The effects of APP reinvestments on euro area bond markets

Closing remarks by Benoît Cœuré, Member of the Executive Board of the ECB, at the ECB’s Bond Market Contact Group meeting, 12 June 2019

In December 2018 the Governing Council decided to halt net purchases under its asset purchase programme (APP) and to continue reinvesting, in full, the principal payments from maturing securities for an extended period of time past the date when we start raising the key ECB interest rates, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation.

In my short remarks this evening I will take stock of euro area bond market developments since the start of the year without elaborating on the future course of monetary policy, which the Governing Council discussed at its meeting last week in Vilnius.

I will show that the APP has continued to provide substantial monetary accommodation also after the transition from net purchases to reinvestments. The stock effect of our asset purchases, alongside clear forward guidance by the Governing Council on its intentions regarding reinvestments and policy rates, has helped to preserve very accommodative financial conditions.

And our decision to distribute redemptions under the public sector purchase programme (PSPP) over the year, and to maintain our presence in primary markets under some of the private asset purchase programmes, has supported the transition with minimal impact on market functioning.

Euro area bond markets in 2019

Since the start of the year, government bond yields in the euro area have fallen noticeably. In many euro area countries they currently stand at, or close to, historical lows and cross-border dispersion of financial conditions across countries has declined considerably, with few exceptions. You can see this on the left-hand side of my first slide.

Reduced cross-country dispersion in financial conditions (slide 1)

Consider Portugal and Greece, which you can see on the right-hand side. Since the start of the year, ten-year government bond yields have fallen by around 100 basis points in Portugal and 160 basis points in Greece. These declines mark a significant easing in financial conditions in an environment of downside risks to growth and imply that the ECB’s accommodative monetary policy stance is now being felt more forcefully across larger parts of the euro area.

It is tempting to argue that the decline in yields is proof enough that the end of net asset purchases did not trigger an unwarranted tightening in financial conditions. But this would be far too simple, of course.

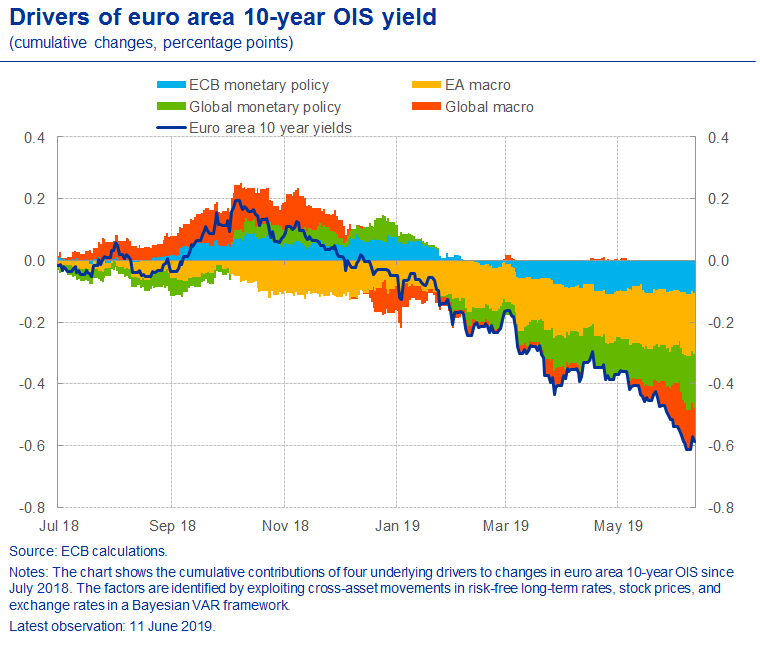

Financial asset prices, as you know, reflect the effects of a large number of forces at any given point in time, pulling yields in different, and often opposing, directions. To make some sense of changes in asset prices, ECB staff use an array of analytical tools, including exploiting cross-asset price restrictions to identify the possible sources of economic shocks. An unexpected tightening in monetary policy, for example, is assumed to lead to higher yields, lower stock prices and an appreciation of the exchange rate, just like textbook economics would teach.

You can see the outcome of such an exercise for the ten-year euro area overnight index swap (OIS) on my second slide. Clearly, according to this model, a number of factors, including global and euro area monetary policies, have contributed to the downward pressure on yields since the start of the year. In other words, there are no signs that the effects of our asset purchases started to evaporate the moment we stopped expanding our balance sheet.[1]

End of net purchases has not put upward pressure on yields (slide 2)

Indeed, I would argue that the effects of asset purchases are highly persistent, and that they have affected recent pricing dynamics in two important ways: through a yield level channel and through a yield sensitivity channel.

The persistence of stock effects

The first channel relates to the growing evidence that central banks, through their stocks of acquired assets and by reinvesting maturing principals, can persistently lower the yield level around which investors evaluate changes to the economic outlook.

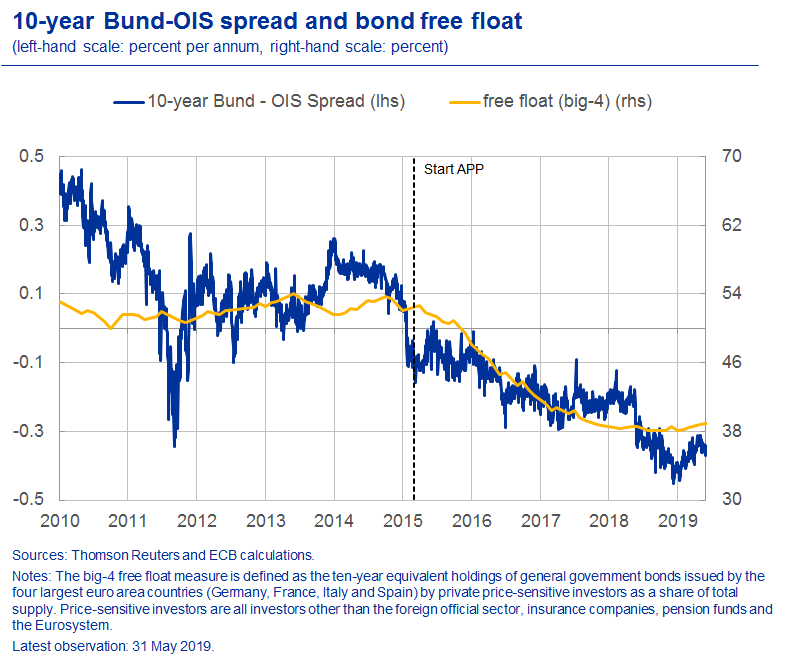

I have laid out the mechanics behind the persistent impact of asset purchases in previous speeches.[2] In short, as the central bank reduces the bond free float – the share of outstanding government bonds held by private price-sensitive investors – it also reduces the compensation, or term premia, that investors, as a whole, demand for holding long-term bonds.

A crude yet simple way to see this is to look at the correlation between a measure of the bond free float and the spread between ten-year German Bund yields and corresponding OIS rates. You can see this on my next slide.

Stock effects have been built up gradually (slide 3)

The intuition is that, both being risk-free assets, changes in the economic outlook or monetary policy expectations would shift Bund and OIS yields to a similar degree.[3] A sudden spike in risk aversion, such as during the sovereign debt crisis or towards the end of last year, can cause the spread to widen. But such episodes are typically short-lived and reverse as investors reduce their demand for safe assets.

In other words, we would expect the Bund-OIS spread to be fairly constant, on average. But the fact that the spread has been gradually and persistently widening over time suggests that it is not being driven by common factors, but rather by factors specific to the Bund market since about the start of 2015. The most plausible candidate for this kind of secular effect is supply-demand effects induced by a shrinking bond free float.[4]

You can see that, according to new ECB staff estimates, only a little more than a third of outstanding general government bonds of the four largest euro area countries are currently in the hands of private price-sensitive investors.[5] Before the APP was launched, more than half of these bonds were held by these investors.

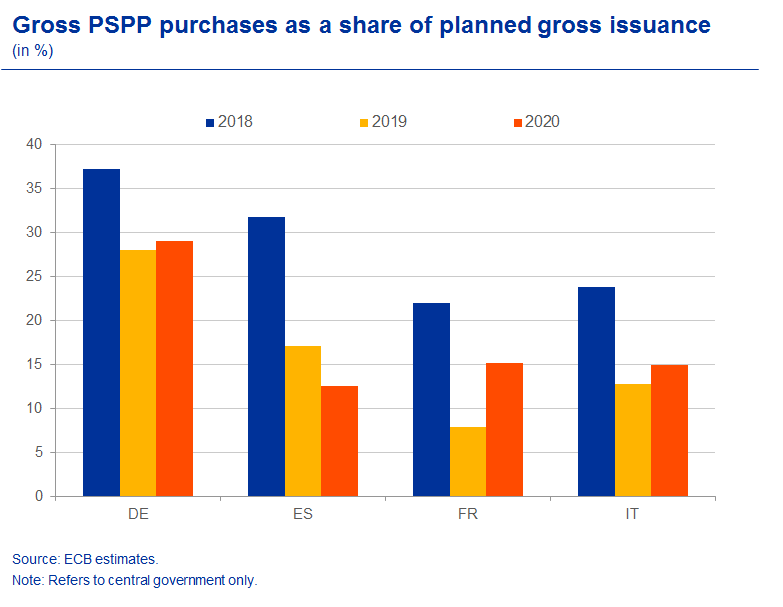

And by rolling over our bond portfolio, we keep removing duration risk from the market. You can see this on my next slide. In Germany, for example, PSPP reinvestments in central government bonds this year and next are expected to still absorb nearly 30% of gross issuance. In some countries, like France and Italy, reinvestments as a share of total gross issuance are expected to rise in 2020.

Reinvestments will continue to absorb a significant share of issuance (slide 4)

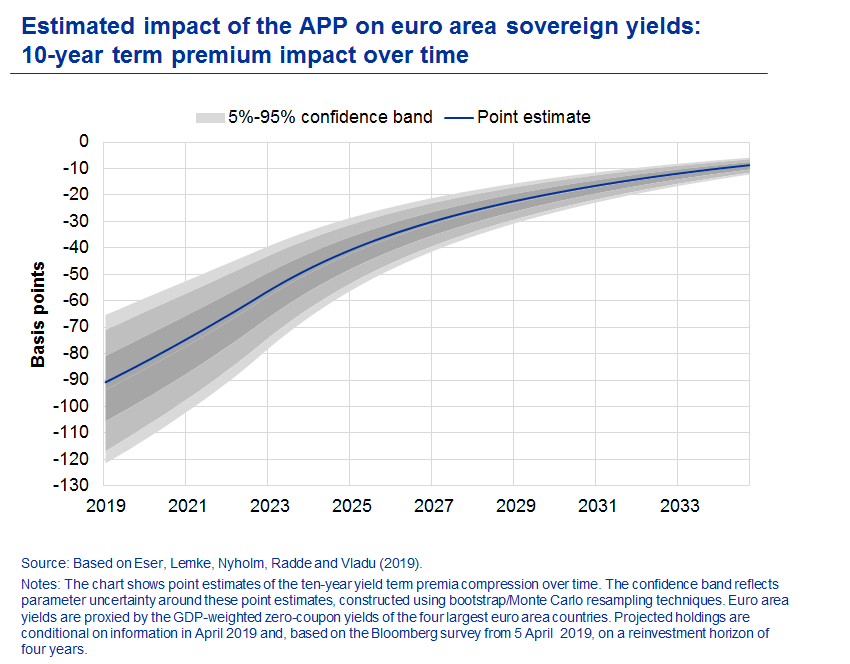

The implication of this is that the stock effect of our purchases will continue to be significant, as you can see on my next slide. Two years from now, the stock of acquired assets is still estimated to compress the ten-year term premium in the four largest euro area government bond markets by some 70 basis points. The main reason why the effect gradually becomes smaller in the coming years is due to the mechanical ageing of the portfolio.

Asset purchases have highly persistent effects on yields (slide 5)

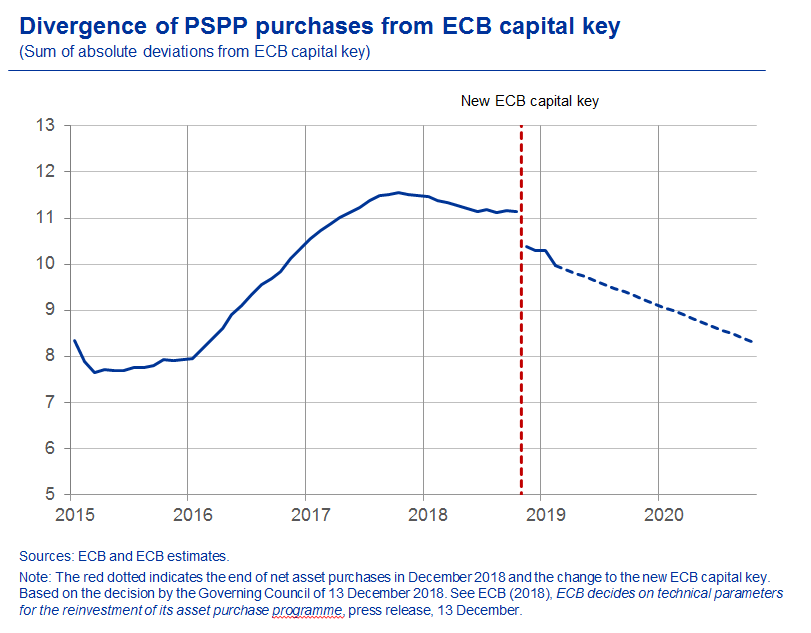

It is also easy to see now why the concerns that many have voiced regarding the potential impact of our intention to reduce deviations from the ECB’s capital key have not materialised.[6] Put simply, these adjustments in our purchases are too small to have a significant effect on yields.

On my next slide you can see the progress we have made so far this year in reducing the overall sum of absolute deviations from the capital key across all euro area countries. It is interesting to see that the introduction of the new capital key in itself contributed to a one-off reduction in overall deviations. This is the jump in the series at the start of the year. We expect to reverse the deviations further in the coming months and years, as you can see by the dotted projection line.

Reduction of deviations from capital key had no discernible impact on yields (slide 6)

Stock effects, yield sensitivity and market functioning

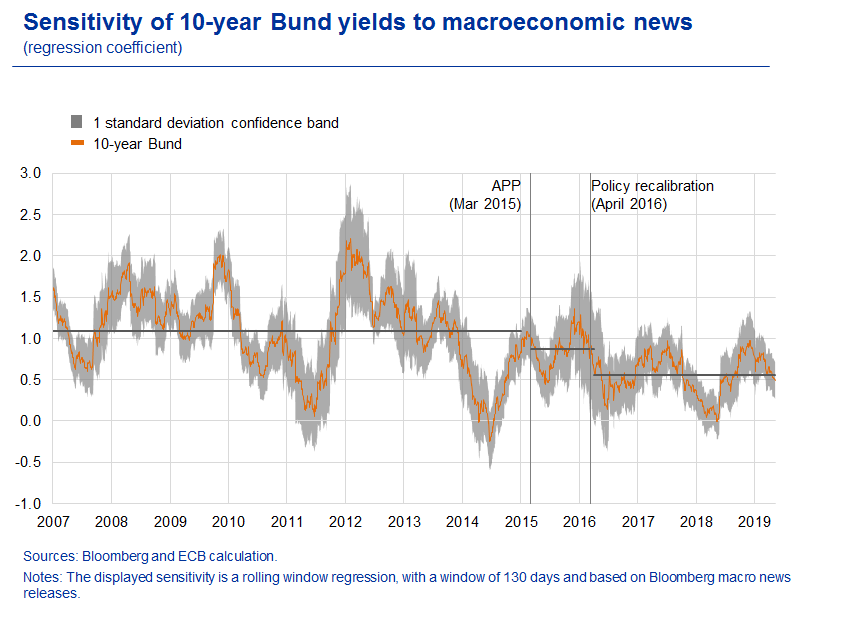

The second channel through which the stock of our assets and continued reinvestments are likely to have affected recent pricing outcomes is through their impact on the sensitivity of yields to macroeconomic shocks. You can see this on my next slide, which shows the rolling coefficient of the impact of macroeconomic news on ten-year German Bund yields.

Stock effects may have helped reduce sensitivity of yields (slide 7)

The chart shows that the average sensitivity of yields to macroeconomic news fell by 20% in the year following the launch of the APP. It has fallen by half since the Governing Council increased the monthly pace of purchases from €60 billion to €80 billion in April 2016 – that is, when stock effects started to become more powerful. And it has not visibly increased after the end of net purchases.

Such reduced sensitivity is remarkable considering the economic and political environment we have been navigating these past three years. Of course, a variety of factors might be at play here. For example, forward guidance may have contributed to reducing the sensitivity of yields to macro news. Or perceptions of reduced policy space, in particular for conventional policy instruments, may have led investors to expect less forceful changes in yields for any given macroeconomic impulse.

This is indeed what we have been seeing for negative news shocks. As you can see on the left-hand side of my next slide, there has been a relatively clear structural break in the sensitivity of ten-year yields to negative news since around the time we lowered the rate on our deposit facility to zero in mid-2012. In the vicinity of the effective lower bound, a central bank has less means to react to adverse shocks by reducing rates further.

Sensitivity lower for both positive and negative macro news (slide 8)

However, on the right-hand side you can see that we have also observed a striking decline in the trend sensitivity of long-term rates to positive news. Today, it is about half of what it was in the earlier part of this decade. Policy space on the way up certainly has far fewer, if any, constraints.

All this suggests that, by reducing the bond free float, stock effects may have helped temper the impact of demand shocks and foreign spillovers on yields. This is not to say that markets have lost their price discovery function. Just consider the large swings in yields we have seen over the past two years, and the changing constellation of intra euro area spreads. The APP has not suppressed market discipline.

But what stock effects do is shield financial conditions from unwanted tightening forces and thereby help preserve the financial conditions that are needed to ensure a sustained convergence path of inflation towards levels that are below, but close to, 2%.

And where the large volume of bonds extracted from the market may have had adverse consequences on market functioning, we took appropriate action to mitigate them. As you well know, growing scarcity of some securities led to a persistent and measurable rise in the share of bonds trading special in the repo market.[7] You can see this on my next slide.

Reduced cash collateral usage suggests markets functioning well (slide 9)

The initial Eurosystem restriction that bonds could only be lent against other securities was too penalising and is likely to have contributed to the growing specialness premium. The Governing Council’s decision in December 2016 to also open the facility for lending against cash was an important step towards alleviating market pressure.

As you can see on the right-hand side, lending against cash collateral was used widely during our net purchase phase and helped stabilise, and later reduce, the share of bonds trading special. The fact that lending against cash has practically evaporated in recent months suggests that both the repo and cash markets are now operating smoothly despite the reduced bond free float.

Continued smooth implementation of the APP during the reinvestment phase corroborates the view of efficient market functioning. The decision to distribute redemptions, where and when needed, over the year has been well understood by market participants and allows Eurosystem central banks to have a continued presence in all euro area sovereign bond markets.

Private purchase programmes and reinvestments

Before concluding, let me briefly discuss the private purchase programmes, which have arguably been the strongest cause for concern for market participants regarding the impact of the end of net purchases. The increase in corporate bond spreads during the course of last year, for example, was widely taken as a sign that investors were anticipating the nearing end of our purchases.

Yet, as you can see on the left-hand side of my next slide, spreads have fallen measurably again since the start of the year, back to levels below those prevailing before the start of our corporate sector purchase programme (CSPP) in March 2016.

Credit spreads and premia have tightened since the start of the year (slide 10)

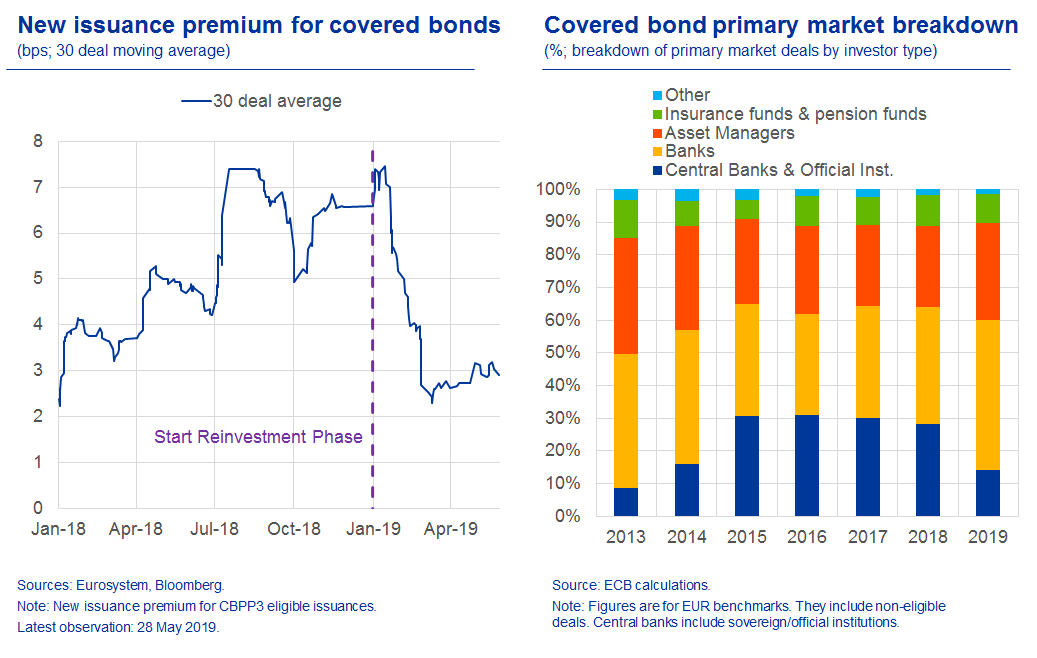

We have observed a similar dynamic for the net issuance premium firms have to pay when tapping the market. You can see this on the right-hand side. The premium rose strongly towards the end of the year but fully reversed its rise during the course of this year, much like in the covered bond market, as you can see on my next slide.

End of net purchases left no void in primary markets (slide 11)

Both charts together make clear that the drop in central bank allocations in primary markets since the start of the year has not left a void. Banks in particular have taken up a larger share of supply in the primary market, keeping premia low and relatively stable.

So, the tightening in financial conditions in credit markets in the last quarter of 2018 was, in all likelihood, unrelated to the Eurosystem ending net purchases. It was rather the result of a sudden global flight to safety that put downward pressure on risky asset prices, similar to what we have been experiencing in recent weeks.

But looking through the ups and downs, current market-based financing conditions for firms have returned to levels that are highly conducive to investment and job creation, thereby complementing our commitment to preserve favourable bank lending conditions through the launch of the new series of quarterly targeted longer-term refinancing operations, TLTRO III, under which banks can borrow at highly favourable rates, conditional on their lending performance.[8]

On my last slide you can see that this two-pronged approach has been successful. The start of the CSPP, and the subsequent drop in spreads, triggered a healthy rebalancing of external funding by some, mainly CSPP-eligible, firms and has thereby freed up bank balance sheet capacity to lend to CSPP-ineligible firms.

Policy package successful in balancing external funding sources (slide 12)

The end of net purchases has not jeopardised this virtuous circle. Today, thanks to our broad package of policy measures, a very large majority of euro area firms can freely decide on their optimal funding mix with few supply constraints.[9]

Conclusion

Taken together, there is convincing evidence that supports the view that the APP has remained a considerable source of financial easing also after the end of net purchases. It continues to provide important accommodation in an environment of increased downside risks to growth and thereby supports the sustained convergence of inflation to levels closer to 2%.

Since our decision to halt net purchases, further employment gains, increasing wages and the underlying strength of domestic demand continue to confirm the Governing Council’s central outlook of gradually rising inflation. At the same time, global headwinds have undisputedly accelerated, and uncertainty has increased, mainly related to the rising threat of protectionism.

In this environment, the Governing Council last week extended its forward guidance on rates and now expects them to remain at their present levels at least through the first half of 2020, and in any case for as long as necessary to ensure the continued sustained convergence of inflation to levels that are below, but close to, 2% over the medium term. We have also announced the technical parameters governing TLTRO III.

The Governing Council is determined to act in case of adverse contingencies and stands ready to adjust all of its instruments, as appropriate, to ensure that inflation continues to move towards the Governing Council’s inflation aim in a sustained manner.

Thank you.

- [1]Of course, such models cannot differentiate between different policy instruments. But the effects of policy tightening or easing should, in principle, have similar effects on asset prices across the central bank’s toolkit.

- [2]See Cœuré, B. (2018), “The persistence and signalling power of central bank asset purchase programmes”, speech at the 2018 US Monetary Policy Forum, New York City, 23 February.

- [3]For example, swap dealers use positions in Bunds to hedge interest rate risk on swaps.

- [4]The phasing in of banks’ Liquidity Coverage Ratio and Net Stable Funding Ratio is also likely to have contributed to this secular effect.

- [5]ECB staff have further refined and expanded the methodology used to calculate the bond free float for the aggregate of the four largest euro area countries that together account for around 80% of euro area sovereign debt and GDP. There are a number of methodological differences and enhancements compared with the bond free float shown in Cœuré (2018), op. cit. The new measure is based on security-level information from the quarterly Securities Holdings Statistics. These data are only available from the last quarter of 2009 but allow for a more granular analysis that also takes into account holdings by other less price-sensitive investors, such as insurance companies and pension funds. Total outstanding debt relates to general government debt and not to the central government. Estimates for the euro area bond free float proxy are naturally higher than for Germany as foreign exchange reserves are predominately held in German Bunds. For more detail, see Eser, F., Lemke, W., Nyholm, K., Radde, S. and Vladu, A., “Tracing the impact of the ECB’s asset purchase programme on the yield curve”, Working Paper Series, ECB, forthcoming.

- [6]See ECB (2018), ECB decides on technical parameters for the reinvestment of its asset purchase programme, press release, 13 December. Because our holdings of some sovereign bonds at the end of our net purchase phase exceeded the amount implied by the share of these countries in the capital key, we communicated last December that we would start to gradually adjust monthly purchase volumes under the reinvestment phase with a view to reducing cumulated deviations from the capital key without adversely affecting financial conditions.

- [7]See Cœuré, B. (2017), “Bond scarcity and the ECB’s asset purchase programme”, speech at the Club de Gestion Financière d’Associés en Finance, Paris, 3 April.

- [8]See ECB (2019), ECB announces details of new targeted longer-term refinancing operations (TLTRO III), press release, 6 June.

- [9]Further efforts to build a true capital markets union would help extend these improvements by, for example, allowing firms to further diversify their investor base or to issue securities on a pan-European level. See also Cœuré, B. (2018), “The euro area’s three lines of defence”, speech at the conference “Deepening of EMU”, Ljubljana, 2 February; and Cœuré, B. (2018), “The role of the European Union in fostering convergence”, speech at the Conference on European Economic Integration (CEEI), Vienna, 26 November.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου