The role of indirect taxes in euro area inflation and its outlook

Published as part of the ECB Economic Bulletin, Issue 6/2020.

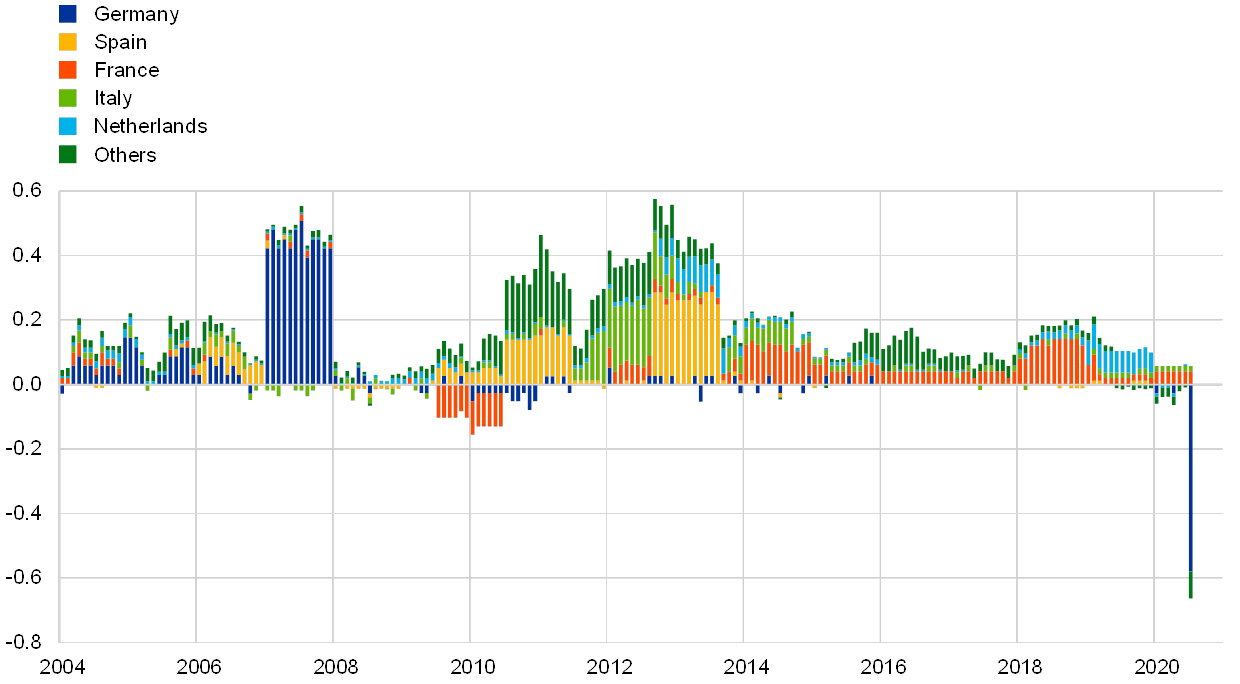

Changes in indirect tax rates can have a visible impact on consumer prices. The precise magnitude of this impact is uncertain, as it depends on decisions by firms on how much of the tax increase they can – or wish to – pass on to consumers. Since 2004 Eurostat has compiled a measure of HICP at constant tax rates. This assumes the full and immediate pass-through of changes in indirect taxes to consumer prices and therefore, on balance, tends to overstate the effects of tax changes.[1] Based on this measure, the contribution from changes in indirect taxes to euro area HICP inflation has been, on average, 0.2 percentage points, but was much stronger during periods when tax rates increased, such as in 2007 and between 2011 and 2014 (see Chart A).

Chart A

HICP and HICP at constant tax rates

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Notes: The latest observation is for July 2020. The dashed line represents the long-term average calculated from 2004 onwards.

Over the past two decades indirect tax rates have mostly increased. However, in response to the coronavirus (COVID-19) pandemic, several euro area countries have reduced indirect tax rates on a scale not seen before in the euro area. In addition to temporary reductions in broad-based value added taxes (VAT) in Germany and Ireland, many other euro area countries have recently introduced targeted reductions in indirect taxes (see Chart B).[2] Assuming full and immediate pass-through, Eurostat’s HICP at constant tax rates implies that the reduction in VAT in Germany would have a downward impact on euro area HICP inflation in July 2020 of around 0.6 percentage points. As the temporary reduction in rates will be applied from July to December 2020, this could translate into an effect roughly half this size for the full year. The mechanically calculated downward impact on HICP inflation excluding energy and food (HICPX) would be of a similar magnitude and would increase by an additional 0.1 percentage points when also taking into account the net effect of all other changes in indirect taxes in euro area countries.[3]

Chart B

Impact of changes in indirect taxes on HICP inflation

(percentage point contributions based on difference between HICP and HICP at constant tax rates)

Sources: Eurostat and ECB calculations.

Notes: The latest observation is for July 2020. The impact of changes in indirect taxes is calculated as the difference between HICP inflation and HICP at constant tax rates inflation, assuming full and immediate pass-through of indirect taxes.

The actual impact of the recent reductions in indirect taxes on inflation is surrounded by considerable uncertainty. First, historically there are few examples of cuts in indirect tax rates in euro area countries that could shed light on the likely degree of pass-through.[4] Second, the abrupt and strong deterioration in the overall economic environment as a result of the COVID-19 pandemic may affect firms’ pricing and profit margin considerations differently from those of a normal business cycle, thereby affecting the degree of pass-through (see the box entitled “The impact of the recent spike in uncertainty on economic activity in the euro area” in this issue of the Economic Bulletin). Lastly, the lion’s share of the current reduction in indirect taxes results from the VAT rate cut in Germany, which is only temporary (and very rare in euro area countries), and might thus generate unusual anticipation effects. All of this suggests that the high pass-through found in the empirical literature for permanent increases in indirect tax rates cannot be easily mapped into similarly high pass-through effects for the current temporary reductions in rates.[5] The United Kingdom implemented a temporary VAT cut for a period of 13 months in 2008-09. The pass-through was initially estimated to have been complete but, owing to some reversals, ultimately it was only partial.[6],[7]

The pass-through of recent reductions in indirect taxes is likely to vary across sectors and to be overall incomplete. In the case of Germany, the pass-through can be assumed to be substantial in some sectors, such as the energy sector or in the supermarket retail sector. However, in sectors suffering higher revenue losses from the lockdown or facing higher menu costs, the pass-through can be assumed to be much lower, for example in the service sector or for retailers of durable goods. Furthermore, a substantial share of the HICP basket is not subject to VAT, for example rents, and is thus not affected by the VAT change. It is therefore likely that the recent reductions in indirect taxes will have a substantial impact on food and energy inflation, while the impact on HICP excluding energy and food will be less marked.

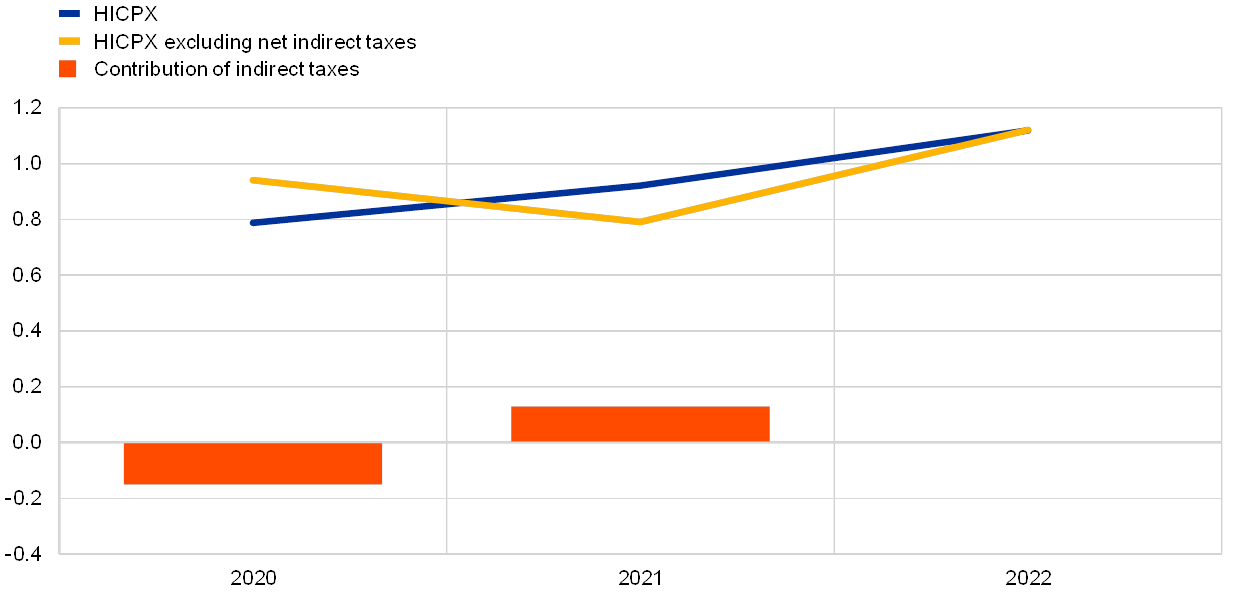

The reductions in indirect tax rates in euro area countries shape the inflation profile for 2020 and 2021 in the September 2020 ECB staff projections. HICP excluding energy and food inflation is expected to increase continuously from 0.8% in 2020 to 0.9% in 2021 and 1.1% in 2022. However, excluding the estimated actual impact of changes in indirect taxes, HICP inflation excluding energy and food is projected to decline from 0.9% in 2020 to 0.8% in 2021[8] before increasing to 1.1% in 2022 (see Chart C). While these projections expect only a quite limited pass-through of the reductions in indirect taxes to inflation (only around 50%), the effects are large enough to transform a continuous increase in inflation from 2020-22 into a slight V-shape profile for underlying inflation. Understanding the impact of indirect taxes on the inflation profile and outlook is relevant for the communication of monetary policy.

Chart C

Impact of changes in indirect taxes on HICPX inflation projections

(annual percentage changes; percentage point contributions)

Sources: Eurostat, ECB calculations, September 2020 Macroeconomic Projection Exercise.

Note: The calculation of the contribution from changes in indirect taxes is based on estimates of actual pass-through.

- See the box entitled “New statistical series measuring the impact of indirect taxes on HICP inflation”, Monthly Bulletin, ECB, Frankfurt am Main, November 2009.

- These cover some sectors that have been hit especially hard by the pandemic, such as travel-related services (for example in Belgium, Greece, Cyprus and Austria) and gym memberships/sport classes (the Netherlands and Portugal), but also food and beverages (Germany, Italy, Austria and Slovakia) and medical supplies (Belgium, Greece, France, Malta, the Netherlands, Austria, Portugal and Slovakia).

- With respect to large euro area countries, increases in indirect taxes on food and energy implemented in France and Italy at the beginning of 2020 are slightly offsetting the recent pandemic-related reductions in indirect taxes. Other indirect tax increases target tobacco (Estonia, France, Lithuania, Luxembourg, the Netherlands and Austria) and energy (Latvia, Lithuania, Luxembourg and Finland).

- Decreases in the standard rate of VAT included typically small cuts in the Netherlands in 1989 and 1992, Portugal in 1992 and 2008, Latvia in 2012, Italy in 1980, France in 2000 and Ireland in 1990, 1991, 2001 and 2010.

- The paper by Benzarti, Y., Carloni, D., Harju, J. and Kosonen, T., “What Goes Up May Not Come Down: Asymmetric Incidence of Value-Added Taxes”, Journal of Political Economy, forthcoming, 2020 presents evidence that the pass-through of VAT changes is larger for VAT increases than for VAT decreases.

- Empirical findings suggest that “firms initially passed through the lower VAT rate (complete pass-through), [however] they subsequently reversed at least part of the cut after around two months” (see Crossley, T.F., Low, H.W. and Sleeman, C. “Using a Temporary Indirect Tax Cut as a Fiscal Stimulus: Evidence from the UK”, IFS Working Paper, No W14/16, 2014.

- Whether companies apply the change in the indirect tax rate by adjusting the prices for each individual product on the shelf or by applying it at the till should not affect inflation numbers if price collections also take into account tax changes applied at the till, as they do for example in Germany.

- The temporary nature of the VAT decrease in Germany, which will be reversed in 2021, implies an upward impact on HICPX in the second half of 2021, which explains the positive difference between HICPX inflation and HICPX excluding net indirect taxes.