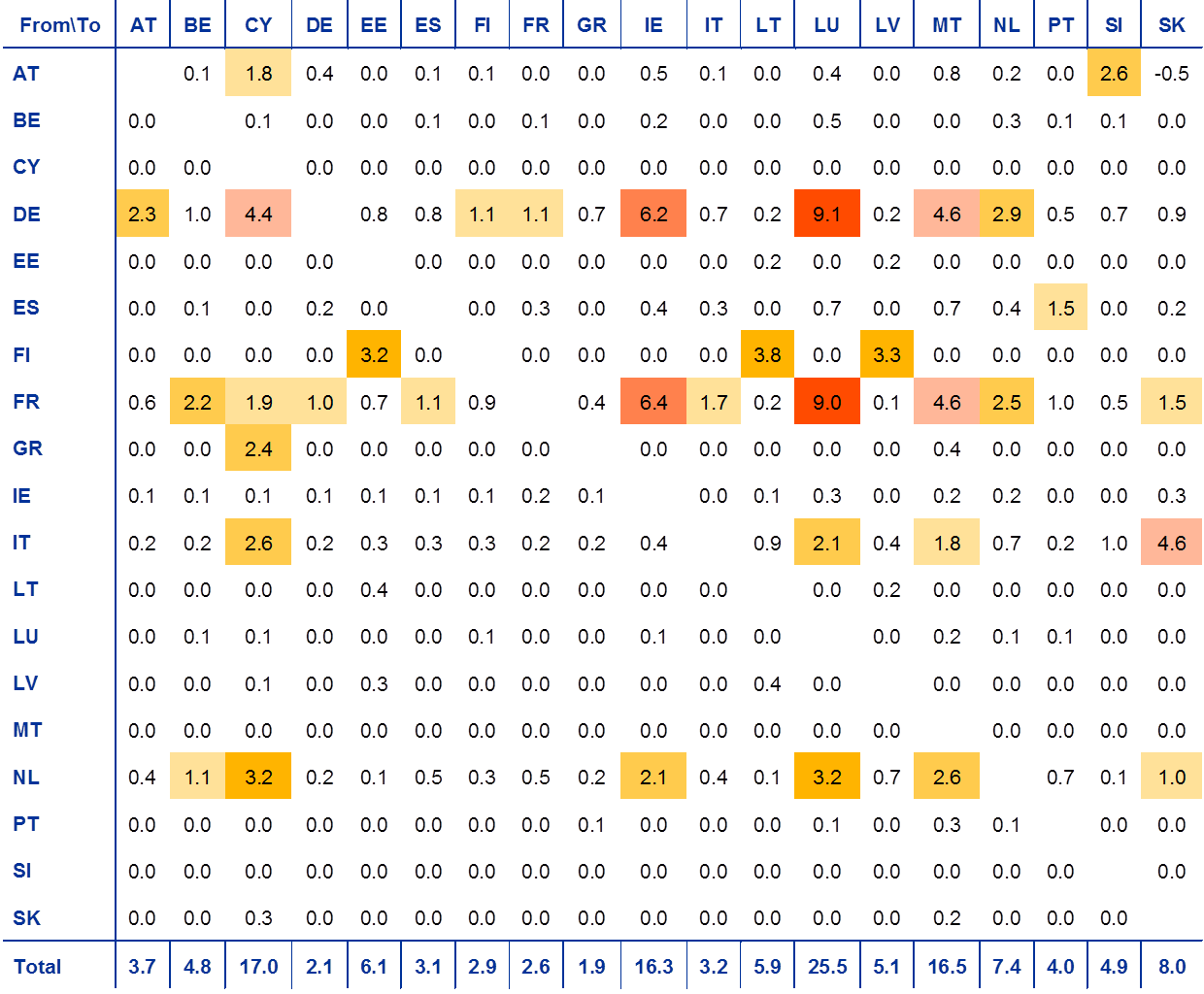

Table A illustrates the country-by-country total foreign credit exposures via foreign branches and direct cross-border lending as a share of total credit in each country of exposure. These exposures exceed 1% (coloured cells) in a number of countries. Reciprocation of the CCyB ensures that foreign banks would also be automatically required to hold additional capital should an authority decide to activate a CCyB in their home country. This is currently only mandatory, however, when a 1% materiality threshold is passed by the individual institutions rather than the aggregate exposures from another country. This may be a deficiency of the current framework, as the individual cross-border exposures may be below 1% while the aggregate exposures are above the threshold.[6] This acknowledges the importance of mandatory reciprocation of the Basel III CCyB up to a buffer rate of 2.5% in line with the international regulatory framework.

Table A

Total credit provided via direct cross-border bank lending and via foreign branches calculated using the “residual approach”

(percent)

Sources: Own calculation.

Notes: Data as of Q3 2018. The table reports the share of total lending to the country (to all sectors) made up of direct cross-border lending or lending from foreign branches using the “residual approach”. The columns indicate the country receiving the credit and the rows indicate the countries from which the credit originated. Credit from banks with a parent institution outside the SSM countries is included in the credit from the SSM country in which the bank is located at its highest level of consolidation. The sample includes subsidiaries in countries with ultimate parent institutions in non-SSM countries and, generally, the total credit for each country is very close to the total credit from other sources (which might include direct lending and lending via foreign branches from banks in non-SSM countries or credit from domestic LSIs that are not included in the sample). For Austria and Germany as the share of credit represented by LSIs not included in the supervisory data is material therefore we considered as denominator the aggregate statistics on lending provided by national authorities. In some Baltic countries the total credit might be underestimated due to direct lending from non-SSM countries which is not available in the sample.

A large part of sectoral cross-border exposures provided through direct cross-border lending and lending via foreign branches refers to the corporate sector, which accounts for around or more than 5% of total lending in 11 SSM countries (see Table 1). Comparing the shares of total cross-border exposures due to direct cross-border lending and lending via foreign branches in Table A with those referring only to non-financial corporate lending in Table 1, lending to non-financial corporations appears to be the most important cross-border sector for a number of SSM countries, with cumulative shares of up to 25% of domestic lending provided via cross-border direct exposures or foreign branches (see Chart 1). In contrast, real estate credit provided via direct cross-border lending or via foreign branches is smaller in magnitude, with the exception of Luxembourg where these exposures account for 20% of domestic credit. In the light of these findings, the following analysis focuses on sectoral macroprudential measures applied to the corporate sector.

Table 1

Non-financial corporate lending provided via direct cross-border bank lending and via foreign branches calculated using the ‘residual approach’

(percent)

Notes: Data as of Q3 2018. The table reports the share of total lending (to all sectors) made up of credit provided via foreign branches or direct cross-border lending to the non-financial corporate sector in the country using the “residual approach”. The columns indicate the country receiving the credit and the rows indicate the countries from which the credit originated. Credit from banks with a parent institution outside the SSM countries is included in the credit from the SSM country in which the bank is located at its highest level of consolidation. The sample includes subsidiaries in countries with ultimate parent institutions in non-SSM countries and, generally, the total credit for each country is very close to the total credit from other sources (which might include direct lending and lending via foreign branches from banks in non-SSM countries or credit from domestic LSIs that are not included in the sample). For Austria and Germany as the share of credit represented by LSIs not included in the supervisory data is material therefore we considered as denominator the aggregate statistics on lending provided by national authorities. In some Baltic countries the total credit might be underestimated due to direct lending from non-SSM; countries which is not available in the sample.

Chart 1

Sectoral credit provided via direct cross-border bank lending and via foreign branches calculated using the ‘residual approach’

(percentage of domestic credit)

Notes: Q3 2018. The chart reports the cumulated shares of total domestic lending due to corporate (left panel) and mortgage (right panel) lending provided either directly or via branches. The LHS Chart reports the cumulated shares which are also reported in Table 1 for the countries with the largest sectoral cross-border exposures.

3 The rationale for reciprocating macroprudential policy measures

Reciprocity is an arrangement ensuring that an activated measure is applied to all institutions that carry out activity in that Member State with regard to the risk in question, irrespective of the location of the parent institution. In the EU Single Market, cross-border lending activities can be provided via foreign subsidiaries, foreign branches or via direct cross-border lending (Figure 1).[7] Macroprudential measures taken in one Member State apply only to domestic banks and subsidiaries of foreign banks. Therefore, such measures usually do not apply to cross-border exposures provided through direct credit and lending via foreign branches.[8]

Figure 1

A schematic view of the effects of reciprocation of macroprudential measures

Country B to potentially activate a macroprudential measure

Source: Own presentation.

Note: Blue indicates lending from bank A, and red indicates lending from bank B.

Cross-border recognition of macroprudential policies in the EU is addressed for a limited set of instruments in CRR and CRD. For example, the countercyclical capital buffer (CCyB) is subject to mandatory reciprocation up to a buffer rate of 2.5%, as well as higher risk weights or loss given default floors for retail exposures secured by residential or commercial real estate (Articles 124 and 164 CRR). Conversely, the remaining set of instruments, namely the use of Article 458 CRR or the (sectoral) SRB applicable to all, or a subset of, institutions (Article 133 CRD) is reciprocated on a voluntary basis between Member States. To this end, the ESRB put in place a voluntary reciprocity framework for macroprudential measures without mandatory reciprocation in 2015 (ESRB/2015/2 and ESRB/2015/4).[9]

The cross-border recognition of macroprudential instruments is of key importance for an effective macroprudential policy implementation.[10] Such recognition through mandatory reciprocity arrangements helps avoid cross-border leakages and regulatory arbitrage and ensures a level playing field for domestic and foreign banks in an integrated financial market. This may be yet more important in the future as further progress on the Banking Union and Capital Markets Union should foster cross-border integration and risk sharing. However, mandatory reciprocity arrangements are not necessarily needed when cross-border exposures in the form of lending via branches or direct credit are not material, as they could pose a burdensome notification procedure for banks. In this regard, the case for mandatory reciprocation is particularly compelling when the measure is applied to all institutions and all or sectoral domestic exposures when these are considered material across borders.

From a financial stability perspective, there is no clear definition of a material cross-border lending exposure. The ESRB’s voluntary reciprocity framework can provide useful guidance, although it does not define quantitative thresholds. For instance, based on case-by-case materiality thresholds, Member States may exempt institutions with non-material exposures from the obligation to reciprocate macroprudential policy measures (de minimis principle).[11] These thresholds can be defined either in absolute or relative terms as the institution’s share of exposures in the activating country in relation to its total or risk-weighted credit exposures.[12] Alternatively, the identification of so-called material third country exposures may also indicate materiality thresholds for reference. For this purpose, the EU’s cross-border exposures to third countries are assessed against varying thresholds ranging between 1% and 5% of total exposures.[13] Based on these common practices, we consider cross-border exposures to be material when more than 1% of total lending in a given country consists of lending from a foreign country.

4 An illustrative simulation of the cross-border effects of sectoral lending activities following the introduction of a sectoral capital buffer for corporate exposures

A counterfactual scenario analysis is conducted to illustrate the benefits of a mandatory reciprocation of sectoral capital buffers applied to corporate exposures. The scenario considers the risk of country-specific build-up of cyclical systemic risk leading to an excessive corporate credit growth of 1% over a one-year horizon, with growth momentum fuelled by loose credit supply conditions, buoyant economic activity and the relaxation of financial constraints for the corporate sector. Two illustrative situations are contrasted: in the first simulation, we consider the activation of a policy hedging against sectoral cyclical systemic risks in the corporate sector (e.g. a sectoral capital buffer in the form of a SCCyB on corporate lending) in order to reduce excessive credit growth, but without reciprocity arrangements in place. In the second scenario, the policy is activated with automatic reciprocation from all other countries to achieve the same reduction in credit growth. For illustrative purposes and based on the relevance of their cross-border interlinkages, the analysis is conducted for three countries: Luxembourg, Malta and Ireland.[14]

The analysis is conducted using a granular bank-level model (MIAU, see Box 2), assuming deterministic bank responses to the policy implementation and a DSGE model including cross-border bank lending.[15] The first model helps to understand the mechanical elasticities of the policy implementation implied by individual banks’ starting points and derive a convex set of potential bank responses under simplistic assumptions, i.e. abstracting from forecast and modelling errors and allowing for a ceteris paribus comparison across banking systems and policies. The second model also considers general equilibrium effects and a more sophisticated description of the real economy and of the banking sector, thereby internalising other relevant factors which might smooth banks’ responses.

Banks are assumed to respond to the activation of macroprudential buffers mainly via the lending channel, although in a differentiated way across the two modelling approaches. In the MIAU-based simulation, it is assumed that banks would primarily deleverage/increase interest rates for all private exposures (corporate and retail) in the country in which the policy is applied. This assumption does not take into consideration potential leakages. For example if returns in the activating country and sector are very high, banks might prefer to deleverage in other countries or decrease exposures with high risk weights and lower return. For this reason, the increase in capital requirements might be underestimated. For the sake of simplicity we abstract from discussing banks’ approaches to deleveraging in this article. Furthermore, the MIAU-based simulations assume that for all banks half of the capital requirements would be met by using the voluntary buffers, where feasible. In the DSGE model, banks are assumed to deleverage and increase interest rates for all exposures and towards all countries, but in a differentiated way: banks’ responses are more elastic on riskier exposures and on the exposures to which the policy is applied.

The analysis indicates that the application of automatic reciprocity arrangements could reduce the capital requirements needed to achieve the same policy objective.[16] Chart 2 illustrates the increased capital requirements needed to achieve the same reduction in credit growth, with and without automatic reciprocation. Results are reported in terms of ranges of the responses across countries. Under the assumption that the policy measure is reciprocated, the increase in sectoral capital requirements is lower on average by about 0.1 percentage points across models. Under the assumption of reciprocation, requirements would increase on average by 0.01 percentage points (first bar for each model in Chart 2), while under the assumption of no reciprocation requirements would increase by 0.1 percentage points (second bar for each model in Chart 2). This result is mainly due to the fact that under the assumption of reciprocation, a larger number of banks with significant exposures to the country and sector of application would be affected by the sectoral capital requirement and, therefore, a lower aggregate increase in the requirements would be needed in order to trigger a similar decline in lending. These results indicate that the automatic reciprocation of macroprudential policy measures could strengthen the level playing field for domestic and foreign banks as it would ensure that a materially larger share of lending to the country would be affected by the policy implementation. Qualitatively similar results would also be obtained from simulations of sectoral capital requirements in other sectors. However, based on the actual banks’ exposures, the benefits would be quantitatively less significant. In this case, a lower share of credit is provided to these sectors via foreign branches or direct cross-border bank lending and, therefore, would fall out from the scope of the policy. Intuitively, applying the policy with and without reciprocation should then lead to similar bank-by-bank change in the capital requirements for foreign banks.

Chart 2

Reciprocation would lessen the increase in the sectoral capital buffer needed to counteract excessive sectoral credit growth in the corporate sector

Increase in the sectoral capital requirement needed to obtain the same amount of sectoral deleveraging across models

(percent)

Notes: Analysis based on supervisory data for Q3 2018. The bars illustrate the minimum and maximum increase in sectoral capital requirements across countries (IE, LU and MT); the red diamonds indicate the average increase in capital requirements.

Under the assumption of automatic reciprocation, the implementation of a SCCyB by macroprudential authorities could reduce the average increase in lending rates for the desired policy outcome. Chart 3 shows the average increase in the lending rate on all private exposures which can be repriced within a year following the implementation of a SCCyB reported in Chart 2. Under the automatic reciprocation assumption, the overall lending rate would increase by less (on average by 2 to 5 basis points, but at country level up to 10 basis points) than under the non-reciprocation assumption. This is because capital requirements would increase less in the case of automatic reciprocation, given the assumptions made about deleveraging strategies. These results further indicate that automatic reciprocation may also enhance the efficient implementation of macroprudential policies.

Chart 3

Reciprocation would lessen the increase in lending rates needed to counteract excessive sectoral credit growth

Average increase in the lending rates needed to obtain the same amount of sectoral deleveraging across models

(basis points)

Notes: Analysis based on supervisory data for Q3 2018. The bars illustrate the minimum and maximum increase in lending rates across countries (IE, LU and MT); the red diamonds indicate the average increase in lending rates.

Box 2

MIAU – Macroprudential policy Impact Assessment Utility

The MIAU tool facilitates the calculation, ceteris paribus, of the potential impact of different macroprudential policies on banks’ lending volumes and rates under simplistic assumptions. Calculations are based on supervisory data (CET1 ratio, risk exposure amounts, risk exposures, etc.) for a sample of about 1,350 banks supervised by the SSM (SIs and LSIs). The tool permits the application of policies at different levels of consolidation and with or without automatic reciprocity. The MIAU calculates the convex area (banks’ reaction space) of banks’ potential responses to the application of macroprudential policies in each SSM jurisdiction, under the assumption that banks would meet the increased requirements by deleveraging and increasing the interest rates on private credit and using the voluntary buffers (see Chart A). One can think of the reaction space in terms of a movement along the loan demand curve whereby changes to banks’ loan supply would give rise to a combination of volume and price adjustments (i.e. amount of loans outstanding and lending rates, respectively).

Chart A

The banks’ reaction space corresponds to all combinations of changes in lending rates and loan volumes that would lead to an increase of the capital ratio under specific assumption on the use of voluntary buffers

Calculations are based on actual accounting figures and the tool implements deterministic rules on banks’ behaviour. The results should therefore be interpreted carefully. The main advantage of the tool is the use of granular data, which allows the non-linearity of banks’ responses to be taken into account as well as the calculation of an effective bank-by-bank policy (e.g. a CCyB is applied bank-by-bank based on the effective CCyB exposures to the country implementing the policy). The tool can be applied for the assessment of the following policies: (i) an increase in the SRB for a selected group of banks (ii) an increase in the sectoral SRB; (iii) an increase in the CCyB rate; (iv) an increase in the sectoral CCyB rate for four sectors (i.e. corporate real estate relate, corporate not real estate related, retail real estate related and retail not real estate related); (v) an add-on to the risk weights on mortgages; (vi) the implementation of a floor for risk weights on mortgages.

The first step is the translation of what the policy measure (e.g. a tightening of the SCCyB rate, a raising of the risk weight floor, etc.) into its effective impact at the individual bank level, which will be a function of each bank’s portfolio composition. For example, under the assumption of an increase of the SCCyB, the tool calculates first bank-by-bank the share of sectoral exposures toward the activating country and then multiplies it by the policy rate increase. The second step is to define how binding is the increased CET1 ratio demand for each bank. For this purpose, an assumption on the use of voluntary buffers is imposed for each bank. This can be implemented as a generic rule (e.g. all banks would increase their CET1 ratio as much as the increase in the requirements or only partially) or as a bank-by-bank rule. The third step is the evaluation of the implied combination of deleveraging and increases in lending rates to meet the increased CET1 ratio demand.[17] The tool allows for any possible combination of deleveraging and lending rate increases, respectively. However, as a general rule, the combination based on the empirically founded elasticity of demand implied by Darracq et al. (2019) is used. This model allows us to use different assumptions as to banks’ response to deleveraging. For this article, we focus on a scenario where banks deleverage and increase interest rates in the country in which the policy is applied and, if this is not sufficient, also do so pro-rata in the country of exposure.

5 Conclusion

The use of capital buffers at sectoral level, e.g. a sectoral SRB or, potentially, a SCCyB, may require expanding the cross-border recognition of risks via reciprocity arrangements for sectoral capital buffers. This may prove important to foster the effectiveness of macroprudential policy implementation. However, mandatory reciprocation could impose a burdensome notification procedure on banks if cross-border exposures in the form of lending via branches or direct credit are not material.

Our analysis shows that sectoral credit provided via foreign branches or direct cross-border bank lending is material for a number of SSM countries from a financial stability perspective. Across SSM countries, cross-border lending activities to particular sectors vary significantly. Direct cross-border credit or lending via branches is material particularly for corporate sector exposures, with cumulative shares of up to 25% of total domestic lending provided via foreign branches or direct cross-border exposures. By comparison, real estate credit provided via foreign branches or direct cross-border bank lending is smaller in magnitude. In addition, model-based simulations assessing the impact of a sectoral capital buffer in the form of a SCCyB provide further evidence that non-reciprocation would imply a higher buffer requirement to achieve the same policy objective.

Further progress towards deeper cross-border financial integration and risk sharing in the context of Banking and Capital Markets Union also reinforces the need for cross-border recognition of macroprudential policies. While the provision of sectoral cross-border lending via branches or direct credit is currently not a widespread EU phenomenon, this might become more pronounced in future. This article provides some evidence that facilitating and enhancing reciprocity arrangements for sectoral capital buffers, where exposures are material, may pre-empt future leakages in the financial system and ensure a level playing field for domestic and foreign banks. Based on the evidence provided in this article and potential future developments in the banking system, the comprehensive review of the macroprudential policy framework by 2022 provides a vital opportunity to address this issue.

We would like to thank Silviu Oprică and Balázs Zsámboki for their valuable comments and suggestions.

Articles 124 and 164 CRR address risks in the real-estate sector and Article 458 CRR addresses risks in residential or commercial real estate sectors or intra-financial sector exposures. The article “Macroprudential analysis of residential real estate markets”, Macroprudential Bulletin, Issue 7, ECB, Frankfurt am Main, March 2019 presents a more detailed discussion of real estate macroprudential instruments.

See the SNB Financial Stability Report 2012 and the SNB’s “Stance of the Basel III countercyclical capital buffer in Switzerland”, published in 2017. Mandatory reciprocity as foreseen in Basel III does not apply to the Swiss sectoral CCyB requirements. See also speech by Pablo Hernández de Cos, Governor of the Banco de España, on 3 June 2019 regarding “A framework for the CCyB”, which is available here.

Data as of September 2018. Data for only the largest LSIs was available for this analysis.

In this article, we look at cross-border lending and not total assets for the following three reasons: first, reciprocity affects cross-border direct lending and lending via foreign branches and looking at total assets of subsidiaries and branches in the host country does not take into account total direct lending (which seems to play a relevant role); second, sectoral macroprudential policies are applied to the share of lending toward a specific sector in the activating country and not to total assets (which includes lending to third countries, for example); third, curbing excessive growth in lending is one key objective for sectoral macroprudential policies.

See ECB (2019), “A conceptual framework for monitoring and assessing cross-border spillover effects from macroprudential policies in the EU”, ECB Occasional Paper (forthcoming).

For a more detailed elaboration on the conceptual cross-border spillover channels due to macroprudential policies, see also ECB (2019), “A conceptual framework for monitoring and assessing cross-border spillover effects from macroprudential policies in the EU”, ECB Occasional Paper (forthcoming).

In the host Member State (country B), foreign subsidiaries are stand-alone entities and subject to the supervision of the host country, including a macroprudential policy activated in that country. Conversely, bank credit provided via foreign branches or direct cross-border lending falls under the supervision of the home country (country A) and is not subject to the macroprudential policy of the host country.

For the ESRB’s voluntary reciprocity framework, see Chapter 11 of the ESRB Handbook on Operationalising Macroprudential Policy in the Banking Sector, April 2018.

See ECB contribution to the European Commission’s consultation on the review of the EU macroprudential policy framework, page 16.

The application of the de minimis exemption was dealt with in an ESRB Recommendation in 2017 (ESRB/2017/4).

Materiality thresholds used in concrete cases range from EUR 250 million to SEK 5 billion applied to exposures in the activating country, relevant authorities permitted to go below these thresholds on a case-by-case basis. For an overview of active or expired measures recommended for reciprocation by the ESRB, see here.

While these materiality thresholds are expressed in terms of total, rather than foreign exposures, it may still provide a starting point for the analysis of relevant cross-border exposures.

Cyprus was not included in the analysis because the cross-border credit is originated from a larger number of countries, therefore we would expect the effects to be more dispersed than in the other cases.

See Darracq Pariès, Matthieu, Kok, Christoffer and Rancoita, Elena, "Macroprudential policy in a monetary union with cross-border banking", Working Paper Series, No 2260, ECB, Frankfurt am Main, March 2019.

Please note that strengthening the resilience of the banking sector is the primary objective of a sectoral capital buffer. This does not contrast with this particular simulation, where we study the increase of capital requirements achieving an illustrative 1% decrease in lending growth.

Assuming no capital raising or restriction of dividend payments.