ECB publishes enhanced statistics on loans to the euro area private sector adjusted for sales and securitisation

- The ECB has published new statistics on loans adjusted for sales and securitisation, providing more complete information on loans that were granted by euro area banks but are no longer recorded on their balance sheets.

- The enhanced method for adjusting loans for sales and securitisation enables a more comprehensive view of lending to the real economy originated by euro area banks, and improves comparability across countries.

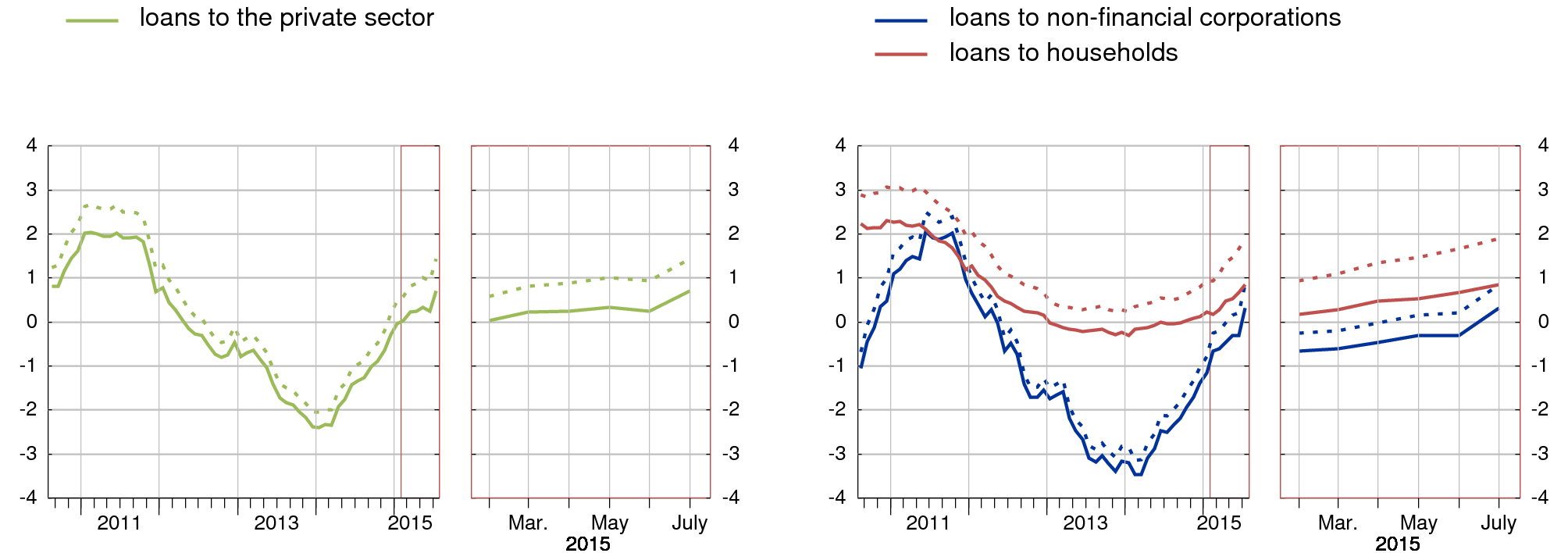

- The flows and growth rates of bank loans to the euro area private sector, households and non-financial corporations are, in general, somewhat lower under this new method of adjustment.

The ECB has published new statistical series on loans adjusted for sales and securitisation, based on an enhanced adjustment method. The new method enables a more comprehensive view of developments in loans originated by euro area banks by taking into account, on an ongoing basis, stocks and repayments of loans that are no longer recorded on banks’ balance sheets (i.e. derecognised loans) as a result of a securitisation or other transfer. In addition to contributing to a more complete picture of lending to the real economy originated by euro area banks, this new method improves comparability through more harmonised adjusted growth rates across countries with differing practices regarding the derecognition of transferred loans.

Previously, statistical series on loans adjusted for sales and securitisation published by the ECB took into account only the one-off impact of transactions resulting from (net) loan transfers, off or on balance sheet, in the period during which the transfer took place. The refined adjustment method also uses data on repayments and stocks of securitised loans that have been derecognised and are serviced by monetary financial institutions (MFIs). These new requirements were introduced under Regulation ECB/2013/33 concerning the balance sheet of the MFI sector, which was implemented with the data transmission for the reference period December 2014. Data on other derecognised loans are also taken into account, where available. Comparable back data have been compiled by national central banks and the ECB in order to make available consistent statistical series from the beginning of 2010.

The inclusion of stocks and repayments of derecognised loans results in somewhat lower adjusted flows and growth rates in general. For the 12 months to July 2015, the growth rates of loans to the euro area private sector, households and non-financial corporations have been revised downwards, on average by 54 basis points, 77 basis points and 41 basis points, respectively.

Future press releases on monetary developments, beginning with the one to be published on 25 September 2015, will provide growth rates based on the new method of adjustment for loan sales and securitisation.

Euro area MFI loans to the private sector

(annual growth rates, adjusted for sales and securitisation; new method as solid line, former method as dotted line)

Notes:

- Data in this press release are adjusted for seasonal and end-of-month calendar effects.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem