Asset price bubbles and monetary policy

Speech by Jean-Claude Trichet, President of the ECBMas lecture8 June 2005, Singapore.

Introduction

Mr Minister, Mr Chairman,

Ladies and Gentlemen,

I would first like to thank Chairman Lee Hsien Loong for giving me the opportunity to address such a distinguished audience. Let me tell you that I consider today’s topic “asset price bubbles and monetary policy” to be one of the most challenging issues facing a modern central bank at the beginning of the 21st century. The economics profession has taught us a lot about the merits of consumer price stability, about the value of independent central banks and the importance of credibility and commitment to the objective of price stability. And a broad consensus has emerged on these issues, which is actually reflected in a number of very well-designed central bank statutes all over the world, with the ECB’s being only one, though prominent, example.

Consumer price inflation has been successfully contained for quite some time now at least in the major OECD economies. But at the same time we are observing large cycles in a variety of asset prices accompanied by ample global liquidity. Economists at the Bank for International Settlements have recently been arguing that the coincidence of low consumer price inflation and high asset price inflation is not by chance. They have labelled this the “paradox of central bank credibility” and hinted at the possibility that due to central banks’ success and gained reputation in fighting inflation, inflationary pressures would first show up in asset price inflation and increase the vulnerability of financial systems.[1] Is this something a central bank should be concerned about to a degree that policy strategies have to be amended? Should a central bank react to asset prices directly or indirectly with regard to possible future threats to price stability? Do we know which of the observed asset price booms are bubbles? Do we need to know? These are important questions and to most of them a fully satisfying answer is still lacking. In the following I will try to deal with some of these issues. I will start by exploring what we know about the existence of asset price bubbles. Then I will discuss whether asset price bubbles are necessarily harmful. Both sections are meant to caution against quick calls for policy intervention whenever unusual and seemingly excessive asset price developments are observed. I will then list some empirical stylised facts about past asset price boom and bust cycles to provide the background for reviewing the recommendations obtained from the economics literature on what is the best monetary policy reaction to asset price booms. I will then explain how the Eurosystem deals with the challenging issue of possible asset price bubbles within the framework of the ECB’s monetary policy strategy.

Are we sure asset price bubbles exist?

There is no consensus about the existence of asset price bubbles in the economics profession. Well reputed economists claim that even the most famous historical bubbles – e.g. the Dutch Tulip Mania from 1634 to 1637, the French Mississippi Bubble in 1719-20, the South Sea Bubble in the United Kingdom in 1720 as well as the worldwide new economy boom in the 1990s[2] – can be explained by fundamentally justified expectations about future returns on the respective underlying assets (or tulip bulbs). Thus, according to some authors, the observed price developments during the episodes that I have just mentioned – although exhibiting extremely large cycles – should not be classified as being excessive or irrational. For example, with regard to the new economy boom of the late 1990s it has been argued that uncertainty about future earnings prospects increases the share value of a company, especially in times of low risk premia.[3] This claim can be derived in a standard stock valuation model, where the price-dividend ratio is a convex function of the mean dividend growth rate. The mean dividend growth rate in turn depends obviously on future expected earnings of the company. Heightened uncertainty about future earnings will increase the price-dividend ratio. It has further been claimed that assuming apparently reasonable parameter values with regard to the discount rate, expected earnings growth and most importantly the variance of expected earnings growth, one can reproduce the NASDAQ valuation of the late 1990s and its volatility. There would thus be no reason to refer to a dotcom bubble. I do not mention this example because I believe the NASDAQ valuation of the late 1990s was not excessive. However, if one takes the narrow definition of a bubble very often used by these economic researchers,[4] there is a fundamental difficulty in calling an observed asset price boom a bubble: it must be proved that given the information available at the time of the boom, investors processed this information irrationally. As the above example shows, this is a formidable task.

Some economists would even argue that apparent evidence of irrationality should always be interpreted as a sign of hidden costs (to acquire or process information in a rational way) or model misspecification (which is responsible for the divergence between the model-based fundamental price and the observed price). According to this view, rationality of behaviour is not a falsifiable hypothesis but an organising principle of economic thinking. The conclusion of this line of thinking – which by the way I certainly do not share – would be that bubbles cannot exist by definition.[5]

I rather tend to believe that occasionally we observe behavioural patterns in financial markets, which can even be perfectly compatible with rationality from an individual investor’s perspective, but nevertheless lead to possibly large and increasing deviations of asset prices from their fundamental values, until the fragile edifice crumbles. A simple example of a bubble occurring possibly despite individual rationality is herding behaviour triggered by some investors’ rather short reporting horizons. In the same vein, some policy-makers and economists stressed in the past that market microstructure developments[6] and regulatory changes, i.e. Basel II and IAS39,[7] had to be carefully designed in order not to lead in the future to more rather than less pro-cyclicality and volatility in asset prices.

I would argue that, yes, bubbles do exist, but that it is very hard to identify them with certainty and almost impossible to reach a consensus about whether a particular asset price boom period should be considered a bubble or not.

Economists have often been described as "the great prophets of the past". Despite the magnificent words, this appellative is obviously not intended to be a compliment but rather a criticism for not being able to predict the future. In light of the difficulties to interpret even extreme historical developments, perhaps we should think more positively about great prophets of the past. After acknowledging the problems to identify a bubble even after the cycle has collapsed, it is not surprising that the challenge to call a boom a bubble is of another order of magnitude if the judgment has to be made in real time, which means when the boom is developing. Prominent economists have even considered this to be an impossible task.[8] I would like to emphasise that acknowledging the possibility of detecting a bubble does not imply that central bankers have more information or better tools for analysis, which would be a position that is difficult to defend.

However, the question whether a boom is a bubble is for many practical purposes more semantic than of real importance. For policy-makers, the important question is whether we can identify a combination of events in the financial and/or real sectors, which expose the financial system to a significantly increased level of risk. A financial crisis can make it very difficult to maintain price stability. This is demonstrated by the fact that all major deflationary episodes in the world have been related to substantial falls in asset prices. The growing academic literature on early warning signals represents some progress. Researchers from the Bank for International Settlements and the European Central Bank illustrate this point in two separate studies.

It has been shown that an indicator defined to provide a warning signal when both the credit-to-income ratio and real aggregate asset prices simultaneously deviate from their trends by 4 percentage points and 40% respectively would have predicted 55% of financial crises three years in advance.[9] The likelihood of this indicator triggering a false alarm has been – at least historically – very small (around 3%). Considering deviations of the credit-to-income ratio in excess of the 4 percentage point threshold alone as a warning signal would have even predicted 79% of financial crises, although in this case the indicator would have provided a false warning signal 18% of the time.[10]

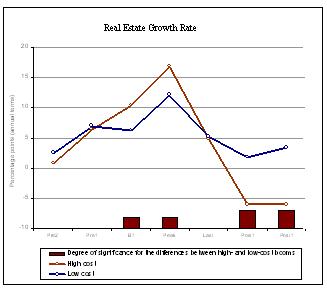

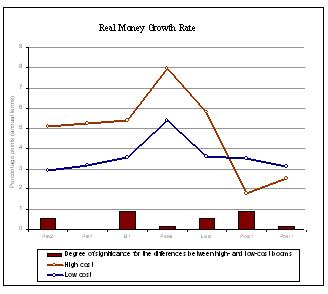

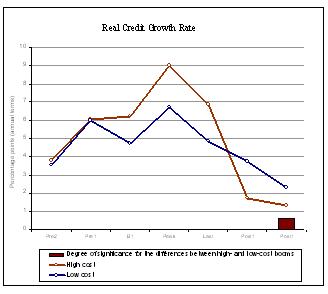

In another paper, ECB staff defined asset price booms as simple deviations from trend beyond a given threshold[11] and classified the resulting boom periods as high-cost or low-cost depending on the depth of the post-boom recession. They found that broad money and credit developments are among the few early indicators of high-cost asset price boom periods.[12]

I consider it the duty of central banks to communicate to the public the results of their analysis with regard to financial stability and potential risks for the financial system and the economy as a whole. This conviction is shared by many of my colleagues as can be seen from the increasing number of financial stability reports published by major central banks, including the ECB. Another example is the Financial Stability Forum, which convened in 1999 and brings together on a regular basis national authorities responsible for financial stability in significant international financial centres, international financial institutions, sector-specific international groupings of regulators and supervisors, and committees of central bank experts. The Financial Stability Forum publishes a status report twice a year on recent and ongoing work relevant to strengthening financial systems.

The welcome increase in transparency with regard to financial stability analyses does, however, not preclude the question whether and to which degree central banks should react to threats to financial stability – potentially triggered by asset price booms – at times when other policy-makers, like supervisory or fiscal and tax authorities, are unable or unwilling to take appropriate action.

Are asset price bubbles dangerous?

This question is not a rhetorical one and the answer is not as straightforward as one might tend to believe. Certainly not all asset price booms are dangerous. Booms are likely to be costly if associated with high leverage, which is, for example, usually the case in housing price booms. Economists have long argued that it is conceivable that a country occasionally experiencing boom-bust cycles could potentially exhibit a faster-rising trend growth path than one would observe for a country that is well known for not experiencing booms.

For example, some researchers have defended the idea that it is possible that asset price bubbles moderate the effects of financial market frictions, like credit constraints, and improve the allocation of investment despite the occasional busts.[13] Of course, one cannot exclude that it could be beneficial for long-run growth to ease borrowing constraints, but it should not be at the expense of a stable financial system, which favours an efficient allocation of capital and is thus intrinsically related to the good performance of the economy and its resilience to shocks.

A different but related argument put forward in the literature is that the optimal degree of vulnerability to banking crises must not be zero. Under certain conditions it can be optimal not to be fully insured against liquidity crises in the banking system, in order to spur financial intermediation, increase the amount of credit available for investment and thus foster growth in the long run.[14]

Each of these theoretical findings is clearly derived under special assumptions, but nevertheless they provide food for thought. I mention these examples in order to remind us to be prudent in calling for policy-makers’ corrective actions when some risk of financial fragility is detected. Even if the existence of a bubble were to be generally acknowledged – an unlikely situation in light of what I mentioned in the previous section – the policy-maker’s response (if any) would have to be carefully devised, especially with regard to its long-run effect on the working of the financial system.

Some stylised facts about asset price boom periods and monetary policy

Let me now turn to some empirical stylised facts about asset price bubbles and the link to monetary policy. A number of researchers have devoted some efforts to analysing historical boom-bust cycles in asset prices in order to detect regularities with regard to the costliness of booms, and to assess the potential for identifying dangerous booms at an early stage. Different studies emphasise different aspects and use different methodologies. However, they all point out a certain range of characteristics and I would like to draw your attention to some of them.

A recently conducted IMF study acknowledges the importance of housing price booms and compares equity and housing bust periods. It reaches the conclusion that although housing price busts are overall less frequent, they are more likely conditional on the existence of a boom. Historically, housing price booms have been followed by busts about 40% of the time, while equity price booms are followed by busts only in 25% of the cases. Housing price peak-to-trough periods are longer on average and, despite the fact that the decline in prices is somewhat smaller, the associated output losses are notably bigger. The output losses incurred during a typical housing price bust amount to 8% of GDP, which is double the average loss during an equity price bust. The reason is a different exposure of the banking system to mortgages than to shares. In this respect, bank-based financial systems incur larger losses than more market-based financial systems during housing price busts, while the opposite is true for equity price busts. This finding is corroborated by the fact that all major banking crises in industrial countries during the post-war period coincided with housing price busts.

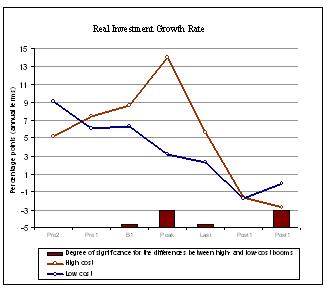

Other studies recently confirmed that developments in the monetary aggregates and credit play an important role in the development of asset price boom episodes. Although the issue of empirical causality between asset prices on the one hand and money and credit developments on the other is a complicated one, the potential role of credit and money in driving asset prices is straightforward. A bubble is more likely to develop when investors can leverage their positions by investing borrowed funds. One would expect to see similar developments in credit and money as credit is the main counterpart of money. Furthermore, a high money stock might signal large amounts of liquidity waiting to be invested in potentially higher-yielding opportunities, which could then fuel a bubble once a trend has been triggered and herding behaviour sets in. Further on, a high level of outstanding debt will increase the negative effects of asset price declines through the forced liquidation of leveraged positions and possible defaults, which in turn put additional pressure on asset prices. In this respect, it should not be surprising that both money and credit variables have recently been found to be pertinent indicators to predict financial crises and identify costly asset price boom episodes.[15] For example, there is evidence that during – and already in the two years before – asset price booms, real (broad) money growth has been about two percentage points higher in those booms that led to serious recessions than in those that did not.[16] More recent evidence along the same lines seems to suggest that it is equally useful to monitor real growth rates of residential property prices and real investment in order to detect potentially costly asset price boom periods at an early stage. [17]

Actual consumer price inflation is not a good early indicator to distinguish costly asset price booms from more benign booms. Only in the last boom year is inflation significantly higher in high-cost than in low-cost booms.[18]

How should monetary policy react to asset price booms?

In the following section I will briefly review the economics underlying the various practical recommendations for central bankers on how to optimally react to or take account of asset price booms.

The orthodox view: no special role for asset prices

In its strong version the orthodox view claims that price stability is a sufficient condition for financial stability. It is argued that the stable and predictable environment provided by a central bank successfully maintaining price stability over the short term prevents financial crises.[19] This view has been in the meantime empirically rejected. Financial crises can occur also in times of relative consumer price stability. However, they often undermine conditions for maintaining price stability. Therefore, a concept of price stability with a longer horizon is clearly associated with financial stability. The Japanese stock market and property price boom in the late 1980s is another vivid example of this. The more moderate version of the orthodox view though has many supporters, especially among central bankers. It says that asset prices should be ignored beyond their impact on consumer price inflation via the regular transmission mechanism channel. The regular transmission mechanism would include wealth effects resulting from changes in asset prices. Reference to the regular transmission mechanism is the key distinction from some other reaction patterns, like “leaning against the wind”, which will be discussed below. The strength of the regular transmission mechanism could very well depend on asset price levels themselves. For example, the size of the wealth effect following changes in the policy interest rate could be larger the higher the asset price valuations, as the share of financial assets in total wealth is then more important. But the key point is that the possibility of financial distress in case of major price corrections is not explicitly taken into account ex ante. Emergency liquidity assistance provided by the central bank in case of a severe bust with expected systemic effects is part of this orthodox view.[20] Despite being a robust theory most of the time, the orthodox view has recently been repeatedly called into question for not being optimal in all circumstances.

Targeting asset prices

One extreme view attributing a more prominent role to asset prices in the conduct of monetary policy is to include asset prices in the consumer price index used to define the policy objective.[21] The general idea is to secure stable prices of current but also future consumer goods by targeting a “cost-of-life” index. Assets are claims to future consumption and it has been argued that the asset price today should be a reasonable proxy for future prices of consumer goods. Today there is something close to a consensus among economists and central bankers that targeting financial asset prices is a bad idea. The ECB has recently provided an overview of the main arguments in a Monthly Bulletin article,[22] so I will limit myself here to listing the arguments against asset price targeting. First, in reality asset prices are a bad proxy for future CPI inflation, as asset price changes are driven by changes in fundamentals and not only inflation expectations. Second, targeting asset prices would increase risk-taking by private agents in anticipation of the attempts of monetary policy to stabilise asset prices. This is the well-known moral hazard argument. Third, with rational forward-looking private agents, there is the possibility of a circular relationship between monetary policy and asset prices. Asset prices would partly determine monetary policy, while simultaneously expected future monetary policy determines today’s asset prices. As a consequence, inflation could be purely determined by self-fulfilling market expectations and thus become extremely volatile. This problem is known as “inflation indeterminacy”. Fourth, if the central bank targets CPI inflation by means of a successful monetary policy strategy taking into account all indicators of inflationary pressure (including signals from asset prices), targeting asset prices directly would amount to double-counting inflationary pressure derived from asset prices. Fifth, the weight for asset prices in a combined price index is ambiguous. It could be extremely large if based on traditional expenditure shares. Using the relative usefulness to forecast CPI inflation, the weight would be much smaller. The methodological discussion on this has not yet converged. And finally, central banks lack sufficient control of asset prices. In the long run, asset prices are driven by fundamental factors and not monetary policy.

Pricking asset price bubbles

The focus of serious academic debate has moved away from this approach more recently, but the view that central banks should act decisively against suspected asset price bubbles occasionally surfaces among market observers. The roots of this position can be traced back to the so-called "liquidationist" view, which was widely entertained by mainstream economists in the context of the heated debate over the stock market boom of the 1920s in the United States. The view had some prominent advocates within the Board of Governors of the Federal Reserve System, who substantiated their inclination for a strong policy reaction to market dynamics on the grounds that the central bank, by acting decisively, would force the liquidation of the most stretched positions without inflicting further damage on sound investment strategies and the economy more broadly. While often taken by economists who are otherwise most distrustful of the central bank's ability to manage economic events, this position is now widely rejected by today’s profession.[23] The monetary policy instrument is too blunt a tool to allow the type of surgical intervention that the "pricking" of a bubble would require.

Leaning against the wind

The leaning against the wind principle describes a tendency to cautiously raise interest rates even beyond the level necessary to maintain price stability over the short to medium term when a potentially detrimental asset price boom is identified. The basic assumption behind this principle is a non-linearity best described as an asymmetric effect of positive and negative asset price shocks. A negative shock is likely to have a larger effect than a positive one. The reasons are that credit constraints can depend on the value of collateral and that in case of a financial crisis the whole financial intermediation process can in the worst case completely fail. The central bank conducts a slightly tighter policy in order to better ensure price stability over extended horizons by possibly containing the future growth of the bubble – or at least not to accommodate it – than it would otherwise if confronted with a similar macroeconomic outlook under more normal market conditions. By doing so, the central bank would tolerate being significantly below its definition of price stability. This behaviour has been compared to buying insurance against a potentially harmful asset boom-bust cycle, where the insurance premium to be paid is some additional tightening leading to a lower level of inflation than would be required by the monetary policy strategy.[24]

Proponents of the leaning against the wind policy have typically been very careful to mention the strong informational requirements concerning the properties of the bubble. Leaning against the wind is advisable only when, first, the probability that the bubble will anyhow burst in the near future is small, second, the future growth of asset prices is sufficiently interest rate sensitive and, third, the efficiency losses rise strongly with the size of the bubble. In particular, the need to specify “small”, “sufficiently sensitive” and “strong” constitutes a severe challenge for the practical implementation of a leaning against the wind policy.[25]

It should be mentioned that leaning against the wind has the advantage that it can to some degree ameliorate the moral hazard problem of the purely reactive approach to asset price boom-bust cycles. By reacting more symmetrically – i.e. being tighter in booms as well as looser in busts – the central bank would discourage excessive risk-taking and thereby reduce over-investment already during the boom. This in turn would lead to a lower level of indebtedness and less severe consequences of a possible future bust.

Thus, despite this property, the leaning against the wind principle faces some other intricate issues. First of all, bubbles – and asset price misalignments in general – may have their roots in underlying structural imbalances. Policies designed to effectively deal with these structural causes, such as prudential regulation or changes to the tax code, could be optimal and preferred in many cases. One should also take into account how and the extent to which a leaning against the wind policy can affect the markets. For example, it could be argued that for a small open economy leaning against the wind with regard to equity price bubbles is infeasible. With globalised equity markets, it is unlikely that the central bank of a small open economy would have the clout to affect domestic share prices against a global trend. On the other hand, a disorderly market reaction to a policy intervention can never be completely ruled out, even in cases where the policy is implemented gradually over an extended time horizon.

In my opinion, while such a policy is compelling in many theoretical aspects, in practice (barring the progress represented by recent research findings on the prediction of financial crises mentioned earlier) it is likely that the circumstances in which a policy-maker will embark with confidence upon an explicit leaning against the wind policy will occur rarely.

Asset prices and the ECB’s monetary policy strategy

In the previous section I discussed an array of possible strategies that a central bank could follow in the presence of suspected asset price bubbles. They range from complete non-intervention to an almost systematic reaction to asset price developments. The two more moderate suggestions are the only reasonable alternatives for policy-makers however. Eventually, it all boils down to the question of whether the reaction to asset prices should be limited to their impact on consumer price inflation via the regular transmission mechanism channel or whether – taking into account the effects that a boom-bust asset price cycle may have on the soundness of the financial system and thus price stability in the medium to long run – a central bank should occasionally consider following the leaning against the wind principle. Informational requirements, the specific details of the asset price misalignment and the underlying structural relationships of the economy will determine the feasibility and optimality of each of these two options.

The ECB’s primary objective is unambiguously the maintenance of price stability. The Governing Council aims at an HICP inflation rate of below and close to 2% with a medium-term orientation.

I mentioned though that boom-bust cycles in asset prices do exist and can potentially harm the entire economy, especially via the effect on the financial system. Maintaining price stability in times of financial crises is a very difficult task. It is thus reasonable for the monetary authority to monitor carefully unusual asset price developments at an early stage. As discussed a moment ago, allowing some short-term deviation from price stability in order to better ensure price stability over more extended horizons might – under very restrictive assumptions – be the optimal policy to follow.[26] The principle behind it should not be misunderstood as a systematic reaction to asset price booms, but rather as a selective response based on the careful analysis of all the available information. With respect to the ECB’s monetary policy strategy, the important point to note is the following: this strategy enables boom developments to be taken into account without any amendments to the strategy and without assigning any additional role to asset prices. Let me be more precise on this point.[27]

The ECB’s two-pillar strategy rests on a broad analytical framework, which is well suited to detecting risks to price stability and to the economy as a whole. It also helps to identify the underlying distortions in asset prices. The ECB singles out money in its monetary analysis in recognition of the fact that monetary growth and inflation are correlated in the long term. However, the monetary analysis also contributes to assessing the extent to which excess creation of liquidity and over-extension of credit can be a driving force behind excessively valued assets. Detecting and understanding this link helps the ECB to form an opinion on whether an observed movement in monetary aggregates and their counterparts might already reflect the inflating of an asset price bubble. It is then clear that a case-by-case analysis based on sound information on the monetary variables (mainly broad money and credit), on the counterparts of monetary aggregates (including the net external asset position of monetary financial institutions) and on the related functioning of the asset market is indispensable.

In this respect, the ECB’s strategic framework has in my view important advantages over an inflation targeting strategy. The ECB’s strategy permanently and comprehensively captures longer-run risks to price stability within its monetary analysis. In the inflation targeting framework, on the contrary, reacting to potential asset price booms will always give the impression that an exceptional escape clause has been introduced in the strategy. Proponents of inflation targeting have recommended simply extending the horizon of the inflation forecast beyond the standard one-to-two-year policy horizon. I doubt that serious inflation forecasts can be derived at this horizon given the uncertainty surrounding asset price boom periods.[28] Thus I fully share the view that the longer horizon in inflation targeting is basically a substitute for a more structured assessment of risks to price stability.[29] This risk assessment is part of the ECB’s monetary analysis.

In order to maintain the effectiveness and credibility of monetary policy, it is important to foster the public understanding of the implications of the ECB’s monetary policy strategy. The fact that our monetary analysis uses a comprehensive assessment of the liquidity situation that may, under certain circumstances, provide early information on developing financial instability is an important element in this endeavour.

Conclusions

Let me conclude. Experience with past asset price boom episodes tells us that we should be very careful in calling a boom, which is observable, a bubble. Such labelling will always contain a substantial degree of arbitrary judgment. Nevertheless, empirical evidence also reveals that it is possible to find characteristics of potentially dangerous asset price boom developments which are useful from a policy-maker’s point of view to identify risks to long-run price stability. The methodologies to identify those threatening booms certainly need to be refined. In particular, we need to know more about the reliability of empirical analyses which, out of necessity or due to a lack of recent boom-bust cycles, have to pool information from various boom episodes in different countries with different financial systems, which moreover differ over time.

Not all boom or bubble episodes threaten financial stability. Policy-makers should not fall into the trap of attempting to eliminate all risk from the financial system. They would either be unsuccessful (due to moral hazard) or they would likely hamper the appropriate functioning of a market economy where risk-taking is of the essence.

With regard to the optimal monetary policy response to asset price bubbles, I would argue that its informational requirements and its possible – and difficult to assess – side-effects are in reality very onerous. Empirical evidence confirms the link between money and credit developments and asset price booms. Thus, a comprehensive monetary analysis will detect those risks to medium and long-run price stability. The fact that the ECB’s monetary policy strategy has this property is, in my view, a significant advantage in light of the current challenges facing modern central banks.

I fully advocate the transparency of a central bank’s assessment of risks to financial stability and of its strategic thinking on asset price bubbles and monetary policy. The fact that our monetary analysis uses a comprehensive assessment of the liquidity situation that may, under certain circumstances, provide early information on developing financial instability is an important element in this endeavour.

The perfect outlet as regards the risks is a publicly available financial stability review, which the ECB now publishes biannually. And the perfect occasion to explain the strategy could very well be a lecture in one of the major financial centres of the world. Thank you very much for your attention.

ANNEX: Comparison of high and low-cost booms for selected variables

The graphs below show the evolution of four synthetic indicator variables aimed at characterising the typical pattern of high and low-cost asset price booms. Specifically, the indicator variables summarise information on real estate prices, real investment, real money growth and real credit growth. The data used to construct these synthetic indicator variables correspond to quarterly series for a sample of 17 OECD countries,[30] covering the period 1970-2003. An asset price boom is defined as a period in which the aggregate real asset price index[31] is continuously more than 11% above its trend. For each period, the trend[32] is recomputed using only the information available up to that period. In this way, the booms are observed as perceived in ‘real time’.

Overall, 32 asset price boom episodes have been identified. Asset price booms that were followed by a sharp drop in real GDP growth rates are labelled as high-cost booms while those that were succeeded by a relatively mild slowdown in real growth are labelled as low-cost booms.[33] 15 booms are considered high-cost booms and 17 are considered low-cost booms.

For each boom, seven periods are defined according to their position relative to the beginning or to the end of the boom. These periods represent an aggregation of four quarters except for the peak period, which corresponds to a single quarter:

Pre2 starts 2 years before the boom,

Pre1 starts 1 year before the boom,

B1 is the first year of the boom,

Peak is the quarter where the difference between the aggregate asset price index and its trend is at its maximum,

Last is the last year of the boom, i.e. the last quarter of the boom plus the three previous quarters,

Post1 is the first year after the end of the boom,

Post2 is the second year after the boom.

As an example, the following boom has been identified for the Spanish economy between 1986:2 and 1991:2:

| Spain: boom and corresponding periods | |

| Pre2 | 1984:2 – 1985:1 |

| Pre1 | 1985:2 – 1986:1 |

| B1 | 1986:2 – 1987:1 |

| Peak | 1989:2 |

| Last | 1990:3 – 1991:2 |

| Post1 | 1991:3 – 1992:2 |

| Post2 | 1992:3 – 1993:2 |

Proceeding like this, 15 Pre2 periods, 15 Pre1 periods, 15 B1 periods and so on are obtained for the high-cost booms. The low-cost booms have 17 Pre2 periods, 17 Pre1 periods, 17 B1 periods and so on. Subsequently, the median values of the synthetic indicator variable have been determined for each period (Pre2, Pre1, B1, etc.) across all high-cost booms on the one hand and across all low-cost booms on the other hand. Specifically, we have computed the median values for four synthetic variables characterising the evolution of the rates of growth in real estate prices, real investment, real money growth and real credit over low and high-cost asset price booms. The patterns of the computed median values are depicted in the graphs.

A bar indicates that the distribution of growth rates in high-cost booms is significantly different[34] from the distribution of growth rates in low-cost booms for the considered period at the 20% (low bar), 10% (medium bar) or 5% (tall bar) significance level. In the graphs, the vertical axis represents annualised percentage points, while the horizontal axis displays the seven periods considered.

References:

Adalid, R. and C. Detken (2005). Forthcoming.

Alchian, A. and B. Klein (1973), “On a correct measure of inflation”, Journal of Money, Credit and Banking, pp. 173-191.

Bordo, M. and O. Jeanne (2002), “Inflation shocks and financial distress: A historical analysis”, Federal Reserve Bank of St. Louis, Working Paper No 2000-005A.

Bordo, M. and D. Wheelock (1998), “Price stability and financial stability: The historical record”, Federal Reserve Bank of St. Louis Review, September/October, Vol. 80, No 5.

Borio, C. (2005), “Monetary and financial stability: so close and yet so far?”, National Institute Economic Review No 192.

Borio, C., B. English and A. Filardo (2003), “A tale of two perspectives: old or new challenges for monetary policy?”, BIS Working Paper No 127.

Borio, C. and P. Lowe (2002), “Asset prices, financial and monetary stability: exploring the nexus”, BIS Working Paper No 114.

Borio, C. and P. Lowe (2004), “Securing sustainable price stability: should credit come back from the wilderness?”, BIS Working Paper No 157.

Bryan, M. F., S. G. Cecchetti and R. O’Sullivan (2003), “A stochastic index of the cost of life and application to recent and historical asset price fluctuations” in C. Hunter, G. Kaufman and M. Pomerleano (eds) (2003), Asset price bubbles – the implications for monetary, regulatory and international policies, Massachusetts Institute of Technology, pp. 277-290.

Detken, C. and F. Smets (2004), “Asset price booms and monetary policy”, ECB Working Paper No 364.

ECB (2005), “Asset price bubbles and monetary policy”, Monthly Bulletin, April 2005, pp. 47-60.

Garber, P. (1990), “Famous first bubbles”, The Journal of Economic Perspectives, Vol. 4, No 2 (Spring), pp. 35-54.

Garber, P. (2000), “Famous first bubbles: the fundamentals of early manias”, Massachusetts Institute of Technology.

Gaytan, A. and R. Ranciere (2003), “Banks’ Liquidity Crises and Economic Growth”, mimeo, NYU.

Goodfriend, M. (2000), “Financial stability, deflation and monetary policy” presented at the 9th International Conference at the Institute of Monetary and Economic Studies, Bank of Japan, July.

Goodhart, C. (2005), “Regulation, financial stability and asset price bubbles”, Schwerpunktthemen und Serien, Börsen-Zeitung, 12 March.

Goodhart, C. and B. Hoffmann (2000), “Do asset prices help to predict consumer price inflation?”, mimeo.

Goodhart, C. and H. Huang (1999), “A model of the lender of last resort”, IMF Working Paper WP/99/39.

Greenspan, A. (2002), Speech on economic volatility at a symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, 30 August.

Gruen, P. and A. Stone (2003), “How should monetary policy respond to asset price bubbles?” in Richards and Robinson, Asset prices and monetary policy, RBA Conference, August.

Issing (2003a), “Monetary and financial stability: is there a trade-off?”, Conference on “Monetary stability, financial stability and the business cycle”, Bank for International Settlements, Basel, 28-29 March.

Issing (2003b), Introductory statement at the ECB Workshop on “Asset prices and monetary policy”, European Central Bank, Frankfurt, 11-12 December.

LeRoy, S. (2002), Review on “Famous first bubbles: the fundamentals of early manias” by Peter M. Garber, Journal of Economic Literature, Vol. 40, No 3 (September), pp. 959-960.

Pastor, L. and P. Veronesi (2004), “Was there a NASDAQ bubble in the late 1990s?”, Working Paper, University of Chicago.

Ranciere, R., A. Tornell and F. Westermann (2003), “Crises and growth: a re-evaluation”, NBER Working Paper 10073.

Schwartz, J. (1995), “Why financial stability depends on price stability”, Economic Affairs, Autumn, pp. 21-25.

Trichet, J.-C. (2003), “Asset price bubbles and their implications for monetary policy and financial stability” in C. Hunter, G. Kaufman and M. Pomerleano (eds) (2003), Asset price bubbles – the implications for monetary, regulatory and international policies, Massachusetts Institute of Technology, pp. 15-22.

Ventura, J. (2003), “Economic growth with bubbles”, CREI Working Paper, November.

Weber, A. (2005), “How to identify asset price bubbles”, Schwerpunktthemen und Serien, Börsen-Zeitung, 29 January.

-

[1] See e.g. Borio (2005).

-

[2] See e.g. Garber (1999, 2000) on the first three and Pastor and Veronesi (2004) on the fourth.

-

[3] The following draws on Pastor and Veronesi (2004).

-

[4] The most usual definition of a bubble used in economic research defines it as the part of asset price movements that is unexplainable based on fundamentals. See Garber (2000).

-

[5] See LeRoy (2002).

-

[6] See Trichet (2003).

-

[7] Goodhart (2005).

-

[8] E.g. Weber (2005).

-

[9] Borio and Lowe (2002). The trend is estimated using information only up to the period under consideration.

-

[10] The evidence is compiled using evidence for 34 countries for the period 1970-1999.

-

[11] Again, the trend is estimated recursively, meaning that no information on future developments is used in its computation.

-

[12] Detken and Smets (2004).

-

[13] See Ventura (2003).

-

[14] Gaytan and Ranciere (2003).

-

[15] However, developments in net external assets of the domestic MFI sector can put a decisive wedge between those in money and credit. This channel is most likely the explanation for those results, which find predictive power only for one or the other. E.g. Borio and Lowe (2004) favour credit, while Adalid and Detken (forthcoming, 2005) favour money as early indicators.

-

[16] Adalid and Detken (forthcoming, 2005). See annex for a graphical presentation of this result.

-

[17] See again the charts presented in the annex.

-

[18] See Detken and Smets (2004) and Adalid and Detken (forthcoming, 2005).

-

[19] Schwartz (1995).

-

[20] E.g. Bordo and Wheelock (1998), Goodfriend (2000) and Greenspan (2002).

-

[21] Alchian and Klein (1973).

-

[22] ECB Monthly Bulletin, April, 2005 (Box 4).

-

[23] E.g. Greenspan (2002).

-

[24] See Bordo and Jeanne (2002), Borio and Lowe (2002), Borio, English and Filardo (2003) and Weber (2005).

-

[25] Bordo and Jeanne (2002), Gruen, Plumb and Stone (2003).

-

[26] This has been previously acknowledged in Issing (2003a, 2003b).

-

[27] See also the April 2005 issue of the ECB Monthly Bulletin.

-

[28] See e.g. Goodhart and Huang (1999) regarding the volatility of the money multiplier in crises.

-

[29] Borio (2005).

-

[30] Australia, Belgium, Canada, Switzerland, Germany, Denmark, Spain, Finland, France, Italy, Japan, the Netherlands, New Zealand, Norway, Sweden, the United Kingdom and the United States.

-

[31] Source: BIS. The index is computed as a weighted average of equity, residential real estate and commercial real estate prices, where the weights are based on the relative share of those assets in the private sector’s wealth.

-

[32] The trend is estimated using a Hodrick-Prescott filter with a smoothing parameter of 100,000.

-

[33] High-cost booms are those booms that were followed by a drop of more than 2.5 percentage points in annualised terms in average real growth (comparing the three years following the boom with the average growth during the boom), as long as the average post-boom growth is below 2.5%.

-

[34] The differences between high and low-cost booms in each period of the boom have been tested using the Wilcoxon/Mann-Whitney test.

Ευρωπαϊκή Κεντρική Τράπεζα

Γενική Διεύθυνση Επικοινωνίας

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Η αναπαραγωγή επιτρέπεται εφόσον γίνεται αναφορά στην πηγή.

Εκπρόσωποι Τύπου