- STATISTICAL RELEASE

Euro area insurance corporation statistics: second quarter of 2020

31 August 2020

- Total assets of euro area insurance corporations amounted to €8,721 billion in second quarter of 2020, €279 billion higher than in first quarter of 2020

- Total insurance technical reserves of euro area insurance corporations rose to €6,647 billion in second quarter of 2020, up €239 billion from first quarter of 2020

Total assets of euro area insurance corporations increased to €8,721 billion in the second quarter of 2020, from €8,442 billion in the first quarter of 2020. Debt securities accounted for 40.9% of the sector's total assets in the second quarter of 2020. The second largest category of holdings was investment fund shares (26.3%), followed by equity (10.4%) and loans (7.3%).

Holdings of debt securities increased to €3,568 billion at the end of the second quarter of 2020 from €3,476 billion at the end of the previous quarter (see Chart 1). Net purchases of debt securities amounted to €15 billion in the second quarter of 2020; price and other changes amounted to €77 billion. The year-on-year growth rate of debt securities held was 1.4%.

Looking at holdings by issuing sector, the annual growth rate of debt securities issued by euro area general government was 0.0% in the second quarter of 2020, with net sales in the quarter amounting to €5 billion. As regards debt securities issued by the private sector, the annual growth rate was 2.9%, and quarterly net purchases amounted to €18 billion. For debt securities issued by non-euro area residents, the annual growth rate was 2.3%, with quarterly net purchases of €2 billion.

Chart 1

Insurance corporations' holdings of debt securities by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

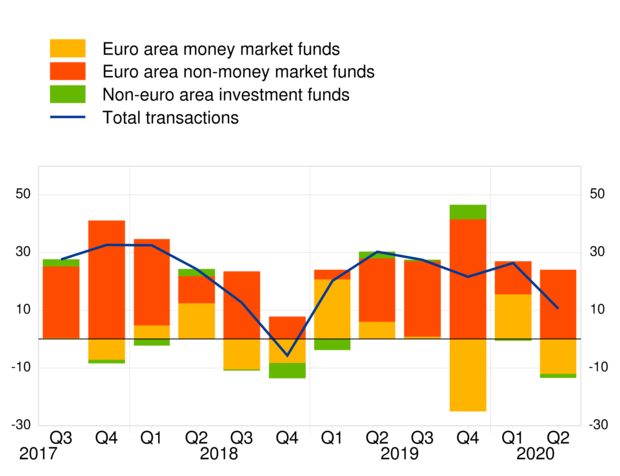

Turning to insurance corporations' holdings of investment fund shares, these increased to €2,296 billion in the second quarter of 2020, from €2,167 billion in the previous quarter, with net purchases of €11 billion and price and other changes of €119 billion (see Chart 2). The year-on-year growth rate in the second quarter of 2020 was 3.9%.

The annual growth rate of euro area money market fund shares held by insurance corporations was -14.0% in the second quarter of 2020, with net sales in the quarter amounting to €12 billion. As regards holdings of euro area non-money market fund shares, the annual growth rate was 5.2%, with quarterly net purchases amounting to €24 billion. For investment fund shares issued by non-euro area residents, the annual growth rate was 5.3%, with quarterly net sales of €1 billion.

Chart 2

Insurance corporations' holdings of investment fund shares by issuing sector

(quarterly transactions in EUR billions; not seasonally adjusted)

In terms of main liabilities, total insurance technical reserves of insurance corporations amounted to €6,647 billion in the second quarter of 2020, up from €6,407 billion in the first quarter of 2020 (see Annex). Life insurance technical reserves accounted for 90.6% of total insurance technical reserves in the second quarter of 2020. Unit-linked products amounted to €1,248 billion, accounting for 20.7% of total life insurance technical reserves.

From now on, this statistical release will also provide annual data on euro area insurance corporations' written premiums, incurred claims and acquisition expenses, which are related to the profitability of insurance corporations. Total written premiums rose to €1,127 billion in 2019 (corresponding to 18.9% of total insurance technical reserves at end-2018), up from €1,053 billion in 2018 (17.5%). In the same period, claims increased from €773 billion (12.8%) to €822 billion (13.8%) and acquisition expenses rose from €106 billion (1.8%) to €116 billion (1.9%).

For queries, please use the statistical information request form.

Notes:

- "Other assets" includes currency and deposits, insurance technical reserves and related claims, financial derivatives, non-financial assets and remaining assets.

- "Private sector" refers to euro area excluding general government.

- "Investment funds" includes money market funds and non-money market funds.

- Hyperlinks in the main body of the statistical release and in the annex table lead to data that may change with subsequent releases as a result of revisions. Figures shown in the annex table are a snapshot of the data as at the time of the current release.

- 31 August 2020