- THE ECB BLOG

Europe needs a fully fledged capital markets union – now more than ever

Blog post by Luis de Guindos, Vice-President of the ECB, and Fabio Panetta and Isabel Schnabel, Members of the Executive Board of the ECB

2 September 2020

Introduction

The capital markets union (CMU) is one of the cornerstones of the euro area’s financial architecture. But progress in developing it has been slow. Since the agreement on establishing CMU in 2015, many subprojects have been launched, and some completed, but European capital markets are still far from being fully integrated. Despite the fact that the coronavirus (COVID-19) crisis has made CMU more important than ever, progress has unfortunately slowed, notwithstanding the substantial headway made on the fiscal side with the agreement on the European recovery package (Next Generation EU).

Financing the post-crisis recovery is one of the most pressing challenges Europe is facing today. Capital markets will be crucial. The new bond issuance by the European Commission, in the context of Next Generation EU, relies on well-functioning capital markets.[1] But public funding cannot do the heavy lifting alone; it will have to be complemented by substantial private financing. With the banking sector under pressure due to the pandemic, private bond and equity markets can play an important role in complementing bank financing.

In order to recover from the pandemic and strengthen the euro area’s growth potential, a new push is needed towards the long-term ambition of creating a genuine single European capital market that is deeply integrated and highly developed. This will not only mobilise the resources needed to reboot the euro area economy after the global contraction. It will also help meet the additional challenges posed by external developments, such as Brexit and global trade tensions.[2] In addition, it will provide opportunities for accelerating the transition to a low-carbon economy – thereby supporting the European Union’s ambition to be a leader in green finance – and for funding the transition towards the digital economy. A single capital market will also strengthen our common currency’s role on the global stage. And last but not least, a deeper and more integrated financial system is also needed from a monetary policy perspective, as integrated capital markets improve the transmission of our single monetary policy to all parts of the euro area. In turn, this will help limit the risk of growing asymmetries among member countries as our economies recover from the COVID-19 shock at different speeds.

Our aim with this blog post is to re-emphasise the importance of strengthening efforts to advance the CMU project, in the light of the European Commission’s forthcoming new Action Plan.[3] First, we explain why CMU is important, especially due to the COVID-19 crisis. Second, we describe the current state of play regarding capital market development and integration in the EU, and identify the areas where progress is needed most. And third, we set out a roadmap of policy measures that would remove core barriers to further integration. Following this roadmap would benefit the euro area, the EU and its citizens. It would stabilise funding sources for households, companies and governments, foster cross-country risk-sharing and consumption smoothing, and stimulate growth and the post-COVID-19 recovery.

The measures we propose are broad in nature and require strong commitments, in line with the ECB’s long-standing view that the CMU project has to be ambitious.[4] Accomplishing these reforms could trigger a virtuous cycle of better economic outcomes and further reforms, strengthening the European project. We recognise that developing and integrating European capital markets will primarily be a market-led process, so the measures we propose are designed to enable market forces.

Why is CMU even more important due to the COVID-19 crisis?

Even before the pandemic, the ECB was a strong supporter of the CMU project. CMU aims to deepen and further integrate capital markets in order to establish a genuine single capital market within the EU, which would allow investors, savers, firms and market infrastructures to access a full range of services and products, regardless of where they are located.[5] Let us explain why CMU matters, and why it is particularly important due to the COVID-19 crisis.

First, European firms would benefit from more diverse funding sources, which would allow them to adapt more effectively to changing funding conditions. Easier access to market-based financing instruments would lessen firms’ reliance on bank financing when the banking sector has been weakened by a shock, such as the COVID-19 crisis. This would also support the smooth transmission of monetary policy.

Second, progress towards CMU would increase private risk-sharing across countries and actors, generating positive effects from a macroeconomic stabilisation perspective and making economies more resilient to local shocks. This is particularly important now, with the risk of diverging economic development within the euro area due to the shock from the pandemic. Within Europe, increasing cross-border ownership of stocks and debt securities and cross-border business financing would be an important way of sharing risks and thereby stabilising households’ consumption and firms’ investment over time.[6] Equity markets tend to have particularly strong risk-sharing properties. Several studies also emphasise that equity funding is more resilient to shocks than debt funding, and can be considered more stable from a risk-sharing perspective.[7]

Third, boosting capital markets through policies aimed at increasing equity financing would support growth and innovation. Research suggests that firms with higher growth potential generally resort more to (public or private) equity financing than debt financing and that capital markets are better at financing innovation and new sources of growth.[8] This makes capital market funding particularly attractive with a view to boosting Europe’s potential growth after the pandemic. A fully fledged CMU would improve funding conditions for innovative firms, which would mean brighter prospects for jobs and growth in a more sustainable economy, thereby helping to successfully implement the structural changes that will be unavoidable after the crisis.

Fourth, advancing CMU would speed up the transition to a low-carbon economy. Recent analysis suggests that an economy’s carbon footprint shrinks faster when it receives a higher proportion of its funding from equity investors than from banks or through corporate bonds.[9] Given equity investors’ propensity to fund intangible projects, equity markets might be more successful in funding green innovation and supporting the reallocation to green sectors.

Fifth, integrated euro area capital markets would strengthen the international role of the euro, as deep and liquid financial markets are fundamental to a currency’s ability to attain international status.[10] By reducing transaction costs, deeper markets would make using the euro more attractive for international financing and settlement. More liquid markets also mitigate rollover risk and are thus perceived as safer by investors. A stronger international role for the euro would benefit our monetary policy, including through greater policy autonomy and improved monetary policy transmission, with positive spillbacks and lower external financing costs.[11] It would complement other measures supporting the international role of the euro, such as the expansion of euro liquidity facilities during the COVID-19 crisis.[12]

Finally, progress on CMU would dovetail with another key EU objective: completing the banking union. Banks and capital markets complement each other in financing the real economy, so the two projects are mutually reinforcing.[13] On the one hand, more integrated capital markets support cross-border banking activities, as banks exploit economies of scale and offer similar capital market products across the EU. More cross-border holdings would also allow banks to have more diversified collateral pools for their securitised products and covered bonds. This could ultimately make banks more resilient, as they would benefit from a wider investor base for capital market-based funding instruments and a broader market to which they could sell non-performing assets. On the other hand, a more resilient and integrated banking system supports the smooth functioning and further integration of capital markets. Just as with CMU, the benefits of banking union become even more visible due to the pandemic.

Where do European capital markets stand today and what has happened during the pandemic?

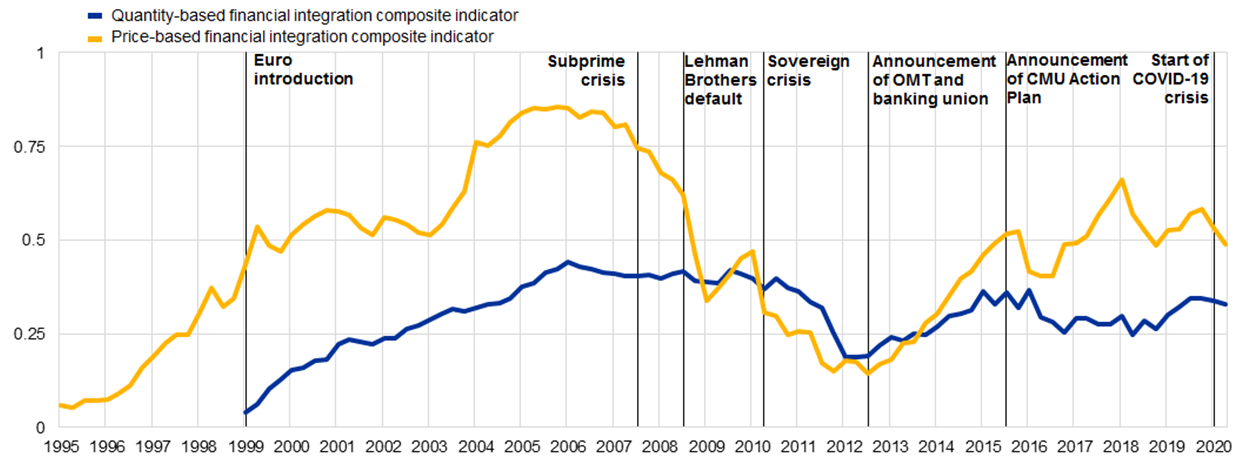

The first CMU Action Plan of 2015 has generated some positive developments in European capital markets. Among other things, it led to some progress on harmonising and improving insolvency frameworks[14] and on establishing a new EU framework for covered bonds and simple, transparent and standardised securitisations. But a significant “CMU effect” has yet to be seen in the data – partly because these measures have only been implemented recently and their full impact will take some time to emerge.[15] European capital markets – and especially equity markets – remain underdeveloped and insufficiently integrated at the European level. While there was a strong positive trend in capital market integration following the great financial and euro area crisis, as shown by the price- and quantity-based indicators in Chart 1, the integration of equity markets has stagnated since 2015 and has even declined since the fourth quarter of 2017. Cross-border holdings of debt have increased, but this is mainly true for shorter maturities, which are less stable than longer-term debt.[16] Another notable trend is that investment funds are playing an increasingly important role in cross-border integration.[17] However, overall risk-sharing is still low compared with the levels typically observed across regions or states within a single country or federation.[18]

While it is too early to fully assess the impact of the COVID-19 outbreak on EU capital markets, some initial indicators show that the pandemic has triggered a refragmentation within euro area financial markets, mainly through bond and equity markets. At the height of the pandemic, this meant that our private purchase programmes could not reach the non-financial corporations (NFCs) of all euro area countries in the same way.[19]

Chart 1

Price and quantity-based indicators of financial integration

(quarterly data; Q1 1995 – Q2 2020)

Source: ECB (2020), Financial Integration and Structure in the Euro Area, March 2020.

Notes: The indicators are bound between zero (full fragmentation) and one (full integration). The result of the quantity-based composite indicator for Q2 2020 is based on money market and equity market benchmark data from Q2 2020; for the bond market, Q1 2020 benchmark data are used. For a detailed description of the indicators and their input data, see the Statistical annex to the ECB report “Financial Integration and Structure in the Euro Area” (see source above) and Hoffmann et al. (2019).

Capital market development is also lagging behind.[20] While the US economy is financed through capital markets to a significant degree, the euro area economy continues to be mainly financed by banks and through unlisted shares. Nevertheless, the role of capital markets in providing a stable source of funding to the European economy is expanding, thereby moving the euro area’s financial structure towards a more balanced composition.[21] NFCs have gradually diversified their funding structures and are increasingly financing themselves in the market by issuing debt securities. At the same time, however, corporate bond markets are very uneven across euro area countries.

Even though the share of all equity instruments in total financing in the euro area is comparable to other countries, financing through equity traded on public markets (listed shares) remains relatively uncommon, and well below the levels seen in other major economies.[22] Conversely, loans and unlisted shares account for particularly large proportions of financing in the euro area economy. Similarly, the EU is lacking in early-stage private equity investment (see Chart 2). Data on venture capital investment relative to GDP show that even in Finland and Estonia, which are the most advanced EU countries in this area, the ratio is less than one-fifth of that in the United States. Early-stage financing is not the only ingredient missing for innovative firms to flourish: the EU is also lagging behind the United States as regards an ecosystem that promotes the next stages of growth when firms mature and need to scale up their businesses.[23]

Chart 2

Venture capital investments in 2019

(percentages of GDP)

Sources: OECD and IMF World Economic Outlook.

Notes: For Japan only 2018 data are available. Data for the EU show the average for all EU countries for which data are available. Data are not available for Croatia, Cyprus, Malta and Slovenia.

European equity markets are underdeveloped for a number of reasons, all of which influence both the supply of, and demand for, equity finance.[24] One important element is investor behaviour: equity ownership by investors, in particular retail investors, is low despite the growth of the investment funds sector, and skewed in the population compared with the United States. At present, only 9% of the adult population of the euro area own publicly traded shares, compared with 52% in the United States. The picture across the euro area is mixed, both in terms of retail investors’ preferences across asset classes and in the overall level of household investments (see Chart 3). Unsurprisingly, the equity share of private pension investment is particularly low in countries with large pay-as-you-go systems.[25] By contrast, countries with large funded pension systems and, therefore, large aggregate private retirement savings, typically have the most developed capital markets.[26] The flip side of Chart 3 and the limited investments in capital market products is that European savers hold large amounts of bank deposits. Appropriate equity shares in funded pension systems would help to ensure satisfactory returns for citizens over the long periods of time relevant for retirement savings. Adequate diversification rules across European countries in the new pan-European Personal Pension Product would help improve private financial risk-sharing.

Chart 3

Share of households holding different asset classes by country

Another element is the interconnection between the structure of the EU economy and that of EU financial markets. Depending on the sectors in which they operate, firms may be better served by bank or market-based finance.[27] On the one hand, firms relying more on bank finance can be protected from the vagaries of investor sentiment.[28] On the other hand, a lack of market-based financing, particularly equity financing, can impede innovative firms in Europe from flourishing and becoming global champions, since banks – by contrast with venture capital or private equity firms – tend to finance less risky projects.

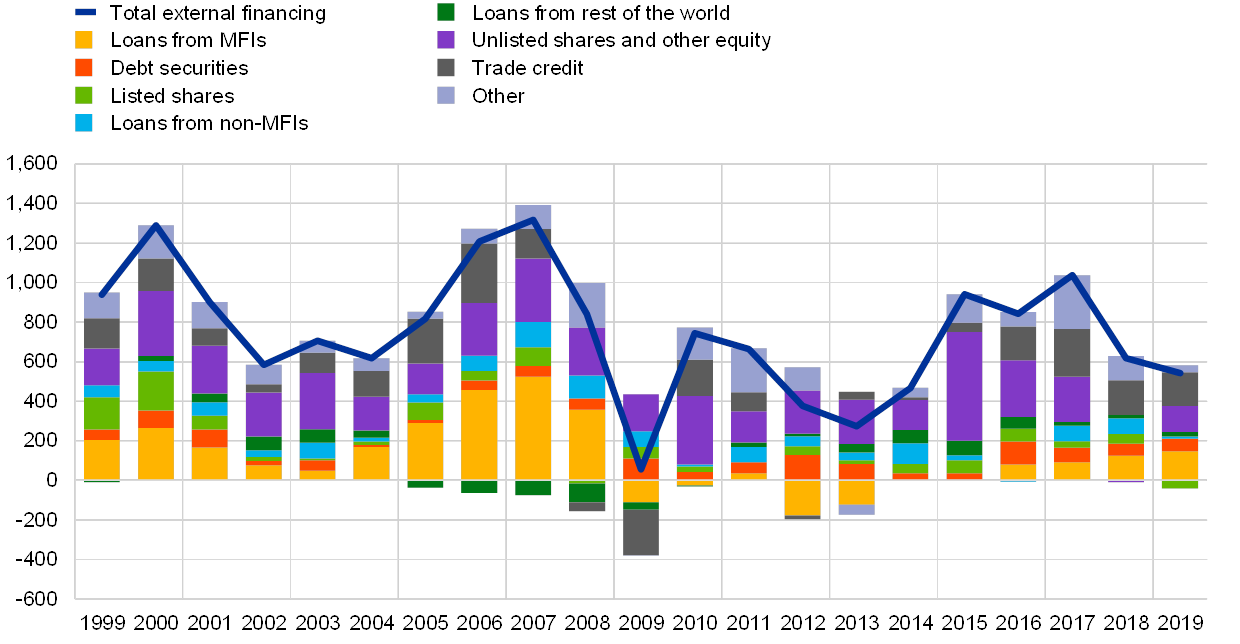

The size of firms also matters for financial structure. The large share of loans and unlisted shares in euro area NFCs’ external financing sources (see Chart 4) partly reflects the larger share of small and medium-sized enterprises (SMEs) in the euro area. Research analysing the willingness of European SMEs to pay for external financing shows that they are willing to pay a non-negligible premium for debt funding, in particular in the form of bank loans, over external equity funding.[29] As this cannot be explained completely by factors such as the debt-equity bias in taxation, the same research suggests that the bank-based system may have created a bias towards those types of firms that are better served by debt finance rather than equity finance, which may hamper innovation. While additional research would be needed to pinpoint other factors explaining the reluctance of EU firms – especially smaller ones – to become publicly listed, oft-cited drivers include the burden of the increased transparency and reporting requirements that result from public listing, a preference for relationship-based funding, or concerns about loss of control and dilution of existing shareholders. Legislative proposals recently published by the European Commission in response to the COVID-19 crisis intend to reduce some of the red tape associated with listing.[30]

Chart 4

External financing of euro area NFCs by instrument

(annual flows; EUR billions; 1999-2019)

Sources: ECB (euro area accounts) and ECB calculations.

Notes: “MFIs” stands for “monetary financial institutions”. Non-MFIs include other financial institutions as well as insurance corporations and pension funds. “Other” is the difference between the total and the instruments included in the chart, and includes inter-company loans and the rebalancing between non-financial and financial accounts data. 2019 data refer to data for the end of the third quarter of 2019.

A roadmap for CMU

The European Commission’s new CMU Action Plan should be ambitious and aim to bring out the full potential of well-developed equity markets and integrated EU capital markets in order to stimulate both the demand for, and supply of, capital market instruments and services. Priority should be given to the following mutually reinforcing areas: [31]

- Regulation and legal frameworks

- Supervision and oversight

- Fiscal policy and public debt markets

- Financial market development

- Securitisation

Regulation and legal frameworks

EU capital markets must be able to rely on common rules and regulatory policies that support a level playing field for all market participants. The single rulebook must be strengthened and applied consistently throughout the EU. Despite the objective to create a single European market for financial services, non-EU service providers still have to navigate a patchwork of regimes adopted at Member State level in order to access national markets. A single, unified approach is needed, particularly in view of the level playing field challenges that might appear after Brexit.

Standardisation and harmonisation are instrumental in developing new markets. A case in point is the green bond market where the EU is already the global leader.[32] A reliable, verifiable and transparent EU green bond standard based on the EU Taxonomy would significantly enhance the credibility of this asset class. To serve its purpose and prevent greenwashing, the EU green bond standard must strike a balance between being selective in financing investment projects and avoiding disproportionately strict rules for issuers.

Collecting, processing and disclosing data will become ever more relevant for market players. For example, it is still challenging for investors to perform due diligence in relation to the management of European equity portfolios since relevant company information is widely scattered across multiple databases and has generally not been harmonised across borders. An adequately designed European Single Access Point, developed under the lead of the European Securities and Markets Authority, would provide investors with centralised access to all relevant financial, trading and regulatory information on European companies and their securities.

In the longer term, further harmonisation of general legal frameworks would be desirable. Investors must be able to trust the predictability of the legal framework. In particular, market participants would find it easier to invest in firms located in different Member States if core elements of insolvency regimes, such as the definition of insolvency triggers, avoidance actions and the ranking of claims, were harmonised at best-practice levels.[33] If full harmonisation of these regimes seems unfeasible, the development of dedicated EU-level regimes or procedures should be considered.

Supervision and oversight

Given that risks do not stop at the EU’s internal borders, there is a strong case for implementing EU-wide supervision of capital markets. This could also ensure consistent implementation of the single rulebook to provide a level playing field for investors and market players.

In particular, capital markets can only function smoothly if they can rely on efficient and robust market infrastructures. Additional efforts to better integrate and supervise key market infrastructures are essential to ensure a level playing field for issuers and investors. This could include genuine EU-level supervision of systemically important EU central counterparties and greater supervisory convergence for central securities depositories by promoting the centralisation of supervisory powers (or at least enhanced cooperation at EU level), as well as launching efforts to ensure that reliable infrastructures are in place to deal with more sophisticated cyber threats.[34]

Fiscal policy and public debt markets

To promote the development of capital markets, national tax frameworks should avoid distorting incentives for firms and investors regarding capital structure. In particular, the existing bias in favour of debt over equity should be addressed in a decisive manner to facilitate the issuance of listed equity by firms.[35] Further simplification and cross-border convergence of withholding tax procedures would reduce the administrative burden for cross-border investors.

This could pave the way for the development of a common, adequately designed, sovereign safe asset, which could have important benefits for financial stability, integration and development in the euro area.[36] The issuance of a low-risk security at European level would enhance the financial system and would be an important component in developing a proper euro area term structure.[37] The EU joint debt issuance for the establishment of the European recovery fund could represent a first step in this direction, as the current proposal includes a plan to issue EU-level bonds with different maturity dates between 2028 and 2058. A safe asset of this nature could lead to the emergence of a genuine single securities market in the EU. In contrast to other currency areas, financial integration and risk-sharing among market participants in the euro area is impeded by the current lack of a pan-European, neutral and harmonised channel for the issuance and initial distribution of debt securities that would address the fragmentation of debt markets along national lines.

Financial market development

Efforts to improve financial literacy would support the CMU agenda and, more importantly, allow households to reap the benefits of capital markets. Citizens would then be better equipped to critically assess investment advice and broaden their long-term investment options.[38] We would welcome initiatives from the European Council and Commission to make financial literacy a priority in lifelong learning and to develop an EU competence framework. The same goes for proposals that seek to ensure the provision of adequate and fair advice and thus improve retail investors’ trust in advisers and capital markets.[39] It would be useful to identify best practices for financial education initiatives, and Member States themselves could devise further initiatives with a broad impact in the long term, such as incorporating financial education into secondary school curricula.

A further major determinant of financial market development is the structure of pension schemes. While we recognise the profound social choices involved in designing national pension systems, we also note that increasing private retirement savings rates in response to demographic changes could have a strong positive impact on European capital markets.[40] Adequate options for portfolio compositions, including various choices about the equity share and (European cross-country) diversification (as embedded in the new pan-European Personal Pension Product, for example), would offer households opportunities to improve their retirement incomes.

The European long-term investment fund was designed to address the lack of equity funding for innovative and young firms. However, this instrument has so far not worked as expected and should be amended in a targeted fashion, for example by increasing the investor pool and simplifying applicable tax rules. Firms could then attract more cross-border and retail investors.

In addition, in the light of the unavoidable increases in debt in order to finance the post-COVID-19 recovery and potential defaults, European markets for trading impaired assets should be better developed and integrated.

Securitisation

Securitisation allows banks to transfer parts of the risks associated with their lending to other investors and can therefore broaden companies’ investment bases and funding conditions. While the new European framework for simple, transparent and standardised securitisation (finalised in 2017) has dealt with the weaknesses and excesses that contributed to the financial crisis of 2008, it has not proven fully effective in reviving the much-reformed EU markets. A review should be conducted to explore how existing rules could be improved. This could include options for facilitating the securitisation of impaired assets.

Conclusion

Advancing CMU is not just about capital markets and financial institutions. It will be of benefit to all of us, entrepreneurs, employees, savers and citizens alike. The COVID-19 pandemic has re-emphasised the importance of the CMU project and the need to make rapid progress. We should be realistic that the benefit to be gained from some measures will take longer to emerge than others. For instance, while further harmonising insolvency frameworks or integrating financial literacy into school curricula could have a very significant impact, it will be many years before we see the related effects. But other measures, such as the creation of a European Single Access Point for company information or the removal of the tax advantage of debt, could be implemented over a relatively short time period and would have near-term implications. Nevertheless, these reforms should be pursued jointly and immediately in order to achieve the desirable level of ambition, as many of them create synergies.

Progressing with reforms in all these areas is particularly crucial in view of the COVID-19 pandemic. It could speed up the European recovery and increase the growth potential, which would also strengthen public finances. Most importantly, it could facilitate the structural changes that have become unavoidable as a result of the pandemic and support the transition to a low-carbon and digitalised economy. The COVID-19 crisis is thus a wake-up call to strengthen CMU and make the EU economy more robust and resilient.

- See Panetta, F. (2020), “Sharing and strengthening the euro’s privilege”, The ECB Blog, 12 June.

- See, for example, Bergbauer, S. et al. (2020), “Implications of Brexit for the EU financial landscape”, Financial Integration and Structure in the Euro Area, March, ECB.

- Several recent reports include suggestions on CMU from market participants and policymakers. See European Commission (2020), “Final report of the High Level Forum on the Capital Markets Union - A new vision for Europe’s capital markets”; The Next CMU High-Level Expert Group (2019), “Savings and Sustainable Investment Union”; Panagiotis, A. and Wright, W. (2019), “Report: Unlocking the growth potential in European capital markets”, New Financial; Lannoo, K. and Thomadakis, A. (2019), “Rebranding Capital Markets Union: A market finance action plan”, CEPS-ECMI Task Force; Bhatia, V.A. et al. (2019), “A Capital Market Union for Europe”, Staff Discussion Notes, IMF; and AFME (2018), “Capital Markets Union: Measuring progress and planning for success”.

- See ECB (2017), “ECB contribution to the European Commission’s consultation on Capital Markets Union mid-term review 2017”, May.

- For the ECB, “the market for a given set of financial instruments and/or services is fully integrated if all potential market participants with the same relevant characteristics: (1) face a single set of rules when they decide to transact in those financial instruments and/or services; (2) have equal access to the above-mentioned set of financial instruments and/or services; and (3) are treated equally when they are active in the market”. See Baele, L. et al. (2004), “Measuring financial integration in the euro area”, Occasional Paper Series, No 14, ECB, April.

- See Beck, R., Dedola, L., Giovannini, A. and Popov, A. (2016), “Financial integration and risk sharing in a monetary union”, Financial Integration in Europe, April, ECB.

- Equity contracts imply gains for stock owners in good times but losses in bad times, whereas debt contracts are characterised by fixed payments over the life of the contract. Studies showing the positive effects include: Artis, M.J. and Hoffmann, M. (2012), “The Home Bias, Capital Income Flows and Improved Long-Term Consumption Risk Sharing between Industrialized Countries”, International Finance, Vol. 13, No 3, pp. 481-505; Forbes, K.J. and Warnock, F.E. (2014), “Debt- and Equity-Led Capital Flow Episodes”, in Fuentes, M., Raddatz, C.E. and Reinhart, C.M. (eds.), Capital Mobility and Monetary Policy: An Overview, Chapter 9, Central Banking Series, Central Bank of Chile, pp. 291-322; and Milesi-Ferretti, G.M. and Tille, C. (2011), “The Great Retrenchment: International Capital Flows During the Global Financial Crisis”, Economic Policy, Vol. 26, No 66, pp. 285-342.

- See Bongini, P., Ferrando, A., Rossi, E. and Rossolini, M. (2019), “SME access to market-based finance across Eurozone countries”, Small Business Economics; and Hsu, P., Tian, X. and Xu, Y. (2014), “Financial development and innovation: Cross-country evidence”, Journal of Financial Economics, Vol. 112, No 1, pp. 116-135.

- See De Haas, R. and Popov, A. (2019), “Finance and carbon emissions,” Working Paper Series, No 2318, ECB, September; and Popov, A. (2020), “Does financial structure affect the carbon footprint of the economy?”, Financial Integration and Structure in the Euro Area, March, ECB.

- See Hartmann, P. (1998), Currency Competition and Foreign Exchange Markets: The Dollar, the Yen and the Euro, Cambridge University Press; Portes, R. and Rey, H. (1998), “The emergence of the euro as an international currency”, Economic Policy, Vol. 13, No 26, pp. 306-343; Detken, C. and Hartmann, P. (2000), “The euro and international capital markets”, International Finance, Vol. 3, No 1, pp. 53-94; Eichengreen, B., Mehl, A. and Chiţu, L. (2017), How Global Currencies Work: Past, Present and Future, Princeton University Press; and Ilzetzki, E., Reinhart, C. and Rogoff, K. (2020), “Why Is the Euro Punching Below Its Weight?”, NBER Working Paper Series, No 26760, National Bureau of Economic Research.

- For the different dimensions of how the international role of the euro affects monetary policy transmission, see Cœuré, B. (2019), “The euro’s global role in a changing world: a monetary policy perspective”, speech at the Council on Foreign Relations, New York City, February; and Gräb, J. and Mehl, A. (2019), “The benefits and costs of the international role of the euro at 20”, The international role of the euro, June 2019, ECB.

- See Panetta, F. and Schnabel, I. (2020) “The provision of euro liquidity through the ECB’s swap and repo operations”, The ECB Blog, 19 August.

- See Constâncio, V. (2017), “Synergies between banking union and capital markets union”, keynote speech at the joint conference of the European Commission and European Central Bank on European Financial Integration, Brussels, 19 May.

- Through Directive (EU) 2019/1023 of the European Parliament and of the Council of 20 June 2019 on preventive restructuring frameworks, on discharge of debt and disqualifications, and on measures to increase the efficiency of procedures concerning restructuring, insolvency and discharge of debt.

- See de Guindos, L. (2019), “Building the EU’s capital markets: what remains to be done”, speech at the Association for Financial Markets in Europe Conference, Supervision and Integration Opportunities for European Banking and Capital Markets, Frankfurt am Main, 23 May.

- See ECB (2020), Financial Integration and Structure in the Euro Area, March.

- See, for example, Giuzio, M. and Nicoletti, G. (2018), “Integrating euro area corporate bond markets: benefits and potential financial stability challenges”, Financial integration in Europe, May. Funds that are domiciled in financial centres facilitate the diversification of asset holdings across euro area countries, see Vivar, L.M., Lambert, C., Wedow, M. and Giuzio, M. (2020), “Is the home bias biased? New evidence from the investment fund sector”, Financial Integration and Structure in the Euro Area, March, ECB.

- See Giovannini, A., Horn, C.-W., Mongelli, F.P. and Popov, A. (2020), “On the measurement of risk-sharing in the euro area”, Financial Integration and Structure in the Euro Area, March, ECB.

- A case in point is our commercial paper purchase programme, explained in a recent blog post by de Guindos, L. and Schnabel, I. (2020), “The ECB’s commercial paper purchases: A targeted response to the economic disturbances caused by COVID-19”, The ECB Blog, 3 April.

- One way of defining financial development (or financial modernisation for an already highly developed financial system like that of the euro area) that is also applicable to capital markets is the process of financial innovation, as well as institutional and organisational improvements in the financial system that reduce asymmetric information, increase the completeness of markets and contracting possibilities, reduce transaction costs and ensure a high level of competition. See the preface to ECB (2020), op. cit.; and ECB (2008), “Financial development: concepts and measures”, Financial integration in Europe, April.

- The data in this paragraph are taken from ECB (2020), ibid.

- Stock market capitalisation was 56% in the EU27, 163% in the United States, 149% in Japan and 110% in the United Kingdom. The data are taken from the 2019 ECMI Statistical Package.

- See Lannoo, K. and Thomadakis, A., op. cit.

- These include cultural barriers to equity investment, unavailability of uniform firm information, biases in taxation, low levels of financial literacy, the design of pension systems and products, low public investment in fundamental research and more market-oriented research and development, and the lack of technology clusters.

- The equity share is less than 20% in the median EU country, compared with 30% in Switzerland, 44% in the United States and 51% in Australia. See, for example, Giovannini, A., Hartmann, P., Imbs, J. and Popov, A. (2018), “Financial integration, capital market development and risk sharing in the euro area”, keynote speech at the 8th International Conference of the Financial Engineering and Banking Society, 4 June.

- See, for example, Scharfstein, D. (2018), “Presidential address: Pension policy and the financial system”, Journal of Finance, Vol. 73, No 4, pp. 1463-1512.

- See, for example, Rajan, R.G. and Zingales, L. (2003), “Banks and markets: the changing character of European finance”, in Gaspar, V., Hartmann, P. and Sleijpen, O. (eds.), The Transformation of the European Financial System, Proceedings of the Second ECB Central Banking Conference, Frankfurt am Main, pp. 123-167; Rajan, R.G. and Zingales, L. (2001), “Financial Systems, Industrial Structure, and Growth”, Oxford Review of Economic Policy, Oxford University Press, Vol. 17, No 4, pp. 467-482; and Hall, P. and Soskice, D. (2001), Varieties of capitalism: the institutional foundations of comparative advantage, Oxford University Press.

- See Kremer, M. and Popov, A. (2018), “Financial development, financial structure and growth: evidence from Europe”, Financial integration in the euro area, May, ECB.

- See, for example, ECB (2020), op. cit.; and Brutscher, P.B. and Hols, C. (2018), “The corporate equity puzzle”, EIB Working Papers, 2018/03.

- European Commission (2020), “Coronavirus response: Making capital markets work for Europe’s recovery”, 24 July.

- Some of these proposals were included in the High Level Forum’s report on CMU and in other reports mentioned above (see footnote 3 for more details).

- In 2019 more than half of global issuance was concentrated in the EU and almost half of global green bond issuance was denominated in euro. For more details, see ECB (2020), “The international role of the euro”, June.

- Research finds that improving insolvency frameworks in euro area countries towards best practice enhances private financial risk-sharing through capital markets. See, for example, Giovannini, A., Hartmann, P., Imbs, J. and Popov, A. (2018), op. cit.

- The ECB has played a key role in fostering public-private cooperation, for example by launching a new cyber-threat intelligence sharing platform for market infrastructures under the Euro Cyber Resilience Board. See Panetta, F. (2020), “Protecting the European financial sector: the Cyber Information and Intelligence Sharing Initiative”, introductory remarks at the fourth meeting of the Euro Cyber Resilience Board for pan-European Financial Infrastructures, February.

- As part of the 2015 Action Plan on Building a Capital Markets Union, the European Commission proposed relaunching work on the common consolidated corporate tax base, including a legislative proposal, which has still not been agreed on by the European Council. Research shows that allowing firms to deduct a notional interest rate on equity against their profits (on top of the existing deductibility of interest expenses) is likely to be beneficial for financial stability as, in the case of Belgium and Italy, it effectively reduced firms’ leverage. See, for example, Hebous, S. and Ruf, M. (2017), “Evaluating the effect of ACE systems on multinational debt financing and investments”, Journal of Public Economics, Vol. 156, pp. 131-149; and Schepens, G. (2016), “Taxes and bank capital structure”, Journal of Financial Economics, Vol. 120, Issue 3, pp. 585-600.

- For a discussion of the features of a safe asset of this nature, see Alogoskoufis, S., Giuzio, M., Kostka, T., Levels, A., Molestina Vivar, L. and Wedow, M. (2020), “How could a common safe asset contribute to financial stability and financial integration in the banking union?”, Financial Integration and Structure in the Euro Area, ECB, March.

- See also Panetta, F. (2020), “Sharing and strengthening the euro’s privilege”, The ECB Blog, 12 June.

- Research finds that levels of financial education vary widely across the euro area, and that financial literacy enhances capital market participation and fosters private financial risk-sharing via capital markets. See, for example, Giovannini, A., Hartmann, P., Imbs, J. and Popov, A. (2018), op. cit.

- See the High Level Forum’s report on CMU (European Commission (2020), op. cit.) for specific proposals regarding inducements for financial advisers and how to enhance the quality of financial advice.

- For example, an estimation of the impact for the euro area if all member countries increased the share of equity investments in their pension savings to a “regular” level for diversified long-term portfolios (about 39%) shows that the additional equity demand would amount to about 3.7% of total equity market capitalisation. See, for example, Giovannini, A., Hartmann, P., Imbs, J and Popov, A. (2018), op. cit.