- CONSUMER EXPECTATIONS SURVEY – LATEST RESULTS

Inflation perceptions and expectations

Frankfurt am Main, 12 January 2023

Overview

This report contains the main aggregate indicators from the Consumer Expectations Survey (CES) related to inflation. Results are reported monthly at the euro area level, by country, by age group and by income quintile. The topics covered include:

- Inflation perceptions over the previous 12 months

- Inflation expectations over the next 12 months

- Inflation expectations three years ahead

The table below provides an overview of the latest results for the main indicators included in this report. For more detailed information on how the aggregate indicators are computed, please refer to the Guide to the computation of aggregate statistics and the CES Methodological information on the survey, available on the data and methodological information section of the CES webpage. The data behind the aggregate series included in this report can also be found under the same section.

Table 1

Overview of latest results – Inflation perceptions and expectations

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses. Mean values are winsorised at the 2nd and 98th percentiles of each survey round and country.

Inflation perceptions over the previous 12 months

In the qualitative question, respondents are asked: “First, we would like to ask you about changes in the general level of prices for goods and services in the country you currently live in. Compared with 12 months ago, what do you think has happened to prices in general?” The possible responses are “Prices went up a lot”, “Prices went down a lot”, “Prices went up a little”, “Prices went down a little” and “Prices stayed exactly the same (that is 0% change)”.

In the open-ended (quantitative) question, respondents are asked: “How much higher/lower do you think prices in general are now compared with 12 months ago in the country you currently live in?”

Chart 1

Inflation perceptions over the previous 12 months – qualitative

Qualitative measure of inflation perceptions (backward-looking)

(percentages of respondents)

Source: CES.

Notes: Weighted estimates. Net percentages are obtained by subtracting the percentage of respondents indicating that prices have decreased from the percentage of respondents indicating that prices have increased.

Chart 2

Inflation perceptions over the previous 12 months – pooled

Quantitative measure of inflation perceptions (backward-looking)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses. Mean values are winsorised at the 2nd and 98th percentiles of each survey round and country.

Chart 3

Median inflation perceptions over the previous 12 months – by country

Quantitative measure of inflation perceptions (backward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 4

Median inflation perceptions over the previous 12 months – by age group

Quantitative measure of inflation perceptions (backward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 5

Median inflation perceptions over the previous 12 months – by income quintile

Quantitative measure of inflation perceptions (backward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Inflation expectations over the next 12 months

In the qualitative question, respondents are asked: “Looking ahead to 12 months from now, what do you think will happen to prices in general?” The possible responses are “Prices will increase a lot”, “Prices will decrease a lot”, “Prices will increase a little”, “Prices will decrease a little” and “Prices will be exactly the same (that is 0% change)”.

In the open-ended (quantitative) question, respondents are asked: “How much higher/lower do you think prices in general will be 12 months from now in the country you currently live in?”

An additional important feature of the CES is that it utilises a probabilistic-type question to elicit expectations and individual uncertainty about inflation over the next 12 months. The question asks respondents to assign probabilities to future inflation outcomes by allocating 100 points across up to ten intervals of changes in prices (bins) to indicate the likelihood that future inflation will lie in each of them.[1]

Chart 6

Inflation expectations over the next 12 months – qualitative

Qualitative measure of inflation expectations (forward-looking)

(percentages of respondents)

Source: CES.

Notes: Weighted estimates. Net percentages are obtained by subtracting the percentage of respondents indicating that prices will decrease from the percentage of respondents indicating that prices will increase.

Chart 7

Inflation expectations over the next 12 months – pooled

Quantitative measures of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses. Mean values are winsorised at the 2nd and 98th percentiles of each survey round and country.

Chart 8

Median inflation expectations over the next 12 months – by country

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 9

Median inflation expectations over the next 12 months – by age group

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 10

Median inflation expectations over the next 12 months – by income quintile

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 11

Median and dispersion of implied inflation expectations 12 months ahead

Probabilistic measures of inflation expectations (forward-looking)

(implied percentage changes)

Source: CES.

Notes: Weighted estimates. The numbers are based on respondent-specific probability distributions derived from the probabilistic bin question on inflation expectations. Note that the total number of bins increased from eight to ten as of July 2022 (survey wave 31). Median inflation expectations are computed as the sample median of the implied mean from the respondent-specific subjective distribution. The dispersion indicates the sample disagreement about inflation expectations. It is computed as the interquartile range between the 75th and 25th percentile of the implied mean inflation expectations.

Chart 12

Median implied uncertainty around 12-month-ahead inflation

Probabilistic measure of inflation uncertainty (forward-looking)

(implied interquartile range)

Source: CES.

Notes: Weighted estimates. The numbers are based on respondent-specific probability distributions derived from the probabilistic bin question on inflation expectations. Note that the total number of bins increased from eight to ten as of July 2022 (survey wave 31). Implied inflation uncertainty is computed as the interquartile range from the respondent-specific subjective distribution.

Inflation expectations three years ahead

In the qualitative question, respondents are asked: “Please think further ahead to two years from now. What do you think will happen to prices in general in the country you currently live in over the 12-month period between two years from now and three years from now?” The possible responses are “Prices will increase a lot”, “Prices will decrease a lot”, “Prices will increase a little”, “Prices will decrease a little” and “Prices will be exactly the same (that is 0% change)”.

In the open-ended (quantitative) question, respondents are asked: “By about what percentage do you expect prices in general in the country you currently live in to increase/decrease over the 12-month period between two years from now and three years from now?”

Chart 13

Inflation expectations three years ahead – qualitative

Qualitative measure of inflation expectations (forward-looking)

(percentages of respondents)

Source: CES.

Notes: Weighted estimates. Net percentages are obtained by subtracting the percentage of respondents indicating that prices will decrease from the percentage of respondents indicating that prices will increase.

Chart 14

Inflation expectations three years ahead – pooled

Quantitative measures of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses. Mean values are winsorised at the 2nd and 98th percentiles of each survey round and country.

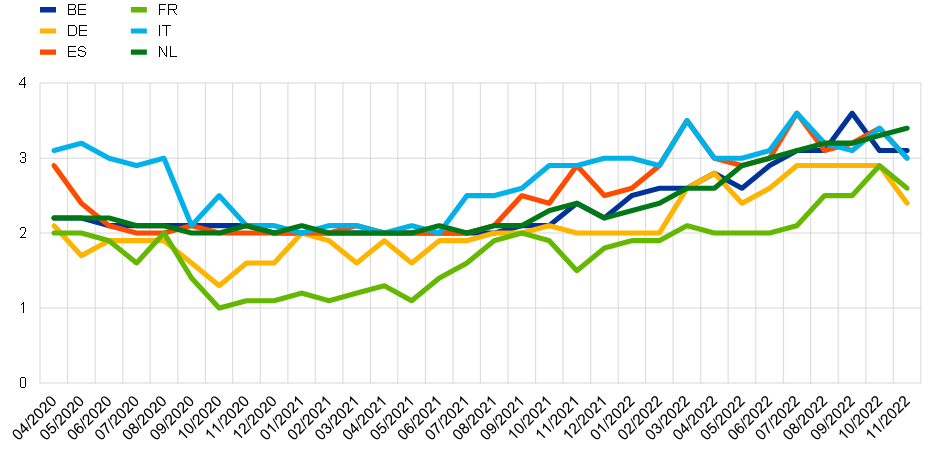

Chart 15

Median inflation expectations three years ahead – by country

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

Chart 16

Median inflation expectations three years ahead – by age group

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

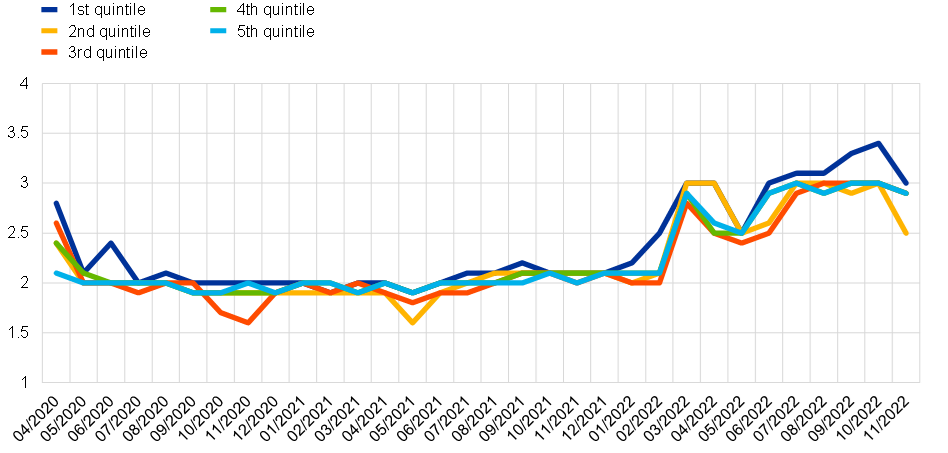

Chart 17

Median inflation expectations three years ahead – by income quintile

Quantitative measure of inflation expectations (forward-looking)

(percentage changes)

Source: CES.

Notes: Weighted estimates. The median is computed on the basis of a symmetric linear interpolation that accounts for rounding of responses.

From July 2022 two additional intervals (“Decrease by 12% or more” and “Increase by 12% or more”) were included at the lower and upper outermost ends of the set of intervals respectively, bringing the total number of bins up from eight to ten.