Monetary Policy and 'Credible Alertness'

Intervention by Jean-Claude Trichet, President of the ECBat the Panel Discussion “Monetary Policy Strategies: A Central Bank Panel”, at the Symposium sponsored by the Federal Reserve Bank of Kansas City, Jackson Hole, Wyoming, 27 August 2005

Dear Alan, dear ladies and gentlemen,

I had the privilege of participating with Alan in all meetings of the G7 Ministers and Governors over the last 18 years. But there is one big difference between us! He participated in all these meetings as President of the Federal Reserve, whereas my responsibilities changed three times during this period. I was successively Undersecretary of the Treasury of my country, Governor of Banque de France and then President of the European Central Bank. I could therefore look at the legendary exposition of Alan in the G7 from three different angles, now not only with the benefit of a multiocular perspective but also of hindsight. And I can say that in 3-D Alan’s expositions in this intimate, restricted format are incredibly sharp, profound and visionary. I personally share fully, in particular, the judgement of Alan Blinder and Ricardo Reis on the lucidity of Alan as regards the early diagnosis of the productivity jump in the US economy.

Not only in the United States, also in Europe as in the rest of the world, Alan has a very high reputation. In some European quarters, he is even sometimes made the principal witness of monetary policy activism, but I am not sure whether he himself would agree with such a role. Still, the issue of the Fed’s movements in interest rates and those of the ECB is frequently debated. Let me elaborate on this debate somewhat further.

Since 1 January 1999, when the European Central Bank (ECB) officially became the monetary authority of the euro area, the ECB has changed its policy rate 15 times. The easing cycle that started in 2001 on both sides of the Atlantic saw a cumulative reduction in the euro area’s policy rate of 275 basis points, accomplished over 7 moves. That cycle has not yet been reversed.

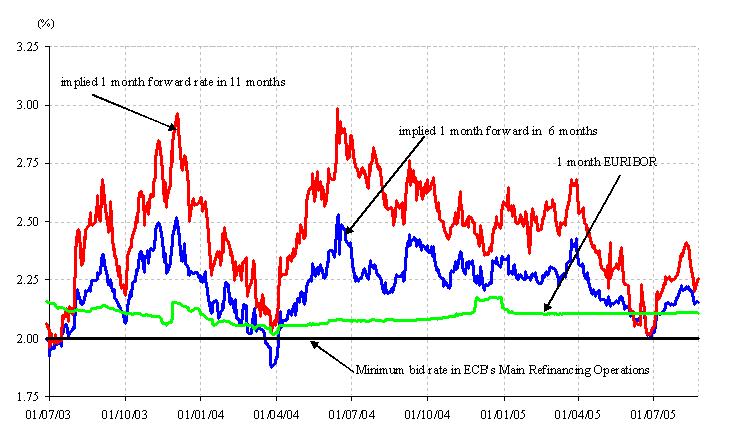

The fact that we have moved less frequently than the Federal Reserve, in particular over the last 2 years, has generated a very interesting discussion on central bank activism. The undisputed notion that the central bank should react to the state of the economy goes a long way to explaining why different currency areas have witnessed different degrees of central bank activism. Shocks of greater magnitude and/or longer duration, and an economic system in which exogenous disturbances run their course more strongly and speedily, can largely explain different policy responses, as measured by the frequency of policy moves and the cumulative change in the policy rate.

So, different contingencies and economic structures – quite naturally – can result in a different conduct of policy. And I could explain at length why in 2001 the highest rates in the euro area were only at the level of 4.75%, when they were at 6.5% in the United States and why the cumulative reduction in the easing cycle has been larger in the United States, only taking into account objective measures of the differences of amplitude of the economic swings that have characterised both sides of the Atlantic.[1] But I would like to share with you today some thoughts on a different sort of difference in “activism”: one that is not induced by the state of the economy, but rather one that finds deeper motivation in the central bank’s strategy.

It is the degree of activism that results from the way policymakers try to reconcile a fundamental tension inherent in their profession. On the one hand, as a quite general principle of prudent monetary governance, it pays to adopt a systematic policy focused on responding to the fundamental forces at work in the economy in a predictable manner, disregarding the vagaries of expectations and markets’ fads. This policy would enhance markets’ ability to anticipate the central bank’s behaviour, favour a smooth adjustment of the economy to disturbances, and prevent instability of expectations from injecting volatility into monetary policy, and in turn into the economy. If successful, the degree of activism displayed by this policy would be mainly related to the variability of the state of the economy. On the other hand, a central bank does also need to recognise that misled expectations can amplify and prolong the response of inflation and economic activity to an inflationary or deflationary shock. This would in general imply that the central bank should embark on an aggressive policy action in response to expectations instability. And, this will add to the degree of activism displayed by the policy rate.

I will argue that, whilst the central bank must always be ready to take aggressive action if needed, a well-designed institutional framework, which undisputedly assigns the central bank the primary objective of price stability, and the adoption of a clear monetary policy strategy, which quantitatively defines price stability and does not pretend to fine-tune directly the business cycle, can make the latter type of policy activism unnecessary in many circumstances. The reason is that this framework reduces uncertainty about the central bank’s ultimate motives, provides a stronger anchor for inflation expectations and makes it easier for the markets to map the expected path of the policy rate to the evolution of macroeconomic conditions. This would reduce the likelihood that expectations might over-react in the first place and, should expectation instability nevertheless occur, provides the central bank with an additional viable option.

I will argue that under some conditions the central bank can regain control of private expectations without necessarily changing interest rates, but by being visibly and credibly “alert”, explaining and stressing its commitment to maintaining inflation at levels consistent with the price stability objective. The threat to act will be more effective the more credible the central bank has been over time in actually delivering price stability, as defined quantitatively. The paradox would be that this policy of a priori “reinforced alertness” would make the central bank appear ex post less “activist” in terms of changes to the policy rate. Importantly, as a side effect, this policy would better sustain economic activity and minimise macroeconomic volatility.

In practice, the central bank would normally make use of all available options – as circumstances dictate – to counteract situations that have the potential for undermining confidence and perturbing market conditions for a lasting period. We have done that in the past and we will do it in the future. As an example, under the chairmanship of my predecessor, Wim Duisenberg, whose passing away a month ago has deprived our community of central bankers of a man of remarkable wisdom and lucid judgement, we took immediate decisions after the dramatic events of 9/11, pouring very large amounts of liquidity in euro, setting up a swap agreement with the Fed and decreasing rates. This has demonstrated very clearly that the ECB was eager to act decisively and immediately when appropriate and had absolutely no enshrined bias for waiting for the “slowest ship in the convoy”. This observation that all observers and market participants made was certainly important in reinforcing the credibility of the Governing Council of the ECB when embarking on a “reinforced alertness”.

In all situations, we have been aided in our task by our monetary policy strategy. Clarity about the quantitative definition of price stability and about the framework we adopt to assess risks to price stability has been particularly important for us to ensure a smooth start to Monetary Union in Europe. Such clarity afforded considerable latitude for action in the early years of the decade, despite repeated unfavourable shocks, and a remarkable leverage over market conditions.

The advantages of a rule-like behaviour

At first thought, a “discretionary” response to shocks might seem exactly what one would expect of a professional central banker. After all, each economic contingency is a unique combination of circumstances that, in its own way, is unprecedented, and will probably never repeat itself again in that precise form. So, each new contingency would seem to command a different, tailor-made response on the part of monetary authorities.

There is some grain of truth to this. But decades of reflections on the role of expectations in macroeconomics have taught us that monetary policy is not a sequence of isolated policy actions. When forming their expectations, agents seek to capture the general pattern of monetary policies, and it is that pattern that matters in shaping their economic behaviour. Therefore, the relevant problem to solve for central banks is not so much about the size and timing of a given interest rate move in response to a particular contingency. It is more about the strategy for repeatedly adjusting the policy instrument in response to the state of the economy, whatever this might be.

If the central bank is able to convince economic agents and markets participants of its analysis and assessment of the outlook, and about the policy measures that it is going to take in response to it, this mechanism of anticipation will act in self-equilibrating manner. As soon as the macroeconomic news is released, expectations of the short-term interest rates will adjust in the equilibrating direction that markets expect to see implemented by the central bank. Such a credibility asset can turn out to be very beneficial in cases of major shocks and risks.

It is clear that a world in which central banks’ inclinations and market views are perfectly aligned is unlikely to emerge in reality. However, decades of academic reflection and central banks’ quest for stability have not past in vain. Our keen preoccupation with making ourselves understood by words and deeds has established a new climate of mutual understanding with academics, investors, market participants and public opinion at large. We have stepped up the number of gatherings in which we document our strategies and carefully explain our actions to broad audiences. On the markets’ side, our constant drive toward a continuous and all-round exchange with the public has been tangibly rewarded with high marks. The leverage of central bank pronouncements and actions over private economic behaviour has strengthened to an extent that we could not have remotely imagined only a decade ago.

There is no shortcut to fully revealing a central bank’s strategy. This disclosure – which we perform in an ongoing process of interactions with a large and complex audience – helps to clarify the policy environment and anchors expectations. But unless deeds support words, words will be unconvincing. So, there is no better way to establish a reputation for actually following a strategy of monetary policy than letting the public infer and recognise it from our repeated behaviour. Consistent behaviour is a precondition for outsiders to understand our actions and believe our pronouncements. In synthesis, it is a precondition for our credibility.

This capital of credibility is built over time and easily squandered. So, as a general principle, in weighing up the arguments for and against such and such a decision, we should never fail to appreciate that our behaviour has durable significance. It can add to the asset of credibility, or detract from it in important ways.

A corollary: beware of false signals

In my view, the statement that a reputation for consistent behaviour is an asset carries an important corollary with it. We should guard against over-reacting to indicators that might give a distorted picture of economic reality and thus promote policies that might be regretted – and hastily reversed – in retrospect.

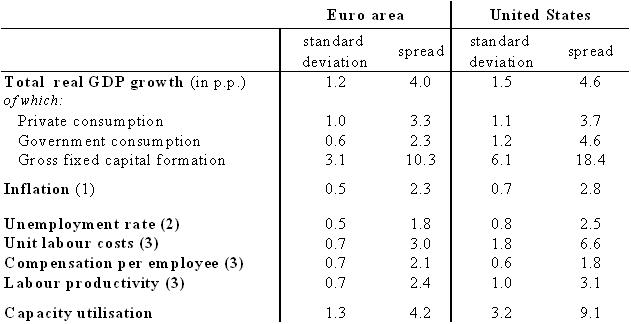

To be more specific, in carrying out our strategies, we would ideally need accurate, quantitative, contemporaneous readings of the current pertinent economic, monetary and financial data. For instance, knowledge of the level of production that would be consistent with stable prices, the so-called “natural” rate of output, would be an important tool for assessing whether the stance of policy is broadly appropriate. However, estimates of the time-varying natural rate of output, and by implication measures of economic slack, are notoriously very imprecise. Even in hindsight, different estimation methods yield quite dispersed figures. Allowing for data revisions, that is re-appraising those synthetic indicators by aggregating revised data, only makes the uncertainty surrounding those measures more pervasive.

Now, acting too strongly on such indicators, only to be forced to reverse gear soon thereafter as new estimates become available, risks the danger of an erratic policy process. Importantly, it confounds the markets, which look back on our record and try to make sense of our past behaviour using the wisdom that is only available in hindsight. If this gives indications that differ markedly from those which could be reasonably inferred in real time, outside observers might extract a distorted picture of our intentions. Even prudent policy conduct could appear ex post – and be deplored – as evidence of incorrect decisions. This could drain the central bank’s stock of credibility.

All this is not new and revives memories of the 1970s. Were the spectacular policy mistakes of that unfortunate decade due to poor economic theory, poor policy or a biased representation of the economy? It was probably a blend of all of these factors, with the last one carrying substantial weight.

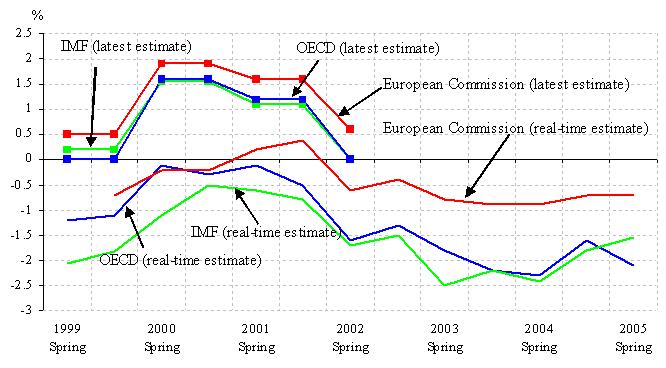

Advances in theory since the 1970s and more sophisticated econometrics have not immunised the policy process from these potential pitfalls. And here is a concrete example of what I mean. The first estimates of the output gap are typically available during the reference year, and are then revised over subsequent years. It is important to note that the final estimate is not available for a very long period of time: 1999 estimates, for example, were still revised by non-negligible amounts in 2004. Revisions are also large: they can often affect the sign, as well as the magnitude of the estimates. In the case at hand, for example, the revised output-gap measure available to us today is positive in almost all estimates for 1999, 2000 and 2001, but it was estimated to be negative in real time [as shown in Chart 1.[2]]

Uncertainty is even higher for output gap projections, which are the only measures of output gap existing at the beginning of each year. For example, the real-time estimates of the output gap for 2005, published in spring by the European Commission, the IMF and the OECD, differ on average more than 25% from the output-gap projections that these institutions made at the end of 2004. And, if we add to the real-time measures of the output gap for 2005 the average size of revisions observed in the past, we can conclude that it may ex post turn out to be anything between -3.6% and +0.8%.

Clearly, output-gap measurement issues are not a fact of the past. Central banks also need to cope with this problem at present. I take this as a warning that the central bank should not rely on any simple indicator of economic slack in taking its policy decisions. To conclude this point I would say that there are, undoubtedly, great differences in terms of monetary policy strategy between us at the ECB and, to use Alan Blinder terms, the Greenspan’s Fed. We consider the public display of our arithmetic definition of price stability essential to the success of our strategy. We equally deem that the communication to the markets of our two-pillar monetary policy concept is important and has been of great help in the actual implementation of our policy. It is true that, in that sense, we belong to two different schools of thoughts on each side of the Atlantic.

But there is an important point on which on the contrary we share exactly the same views. We both want to be as comprehensive as possible in our analysis. We both do not want to neglect any information, any in-depth appreciation of a particular situation. We both do not want to rely exclusively on a single particular model of the economy, as sophisticated as it may be. I have myself said several times that the Governing Council of the ECB has no intention of being the “prisoner” of a single system of equations. We both highly praise “robustness”. There is no substitute for a comprehensive analysis of the risks to price stability that pays due attention to all relevant information. It stands better chances of anchoring policy and – through that channel – expectations in a durable fashion.

Responding to risks of instability

It is to expectations and the way their dynamics should be factored into policy that I now turn.

Why should expectations be a problem within a credible policy environment? Because the economy is never at rest. Agents have to catch up with the continuous change in their environment by an ongoing process of learning. When shocks are moderate, or the underlying evolution of the economic structure proceeds at a slow pace, imperfect information and learning do not excessively complicate our interactions with the private sector. But there are times in which stormy perturbations and accelerated structural change make uncertainty more acute. These are times in which a perpetual process of learning on the part of economic agents can have implications for the overall stability of the economic system – to some extent, independently of the monetary policy regime that is in place. If agents do not possess rational expectations, but have to re-estimate continuously the coefficients of an unknown model of the economy, using rolling windows of new observations, it can well happen that a shock of sufficiently serious magnitude can unsettle expectations, even under credible monetary institutions. The reason for this is simple. It might become impossible for private forecasters quickly to form a reasoned guess about the scale of the shock, its duration and persistence, and the likelihood that it might not be easily washed away, so that it would become, in their eyes, embedded in the fundamental relations regulating the functioning of the economy for some time to come. Long-term expectations thus may over-react to the shock. They may drift endogenously reflecting the impact that the unprecedented disturbance exerts on agents’ own re-assessment of the key structural features of the economy.

These are times in which, typically, there is a disconnection between private views about the macroeconomic outlook and the central bank’s own internal forecasts. The expectation of the most likely outcome entertained by the median agent in the economy is likely to depart from the central scenario that is considered most plausible, given the conditioning assumptions, for purposes of the central bank’s own internal assessment of the macroeconomic outlook. As agents’ expectations shape the market reaction to new economic data and to the central bank’s own policy actions, they embed information that the central bank cannot neglect or grossly underrate in its own analysis.

The difficulty lies in devising a prudent way to factor such situations into policy. And here is where the fundamental tension inherent in our profession comes in. On the one hand we want to keep our eyes on the fundamentals and avoid being misled or intoxicated by what could well be noise and unfounded overreactions. On the other hand, excess endogenous volatility in private expectations could indeed provide advance warning of pending risks that the central bank should take into account. Misled market expectations can prolong the dynamic response of inflation and real activity to an inflationary or deflationary shock of sufficiently great potency. This might entail serious risks of instability. Recent work done at the Federal Reserve Board by Athanasios Orphanides and John Williams[3] shows that, in these circumstances, a rise (or fall) of private inflation expectations beyond (or short of) those implied by perfect knowledge should elicit a more aggressive response than could be expected in normal conditions. The optimality of such a response is corroborated in a study by Vitor Gaspar, Frank Smets and David Vestin[4] at the ECB. They argue that when agents perceive inflation persistence to be high, inflationary – or deflationary – shocks can easily become entrenched, because agents suspect that these forces will be perpetuated by the economic structure.

An aggressive policy adjustment in reaction to detected signs of expectation instability can help head off the risks that one might see associated with the manifestation of such phenomenon. It might be an effective way to prove that the central bank is perceptive to changing circumstances – even to changing views about circumstances, present and prospective – and ready to act pre-emptively. However, any unexpected and possibly unprecedented action that the central bank takes in response to these risks might disorient the market. So, the process by which market participants price long-dated securities and assets in general might be impaired, as investors might misinterpret the central bank’s intentions. As a consequence, asset prices could be driven far away from fundamental values and confidence could be undermined.

This would suggest that action may not always be advisable. Sometimes, more optimal behaviour consists in appropriately communicating the central bank’s assessment of the fundamental state of the economy and its prospects in order to regain control of inflation expectations. In the long term, the advantages of having systematically avoided hasty reactions outweigh the benefits that might be apparent in the short term. By maintaining a steadier posture, the central bank embracing this policy views its role as that of a lighthouse or, more accurately, a lightship, in a storm. In this respect, building a reputation for a calm and firm management of the events can pay off.

The viability of this approach – and its efficiency – is enhanced when the central bank operates within a clearly defined institutional framework. In policy-making regimes that feature a primary, sharply-defined objective – reinforced by a precise numerical definition of the central bank’s notion of price stability – the likely evolution of the economy vis-à-vis that objective gives clear indications as to the most likely future stance of policy. This is supposed to diminish the odds that expectations might start diverging in the first place. And, if expectation instability should develop nonetheless, being able to refer in communication unambiguously to that objective can – at times and under certain circumstances – provide an effective substitute for tangible action, provided “credible alertness” of the central bank is undisputed by market participants.

Action and vigilance

All in all, the art of central banking involves finding a fine balance between action and words in order to react to changing market expectations. The easing cycle that started in 2001 and the instability in inflation expectations that occurred in 2003 represent 2 episodes that illustrate how the ECB has in practice devised its own way to address these issues.

In early 2001 the ECB started an easing cycle. At the time, on the heels of significant adverse supply shocks and rather strong wage dynamics, inflation rates were high at levels unseen since the late phases of convergence to the new currency in the euro area. However, we equally saw an upcoming worsening of the outlook for economic activity, as indicated by the rapid decline in several confidence measures. This lowered the risks to inflation coming from wages, and inflationary pressures more generally.

While we assessed that the information coming from monetary trends was consistent with price stability over the medium term, we took the view that the upward inflationary pressures were of a temporary nature and warranted looking through the shocks that had caused them to emerge. We held the view that a protracted period of weak economic activity, and the increasing odds that the recovery would not materialise soon, would eventually facilitate a downward adjustment in price and wage-setting behaviours. The easing cycle, which we readily initiated, registered a cumulative decline in the policy rate of 275 basis points over 2 years, moving the policy rate down to 2%, which was below the lowest intervention rates of the central banks over a century for an overwhelming majority of countries that are members of the euro area, including Germany.

Let me stress a point which is often underestimated. What looks perfectly appropriate with the benefit of hindsight, moving down interest rates to such low levels – exploring secular uncharted waters – was indeed bold ex ante for a new institution, which in mid 2003 was exactly 5 years old – and for a new currency – that at that time was 4½ years old. It had not been done to that extent by either the Fed or the Bank of England! In retrospect, we have been bold and equally lucid. There is no doubt that the Governing Council used appropriate judgement in granting high weight to the decrease of inflationary pressures stemming from the downside risks to economic activity. And there is also no doubt that the resolute action of the ECB, based on its own inflationary analysis, not only permitted to stabilise inflation and inflationary expectations, but also helped to forestall a much deeper slowdown in the economy.

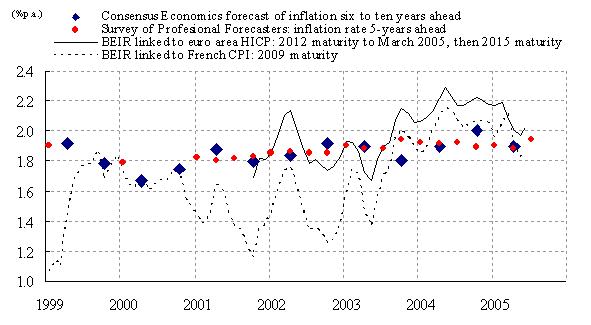

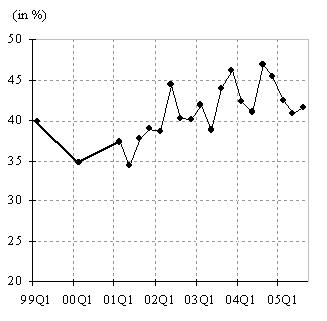

The behaviour of inflation expectations brings me to the other episode I have mentioned. Long-term inflation expectations, which had remained well anchored at levels in line with the ECB definition of price stability from the outset of Monetary Union in January 1999, started displaying signs of upward instability in the second half of 2003 after the last decision to decrease rates. The ten-year Break-Even Inflation Rate (BEIR) suggested an incipient rise in longer-term inflation expectations [see Chart 2]. Survey-based data also revealed that the probability assigned to inflation outcomes being above our definition of price stability at long horizons was rising [see Chart 3a].

Movements in these indicators of long-term inflation expectations possibly reflected concerns that the policy stance was incompatible with the inflationary impact of the surge in oil prices, accompanied by a pick-up in economic activity and protracted conditions of ample liquidity, which could be seen as favouring spending propensities and granting firms increasing pricing power.[5]

The rise in inflation expectations was considered very carefully by the ECB’s Governing Council. It was of utmost importance to regain control of these expectations. For all reasons that would be common to all central banks plus three which were peculiar to the ECB. First, as I have already explained, we had been bold in exploring new territory in the lower side of interest rates, and we had to dissipate any wrong sentiment in the markets that we could have neglected our main objective, namely price stability. Second, we also had to eliminate the risk that part of the market might be tempted to regard the single currency as embedding the average features of the constituent currencies, rather than inheriting the characteristics of the best performing monetary regimes that constituted its legacy: that the euro, since its inception, has been, was and will be at least as credible, as stable and as good a store of value as the most credible national currencies were, was a fundamental goal of Monetary Union, remarkably marshalled with the greatest success at the time of the transition. And, third, because our analysis was that market participants – by possibly over-assessing medium and long-term inflationary expectations – were pushing up medium and long-term market rates at a moment when it was not necessarily advisable in our own judgement.

Our concern about rising inflation expectations was signalled to the market from autumn 2003 in the press conference. Over time, our communication became increasingly “alert”, signalling our vigilance to the upside risks to inflation which grew at the time. We made it clear in our June 2004 policy statement, stating that such an upward trend in inflation expectations called for “particular vigilance”, and in September the expression of concern was reinforced with a statement of “strong vigilance”, making it crystal clear that the ECB was ready to take whatever action necessary to eliminate the drift in expectations and restore stability.

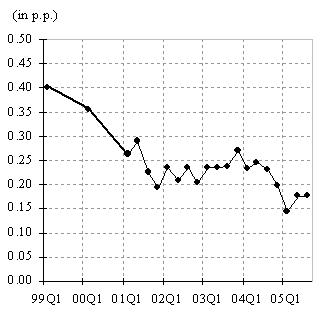

It is of course difficult to isolate the effect of our renewed emphasis on our objective and on the determination with which we would enforce it. But what we could observe from the second quarter of 2004 onwards was that measures of inflation expectations stabilised, then started to edge down and the probability assigned by survey respondents to inflation outcomes being higher than our price stability objective declined. We also observed a decline to unprecedented low levels in the standard deviation of individual respondents’ point forecasts, the “disagreement”, revealing increased alignment of private sector expectations around a focal point – which was coherent with our notion of price stability [see Chart 3b]. As the stabilisation of inflation expectations and their following decline coincide with the display by the ECB of its constant alertness as a key feature of the central bank’s policy, it can probably be argued that the market had become increasingly aware of the ECB’s readiness to act, and therefore that the ECB’s communication was one of the main factors driving expectations. An argument supporting this view is that the decline in Break-Even Inflation coincides with a sharp rise in oil prices. This constituted a major break from the past, when rises in oil prices regularly led to higher Break-Even Inflation rates. However, other factors also may have contributed to the fall in expected inflation, such as technical market factors, dampened dynamics in labour costs and increasing weakness in leading indicators of economic activity. Of course, while communication can play a decisive role in steering expectations, it is in the end the actual conduct of monetary policy and its success in maintaining price stability that over the longer run will determine inflation expectations.

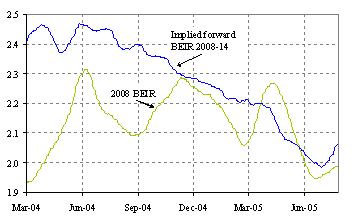

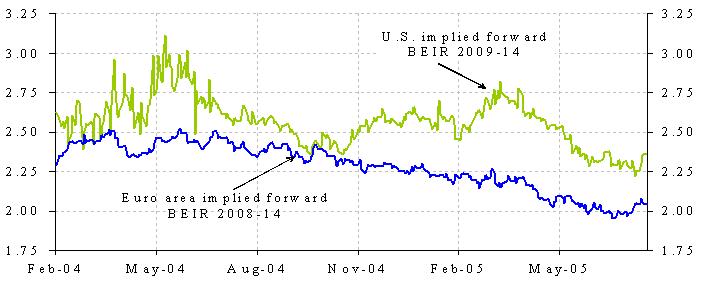

Further insights about this episode can be obtained by looking at developments in inflation expectations at different horizons [see Chart 4a]. The short-term Break-Even Inflation Rate (derived from instruments with maturity 2008) was not lastingly affected by the ECB’s communication of 2004 and remained at values slightly above the ECB’s definition of price stability all along 2004 and up to June 2005. As should be expected, its dynamics were more closely associated to movements in actual inflation and short-term indicators of inflationary pressure, such as oil price dynamics. However, the implied forward Break-Even Inflation Rate (referring to the period 2008-14) – which one would expect to reflect much more closely central bank’s credibility – exhibits a downward trend that starts in mid-2004. These patterns are even more striking if compared to the experience of other countries with a long track record, such as the United States. Over the same period, indicators of short and long-term inflation expectations in the United States display a tighter association [see Chart 4b], and, in turn, they are more closely correlated with actual inflation and developments in oil prices.[6]

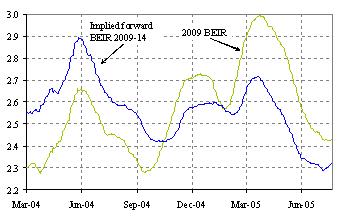

Over the last 2 years, stability in long-term inflation expectations was restored without engineering policy actions. The easing cycle that started in 2001 has not been reversed yet and the ECB has kept the policy rate constant at 2% since June 2003. During this period, the ECB has stressed that its policy assessment is conditional to macroeconomic conditions and this seems to be well understood by the markets. Changes in economic conditions and concomitantly in the ECB’s assessment of these conditions and their implications for the prospects, and the associated risks, for economic activity and inflation have allowed market participants to read signals about future changes in the policy rate. This is evident in movements in money-market forward rates, which are mainly driven by expectations of future policy rates: although the ECB has maintained constant its interest rates over this long period, forward rates have displayed substantial movements [see Chart 5]. A close look at these movements, and especially their timing, show how difficult it has been to correctly forecast the turning point during the current economic cycle in the euro area and the outlook for price stability, as evidence of a brightening in the prospects for a gradual economic recovery was shortly afterwards contradicted by the appearance of downside risks to economic growth, and as oil prices showed significant volatility. This pattern of events has repeated itself more than once over this period and uncertainty has still to fully dissipate.

The Governing Council, on the basis of its comprehensive economic and monetary analyses, has constantly monitored and assessed macroeconomic conditions and the outlook for price stability, and, in its judgment, overall, they have required keeping the policy rate at 2% in each meeting over this period. In the monthly press conference following the Governing Council meeting in which we discuss monetary policy, I have very regularly made the point that we were not making any promises to the markets about future policy moves and that we stood ready to act as soon as is necessary to maintain price stability.

Conclusion

If I had to draw some lessons for the future both from what has been observed on this side of the Atlantic, during Alan’s tenure, and what has been our experience in Europe, I would like to suggest three words: risks, robustness and credibility.

First, we have to stand ready at any time to weather the materialisation of new risks. The last 18 years have been particularly impressive from that standpoint. Those risks are probably the unavoidable and necessary counterpart of the immense chances that science and technology on the one hand, and the success of emerging economies and globalisation on the other, are bringing about in the world economy. Being intellectually and conceptually ready is extremely important. Incidentally, that is the reason why financial stability should continue to be of the essence and be a constant inspiration for monetary policy.

Second, we have to fully accept that our economies, as well as the global economy, are experiencing a period of very rapid structural changes. I would fully subscribe to Alan’s remark that “the economic world … is best described by a structure whose parameters are continuously changing”. It is even truer in Europe. Because in addition to the impact of science and technology, in addition to the effect of globalisation, in addition to the very rapid demographic changes that characterise the industrial world, we also have to take into account the structural transformations that Europe has boldly marshalled for itself: the single market, the single currency, the historic enlargement. But the lesson is valid for all. Robustness in the present situation is key and we should not depend on a single model which would necessarily impoverish considerably the wealth of information needed for an enlightened decision.

Third, I would stress more than ever for the future the concept of credibility. It is because the Fed has, throughout the last 18 years, been very highly credible that remarkable successes have been achieved on price stability, even without what I would consider as a precondition for anchoring inflationary expectations: a quantitative definition of price stability. In all difficult episodes and crises the credibility of the Fed has been decisive in the effectiveness of its handling of the situation. In the case of the Governing Council of the ECB I have explained that our credibility has enabled us to regain full control of inflationary expectations with remarkable efficiency over the last two years. And this was because observers and market participants rightly had the intimate conviction that we intended to be absolutely ready to act at any time if needed and were not inhibited in any respect either by unconditional commitments – that we have always carefully avoided – or by any kind of well intentioned public pressures coming from many circles, including the political sphere, of which we were not particularly deprived since the setting up of our Institution.

I thank you for your attention.

| Chart 1 Measures of output gap for the euro area |

|---|

|

| Source: European Commission, IMF, OECD. Note: The European Commission’s output-gap measure displayed in the chart refers to “trend GDP gap”. Making the simplifying assumption that data revised 3 years after the initial estimates are approximately correct, the chart displays revised data for the period up to spring 2002. |

| Chart 2 Developments in long-term inflation expectations |

|---|

|

| Note: Last observation is April 2005 for Consensus Economics forecast, and July 2005 for SDF and BEIR. |

| Chart 3a Survey of Professional Forecasters: probability that 5-years ahead inflation may stand at or above 2% | Chart 3b Survey of Professional Forecasters: disagreement of 5-years ahead forecast of inflation |

|---|---|

|

|

| Note: Disagreement is measured as the standard deviation of individual forecasters’ point estimates. |

| Chart 4a Developments in short-term and long-term inflation expectations in the euro area (20-day centred moving averages of daily observations, March 2004-August 2005) | Chart 4b Developments in short-term and long-term inflation expectations in the United States (20-day centred moving averages of daily observations, March 2004-August 2005) |

|---|---|

|

|

| Note: short-term inflation expectations are measured by the 2008 BEIR. Long-term inflation expectations are measured by the implied forward BEIR 2008-14. | Note: short-term inflation expectations are measured by the 2009 BEIR. Long-term inflation expectations are measured by the implied forward BEIR 2009-14. |

| Chart 5 Money market rates, implied forward rates and minimum bid rate |

|---|

|

| Note: The minimum bid rate in the ECB’s Main Rifinancing Operations is one of the ECB’s key policy rates. Last observation is 23 August 2005. |

ANNEX

| Table 1 Dispersion in economic activity and inflation in the euro area and the US (1999Q1 – 2005Q1) |

|

| Sources: European Commission, US Bureau of Economic Analysis, Bureau of Labor Statistics, Federal Reserve Board. Note: Spread is the difference between the maximum and the minimum value in the sample. (1) HICP for the euro area, CPI for the US. Dispersion is measured on monthly y-o-y growth rates. Last observation is June 2005. (2) Dispersion is measured on monthly data. Last observation is June 2005. (3) Total economy for euro area and Business sector for the US. |

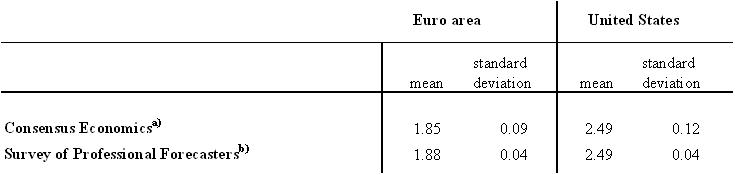

| Table 2 Survey-based measures of long-term inflation expectations for the euro area and the United States (1999-2005) |

|---|

|

| Sources: Consensus Economics Inc., ECB calculations, Reuters. Note: (a) Long-term inflation expectations from Consensus Economics refer to 6-10 years ahead. The last observation is April 2005. For the euro area, data before 2003 are taken from ECB Working Paper No. 273. (b) Long-term inflation expectations from the Survey of Professional Forecasters refer to 5 years ahead for the euro area and 10 years ahead for the US. Last observation is July 2005 for the euro area and August 2005 for the US. |

| Chart A Long-term implied forward Break Even Inflation rates in the euro area and the United States |

|

| Source: Reuters and ECB calculations. Euro area BEIRs are derived from Italian government inflation indexed bonds maturing in 2008 and 2014. |

-

[1] Table 1 in the Annex displays the evolution of several macroeconomic indicators both for the euro area and the United States over the last few years.

-

[2] Chart 1 displays estimates of the output gap constructed by the European Commission, the IMF and the OECD. To better contrast the difference between initial estimates and revised data, Chart 1 shows real-time estimates and the latest available revisions only and, making the simplifying assumption that data revised 3 years after the initial estimates are approximately correct, it displays revised data for the period up to spring 2002.

-

[3] Athanasios Orphanides and John Williams (2005): “Inflation Scares and Forecast-Based Monetary Policy”, CEPR Discussion Paper Series No. 4844.

-

[4] Vitor Gaspar, Frank Smets and David Vestin (2005): “Monetary Policy under Adaptive Learning”, ECB, mimeo, available at http://econ.ucsc.edu/~walshc/Workshop_Program_links.pdf.

-

[5] BEIR may have been also affected by technical market factors. When assessing developments in BEIR, caution is needed. Beyond short-term movements in financial prices that may distort the information content of long-term interest rates, an upward movement in BEIR may signal an increase in inflation expectations or in the risk premium associated to higher inflation uncertainty, although both are of obvious concern for a central bank.

-

[6] This decomposition of Break-Even Inflation into short and long-term expectations can be carried out for the euro area only from 2004, as the financial instruments needed to compute it are not available for previous periods. However, survey-based data are available since 1999 - the inception of the single monetary policy. Table 2 in the Annex presents mean and standard deviation of these survey-based measures of inflation expectations and compare them with corresponding measures of inflation expectations for the United States. Chart A in the Annex displays long-term implied forward Break Even Inflation rates for the euro area and the United States.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem