- THE ECB BLOG

Don’t take it for granted: the value of high-quality data and statistics for the ECB’s policymaking

Blog post by Isabel Schnabel, Member of the Executive Board of the ECB

20 October 2020

Institutions all over the world are today celebrating the third World Statistics Day with the theme “Connecting the world with data we can trust”.[1] Established by a UN Resolution, this day reminds us that data and statistics are indispensable inputs for sound policy decisions. Many take the availability of data for granted and do not question where and how data are produced.

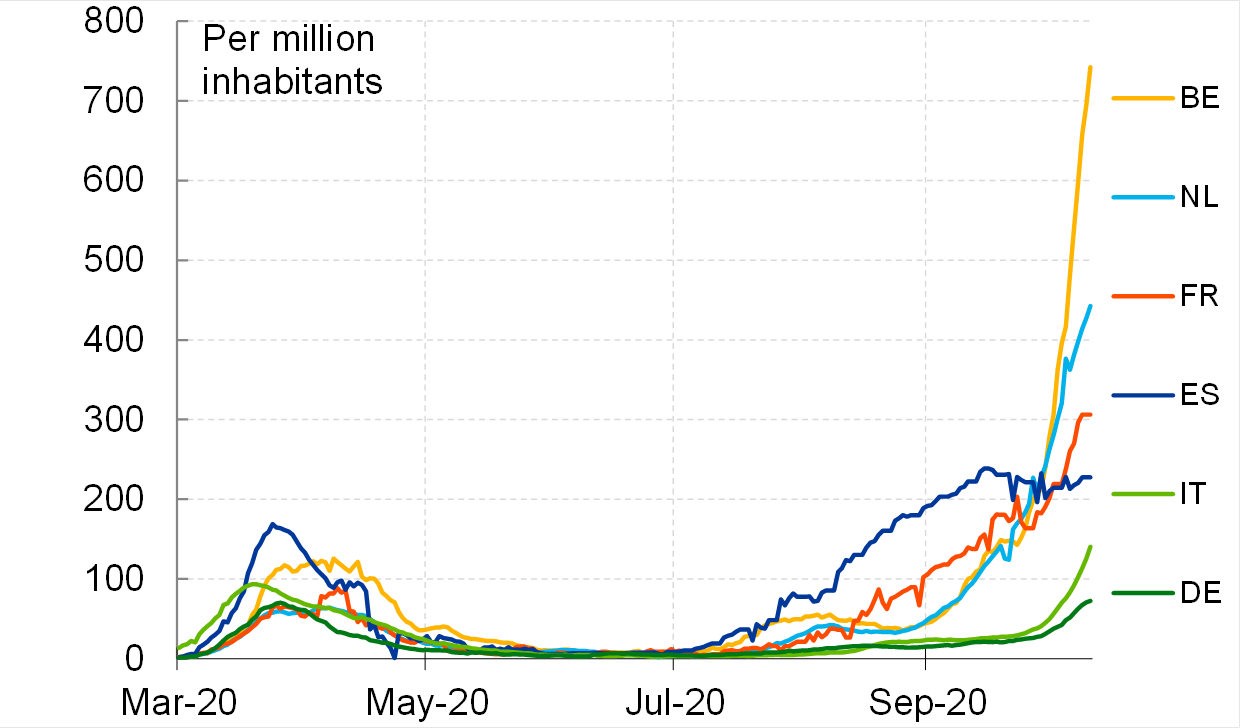

But since the beginning of the coronavirus (COVID-19) pandemic, everyone has started to appreciate the value of data. In order to assess the current health situation, politicians follow the evolution of infection numbers closely (Chart 1) and use them to decide which measures to implement to contain the virus. It is well understood that timely, reliable and granular data are crucial in order to take effective decisions.[2]

Chart 1

COVID-19 new daily infections, seven-day moving average, per million inhabitants for selected euro area countries.

Source: Bloomberg.

Notes: Confirmed COVID-19 case counts compiled by Bloomberg Newsroom. Counts are subject to change as governments survey and confirm cases. Data are based on reported values as of midnight EST. Sources include Johns Hopkins University, the World Health Organization, the European CDC and Italy’s Ministry of Health.

Latest observation: 19 October 2020.

Data and statistics are also at the core of the ECB’s decision-making process. At our most recent monetary policy press conference, President Christine Lagarde began her Introductory Statement with the words “The incoming data […] suggest”.[3] This illustrates how strongly the ECB’s monetary policy decisions are driven by data and underlines the importance of statistics for achieving our policy objectives.

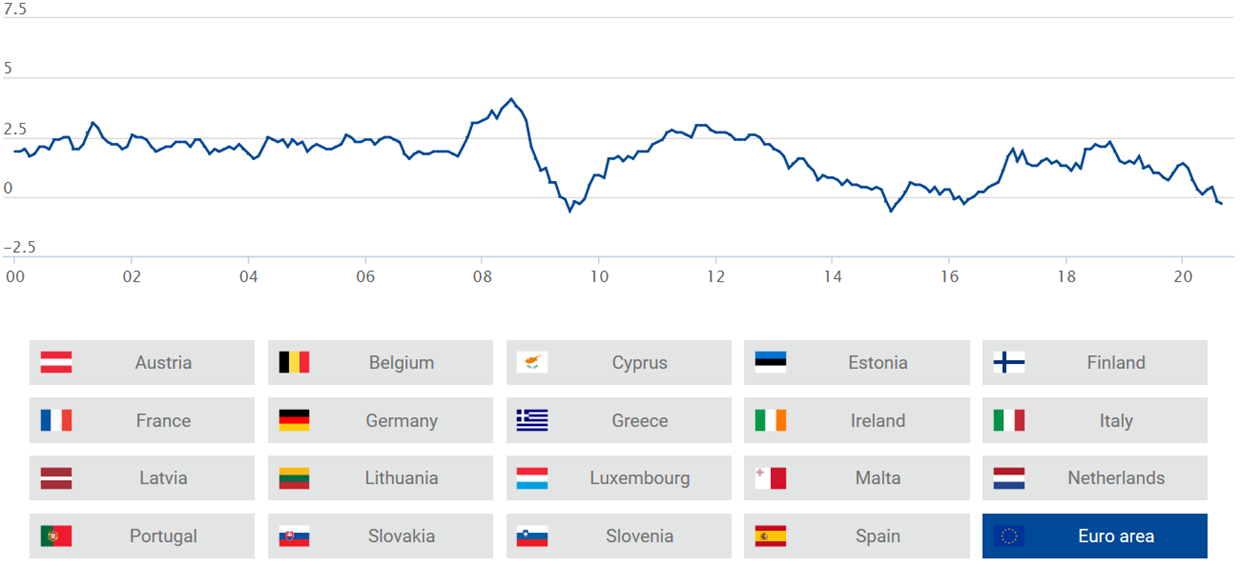

The ECB’s mandate is to safeguard price stability in the euro area – that is, to maintain an inflation rate of below, but close to, 2% over the medium term. So the most important data for our policy decisions are those on inflation. Our main measure of inflation is the Harmonised Index of Consumer Prices (HICP), calculated at euro area level (Chart 2). But the HICP is only one of many economic and financial indicators that the ECB’s Governing Council assesses when making its monetary policy decisions.[4]

Chart 2

Interactive presentation of consumer price inflation in the euro area: Harmonised Index of Consumer Prices.

(the interactive version of the chart is available on the Euro Area Statistics website)

Sources: ECB, Eurostat.

Notes: The chart is based on data available on the Euro Area Statistics website and shows overall HICP inflation rates (annual rate of change) for the euro area, calculated at monthly intervals. The visualisation tool, which is available on the Euro Area Statistics website, allows users to add inflation rates for the index of consumer prices used at national level. The tool also allows the visualisation of monthly inflation rates for individual goods categories that are used in calculating the overall index of consumer prices.

In this blog post, I will explain why data and statistics – the collection, organisation and presentation of data – are of strategic importance for a policy institution like the ECB. I will focus on three essential aspects: first, the independence of official statistics; second, data quality and reliability; and third, effective communication.

We will see that the provision of high-quality statistics by the ECB requires a sophisticated support infrastructure and involves expert input from statisticians across the Eurosystem. At the ECB, around 280 statisticians in the Directorate General Statistics work to ensure that high-quality statistics are available to decision-makers, in close collaboration with statisticians at the national central banks (NCBs) of the 19 euro area countries and other international bodies, such as Eurostat.

The strategic importance of data and statistics

Data are increasingly becoming a strategically important input for robust decision-making processes, both in public institutions and in the private sector.

The availability of data has increased enormously over the past decade. In the financial sphere, the global financial crisis acted as a catalyst for this development: policymakers realised that, in order to identify warning signs in the financial system at an early stage, they need to analyse risks at the microeconomic level (e.g. by analysing transaction-level data on the links between individual banks). The decision to supplement macroeconomic statistics with the collection of micro-level data is the main factor explaining the substantial growth in the volume of data produced and used by public authorities like the ECB (Chart 3).

Chart 3

Evolution of the quantity of time series and data points at the ECB.

Source: ECB.

Notes: The number of time series (a series of data observations indexed in time order) available within the ECB’s Statistical Data Warehouse has increased tenfold relative to the start of the financial crisis. The ECB increased the collection of micro data shortly after the start of the financial crisis. Today, 2.9 trillion data points (individual observations at a certain point in time) are available, including AnaCredit (analytical credit data for individual bank loans), CSDB (Centralised Securities Database), SHS (Securities Holdings Statistics), RIAD (Register of Institutions and Affiliates Database), as well as SUBA (Supervisory Banking Database) statistics collected under the financial and common reporting frameworks (FINREP and COREP).

The growing volume of data creates challenges for policymakers and those responsible for producing statistics. It implies that existing data governance frameworks need to be overhauled. It also requires the application of novel data science techniques, including machine learning and artificial intelligence.[5]

Moreover, international collaboration is vital. This is all the more true for the ECB, whose work relies on data from 19 euro area countries and beyond. For data and statistics to flow freely across borders, users all over Europe have to be able to access and analyse datasets generated by national governments and public authorities. This interoperability among different national statistical systems is only feasible if the data are structured, standardised and categorised using integrated data models and the same digital identifiers for statistical entities, such as individuals, firms and transactions.[6] The ECB has a clear interest in supporting this process of standardisation, while ensuring the necessary protection of privacy and confidentiality.[7]

The importance of independent statistics

But more data does not automatically mean better data. The independence of official statistics is a fundamental prerequisite for safeguarding the quality of statistics. It is enshrined in European legislation to avoid political influence and conflicts of interest that could affect the provision of data.[8] This is crucial for enabling policy makers to take sound policy decisions that benefit everyone in Europe. Therefore, any threat to this independence should be counteracted decisively.[9]

In line with this principle, the statistical function of the European System of Central Banks (ESCB) is based on a legal mandate to collect all necessary and relevant data in order to produce and release impartial, reliable, appropriate, timely, consistent and accessible statistics in countries under the ESCB’s responsibility.[10]

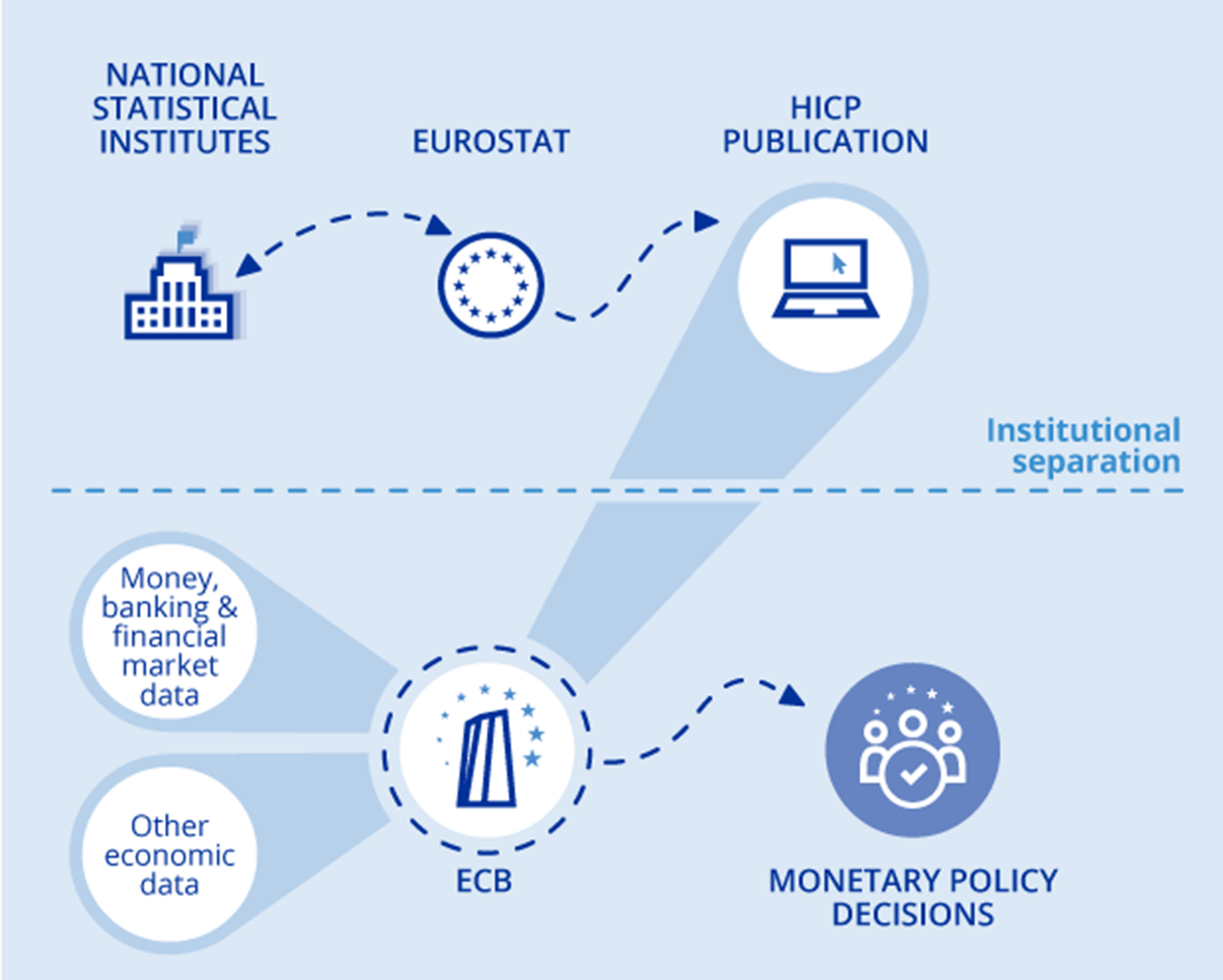

To ensure good governance, institutions that use specific indicators to measure their policy objectives should not produce these indicators themselves. For example, the ECB does not calculate the HICP itself. Instead, the European statistical authority, Eurostat – together with national statistical institutes across the European Union – is responsible for calculating the inflation rate. Hence, the measurement of price stability is institutionally separated from monetary policy decisions in the euro area (Chart 4).

Chart 4

Production of data entering monetary policy decision and the principle of institutional separation.

Source: ECB.

Notes: The European Official Statistics are organised in two systems. The European Statistical System (ESS) is led by Eurostat and the National Statistics Institutes. The ESCB is led by the ECB and the NCBs. The Directorate General Statistics coordinates the work on statistics within the ESCB. The production of the HICP is the responsibility of Eurostat so as to ensure institutional separation between producers and users of inflation statistics. The respective responsibilities for official statistics in the European Union are laid down in a corresponding Memorandum of Understanding.

The governance of the European Union and the euro area is reliant on the availability and dissemination of reliable official statistics.[11] However, European policymakers are not the only users of official statistics. Citizens, researchers, financial market participants and firms expect statistical offices to provide impartial statistics that are not influenced by the political process. Official statistics constitute a public good. Their production has to be transparent, and the results should be accessible to everybody, within the boundaries of legislation protecting data confidentiality.[12]

In effect, the independence and verifiability of statistics are necessary prerequisites for people to be able to trust the public authorities that draw on such data when implementing policies affecting people’s daily lives.

Ensuring the quality and reliability of statistics

Besides impartiality and independence, the quality of data and statistics is essential because it has a direct impact on the quality of policy decisions.

Data used for decision-making need to be consistent and comparable, both over time and across countries. Consistency and comparability, in turn, can only be guaranteed if robust and transparent processes are in place to maintain the quality of data.[13]

The increasing availability of poor-quality data creates opportunities for biased representation and misinformation campaigns. The work of statisticians is crucial in ensuring that such misinformation can be countered with objective and impartial information, based on high-quality statistics. Statisticians are therefore instrumental in helping to fight misleading narratives that can fuel populism.

The ESCB and the ECB attach great importance to the quality of statistics. We are committed to good governance, observe international data quality standards and ensure the confidentiality of statistical information.[14] Data quality is critical for our ambition to serve the European citizens and to act in the best interest of the general public. The Eurosystem therefore employs a rigorous approach with multiple checks to guarantee the quality of our data (Chart 5).

Chart 5

Multiple quality assurance steps in the production of statistics.

Source: ECB.

Note: The term “reporting agents” includes banks, companies, households and other agents subject to statistical reporting regulations. At national level, data is collected by NCBs in collaboration with the respective national competent authorities. To ensure consistently high data quality, national reporting agents, NCBs and the ECB jointly conduct plausibility checks (relative to previous data submissions), consistency checks, data checks vis-à-vis other data sources, confidence interval checks as well as syntax and format checks. Before publication of euro area and national statistics, the ECB also conducts confidentiality checks.

At the start of this process, reporting agents[15] provide data to their respective NCB, in line with a commonly agreed methodology and a synchronised timetable across the euro area. The NCBs then verify the data and make these statistics available to the ECB. In the final step, the statistical information is disseminated to the general public. At each step, statisticians ensure the quality of the data by conducting a comprehensive set of compliance and quality checks and by interacting with the reporting agents.[16]

Besides ensuring the quality of statistical information submitted by reporting agents, the Eurosystem’s statisticians also help to improve the efficiency of data collection, with a view to containing the costs imposed on reporting agents.[17] By simplifying data collection processes, our statisticians also enhance the quality of the data that are eventually submitted. Moreover, the continuous information exchange between the Eurosystem and reporting agents helps to minimise reporting errors, further improving data reliability.

High-quality statistics are beneficial for policymakers and reporting agents alike. Harmonised and standardised statistics make it easier for policymakers to devise a timely and targeted policy response to economic developments in the euro area. At the same time, the statistics become available to reporting agents, as well as other users, as a public good, which they can use for their own data analysis and for benchmarking, leading to better-quality decision-making.

In exceptional circumstances, the quality and reliability of data can be affected by unforeseeable events. At the height of the COVID-19 pandemic, for example, Eurostat statisticians faced substantial challenges in measuring HICP inflation as the quality of information was impaired by the inability to collect price information in shops while national lockdown measures were in place. The crisis also changed patterns of consumption behaviour: travel services, for example, were drastically reduced. If these changes prove to be persistent, they might affect the representative “basket of goods” that is used to calculate HICP inflation. Robust procedures need to be in place to deal with such temporary challenges and continue to ensure the quality of statistics, at both national and European level.

Communication matters, also for statistics

The production of independent and high-quality statistics is a necessary, but not sufficient, precondition for fact-based policymaking. In addition, effective communication of statistics is pivotal because it allows policymakers and other interested parties to understand the data and use them for their purposes. Accessible communication of statistics also enables people to understand policy decisions and hold decision-makers accountable for their actions.

At the same time, the rapid increase in the quantity of data requires statisticians to employ more sophisticated communication methods. Presenting data in clearly laid out tables is no longer enough. Given changes in user requirements and technological developments, modern techniques are needed to facilitate the presentation and digital sharing of data. Visuals and graphics are particularly powerful tools for communicating complex statistical information to the public, particularly if presented in an interactive way.[18]

As frequently underlined by President Christine Lagarde, the ECB is committed to improving its communication. By explaining its objectives and decisions, the ECB ultimately makes its monetary policy more effective. Furthermore, as a public institution, the ECB is transparent and accountable to all Europeans. Explaining the tasks of the ECB necessarily entails informing people about the statistics and economic data underlying our decisions in a manner that is as accessible as possible.

That is why the way we communicate will be a central element of the ongoing ECB monetary policy strategy review. Throughout this process, the ECB will take into account the views of civil society through a series of ECB Listens events, and the understanding of data, in particular of our measure of inflation, will clearly play an important role in this dialogue.

The ECB has therefore created a dedicated website to present and communicate data in an accessible way: the Euro Area Statistics website, available in 23 official EU languages. This website aims to improve the communication of central banking statistics by presenting selected core data series as interactive visuals, thereby facilitating the comparison and use of both euro area and national statistics. A core function of the website is that it allows users to easily share statistics in digital form, including through social media or by embedding infographics into other digital publications.

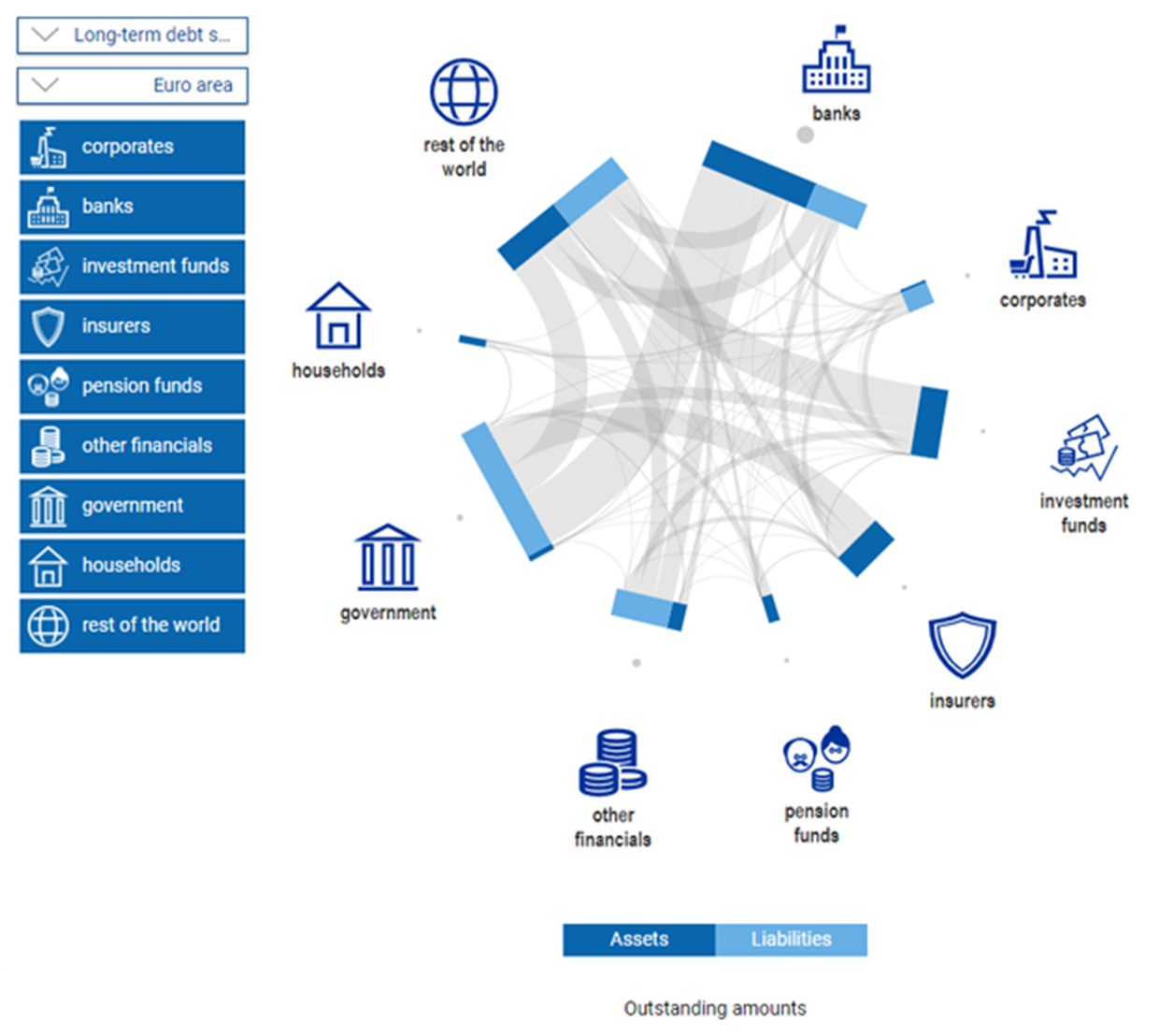

The chart below presents an example of a diagram created on the Euro Area Statistics website (Chart 6). The chart condenses a large set of individual statistics into one comprehensive visual representation of the underlying data. It illustrates both the holdings and the issuance of debt securities by different financial market participants and enables users to explore complex statistical information interactively.

Chart 6

Interactive presentation of the issuance and holdings of long-term debt securities in the euro area.

(the interactive version of the chart is available on the Euro Area Statistics website)

Source: ECB, Euro Area Statistics website.

Note: This chart illustrates which types of financial market participants are issuing long-term debt securities (light blue – liabilities) and which types of financial market participants are holding these long-term debt securities (dark blue – assets), expressed in outstanding amounts. The category “rest of the world” comprises long-term debt securities issued outside the euro area but held inside the euro area (light blue – liabilities); it also includes holdings of long-term debt securities issued in the euro area but held abroad (dark blue – assets). For each financial market participant, the width of the bar represents the absolute outstanding amount of long-term debt securities issued and held. Dark and light blue indicate the relative share of total issuance and total holdings of long-term debt securities by each type of financial market participant. An interactive version of this chart is available on the Euro Area Statistics website. The data is updated continuously using the latest data releases.

Our most recent innovation is a digital publication that explains the importance of money, credit and central bank interest rates for households in the euro area. This method of publication – in the form of a highly interactive communication tool designed to better explain the ECB’s tasks and policies – will be expanded to numerous other topics. The website makes extensive use of interactive charts and illustrations, which are automatically updated when new data become available. We plan to make more use of such interactive communication tools, complemented by short explainers and easily understandable videos, to improve people’s understanding of key statistical concepts.[19]

Conclusion

Data and statistics are indispensable inputs for decision-making by governments and public institutions. As a prime example of a data-driven institution, the ECB relies every day on data and statistics for analysing the economic development of the euro area, and the Governing Council takes monetary policy decisions after carefully examining a broad range of economic and financial indicators.

Three key ingredients are needed for data to provide a foundation for sound decision-making: appropriate governance, particularly the independence of official statistics, proper procedures to guarantee high data quality and effective communication.

At the ECB, statisticians and economists are continuously working to improve on these fronts, serving both our expert data users and European citizens, as we have done since the inception of the Economic and Monetary Union. First, several initiatives are under way to enhance the quality of statistics while reducing the administrative costs for reporting agents. Second, we are investigating new ways to leverage both existing and new (big) data sources and data science techniques to improve our economic analysis and gain additional insights into emerging policy questions related to issues such as climate change, crypto-assets and the distribution of income and wealth. Third, we are working on making our statistics more accessible, both to experts and the general public, including through the use of digital media and by improving our ECB Data Portal.

World Statistics Day is a good time to remember that we should not take high-quality and trustworthy data and statistics for granted. It requires tremendous effort, good governance and permanent striving for improvement in order to provide a reliable foundation for the ECB’s and other institutions’ decision-making.

I would like to thank Per Nymand-Andersen and Philippe Rispal for their contributions to this blog.

A recent report by the Committee for the Coordination of Statistical Activities contains a summary of the various initiatives taken by international organisations to support policymaking in the context of the COVID-19 pandemic.

“The incoming data since our last monetary policy meeting in July suggest a strong rebound in activity broadly in line with previous expectations, although the level of activity remains well below the levels prevailing before the coronavirus (COVID-19) pandemic.”

The ECB’s current monetary policy strategy comprises an economic analysis and a monetary analysis. For both types of analysis, data are crucial. In the area of financial supervision, data are also vital. Banking supervisors rely on high-quality information on banks (e.g. capital ratios, leverage ratios and liquidity ratios) as well as statistics on the quality of banks’ assets. This allows them to calculate key indicators such as the non-performing loan (NPL) ratio.

The importance of such data science techniques has prompted the European Commission to issue a White Paper on Artificial Intelligence as part of its work to support digitalisation in Europe.

Hence the existence of initiatives to promote standardisation and the ECB’s involvement in creating identifiers such as the Legal Entity Identifier (LEI), Unique Transaction Identifier (UTI) and Unique Product Identifier (UPI).

In fact, the reliance on standardisation and digital identifiers is in line with the new European data strategy and the Open Data Directive adopted by the European Commission as part of its efforts to support access to, and the availability of, digital data within Europe. The confidentiality of statistical information is ensured by Council Regulation 2533/98 (as amended).

Regulation No 223/2009 of the European Parliament and of the Council safeguards the independence of statistical offices in the European Union and thus their impartiality in providing input for decision-making by governments and public institutions. The high standards for the production of statistics in the European Union are also set out in Article 338(2) of the Treaty on the Functioning of the European Union (TFEU). Council Regulation No 2533/98 grants the ECB the right to independently collect statistical information in the pursuit of its tasks.

The relevance of the independence of statistics can be seen in the still-ongoing trials of the former President of the Hellenic Statistical Authority (ELSTAT), Andreas Georgiou, and other statisticians in Greece, in which the work and integrity of independent statisticians have been subject to substantial political pressure. The long judicial process and the lack of instruments at EU level to effectively guarantee the fair treatment of statisticians pose a fundamental challenge to the principle of independence. See also page 13 of the European Commission’s Enhanced Surveillance Report on Greece from June 2019.

Article 338(2) TFEU.

For example, the monitoring of deficit figures and debt-to-GDP ratios is a central element of the European Union’s Stability and Growth Pact.

For ECB statistics, accessibility is ensured by providing open access to the ECB’s Statistical Data Warehouse.

See the ECB’s Statistics Paper Series and statistics webpage.

See the public commitment on European Statistics by the ESCB. There are a number of frameworks that govern the quality of data and standards for handling this data globally, including the United Nations’ Fundamental Principles of Official Statistics.

“Reporting agents” are defined as the legal and natural persons and the entities and branches that are subject to the ECB’s statistical reporting requirements.

For the data reported by banks, these checks include plausibility checks (relative to previous data submissions), consistency checks, data checks vis-à-vis other data sources, confidence interval checks, comparisons with the data reported by banks of a similar size, as well as syntax and format checks.

For example, the ESCB recently provided input to the European Banking Authority to reduce the reporting obligations for banks while also increasing data quality. This objective can be achieved through the use of a common standard data dictionary, a common data model for statistical, resolution and prudential information requirements, harmonised transmission reporting formats, the removal of duplications and improved data sharing between authorities, among other measures.

Nymand-Andersen, P. (2019) “Modernising statistics: communicating the wealth of statistics in a digital age”, 62nd ISI World Statistics Congress, August.

A video related to the topic of this blog post (The ECB Explains: reliable statistics) has also been released today.