Euro area monthly balance of payments (December 2015)

- In December 2015 the current account of the euro area recorded a surplus of €25.5 billion. [1]

- In the financial account, combined direct and portfolio investment recorded an increase of €28 billion in assets and a decrease of €57 billion in liabilities.

Current account

The current account of the euro area recorded a surplus of €25.5 billion in December 2015 (see Table 1). This reflected surpluses for goods (€26.5 billion), services (€4.6 billion) and primary income (€5.5 billion), which were partly offset by a deficit in secondary income (€11.2 billion).

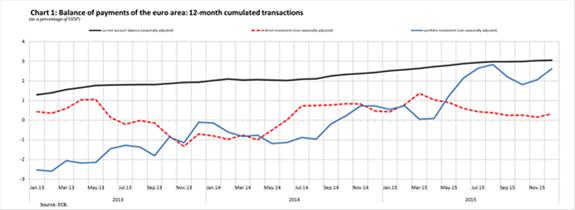

According to the preliminary results for 2015 as a whole, the current account recorded a surplus of €314.0 billion (3.0% of euro area GDP), compared with one of €245.6 billion (2.4% of euro area GDP) in 2014 (see Table 1 and Chart 1). The increase in the current account surplus was largely due to an increase in the surplus for goods (from €251.5 billion to €320.1 billion) and, to a lesser extent, to a decrease in the deficit for secondary income (from €138.6 billion to €133.1 billion) and an increase in the surplus for primary income (from €61.9 billion to €64.4 billion). These were partly offset by a decrease in the surplus for services (from €70.8 billion to €62.6 billion).

Financial account

In December 2015 combined direct and portfolio investment recorded an increase of €28 billion in assets and a decrease of €57 billion in liabilities (see Table 2).

Euro area residents recorded an increase of €8 billion in direct investment assets, as a result of an increase in debt instruments (€64 billion), which was partly offset by a decrease in equity (€57 billion ). Direct investment liabilities increased by €1 billion, also on account of the increase in debt instruments (€7 billion), which was almost offset by a decrease in equity (€6 billion).

As regards portfolio investment assets, euro area residents made net purchases of foreign securities amounting to €20 billion. This was mainly a result of net acquisitions of short-term debt securities (€24 billion), which were partially offset by net sales of both equity and long-term debt securities (€3 billion and €1 billion respectively). The decrease of €58 billion in euro area portfolio investment liabilities was due to non-euro area residents’ net sales/amortisation of both short-term and long-term debt securities (€51 billion and €19 billion respectively), which were partly offset by net acquisitions of equity issued by euro area residents (€12 billion).

The euro area net financial derivatives account (assets minus liabilities) recorded positive net flows of €7 billion.

Other investment recorded decreases of €251 billion in assets and €191 billion in liabilities. The decrease in assets was driven by decreases in the MFI sector (excluding the Eurosystem) (€220 billion) and other sectors (€32 billion), which were, to a limited extent, offset by increases in the Eurosystem (€2 billion). The decrease in liabilities is also explained by decreases mainly in the MFI sector (excluding the Eurosystem) (€197 billion), which were partly offset by increases in the other sectors and the Eurosystem (€4 billion each).

The Eurosystem’s stock of reserve assets decreased by €9 billion in December 2015 (to €644 billion). This can mainly be attributed to a negative effect from asset prices (primarily gold prices) and exchange rate developments (€17 billion), which were partly offset by net acquisitions of reserve assets (€8 billion).

In 2015 as a whole, combined direct and portfolio investment recorded cumulated increases of €822 billion in assets and €520 billion in liabilities, compared with increases of €582 billion and €463 billion respectively in 2014. This development resulted from a significant increase in the direct investment activity of both euro area residents abroad and non-residents in the euro area, with the net acquisition of assets increasing from €141 billion to €440 billion and the net incurrence of liabilities increasing from €95 billion to €407 billion.

The developments in portfolio investment were in the opposite direction. The net acquisition of foreign securities by euro area residents decreased from €441 billion to €383 billion, which is still high due to increases in net purchases of long-term debt securities (from €225 billion to €353 billion). On the liability side , acquisitions of euro area securities by non-residents decreased (from €368 billion to €113 billion), which is explained by fewer purchases of equity (from €292 billion to €216 billion), an increase in disinvestments in short-term debt securities (from €23 billion to €79 billion) and a shift in long-term debt securities from net purchases (€99 billion) to net sales (€24 billion).

According to the monetary presentation of the balance of payments, the net external assets of euro area MFIs decreased by €71 billion in 2015, compared with an increase of €196 billion in 2014. This development in MFIs’ net external assets continued to primarily reflect the surplus in the current and capital account balance, which has in the last 12 months been offset by, among other things, a shift from net purchases by non-residents of debt securities issued by euro area non-MFI residents (€82 billion) to net sales/amortisation (€48 billion) and a decrease from €218 billion to €142 billion in net purchases by non-residents of euro area equity.

Data revisions

This press release incorporates revisions for October and November 2015. These revisions resulted in a decrease of the portfolio investment account by €13 billion for November 2015.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW)

Methodological information: ECB’s website

Monetary presentation of the balance of payments Next press releases:Monthly balance of payments: 21 March 2016 (reference data up to January 2016);

Quarterly balance of payments and international investment position: 7 April 2016 (reference data up to the fourth quarter of 2015).

Annexes

Table 1: Current account of the euro area

Table 2: Balance of payments of the euro area

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

[1]References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου