Trends in residential real estate lending standards and implications for financial stability

Published as part of Financial Stability Review, May 2020.

It is often maintained that the recent real estate booms in many euro area countries have been accompanied by a loosening in lending standards. However, data for a thorough cross-country assessment of lending standards have been missing. This special feature uses a novel euro area dataset from a dedicated data collection covering significant institutions supervised by ECB Banking Supervision to analyse trends in real estate lending standards and derive implications for financial stability. First, lending standards for residential real estate loans in the euro area, in particular loan-to-income ratios, eased between 2016 and 2018. Given the significant deterioration in the euro area economic outlook since the coronavirus outbreak, this vulnerability seems of particular relevance. Second, lending standards appear to be looser in countries that saw stronger real estate expansions, suggesting that real estate vulnerabilities may have been growing in some euro area countries. Third, lending standards deteriorated less in countries with borrower-based macroprudential policies in place, highlighting the importance of early macroprudential policy action to help prevent the build-up of real estate vulnerabilities.

1 Introduction

The 2008-09 global financial crisis demonstrated that real estate booms can unwind abruptly and lead to financial crises with large economic costs. Based on data for 17 countries over the past 140 years, Jordá et al. (2015) show that credit-fuelled house price bubbles are a particularly dangerous phenomenon: they increase the likelihood of financial crises and are associated with deeper recessions and slower recoveries when they collapse.[1]

Credit-fuelled real estate booms often go hand in hand with a loosening of lending standards. For example, Kelly et al. (2019) document significantly higher loan-to-value (LTV) and loan-to-income (LTI) ratios and increasing loan maturities in euro area countries that experienced property price boom/bust cycles during the 2000s.[2] Moreover, as shown in Gaudêncio et al. (2019) for euro area countries, higher LTV ratios, higher LTI ratios and longer loan maturities increase the probability of default of borrowers.[3] Hence, lending standards are central to monitoring financial stability risks related to real estate booms.

While real estate cycles differ across euro area countries, a number of them have experienced real estate booms during the past years. In 2019, the European Systemic Risk Board (ESRB) carried out an assessment of residential real estate (RRE) risks and issued five warnings and six recommendations to selected countries.[4] While a loosening of lending standards is often highlighted as one of the key vulnerabilities during the recent expansion phase of the RRE cycle, detailed cross-country evidence on loosening lending standards has been missing due to a lack of data.

This special feature analyses trends in RRE lending standards and implications for financial stability in euro area countries based on a unique ECB dataset. The data were collected in 2019 by ECB Banking Supervision from significant institutions under its direct supervision, and contain information on lending standards for new loans for the years 2016-18.

The key finding of the analysis is that RRE lending standards of significant institutions have loosened in recent years, in particular in countries that have experienced real estate booms. First, lending standards for RRE loans, and in particular LTI ratios, eased in the euro area between 2016 and 2018. Given the recent deterioration in the euro area economic outlook, this vulnerability seems of particular relevance. Second, lending standards are looser in countries that have seen pronounced real estate booms, as represented by robust real estate price and mortgage loan growth. Third, lending standards have deteriorated less in countries with borrower-based macroprudential policies in place. The findings suggest that real estate vulnerabilities may have been growing in some euro area countries in recent years and that early macroprudential policy action can help contain the build-up of such vulnerabilities.

The remainder of this special feature is structured as follows. Section 2 provides an overview of the dataset and recent trends in RRE lending standards. Section 3 links these trends to overall macro-financial developments. Section 4 explores the impact of borrower-based macroprudential policies on lending standards. Section 5 concludes.

2 Recent trends in residential real estate lending standards

The analysis is based on data collected by ECB Banking Supervision about lending standards for new loans granted by large euro area banks between 2016 and 2018. The dataset comprises 145 country-specific mortgage loan portfolios representing roughly 75% of the entire RRE loan market in the euro area.[5] While data coverage varies across countries, in most cases the dataset represents between 60% and 100% of the domestic RRE loan market. The dataset provides a comprehensive overview of loan characteristics (e.g. maturity), key risk indicators (e.g. LTV, LTI and loan service-to-income (LSTI) ratios), risk parameters (e.g. expected loss) and loan pricing spreads for new loans.[6] New loan volumes include drawn and undrawn amounts, as well as renegotiations with active customer involvement, and exclude non-performing or forborne exposures.

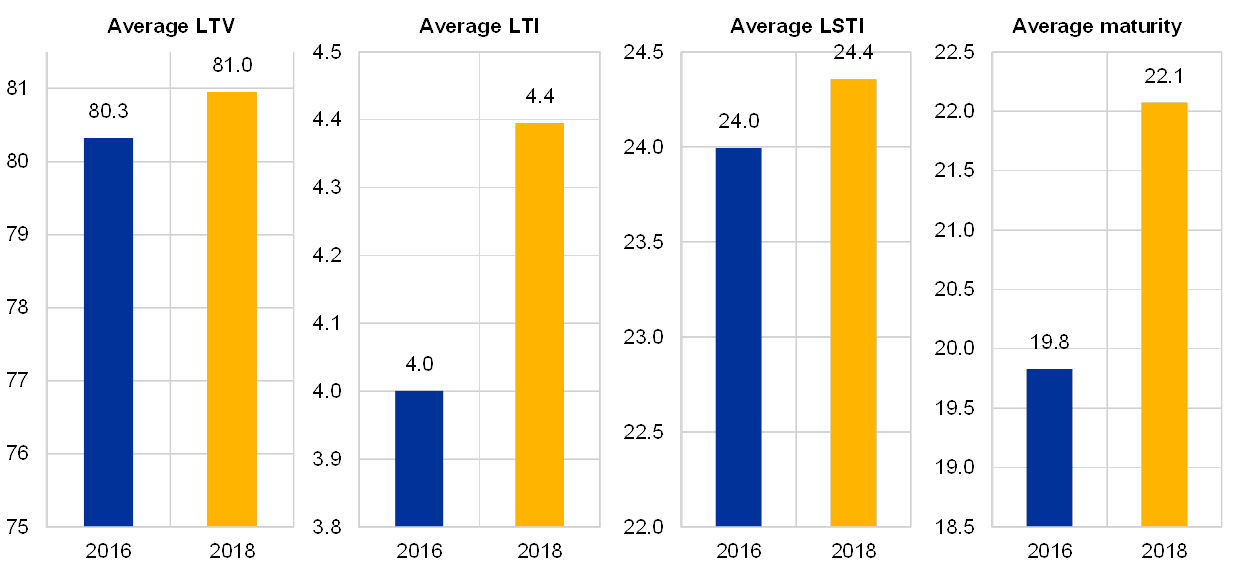

The novel dataset reveals that lending standards for RRE loans of significant institutions eased on aggregate in the euro area between 2016 and 2018. The average LTV, LTI and LSTI ratios all increased between 2016 and 2018 (see Chart A.1), indicating an easing of lending standards. While the average LTV and LSTI ratios increased slightly from 80.3% to 81.0% and 24.0% to 24.4% respectively, the average LTI ratio rose considerably from 4.0 to 4.4. These numbers imply that in 2018 euro area households taking out loans to buy a house or an apartment borrowed on average 81% of the purchase price, which represented 4.4 times their annual disposable income, and they spent 24.4% of their income to service the loan.

Average LTV, LTI and LSTI ratios in the euro area all increased between 2016 and 2018

(ratios as a percentage or multiple, years)

Source: SSM credit underwriting data collection exercise in 2019.Note: Aggregates based on bank micro data weighted by the respective shares in the total euro area new business volume of RRE loans.

The substantial increase in the average LTI ratio was accompanied by a lengthening of maturities and a reduction in interest rates. The average loan maturity increased from 19.8 to 22.1 years between 2016 and 2018 (see Chart A.1). Over the same period, the average mortgage loan interest rate in the dataset decreased from 2% to 1.8%. Hence, the considerable easing in the average LTI ratio only translated into a slight easing in the average LSTI ratio.[7] But longer maturities also come with risks: (i) they reduce annual loan repayments and can thus increase the loss given default (LGD); and (ii) they can lead to higher interest rate risk for borrowers if coupled with short interest rate fixation periods.

Lending standards differ widely across euro area countries, with tighter standards in countries more affected by the euro area sovereign debt crisis. For example, the average LTV ratio and average LTI ratio over the period 2016-2018 varied between 53% and 87% and 3.1 and 6.7 respectively across euro area countries (see Chart A.2, left panel). One can distinguish three broad country groups: (i) countries with high average LTV and LTI ratios (AT, BE, DE, LU, SI, SK); (ii) countries with a high average LTV ratio, but a low average LTI ratio (EE, FR, IE, LT, NL, PT); and (iii) countries with low average LTV and LTI ratios (CY, ES, GR, IT).[8] Interestingly, the lowest average LTV and LTI ratios are observed in those countries that had higher non-performing loan (NPL) ratios in recent years.

The average LTI ratio has risen in the vast majority of euro area countries, while the average LTV ratio has risen in more than half of the countries. Increases in the average LTI ratio between 2016 and 2018 were mostly in the range of 0.1 to 0.9 (see Chart A.2, right panel). This means that households borrowed on average an additional 10% to 90% of their annual income when buying a house or an apartment. In total, nine euro area countries saw both the average LTV and the average LTI ratio increase between 2016 and 2018 (AT, BE, DE, ES, FR, IE, IT, PT, SK), with increases in the average LTV ratio in a range from 0.5 percentage points (p.p.) to 4 p.p. However, average lending standards can mask important pockets of risk. From a financial stability perspective, a focus on lending with elevated LTV or LTI ratios is therefore of particular importance, as these are usually more risky, other things being equal.[9]

Lending standards and their dynamics differ widely across euro area countries

Source: SSM credit underwriting data collection exercise in 2019.

The share of new lending with an LTV ratio above 80% or an LTI ratio greater than 5 has been increasing for the euro area as a whole and it is substantial in a number of countries. For more than half of all RRE lending in 2018, households borrowed more than 80% of the purchase price of the house or apartment (see Chart A.3, left panel). In addition, for more than one-third of all RRE lending in 2018, households borrowed more than five times their annual disposable income (see Chart A.3, right panel).

The share of loans with elevated LTV or LTI ratios has been increasing in the euro area

Source: SSM credit underwriting data collection exercise in 2019.

The loosening of euro area RRE lending standards was accompanied by decreases in bank lending spreads over the same period. The average spread relative to funding costs (i.e. the financing cost to obtain the liquidity used to originate the loan, including the reference rate) for real estate loans in the euro area decreased by 20 basis points (bps) between 2016 and 2018, from 76 to 56 bps (see Chart A.4, left panel). A decrease in average spreads relative to funding costs is visible across all classes of borrower riskiness, as represented by banks’ own estimates of expected loss (see Chart A.4, right panel). Risk-adjusted compensation (i.e. the difference between the spread and expected loss) is lower for high-risk mortgage loans. Simulations based on aggregate banking sector data suggest that bank interest margins on the stock of residential mortgages could further decline in the coming years (see Box A).

As lending standards have loosened, bank lending spreads have also decreased

Source: SSM credit underwriting data collection exercise in 2019.

3 Links between lending standards and macro-financial developments

Developments in macro-financial indicators such as RRE price growth, price overvaluation or loan growth are important for assessing systemic risks from RRE lending standards. For example, even moderate LTV ratios might be problematic if house prices are overvalued. Similarly, moderate LSTI ratios might pose risks in the future, if interest rate fixation periods are short and interest rates increase suddenly. Finally, house price booms are more prone to end in busts when associated with deteriorating lending standards that feed a credit and house price spiral. This section uses country-level scatter plots and bank-level panel regressions to assess developments in lending standards against developments in these macro-financial variables.

Lending standards tended to be looser in countries which experienced stronger house price and mortgage loan growth and lower banking sector profitability. New loans originated in countries with higher mortgage loan growth and, to some extent, also higher RRE price growth had on average higher LTV and LTI ratios over the 2016-18 period (see Chart A.5). In addition, in countries where prices appeared to be more overvalued households tended to take out larger loans in relation to their income (AT, DE, LU). Results from the panel regressions corroborate these findings and further reveal that banking sectors with lower bank profitability tended to originate loans with looser lending standards (see Table A.1). Moreover, the regressions confirm the finding from the previous section that LTV ratios tended to be more conservative in countries that were more affected by the sovereign debt crisis (i.e. with higher NPL ratios).

Countries with higher mortgage loan growth, and higher RRE price growth or price overvaluation, had on average higher LTV and LTI ratios over the 2016-18 period

Source: SSM credit underwriting data collection exercise in 2019.Notes: The colouring of countries is based on the 2019 risk assessment by the ESRB. Dark red = pronounced risk; orange = medium risk; yellow = low risk; blue = no exposures to RRE risks. For details, see “Vulnerabilities in the residential real estate sectors of the EEA countries”, ESRB, September 2019. The overvaluation estimates are based on the simple average of the deviation of the price-to-income ratio from the long-term mean and the output of an econometric model.

Income-based lending standards deteriorated more in countries with faster mortgage loan growth, while the average LTV ratio increased more in countries with lower interest rates. For example, countries with more dynamic mortgage loan growth saw larger increases in the average LTI and LSTI ratios (see Chart A.6, left panel). This is also supported by the regression results (see Table A.1, last two columns). In addition, it appears that in countries where mortgage interest rates were lower, the average LTV ratio tended to increase more over the 2016-18 period (see Chart A.6, right panel). Worryingly, especially the average LTI ratio seems to have deteriorated more in countries with more pronounced indications of price overvaluation.

Lending standards deteriorated more in countries where mortgage loan growth was more dynamic and where house prices seem to be overvalued

Source: SSM credit underwriting data collection exercise in 2019.Notes: Changes are computed using a balanced sample of banks. Dark red = pronounced risk; orange = medium risk; yellow = low risk; blue = no exposures to RRE risks. For details, see “Vulnerabilities in the residential real estate sectors of the EEA countries”, ESRB, September 2019. The overvaluation estimates are based on the simple average of the deviation of the price-to-income ratio from the long-term mean and the output of an econometric model.

Overall, lending standards are looser in countries where macro-financial indicators also signal RRE vulnerabilities, highlighting the importance of mitigating macroprudential policies. Data on lending standards complement aggregate indicators of RRE vulnerabilities such as overvaluation estimates, price and lending growth dynamics and household indebtedness and thus fill an important gap in the assessment of euro area countries’ exposure to RRE risks.[10] Overall, the evidence of loose or loosening lending standards suggest that real estate vulnerabilities have been building up in some euro area countries in recent years.[11] A pre-emptive macroprudential communication stressing the importance of lending standards in RRE lending or, when deemed necessary, an early activation of borrower-based macroprudential instruments such as LTV or LSTI/LTI/DSTI/DTI limits could have contributed to limiting the build-up of such vulnerabilities, as also suggested by the recent ESRB warnings and recommendations.

Estimated relationships between lending standards, macro-financial indicators and macroprudential policy action for euro area banks between 2016 and 2018

Sources: ECB calculations based on the SSM credit underwriting data collection exercise in 2019.Notes: The coefficients reported in the table are obtained from a bank-level panel regression of the respective lending standards variable on a number of bank-specific and country-specific factors and year fixed effects. Macroprudential policy dummy equals one for countries which implemented LTV, LTI/DTI or debt service-to-income (DSTI) limits before 2018. The asterisks indicate statistical significance based on robust standard errors: *** p<0.01, ** p<0.05, * p<0.1.

4 Gauging the impact of borrower-based macroprudential policies

In recent years, many euro area countries have activated borrower-based macroprudential instruments such as LTV, DSTI and maturity limits to increase the resilience of households and banks and to counter the build-up of risks. By end-2018, when the lending standards dataset ends, 11 countries had activated such measures.[12] The design and calibration of these instruments vary greatly across countries. In general, LTV limits are set between 70% and 100%, DSTI limits between 10% and 80%, and maturity limits between 30 and 40 years (see Table A.2).[13] In some countries, banks are allowed to grant a limited fraction of new lending above the macroprudential limits (e.g. IE, SK), while in others different limits apply to different categories of borrowers (e.g. FI, IE) or loan types (e.g. CY, EE, LV). It is important to note that the ECB does not have powers to activate borrower-based macroprudential instruments. The legal frameworks for borrower-based instruments are based on national legislation and are not harmonised across the EU.[14] While a comprehensive legal framework for borrower-based instruments exists in most euro area countries, in some it is not yet in place or not all instruments are available (see Table A.2).

Overview of borrower-based instruments applied to RRE loans in place in euro area countries in 2018

Sources: ESRB and national notifications.Notes: FTB: first-time buyer; SSB: second and subsequent buyer; BTL: buy to let. The + sign indicates the exemption/speed limit (the percentage of new loans that can be granted above the limit of the lending standard). “Mat.” denotes maturity limit. The borrower-based measures in AT, PT and SI (only the LTV limit in the case of the latter) are in the form of non-legally binding recommendations. National specific measures are not always comparable given different definitions of loans, value/collateral and/or income.(1) Only instruments that can be introduced through a legally binding act.(2) In AT and PT, borrower-based measures were enacted in 2018.(3) The primary legal framework for borrower-based instruments in Spain was passed in November 2018. The preparation of secondary legislation for the operationalisation of BBM instruments by the Banco de España is currently under way.(4) The limit in FI is on the loan-to-collateral (LTC) ratio, rather than the LTV ratio.(5) While a legal framework specifically for borrower-based measures does not exist, Article 53(1)(b) of the Italian Banking Law stipulates that the Banca d’Italia “[…] shall issue general regulations concerning: […] b) the limitation of risk in its various forms”.(6) Depending on borrowers’ income.(7) The share of loans allowed with a DSTI ratio of up to 60% was tightened to 10% in February 2020. The calculation of the DSTI numerator considers both the impact of an interest rate rise and, in the case of a borrower aged 70 and over at the planned expiry of the agreement, a reduction in income of at least 20% of current annual income.(8) To protect and also support a proportionate market access for low-income borrowers, disposable income is defined as net income less a minimum subsistence amount (only for the DSTI ratio).

The evidence suggests that borrower-based measures are effective in limiting a build-up of systemic risks from the deterioration of RRE lending standards, thereby reducing vulnerabilities. The cross-country distributions of changes in the average LTV and LSTI ratios lie to some extent in negative territory for countries where borrower-based tools such as LTV and DSTI limits were in place (see Chart A.7). This implies that some countries with such measures in place registered improvements in lending standards between 2016 and 2018. By contrast, the cross-country distributions of changes in average LTV and LSTI ratios are tilted towards the positive side for countries where no borrower-based tools were in place. This implies that many countries without LTV or DSTI limits experienced deteriorating average LTV and LSTI ratios over the review period. These findings are corroborated by the econometric evidence: banks in countries with borrower-based instruments in place had more conservative average LTV and LTI ratios (-1.14 p.p. and -0.45 p.p. respectively), and they saw less of a deterioration in the average LTV, LTI and LSTI ratios (-1.7 p.p., -0.16 p.p. and -1.8 p.p. respectively) between 2016 and 2018 compared with banks in countries where such instruments were not yet activated (see Table A.1).

Borrower-based measures help to contain the loosening of lending standards and thereby contribute to limiting a build-up of vulnerabilities

Source: SSM credit underwriting data collection exercise in 2019.Notes: The yellow bar denotes the difference between the median and the 75th percentile, while the blue bar denotes the difference between the 25th percentile and the median. The lines indicate the min.-max. range.

Countries that imposed borrower-based measures (either in form of legally binding limits or recommendations) often saw reductions in the share of the riskiest loan segments in terms of lending standards. For example, in countries with LTV limits in place, the share of loans with an LTV ratio greater than 80% declined by between 0.5 p.p. and 5 p.p. between 2016 and 2018 (IE, NL, PT, SI, SK) (see Chart A.8). In many countries without such measures in place, the share of loans with an LTV ratio above 80% increased during the same period (AT[15], BE, DE, FR, IT). In addition, in some countries with DSTI policies in place (NL, PT, SK), the share of loans with an LSTI ratio greater than 45% declined between 2016 and 2018, while it increased in some of the countries that did not have DSTI limits in place (AT, BE, DE, GR). Moreover, the largest increases in the share of loans with an LTI ratio above 5 were also seen in countries without DSTI limits in place (AT, BE, DE, FR).

Countries where borrower-based measures are in place often saw reductions in the share of the riskiest loan segments in terms of lending standards

Source: SSM credit underwriting data collection exercise in 2019.Notes: In AT and PT, borrower-based measures were enacted at the end of 2018. BBMs: borrower-based measures.

Conclusion

This special feature has shown that loosening lending standards may have contributed to an increase in RRE vulnerabilities in some euro area countries and that macroprudential policy can mitigate such vulnerabilities. In particular, the broad-based rise in average LTI ratios has increased the vulnerability of many households to negative income shocks. Given the significant deterioration in the euro area economic outlook since the coronavirus outbreak, this RRE vulnerability seems of particular relevance. While pre-emptive macroprudential policy action has contributed to containing vulnerabilities arising from loosening lending standards in some countries, more timely policy action would have been desirable in some euro area countries, as also reflected in the 2019 ESRB warnings and recommendations. A key lesson for macroprudential policy is that the use of borrower-based measures early on in the upswing of the RRE cycle can help contain the build-up of vulnerabilities that could otherwise arise from long periods of loose lending standards.

Box A Quantifying the drift in banks’ net interest margins on residential mortgages

Net interest income is the dominant income source for euro area banks. Declines in interest rates result in higher intermediation volumes, supporting income. At the same time, they squeeze margins, in particular when part of banks’ funding costs are bound by zero and no longer decline in synch with market rates, while the yield on bank assets still does.

The focus here is on banks’ long-term residential mortgage portfolios. Residential mortgages make up around 35% of banks’ loan books, so an important determinant of margin squeeze will be the extent and pace at which effective mortgage rates adjust. At initiation the typical maturity of a mortgage is long, often 25 to 30 years, and a significant share is granted at fixed rates, with fixation periods well in excess of five years. Thus, declines in market rates affect banks’ residential mortgage yield with a delay, resulting in a persistent downward drift. But compositional shifts shape the dynamics too. Strong declines in long-term interest rates also tend to be associated with a preference for fixed rate mortgages as households seek to lock in low interest rates. In parallel, banks may offer more fixed rate loans to boost unit margins as on these a term premium can be charged.

Chart A

Yields on euro area banks’ mortgage books are expected to decline over the next four years if interest rates on new mortgages remain around January 2020 levels, despite compositional shifts in mortgage portfolios

Sources: ECB and ECB calculations.Notes: Out-of-sample simulation of interest rates on the stock of banks’ mortgage books assuming that new business rates will remain unchanged at their level in January 2020 over the period 2020-23. Mortgages are assumed to amortise linearly over time. The average maturity at origination is calibrated based on ECB Occasional Paper No 101. In each year, new mortgage origination equals the sum of reported net flows plus calibrated repayments of old loans. Two portfolios per country are tracked: a floating rate portfolio of mortgages with a rate fixation period of less than one year and a fixed rate portfolio of loans with a rate fixation period of more than one year. For the fixed rate portfolio, mortgages are assumed to be granted at a fixed rate equal to the weighted average new business rate for loans with a rate fixation period of more than one year. The rate fixation period is set at ten years, after which the residual balance is assumed to reprice in line with mortgage rates prevailing at that moment. The interest rate on the floating rate portfolio is assumed to be indexed to a reference rate (three-month or 12-month EURIBOR) with a fixed spread determined at the time of loan origination. The chart presents the weighted average interest rate across these two portfolios.

This box quantifies the expected downward drift in banks’ net interest margins on residential mortgages using a simulation method. Banks’ mortgage book structure is backed out by vintage using information on net flows and calibrated repayments.[16] The share of fixed rate loans and the applicable interest rate for each mortgage vintage are tracked too. This allows the projection of how interest rates on the stock of long-term residential mortgages would evolve if maturing loans, which carry high interest rates, were to be replaced with new loans at lower mortgage rates. Also at the end of the rate fixation periods, old loans are assumed to reprice at current, lower interest rates. Both effects result in a mechanic downward pressure on banks’ mortgage yields. As regards funding costs, deposit rates are assumed to remain largely unchanged, while banks’ bond market financing costs are projected.

The average interest rate on euro area banks’ mortgage books is estimated to decline by 40 basis points over the next four years if new business rates remain at January 2020 levels. Banks in the large euro area countries which currently have a larger share of floating rate loans are likely to see a smaller downward drift (see Chart A, left panel), as they are able to partly counteract the downward pressure on mortgage yields by shifting towards fixed rate loans (see Chart A, right panel). Such fixed rate loans pay on average higher interest rates. By contrast, banks in the large euro area countries with an already high share of fixed rate mortgages are projected to see a substantial decline in the interest rates they earn on their long-term residential mortgage books.

Chart B

Lower costs of bond financing provide no noteworthy offset, resulting in a compression of net interest margins on euro area banks’ long-term residential mortgage books

Sources: ECB, Dealogic, IHS Markit and ECB calculations.Notes: Left panel: out-of-sample simulation of banks’ average bond market funding costs assuming that maturing bank bond funding will be rolled over into new issuances at costs observed in early April 2020. The cost of new issuance is based on secondary market yields due to very limited issuance activity outside the covered segment. Right panel: the change in the blended cost of funding assumes that banks’ bond market financing costs adjust, while the remaining components of bank funding have either already fully repriced (e.g. money market funding) or do not adjust (e.g. deposits).

The coronavirus outbreak may have material implications which are not reflected in the above quantification. The elevated uncertainty and sharp decline in macroeconomic activity will likely have profound effects on euro area households’ demand for, banks’ supply of and ultimately the pricing and origination volume of residential mortgages. The simulation method mechanically extrapolates recent trends, which largely occurred before the worldwide spread of the disease. Also, some banks have announced “payment holidays” on mortgage debt for households, with potentially large effects on the profitability of banks’ residential mortgage books. The pandemic has also led to a material increase in banks’ bond market funding costs, which is taken into account when projecting funding costs.

Bank funding costs are expected to decline marginally, providing little offset. The average bond funding costs of euro area banks are projected to decline over the next years despite the recent spike in issuance costs as the current cost of bond issuance is still below the weighted average cost of the stock of bank bonds. The rollover of maturing funding at the rates observed in early April 2020 should lower average bond funding costs by around 25 basis points for the euro area by end-2023 (see Chart B, left panel).[17] Since bonds constitute only 12% of banks’ total liabilities, the decline in banks’ average funding costs is small (see Chart B, right panel), assuming that deposit rates will remain largely unchanged.[18] The combination of a significant downward drift in interest rates on the stock of loans and a marginal decline in overall funding costs results in a compression of overall net interest margins on the mortgage book of around 35 basis points (see Chart B, right panel). This effect will put further pressure on the already low bank profitability in a challenging environment.

- [1]Jordà, O., Schularick, M. and Taylor, A. M., “Leveraged Bubbles”, Journal of Monetary Economics, Vol. 76(S), 2015, pp. 1-20.

- [2]Kelly, J., Le Blanc, J. and Lydon, R., “Pockets of risk in European housing markets: then and now”, Working Paper Series, No 2277, ECB, May 2019.

- [3]Gaudêncio, J., Mazany, A. and Schwarz, C., “The impact of lending standards on default rates of residential real estate loans”, Occasional Paper Series, No 220, ECB, March 2019.

- [4]The Czech Republic, Germany, France, Iceland and Norway received warnings, while Belgium, Denmark, Luxembourg, the Netherlands, Finland and Sweden received recommendations.

- [5]As the domestic market share of significant institutions differs across countries, the data may not always be representative of each national mortgage market. In the case of Germany, for example, the data cover only around one-third of the domestic RRE market (based on a national survey by the Bundesanstalt für Finanzdienstleistungsaufsicht and the Deutsche Bundesbank of small and medium-sized banks on real estate financing and the ECB credit underwriting data collection for the year 2018). For further information on the dataset, see Trends and risks in credit underwriting standards of significant institutions in the Single Supervisory Mechanism, ECB Banking Supervision, forthcoming.

- [6]Data availability and the extent to which some of the indicators adhered to the common indicator definitions of the ESRB Recommendations 2019/3 and 2016/14 on closing real estate data gaps varied across institutions, especially for income-based indicators. This should be kept in mind when comparing lending standards across countries. For some countries and indicators data availability was insufficient to show country aggregates. Country scatter plots in this special feature therefore feature less than 19 euro area countries.

- [7]This is because longer maturities and lower interest rates reduce the LSTI ratio for a given LTI ratio. For an annuity loan, the relationship between LSTI, LTI, maturity (m) and interest rate (i) is:

- [8]Even though common indicator definitions were provided for the data collection, some institutions provided data based on slightly different definitions. This should be kept in mind when comparing lending standards across countries. See also footnote 6.

- [9]To fully characterise risks in RRE lending, combinations of various indicators (such as a high LTV in combination with a high LTI) need to be analysed; however, the scope of the data collection did not extend to gathering such combinations of indicators.

- [10]See Lo Duca, M., Pirovano, M., Rusnák, M. and Tereanu, E., “Macroprudential analysis of residential real estate markets”, Macroprudential Bulletin, ECB, March 2019, for details of the ECB framework for assessing financial stability risks stemming from RRE markets and for designing macroprudential policy responses.

- [11]See also the evidence in “Vulnerabilities in the residential real estate sectors of the EEA countries”, ESRB, September 2019.

- [12]Countries with borrower-based macroprudential tools in place as at end-2018 were AT, CY, EE, FI, IE, LT, LV, NL, PT, SI and SK. In 2019 and 2020, borrower-based measures were enacted also in BE, FR and MT.

- [13]The wide calibration window for DSTI limits results from the use of different definitions of income across countries.

- [14]This heterogeneity hinders cross-country comparisons, but the national legal frameworks make it possible to account for the specific characteristics of national RRE markets.

- [15]Austria adopted the recommendation on sustainable lending with specific limits in September 2018.

- [16]Based on Adalid, R. and Falagiarda, M., “How repayments manipulate our perceptions about loan dynamics after a boom”, Working Paper Series, No 2211, ECB, December 2018. For details on how the simulation algorithm has been adapted, see the notes to Chart A.

- [17]It should be noted that the coronavirus outbreak has led to a significant worsening of banks’ wholesale bond market funding costs. If instead maturing bonds were to be rolled over at the rates observed in September last year, a significantly stronger decline of around 70 basis points would be projected over the same period.

- [18]The methodology used does not capture: (i) volume effects, which could in principle mitigate the impact of compressed margins on net interest income; (ii) behavioural changes by banks, which may adjust the composition of their assets and liabilities to counteract the downward drift in banks’ net interest margins; (iii) prepayments of mortgage debt; and (iv) the impact of hedging.