- PRESS RELEASE

July 2023 euro area bank lending survey

25 July 2023

- Credit standards tightened further for all loan categories

- Demand for loans decreased strongly for both firms and households

- Banks more concerned about non-performing loans, set to tighten lending conditions

- Climate risks increasingly reflected in lending conditions

According to the July 2023 euro area bank lending survey (BLS), credit standards – i.e. banks’ internal guidelines or loan approval criteria – for loans or credit lines to enterprises tightened further in the second quarter of 2023. The net percentage of banks reporting a tightening was smaller than in the previous quarter, standing at 14%, compared with 27% in the first quarter (Chart 1), in line with what banks had expected. The cumulated net tightening since the beginning of 2022 has been substantial, and the BLS results have provided early indications about the significant weakening in lending dynamics observed since last autumn. Banks also reported a further net tightening of their credit standards for loans to households for house purchase and consumer credit and other lending to households (net percentages of 8% and 18% respectively). For households, the net tightening was less pronounced than in the previous quarter for housing loans, while it was more pronounced for consumer credit. Higher risk perceptions related to the economic outlook and borrower-specific situation, lower risk tolerance as well as banks’ higher cost of funds contributed to the tightening. For the third quarter of 2023, euro area banks expect a further, albeit more moderate, net tightening of credit standards on loans to firms, and unchanged credit standards on loans to households for house purchase. For consumer credit, euro area banks expect a minor net tightening of credit standards.

Banks’ overall terms and conditions – i.e. the actual terms and conditions agreed in loan contracts –tightened further for loans to firms and loans to households in the second quarter of 2023. Widening loan margins and rising interest rates accounted for the main tightening effect, reflecting the ongoing pass-through of higher market rates to lending rates for firms and households.

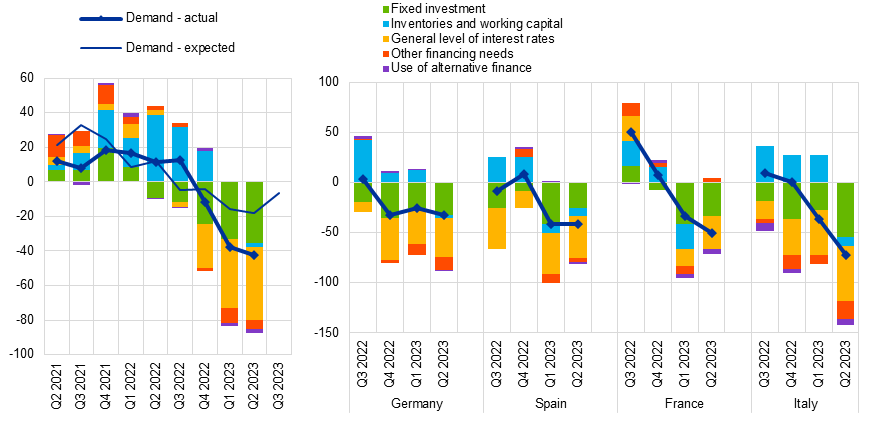

Banks reported a strong net decrease in demand from firms for loans or drawing of credit lines in the second quarter of 2023, which dropped to an all-time low since the start of the survey in 2003 (Chart 2). The net decrease was again substantially stronger than expected by banks in the previous quarter. Rising interest rates and lower financing needs for fixed investment were the main drivers of reduced loan demand. For the third quarter of 2023, banks expect a further net decline in demand for loans to firms, albeit much smaller than in the second quarter. Euro area banks also reported a strong net decrease in demand for housing loans which, however, was lower than the very large net decrease in the previous two quarters. Higher interest rates, weakening housing market prospects and low consumer confidence all contributed negatively to the demand for loans for house purchase. There was also a net decrease in demand for consumer credit and other lending to households, driven mainly by rising interest rates and low consumer confidence. In the third quarter of 2023, banks expect a further, although markedly less pronounced, net decrease in housing loan demand, and a somewhat smaller net decrease in demand for consumer credit.

According to the banks surveyed, access to funding deteriorated in most market segments in the second quarter of 2023, especially for retail funding. The reported net deterioration in access to retail funding may reflect increased competition for retail deposits in the current environment of higher interest rates and outflows of overnight deposits. For debt securities, the deterioration reflects somewhat higher bank bond yields compared with the end of the first quarter, while access to money markets remained broadly unchanged.

Euro area banks reported a net tightening impact of non-performing loan (NPL) ratios on their lending conditions for loans to enterprises and consumer credit in the first half of 2023. NPL ratios had a broadly neutral impact for housing loans. Banks referred to higher risk perceptions and their lower risk tolerance as main factors behind the contribution of NPL ratios to tightening lending conditions.

Credit standards for new loans to enterprises tightened further across all main sectors of economic activity in the first half of 2023, especially for commercial real estate. Credit standards also tightened substantially in the energy-intensive manufacturing sector, although considerably less than in the second half of last year. The net percentage of banks reporting this development was broadly in line with other sectors like residential real estate, construction, and wholesale and retail trade. The net tightening was relatively lower in the services sector. In addition, euro area banks reported a net decrease in demand for loans or credit lines across all main economic sectors, which was especially strong in the real estate sector.

The July 2023 survey questionnaire included a new annual ad hoc question aimed at gauging the impact of climate change on bank lending to enterprises. Euro area banks indicated that climate risks of euro area firms and measures to cope with climate change had a net tightening impact on credit standards and terms and conditions for loans to brown firms over the past 12 months, while they had a net easing impact for loans to green firms and firms in transition (see Notes). Euro area banks also reported a net increase in demand for loans to firms owing to climate-related risks and opportunities over the past 12 months, driven by firms in transition and green firms, while brown firms showed a net decrease in loan demand. The main driver of loan demand related to climate risks was financing needs for fixed investment and corporate restructuring.

The euro area bank lending survey, which is conducted four times a year, was developed by the Eurosystem to improve its understanding of bank lending behaviour in the euro area. The results reported in the July 2023 survey relate to changes observed in the second quarter of 2023 and expected changes in the third quarter of 2023, unless otherwise indicated. The July 2023 survey round was conducted between 19 June and 4 July 2023. A total of 158 banks were surveyed in this round, with a response rate of 100%.

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- A report on this survey round is available on the ECB’s website. A copy of the questionnaire, a glossary of BLS terms and a BLS user guide with information on the BLS series keys can be found on the same webpage.

- “Green firms” – firms that do not contribute or contribute little to climate change; “firms in transition” – firms that contribute to climate change, but are making considerable progress in the transition; “brown firms” – firms that contribute significantly to climate change and have not yet started the transition or have made little progress.

- The euro area and national data series are available on the ECB’s website via the ECB Data Portal. National results, as published by the respective national central banks, can be obtained via the ECB’s website.

- For more detailed information on the BLS, see Köhler-Ulbrich, P., Hempell, H. and Scopel, S., “The euro area bank lending survey”, Occasional Paper Series, No 179, ECB, 2016.

Chart 1

Changes in credit standards for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting a tightening of credit standards, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages are defined as the difference between the sum of the percentages of banks responding “tightened considerably” and “tightened somewhat” and the sum of the percentages of banks responding “eased somewhat” and “eased considerably”. The net percentages for “other factors” refer to further factors which were mentioned by banks as having contributed to changes in credit standards.

Chart 2

Changes in demand for loans or credit lines to enterprises, and contributing factors

(net percentages of banks reporting an increase in demand, and contributing factors)

Source: ECB (BLS).

Notes: Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks responding “increased considerably” and “increased somewhat” and the sum of the percentages of banks responding “decreased somewhat” and “decreased considerably”.

Banca Centrală Europeană

Direcția generală comunicare

- Sonnemannstrasse 20

- 60314 Frankfurt pe Main, Germania

- +49 69 1344 7455

- media@ecb.europa.eu

Reproducerea informațiilor este permisă numai cu indicarea sursei.

Contacte media