Published as part of the ECB Economic Bulletin, Issue 8/2023.

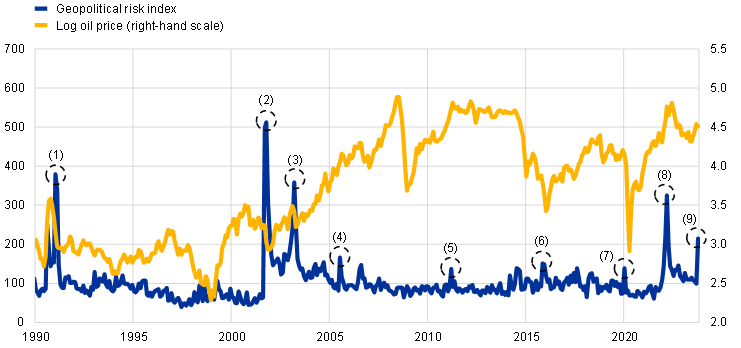

The relation between geopolitical developments and oil prices is not clear-cut. Historically, there is no clear relationship between oil prices and geopolitical events, such as emerging tensions between countries or terrorist attacks. For example, immediately after the 9/11 attacks, Brent prices increased by 5% (about five times the average daily change in the Brent price between 2000 and 2023). However, within 14 days the price dropped by around 25% on the back of concerns about weakening oil demand. When Russia invaded Ukraine in February 2022, Brent prices increased by almost 30% within the first two weeks following the invasion. However, prices then decreased again, returning to their pre-invasion levels after around eight weeks. More recently, Brent prices increased by about 4% after the terrorist attacks in Israel on 7 October 2023 before subsequently stabilising.[1] Taking a more comprehensive perspective, Chart A plots the global geopolitical risk (GPR) index of Caldara and Iacoviello (2022) against the log of the Brent crude oil price.[2] The index is constructed by applying text analysis methods to newspaper articles and tracking the news coverage of events related to geopolitical tensions globally.[3] Large spikes in the index, which capture major geopolitical events, are not systematically associated with higher or more volatile oil prices. On the contrary, after many events, oil prices remain weak for several months.

Chart A

Oil prices and geopolitical risk since 1990

(left-hand scale: index, right-hand scale: log of the Brent crude oil price)

Sources: Haver, Caldara and Iacoviello (2022), and ECB staff calculations.

Notes: The latest observations are for October 2023. The numbered peaks refer to the following geopolitical events: (1) Gulf War; (2) 9/11 terrorist attacks; (3) Invasion of Iraq; (4) London terrorist attack; (5) Arab Spring and civil war in Libya; (6) Paris terrorist attacks; (7) Attack on US embassy in Iraq; (8) Russian invasion of Ukraine; (9) Israel-Hamas war.

Geopolitical shocks can have an impact on oil prices through lower economic activity or higher risks to commodity supply. In principle, geopolitical risk can affect commodity and oil prices through two main channels. First, higher geopolitical tensions act as a negative global demand shock, because these tensions increase uncertainty about the economic outlook, which negatively affects consumption and investment and potentially disrupts international trade. Combined, these forces lead to a contraction in global economic activity, ultimately dampening global oil demand and prices. This is known as the economic activity channel. Second, the risk channel involves financial markets potentially pricing in higher risks to future oil supply over and above the current geopolitical shock. This increases the cash value of holding oil contracts, also known as the convenience yield, and puts upward pressure on Brent prices.[4] These two channels move oil markets in opposite directions, and the channel that prevails is an empirical question. Additional confounding factors include oil producers potentially deciding to adjust their oil production to stabilise prices.

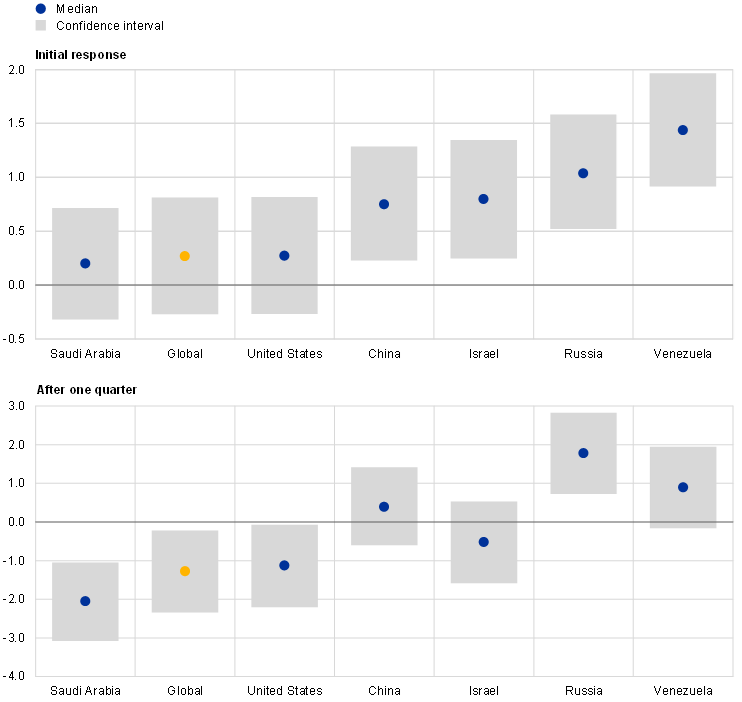

On average, a global geopolitical shock puts downward pressure on the oil price. The reaction of oil prices – as measured by the Brent variety – to global geopolitical shocks can be identified with a VAR model, netting out the response of oil producers and controlling for global activity and the financial cycle.[5] The model covers the period from January 2000 to October 2023 and is estimated with Bayesian methods.[6] Chart B plots the initial and three-month estimated responses of the Brent price to a one standard deviation geopolitical shock, which corresponds to about one-tenth of the value assumed by the index in the aftermath of the 9/11 attacks (yellow dot in the chart, referring to a global geopolitical risk shock). The estimated elasticities indicate that it takes time for global geopolitical shocks to have an impact on Brent prices, which initially remain stable (the elasticity is not significantly different from zero), before falling by about 1.2% after one quarter. This suggests that the economic activity channel – the knock-on effects of higher uncertainty on demand – dominates in the reaction of oil markets.[7] In other words, global geopolitical shocks typically imply downward risks to oil prices.

Chart B

Estimated responses of oil prices to country-specific and global geopolitical shocks

(percentages)

Sources: Haver, Caldara and Iacoviello (2022) and ECB staff calculations.

Notes: The chart shows the response of the Brent oil price to a one standard deviation geopolitical risk shock. Shocks are identified as in Caldara and Iacoviello (2022), estimating country-specific VAR models with Cholesky ordering and the GPR index ordered first. Each VAR includes a country-specific GPR index, global industrial production, the Brent oil price, the domestic stock market index and the US two-year yield. All variables excluding the index and the two-year yield enter in logs. The sample covers the period from January 2000 to October 2023. Countries are ordered according to the size of the initial response.

However, the impact of geopolitical shocks varies across countries, depending on the origin of the shocks in question. Tensions originating from key oil producers or from countries playing a strategic role in the distribution of oil products might affect oil markets differently. If countries involved in geopolitical tensions account for a small share of the global economy, they are unlikely to significantly affect global growth; this would tend to dampen the economic activity channel of geopolitical shocks. However, if the countries involved are key producers in global oil markets, the risks to oil supply could generate significant upward pressure on prices. This hypothesis can be tested by estimating the response of Brent prices to country-specific, as opposed to global, geopolitical shocks. To this end, Chart B also reports the estimated elasticities of the oil price to geopolitical shocks originating in some of the largest oil producers (the United States, Saudi Arabia, Russia and China), Venezuela (which has the largest oil reserves) and Israel (which is not an oil producer itself but a key player in Middle Eastern politics).[8] The estimates point to significant variations in country-specific responses, which suggests that not all geopolitical shocks are alike. US shocks behave similarly to global shocks; the reaction is initially insignificant and then turns negative after one quarter, by -1.1%. This is not surprising considering the major role of the United States in the global economy. Reactions are different when shocks from other sources are considered. Shocks in Saudi Arabia remain contractionary, suggesting that geopolitical developments in that country mirror global patterns.[9] However, geopolitical tensions associated with China, Israel, Russia and Venezuela put upward pressure on the Brent oil price, which immediately increases by between 0.8 and 1.5%.[10] For these countries, the risk channel clearly dominates: oil prices increase because traders expect disruptions to future oil supplies.

Oil price pressures arising from adverse geopolitical shocks are generally short-lived, with elasticities becoming insignificant after one quarter for most countries.[11] Price pressures due to geopolitical shocks in most countries are short-lived, as concerns over future oil supply fade out.[12] However, price effects can last longer depending on the duration of geopolitical tensions in the sample considered or because of country-specific factors. Overall, the empirical evidence suggests that geopolitical shocks can have different implications depending on the countries involved. Recent heightened geopolitical uncertainty stresses the need to identify the nature of geopolitical shocks to disentangle their effects on oil prices and inflation.

After one month, the Brent price stood below the level observed on the day before the attacks, at USD 79 per barrel.

Caldara, D. and Iacoviello, M., “Measuring Geopolitical Risk”, American Economic Review, American Economic Association, Vol. 112, No 4, 2022, pp. 1194-1225.

The index is based on ten newspapers (Chicago Tribune, The Daily Telegraph, Financial Times, The Globe and Mail, The Guardian, Los Angeles Times, The New York Times, USA Today, The Wall Street Journal and The Washington Post) and is constructed by counting the number of articles related to adverse geopolitical events in each newspaper for each month (as a share of the total number of news articles). It is separately constructed for the global economy and 44 countries.

See Szymanowska, M., de Roon, F., Nijman, T. and van den Goorbergh, R., “An Anatomy of Commodity Futures Risk Premia”, Journal of Finance, American Finance Association, Vol. 69, No 1, 2014, pp. 453-482.

Shocks are identified through Cholesky ordering, with the GPR index ordered first, as in Caldara and Iacoviello, op. cit. The ordering implies that any contemporaneous correlation between economic variables and the GPR index reflects the effect of geopolitical events on the economic variables, rather than the other way around. Caldara and Iacoviello provide extensive validation of this exogeneity assumption.

Specifically, the VAR model includes 12 lags of five monthly variables: the global GPR index, the (log) Brent oil price, (log) world industrial production, the (log) US stock market price and the two-year yield to capture the global financial cycle. The model is estimated using Bayesian methods and standard Minnesota priors. Results are robust to accounting for the COVID-19 pandemic as in Lenza, M. and Primiceri, G.E., “How to estimate a vector autoregression after March 2020”, Journal of Applied Econometrics, Vol. 37, No 4, 2022, pp. 688-699. The sample covers the period from January 2000 to October 2023.

Global industrial production contracts by about 0.1% and stock prices by 0.5% over the same horizon.

Iran and Iraq – two other important oil-producing countries – are excluded, because country-specific indices are not available for them. Instead, Israel is included as the closest geopolitical neighbour to Iran, as tensions in Israel often also involve Iran. In this case, elasticities are constructed by substituting the global index with one of the country-specific indices. The VAR controls for local and global macroeconomic developments and uses the index as an internal instrument to identify country-specific geopolitical shocks.

The global and Saudi Arabia GPR indices are strongly correlated.

The results for Israel might capture the potential involvement of Iran – a major oil producer – in geopolitical tensions.

With regard to Russia, geopolitical shocks continue to influence oil markets after one quarter, as prices remain 2% higher. In the case of Russia’s invasion of Ukraine in 2022, this might reflect the imposition of an embargo on oil imports from Russia.

This is likely due to geopolitical tensions being short-lived or supply being substituted by other oil producers. The data do not seem to support the alternative explanation that global demand contracts after regional geopolitical shocks in these economies, as the response of global output is typically insignificant in the country-specific VARs.