- Press release

Survey on the Access to Finance of Enterprises: tightening of financing conditions amid increased economic uncertainty

1 June 2022

- Euro area enterprises continued to signal a recovery in business activity, but firms’ profitability was reduced by surging input costs

- The availability of external funds continued to improve, albeit at a slower pace, as euro area firms deemed the macroeconomic environment to have adversely affected the availability of funds.

- While the availability of external funds was broadly in line with firms’ demand for financing, enterprises reported a tightening of financing conditions and expect a deterioration in the availability of funds

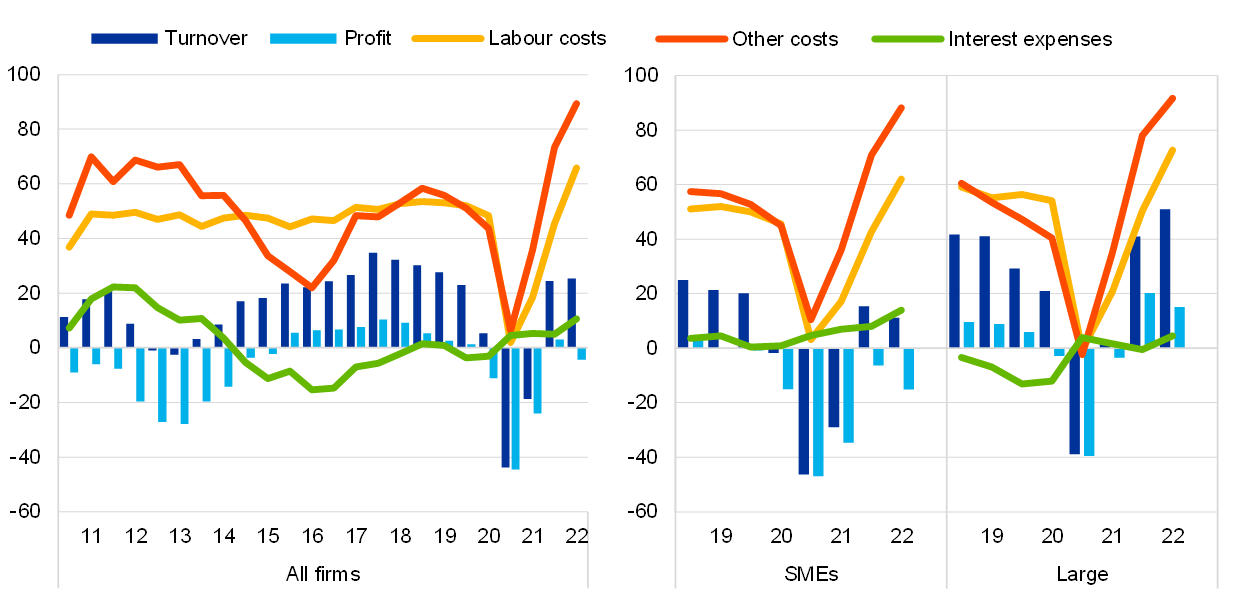

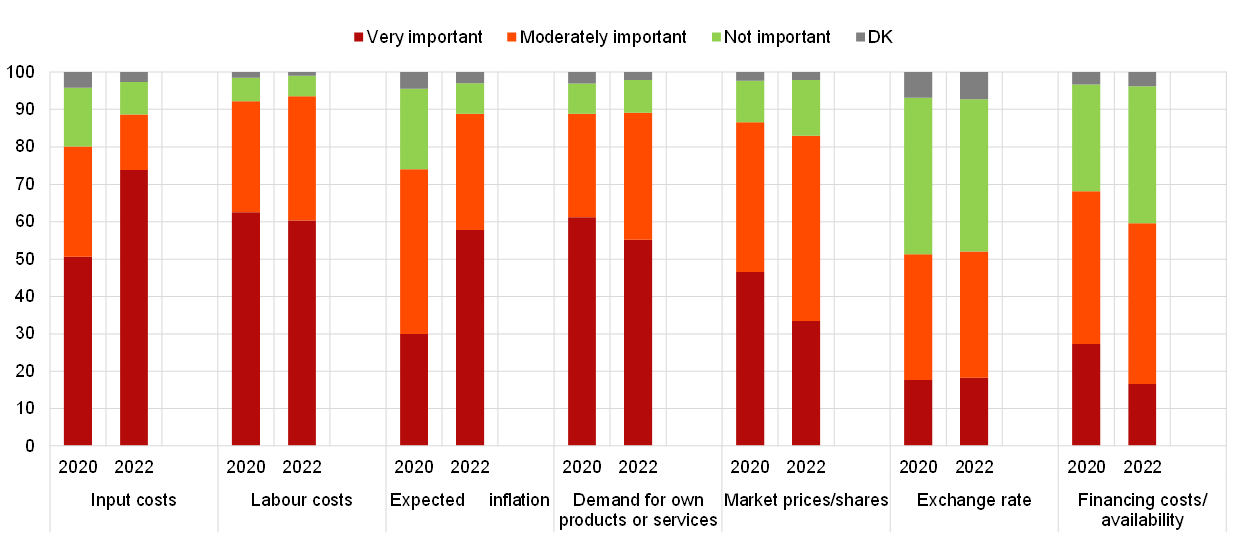

The results of the Survey on the Access to Finance of Enterprises (SAFE) in the euro area for the period from October 2021 to March 2022 indicate that the recovery in firms’ economic activity continued, with increases in turnover reported more frequently among large enterprises than among small and medium-sized enterprises (SMEs) (Chart 1). However, firms’ profitability was reduced by surging production costs, with 89% of firms reporting, in net terms,[1] an increase in raw materials and energy costs and 66% in labour costs, both standing at a historical peak in the survey. The impact of supply disruptions and higher energy costs, which are likely to be related in part to the Russian invasion of Ukraine, is expected to continue to affect prices (Chart 2). Moreover, the perceived importance of expected inflation as a factor in selling prices has increased compared with 2020, with 58% of firms now reporting expected inflation as a “very important” factor (up from 30% in 2020).

In this survey round, while euro area firms felt that changes in the general economic outlook had had a strong negative impact on their access to finance (-29%, down from 8%), with a similar negative impact among SMEs and large firms, the availability of external funds still continued to improve, albeit at a slower pace. Overall, smaller improvements in firms’ access to external funds broadly compensated for the moderate increases in their financing needs, so that the external financing gap – the difference between the change in demand for and the change in the supply of external financing – reached 1% (up from -4% in the previous round).

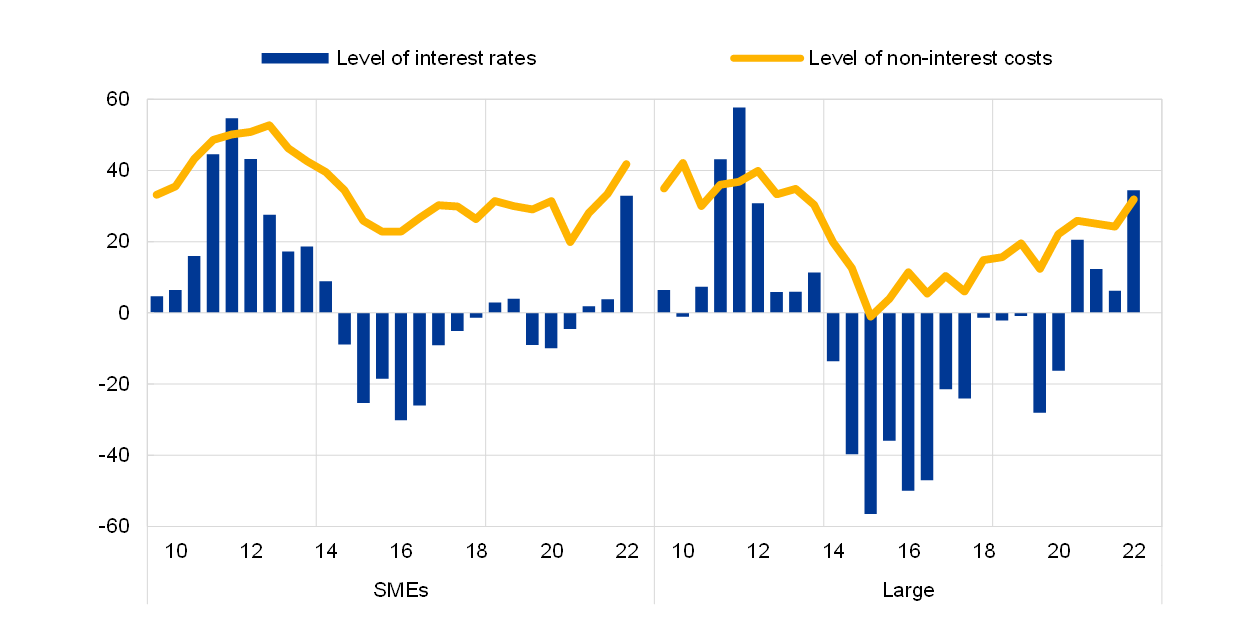

A significant number of euro area firms reported a tightening of financing conditions, with 34% signalling increases in bank interest rates, up from 5% in the previous round (Chart 3). A comparable percentage has not been observed in the SAFE since 2012 and is consistent with the recent net widening on margins applied to bank loans also reported by banks in the April 2022 bank lending survey. Looking ahead firms anticipated a deterioration in access to bank loans and credit lines for the first time since the outbreak of the coronavirus (COVID-19) pandemic, probably reflecting the prevailing uncertainty and a changing attitude on the part of banks.

This report presents the main results of the 26th round of the SAFE in the euro area, which was conducted between 7 March 2022 and 15 April 2022, and covered the period from October 2021 to March 2022. The sample comprised 10,950 firms, of which 9,999 (91.3%) are SMEs (i.e. firms with fewer than 250 employees).

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- A report on this SAFE survey round, together with the questionnaire and methodological information, is available on the ECB’s website.

- Detailed data series for the individual euro area countries and aggregate euro area results are available from the ECB’s Statistical Data Warehouse.

Chart 1

Changes in the income situation of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 3-26 of the survey (from March 2010-September 2010 to October 2021-March 2022) for all firms and to rounds 19-26 (from April 2018-September 2018 to October 2021-March 2022) for SMEs and large firms.

Note: Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease.

Chart 2

Factors influencing selling prices for euro area enterprises (2022 situation compared with 2020 pre-pandemic situation)

(percentages of respondents)

Base: All enterprises. The figures refer to round 26 (October 2021-March 2022) of the survey.

Note: DK stands for “Don’t know”.

Chart 3

Change in the cost of bank loans granted to euro area enterprises

(net percentages of respondents)

Base: Enterprises that had applied for bank loans (including subsidised ones), credit lines, or bank or credit card overdrafts. The figures refer to survey rounds 1-26 (from January 2009-June 2009 to October 2021-March 2022).

Net percentages are defined here as the difference between the percentage of enterprises reporting that something has increased and the percentage reporting that it has declined.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου