Access to finance for small and medium-sized enterprises since the financial crisis: evidence from survey data

Published as part of the ECB Economic Bulletin, Issue 4/2020.

1 Introduction

The tightening of financial conditions as a result of the Global Financial Crisis (GFC) and the subsequent sovereign debt crisis in the euro area led to severe difficulties for small and medium-sized enterprises (SMEs) in accessing finance. The survey on the access to finance of enterprises (SAFE), which has been conducted on behalf of the ECB and the European Commission since 2009, reveals significant shifts in firms’ financing conditions since the start of the GFC.[2] During the financial crisis and the subsequent euro area sovereign debt crisis, a substantial share of SMEs highlighted access to finance as one of the most pressing problems affecting their business activity. Moreover, firms across different countries and sectors faced the same issue.

Monetary policy measures, including non-standard ones, have contributed to improving access to finance for euro area non-financial corporations since the GFC. This article reviews the available evidence on the impact of some of the non-standard measures. These measures – particularly those related to bank financing, but also those related to some additional sources of financing for SMEs – are key to understanding the evolution of SMEs’ financing conditions over the last ten years.

While SMEs’ financing conditions have significantly improved over recent years, some important challenges remained even before the coronavirus (COVID-19) pandemic that started late in 2019. For example, SAFE results indicate that financing gaps i.e. the difference between financial needs and the availability of external funding – remained for specific financing instruments, notably the market-based ones. Diversification across alternative financing instruments can make an important contribution to resilience against adverse financial and real shocks. Therefore, this article provides both a taxonomy of SMEs’ financing patterns based on a cluster analysis – before the onset of the pandemic crisis – and some evidence on the implications for firms’ investment decisions. For example, SMEs tend to be in the clusters where flexible short-term debt or long-term bank loans are the main financing instruments. Also, a combination of leasing/factoring and short-term loans was of particular importance for SMEs, compared with larger firms.

In the context of the coronavirus crisis, the emergence of new financing difficulties should stand out in relation to the current vintage of data and against the background of the pre-existing financing options for SMEs across the euro area. A companion box in this Economic Bulletin issue summarises the results of the last round of SAFE conducted during March and April 2020, and elaborates on the specific challenges posed by the coronavirus crisis for SMEs.

2 Access to finance and credit rationing over time

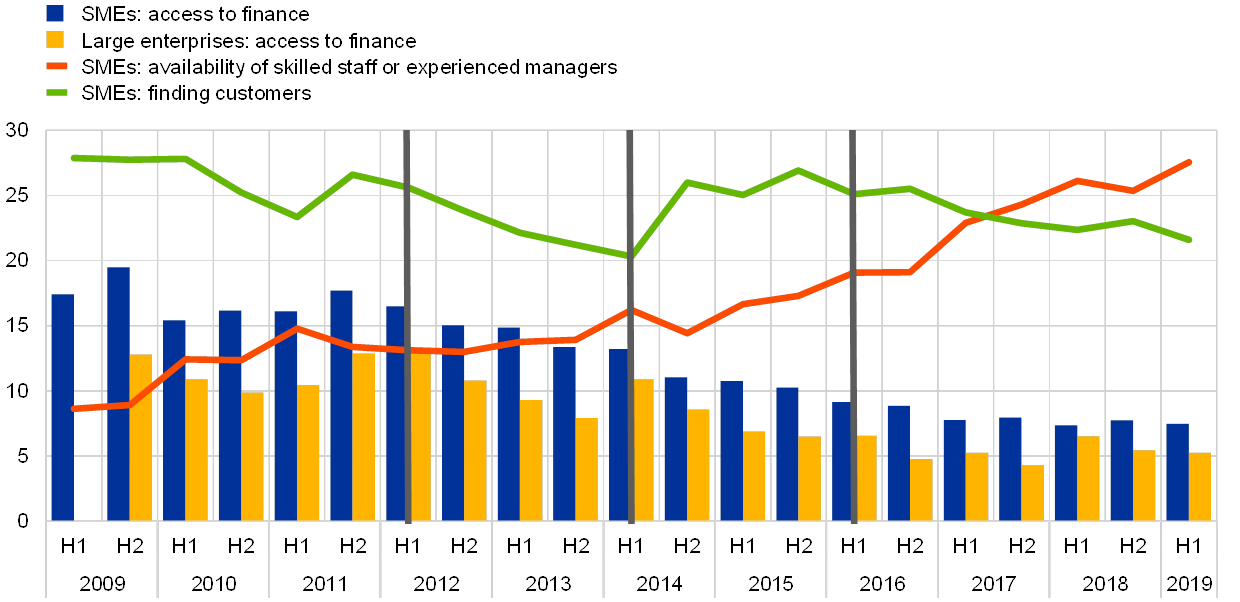

Starting in 2009, there have been three important phases in firms’ perceptions of their financing conditions. These phases have coincided with periods over which the monetary transmission mechanism was impaired to various degrees, negatively affecting SMEs’ financing conditions. Therefore, ECB measures taken to restore the transmission mechanism also had a positive impact on SMEs’ access to finance during those periods. The first phase covered the period from the launch of the survey in 2009, to September 2012, when the Outright Monetary Transactions (OMT) programme was announced. During this period, SMEs reported that access to finance ranked second, after finding customers, among the biggest obstacles to conducting business (see Chart 1).[3] The second period, from the last quarter of 2012 to March 2016, was characterised by several unconventional monetary policy (UMP) measures, including the introduction of negative rates in June 2014, the start of the Targeted Longer-Term Refinancing Operations (TLTRO I) in September 2014 and the ECB’s asset purchase programme (APP) in March 2015. According to the survey, difficulty accessing finance, while remaining an important concern for firms, started to gradually become less acute during this period, and was outweighed by difficulties with finding skilled staff and experienced managers. The last period starts in spring 2016 and runs until September 2019, before the coronavirus pandemic. The same period witnessed the launching of the TLTRO II and TLTRO III, as well as the corporate sector purchase programme (CSPP). Since spring 2016, only about 8% of SMEs have reported access to external financing as their main concern, compared with nearly 20% in 2009.

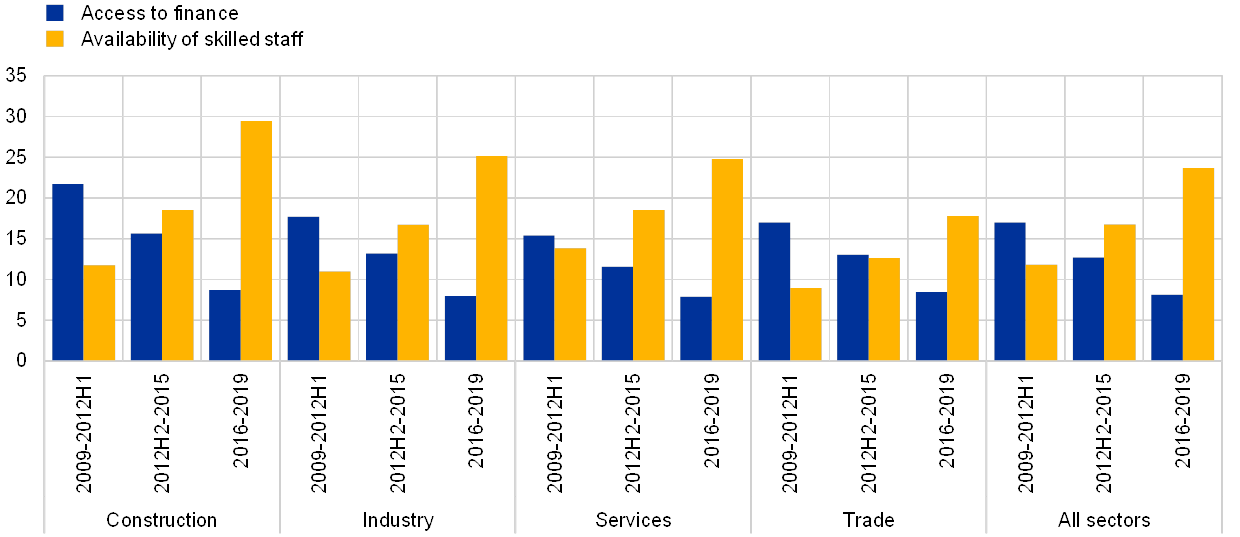

The financing situation of euro area firms was particularly severe for SMEs, with some differences across sectors. The percentage of firms that perceived access to finance as their main problem was consistently higher for SMEs than for large companies over the whole period concerned (see Chart 1). Regarding sectors, until September 2012 it was particularly the construction sector that found access to finance to be a major concern, with 22% of construction SMEs reporting this, compared with 15% of SMEs from the services sector (see Chart 2). This may reflect, for example, greater scrutiny by financial institutions when lending to the construction sector following the GFC. In the last phase, however, little variation was evident across sectors in this regard. At the same time, the availability of skilled staff became the most pressing issue affecting the construction sector (29%), often related to the introduction of new technologies combined with an ageing workforce. Construction was affected to a larger extent than, for instance, the trade sector (18%), which was least affected by this issue.

Chart 1

Most significant problems faced by euro area firms

(weighted percentages of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: The first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the start of the TLTRO I and the negative rate policy; and the third vertical grey line denotes the start of the TLTRO II and the CSPP. The latest observation is for the period April-September 2019.

Chart 2

Most significant problems faced by euro area SMEs across sectors

(weighted percentages of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE). The latest observation included is for the period April-September 2019.

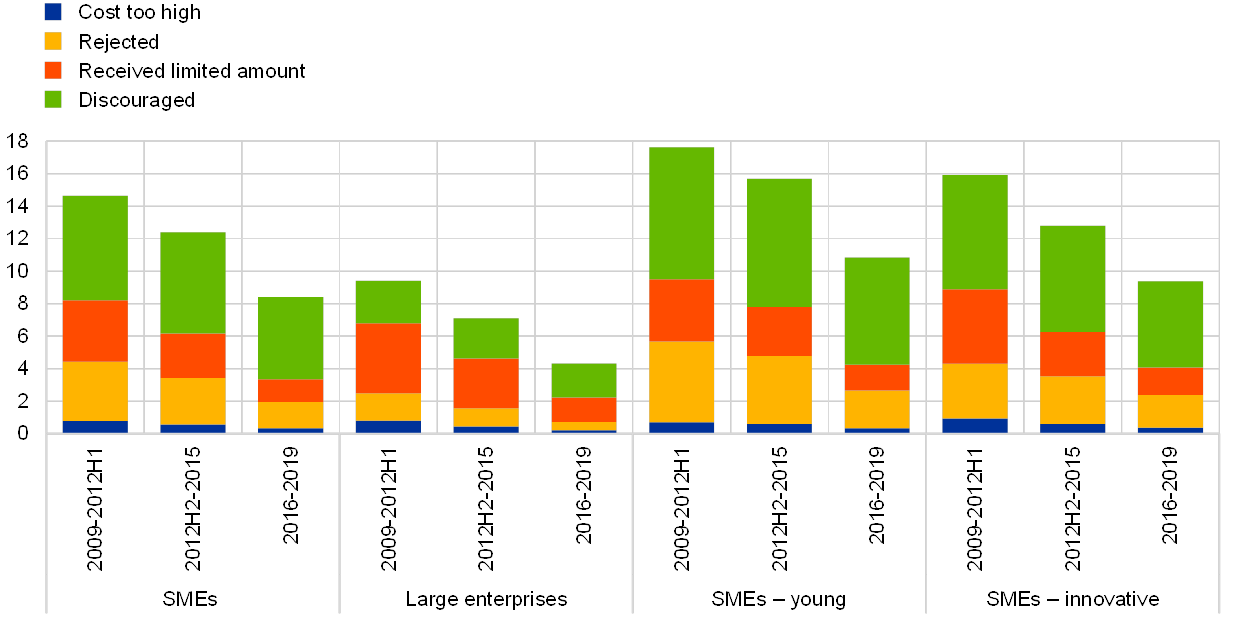

Firms that were actively seeking external financing became less financially constrained over time. On the basis of the SAFE results, firms are considered financially constrained if any of the three following conditions apply: (i) they applied for a bank loan and had their application rejected; (ii) they received a loan offer but either the cost was too high or the quantity offered was too low; or (iii) they did not apply for a loan because they feared a rejection.[4] During the 2009-12 period, about 15% of euro area SMEs that regarded bank loans as relevant to their funding were constrained in obtaining a bank loan. In the second phase (until around March 2016), that percentage declined to approximately 12% and it has stabilised at around 8% in recent years (see Chart 3).

The share of financially constrained firms varied by firm size, category and country. SMEs tended to more frequently report that they were financially constrained than large companies, although the percentages have declined over time (see Chart 3). Among SMEs, other characteristics that determine differences across firms are their ages and the degree of innovation. Small and young firms have particular difficulties in accessing external finance.[5] This might be related to the fact that they are more likely to face a higher degree of asymmetric information and contracting problems.[6] Mature SMEs (i.e. those in business for ten years or more) tended to be considerably less financially constrained than young ones (existing for less than 10 years). SMEs involved in innovative activities experienced greater obstacles to obtaining a bank loan than firms that were providing mostly traditional products and services. In general, financing innovation is often difficult for firms, given the additional uncertainty involved.[7] Chart 3 provides some evidence that innovative SMEs were more financially constrained.

Chart 3

Financially constrained firms by age and size

(weighted percentages of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: the first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the start of the TLTRO I and the negative rate policy; and the third vertical grey line denotes the start of the TLTRO II and the CSPP. Information about innovative companies is not available in each round. The latest observation is for the period April-September 2019.

For large firms, it is not only the degree of financial constraint that is less serious compared with SMEs, but also the form of the constraint. Large companies more often reported being quantity constrained (i.e. banks offering a limited amount of the requested credit) than SMEs, while outright rejections were much smaller for large firms compared with SMEs (see Chart 4). Moreover, SMEs – particularly young and/or innovative firms – were more frequently discouraged from applying for loans. The percentage of discouraged firms remained relatively stable throughout the period considered, while the rejection rate clearly declined and reached lows of 2% for SMEs and 1% for large companies in 2019. Bank credit costs appeared negligible in determining financial constraints for all companies, reflecting the significant extent of monetary policy accommodation since 2009.

Chart 4

Components of financially constrained firms by age and size

(weighted percentages of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE). The latest observation included is for the period April-September 2019.

3 Effects of unconventional monetary policy

In response to the weak economic conditions prevailing in the euro area, several monetary policy stimulus measures have been introduced over recent years. These have included a series of unconventional monetary policy measures, with the aim of restoring the transmission mechanism of monetary policy and bringing inflation back to the ECB’s price stability objective in a sustained way. These measures worked through several different channels, with some of the measures proving particularly useful in mitigating banking sector problems, restoring bank lending dynamics and sustaining financing conditions in general.[8] In particular:[9]

- The Outright Monetary Transactions (OMT) programme was launched in the summer of 2012. Once a programme is established by the European Stability Mechanism (ESM), the OMT programme enables the purchase of eligible sovereign bonds issued by euro area governments in order to address severe distortions in sovereign bond markets. While no purchase has yet been conducted under the OMT programme, its announcement helped to reduce the yields on sovereign bonds issued by fiscally-stressed countries immediately, sharply, and permanently.[10] Furthermore, by alleviating pressure on euro area banks holding such bonds, the announcement of the OMT programme helped to sustain lending.

- Interest rates were lowered to negative territory in the summer of 2014, thus providing additional monetary stimulus.[11] Also, the ECB has repeatedly communicated its intention to keep short-term interest rates low for an extended period of time, with such forward guidance reinforcing the signalling channel of policy rate cuts.

- The CSPP was first announced as part of a broader set of measures under the expanded APP in March 2016. It was launched in June 2016 to allow for large direct purchases of eligible (i.e. investment grade) bonds issued by companies based in the euro area.[12] The programme was aimed at reducing debt-financing costs for large firms which could issue such bonds as an alternative financing source to bank loans, thereby freeing up more loan supply for smaller firms.[13]

- Several rounds of TLTROs were launched to further foster corporate lending. The amounts that credit institutions could borrow as part of these operations were linked to their eligible credit granted to euro area-resident non-financial corporations and households, excluding lending for house purchases, in all currencies. The first series of TLTROs (TLTRO I) was announced in June 2014 and implemented in September 2014. The second series (TLTRO II) was announced in March 2016 and implemented in June 2016. Finally, a third series of TLTROs (TLTRO III) was announced in March 2019 and implemented starting from September 2019.[14]

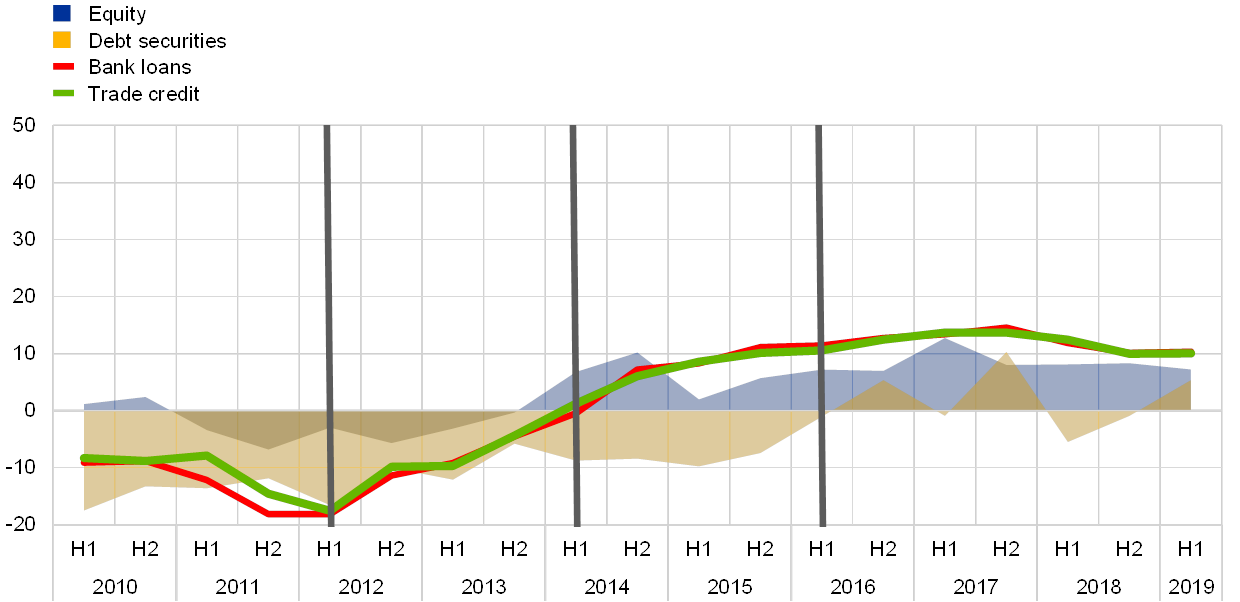

All of these measures shaped euro area firms’ perceptions of the availability of external finance (see Charts 5 and 6).

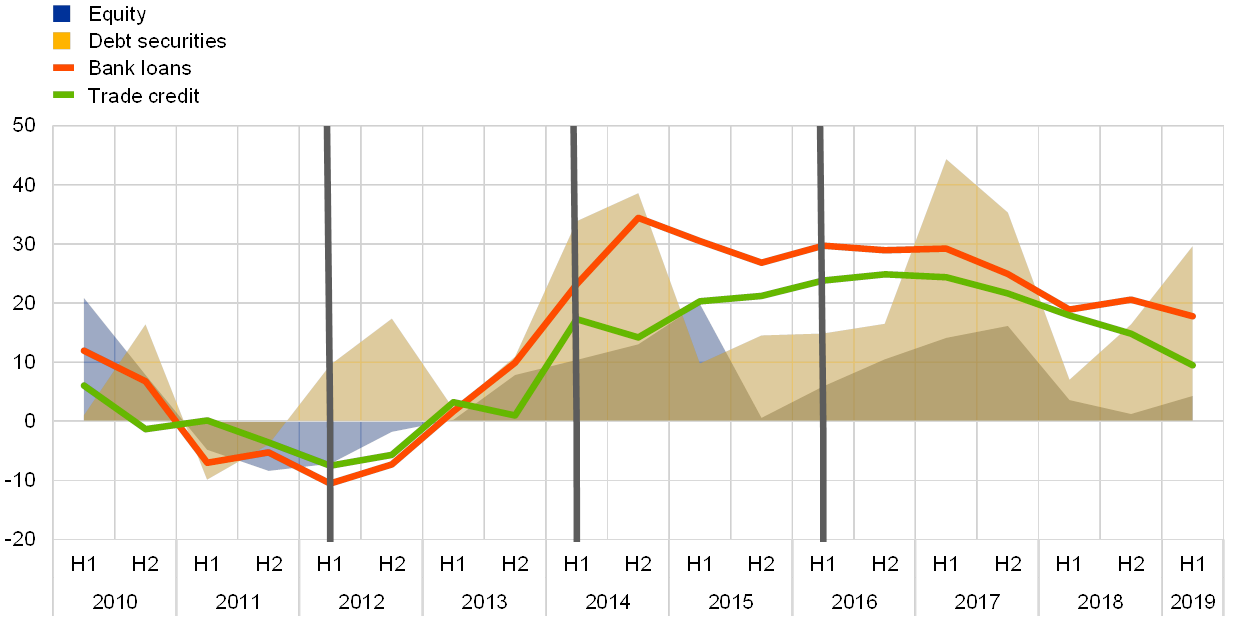

Chart 5

Availability of external financing instruments for SMEs

(net percentages of respondents for which the respective instrument is relevant)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: The first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the start of the TLTRO I and the negative rate policy; and the third vertical grey line denotes the start of the TLTRO II and the CSPP. The latest observation is for the period April-September 2019.

Chart 6

Availability of external financing instruments for large firms

(net percentages for which the respective instrument is relevant)

Source: ECB and European Commission survey on the access to finance of enterprises.

Notes: Net percentages are defined as the difference between the percentage of enterprises reporting that a given factor has increased and the percentage of those reporting that it has declined. The first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the start of the TLTRO I and the negative rate policy; and the third denotes the start of the TLTRO II and the CSPP. The latest observation is for the period April-September 2019.

In the aftermath of the GFC, the sovereign debt crisis in some euro area countries posed additional challenges to SMEs’ access to finance. Since banks tend to hold large quantities of domestic sovereign bonds, banking sectors of stressed countries also came under pressure in financial markets, and their funding costs rose. Furthermore, the rationing of credit to SMEs intensified. Against this background, the announcement of the OMT was specifically aimed at easing the financial market conditions in stressed countries and thereby indirectly improving access to finance in those countries.

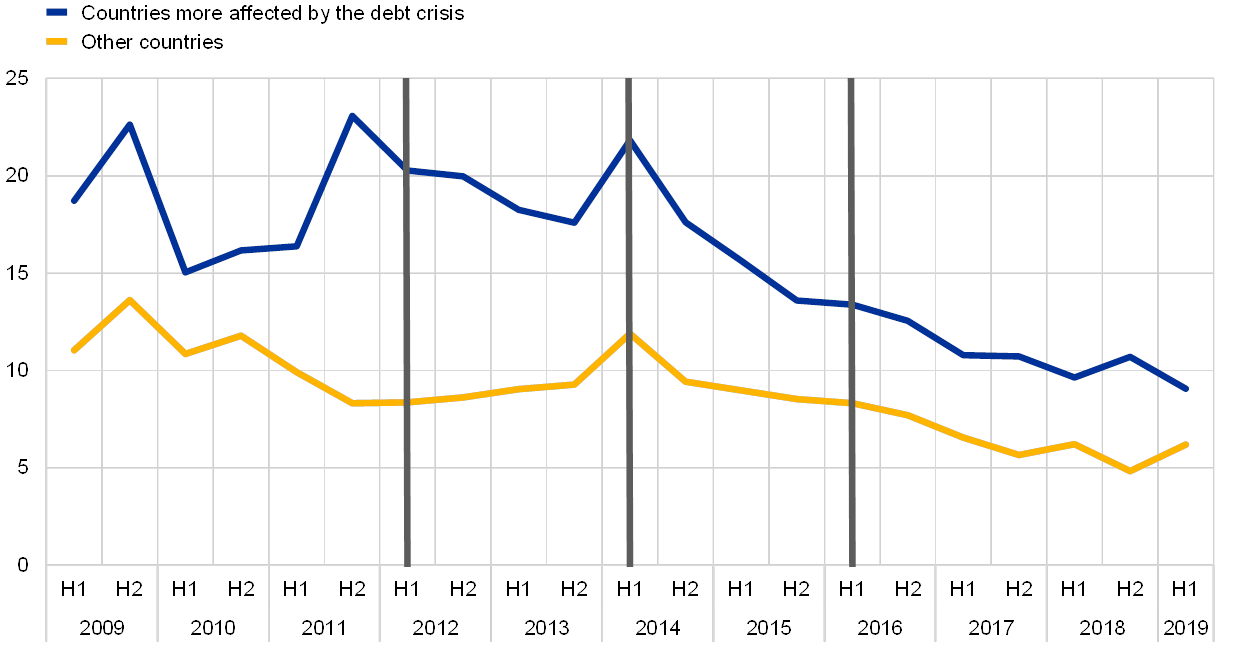

The announcement of the OMT programme led to an improvement in credit access. Just before the OMT programme announcement, 18% of euro area SMEs and 10% of large enterprises were reporting a deterioration in the availability of bank loans in net terms (see Charts 6 and 7).[15] The programme represented a turning point in firms’ perceptions, a conclusion that is confirmed by econometric analysis. Ferrando et al. showed that SMEs from vulnerable countries reported being less likely to be rationed or discouraged from applying for loans in the six months after the programme announcement.[16]

Despite the positive impact of the OMT and other UMP measures, developments in credit supply to non-financial corporations have diverged across the euro area since the European sovereign debt crisis (see Chart 7). Corbisiero and Faccia found that the rejections of non-financial corporations’ loan applications tended to be more frequent in countries more affected by the European sovereign debt crisis.[17] These rejections were influenced by the health of bank balance sheets, in particular by the presence of non-performing loans (NPLs). This suggests that supply factors did play an important role in subdued credit in these countries. At relatively high levels of NPLs, banks tend to lend less, even to creditworthy firms.[18] Such high levels of NPLs were mainly observed in vulnerable countries during the European sovereign debt crisis, implying that the balance sheet weakness of individual banks in vulnerable countries may have contributed to the weak credit dynamics observed. Taken together, the above-mentioned empirical evidence lends support to the success of the ECB’s UMP measures in improving the terms and conditions of bank credit to SMEs, consistent with the “bank lending view” of monetary policy transmission.[19]

Chart 7

Financially constrained SMEs in countries more affected by the debt crisis

(weighted percentages of respondents)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: “Countries more affected by the debt crisis” refers to Ireland, Greece, Spain, Italy, Cyprus and Portugal.

The first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the start of the TLTRO I and the negative rate policy; and the third vertical grey line denotes the start of the TLTRO II and the CSPP. The latest observation is for the period April-September 2019.

Several studies show that the TLTROs led to significant improvements in various aspects of financing conditions for firms, for example by improving actual and expected loan availability or lowering interest expenses.[20] Importantly, there was an improvement in bank credit availability for firms from countries more affected by the European sovereign debt crisis but also, and more strongly so, for those from the rest of the euro area. In addition, the improvements varied across different types of firms, with medium/large firms and mature firms benefiting most, as there is evidence that the impact of credit constraints on firms’ investment was greater for them.[21]

Access to other sources of finance beyond bank lending is also important for SMEs. While bank loans have been the main source of finance for euro area SMEs, the changes in financial market conditions and the difficulties faced by the banking sector since the GFC have highlighted that diversified sources of external finance are a key element of resilience to adverse financial and real economic shocks.[22]

Corporate bond purchases through the CSPP also contributed to an improvement in SMEs’ access to finance. Betz and De Santis showed that the CSPP strongly contributed to an increase in the size of the euro area corporate bond market, pushing banks to increase lending to smaller firms.[23] Indeed, according to the SAFE replies, the increased availability of bank loans to SMEs during this period was accompanied by improvements in the issuance of debt securities by large enterprises (see Charts 5 and 6).

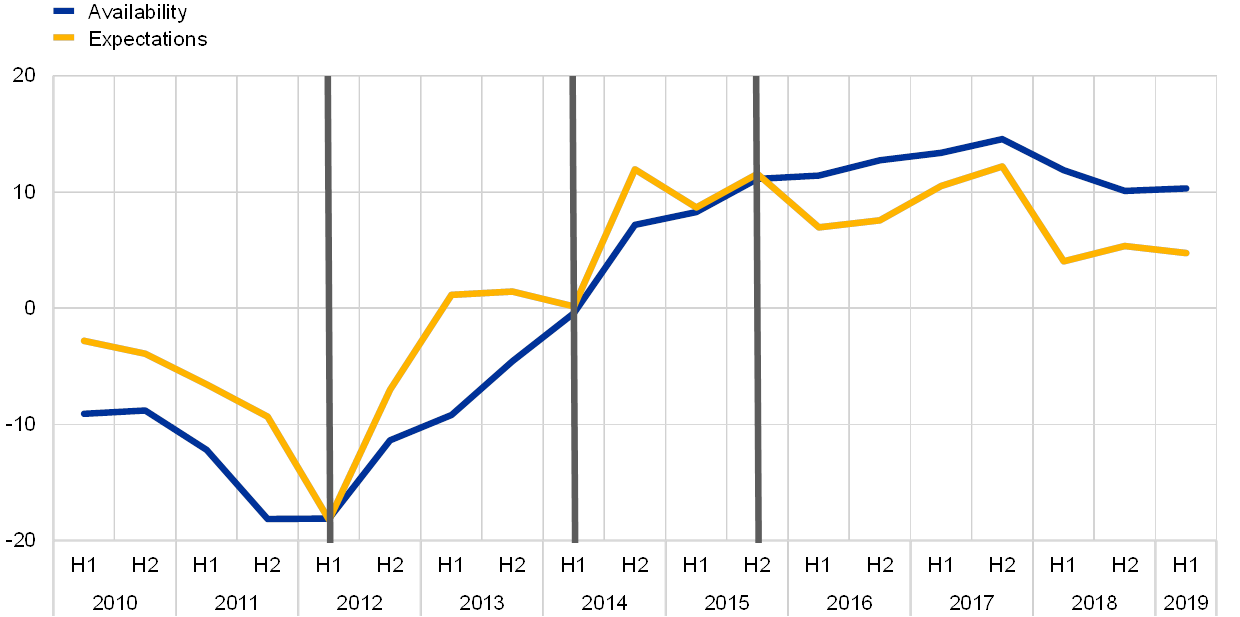

In addition to the transmission channels already discussed, UMP measures can have an impact on SMEs’ access to finance through their expectations of the future availability of finance. Ferrando et al. provide evidence for a “funding expectations channel” of monetary policy by looking at how SMEs’ decisions are affected by their expectations of future credit access.[24] This “funding expectations channel” complemented the standard “bank lending channel”, under which monetary policy is transmitted to the real economy through changes in the level and composition of bank credit. The authors provide supporting evidence that three of the unconventional policies mentioned above, namely the announcements of the OMT, the negative rates and the CSPP, had a significant effect on expectations of future credit availability (see Chart 8). In particular, immediately after the policy announcements, expectations of future credit access improved relatively more for SMEs borrowing from banks that were expected to increase SME lending due to the policy measure.[25] The authors also find evidence that SMEs’ investment and employment increased more at those firms expecting bank credit to improve in the future.

Chart 8

UMP announcements and SMEs’ expectations of bank loan availability

(net percentages of respondents for which bank loans are relevant)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: Net percentages are defined as the difference between the percentage of enterprises reporting that a given factor has increased and the percentage of those reporting that it has declined. The first vertical grey line denotes the announcement of the OMT; the second vertical grey line denotes the announcement of the TLTRO I and the negative rate policy; the third denotes the announcement of the TLTRO II and the CSPP. The latest observation is for the period April-September 2019.

Overall, existing empirical evidence provides strong support for the positive impact of the UMP measures launched by the ECB over recent years to support the financing conditions of euro area firms, including SMEs. Importantly, the reported evidence suggests that the non-standard measures worked through different channels and that their impact varied somewhat across countries. In interpreting the results, it has to be kept in mind that isolating the effects of monetary policy is always challenging. Furthermore, in the case of the research reviewed in this section, the non-standard nature of the measures – for which a very limited number of episodes exists – further complicates the identification process.

4 Financing patterns and financial behaviour

Despite the improvement in financing conditions and the policy measures implemented so far, some structural challenges for SMEs’ access to finance remain. These challenges are mainly related to the fact that euro area firms still use a limited number of the available financing instruments. To analyse this structural feature, this section focuses on the period from April to September 2019. It represents a snapshot of the financing options chosen by euro area firms after the developments described in the previous section.

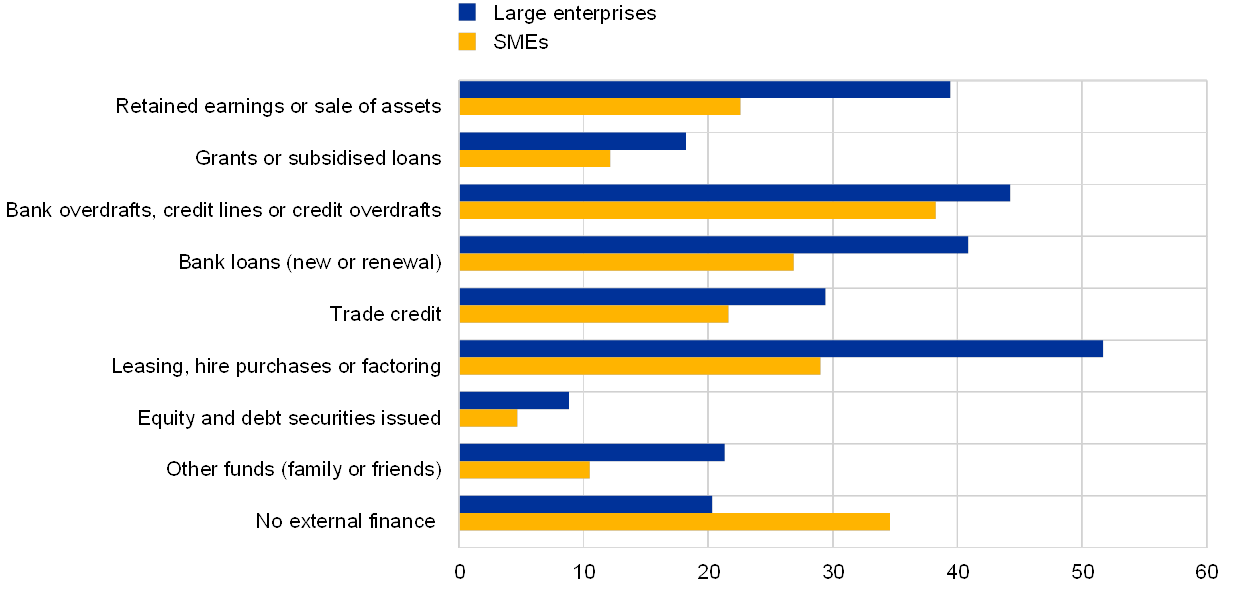

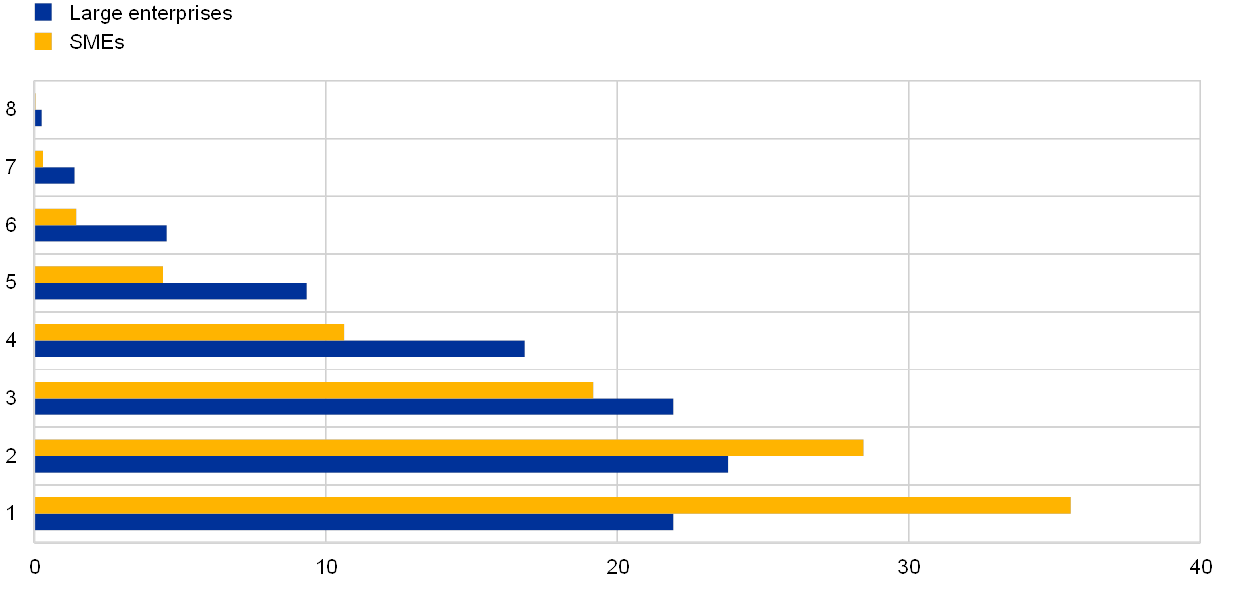

The financing options of euro area enterprises are limited to a few instruments, mostly related to the banking sector. Leasing and factoring for large companies and trade credit for SMEs are also important (see Chart 9). There are differences across firm sizes, though the relative importance of the funding sources remains the same overall. In particular, SMEs tend to make less use of external funds: at least one-third of them report that they have not used external sources of finance. For large firms, the share is 20%. Irrespective of firm size, the use of market-based finance (i.e. debt or external equity) remains limited.

Chart 9

Use of financing sources for euro area firms

(weighted percentages over the period 2009-19)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Notes: Sources of finance that are relevant and that have been used in the past six months.

SMEs use a limited number of sources of finance. Chart 10 shows the distribution of the number of financing sources used by SMEs and by large enterprises. As predicted by the literature[26], the data show the limited diversification of financing sources of SMEs in contrast to large enterprises. Many SMEs used only one type of finance (36%), whereas the respective percentage is lower for large enterprises (22%). When looking at firms using four or more financing sources, the percentage of large enterprises is almost twice as high as for SMEs.

Chart 10

Number of sources of finance used (by firm size)

(weighted percentages over the period 2009-19)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE).

Note: The figure shows the frequency of the number of different sources of finance the firms used to finance their operations.

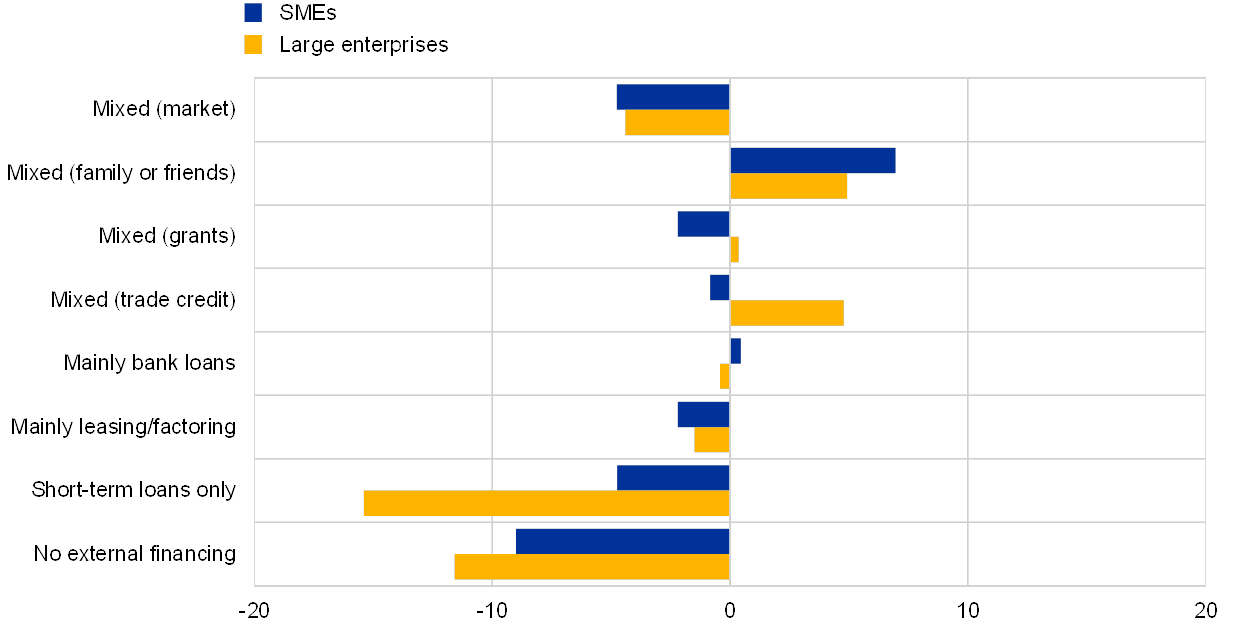

Firms of different sizes use different combinations of financial instruments. In order to establish a taxonomy of financing patterns, firms in the SAFE sample are grouped on the basis of their sources of finance using a “cluster analysis”. Box 1 reports on the results of such an analysis, based on the survey round for the period April-September 2019. The taxonomy provides a snapshot of the financing behaviour of euro area firms until the period just before the coronavirus crisis. While the approach is by its nature related to a specific period, the analysis of survey replies in alternative periods, for instance April-September 2012, shows that firms displayed broadly similar financing patterns.[27] In the survey round for the period April-September 2019, each of the eight clusters contains around 7% to 10% of the total number of firms, except for the largest cluster, which contains firms that have not reported the use of external sources of finance (38%). The taxonomy presented in Table 1 confirms that large companies, as defined by the number of employees or turnover, are using more diverse sources of finance than SMEs, and are also more likely to be listed on the stock market or be part of a business group. A higher percentage of large firms belongs to the clusters with more financial instruments (mixed – market, mixed – family or friends and mixed – grants, see Box 1), particularly when considering the difference between firms with very high turnover (more than €50 million) and low turnover (less than €10 million). By contrast, SMEs tend to more often be in the clusters where flexible short-term debt or long-term bank loans are the main financing instruments. A combination of leasing/factoring and short-term loans was also of particular importance for SMEs (mainly leasing-factoring cluster).

Box 1 A taxonomy of financing patterns in the euro area: a cluster analysis approach

The empirical analysis used to identify financing patterns for euro area enterprises is based on a cluster analysis approach similar to the research carried out by Moritz et al. and Masiak et al.[28] The cluster analysis groups firms according to their use of the nine financing instruments described in Chart 9 in such a way that the groups are both homogenous (small within-cluster variance) and very distinct from each other (large between-cluster variance). The empirical analysis is based on the round that covers the April to September 2019 period for a total of 10,732 firms that reported whether they have used internal or external finance for their business activity in the previous six months. Being solely based on one round, the taxonomy provides a snapshot of the financing behaviour of euro area firms.[29]

Table A presents the eight clusters obtained following the above-mentioned procedure. The different clusters are presented by starting with those that include several financing instruments, and moving towards clusters that use fewer financing options. Each cluster contains around 7% to 10% of the total number of firms, except the last cluster, which includes a large share of firms that have not reported the use of external sources of finance (38%).

Cluster 1 (mixed – market): Firms in this cluster use a broad range of instruments which combines the highest use of retained earnings and sales of assets (81%) with a high usage of short-term and long-term bank loans (58% and 34% respectively). In contrast to other clusters, firms in this group are the only ones to access market-based finance (26%). Leasing and factoring are also relatively important instruments (50%), followed by trade credit (40%).

Cluster 2 (mixed – family or friends): The main characteristic of this cluster is that all firms rely on funds from related companies or family and friends. In addition, firms in this group mostly use short-term bank loans (50%), together with leasing and factoring (39%).

Cluster 3 (mixed – grants): In this cluster, all firms use subsidised loans for their business activity, which they combine with banking products (58% short-term bank loans and 48% long-term bank loans) and leasing and factoring (41%).

Cluster 4 (mainly trade credit): These firms use only trade credit for their business activity, which they combine with short-term bank financing (54%) and, to a lesser extent, with long-term bank loans (26%). Leasing and factoring are also relatively important (38%).

Cluster 5 (mainly bank loans): This cluster is characterised by firms that use long-term loans together with short-term ones (55%). The other financing instrument used by firms in this cluster is leasing and factoring (37%).

Cluster 6 (mainly leasing and factoring): For firms in this cluster, leasing and factoring are the most important source of finance together with short-term loans (39%).

Cluster 7 (short-term loans only): Firms in this group only focus on short-term financing, and represent 8.7% of the total sample.

Cluster 8 (no external financing): The last cluster is the largest one, covering 38% of the total sample of firms. It comprises firms that have not used external funds for their business and only 9% of them reported having used internal funds in the previous six months.

Table A

Cluster composition

(percentages)

Sources: ECB and European Commission survey on the access to finance of enterprises (SAFE) and authors’ own calculations.

Notes: N = 10372; Pearson’s chi-square tests for categorical variables are all significant at p<0.01.

Table 1

Cluster comparison according to firm characteristics

Sources: ECB and European Commission survey on the access to finance of enterprises (SAFE) and authors’ own calculation.

Notes: The cluster analysis refers to the period April-September 2019. Pearson’s chi-square test and Cramer’s V for categorical variables are all significant at p<0.01 (not reported). The percentages presented are weighted.

Financially fragile firms tended to receive funds more often from family, friends or related businesses. Financially fragile firms are defined as those that are either financially constrained (as explained in Section 2), or are financially vulnerable in that they have difficulties serving their existing debt due to decreasing profits and turnover and increasing interest expenses.[30] Such financially fragile firms tended to obtain funds more often from family or friends, or related businesses (mixed – family or friends cluster) or through trade credit (mixed – trade credit cluster, see Table 1). Beyond these financing sources, vulnerable firms were more likely to receive funds through grants or subsidised bank loans. By contrast, a high share of profitable firms was in the cluster “no external financing”, probably because they have high retained earnings. They were more often using a variety of financial instruments, including market-based ones (mixed – grants cluster). This is also the case for innovative firms and exporters. Bank loans – either short or long-term – remained an important source of finance for these three groups of firms.

Firms diversified their sources of finance according to the sector they belong to. Industrial firms were slightly more often in the cluster with more diversified financing options (mixed – market cluster). Industrial firms are on average larger and are more likely to be exporters. Overall, they are able to attract debt and long-term financing, given their ability to provide collateral to secure their debt. By contrast, firms in the construction sector rely more on asset-backed financing and short-term bank loans, as is the case in the cluster mainly leasing/factoring. Firms in the trade sector required more short-term debt and trade credit in their operations. The cluster analysis indicates that a relatively high percentage of them are grouped together in the cluster with more financing options. Finally, firms in the services sector are less likely to use external financing instruments compared with firms in the other industries, with many being in the cluster related to asset-backed financing (mixed – leasing/factoring).

Firms that are expecting to grow in the near future rely on several financing options. Firms that were expecting to grow in 2020 had higher financing needs. As the taxonomy shows, they made use of several financing instruments, being mostly grouped in the first three clusters of Table 1.

Financing gaps are more acute for firms using informal sources of finance. An important indicator derived from the SAFE dataset is the degree of financing gap, defined as the difference between the change in demand and in the availability of external financing. In the euro area, the financing gap has remained negative since 2014 for large companies and since 2015 for SMEs, meaning that the increase in needs for external financing was smaller than the improvement in access to external funds. In 2019, the weighted net percentages were quite similar between large firms and SMEs (-3% and -4% respectively). Chart 11 plots the financing gap across the different clusters. The financing gap is larger for the group of firms using mostly loans granted by family or friends, or by related businesses (mixed – family or friends). On average, these are companies that are financially vulnerable, with little capacity to generate internal funds. Many of them are financially constrained.

Chart 11

Financing gaps across clusters for euro area firms

(weighted net percentages)

Source: ECB and European Commission survey on the access to finance of enterprises (SAFE) and authors’ own calculations.

Notes: For the construction of the financing gap indicator, see Chart 17 in the SAFE report.

5 Real effects of financing patterns

The diversification of external sources of finance can be linked to the decisions of companies to invest, to hire or to build up inventories. In the SAFE survey, firms are asked about the use of both external and internal financing. The options in the questionnaire comprise decisions about: (1) investment in fixed assets (property, plant or equipment); (2) inventory and other working capital; (3) hiring and training of employees; (4) developing and launching of new products or services; (5) refinancing or paying off obligations and (6) expenditure for other purposes. Firms mainly use their external financing for fixed investment and working capital financing.

Some stylised facts can be derived by plotting the percentages of firms that have used finance for the named purposes in each of the eight clusters (see Chart 12).[31]

First, firms investing in fixed assets use several financing instruments, mostly consisting in banking products. More than 60% of firms in the clusters with more financing options (mixed – grants, mixed – market and mainly bank loans) use finance for fixed investment. While firms used mostly long-term bank loans in the mainly bank loans cluster, they tended to substitute them with subsidised loans and other sources in the other two clusters.

Second, firms are mainly using trade credit and short-term loans to finance their working capital, as shown in the second panel of Figure 12.

Third, firms engaging in hiring and training activities use mostly leasing/factoring or internal sources of funds only. According to the taxonomy, firms that decide to increase their headcount or their training link this decision to the leasing of fixed assets.

Fourth, firms developing and launching new products or services tend to use a variety of financing products. This is in line with the results presented in Table 1. Innovative companies are clustered around market-based products but also use other financing instruments.

Finally, firms reporting having used finance for refinancing or paying off obligations, or for other purposes, rely slightly more on funds from family or friends or related businesses. As observed in the previous section, these firms are financially constrained and encounter some difficulties in repaying their existing debt.

Chart 12

Purpose of financing as perceived by firms across financing clusters

(percentages)

Sources: ECB and European Commission survey on the access to finance of enterprises (SAFE) and authors’ own calculations.

A more formal approach that takes into consideration several other dimensions simultaneously confirms the stylised facts. To further investigate the link between financing options and firms’ decisions in the real economy, a logistic regression model is run.[32] The set of dependent variables, which are dummies set to one if firms are using finance for the five specific purposes, are regressed against dummies for each cluster group and a set of variables that control for differences in firm size, age, industry and country.

Table 2 reports the effects of the diversification of external funds by clusters on the purposes for which firms used financing.[33] Focusing on the highest marginal effects, the results show that firms using more grants or long-term bank loans (i.e. grouped in the mixed – grants cluster) are 27% more likely to have invested in fixed asset activities than those not using external finance, all the other characteristics being equal. Also, the probability of a firm investing in working capital is 26% higher for firms in the trade credit financing cluster. By contrast, the third column in Table 2 appears to indicate that external finance is not better than internal financing for firms hiring and training their employees. In fact, the marginal effect is even negative in some clusters. This is in line with previous findings demonstrating that bank finance displays a negative relationship to investment in intangible assets such as R&D, software, databases and IT networks, and training.[34] Furthermore, the probability of developing new products or services is not related to the use of bank products, but it is higher for firms using grants or market-based finance in particular. In these cases, however, the marginal effects are relatively modest at around 7%. Finally, in the last two columns, the regression results confirm the stylised fact on the relative importance of informal finance for refinancing and other purposes.

Table 2

Purposes of financing and diversification of financing instruments

(marginal effects)

Sources: ECB and European Commission survey on the access to finance of enterprises (SAFE) and authors’ own calculations.

Notes: Logit regressions. In the analysis the omitted reference category is the no external financing cluster. Other reference categories are large and mature companies in the German manufacturing sector. All specifications use weights based on the number of employees to restore the proportions of the economic weight of each size class, economic activity and country. Standard errors in parentheses, *** p<0.01, ** p<0.05, * p<0.1.

6 Conclusions

Since the Global Financial Crisis, a series of unconventional monetary policy measures have contributed to easing SMEs’ access to finance. This article has described the evolution of firms’ assessments of their financing conditions throughout the period until the outbreak of the coronavirus crisis. In particular, firms in all euro area countries reported an overall decrease over time in their perceptions of being financially constrained.

Although it has gradually improved since the mid-2010s, challenges for SMEs’ access to finance remain, for example in terms of funding diversification. Taking stock of the overall development of firms’ financing conditions from 2009 onwards, this article analysed the funding options firms had at their disposal in mid-2019 through a cluster analysis approach. The resulting taxonomy highlights that the percentage of firms using market-based financial instruments to fund their business remained small. This is despite both the difficulties encountered with their traditional funding source (i.e. bank lending) during the crisis and the many subsequent efforts since 2015 to set up a capital markets union (CMU) to facilitate SMEs’ fundraising. From the taxonomy, it emerges that firms that were exporters, more profitable, more innovative and that were planning to grow more in the future tended to diversify their financing instruments to a higher degree. However, these firms also tended to report higher financing gaps, namely the overall availability of external sources of finance being lower than their demand for them.

The analysis highlights some important effects of monetary policy decisions on SMEs’ access to finance over recent years.

- First, monetary policy measures predominantly aimed at supporting bank credit are crucial for SMEs in the light of their dependence on bank credit as the main source of external finance.

- Second, support for bank finance is particularly relevant for the funding of fixed investment by SMEs, which may play an important role in the transmission of monetary policy.

- Third, from a structural point of view, initiatives taken at the EU or national levels to support access to market-based instruments are of the utmost importance. A diversification in sources of finance would facilitate the activity and the expansion of innovative firms in particular, while also generally making SMEs more resilient in situations where the supply of credit tends to dry up.

The outbreak of the pandemic has given rise to new, more severe and immediate challenges for SMEs in terms of their access to financing. See Box 3 in this issue for additional information.

- . Gianmarco Rimoldi provided data support.

- As a reference, in the survey conducted between 16 September and 25 October 2019, the sample size for the euro area was 11,204 firms, of which 10,241 (91%) had fewer than 250 employees. For more detailed information on the survey, see: https://www.ecb.europa.eu/stats/ecb_surveys/safe/html/index.en.html. The survey contains a sample of large companies in order to better gauge possible financing conditions/constraints only affecting SMEs.

- SAFE contains a broad question to shed light on firms’, and in particular SMEs’, assessments of problems affecting their business operations. Those concerns can be either on the demand side, such as finding customers, competition, regulation and the availability of skilled labour, or on the supply side, such as access to finance and production or labour costs.

- The definition of financially constrained firms is available in Chart 20 of the SAFE report.

- See Ferrando, A. and Mulier, K., “Firms’ Financing Constraints: Do Perceptions Match the Actual Situation?”, Economic and Social Review, Vol. 46, No 1, Frankfurt am Main, 2015, pp. 87-117.

- See, for example, Berger, A. N. and Udell, G. F., "A more complete conceptual framework for financing of small and medium enterprises”, Policy Research Working Paper Series 3795, The World Bank, 2005; Rauh, J., “Investment and Financing Constraints: Evidence from the Funding of Corporate Pension Plans”, Journal of Finance, Vol. 61, No 1, 2006, pp. 33-71; Fee, C. E., Hadlock, C. J. and Pierce, J. R., “Investment, Financing Constraints, and Internal Capital Markets: Evidence from the Advertising Expenditures of Multinational Firms”, The Review of Financial Studies, Vol. 22, No 6, June 2009, pp. 2361-2392; and Hadlock, C. J. and Pierce, J. R., “New Evidence on Measuring Financial Constraints: Moving Beyond the KZ Index”, The Review of Financial Studies, Vol. 23, No 5, May 2010, pp. 1909-1940.

- See Acharya, V. and Xu, Z., “Financial dependence and innovation: The case of public versus private firms”, Journal of Financial Economics, Vol. 124, No 2, 2017, pp. 223-243.

- For a comprehensive assessment of the transmission channels of the ECB’s non-standard measures, see Rostagno, M., Altavilla, C., Carboni, G., Lemke, W., Motto, R., Saint Guilhem, A. and Yiangou, J., “A tale of two decades: the ECB’s monetary policy at 20”, ECB Working Paper Series, No 2346, 2019. See also the box entitled “Impact of the ECB’s non-standard measures on financing conditions: taking stock of recent evidence”, ECB Economic Bulletin, Issue 2, ECB, Frankfurt am Main, 2017.

- In this article, the focus is on analyses of UMP decisions based on the assessment of firms through SAFE replies. For this reason, not all the UMP measures implemented are considered here, for example, the programmes for the purchases of asset-backed securities (ABS) or public assets (PSPP), although they had an impact on the financing conditions of euro area non-financial corporations.

- Altavilla, C., Giannone, D., and Lenza, M., “The financial and macroeconomic effects of the OMT announcements”, International Journal of Central Banking, Vol. 12, No 3, 2001, pp. 29-57.

- For a comprehensive assessment of the impact of negative rates, see the article “Negative rates and the transmission of monetary policy”, Economic Bulletin, Issue 3, 2020; and Altavilla, C., Burlon, L., Giannetti, M., and Holton, S., “Is there a zero lower bound? The effects of negative policy rates on banks and firms”, ECB Working Paper Series, No 2289, ECB, Frankfurt am Main, June 2019.

- For an assessment of the impact of the CSPP, see the box entitled “The ECB’s corporate sector purchase programme: its implementation and impact”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2017.

- Grosse-Rueschkamp, B., Steffen, S. and Streitz, D., “A Capital Structure Channel of Monetary Policy”, Journal of Financial Economics, Vol. 133, No 2, 2019, pp. 357-378.

- See Rostagno, M. et al., op. cit.

- Net percentages are defined as the difference between the percentage of enterprises reporting that a given factor has increased and the percentage of those reporting that it has declined.

- Ferrando, A., Popov, A. and Udell, G. F., “Do SMEs Benefit from Unconventional Monetary Policy and How? Microevidence from the Eurozone”, Journal of Money, Credit and Banking, Vol. 51, No 4, 2019, pp. 896-928.

- Corbisiero, G. and Faccia, D., “Firm or bank weakness? Access to finance since the European sovereign debt crisis”, ECB Working Paper Series, No 2361, ECB, Frankfurt am Main, 2020.

- The study shows that the key findings are robust to alternative definitions of credit rejection and an alternative firm-bank matching criterion applied to those firms reporting multiple bank relationships, either matching firms with their first listed bank or to the healthiest bank among those listed. In addition, they are not driven by a larger concentration of distressed firms in the periphery countries. See also the July 2018 report of the Bank Lending Survey.

- For additional evidence see Burlon, L., Dimou, M., Drahonsky, A.-C. and Köhler-Ulbrich, P., “What does the bank lending survey tell us about credit conditions for euro area firms?”, ECB Economic Bulletin, Issue 8, ECB, Frankfurt am Main, 2019.

- See Afonso, A. and Sousa-Leite, J., “The Transmission of Unconventional Monetary Policy to Bank Credit Supply: Evidence from the TLTRO”, REM Working Paper, No 65, 2019.

- García-Posada Gómez, M., “Credit constraints, firm investment and employment: Evidence from survey data”, Journal of Banking and Finance, Vol. 99, 2019, pp. 121-141.

- De Fiore, F. and Uhlig, H., “Corporate Debt Structure and the Financial Crisis”, Journal of Money, Credit and Banking, Vol. 47, No 8, 2015, pp. 1571-1598.

- Betz, F. and De Santis, R., “ECB corporate QE and the loan supply to bank-dependent firms”, ECB Working Paper Series, No 2314, ECB, Frankfurt am Main, 2019.

- Ferrando, A., Popov, A. and Udell, G. F., (2020) “A Funding Expectations Channel of Monetary Policy” ECB Working Paper Series, forthcoming. In another paper, Ferrando, A., Ganoulis, I. and Preuss, C., “Firms’ expectations on the availability of credit since the financial crisis”, Review of Behavioural Finance, 2020 look at the formation of expectations relating to the availability of bank finance among euro area SMEs. Firms seem to use a wider range of information at their disposal, e.g. on their sales and profits and the general economic environment. Importantly, SMEs seem to combine both backward and forward-looking elements, in some cases including important policy announcements, such as the OMT.

- This may well be the result of several additional factors set in motion by the announcement of the measures. For example, in the case of negative interest rate policy, Altavilla et al. highlight another channel of pass-through of the monetary policy transmission mechanism, through which sound banks can pass negative rates on to their corporate depositors without experiencing a contraction in funding. Furthermore, they show that the negative interest rate policy provides further stimulus to the economy through firms’ asset rebalancing.

- See Berger, A. and Udell, G., “The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in the Financial Growth Cycle”, Journal of Banking & Finance, Vol. 22, Nos 6-8, 1998, pp. 613-673; Cressy, R. and Olafsson, C., “European SME Financing: An Overview”, Small Business Economics, Vol. 9, No 2, 1997, pp. 87-96; Lawless, M., O’Connell, B. and O’Toole, C., “Financial structure and diversification of European firms”, Applied Economics, Vol. 47, No 23, 2015, pp. 2379-2398.

- As a signal that the taxonomy has changed slightly over time along with firms’ financing conditions, the empirical analysis referring to 2012 points to seven instead of eight clusters, as it is not possible to group firms around the cluster with the extensive use of grants or subsidised loans.

- Moritz, A., Block, J. H., and Heinz, A., “Financing Patterns of European SMEs: An Empirical Taxonomy”, Venture Capital, Vol. 18, No 2, 2016, pp. 115-148; and Masiak, C., Moritz, A., and Lang, F., “Financing patterns of European SMEs revisited: an updated empirical taxonomy and determinants of SME financing clusters”, EIF research and market analysis working paper, No 40, 2017. Both papers are based on previous survey rounds (2013 and 2015) and refer only to SMEs.

- Technically, the cluster procedure that has been chosen is the hierarchical one, using the Dice-similarity measure. The algorithm used to merge clusters at successive steps was the Ward clustering algorithm. Finally, the choice of the number of clusters was based on the combination of a visual inspection of the resulting dendogram with several criteria, called stopping rules, such as the variance ratio criterion (VRC) and the Duda-Hart indices. See Mooi, E., Sarstedt, M. and Mooi-Reci, I., “Market Research: The process, Data and Methods using Stata”, Springer Verlag, Berlin, 2018.

- See footnote 3 in the SAFE report.

- The regularities could be subject to simultaneity concerns. For example, high-growth firms are more reliant on multiple sources, but firms with more diversified funding can also be more innovative and high-growth as a result. Hence, there is no intention to provide any causal link in the stylised facts.

- There is a vast range of literature that has tried to establish a link between financing patterns and real effects. For example, see: Lamont, O., “Cash flow and Investment: Evidence from Internal capital markets”, Journal of Finance, Vol. 52, No 1, 1997, pp. 83-109; Brown, J. R., Fazzari, S. M. and Petersen, B. C., “Financing Innovation and Growth: Cash Flow, External Equity, and the 1990s R&D Boom”, Journal of Finance, Vol. 64, No 1, 2009, pp. 151-185; Popov, A., “Credit constraints and investment in human capital: Training evidence from transition economies”, Journal of Financial Intermediation, Vol. 23, No 1, 2014, pp. 76-100; and Chodorow-Reich, G., “The Employment Effects of Credit Market Disruptions: Firm-Level Evidence from the 2008-09 Financial Crisis”, Quarterly Journal of Economics, Vol. 129, pp.1-59. Most of the literature describes correlations between the two, as is also demonstrated in this article.

- The table reports the marginal effects over and above the cluster referring to firms with no external financing.

- See Covas, F., and Den Haan, W. J., “The role of debt and equity finance over the business cycle”, The Economic Journal, Vol. 122, No 565, 2012, pp. 1262-1286; Grundy, B., and Verwijmeren, P., “The external financing of investment”, SSRN Electronic Journal, 2019; and Ferrando, A. and Preuss, C., “What finance for what investment? Survey-based evidence for European companies”, Economia Politica, Vol. 35, 2018, pp. 1015-1053.