- STATISTICAL RELEASE

Euro area quarterly balance of payments and international investment position:

second quarter of 2022

5 October 2022

[This statistical release was updated on 5 October 2022 at 12:40 CET to correct an error in some values reported in Table 3]

- Current account surplus at €76 billion (0.6% of euro area GDP) in four quarters to second quarter of 2022, down from €330 billion (2.8% of GDP) a year earlier

- Geographic counterparts: largest bilateral current account surpluses vis-à-vis United Kingdom (€141 billion) and Switzerland (€65 billion), largest deficits vis-à-vis China (€130 billion) and Russia (€69 billion)

- International investment position showed net assets of €357 billion (2.8% of euro area GDP) at end of second quarter of 2022

- Euro area financial assets vis-à-vis Russia amounted to €394 billion (1.2% of euro area external assets) at end of second quarter of 2022, up by 4% since the end of previous quarter mainly owing to exchange rate changes

Current account

The current account surplus of the euro area decreased sharply to €76 billion (0.6% of euro area GDP) in the four quarters to the second quarter of 2022, down from €330 billion (2.8% of GDP) a year earlier (Table 1). This decrease was driven by a strong reduction in the surplus for goods (down from €386 billion to €84 billion) and, to a lesser extent, by a smaller surplus for primary income (down from €44 billion to €22 billion). This development was partly offset by a larger surplus for services (up from €61 billion to €122 billion) and a smaller deficit for secondary income (down from €160 billion to €153 billion).

The larger surplus for services was mainly due to increases in the surpluses for telecommunication, computer and information services (from €112 billion to €141 billion), travel services (from €11 billion to €37 billion) and transport services (from €4 billion to €21 billion), while a larger deficit was recorded for other services (from €27 billion to €35 billion).

The decrease in the primary income surplus was mainly due to a larger deficit in portfolio equity income (increasing from €67 billion to €93 billion) and due to a lower surplus in other primary income (from €10 billion to €1 billion), the latter mostly related to payments to the EU institutions.

Table 1

Current account of the euro area

Source: ECB.

Notes: “Equity” comprises equity and investment fund shares. Discrepancies between totals and their components may arise from rounding.

Data on the geographic counterparts of the euro area current account (Chart 1) show that, in the four quarters to the second quarter of 2022, the euro area recorded its largest bilateral surpluses vis-à-vis the United Kingdom (€141 billion, down from €159 billion a year earlier), Switzerland (€65 billion, down from €66 billion) and the United States (€34 billion, down from €53 billion). It also recorded a current account surplus vis-à-vis a residual group of other countries (€62 billion, down from €180 billion). The largest bilateral deficits were recorded vis-à-vis China (€130 billion, up from €64 billion) and Russia (€69 billion, following a surplus of €8 billion).

The most significant geographic changes in the components of the current account in the four quarters to the second quarter of 2022 relative to the previous year were as follows. The goods balance vis-à-vis the residual group of other countries turned from a surplus of €92 billion to a deficit of €73 billion, largely due to imports of energy products. The deficit vis-à-vis China increased from €86 billion to €157 billion. The goods deficit vis-à-vis Russia also increased, from €10 billion to €86 billion, mainly on account of higher prices for imported energy products. A larger surplus was recorded vis-à-vis the EU Member States and EU institutions outside the euro area (up from €44 billion to €69 billion).

In services, the surplus vis-à-vis the United Kingdom increased (from €25 billion to €43 billion), as it did vis-à-vis the residual group of other countries (from €67 billion to €91 billion). In primary income, a larger deficit was recorded vis-à-vis the United States (up from €38 billion to €60 billion), while the deficit declined vis-à-vis offshore centres (down from €33 billion to €13 billion). Moreover, the primary income surplus vis-à-vis the United Kingdom declined from €24 billion to €0.4 billion, while it widened vis-à-vis the residual group of other countries (up from €83 billion to €109 billion). In secondary income, the deficit vis-à-vis the EU Member States and EU institutions outside the euro area decreased from €94 billion to €84 billion.

Chart 1

Geographical breakdown of the euro area current account balance

(four-quarter moving sums in EUR billions; non-seasonally adjusted)

Source: ECB.

Note: “EU non-EA” comprises the non-euro area EU Member States and those EU institutions and bodies that are considered for statistical purposes as being outside the euro area, such as the European Commission and the European Investment Bank. “Other countries” includes all countries and country groups not shown in the chart, as well as unallocated transactions.

International investment position

At the end of the second quarter of 2022, the international investment position of the euro area recorded net assets of €357 billion vis-à-vis the rest of the world (2.8% of euro area GDP), up from €197 billion in the previous quarter (Chart 2 and Table 2).

Chart 2

Net international investment position of the euro area

(net amounts outstanding at the end of the period as a percentage of four-quarter moving sums of GDP)

Source: ECB.

The €160 billion increase in net assets reflected large but partly offsetting changes in the various investment components. Lower net liabilities were recorded in portfolio equity (down from €3.0 trillion to €2.8 trillion), while net assets increased for direct investment (up from €2.1 trillion to €2.2 trillion). Net assets declined for portfolio debt (down from €1.4 trillion to €1.2 trillion), while net liabilities increased in other investment (up from €1.3 trillion to €1.4 trillion).

Table 2

International investment position of the euro area

(EUR billions, unless otherwise indicated; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted)

Source: ECB.

Notes: “Equity” comprises equity and investment fund shares. Net financial derivatives are reported under assets. “Other volume changes” mainly reflect reclassifications and data enhancements. Discrepancies between totals and their components may arise from rounding.

The developments in the euro area’s net international investment position in the second quarter of 2022 were driven mainly by positive net flows owing to exchange rate changes and, to a lesser extent, other volume changes and transactions, which were partly offset by negative net price changes (Table 2 and Chart 3).

The decrease in net liabilities for portfolio equity was driven mainly by price changes, as prices in portfolio equity liabilities decreased more than those on the asset side, as well as positive net flows for other volume changes and exchange rate changes that were partially offset by negative net transactions (Table 2). The decline in net assets for portfolio debt also resulted mainly from negative net flows due to price changes, and to a lesser extent, other volume changes that were partially offset by positive net exchange rate changes and transactions. The increase in net assets for direct investment resulted mainly from positive net transactions, positive net flows owing to exchange rate and other volume changes that were partially offset by negative net price changes. The increase in net liabilities for other investment was driven mainly by negative net transactions.

At the end of the second quarter of 2022 the gross external debt of the euro area amounted to €16.5 trillion (around 128% of euro area GDP), up by €108 billion compared with the previous quarter.

Chart 3

Changes in the net international investment position of the euro area

(EUR billions; flows during the period)

Source: ECB.

Note: “Other volume changes” mainly reflect reclassifications and data enhancements.

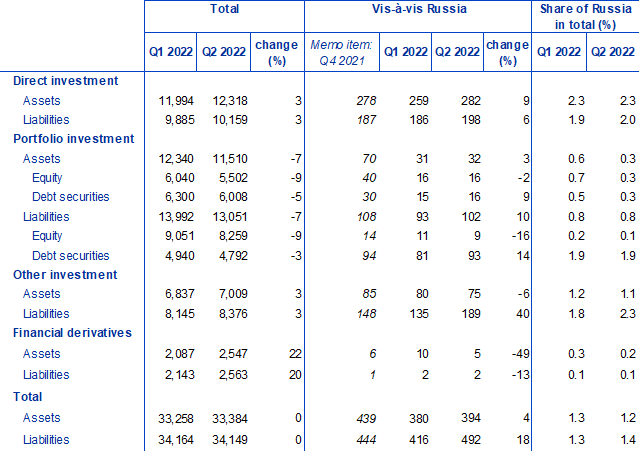

This release provides an overview of the euro area’s international investment position vis-à-vis residents of Russia at the end of the second quarter of 2022 and reports the main changes compared with the previous quarter (Table 3).[1] Euro area financial assets vis-à-vis Russia amounted to €394 billion (1.2% of euro area external assets) at the end of the second quarter of 2022, a 4% increase since the end of the previous quarter. This increase was mainly due to euro area foreign direct investment assets in Russia, which rose by 9% in the second quarter of 2022, largely on account of the appreciation of the Russian rouble. At the same time, the euro area recorded liabilities of €492 billion vis-à-vis Russia (1.4% of total external liabilities), an increase of 18%, driven mainly by larger liabilities in other investment due to the sanctions imposed by the EU on Russia, which include restrictions of payments to Russian residents and asset freezes.[2]

Table 3

International investment position of the euro area – geographical breakdown vis-à-vis Russia

(EUR billions, unless otherwise indicated; at the end of the period; non-working day and non-seasonally adjusted)

Source: ECB.

Notes: “Equity” comprises equity and investment fund shares. “Total assets/liabilities” refer to the sum of direct investment, portfolio investment, other investment and financial derivatives. Reserve assets are not included in the total and financial derivatives are reported separately in gross terms under assets and liabilities. Discrepancies between totals and their components may arise from rounding.

Data revisions

This statistical release incorporates revisions to data for the reference periods between the first quarter of 2018 and the first quarter of 2022. The revisions reflect revised national contributions to the euro area aggregates as a result of the incorporation of newly available information.

Next releases

- Monthly balance of payments: 20 October 2022 (reference data up to August 2022)

- Quarterly balance of payments and international investment position: 11 January 2023 (reference data up to the third quarter of 2022)

For queries, please use the Statistical information request form.

Notes

- Data are neither seasonally nor working day-adjusted. Ratios to GDP (including in the charts) refer to four-quarter sums of non-seasonally and non-working day-adjusted GDP figures.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

Table 3 does not include reserve assets in the total euro area external asset positions and financial derivatives are reported in gross terms instead of net terms (which are reported in Table 2).

See Council of the EU: EU sanctions against Russia explained.