Euro area quarterly balance of payments and international investment position (Second quarter of 2014)

First press release in accordance with Guideline ECB/2011/23, which adheres to the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6)

The current account of the euro area showed a surplus of €207.7 billion (2.1% of euro area GDP) in the four quarters up to the second quarter of 2014.

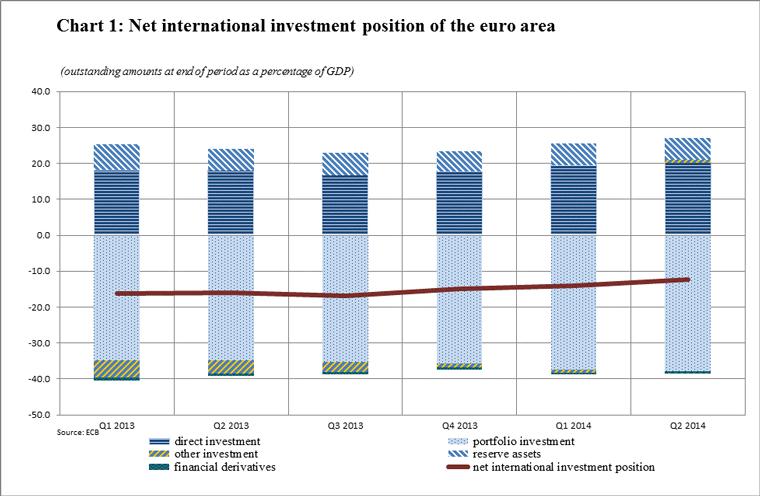

At the end of the second quarter of 2014, the international investment position of the euro area recorded net liabilities of €1.2 trillion (approximately 12% of euro area GDP).

Current account

In the second quarter of 2014, the current account of the euro area showed a surplus of €42.7 billion, compared with €45.5 billion in the second quarter of 2013 (see Table 1). The decrease in the current account surplus was due to increases in the deficit for primary income (from €4.5 billion to €9.4 billion) and secondary income (from €30.7 to €33.8 billion), as well as to a slight decrease in the surplus for goods (from €61.6 billion to €60.4 billion). These developments were partly offset by an increase in the surplus for services (from €19.1 billion to €25.5 billion). [1]

The developments in services were mostly explained by improvements in the balances for telecommunication, computer and information services (where the surplus rose from €8.4 billion to €10.5 billion), other business services (where the deficit of €1.1 billion changed into a surplus of €1.0 billion) and the residual category other (where the deficit decreased from €3.3 billion to €0.3 billion, on account of, in particular, better figures for manufacturing, maintenance and repair services).

The increase in the primary income deficit was driven by a deterioration in the balance of all investment income components, excluding income from reserve assets, which remained unchanged.

International investment position

At the end of the second quarter of 2014, the international investment position of the euro area recorded net liabilities of €1.2 trillion vis-à-vis the rest of the world (approximately 12% of euro area GDP; see Chart 1). This represented a decrease of €172 billion in comparison with the first quarter of 2014 (see Table 2).

This decrease was the result of a higher net asset position for direct investment (from €1,853 billion to €1,918 billion) and reserve assets (from €571 billion to €583 billion), as well as of a switch from net liabilities to net assets for other investment (from €67 billion to €67 billion) and a decrease in the net liability position for financial derivatives (from €49 billion to €44 billion). The above developments were partly offset by an increase in the net liability position for portfolio investment (from €3,567 billion to €3,609 billion).

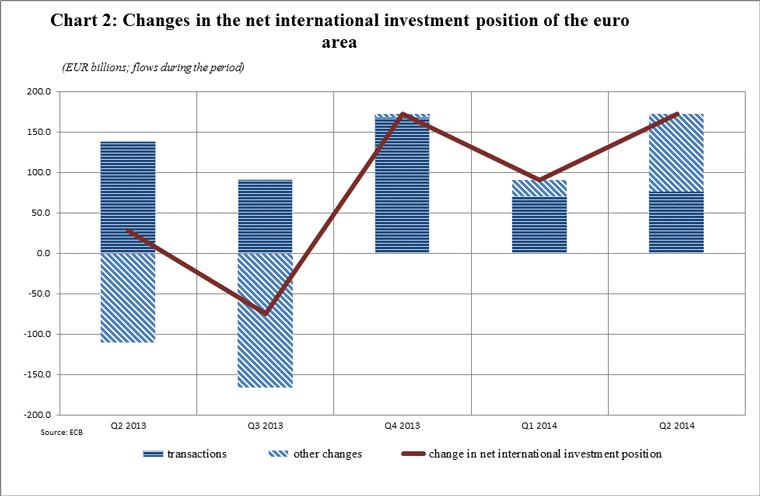

The changes in the net position for direct investment and reserve assets mainly reflected revaluations – changes in exchange rates and asset prices – and other volume changes ( other changes), whereas most of the developments in portfolio investment and other investment (mainly currency and deposits) were explained by transactions (see Chart 2).

At the end of the second quarter of 2014, the gross external debt of the euro area amounted to €11.7 trillion (approximately 120% of euro area GDP), which represented an increase of €115 billion in comparison with the first quarter of 2014. By contrast, the net external debt decreased by €175 billion on account of a more marked increase in euro area residents’ holdings of (debt) assets issued by non-residents.

Data revisions

This press release is the first that is based on Guideline ECB/2011/23, which adheres to the sixth edition of the IMF’s Balance of Payments and International Investment Position Manual (BPM6). Therefore, new time series have been compiled to accommodate the new methodology and changes to national compilation systems. The new edition of the IMF’s manual takes into account important developments that have occurred in the global economy since the fifth edition was released. Three major themes influenced the revision, namely globalisation (increased use of cross-border production processes, complex international company structures and international labour mobility), an increasing focus on balance sheet issues (depicted in the international investment position) and financial innovation (more and complex financial instruments). More detailed information on the major changes is available on a dedicated webpage.

Additional information

Time series data: ECB’s Statistical Data Warehouse (SDW).

Methodological information: ECB’s website.

Next press releases:Monthly balance of payments: 19 November 2014 (reference data up to September 2014).

Quarterly balance of payments and international investment position: 13 January 2015 (reference data up to the third quarter of 2014)

For media queries, please contact Rocio Gonzalez, Tel.: +49 69 1344 6451.

Annexes

Table 1: Current account of the euro area

Table 2: International investment position of the euro area

-

[1]In broad terms, the new BPM6 concept of “primary income” corresponds to the old BPM5 concept of “income”, and the new concept of “secondary income” corresponds to the old concept of “current transfers”.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου