ECB publishes quarterly Consolidated Banking Data for March and June 2015

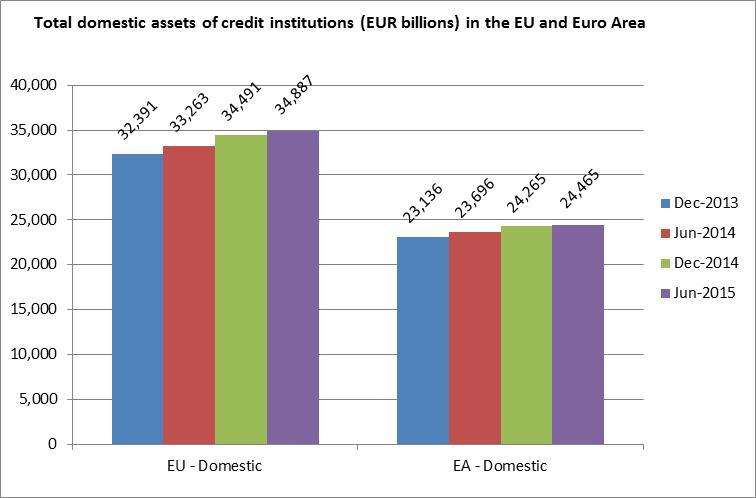

- Total domestic assets of credit institutions in the euro area increased slightly in the first half of 2015, by €200bn to €24,465bn

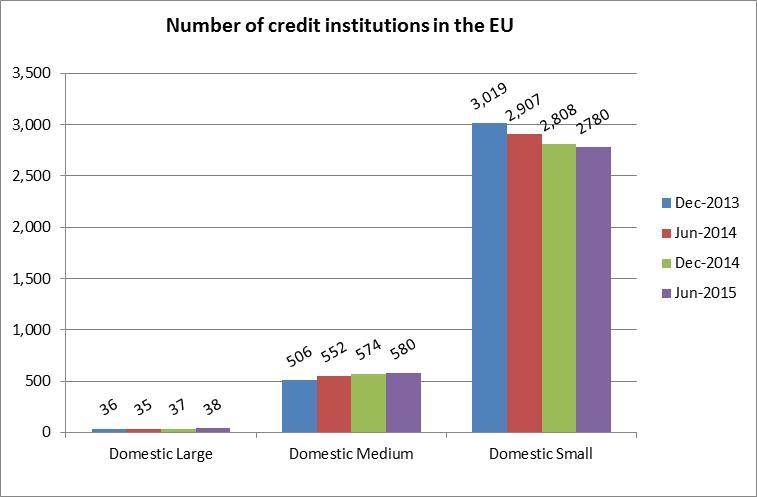

- The number of domestic credit institutions in the EU continued to decrease from 3,419 to 3,398.

- Consolidated Banking Data are to be disseminated with a quarterly frequency starting with the data for 2015, thus facilitating a more frequent picture on developments in the European banking sector.

- Quarterly data are a subset of the corresponding annual data, but nevertheless covering to great extent relevant information for the analysis of the banking sector.

- For the first time Consolidated Banking Data are disseminated with a quarterly frequency; data are provisional and may be subject to revisions.

The European Central Bank (ECB) has published the March and June 2015 Consolidated Banking Data (CBD), a data set of the EU banking system on a consolidated basis. The novelty of this release is that from now on the CBD will be disseminated with a quarterly frequency, compared to a semi-annual frequency thus far, thus ensuring a more frequent picture of developments in the European banking sector.

Under the new framework, CBD distinguish between a comprehensive set of end-year data and a leaner subset for quarterly data. Still, the quarterly CBD cover relevant information required for the analysis of the EU banking sector. This improvement in the data quality and increased frequency has been made possible due to the entry into force of the European Banking Authority’s (EBA) Implementing Technical Standards on Supervisory Reporting which greatly helped increase the availability and extend the scope of harmonised supervisory data across the EU. In particular, the indicators on asset quality have largely been replaced by new data on non-performing exposures, as well as key items on forbearance. New statistics are also provided with measures of liquidity, funding and encumbered assets.

The Consolidated Banking Data include statistics on individual EU Member States and on the European Union and Euro Area as a whole. This dataset includes an extensive range of indicators on profitability and efficiency, balance sheets, liquidity and funding, asset encumbrance, non-performing exposures developments and capital adequacy and solvency.

Disclosed aggregates and indicators are published for the full sample of the banking industry, which comprises reporters (data sources) applying International Financial Reporting Standards and the EBA Implementing Technical Standards on supervisory reporting, reporters applying national accounting standards and the EBA standards and reporters not applying the EBA standards at all. Aggregates and indicators are published also for reports based on supervisory and national accounting standards, based on the availability of the underlying items.

The CBD series for EU banking groups are available on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” to affiliates of banking groups that can be classified as other financial institutions. Insurance companies are not included within the consolidation perimeter.

The CBD data are separately reported for domestic banking groups (broken down into small, medium-sized and large groups). Information is also provided on foreign-controlled institutions active in EU countries.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes:

- The Consolidated Banking Data are available in the ECB Statistical Data Warehouse: [ http://sdw.ecb.europa.eu/browse.do?node=9689600].

- The data and more information about the methodology behind the data compilation are available on the ECB’s website: http://www.ecb.int/stats/money/consolidated/html/index.en.html.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem