Payment Statistics for 2011

The European Central Bank (ECB) has today published the 2011 statistics on non-cash payments, which comprise indicators on access to and use of payment instruments and terminals by the public, as well as volumes and values of transactions processed through payment systems. Statistics are published for each EU Member State, in addition to EU and euro area aggregates and comparative data.

Payment instruments[1]

The total number of non-cash payments in the EU, using all types of instruments, increased by 4.6% to 90.6 billion in 2011 compared with the previous year. Card payments accounted for 41% of all transactions, while credit transfers accounted for 27% and direct debits for 24%.

The number of credit transfers within the EU increased in 2011 by 4.4% to 24.9 billion. The importance of paper-based transactions continued to decrease, with the ratio of paper-based transactions to non-paper-based transactions standing at around one to five.

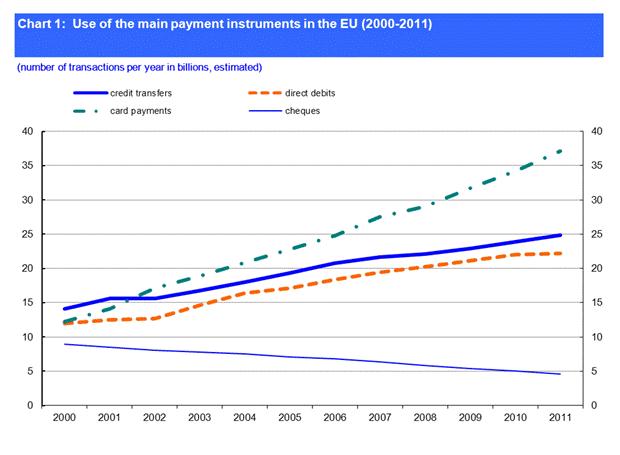

The number of cards with a payment function in the EU remained stable at 727 million (identical to the figure in 2010). This represented around 1.44 payment cards per EU inhabitant. The number of card transactions rose by 8.7% to 37.2 billion, with a total value of €1.9 trillion. This corresponds to an average value of around €52 per card transaction. Chart 1 below shows the use of the main payment instruments from 2000 to 2011.

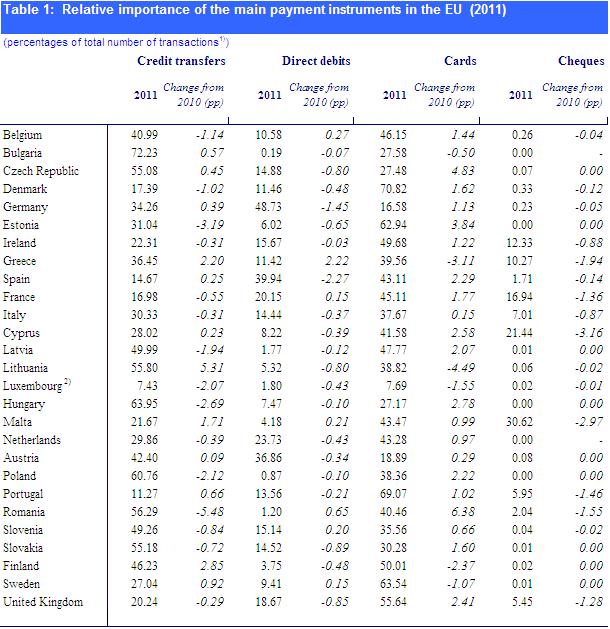

The relative importance of each of the main payment instruments continued to vary widely across EU countries in 2011 (see Annex).

In 2011, the total number of automatic teller machines (ATMs) in the EU increased by 0.9% to 0.44 million, while the number of points of sale (POS) terminals increased by 3.2% to 8.8 million.

Source: ECB.

Note: Data have been partially estimated for periods prior to 2010, as methodological changes were implemented in previous years and some data are not available. The historical estimation done by the ECB for this press release ensures comparability of figures over the entire eleven-year period. Statistics are also collected (but not shown in Chart 1) on e-money transactions and other payment instruments, which account for less than 2% of the total number of EU transactions.

Retail payment systems

Retail payment systems in the EU handle mainly payments that are made by the public, with a relatively low value and no time-criticality.

In 2011, 42 retail payment systems existed within the EU as a whole, serving a total population of approximately 500 million. [2] During the year, 39.9 billion transactions were processed by those systems with an amount of €29.3 trillion. 22 of these systems were located in the euro area, where they served a total population of around 330 million. The euro area systems processed 28.3 billion transactions in 2011 (i.e. 71% of the EU total) with a value amounting to €19.7 trillion (i.e. 67% of the EU total).

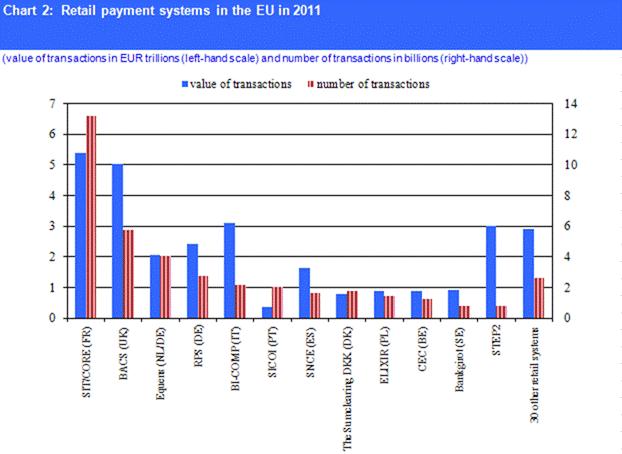

There continues to be a notable degree of concentration in EU retail payment systems in 2011. The five largest systems in terms of number of transactions (SIT/CORE in France, BACS in the United Kingdom, Equens in the Netherlands and Germany, RPS in Germany and BI-COMP in Italy) processed 69% of the volume and 61% of the value of all transactions processed by EU retail payment systems. Chart 2 shows the number and value of transactions processed by EU retail payment systems in 2011.

Source: ECB.

Large-value payment systems

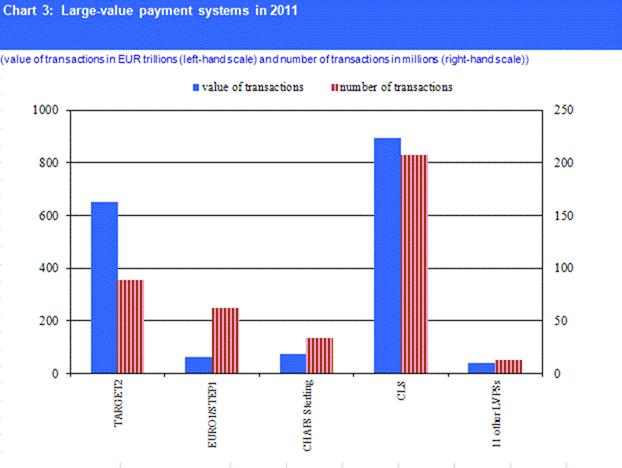

Large-value payment systems (LVPSs) are designed primarily to process urgent or large-value interbank payments, but some of them also settle a large number of retail payments. During 2011, 15 LVPSs settled 713 million payments with a total value of €837 trillion in the EU. [3] The two main LVPSs in the euro area (TARGET2 and EURO1/STEP1) [4] settled 151 million transactions amounting to €716 trillion in 2011, i.e. 86% of the total value. In the non-euro area EU countries, CHAPS Sterling [5] in the United Kingdom is the largest LVPS in terms of value and number of transactions.

Outside the EU, Continuous Linked Settlement [6] (CLS) is the most important large value payment system processing, inter alia, euro and other EU currencies. CLS (all currencies) settled 207 million transactions with a value of €894 trillion in 2011. Chart 3 below shows the number and value of transactions processed by LVPSs in 2011.

Source: ECB.

Note: Other LVPSs exclude CERTIS and ESTA, which act as both LVPSs and retail systems.

The full set of payment statistics can be downloaded from the Statistical Data Warehouse (SDW) on the ECB’s website ( http://sdw.ecb.europa.eu/browse.do?node=2746). The “Reports” section of the SDW also contains pre-formatted tables with payment statistics for the last five years. The data are presented in the same format as in the former “Blue Book Addendum”, which is available in the “Statistics” section of the ECB’s website ( http://sdw.ecb.europa.eu/reports.do?node=100000760). For detailed methodological information, including a list of all data definitions, please refer to the “Statistics” section of the ECB’s website ( http://www.ecb.europa.eu/stats/payments/paym/html/index.en.html).

Annex

Source: ECB.

Notes:

1) Percentages may not add up to 100% as e-money transactions and other payment instruments are not shown. A dash (-) indicates data are not applicable.

2) In the special case of Luxembourg, a very high number of e-money payments are executed on accounts held in their vast majority by non-residents but recorded in Luxembourg data due to the methodology applied. Therefore, the relative importance of the payment instruments in Luxembourg, as presented in the table, appears to be lower than their actual domestic importance. When disregarding e-money, the relative importance of the main payment instruments in 2011 is as follows: credit transfers (43.84%), direct debits (10.63%), cards (45.40%) and cheques (0.13%).

-

[1]SEPA instruments are included in the respective categories. Information on the SEPA instruments can be found on the ECB’s website ( http://www.ecb.europa.eu/paym/sepa/html/index.en.html).

-

[2]STEP 2 is considered as a single system.

-

[3]Among the LVPSs that also process retail payments, CERTIS – a Czech Republic system – is the main contributor in terms of number of transactions to the EU aggregate figure, with 490 million. In terms of value, CERTIS settled €5.5 trillion during 2011.

-

[4]TARGET2 is the second-generation Trans-European Automated Real-time Gross settlement Express Transfer system. It is operated by the Eurosystem and settles payments in euro in central bank money. EURO1/STEP1 is an EU-wide multilateral net large-value payment system for euro payments operated by EBA CLEARING. Credit transfers and direct debits are processed in EURO1 throughout the day and final balances are settled at the end of the day in TARGET2.

-

[5]CHAPS Sterling handles sterling-denominated interbank payments.

-

[6]CLS is a worldwide clearing and settlement system that settles FX transactions on a payment-versus-payment basis.

Europese Centrale Bank

Directoraat-generaal Communicatie

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Duitsland

- +49 69 1344 7455

- media@ecb.europa.eu

Reproductie is alleen toegestaan met bronvermelding.

Contactpersonen voor de media