The impact of rising mortgage rates on the euro area housing market

Published as part of the ECB Economic Bulletin, Issue 6/2022.

Mortgage rates in the euro area have risen significantly since the beginning of 2022, following a historical low in 2021. Over the past two years the euro area housing market has been buoyant and has been supported by favourable mortgage rates (Chart A).[1] Aggregate euro area house price growth accelerated from an annual increase of around 4% at the end of 2019 to close to 10% in the first quarter of 2022 – the highest rate since early 1991. At the same time, housing investment recovered rapidly after the pandemic-related slump in 2020 to stand around 6% above pre-crisis levels in the first quarter of this year. The composite cost-of-borrowing indicator for households for house purchase fell to a historical low of 1.3% in September 2021 and remained largely unchanged until December 2021.[2] However, mortgage rates rose significantly (by 63 basis points) in the first half of this year, the largest six-monthly increase ever recorded.

Chart A

Housing investment, house prices and mortgage interest rates

(left-hand scale: annual percentage changes; right-hand scale: percentages)

Sources: Eurostat, ECB and ECB staff calculations.

Note: Mortgage rates refer to the composite cost-of-borrowing indicator for households for house purchase and are expressed in quarterly averages.

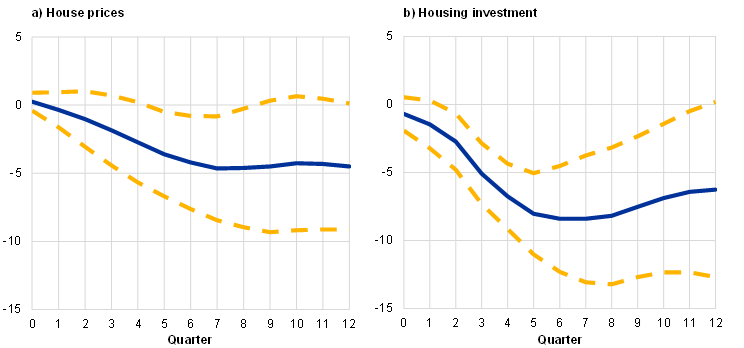

Empirical evidence suggests that housing market dynamics are very sensitive to mortgage rates. A linear local projection framework is used to shed light on the impact that rising mortgage rates have on euro area house prices and housing investment.[3] According to the estimated model, a 1 percentage point increase in the mortgage rate leads, all else being equal, to a decline in house prices of around 5% after about two years (Chart B).[4] However, the same percentage point increase in the mortgage rate has a greater impact on housing investment, leading to a drop of 8% after about two years.

Chart B

Estimated semi-elasticities of house prices and housing investment to a 1 percentage point increase in the mortgage rate

(percentages)

Sources: Eurostat, ECB and ECB staff calculations.

Notes: The charts show “smoothed” estimated semi-elasticities of house prices and housing investment to a 1 percentage point increase in the mortgage rate, using linear local projections. The projections include real GDP, the HICP, a short-term interest rate and housing loans as control variables and are estimated for the period running from the first quarter of 1995 to the last quarter of 2019 (i.e. excluding the period of the COVID-19 crisis). “Smoothed” refers to centred three-period moving averages of the estimated semi-elasticities, excluding the initial and final points. The dashed lines refer to the 90% confidence bands.

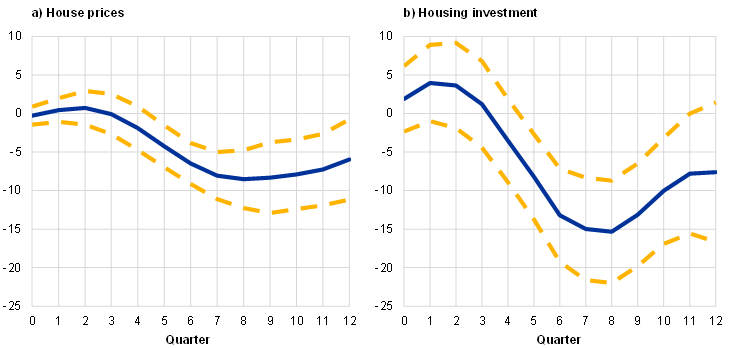

The impact of rising mortgage rates on house prices and housing investment is larger in a low interest rate environment. Asset price theory suggests that the lower the level of mortgage rates, the more sensitive house prices are to changes in mortgage rates, because lower mortgage rates lead to greater discounting effects on future rents and prices.[5] This higher sensitivity of house prices may, in turn, also imply a higher sensitivity of housing investment via housing profitability and collateral value effects, as both are important drivers of housing investment and are affected by house price movements.[6] To capture this non-linearity, the model is adjusted to include an indicator that controls for the level of mortgage rates.[7] The results of this non-linear model show that in a low interest rate environment the estimated decline in house prices and housing investment in response to a 1 percentage point mortgage rate increase is about 9% and 15% respectively after about two years. This is around twice as large as the linear results suggest (Chart C).[8]

Chart C

Estimated semi-elasticities of house prices and housing investment to a 1 percentage point increase in the mortgage rate in a low interest rate environment

(percentages)

Sources: Eurostat, ECB and ECB staff calculations.

Notes: The charts show “smoothed” estimated semi-elasticities of house prices and housing investment to a 1 percentage point increase in the mortgage rate in a low interest rate environment, using non-linear local projections. The projections include real GDP, the HICP, a short-term interest rate and housing loans as additional variables and are estimated for the period running from the first quarter of 1995 to the last quarter of 2019 (i.e. excluding the period of the COVID-19 crisis). "Smoothed" refers to centred three-period moving averages of the estimated semi-elasticities, excluding the initial and final points. The dashed lines refer to the 90% confidence bands.

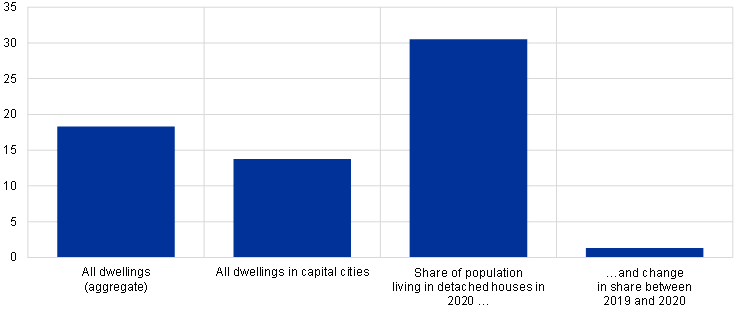

However, housing market developments are affected by other factors – including those of a structural nature – in addition to mortgage rates. While the empirical evidence from local projections points to potentially large downward corrections for the euro area housing market, other factors – not captured by the models – should also be considered. Such factors could increase uncertainty surrounding the housing outlook.[9] Following the COVID-19 pandemic, households now seem to be attaching greater value to more spacious properties that allow people to work from home and are finding locations further from the office more appealing.[10] Preliminary evidence points to higher price rises since the COVID-19 pandemic for detached houses in some of the euro area countries for which data are available (Chart D, panel a). In addition, euro area prices have increased more for properties outside euro area capital cities since the COVID-19 pandemic, and the share of the euro area population living in detached houses increased in 2020 (Chart D, panel b).[11] A preference for more space could also support housing investment. Pandemic-induced shifts in housing preferences could counteract higher mortgage rates and could explain some of the resilience which has been observed in the euro area housing market.

Chart D

Price rises for detached houses compared with price rises for semi-detached houses, aggregate euro area house prices and house prices in euro area capital cities, and share/change in the share of the population living in detached houses

a) Price rises for detached houses compared with price rises for semi-detached houses

(percentage point differences since the first quarter of 2020)

b) Euro area house prices and share/change in share of population living in detached houses

(percentage changes in prices since the first quarter of 2021; share of population as a percentage of total population, percentage point change in share of population)

Sources: OECD, BIS, Eurostat, ECB and ECB staff calculations.

Notes: Panel a: For Germany and Belgium the data refer to the difference between the prices of houses and flats. Data for Germany, Estonia, Ireland and Lithuania refer to all dwellings (new and existing), while for other countries they refer to existing dwellings. The latest observation is for the first quarter of 2022, except for Luxembourg, Austria and Finland, for which it is the last quarter of 2021. Panel b: The euro area aggregate series for house prices is a weighted average based on GDP weights and includes Belgium, Germany, Estonia, Ireland, Spain, France, Italy, the Netherlands, Austria, Slovenia and Finland.

For an assessment of euro area housing market developments during the coronavirus (COVID-19) pandemic, see the article entitled “The euro area housing market during the COVID-19 pandemic”, Economic Bulletin, Issue 7, ECB, 2021. For a discussion of housing market risks, see Igan, D., Kohlscheen, E. and Rungcharoenkitkul, P., “Housing market risks in the wake of the pandemic”, BIS Bulletin, No 50, BIS, March 2022.

Throughout this box mortgage rates refer to the composite cost-of-borrowing indicator for households for house purchase.

The model includes lags for each housing variable as well as lags for a set of additional variables that control for the state of the economy and for financial and credit market conditions, such as real GDP, the HICP, a short-term interest rate and housing loans. These control variables are also included up to lag zero, so the estimated sensitivity of house prices and housing investment to changes in mortgage rates only reflects the impact of a “mortgage spread shock” which is driven by any other factor not captured by the control variables including, for example, changes in borrowers’ riskiness and term premia for long-term rates. For a similar model for the US housing market see Liu, H., Lucca, D., Parker, D. and Rays-Wahba, G., “The Housing Boom and the Decline in Mortgage Rates”, Liberty Street Economics, Federal Reserve Bank of New York, September 2021.

All model variables are expressed in logarithmic values multiplied by 100, except for interest rates, which are expressed in percentages. Hence, the estimated sensitivity of house prices and housing investment measures the percentage change in house prices and housing investment in response to a 1 percentage point change in the mortgage rate. This is commonly referred to as “semi-elasticity”.

See, for instance, Himmelberg, C., Mayer, C. and Sinai, T., “Assessing High House Prices: Bubbles, Fundamentals and Misperceptions”, Journal of Economic Perspectives, Vol. 19, No 4, Fall 2005, pp. 67-92.

For the link between housing profitability and housing investment see, for example, Jud, G. D. and Winkler, D. T., “The Q Theory of Housing Investment”, The Journal of Real Estate Finance and Economics, No 27, November 2003, pp. 379-392.

Specifically, the indicator measures the probability of being in a low interest rate environment and is determined by a logistic function, with the 12-quarter moving average of the mortgage rate as the state variable and the low interest rate environment threshold set at the median of this variable, implying an interest rate of 4.5%. The transition speed parameter is set at 5. For different applications of this technique see, for example, Auerbach, A.J. and Gorodnichenko, Y., “Fiscal Multipliers in Recession and Expansion”, in Alesina, A. and Giavazzi, F. (eds.), Fiscal Policy after the Financial Crisis, University of Chicago Press, 2013, pp. 63-102, also Tenreyro, S. and Thwaites, G., “Pushing on a String: US Monetary Policy Is Less Powerful in Recessions”, American Economic Journal: Macroeconomics, Vol. 8, No 4, October 2016, pp. 43-74.

For further evidence of the higher sensitivity of housing market developments in the euro area to changes in mortgage rates in a low interest rate environment, see the box entitled “Drivers of rising house prices and the risk of reversal”, Financial Stability Review, ECB, May 2022, which suggests that real house prices decline 280 basis points more in response to a 1 percentage point increase in real mortgage rates from current levels when non-linear relationships are taken into account. A greater impact at low interest rates is also confirmed by simulations using the ECB-BASE model, albeit in a much weaker form. For the ECB-BASE model, see Angelini, E., Bokan, N., Christoffel, K., Ciccarelli, M. and Zimic, S., “Introducing ECB-BASE: The blueprint of the new ECB semi-structural model for the euro area”, Working Paper Series, No 2315, ECB, September 2019. An important caveat of the non-linear local projections relates to the concerns about the endogeneity of the state variable recently raised in Gonçalves, S., Herrera, A. M., Kilian, L. and Pesavento, E., “When Do State-Dependent Local Projections Work?”, Research Department Working Papers, No 2205, Federal Reserve Bank of Dallas, May 2022. To address these concerns, the state variable is based on the assumption of a long lag (see the previous footnote).

Among other factors, the attractiveness of housing for investment purposes is likely to diminish, given the relative stability of rental yields compared with the observed increase in bond yields. However, higher inflation, which tilts portfolio allocation towards “real assets” such as housing, could partly mitigate this effect.

See, for example, Bottero, M., Bravi, M., Caprioli, C., Dell’Anna, F., Dell’Ovo, M. and Oppio, A., “New Housing Preferences in the COVID-19 Era: A Best-to-Worst Scaling Experiment”, Computational Science and Its Applications – ICCSA 2021, September 2021, pp. 120-129, also Tajani, F., Morano, P., Di Liddo, F., Guarini, M. R. and Ranieri, R., “The Effects of Covid-19 Pandemic on the Housing Market: A Case Study in Rome (Italy)”, Computational Science and Its Applications – ICCSA 2021, September 2021, pp. 50-62.

It is worth stressing that such preference shifts affect relative rather than aggregate property prices.