- PRESS RELEASE

As market matures central banks conclude that a formal gold agreement is no longer necessary

26 July 2019

- Signatories of the fourth Central Bank Gold Agreement no longer see need for formal agreement as market has developed and matured

- Signatory central banks confirm gold remains an important element of global monetary reserves and none of them currently has plans to sell significant amounts of gold

The European Central Bank (ECB) and 21 other central banks that are signatories of the Central Bank Gold Agreement (CBGA) have decided not to renew the Agreement upon its expiry in September 2019.

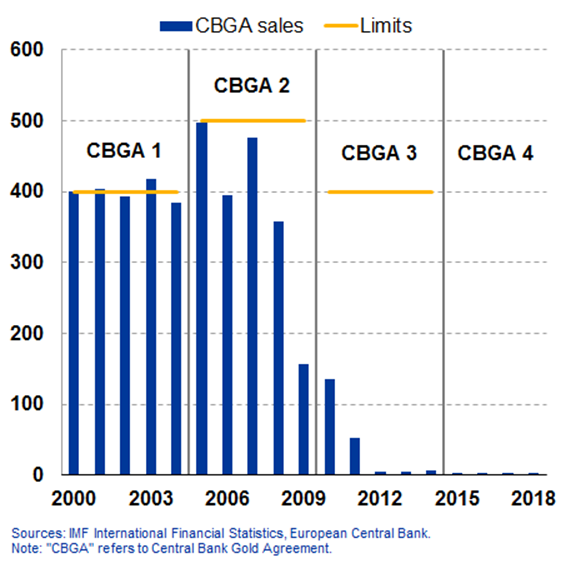

The first CBGA was signed in 1999 to coordinate the planned gold sales by the various central banks. When it was introduced, the Agreement contributed to balanced conditions in the gold market by providing transparency regarding the intentions of the signatories. It was renewed three times in 2004, 2009 and 2014, gradually moving towards less stringent terms.

Since 1999 the global gold market has developed considerably in terms of maturity, liquidity and investor base. The gold price has increased around five-fold over the same period. The signatories have not sold significant amounts of gold for nearly a decade, and central banks and other official institutions in general have become net buyers of gold.

The signatories confirm that gold remains an important element of global monetary reserves, as it continues to provide asset diversification benefits and none of them currently has plans to sell significant amounts of gold.

The fourth CBGA, which expires on 26 September 2019, was signed by the ECB, the Nationale Bank van België/Banque Nationale de Belgique, the Deutsche Bundesbank, Eesti Pank, the Central Bank of Ireland, the Bank of Greece, the Banco de España, the Banque de France, the Banca d’Italia, the Central Bank of Cyprus, Latvijas Banka, Lietuvos bankas, the Banque centrale du Luxembourg, the Central Bank of Malta, De Nederlandsche Bank, the Oesterreichische Nationalbank, the Banco de Portugal, Banka Slovenije, Národná banka Slovenska, Suomen Pankki – Finlands Bank, Sveriges Riksbank and the Swiss National Bank.

Gold sales within central bank gold agreements(tonnes)

For media queries, please contact Eva Taylor, tel.: +49 69 1344 7162.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου