China’s path to normalisation in the aftermath of the COVID-19 pandemic

Published as part of the ECB Economic Bulletin, Issue 6/2020.

This article will trace the decline and subsequent recovery of China’s economy following the outbreak of the coronavirus (COVID-19). It employs high-frequency data to assess the speed at which activity in different sectors of the economy is normalising after businesses were allowed to resume operations. One particular focus will be on differentiating between the industrial and services sectors, which are subject to different health and safety measures. The article finds that China’s economic activity rose from a trough of around 20% of normal levels in February 2020 to 90% in the span of just three months. While production capacity recovered swiftly, activity normalised more gradually in the services sector, where COVID-19 containment measures had continued to weigh heavily. The recovery was driven primarily by private domestic demand and the authorities’ policy response, as the normalisation in China coincided with the implementation of lockdown measures by many of its trading partners and hence also with a fall in external demand. Looking ahead, uncertainty and risks surrounding the recovery path remain exceptionally high, owing in large part to the uncertainty regarding how the COVID-19 pandemic will develop and if and when a medical solution to the virus can be found.

1 Introduction

Since the mid-1990s, China’s economy has experienced a period of rapid growth resulting in greater interconnectedness with the global economy. In conjunction with a gradual process of reform and opening-up, this has turned China into one of the largest economies in the world and a trading powerhouse. Over the past five years, the country’s economy has grown at an average rate of 6.7%, accounting for around one-third of global growth. At the same time, China’s demand for foreign goods and services from many economies, including the euro area, has increased considerably. From 1995 to 2019, its share in euro area foreign demand increased from 2% to around 7% (see Chart 1). This trend highlights that the extent to which China recovers from the COVID-19 pandemic is critical outside as well as inside its borders.

Chart 1

China’s share in world GDP and euro area foreign demand

(percentages)

Sources: International Monetary Fund, World Economic Outlook, April 2020 (for GDP figures) and ECB (for China’s share in euro area foreign demand).

Notes: The x-axis shows China’s GDP as a percentage share of total world GDP and the y-axis shows China’s percentage share in euro area foreign demand. The size of each bubble represents China’s GDP based on purchasing power parity in nominal international dollars.

The COVID-19 pandemic affected China earlier than it affected other economies. According to official statistics, the number of confirmed COVID-19 cases rose from under 1,000 at the end of January 2020 to over 80,000 by early March. Strict lockdown measures were put in place to bring the epidemic quickly under control. These containment measures necessitated the powering down of the economy for an extended period of time, leading to a significant short-term decline in economic activity. While the outbreak was brought largely under control in China, COVID-19 spread rapidly across the globe, with the number of confirmed cases in other countries surpassing those in China by mid-March. As of early August, worldwide cases had climbed to over 19 million.

The nature of the downturn during the COVID-19 pandemic is very different from other cyclical downturns. In the current episode, both supply and demand have been supressed through business closures and mobility restrictions. As such, there is a higher than usual degree of overall uncertainty surrounding the economic recovery path, not least because of fears that a flare-up in new cases could derail the recovery. Furthermore, the length of time it will take to develop and implement a medical solution remains uncertain, as does the medium-term impact of continued containment measures on the labour market. In this regard, the recovery in China, which commenced earlier than in the rest of the world, can be instructive for other economies that are in the process of easing their containment measures.

2 The COVID-19 outbreak in China and its economic impact

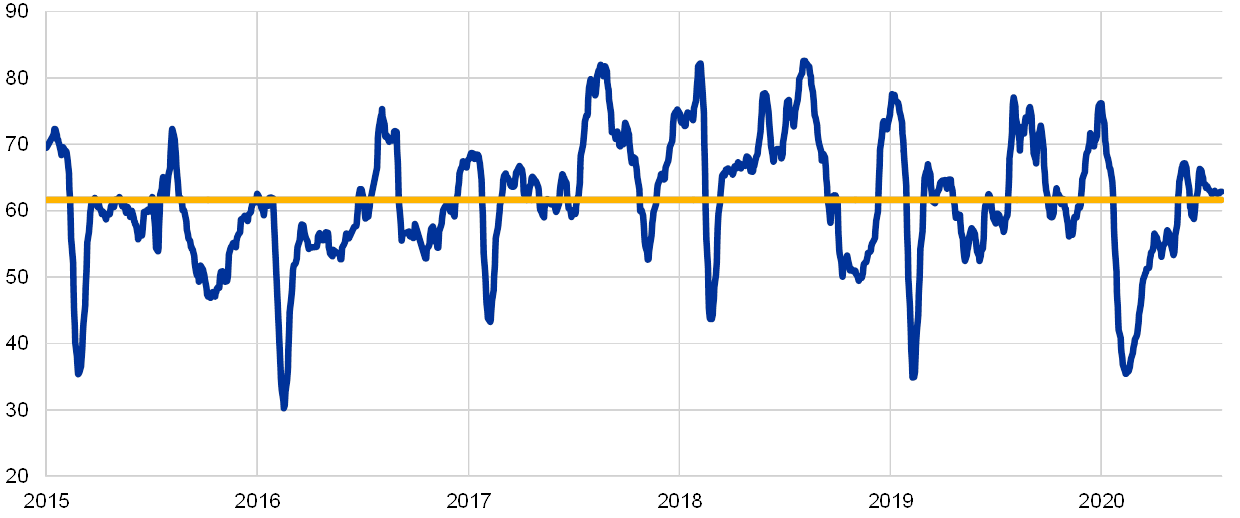

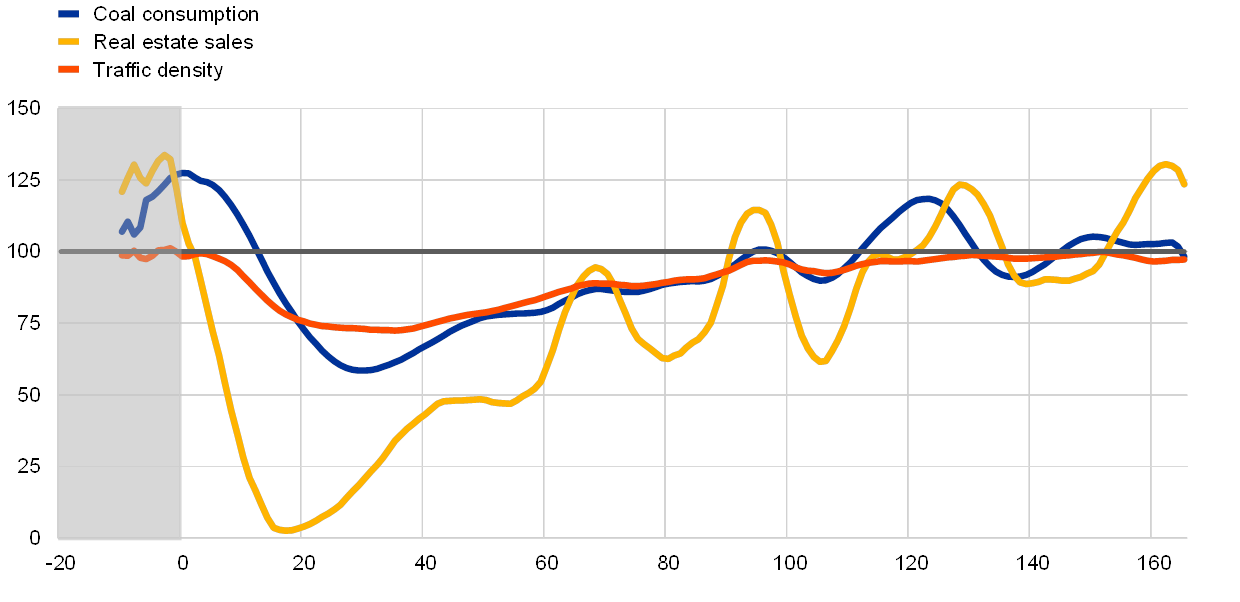

The rapid intensification of the COVID-19 outbreak in China broadly coincided with the start of the Lunar New Year holiday. The Lunar New Year is a seven-day national public holiday which starts between late January and mid-February and for which virtually all factories close down for a prolonged period of time. During this period, migrant workers traditionally return home, giving rise to a peak travel season which involves several hundred million passengers travelling across China every year. Towards the end of January 2020, the Chinese economy powered down, as can be seen, for instance, by the coal consumption of major electricity producers (see Chart 2). The extent of the decline in coal consumption in January 2020 was not unusual compared with that of previous Lunar New Year holidays. However, owing to the COVID-19 outbreak, the public holiday was extended and the resumption of business activity was considerably delayed. A comparison of a number of high-frequency indicators of economic activity with their corresponding levels the previous year shows that it took more than three months for several of these indicators, such as coal consumption, real estate sales and traffic density, to return to their 2019 levels (see Chart 3).

Chart 2

Coal consumption of major electricity-generating power plants

(10,000 metric tonnes/day)

Sources: Beijing China Coal Times Technology Development Co., Ltd via Haver Analytics.

Notes: The chart shows the daily coal consumption of six major electricity-generating power plants in China (seven-day moving average). The yellow line shows the five-year average. The latest observation is for 27 July. The series was discontinued thereafter.

Chart 3

High-frequency indicators of economic activity

(percentages of level at same point in 2019)

Sources: Wind Economic Database and ECB staff calculations.

Notes: “Coal consumption” shows the use of coal by major energy producers; “Real estate sales” shows the volume of real estate transactions for 30 major cities; “Traffic density” shows the average traffic density across 100 Chinese cities. Data show seven-day average deviations from levels at the same point following the start of the 2019 Lunar New Year. The x-axis shows days since the start of the Lunar New Year. The shaded area shows the days in 2020 preceding the beginning of the 2020 Lunar New Year holiday. The latest observation is for 8 July 2020.

The COVID-19 outbreak led the authorities to implement strict and comprehensive containment measures. The city of Wuhan, which was at the centre of the outbreak, was placed under lockdown just ahead of the Lunar New Year holiday. Transport into and out of the city was shut down and businesses were closed, with few exceptions. Within days, residents were prohibited from leaving their homes except to make essential purchases, and the quarantine measures were strictly enforced. The containment measures were extended to the province of Hubei (in which Wuhan is located) and to the rest of the country, while the public health response level was escalated to its highest state of emergency nationwide. The holiday was officially extended and both national and international travel restrictions were put in place. In the course of February and March, decisions on reopening non-essential businesses were taken at the province level, depending on local developments in COVID-19.

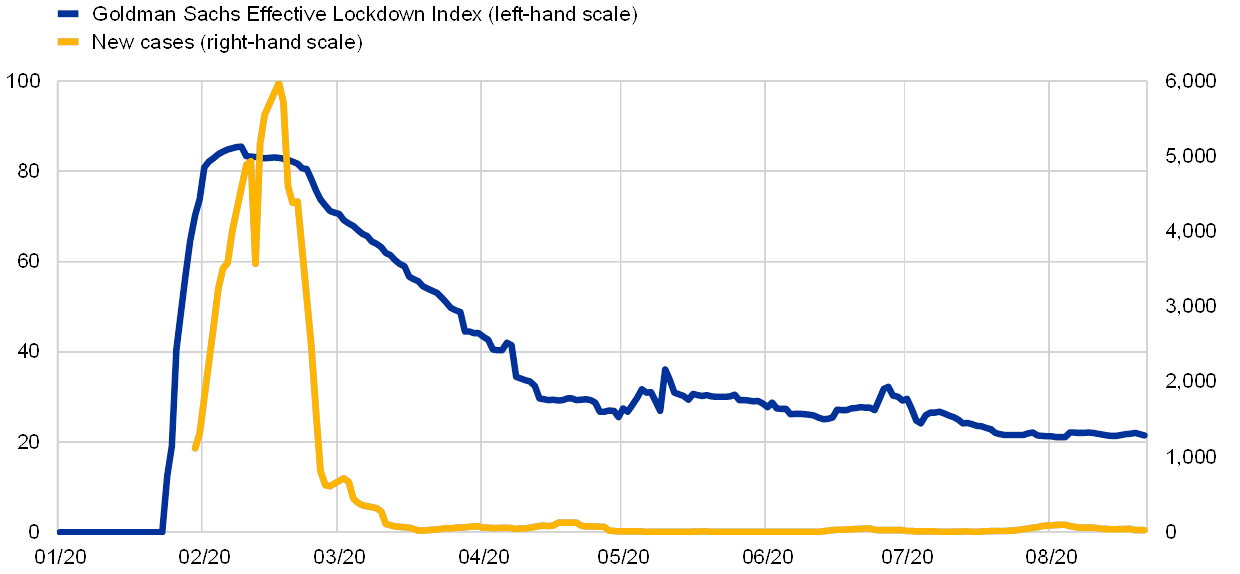

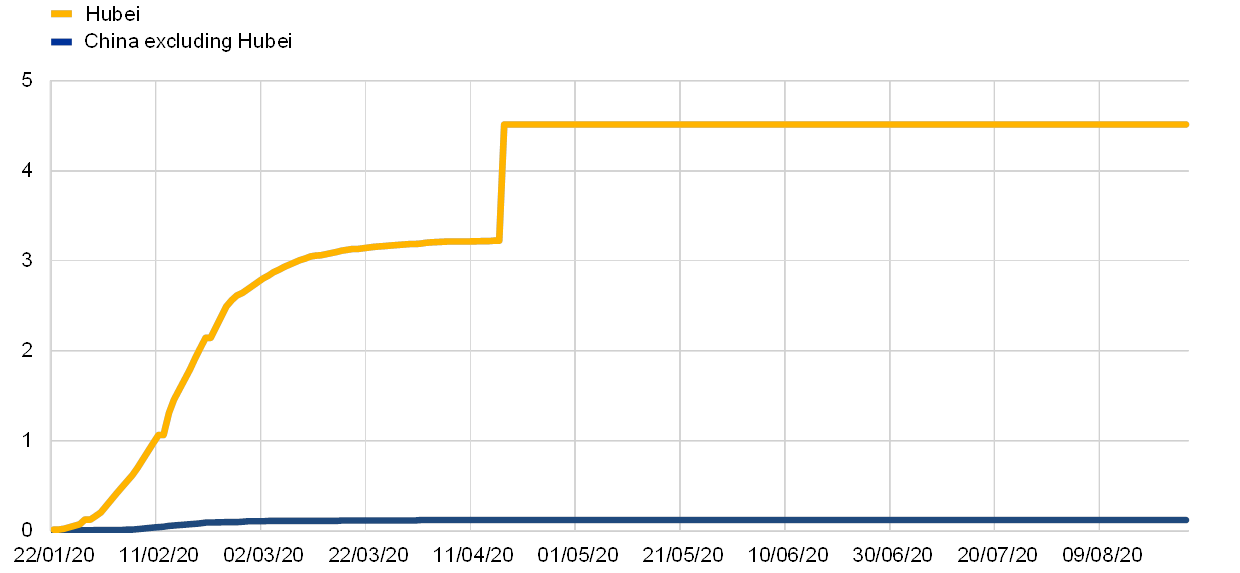

The containment measures limited the spread of COVID-19. Daily new cases increased exponentially for a period of roughly three weeks, before rapidly falling from around mid-February. The lockdown measures introduced swiftly at the end of January, as reflected in the Goldman Sachs Effective Lockdown Index (see Chart 4), were gradually relaxed again with the decline in the growth rate of new COVID-19 cases. The overall official number of COVID-19 cases stabilised at approximately 85,000. National data suggest that the strict lockdown measures greatly limited the spread of the virus throughout China. According to official data, about 80% of all COVID-19 cases and over 95% of COVID-19 deaths in China were registered in Hubei province (see Charts 5 and 6). As Hubei only accounts for 4% of China’s population, this would imply that cases in the rest of China were exceptionally sparse.

Chart 4

Containment measures and daily new COVID-19 cases

(left-hand scale: index; right-hand scale: daily new COVID-19 cases)

Sources: Johns Hopkins University, Goldman Sachs and ECB staff calculations.

Notes: The Goldman Sachs Effective Lockdown Index combines official restrictions with mobility data. The latest observations are for 21 August 2020.

Chart 5

Confirmed COVID-19 cases

(thousands)

Sources: Johns Hopkins University and ECB staff calculations. The latest observations are for 25 August 2020.

Chart 6

Confirmed COVID-19 deaths

(thousands)

Sources: Johns Hopkins University and ECB staff calculations.

Note: On 17 April, China revised its official figures for COVID-19 deaths up by 1,290, all in the city of Wuhan. The latest observations are for 25 August.

The containment measures were successful in curbing the spread of the virus but weighed heavily on China’s economy. In the first quarter of 2020, real GDP contracted by 10.0% quarter on quarter and by 6.8% year on year. Weak consumption made the largest negative year-on-year contribution to GDP, at -4.4%, while investment contributed -1.5% and net trade -1%. The decline in economic activity was sharp and swift and GDP decreased for the first time in decades. The Caixin China General Manufacturing Output Purchasing Managers’ Index (PMI) fell in February to 28.6 points, far below the level observed during the global financial crisis. The Caixin China General Services Business Activity PMI also fell substantially, from 51.8 in January to 26.5 in February. These PMI declines proved to be short-lived, however, because in March the manufacturing PMI rebounded to above 50, implying that the trough in business activity had occurred in February. Nevertheless, overall PMI readings signalled sharp contractions across China’s economy amid prolonged production cuts. The marked fall in economic activity in January and February was also reflected in the large year-on-year contractions in industrial production (-13.5%), fixed asset investment (-24.4%) and retail sales (-20.5%). For the first quarter as a whole, year-on-year industrial production declined by 9.3%, while retail sales contracted by around 19%.

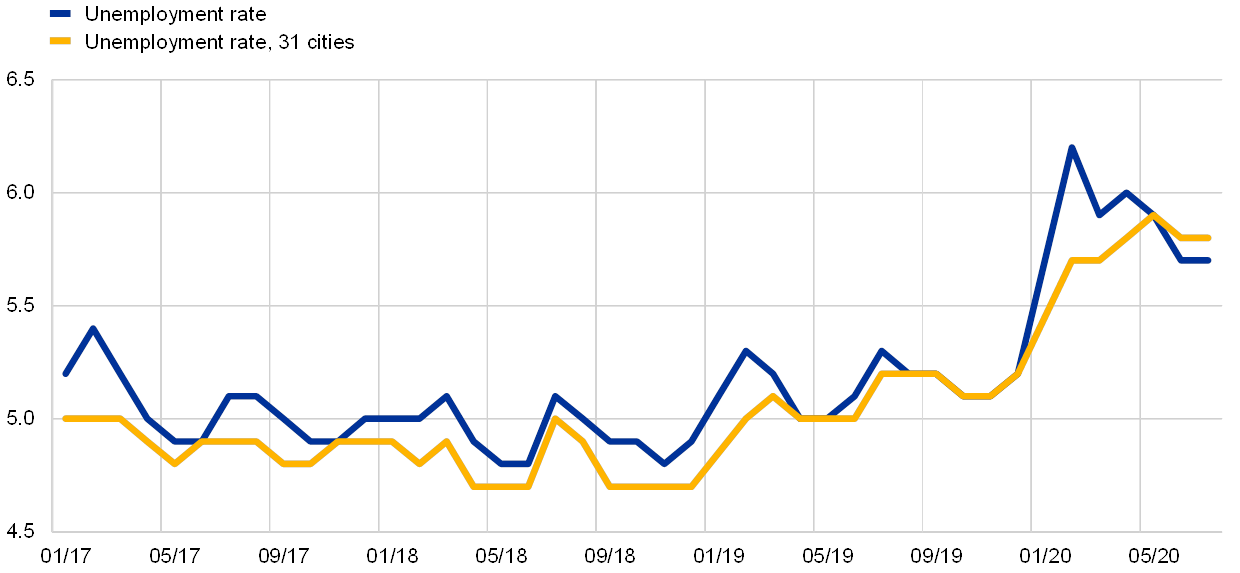

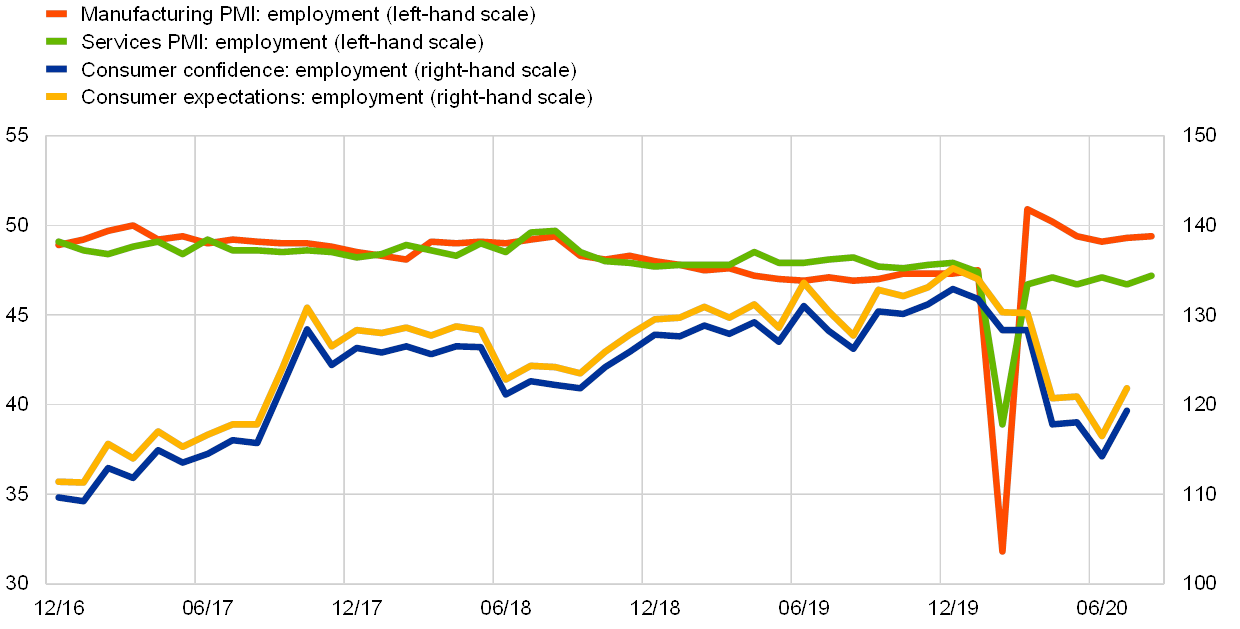

Labour market conditions have deteriorated since the outbreak of the pandemic. Official measures show a relatively modest increase in unemployment since the outbreak, from 5% to just below 6% (see Chart 7). This might be due to the authorities’ efforts to persuade many businesses to keep their employees. However, unemployment might be higher when non-urban workers are included and could be a drag on future economic recovery. Indeed, employment surveys point to a mixed picture regarding expected employment rates, with businesses foreseeing a quick rebound, while consumers remain more pessimistic about employment prospects (see Chart 8).

Chart 7

Unemployment rate

(percentages)

Sources: National Bureau of Statistics of China via Haver Analytics.

Notes: “Unemployment rate” refers to the urban unemployment rate; “Unemployment rate, 31 cities” refers to the urban unemployment rate for 31 major cities. The latest observations are for July 2020.

Chart 8

Employment expectations surveys

(left-hand scale: diffusion index; right-hand scale: index)

Sources: National Bureau of Statistics of China, CEIC Data, Caixin and IHS Markit.

Note: The latest observations are for August 2020 for the PMIs and July 2020 for the consumer surveys.

3 The gradual normalisation of the economy after the containment of the outbreak

Following the containment of new COVID-19 cases, the Chinese authorities gradually lifted the protective measures. The easing of restrictions was contingent on local developments in the growth rate of COVID-19. In most provinces, the Lunar New Year holiday had been extended by a week or more into February 2020, while in Hubei province the holiday was extended to 10 March. In terms of the order in which these restrictions were lifted, businesses were allowed to resume operations first, while travel restrictions initially remained in place. The reopening of businesses presented a logistical challenge, as in some instances supply chains had been disrupted and travel constraints meant that workers were still dispersed across the country.

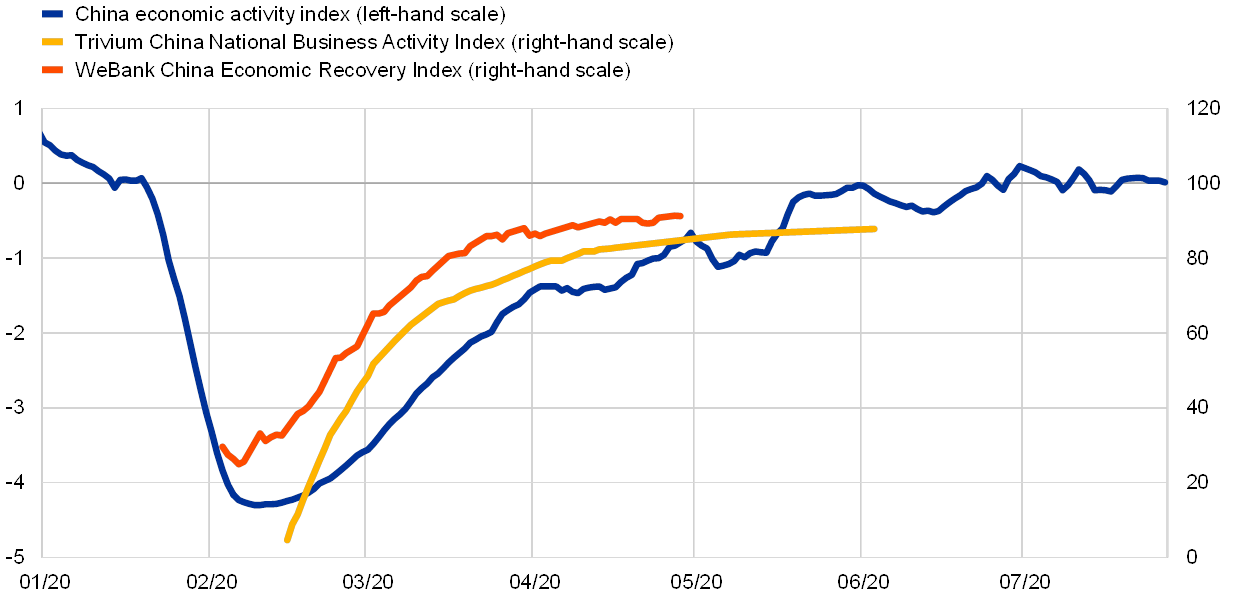

Following the sharp contraction in economic activity in China during the first quarter, the economy made a relatively swift recovery. In the second quarter, China’s GDP increased by 11.5% quarter on quarter and 3.2% year on year, driven primarily by investment, while consumption growth remained negative in year-on-year terms. A broad number of indicators suggest that, within three months, China’s economic activity rose from its trough to around 90% of normal levels. A newly developed daily activity indicator[1] that summarises information from electricity plant coal consumption, real estate market activity, traffic density data and changes in pollution levels shows that economic activity bottomed out in the first half of February and had already recovered to close to its long-term average level by mid-May. Other indicators, such as the Trivium China National Business Activity Index, which estimated China’s economic capacity utilisation, and the WeBank China Economic Recovery Index, which tracked the number of businesses reopening, also show resumption rates of around 90% by the beginning of May (see Chart 9).

Chart 9

Economic activity indices

Sources: Trivium China, WeBank and ECB staff calculations.

Notes: 100 denotes the normal level of activity. The latest observations are for 27 July for the China economic activity index, which is measured in standard deviations, 3 June for the Trivium China National Business Activity Index and 28 April for the WeBank China Economic Recovery Index (the latter two indices were discontinued when resumption exceeded 90%).

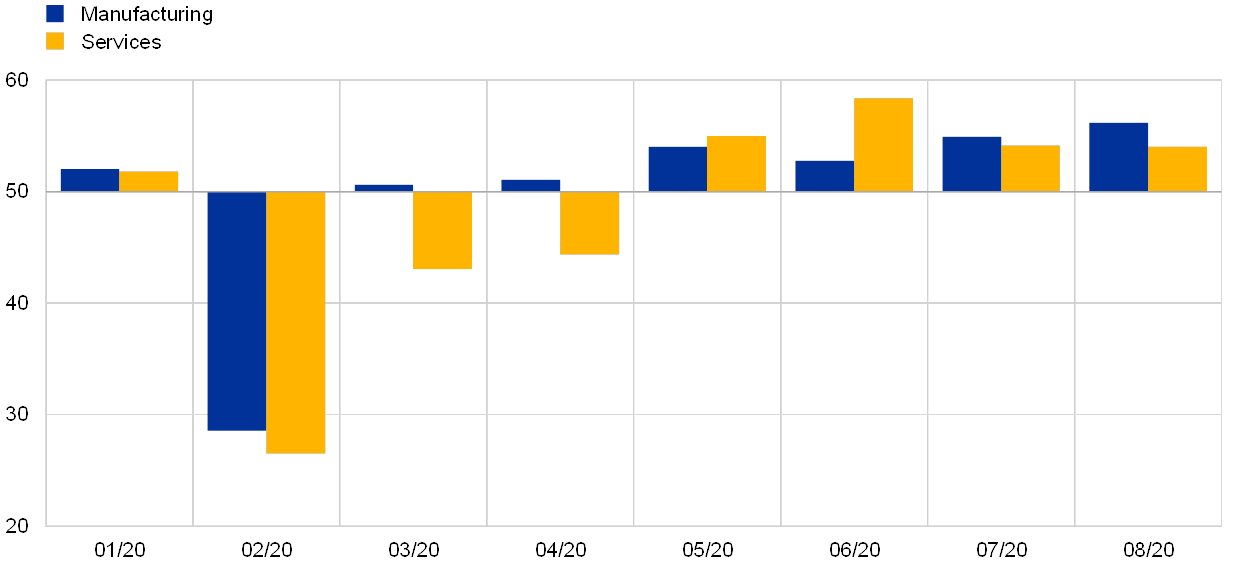

Survey data point to an uneven recovery, with manufacturing rebounding earlier than the services sector. While the elevated uncertainty necessitates some caution in interpreting PMIs, the manufacturing PMI returned to expansionary territory as early as March, whereas the services PMI continued to signal a softening of activity until May, when it rose above the neutral threshold (see Chart 10). Although the services PMI reached 58.4 in July, its levels in the period from February to April imply that the contraction in the services sector was larger than in manufacturing. Overall, the manufacturing and construction sectors returned to almost full capacity in the course of May. On the other hand, services sectors, in particular those associated with close physical interaction such as tourism, business travel, and cultural and sporting events, have tended to remain well below pre-outbreak capacity, with activity ranging between 20% and 80% of normal levels.

Chart 10

PMI: manufacturing and services

(diffusion index)

Sources: Caixin and IHS Markit.

Note: “Manufacturing” refers to the Caixin China General Manufacturing Output PMI and “Services” to the Caixin China General Services Business Activity PMI.

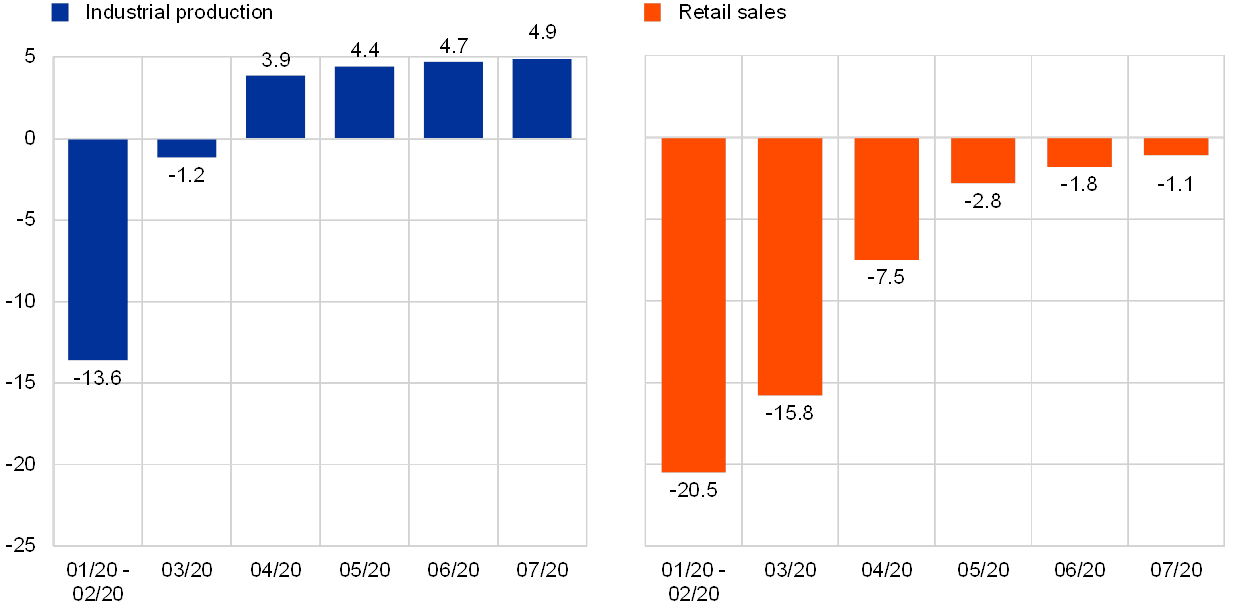

The differential speed of recovery is also apparent in production and sales data. After a weak first quarter, industrial production growth in year-on-year terms returned to positive rates in April and rose further in May. Retail sales, on the other hand, continued to contract in year-on-year terms in the first two months of the second quarter; sales growth improved markedly after the trough in January and February but has not yet returned to positive rates (see Chart 11). The slower rate of recovery in services is due to several factors. Ongoing mandatory social distancing measures are limiting the capacity of businesses in a number of sectors, including catering, entertainment, tourism and cultural services. Uncertainty regarding the renewed rise in COVID-19 cases, particularly in the absence of a medical solution, is further weighing on the demand for services where social distancing remains challenging, such as transportation. Finally, increased unemployment and economic uncertainty are lowering domestic demand for non-essential purchases, which disproportionately affects the services sector. The slow recovery in services is significant for the Chinese economy, as the services sector now contributes more than 50% of China’s real GDP growth.

Chart 11

Industrial production and retail sales

(year-on-year percentage change)

Sources: National Bureau of Statistics of China via Haver Analytics and ECB staff calculations.

Notes: “Retail sales” data are not seasonally adjusted. January and February data are not individually available, so the sum of data for these months is compared with the sum of the previous year’s data for January and February.

At the same time, weak foreign demand is impeding China’s recovery. Since China was the first country to experience the COVID-19 outbreak, its recovery has coincided with the implementation of strict containment measures among its trading partners as the COVID-19 pandemic took hold across the globe. The lockdown measures in Europe, the United States and the rest of Asia gave rise to a strong decline in demand for China’s exports, as can be seen in the Caixin China Composite New Export Orders PMI. In February, a supply shock reduced exports as producers and shipping ports operated at a fraction of their capacity. Following a nascent recovery in March, new export orders declined significantly again in April as external demand plummeted during lockdowns of trading partners. Data for May to August show that foreign demand for China’s goods is once again recovering, but also that the spread of the COVID-19 pandemic has led to a decoupling of broader economic growth, as reflected in the Caixin China Composite Output PMI, from its new export orders component (see Chart 12). With export orders passing the neutral threshold of 50 only in August, China’s recovery thus far has been driven primarily by domestic factors.

Chart 12

PMI: composite output and new export orders

(diffusion index)

Sources: Caixin and IHS Markit.

Note: “Composite output” shows the Caixin China Composite Output PMI; “Composite new export orders” shows the Caixin China Composite New Export Orders PMI. The latest observation is for August 2020.

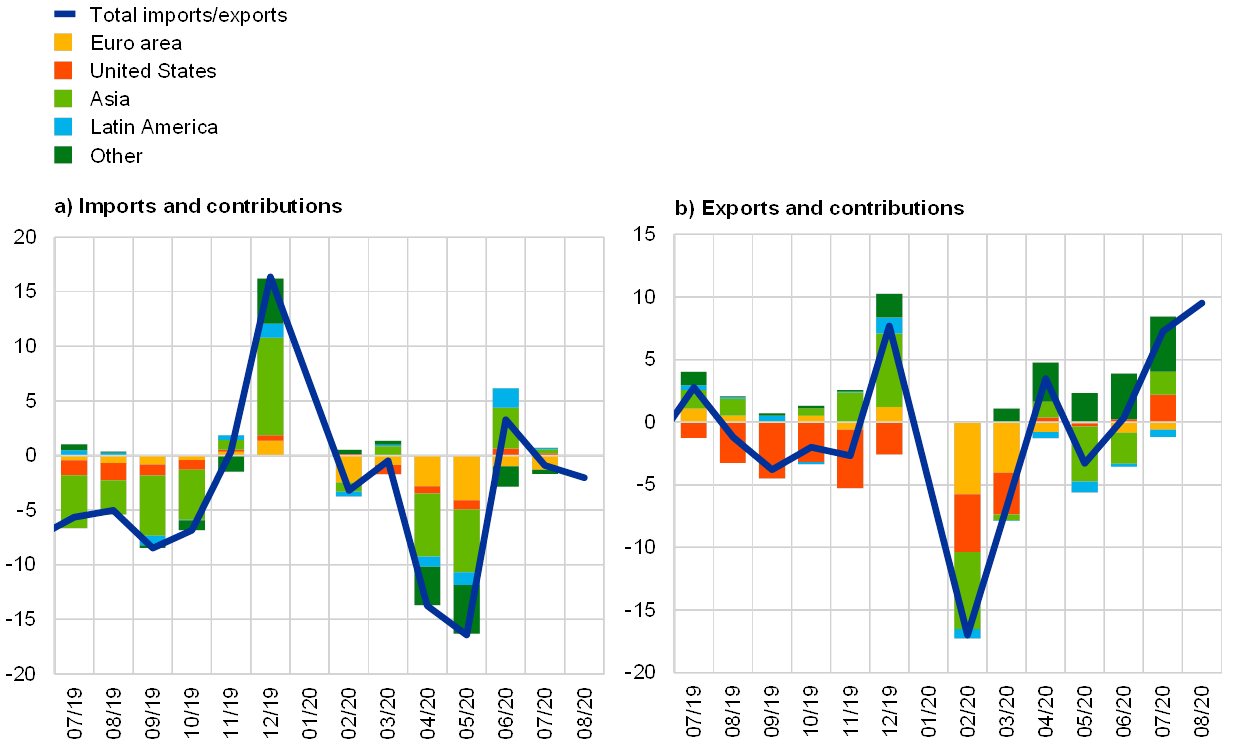

Looking ahead, global developments outside China will also be important for the economy’s near-term outlook. As China emerged from the lockdown, lifting restrictions on businesses and citizens, important trading partners, such as Europe and the United States, enforced containment measures. This has affected China’s foreign demand at a time when its domestic recovery also remains relatively fragile. Trade collapsed in the first few months of the year and the sharp decline in exports implied a negative contribution of net trade to growth (see Chart 13). In April, growth in goods exports returned to positive territory, only to contract again the following month as China’s main trading partners implemented containment measures. However, since June year-on-year growth in exports has been increasing. Imports have remained very subdued owing to weaker domestic demand and lower oil prices. In addition, the dynamics of exports and imports are intertwined – a considerable share of China’s imports ultimately feeds into its exports given its prominent position in global value chains. Recent debates in a number of countries about access to medical equipment and medications may also have longer-term implications for global supply chains. For a number of sectors, such as those considered critical to health or national security, countries may choose to repatriate certain production stages to assume greater domestic control over their production, effectively delinking supply chains. This could weigh on the economic growth of countries that are strongly interlinked with the relevant global value chains.

Chart 13

Imports and exports by trading partner

(year-on-year percentage changes)

Sources: China’s General Administration of Customs, CEIC Data and ECB staff calculations.

Note: Figures for January and February 2020 are aggregated, as monthly contributions are not available.

Meanwhile, some domestic demand components are showing signs of strengthening. For instance, automobile sales turned positive in April for the first time since mid-2018 (see Chart 14). This reflects in part pent-up domestic demand, following a period of very low car sales. It also potentially reflects a shift away from public transport. Moreover, increasing infrastructure spending has led to particularly strong growth in sales of commercial vehicles such as trucks and construction vehicles. Real estate sales have also recovered to reach their 2019 levels, which points to a broader recovery in domestic demand. Revenue from restaurants, on the other hand, was still down in mid-June, at around 34% of the previous year’s level.

Chart 14

Vehicle sales in China

(year-on-year percentage changes)

Sources: China Association of Automobile Manufacturers and ECB staff calculations.

Note: The latest observation is for August 2020.

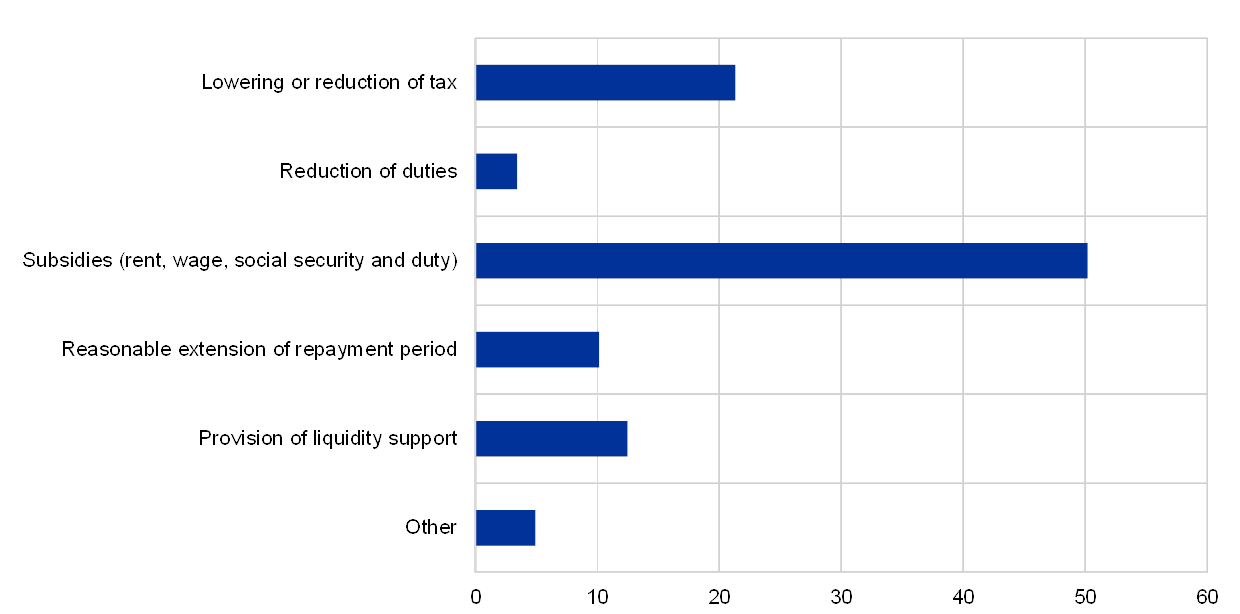

The Chinese authorities have been implementing substantial fiscal and monetary stimuli to cushion the economic shock. With regard to fiscal policy, they are aiming to stabilise employment and economic growth by expanding unemployment insurance, investment and tax relief. Discretionary fiscal measures amounting to around 4% of GDP have been announced, but the total fiscal package is expected to be bigger (see Chart 15). In particular, small and medium-sized enterprises (SMEs) seem to expect substantial additional government support, including tax relief and subsidies, according to a survey conducted by Tsinghua University and Peking University.[2] The authorities are planning to bring forward infrastructure spending, reduce the tax burden on exporting industries and subsidise durable goods purchases.

Chart 15

Expectations of government support in the light of COVID-19 shocks

(percentages)

Source: Huang, Y. et al., “Saving China from the coronavirus and economic meltdown: Experiences and lessons”, VoxEU, March 2020, based on Zhu, W. et al., “COVID-19 and Impacts on SMEs: Survey Evidences”, CEIBS Business Review, 2020.

Note: The x-axis shows the percentage of respondents expecting the given support measures to materialise.

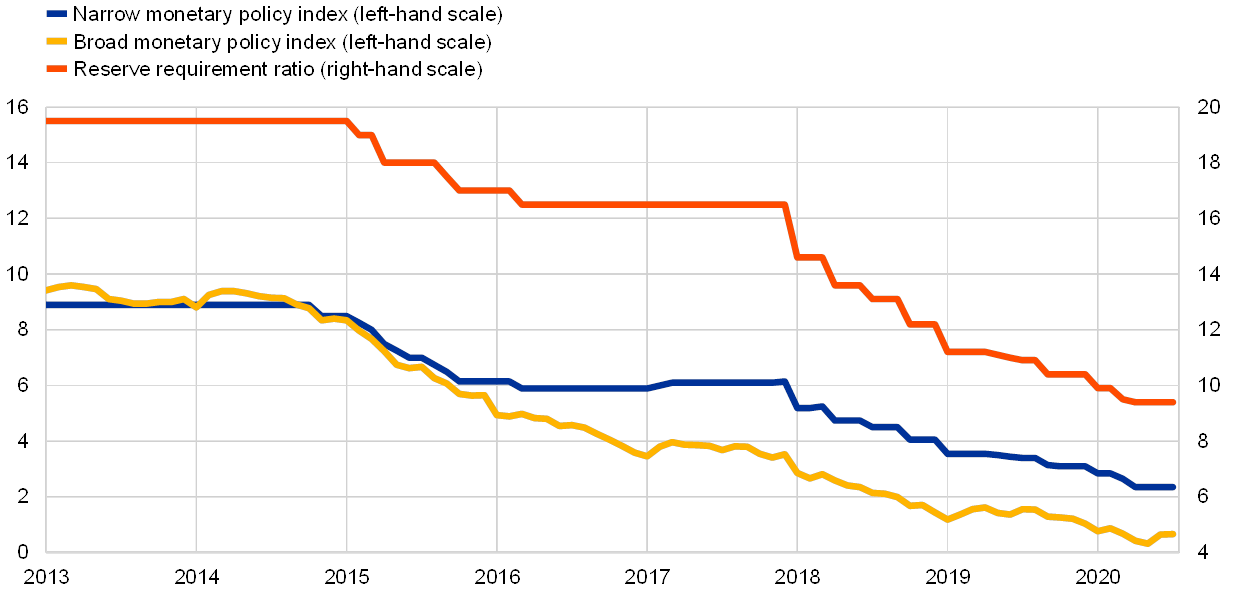

Monetary policy measures are complementing fiscal policy by ensuring sufficient liquidity in the banking system. The People’s Bank of China has cut key policy rates and reserve requirements. Monetary policy has been further loosened since the beginning of 2020 in order to support economic activity, according to summary measures of monetary policy conditions (see Chart 16). Furthermore, the People’s Bank of China has directed banks to accommodate delayed loan repayments by businesses, and the banking regulators have provided regulatory relief to banks. These policies have prevented larger increases in bankruptcies and unemployment.

Chart 16

Monetary policy index and reserve requirement ratio

(percentages)

Sources: Lodge, D. and Soudan, M., “Credit, financial conditions and the business cycle in China”, Working Paper Series, No 2244, ECB, Frankfurt am Main and ECB staff calculations.

Note: The monetary policy index is an ECB summary measure of different monetary policy instruments of the People’s Bank of China, including interest rates and quantity-based instruments, adjusting for their relative importance over time.

4 Outlook and risks to the recovery

China’s economic outlook remains highly uncertain despite the gradual recovery. In the near term, China’s prospects will depend on the resilience of domestic demand in the presence of increased uncertainty and on developments in the external environment. In addition, the outlook is partially shaped by the extent to which the impact of COVID-19 leads to entrenched changes in the structural and behavioural patterns of the economy. At the last National People’s Congress in May 2020, the authorities did not announce an official growth target for the year for the first time in 20 years. This underscores the current uncertainty surrounding China’s economic performance, while also pointing to the difficulties of achieving a rate of growth even close to that expected before the current crisis. Furthermore, pandemics can have long-lasting effects through increased precautionary saving and fewer investment opportunities. These potential effects pose additional risks to China’s medium-term outlook and reduce the possibility of a quick convergence towards the income levels expected prior to the initial COVID-19 outbreak.

In the absence of a medical solution to COVID-19, social distancing measures will continue to compress economic growth. Until a medical solution has been developed and is widely available, social distancing measures are likely to remain in place. Distancing measures, while essential to control the pandemic, will continue to affect the economy in a number of ways. In some industries, distancing requirements directly reduce capacity, for instance in restaurants and other venues which host large numbers of customers. More broadly, health risks discourage demand for services which are associated with denser customer and staff attendance. Furthermore, some industries may experience permanent demand losses. For instance, increased experience with remote working arrangements may permanently reduce the demand for business travel and associated services. It will require time for workers in these sectors who have been made redundant to be relocated to other sectors of the economy. In turn, the loss of jobs reduces disposable income and can further weigh on consumption.

China’s recovery is subject to a number of risks and could be jeopardised if the country experiences a second wave of infections later this year. As there is still high uncertainty regarding the availability of a medical solution to COVID-19, it cannot be excluded that – as containment measures are relaxed and social distancing is reduced – a second wave of infections might force the government to reimpose restrictions. Protracted subdued external demand as a result of the pandemic’s development in the rest of the world might also weigh on China’s recovery. For example, longer-lasting effects on China’s trading partners, delays in containing the pandemic across the globe or the emergence of second waves could all affect China’s export sector. Further risks to the recovery stem from a potential reescalation of the trade dispute between China and the United States. Although these trade tensions have been attenuated by the “Phase one” trade deal agreed earlier this year, the pandemic and its economic implications have increased the risk that agreed targets will not be met. A further escalation of trade tensions between the two economies and the resultant negative spillovers could further impinge on China’s recovery. Ongoing high levels of leverage and other financial imbalances continue to indicate risks to financial stability. While the Chinese authorities have successfully clamped down on credit growth in recent years, the stock of debt is still relatively high, both at the household and at the corporate level. In addition, although macroprudential policies have curbed the growth of the shadow banking sector, its level remains elevated. In particular, the short-term funding structure in large parts of the shadow banking system could be susceptible to sudden changes in investors’ risk appetite, and thus subject to liquidity and rollover risks.

5 Conclusion

This article reviews both traditional data and non-conventional high-frequency indicators to assess the pace of the economic recovery in China. Following a downturn that materialised with unprecedented speed in early 2020, the economy rebounded to activity levels close to those seen prior to the COVID-19 outbreak in a matter of three months. This relatively swift pace of recovery is due to the supply shock nature of the downturn, which meant that production capacity was able to resume in a relatively short period of time. However, the contraction of demand will take longer to fully normalise as the ongoing need for social distancing weighs on activities that involve denser congregations of people.

The outlook for China’s economy hinges on several uncertain factors. The first and most significant factor is the time required to develop and implement a medical solution to the pandemic. The second is the potential for flare-ups and second waves of COVID-19 prior to the availability of a medical solution. The third factor is the pace of the recovery of China’s trading partners. Finally, a number of structural and geopolitical factors also affect the future growth path of China, including the extent of a potential decoupling from global value chains, as well as future trade relations with major trading partners, particularly the United States. While a normalisation of economic activity in the course of 2021 appears the most likely scenario, the above factors could lead to considerable deviations from this baseline. In view of China’s increasing role in determining global growth, the uncertain factors surrounding China’s recovery are of utmost importance for the world’s economic outlook.

- The high-frequency China economic activity index is an ECB internal measure which uses principal component analysis to combine data for the above-mentioned indicators.

- See Huang, Y. et al., “Saving China from the coronavirus and economic meltdown: Experiences and lessons”, VoxEU, March 2020, based on Zhu, W. et al., “COVID-19 and Impacts on SMEs: Survey Evidences”, CEIBS Business Review, 2020.