Extended publication of Securities Holdings Statistics

- For the first time break-down by instrument type, holder sector and issuer sector

- Dataset compiled from micro-data and thus provides more detailed information

- Dataset gives insights in euro area exposures and their developments between sectors

The ECB is extending the regular publication of Securities Holdings Statistics by Sector (SHSS). In addition to the current breakdown by instrument type and selected issuer countries, holdings by the euro area broken down by holder sectors and issuer sectors are made available. The list of issuer countries for which holdings are published has also been extended. As a result, the number of published series from the SHSS dataset is increasing from currently 150 to approximately 11,000 series.

In order to minimise the reporting burden, data are generally collected from financial sectors on their own holdings and from custodians on the holdings of non-financial sectors, as well as on a security-by-security basis, which avoids that reporting agents have to perform multiple aggregations of their data.

Total holdings by euro area investors as covered by this dataset amounted to EUR 27.9 trillion at the end of 2016-Q3, covering holdings of both securities issued by the euro area residents (EUR 20.9 trillion) and non-euro area residents (EUR 6.9 trillion). Total euro area holdings of debt securities amounted to EUR 14.9 trillion while total euro area holdings of listed shares and investment funds shares/units stood at EUR 13.0 trillion.

Securities Holdings Statistics by Sector have been collected by the ECB as of end 2013 on a security-by-security basis and cover quarterly euro area securities holdings of the main instrument types (debt securities, listed shares and investment funds shares/units) at market values for the sector of the holder (excluding the Eurosystem) as well as of the issuer (see also ECB Economic Bulletin March 2015, pp. 72-84). The SHSS data significantly help to close the information gap on securities holdings both within the euro area and between the euro area and the rest of the world. They allow for very flexible data analyses and feed into a wide range of research, e.g. on monetary policy, financial stability or financial integration (which has allowed to incorporate them in various publications, e.g. ECB Financial Stability Review).

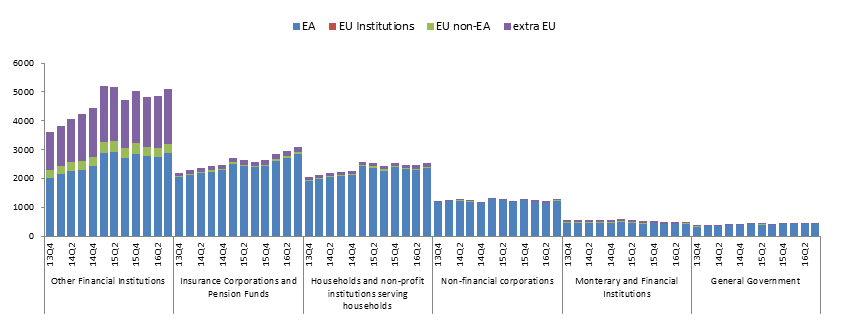

The following charts illustrate the developments in the euro area holdings since the start of the collection of SHSS, i.e. Q4-2013. Further illustrative charts are provided in the Annex.

Chart 1. Euro area holdings of debt securities by holder sector and issuer area (EUR billion, positions at end of period)

Chart 2. Euro area holdings of listed shares and investment funds shares/units by holder sector and issuer area (EUR billion, positions at end of period)

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- List of selected issuer countries: EU countries, Switzerland, Norway, Jersey, Turkey, Russia, US, Canada, South Africa, Cayman Islands, Argentina, Mexico, Brazil, Australia, India, China, Japan, South Korea, Hong Kong, Indonesia, Saudi Arabia offshore financial centres (R12).

- The SHSS dataset does not include holdings by the Eurosystem.

- Time series data: ECB's Statistical Data Warehouse (SDW)

- Methodological information: Securities holding statistics

- ECB Economic Bulletin, March 2015: Who Holds What? New Information on Securities Holdings

- Financial Stability Review, November 2016 (Box 7 in page 97)

ANNEX[1]

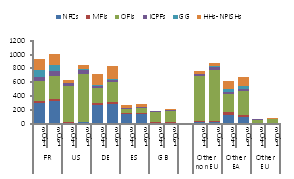

Chart 3.1 Euro area holdings of debt securities issued by non-financial corporations, broken down by issuer country and holder sector (EUR billion, positions at end of period)

Chart 3.2 Euro area holdings of listed shares issued by non-financial corporations, broken down by issuer country and holder sector (EUR billion, positions at end of period)

Chart 4 Euro area holdings of government debt securities, broken down by issuer country and holder sector (EUR billion, positions at end of period)

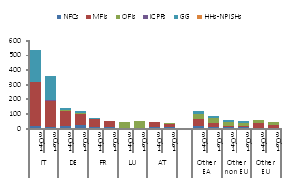

Chart 5.1 Euro area holdings of debt securities by households*, broken down by issuer country and issuer sector (EUR billion, positions at end of period)

Chart 5.2 Euro area holdings of listed shares by households*, broken down by issuer country and issuer sector (EUR billion, positions at end of period)

Chart 5.3 Euro area holdings of investment funds shares/units by households*, broken down by issuer country and issuer sector (EUR billion, positions at end of period)

[1]NFCs: non-financial corporations; MFIs: monetary and financial institutions, except the central bank; OFIs: other financial institutions; ICPFs: insurance corporations and pension funds; GG: general government; HHs-NPISHs: households and non-profit institutions serving households

Europese Centrale Bank

Directoraat-generaal Communicatie

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Duitsland

- +49 69 1344 7455

- media@ecb.europa.eu

Reproductie is alleen toegestaan met bronvermelding.

Contactpersonen voor de media