Introduction

Market infrastructures, together with markets and institutions, constitute one of the three core components of the financial system. The market infrastructure for payments[1] consists of the set of instruments, networks, rules, procedures and institutions that ensure the circulation of money. Its purpose is to facilitate transactions between economic agents and to support efficient resource allocation in the economy.

The Eurosystem has the statutory task of promoting the smooth operation of payment systems. This is crucial for a sound currency, the conduct of monetary policy, market functioning, and financial stability. A key instrument which the Eurosystem uses for carrying out this task[2] is the provision of payment settlement facilities. To this end, the Eurosystem operates the second-generation Trans-European Automated Real-time Gross settlement Express Transfer system[3] (TARGET2) for the euro.

In May 2008, TARGET2 replaced the first-generation system, TARGET, which was created in 1999 by the Eurosystem for the settlement of large-value payments in euro, offering a central bank payment service across national borders in the European Union (EU).

TARGET was developed to meet three main objectives:

- Provide a safe and reliable mechanism for the settlement of euro payments on a real-time gross settlement (RTGS) basis;

- Increase the efficiency of inter-Member State payments within the euro area;

- Serve, most importantly, the needs of the monetary policy of the Eurosystem.

Like its predecessor, TARGET2 is used to settle payments connected with monetary policy operations, as well as interbank payments, customer payments exchanged between banks, and transactions related to other payment and securities settlement systems, i.e. ancillary systems. As TARGET2 provides intraday finality, i.e. settlement is final for the receiving participant once the funds have been credited, it is possible to reuse these funds several times a day.

Since June 2015, TARGET2 participants have been able to open dedicated cash accounts (DCAs) on the TARGET2-Securities (T2S) platform,[4] which they can use to settle the cash leg of their securities transactions. Moreover, since November 2018, TARGET2 participants have been able to access the new service implemented by the Eurosystem for settling euro-denominated instant payments on an individual basis, around the clock. This new service is called TARGET Instant Payment Settlement (TIPS).

Building on the synergies between the two market infrastructures, the Eurosystem has been working intensively to consolidate TARGET2 and T2S services. This consolidation will, in particular, enhance the Eurosystem’s RTGS operations. In addition, the project will further strengthen cyber resilience capabilities and establish a single point of access to all Eurosystem market infrastructure services.

TARGET2 offers harmonised market infrastructure services at EU level, as well as a single pricing structure. It provides ancillary systems with a harmonised set of cash settlement services and supports its users with enhanced liquidity management tools. In this manner it contributes to financial integration, financial stability and liquidity efficiency in the euro area.

TARGET2 is accessible to a large number of participants. Over 1,000 credit institutions in Europe use TARGET2 to make payments on their own behalf, on behalf of other (indirect) participants or on their customers’ behalf. Taking branches and subsidiaries into account, almost 45,000 banks worldwide (and thus all of the customers of these banks) can be reached via TARGET2.

The report and its structure

This report is the 20th edition of the TARGET Annual Report. The first edition was published in 2001, covering TARGET’s first two years of operation (1999 and 2000). As in previous years, the report provides information on TARGET2 traffic, its performance and the main developments that took place in 2019. It is aimed mainly at decision-makers, practitioners and academics who need to reach an in-depth understanding of TARGET2. We hope it will also appeal to members of the general public with an interest in market infrastructure issues and, in particular, TARGET2.

In addition to the core content, this report includes seven boxes on topics of particular relevance in 2019 and an in-depth analysis of a specific TARGET2 feature. The boxes focus, respectively, on the evolution of traffic in TARGET2; a survey of TARGET2 activities and plans for the TARGET consolidation; liquidity distribution in TARGET2; the treatment of a TARGET2 participant in resolution; endpoint security in TARGET2; the detection of fraudulent payments in TARGET2; and the TARGET2/T2S consolidation project and future RTGS services.

In the report, references made to the first-generation TARGET system (which was in operation from January 1999 to May 2008) are also applicable to its second generation, TARGET2 (which replaced TARGET in May 2008).

Note

Liquidity transfers between TARGET2 and T2S/TIPS DCAs and payments processed on T2S/TIPS DCAs were not included when calculating the TARGET2 indicators presented in this report.

Despite the fact that both T2S and TIPS DCAs are legally part of TARGET2, these (technical) transactions are excluded from the calculations to prevent the system’s indicators being artificially inflated and to make the figures more easily comparable from year to year. Nevertheless, as a matter of transparency, some general (cash-based) and per-country statistics on T2S DCAs are provided on the ECB website.[5]

TARGET2 activity

In 2019, TARGET2 maintained its leading position in Europe, processing 89% of the total value settled by large-value payment systems in euro, and in the world, as one of the biggest payment systems. Compared with the previous year, the total turnover processed increased slightly, reaching €441.3 trillion.[6] The total volume of payments fell slightly by 0.8% to 87.8 million transactions.

The highest daily turnover during the year was recorded on 28 June, with a total value of €2,523 billion, and the highest daily volume of payments was recorded on 30 September, when 525,076 transactions were processed.

In 2019, the availability of TARGET2’s Single Shared Platform (SSP) stood at 100%.

1 Evolution of TARGET2 traffic

Table 1

Evolution of TARGET2 traffic

Note: There were 255 operating days in both 2018 and 2019.

1.1 TARGET2 turnover

TARGET2 turnover in 2019 amounted to €441.3 trillion, corresponding to a daily average of €1.7 trillion. Chart 1 shows the evolution of the value of TARGET2 traffic over the last eight years. In 2011 and 2012, TARGET2 settlement values continued to recover after the slump caused by the financial crisis, with an annual growth rate of around 3%. The observed drop of 22% in 2013 was due mainly to a change in the statistical methodology, which involved some transactions ceasing to be included in the aggregate representing the turnover.[7] Overall, after two years of stable figures, TARGET2 turnover on RTGS accounts fell by almost 15% between 2015 and 2017, following the launch of T2S.[8] In 2018 the TARGET2 value stabilised, and in 2019 experienced a 2% annual increase. This increase in turnover stemmed mainly from ancillary system settlement activity.

Chart 1

TARGET2 turnover

(left-hand scale: EUR billions; right-hand scale: percentages)

In terms of activities involving market participants (i.e. excluding central bank and ancillary system transactions), interbank transactions (transactions exclusively involving credit institutions) accounted for 77% of the total value of payments in 2019, whereas the remaining share was composed of customer transactions (i.e. transactions processed on behalf of a non-bank party, be they individuals or corporates). This share has remained stable over the past few years (78% of interbank payments in 2018).

A comparison of the TARGET2 turnover and the euro area’s annual GDP (around €11 trillion) shows that TARGET2 settles the equivalent of the annual GDP in less than seven days of operations. This indicates the role and efficiency of TARGET2, which provides intraday finality for transactions and allows the funds credited to the participant’s account to become immediately available for other payments. Consequently, the same euro can be reused several times by several TARGET2 participants in the same day.

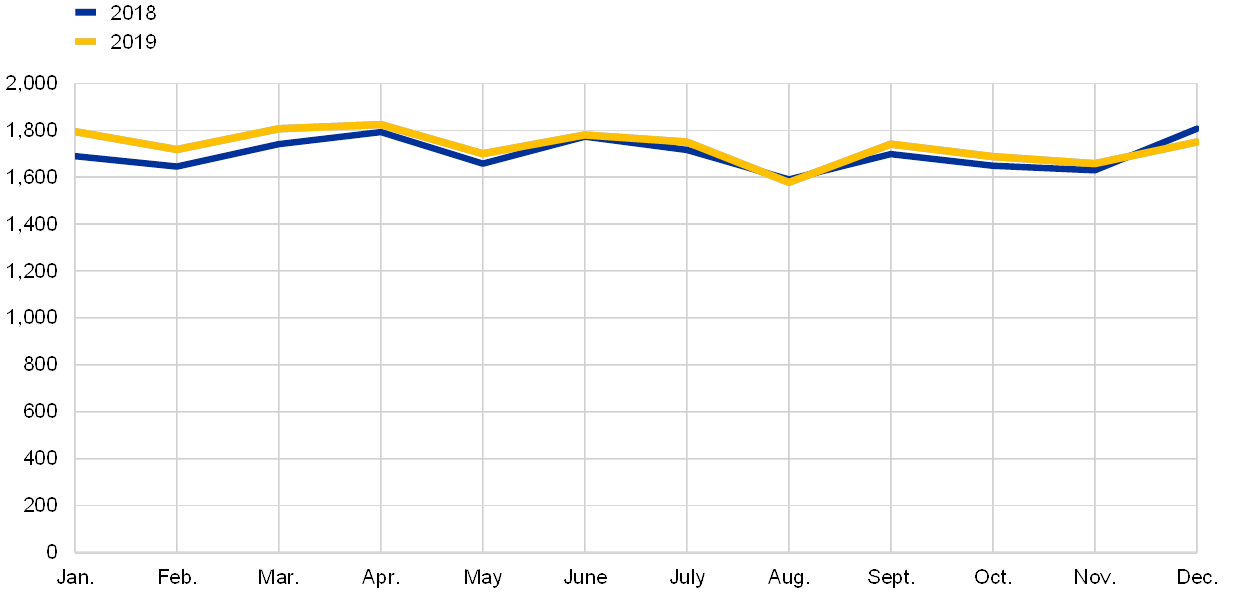

Chart 2 depicts the average daily turnover generated in TARGET2 for each month in 2018 and 2019, thus showing the seasonal pattern of the system. While the general pattern for both years is very similar, the values recorded in January and February 2019 are visibly higher than they were in the same period of 2018. The difference is largely attributable to the greater level of ancillary system settlement activity during these months.

Chart 2

Average daily TARGET2 turnover

(EUR billions)

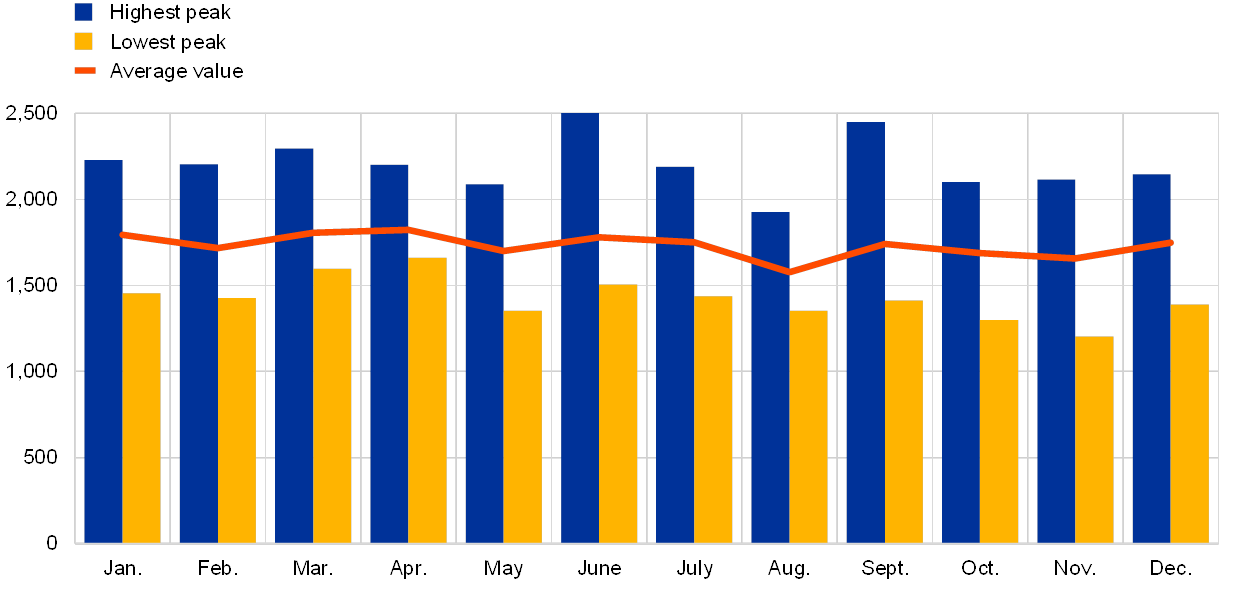

Chart 3 displays the highest and lowest daily TARGET2 values for each month of 2019, as well as the average daily values for each month. Usually, the days with the highest peaks are at quarter-ends, typically on the last day of the month, owing to reimbursements and due dates in various financial markets. This seasonal pattern was also visible in 2019, when the day with the largest turnover of the year with a total value of €2,524 billion was 28 June.

Chart 3

Monthly maxima and minima, troughs and averages of TARGET2 daily values in 2019

(EUR billions)

Throughout 2019, the amplitude of TARGET2 turnover, expressed by the difference between the highest and the lowest values, was 52%, compared with 48% the previous year. Overall, the average values throughout the year followed a well-established seasonal pattern.

Peaks and troughs in the system’s values can also be influenced by other factors, such as TARGET2 holidays or the end of reserve maintenance periods. For example, the lowest values are typically recorded during the summer holidays and on days that are national holidays in some Member States or in other important economies outside the EU. For example, in 2019, the lowest values processed coincided with a public holiday that is observed in several EU Member States and the United States (11 November).

Finally, Chart 4 compares traffic developments in the world’s major payment systems. In particular, it depicts the daily average turnover in euro equivalents for the last 20 years of TARGET/TARGET2, Continuous Linked Settlement (CLS), Fedwire Funds (the US dollar-denominated RTGS system operated by the Federal Reserve System) and the Bank of Japan Financial Network System (BOJ-NET). Some common patterns, including the effect of the financial crisis on the number of processed transactions, can be identified across systems. However, the comparability of TARGET2 with other systems has been hampered by the change in the TARGET2 statistical methodology in 2013, as well as by the migration of the securities settlement systems to T2S.[9] In the latter case, if the average daily volume in TARGET2 after 2015 is considered together with the average daily turnover for DCAs, which are technically held in T2S, total traffic continues to increase.[10]

Chart 4

Major large-value payment systems around the globe

(EUR billions)

Sources: Fedwire Funds Service (Federal Reserve website); BOJ Time-Series Data (Bank of Japan website); ECB data.

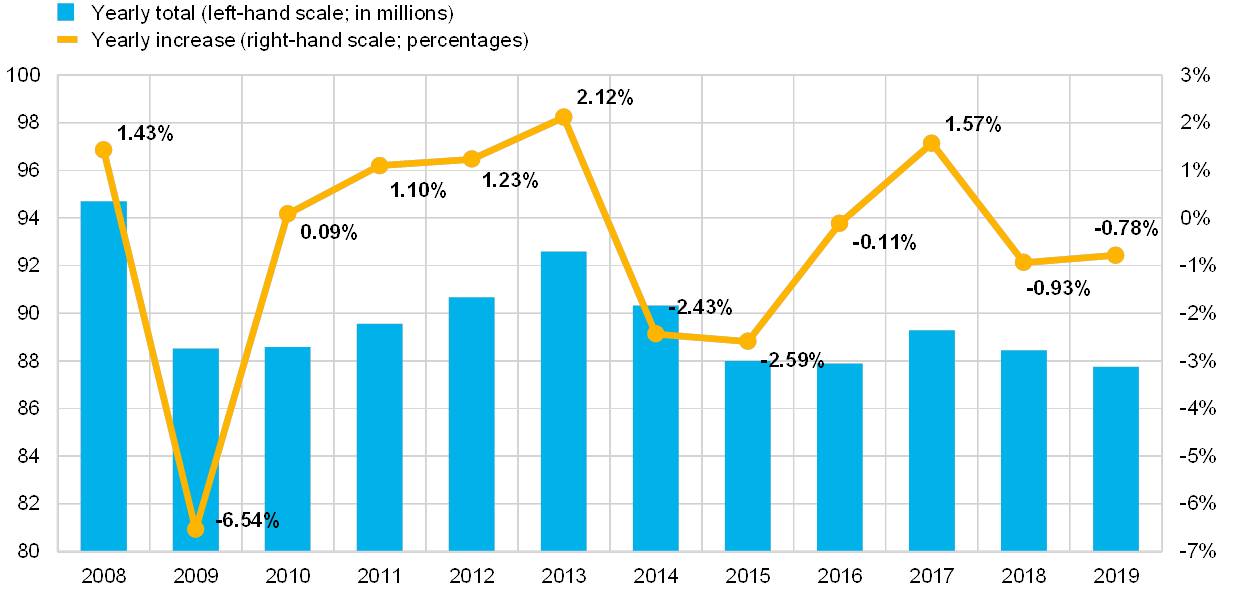

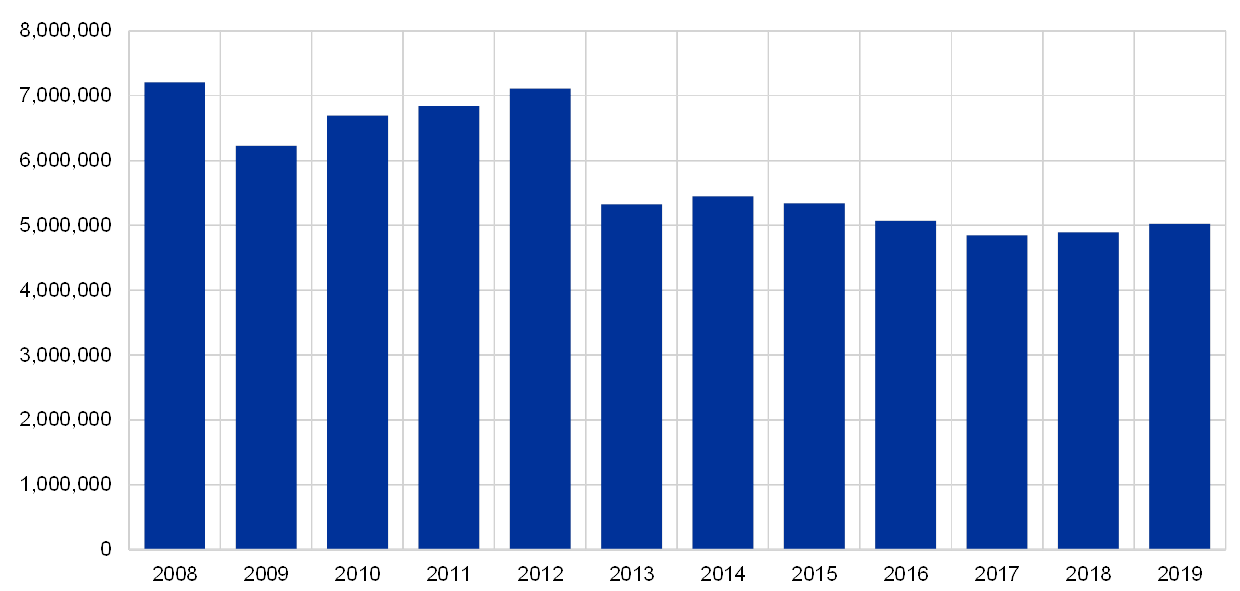

1.2 Volume of transactions in TARGET2

After low transaction volumes resulting from the financial crisis, TARGET2 traffic recovered, posting a positive trend between 2010 and 2013 (Chart 5). Although the number of transactions never reached pre-crisis levels, the system attracted around four million transactions more over that period. However, this trend reversed in 2014 and 2015: because the period for migration to Single Euro Payment Area (SEPA) instruments ended,[11] there was, once again, a significant reduction in the customer payment segment, leading to lower TARGET2 volumes. Following the completion of the migration to SEPA, TARGET2 traffic has stabilised at around 88 million transactions yearly.[12]

Chart 5

TARGET2 traffic

(left-hand scale: EUR millions; right-hand scale: percentages)

The exact volume settled in TARGET2 in 2019 amounted to 87,751,040 transactions, corresponding to a daily average of 344,122 payments. Compared with the previous year, the overall number of processed payments fell by around 0.8%. The decrease was driven mainly by the lower number of ancillary system-related transactions, which was not fully offset by the increase recorded in other segments, particularly customer and interbank. More detailed information on the evolution of the different traffic segments is provided in Box 1.

Box 1

Traffic evolution in TARGET2

The Eurosystem has been carefully monitoring the development of TARGET2 volumes over time, especially given their relevance for TARGET2 revenues and cost recovery. This box aims to share the insights gained from the analysis of 2019 volumes.

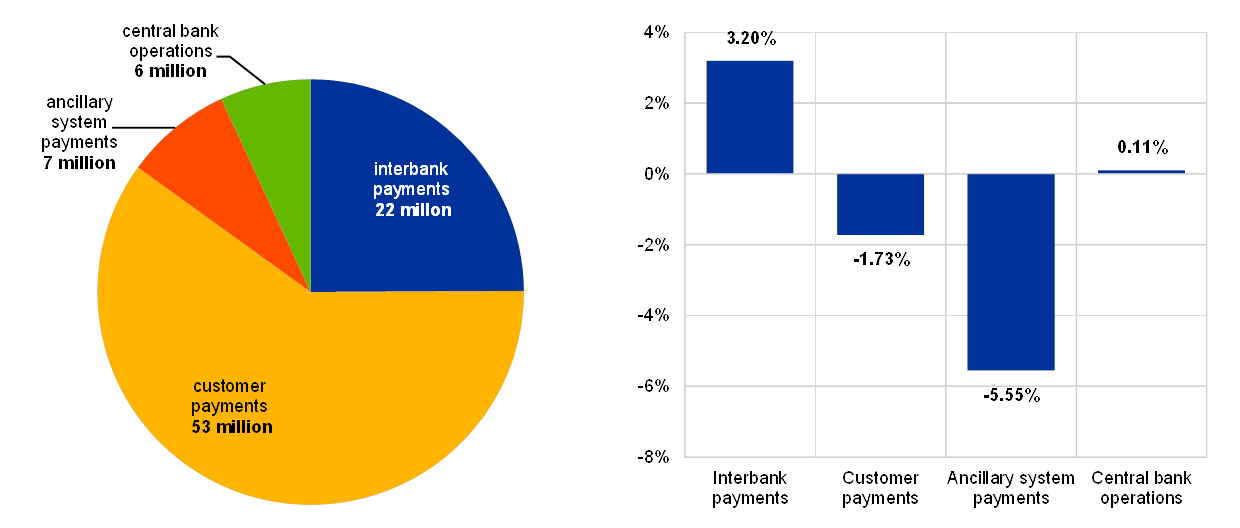

In 2019, customer payments accounted for 60% of total TARGET2 traffic in terms of volume, followed by interbank payments (25%), ancillary system payments (8%) and other payments such as central bank operations (7%).

Customer payments traffic decreased by 1.73% compared with 2018, driven primarily by lower traffic in the Netherlands (-70.32%) as a result of the country’s move to instant payments.[13] This decline was partially offset by an increase in France (+23.74%). Interbank payments traffic increased by approximately 3.20% compared with 2018, recording in particular a significant increase in traffic in Germany (more than 560,000 payments or +4.54%) and France (around 500,000 payments or +26.09%) and a decline in the Netherlands (around 600,000 payments or -41.60%). These changes were largely due to UK-based credit institutions relocating their point of access to TARGET2 from the Netherlands to France and Germany in preparation for Brexit. Central bank-related payments showed a slight increase of 0.11%.

Chart A

TARGET2 traffic – volume distribution and yearly growth rate for 2019 payments by payment type

At the same time, the greatest change, in relative terms, was seen in ancillary system traffic. 2019 saw a reduction of 5.55% in annual ancillary system volumes compared with 2018, with the largest traffic decline taking place in Germany. The drop followed the sharp year-on-year reduction of 36.13% in 2018, which reflected the impact of the last migration wave to T2S. However, this decrease was, to a large extent, counteracted by the above-mentioned positive developments in interbank payments, which account for the second-largest share of TARGET2 traffic. As a result, there was only a slight drop of 0.75% in overall TARGET2 volumes.

There were between 4.0 million and 4.8 million customer payment transactions per month during 2019. Historically, customer payments exhibit strong seasonal patterns, typically showing a decrease in traffic around April (Easter) and the summer months (August and September), and an increase towards the year-end. This pattern shifted slightly in 2019, which displayed the largest seasonal reductions in monthly transaction volumes in February, June and August (see Chart B for the particular seasonal patterns observed in 2019). Meanwhile, interbank payments ranged from 1.6 million to 1.9 million transactions per month during 2019, and were affected by similar seasonal trends. By contrast, ancillary systems and operations with central banks are not significantly affected by seasonal patterns.

Chart B

TARGET2 traffic – number of interbank, customer, ancillary system and central bank-related payments per month in 2019

Following the final T2S migration wave in September 2017, the share of ancillary system traffic in TARGET2 dropped from 15% to 9% in 2018 and remained stable at around 8% in 2019. Finally, payments relating to central bank operations also remained relatively stable in 2019.

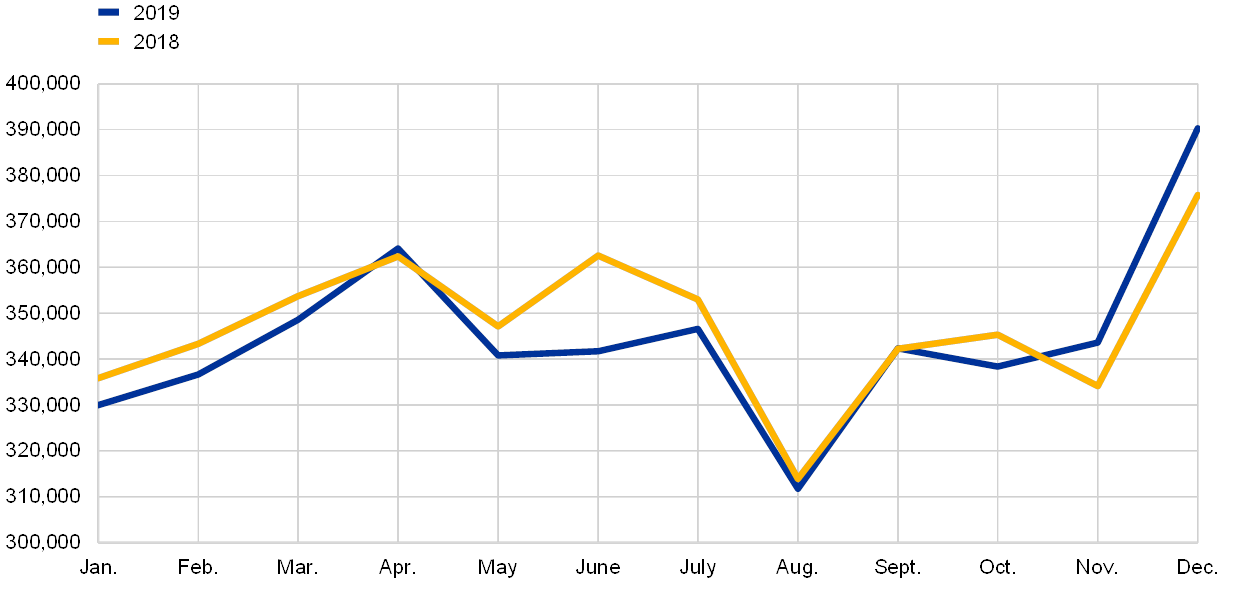

For more than six months in 2019, the average daily volumes in TARGET2 calculated on a monthly basis were below the levels recorded for the corresponding months in 2018 (Chart 6). The biggest difference, amounting to 6%, was observed in June, and was largely due to a decrease in customer payments, as highlighted in Box 1. Overall, Chart 6 indicates a seasonal pattern that was very similar to that seen the previous year.

Chart 6

Average daily TARGET2 volumes per month

(number of transactions)

The highest average daily volume was recorded in December, when it reached more than 390,000 transactions. A high figure such as this may be related to the high daily volumes normally observed at the end of the year.

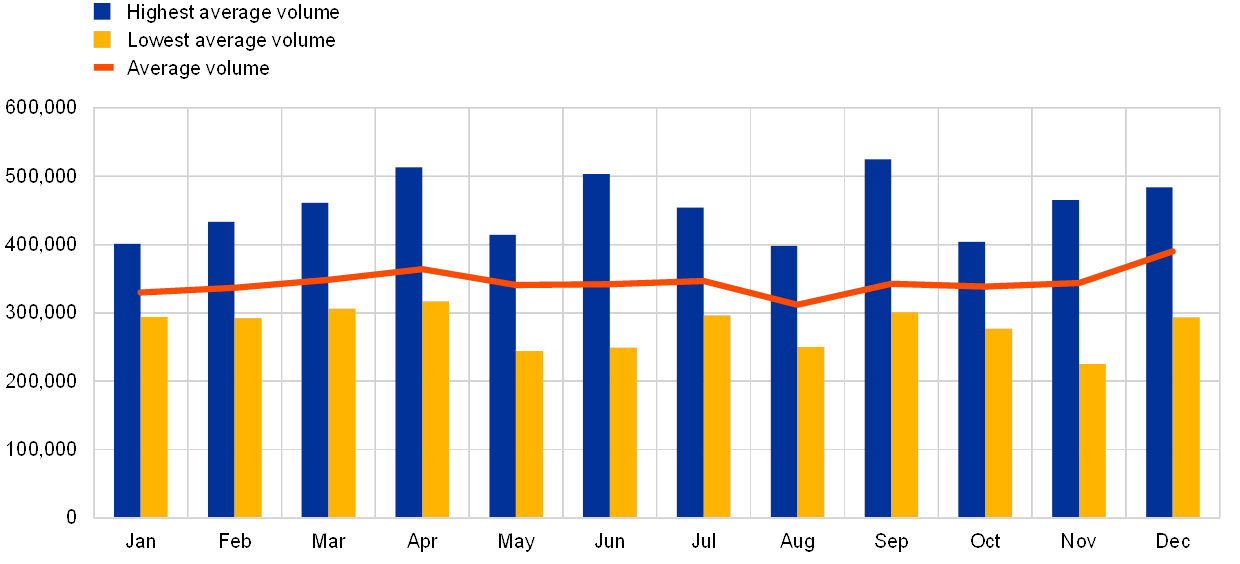

Chart 7

Monthly peaks, troughs and averages of TARGET2 daily volumes in 2019

(number of transactions)

Chart 7 depicts the peaks and troughs in terms of the daily volume on RTGS accounts in TARGET2 in 2019 as well as the average daily volume for each month. As already observed for the value-based figures, the peaks typically fall on the last day of the month, and are especially pronounced at quarter-end for the same reasons (i.e. deadlines in financial markets or for corporate business). In 2019, the highest daily volume was recorded on 30 September, when 525,075 transactions were processed. The lowest daily volume was recorded on 1 November (225,314 transactions), which was a public holiday in most European countries (All Saints’ Day). Similar developments were also observed in 2018, when the highest yearly peak was recorded on 3 April, the first day after the Easter period, and the lowest on 1 November.

Chart 8 shows the yearly moving average of TARGET2 volumes (i.e. the cumulative volume processed in the preceding 12 months) for each month. This indicator helps to eliminate the strong seasonal pattern observed in TARGET2 traffic. The variation of this cumulative volume from one year to the next is also presented as a percentage. The chart shows that the cumulative volume started to decline in the second half of 2008, when the financial crisis erupted. The number of transactions continued to drop sharply, almost until the end of 2009. After that, TARGET2 volumes were roughly stable until the end of 2011. They then started to grow moderately until the end of the first quarter of 2014, when they reached their highest point since the crisis. Thereafter, the cumulative volume started dropping for the reasons already explained at the beginning of this section (SEPA migration) and, in October 2014, the cumulative growth rate on a yearly basis turned negative and continued to decrease until mid-2017. The negative trend reversed in 2017 because of the increases observed in the customer and interbank payments segment, and remained stable throughout 2018 and 2019.

Chart 8

TARGET2 volumes

(left-hand scale: million transactions; right-hand scale: percentages)

Chart 9 compares the growth rate (between 2018 and 2019) of traffic in TARGET2 with the growth rates of the major payment systems worldwide, as well as with the growth rate of SWIFT payment-related FIN traffic (categories 1 and 2). The chart reveals that, with the exception of TARGET2,[14] traffic in the main payment systems increased in this period. The biggest increase – almost 8% – was recorded by SIC (CH), followed by Fedwire Funds (US).

Chart 9

Comparison of the changes in traffic in some major large-value payment systems and SWIFT between 2018 and 2019

(in percentages)

Sources: Fedwire Funds Service (Federal Reserve website); SWIFT FIN traffic (SWIFT website); BOJ Time-Series Data (Bank of Japan website);

Key payment statistics (Bank of England website); Annual Statistics From 1970 to 2019 (the Clearing House website); SIC statistics (SIX-SIC website); ECB data.

1.3 Interactions between TARGET2 and T2S[15]

T2S is the Eurosystem’s pan-European platform for securities settlement in central bank money, bringing together both securities and cash accounts on a single technical platform.

T2S went live on 22 June 2015, with central securities depositories (CSDs) joining the platform for euro settlement in waves. The final migration wave was completed on 18 September 2017, thus making 2019 the second full year of operations. In addition, on 29 October 2018, Danmarks Nationalbank connected its RTGS and collateral management system, Kronos2, to T2S, so Danish kroner can now also be used to settle the cash legs of securities transactions in T2S. On the same date, VP Securities (a Danish CSD that had already been using T2S for settlement in euro) migrated its Danish kroner settlement to the platform.

Although the accounts are centralised on a single platform, the legal and business relationships of the holders of the securities and cash accounts remain with the CSDs and national central banks respectively.T2S DCAs are opened with the central banks and are used exclusively for the securities settlement business in T2S. Although they are technically held on the T2S platform, euro-denominated DCAs are legally part of TARGET2. Therefore, the rights and obligations of T2S DCA holders are reflected in the TARGET2 Guideline. At the end of 2019, there were 811 active euro-denominated DCAs on the T2S platform.

At the start of each T2S business day, liquidity is sent from TARGET2 to T2S while, towards the end of the day, any remaining liquidity on DCAs is swept back to the RTGS accounts in TARGET2. During the day, liquidity can be freely transferred from TARGET2 to T2S and vice versa.

In 2019, there were an average of 573 inbound liquidity transfers from TARGET2 to T2S and 677 outbound liquidity transfers from T2S to TARGET2 every day.

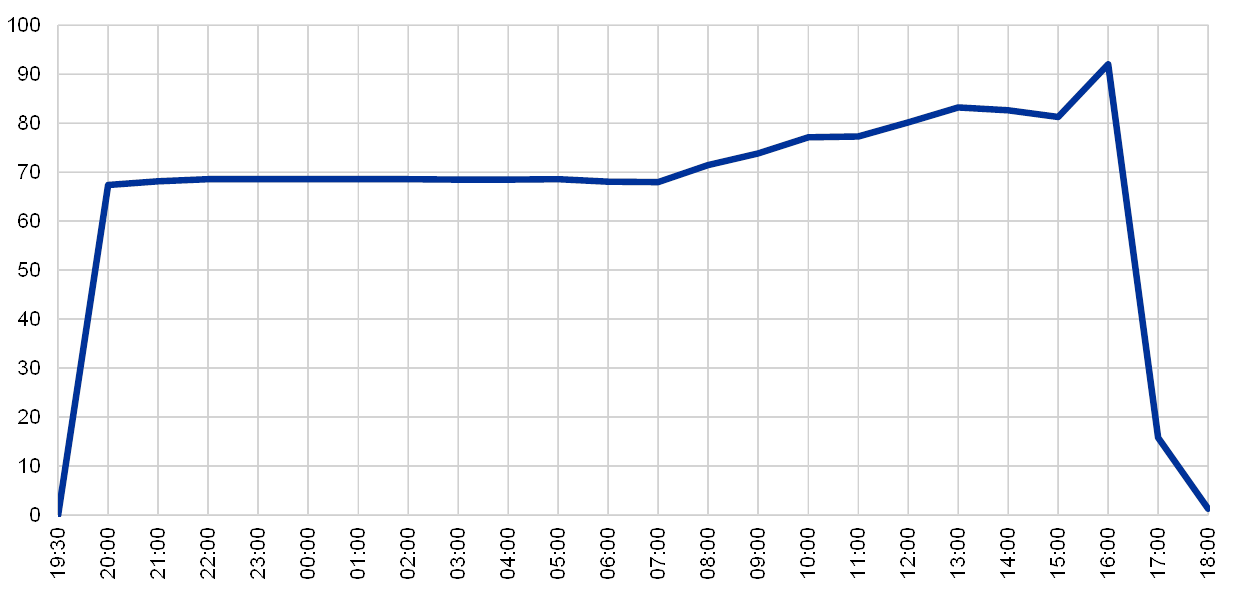

Chart 10 shows the average cumulative central bank liquidity held in T2S on a daily basis between January and December 2019.[16]

Chart 10

Time distribution of liquidity in DCAs

(EUR billions, daily averages)

In terms of intraday pattern, liquidity is injected into T2S at the beginning of the TARGET2 night-time phase (19:30) and its level then remains fairly constant until the T2S maintenance window is completed (between 03:00 and 05:00). After this, more liquidity reaches T2S and fluctuations occur. There is a spike in the liquidity held in T2S before 16:00, owing to participants sending liquidity to T2S to reimburse auto-collateralisation and to ensure the remaining transactions are settled. At 16:30 the liquidity in T2S decreases sharply as a consequence of the optional cash sweep that brings liquidity back from T2S to TARGET2. The next drop, to zero, is observed towards the end of the business day, and is related to the execution of the automated cash sweep from T2S to TARGET2 at 17:45, when all remaining liquidity on DCAs is pushed from T2S back to TARGET2. The optional cash sweep is preferred to the automated cash sweep.

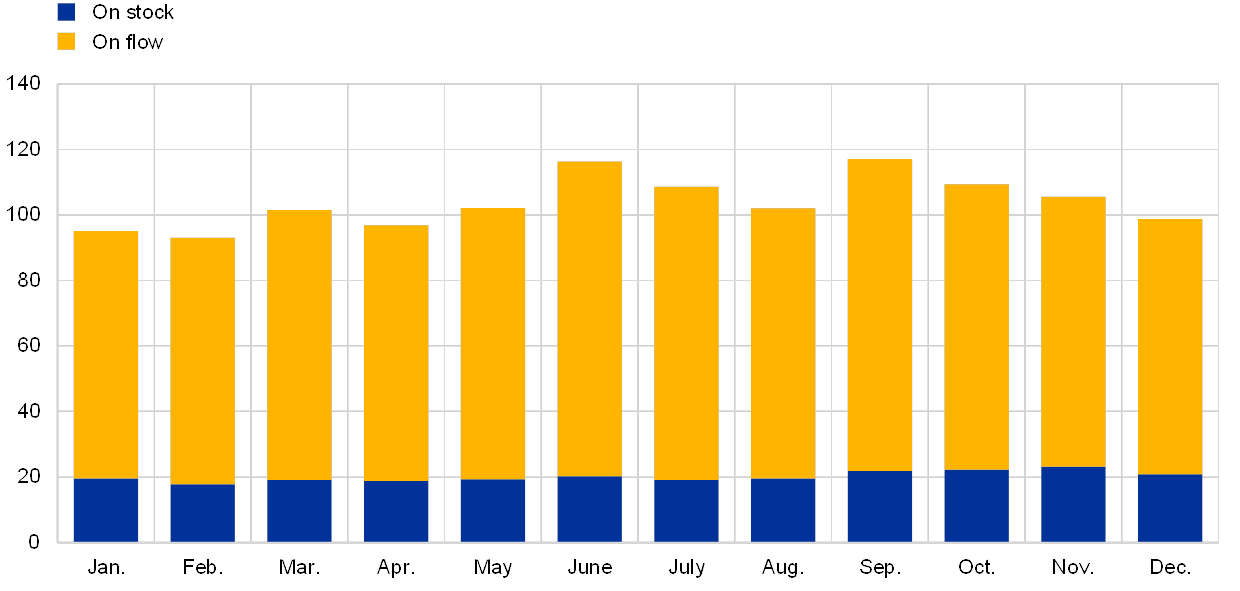

Chart 11 illustrates the daily average value of auto-collateralisation in T2S by month in 2019. Auto-collateralisation is intraday credit granted by a euro area central bank and triggered when a T2S DCA holder has insufficient funds to settle securities transactions.

The use of auto-collateralisation on stock, i.e. where the credit received from the central bank is collateralised by securities already held by the buyer, remained relatively stable throughout the year. The average daily value was €20.12 billion.

The usage of auto-collateralisation on flow, i.e. settlement transactions that are financed via credit received from a central bank and collateralised by securities that are about to be purchased, was less stable and peaked at €96.02 billion in June 2019. The average daily value was €83.78 billion.

On average, in 2019 19.37% of the total value of auto-collateralisation was represented by auto-collateralisation on stock and 80.63% by auto-collateralisation on flow.

Chart 11

Daily average value of auto-collateralisation for euro and Danish kroner activity

(EUR billions)

Note: amounts settled in Danish kroner are converted into euro at an exchange rate of EUR 0.13/DKK 1.

1.4 Interactions between TARGET2 and TIPS

TARGET Instant Payment Settlement (TIPS) is a harmonised and standardised pan-European service for the settlement of instant payments in central bank money. TIPS went live on 30 November 2018 with a high capacity and 24/7/365 availability.

TIPS provides for the sending and receipt of instant payments, liquidity transfers, and recalls of settled instant payment transactions, based on the ISO 20022 standard and in accordance with the SEPA Instant Credit Transfers (SCT Inst) scheme. These instant payments are settled on TIPS DCAs held with the respective national central banks.

Legally, the euro-denominated TIPS DCAs fall under the perimeter of TARGET2 and, therefore, the rights and obligations of TIPS DCA holders are included in the TARGET2 Guideline. At the end of 2019, there were 29 active euro-denominated TIPS DCAs and 3,797 reachable parties in TIPS.

TIPS is also designed to be currency-agnostic, providing settlement in non-euro central bank money if requested as it can connect to any other RTGS system.

1.5 Comparison with EURO1

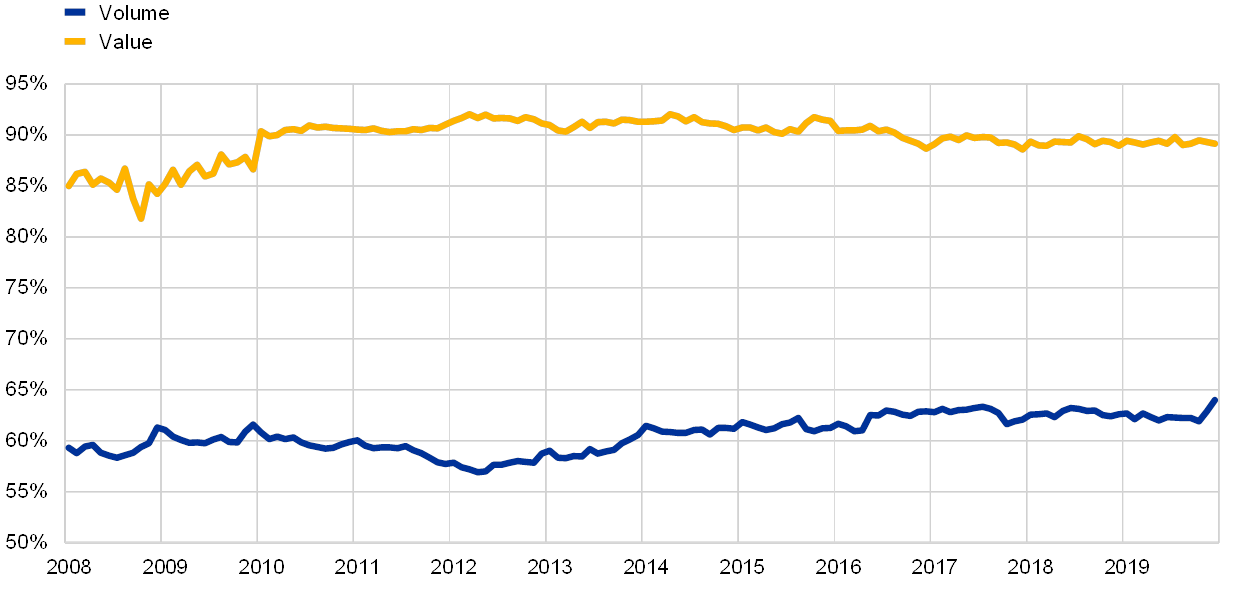

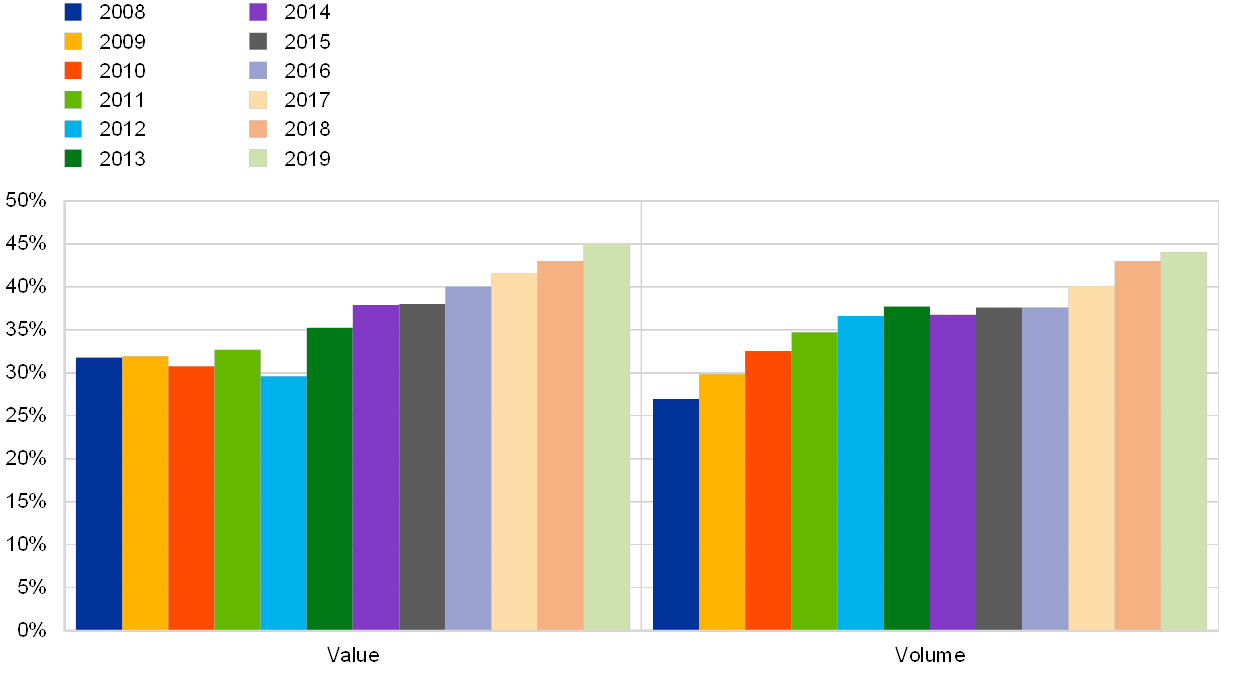

EURO1 is the only direct competitor of TARGET2 among large-value payment systems denominated in euro. Thus, the market share of TARGET2 is defined as its relative share vis-à-vis EURO1, as shown in Chart 12.

The two systems are different by design, since EURO1 operates on a net settlement basis and only achieves final settlement in central bank money (in TARGET2) at the end of the day. Furthermore, they respond partly to different business cases, since only TARGET2 settles individual transactions in central bank money and processes ancillary system transactions and payments related to monetary policy operations.

However, the actual composition of the traffic in the two systems is made up largely of interbank and customer payments. This helps to explain, in part, the relative share of TARGET2 vis-à-vis EURO1, as shown in Chart 12, which only takes these two payment categories into account. In 2019, TARGET2 maintained its share in terms of both the value and the volume of payments processed. It processed 89% of the value and 62% of the volume settled by large-value payment systems in euro.

When reading Chart 12, it should be kept in mind that it does not provide a full picture of the banks’ routing preferences vis-à-vis all systems, but instead gives only a partial picture of the market’s preferences related to the settlement of large-value euro-denominated transactions. In particular, the extent to which payments are channelled through automated clearing houses (ACHs) or correspondent banking arrangements is not reflected in this chart.

Chart 12

Market share of volumes and values settled in TARGET2 vis-à-vis EURO1

(in percentages)

Source: TARGET/Euro LVPS (ECB website).

Note: This chart is not affected by the change in the statistical methodology implemented in 2013, since the calculations are based on interbank and customer payments only, and do not include transactions with the central banks, which were most affected by the methodological change.

1.6 Value of TARGET2 payments

Chart 13 shows the evolution of the average value of a TARGET2 payment between 2008 and 2019.[17] The continuous decrease from 2015 to 2017 could be related to the migration to T2S of securities settlement system traffic.[18] In 2019 the average value of a payment increased slightly to €5.2 million, from €4.8 million in 2018.

Chart 13

Average value of a TARGET2 payment

(in EUR)

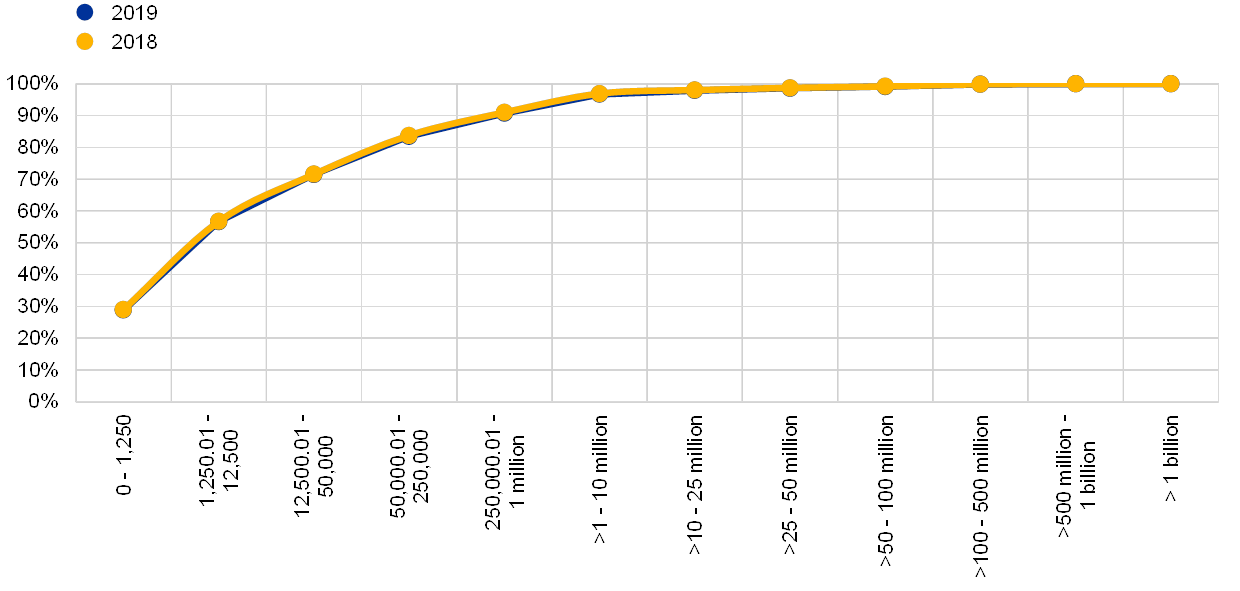

Chart 14 illustrates the distribution of TARGET2 transactions per value band, indicating the shares, in terms of volume, that fall below a certain threshold. The picture remained similar to that of the previous year. Generally, 70% of all TARGET2 transactions were for values of less than €50,000. Payments of above €1 million accounted for only 9% of traffic.

Chart 14

Distribution of TARGET2 transactions across value bands in 2019

(in percentages)

On average, there were almost 160 payments per day with a value of above €1 billion, which accounted for 0.05% of payment flows. Given the wide distribution of transaction values, the median payment in TARGET2 is calculated as €7,404, which indicates that half of the transactions processed in TARGET2 each day are for a value lower than this amount. This figure confirms that TARGET2 offers a range of features attracting a high number of low-value transactions, especially those of a commercial nature. Although the picture has changed slightly since the completion of the migration to SEPA, particularly with regard to commercial payments, TARGET2 is still widely used for low-value payments, especially urgent customer transactions. This is not unusual in the field of large-value payments and is also observed in other systems worldwide.

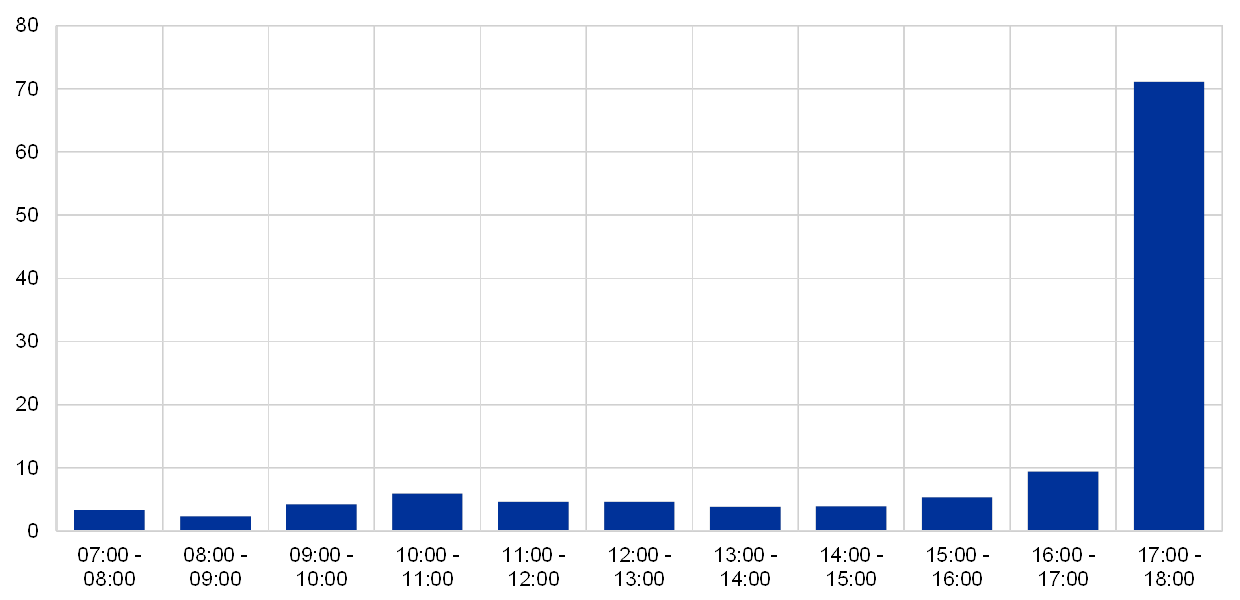

Chart 15

Intraday pattern: average value of a TARGET2 payment

(EUR millions)

Chart 15 depicts the average value of TARGET2 payments executed at different times of the day. The chart indicates that in 2019, as in previous years, TARGET2 settlement showed a strong intraday pattern. After the system opens at 07:00 CET, the hourly average value of transactions fluctuates minimally throughout the day. Between 09:00 CET and 13:00 CET, the average value increases slightly, owing to the settlement of CLS and other ancillary system transactions at this time. A more visible increase is recorded between 16:00 CET and 17:00 CET, while an optional cash sweep from T2S DCAs to TARGET2 is taking place and when ancillary systems such as EURO1 settle their cash balances in TARGET2. The last hour of operations, between 17:00 CET and 18:00 CET, is reserved for interbank transactions, while the cut-off time for customer payments is 17:00 CET. The average size of payments increases dramatically at this time, owing to banks squaring their balances and refinancing themselves on the money market. Overall, the last two hours of the TARGET2 operation are characterised by a limited number of transactions, albeit at very high values.

The average payment value in 2018 during the last TARGET2 opening hour was 14% lower than in 2017. In 2019 the average payment was a further 25% lower than in 2018. This trend most probably stems from excess liquidity conditions in the market.

The chart does not take into account payments that take place before the start and after the end of the business day, since these transactions fall under the night-time settlement category (see Section 1.6) and relate to pure accounting, e.g. liquidity transfers from the local accounting systems of central banks or the fuelling of sub-accounts as well as T2S DCAs.

1.7 Night-time settlement in TARGET2[19]

TARGET2 operates during the day from 07:00 CET to 18:00 CET, and also offers the possibility of settling payments during the night. Although during the day-trade phase the system is open for regular payments from financial institutions and ancillary systems, night-time settlement is only for ancillary systems connecting via the Ancillary System Interface (ASI) as well as liquidity transfers to/from T2S and TIPS. Other operations, such as bank-to-bank transactions or customer payments, are only allowed during the day.

There are two night-time settlement windows: 19:30 CET to 22:00 CET and 01:00 CET to 07:00 CET. The two windows are separated by a technical maintenance window, during which no settlement operations are possible.

Since the system is closed during the night to any other form of payments processing, ancillary systems can take advantage of banks’ stable and predictable liquidity situations, thereby settling their transactions efficiently and safely. In general, the night-time windows are used mainly by retail payment systems. On average, around 1,500 payments, representing a value of €14 billion, were settled every night in TARGET2 in 2019. While the average amount of payments during night-time settlement remained stable in comparison with 2018, the average value of transactions increased by €2 billion. This increase stemmed mainly from Spain and related to the liquidity transfer supporting the settlement of instant payments and cash operations.

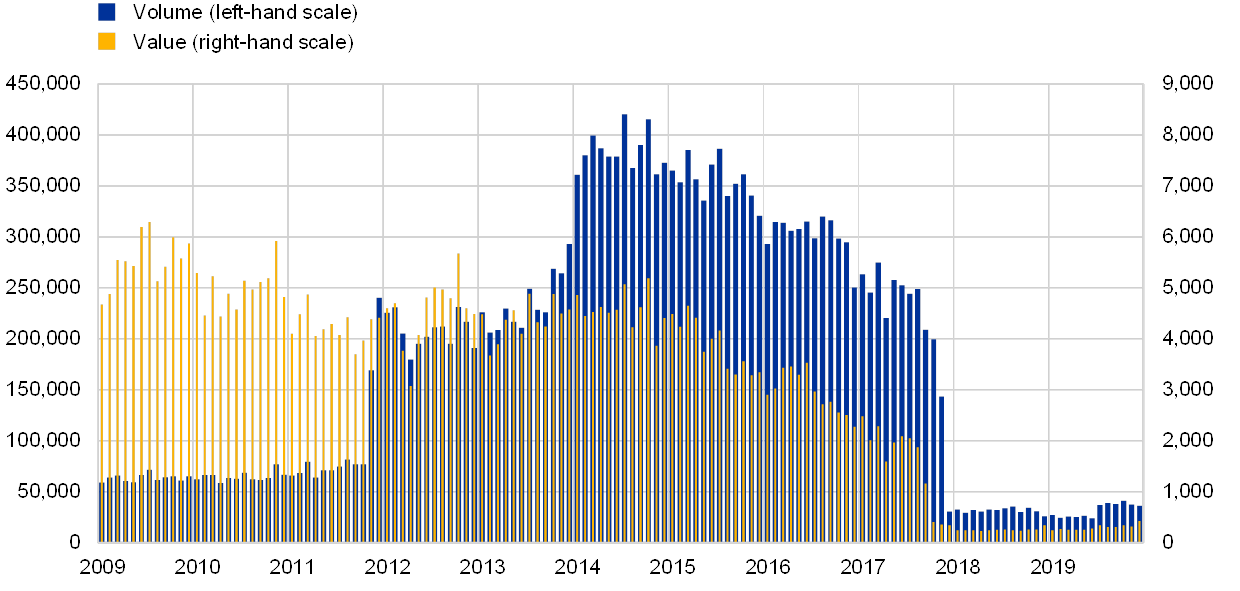

Chart 16 shows how the volumes and values settled in TARGET2 during the night have evolved since 2009. The increase in volume in November 2011 was because the SEPA Clearer ancillary system started to make use of the night-time settlement service in TARGET2. Since then, the number of payments settled at night has increased steadily, notably in 2014, whereas values have remained fairly stable. The trend reversed in 2015, with night-time settlement values as well as volumes decreasing continuously. As indicated above, the changes in the night-time settlement pattern in this period can be attributed primarily to securities settlement systems that had migrated their operations to T2S. Since December 2018, night-time settlement values and volumes have reached historically low levels because some ancillary systems’ TARGET2 night-time settlement activity has moved to the day-trade phase.

Chart 16

Night-time settlement in TARGET2

(left-hand scale: number of transactions; right-hand scale: EUR billions)

1.8 Payment types in TARGET2

Charts 17 and 18 present a breakdown of TARGET2 volumes and turnover by type of transaction. Traffic is divided into four categories: payments to third parties (e.g. interbank transactions and customer transactions), payments related to operations with the central bank (e.g. monetary policy operations and cash operations[20]), ancillary system settlement, and liquidity transfers between participants belonging to the same group.

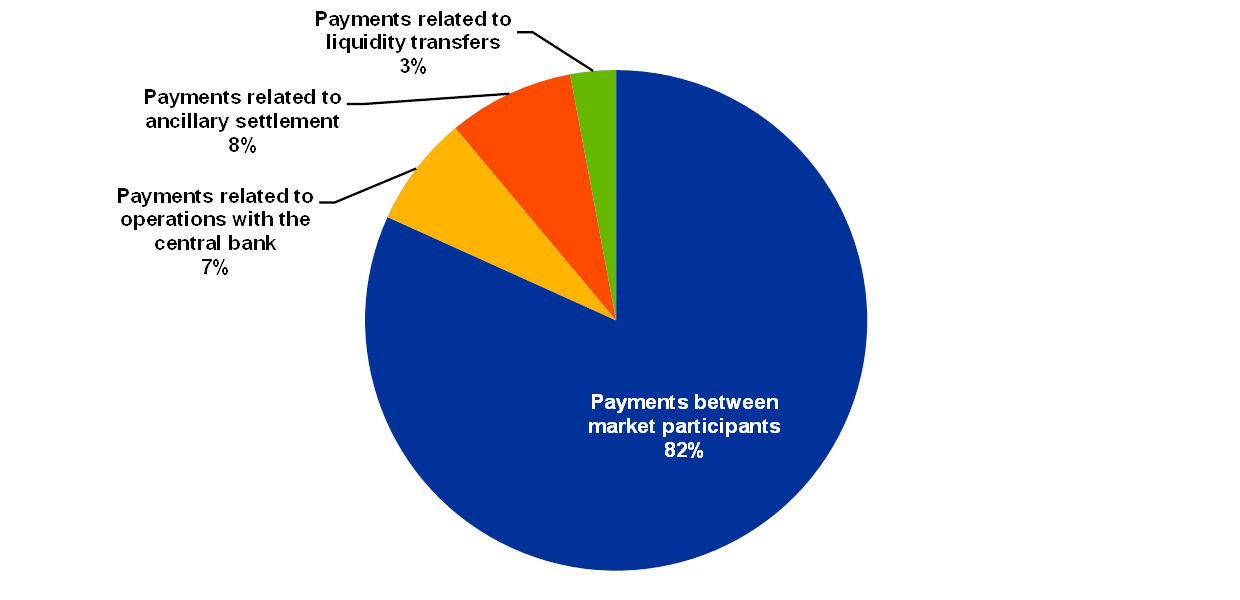

More than 80% of the TARGET2 volume is made up of payments to third parties, i.e. payments between market participants. The volume of ancillary system settlement represents 8% of the total volume, 7% is generated through operations with the central bank, and the remaining 3% is linked to liquidity transfers. Overall, all these figures remained similar to those for the previous year.

Chart 17

Breakdown of TARGET2 volumes in 2019

(in percentages)

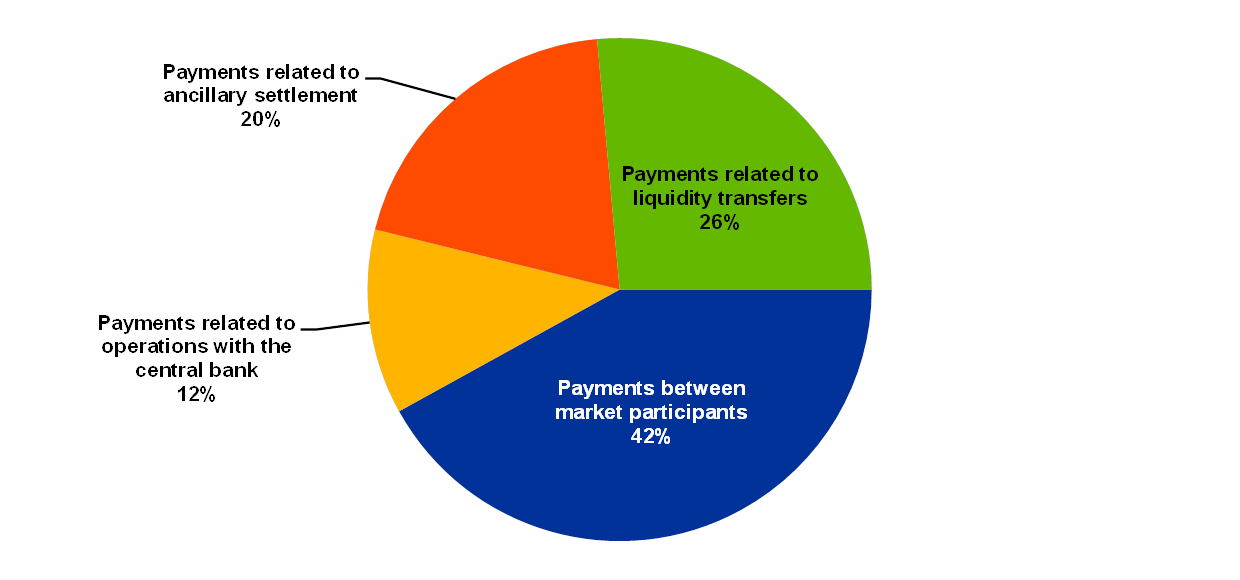

Chart 18

Breakdown of TARGET2 turnover in 2019

(in percentages)

With regard to turnover, payments between participants represent only 42% of total value. The value of ancillary system settlement represents 20% of the total volume, 12% is generated through operations with the central bank, and the remaining 26% is linked to liquidity transfers. Overall, all these figures remained similar to those for the previous year.

The difference between the volume-based and the value-based indicators across payment categories stems from the fact that the average sums involved in monetary policy transactions, ancillary system instructions and liquidity transfers are typically much larger than payments to third parties.

Box 2

Survey of TARGET2 activity and plans for the TARGET consolidation

The TARGET2 operator is interested in understanding what drives participants’ activity in the system, as well as their plans for when the consolidated platform goes live in November 2021. For this reason, in 2019 the Eurosystem launched a survey among participants and collected a total of 180 replies. In terms of daily average TARGET2 traffic, the respondents represented around 60% of the value and 55% of the volume. Respondents were of different types, including commercial and universal banks, investment banks, public banks, specialised lenders, savings banks, credit unions and other types of institutions. This box presents the key takeaways from the survey – a more detailed analysis was shared bilaterally with the respondents.

Current activity

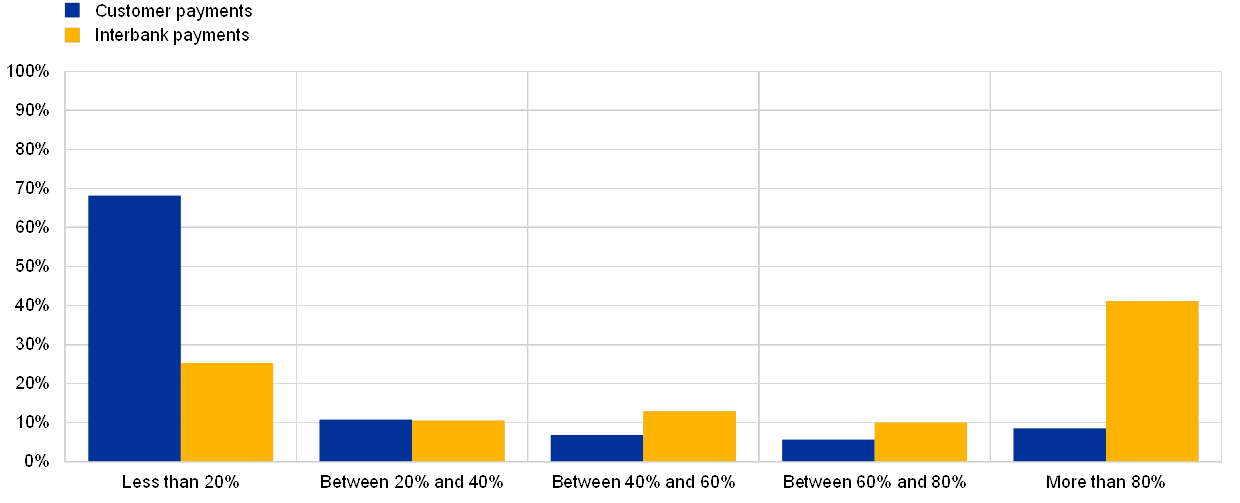

As expected, respondents process a larger share of their euro-denominated interbank payment activity than their customer payment activity in TARGET2. Chart A shows the percentage of respondents’ total customer and interbank payment activity processed via TARGET2. Over two-thirds of respondents indicated that they process less than 20% of their total customer payments via TARGET2 (i.e. the first blue bar), while a similar portion settle at least 40% of their interbank payments in TARGET2 (i.e. aggregating the third, fourth and fifth yellow bars). Respondents specialising in retail business generally indicated low shares of euro-denominated customer payments processed in TARGET2, while the share of interbank payments processed in TARGET2 does not appear to be significantly linked to a bank’s business model. This finding is consistent with the definition of TARGET2 as a Large-Value Payment System (LVPS) and the availability of alternative payment channels in addition to correspondent banks. In particular, customer payments can be processed via several domestic and pan-European (instant) retail payment systems (RPS), whereas interbank payments are processed mainly via other LVPS.

Chart A

Payments processed via TARGET2 as a percentage of banks’ total payment activity

(Respondents, in percentages)

Notes: 176 replies were considered for customer payments and 170 replies were considered for interbank payments. Non-available answers are not included in the chart.

More than two-thirds of respondents indicated their usage of one or more of the liquidity management features available in TARGET2. Intraday credit, priorities, reservations and warehoused payments are among the most widely used features across all respondents, irrespective of their business models. The two main reasons for not using such features are the current levels of liquidity and the availability of internal liquidity management systems.

Future activity

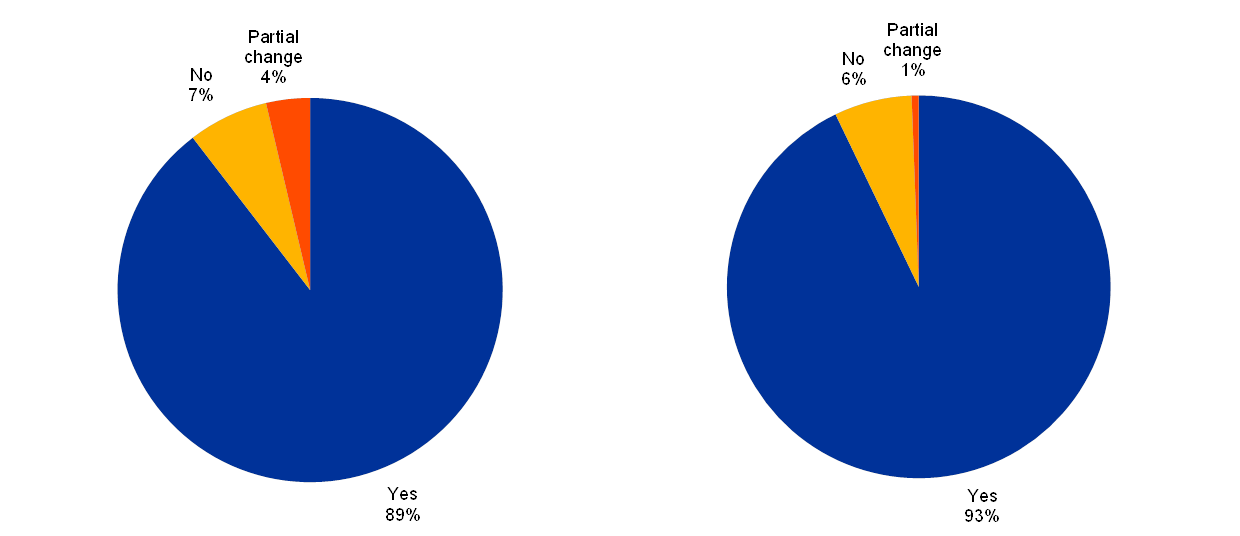

Respondents largely expect to continue to settle their euro-denominated customer and interbank payments in the upcoming consolidated platform as they do today. 89% of respondents will continue to settle their euro-denominated customer payments in the RTGS system, while 93% indicate continuity for interbank payments (see Chart B). Respondents appreciate TARGET2 primarily for its speed, its reachability and the fact that it offers settlement in central bank money.

Chart B

Plans to continue processing customer (left panel) and interbank payments (right panel) in T2

(Respondents, in percentages)

Notes: 163 replies were considered for customer payments and 168 replies were considered for interbank payments (some respondents indicated that they do not currently process these payments via TARGET2). Non-available answers are not included in the charts.

At the same time, instant payments could impact the customer payment activity processed in TARGET2. A third of respondents indicated that they already offer instant payment services. The current availability of instant payment solutions appears to be linked to a bank’s business model, as respondents active in the retail business are more likely to offer such services to their clients. In addition, several respondents who do not yet offer instant payment solutions indicated that they have plans to do so in the future. Nevertheless, only a minority of participants signalled their intention to shift their TARGET2 customer payments to instant payments.

Overall, the survey has contributed to improving the understanding of today’s activity in TARGET2 and offers interesting insights into participants’ future plans. The TARGET2 operator will continue to monitor its participants’ activity in the system and to gather the views of its user community to provide the services and functionalities needed.

1.9 The use of prioritisation

Priority options help TARGET2 participants optimise their liquidity usage by allowing them to reserve a certain amount of liquidity for specific payment priorities. When submitting payments in TARGET2, participants can assign them a certain priority: “normal”, “urgent” or “highly urgent”. In general, payments are settled immediately on a “first in, first out” basis, as long as sufficient liquidity is available in the participant’s RTGS account. However, if this is not the case, payments that cannot be settled immediately are queued according to priority. Participants can reserve a set amount of their liquidity for the priority classes “urgent” and “highly urgent”, and less urgent payments are made when excess liquidity is sufficient. This is a way of securing liquidity for more urgent payments. The priorities for pending transactions can be changed at any time via the information and control module (ICM).

Chart 19 gives an overview of the use of priorities in TARGET2 in 2019 in terms of the overall TARGET2 volume. It shows that more than 80% of transactions were assigned normal priority, with 9% highly urgent and the remainder urgent. The distribution of the use of the priorities when submitting payments to TARGET2 has remained stable over the years.

Chart 19

Use of priorities in TARGET2 in 2019

1.10 Non-settled payments

Non-settled payments in TARGET2 are transactions that have not been processed by the end of the business day because of, for example, erroneous transactions made by participants, a lack of funds in the account to be debited, or a sender’s limit being breached. The transactions are, ultimately, rejected. Chart 20 shows the evolution of the daily average of non-settled payments on a monthly basis between 2009 and 2019 in terms of both volume and value.

The average daily number of non-settled transactions in 2018 decreased sharply, amounting to as few as 273 transactions for the whole year (i.e. a two-thirds decrease in unsettled transactions compared with the average observed in 2017). The decrease was driven mainly by the migration to T2S at the end of 2017 of one of the securities settlement systems. Due to its gross settlement model, some of its transactions were rejected, either due to liquidity shortage or cancellation, and reported as non-settled TARGET2 payments. In 2019, the average daily number of non-settled transactions increased to 366. However, the average total value of these transactions more than halved, from €4.5 billion in 2018 to €2.0 billion in 2019.

Chart 20

Non-settled payments in TARGET2

(left-hand scale: number of transactions; right-hand scale: EUR billions)

For the same reasons, the average daily value of non-settled payments also decreased drastically in 2018, falling to an average of just €4.5 billion for the year and to €2.0 billion in 2019.

Overall, non-settled payments in 2019 represented 0.1% of the total daily volume and 0.1% of the total daily turnover in TARGET2. The levels may be considered very low and confirm that liquidity was appropriately distributed across participants throughout that period.

1.11 Use of credit lines in TARGET2

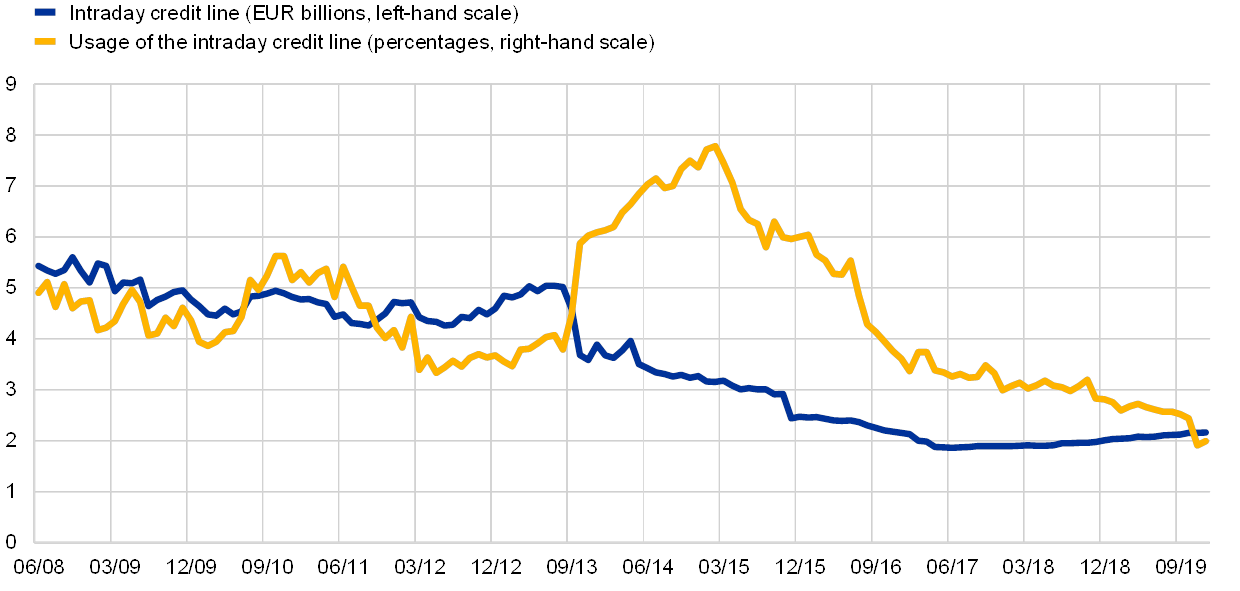

The intraday credit line is a facility in TARGET2 through which banks can overdraw their intraday account against eligible collateral. The average maximum intraday credit line at participant level increased by 8.3% compared with 2018 to a value of €2.1 billion. Although the intraday credit value accessible by TARGET2 participants increased, its usage slightly decreased. In 2019 only 2% of payments were settled using the intraday credit line, while the figure for 2018 was 3% (see Chart 21). This decrease in the usage of the intraday credit line has been observed since the start of the ECB asset purchase programme (APP) and can be explained by the fact that participants have substituted it with other sources of liquidity funding, in particular the reserves on their settlement accounts, which have increased considerably since the start of the APP.

Chart 21

TARGET2 intraday credit line and its usage

Notes: The chart covers the period from June 2008 to December 2019. Figures represent monthly averages. The intraday credit line is calculated as the maximum intraday credit that can be accessed, on average, by one bank during the day against collateral posted. The usage of the intraday credit line represents the percentage of payments that are settled using the intraday credit line, with calculations based on McAndrews J. and Rajan S., “The timing and funding of Fedwire Funds transfers”, Economic Policy Review, Federal Reserve Bank of New York, 2000.

1.12 Share of inter-Member State traffic

The share of inter-Member State traffic in TARGET2 indicates the percentage of traffic that is exchanged between participants belonging to different banking communities. Chart 22 shows that, in 2019, this share continued to increase, reaching 45% in value and 43% in volume. Overall, since 2009, there has been a positive trend for both volume-based and value-based indicators, reflecting the increasing level of financial integration in the large-value payment segment, largely supported by TARGET2.

Chart 22

Share of inter-Member State traffic in TARGET2

(in percentages)

When analysing these data, it should be kept in mind that whether a payment is sent or received by a given banking community may depend more on a bank’s internal organisation than on its actual geographical domicile. For example, a subsidiary of a French bank, located in Italy, because of its internal organisation, may send TARGET2 payments to another bank, also located in Italy, via its headquarters in France. In such a case, the payment flow will be considered to be cross-border, even though the payment is taking place between two entities located in the same country. By contrast, banks located in European Economic Area (EEA) countries whose central banks do not provide TARGET2 services, e.g. the Czech Republic or Sweden, can participate in TARGET2 component systems provided by other central banks. For example, if a Swedish bank participating in TARGET2-Bank of Finland sends TARGET2 payments to banks in Finland that also participate in TARGET2-Bank of Finland, the payment flows will be considered to be domestic, even though they are taking place between entities located in different countries.

The inter-Member State payments shown in Chart 22 were identified based on the national banking communities of the sending and receiving direct participants on the platform. Since it is also possible to connect to TARGET2 from a non-EEA country, e.g. as an indirect participant or an addressable BIC holder, the evolution of the cross-border share in terms of volume was also computed on the basis of the originator and the beneficiary of the payment, taking into account the full payment chain information (i.e. originator, sending settlement bank, receiving settlement bank and beneficiary). When calculating the inter-Member State shares based on the originator and beneficiary of the payment, the share of cross-border payments in 2019 amounted to 56% in terms of volume and 41% in terms of value. Therefore, taking the full payment chain into account leads to a cross-border share that is significantly higher in volume and slightly higher in value.

Box 3

Liquidity distribution in TARGET2

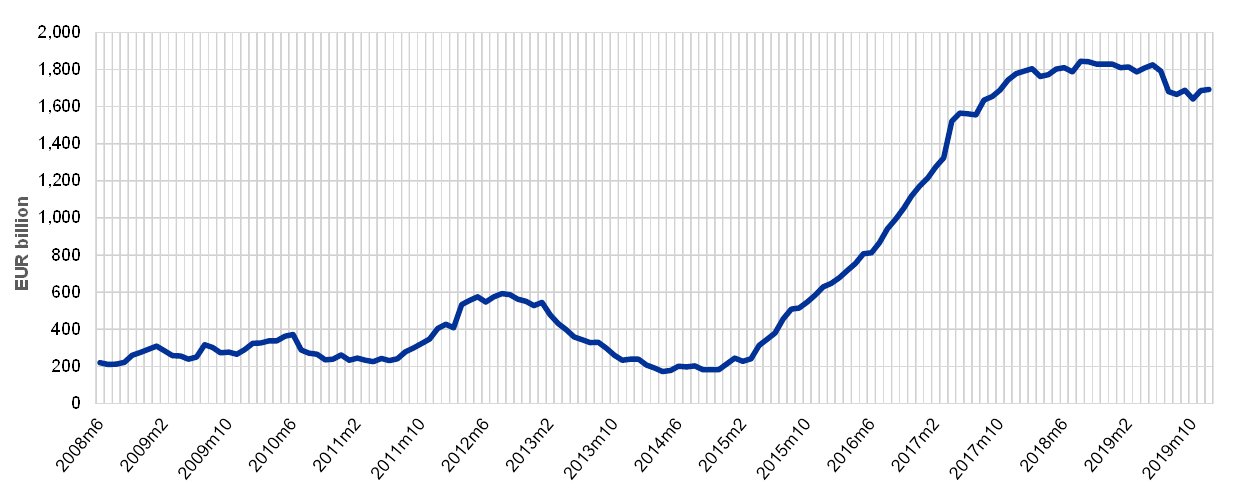

TARGET2 liquidity refers to the liquidity available on TARGET2 accounts. It represents a measure of central bank liquidity available[21] and is also commonly referred to as central bank reserves or balances at the central bank.[22] TARGET2 liquidity is calculated as the sum of start-of-day balances on all TARGET2 accounts[23] and can be used by TARGET2 participants to make payments throughout the day. In 2019, liquidity in TARGET2 stood, on average, at €1.74 trillion, a decline of 3.8% on the previous year (see Figure 1). Notwithstanding the decline, the current levels of liquidity are still very high compared with 2014, i.e. the year before the start of the APP, when TARGET2 liquidity stood, on average, at €0.2 trillion, representing almost one-ninth of the liquidity available in 2019. High levels of central bank liquidity are generally seen as beneficial for payment systems as they decrease recourse to intraday credit and payments are settled, on average, earlier in the day.[24]

Chart A

Liquidity evolution in TARGET2

Data source: TARGET2, June 2008-December 2019, ECB calculations.

Note: Monthly averages of daily data.

Approximately 93.1% of the liquidity held by participants in TARGET2 in 2019 was concentrated in a limited number of countries: Germany (28.4%), France (26.4%), the Netherlands (11.7%), Spain (6.0%), Italy (5.8%), Finland (5.7%), Belgium (4.8%) and Luxembourg (4.3%) (see Figure 2). Although this distribution looks almost the same as it did in 2018, with differences at country level being within one percentage point of 2014 figures, i.e. before APP implementation, there are some differences worth mentioning. France increased its share by 6.4 percentage points and Germany by 2.5 percentage points; Belgium and Luxembourg also increased their shares, but by fewer percentage points. This was balanced by a decrease in the share of Italy (-3.4 percentage points) and the Netherlands (-2.8 percentage points), as was the case in Finland and Spain, with less significant changes for the latter. Overall, these eight countries held more in relative terms in 2019 than in 2014.

During 2019 the distribution did not vary much (see Figure 3). In November 2019, there was a contained shift of liquidity across countries. Among these countries, in particular, Germany decreased its share of liquidity holdings by 2.0 percentage points, while Italy’s increased by 2.4 percentage points. This shift remained roughly stable until the end of the year and appears to be related to the introduction of the two-tier system for reserves remuneration on 30 October. Under this two-tier system, banks’ excess liquidity holdings of up to six times their reserve requirements are remunerated at 0%, creating an incentive for banks to exploit the unused exemption allowances.[25] The liquidity shift in TARGET2 indicates that at least part of the exempted allowances was filled cross-border. The impact of the introduction of the two-tier system is expected to be one-off, as the majority of unused exempted allowances have already been filled.[26]

Chart B

TARGET2 liquidity distribution by country in 2019

Data source: TARGET2, 2019, ECB calculations.

Note: Annual averages of daily data.

Chart C

Variation of TARGET2 liquidity distribution by country in 2019

Data source: TARGET2, 2019, ECB calculations.

Note: Monthly averages of daily data.

Looking at the liquidity distribution by country according to their TARGET2 balance position, TARGET2 claim countries held, in 2019, on average approximately 68.0% of the liquidity in TARGET2, an 11 percentage point increase on the previous year, while liability countries held 32.0%.[27] Historically, claim countries have held more liquidity than liability countries, although the gap increased with APP implementation. On average, liquidity distribution was split close to 50-50 between claim and liability countries back in 2008 and 2014, coinciding with TARGET2 balance levels reaching some of the lowest levels in their history.

At bank level, liquidity is distributed unevenly among TARGET2 participants. In 2019, more specifically, 25% of TARGET2 participants held 98.4% of the liquidity available in TARGET2. It is also notable that ten TARGET2 participants[28] held, on average, 22.6% of the total liquidity. With variations of within a few percentage points, this holds true historically.

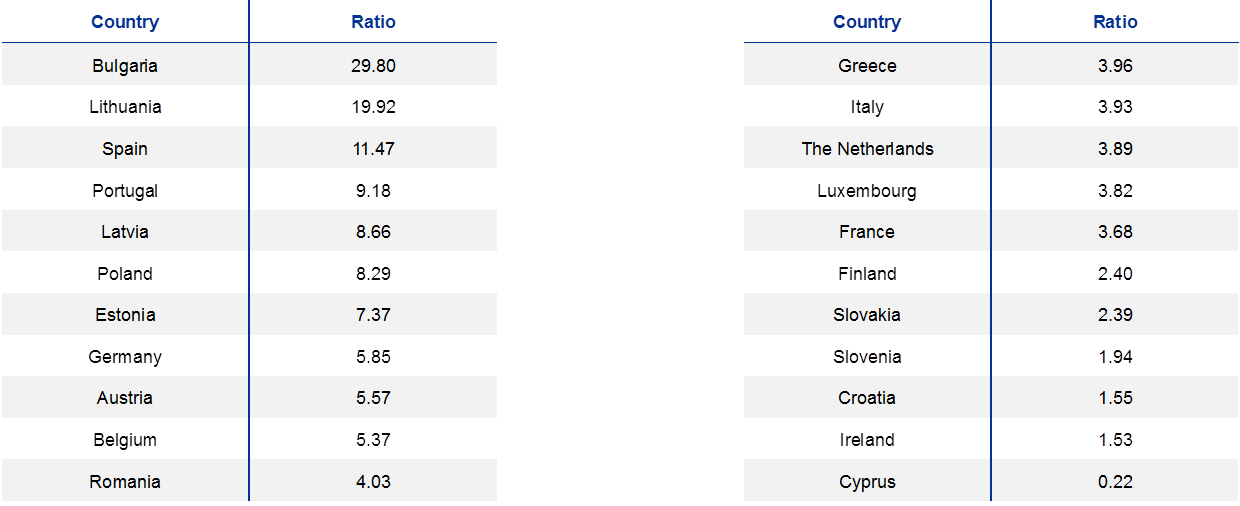

As mentioned above, TARGET2 participants use this liquidity to settle payments. Overall, there is a strong positive correlation between the total value of traffic generated and liquidity held. Table A shows the ratios between payments sent and liquidity held at jurisdiction level. All countries except one have ratios above 1, meaning that the total turnover the TARGET2 participants of these jurisdictions process is higher than the overall liquidity levels in their participants’ accounts. This implies that liquidity is recirculated several times during the day.

Table A

Country ratio between payments sent and liquidity available

Data source: TARGET2, Analytical Team calculations.

Notes: The table provides, for each country, the average ratios between the payments sent and the available liquidity. Average figures of daily data. Due to computational issues, the ratios for Malta and Denmark have not been reported.

1.13 Tiering in TARGET2

Tiered participation arrangements occur in a payment system when a direct participant of that system provides services that allow other participants to access the system indirectly. The indirectly connected participants benefit, in turn, from the clearing and settlement facility services offered by direct participants.

While indirectly connected parties, i.e. indirect participants and addressable BIC holders, benefit from the settlement facility that would otherwise be costly to access directly, these types of arrangement also entail risks. Tiered participation arrangements can create dependencies that may lead to overall credit, liquidity or operational risks for the payment system, its participants or the stability of the banking system. Close monitoring of the tiering level in TARGET2 is thus of paramount importance. It is also an oversight requirement of Article 17 of the SIPS Regulation.[29]

The image below shows the map of TARGET2 flows based on the location of the payment originators and final beneficiaries. This shows that, when considering the institutions at both ends of the payment chain, TARGET2 has global reach.

TARGET2 transfers based on the originator and final beneficiary banks’ locations

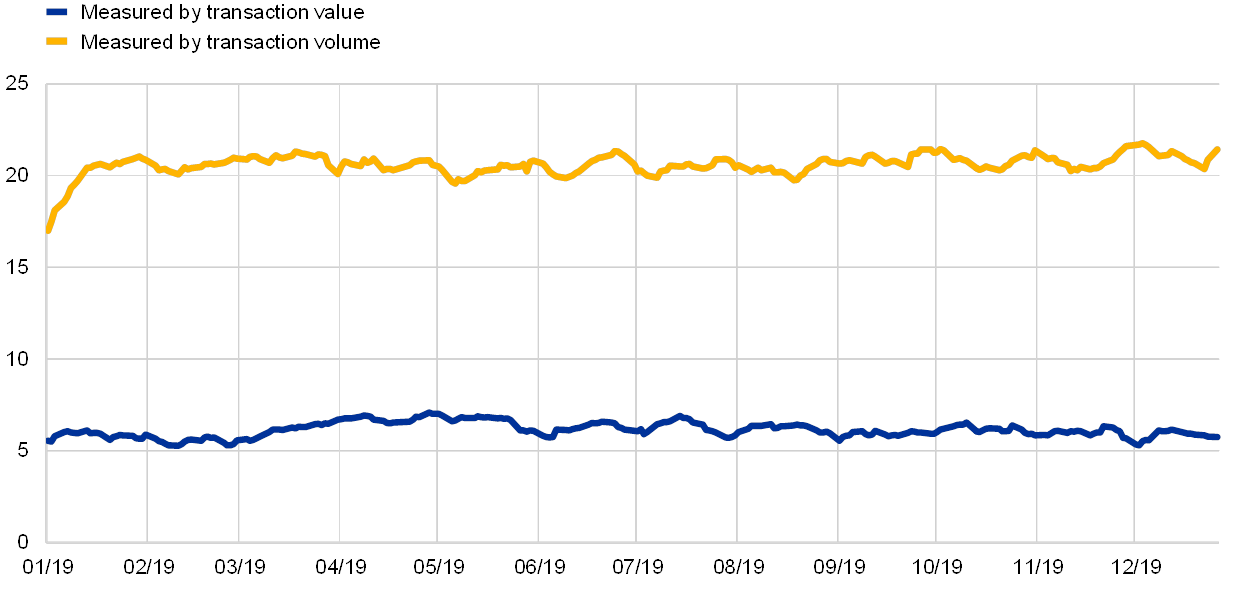

During 2019 the aggregate level of tiering on the sending side in TARGET2 reached around 6.13% in terms of value and 20.61% in terms of volume (see Chart 23). This meant that, on average, of every euro sent by direct participants in TARGET2 during the year, only 6.13 cents were settled on behalf of indirectly connected parties outside their banking group perimeter. More than 75% of the tiered business (consolidated at banking group level) comes from outside the EEA, showing that TARGET2 makes it possible for institutions around the world to access the euro market.

Chart 23

Tiering by sender in TARGET2

(in percentages; ten-day moving average)

The largest indirect participant in terms of value sent (consolidated at banking group level) was ranked approximately 53rd out of all TARGET2 direct participants in 2019.

Further analysis reveals that 57.66% of all direct participants in TARGET2 (consolidated at banking group level) did not conduct any business during the year on behalf of indirect parties. Overall, these statistics for 2019 point to a relatively stable and contained level of tiered participation in TARGET2.

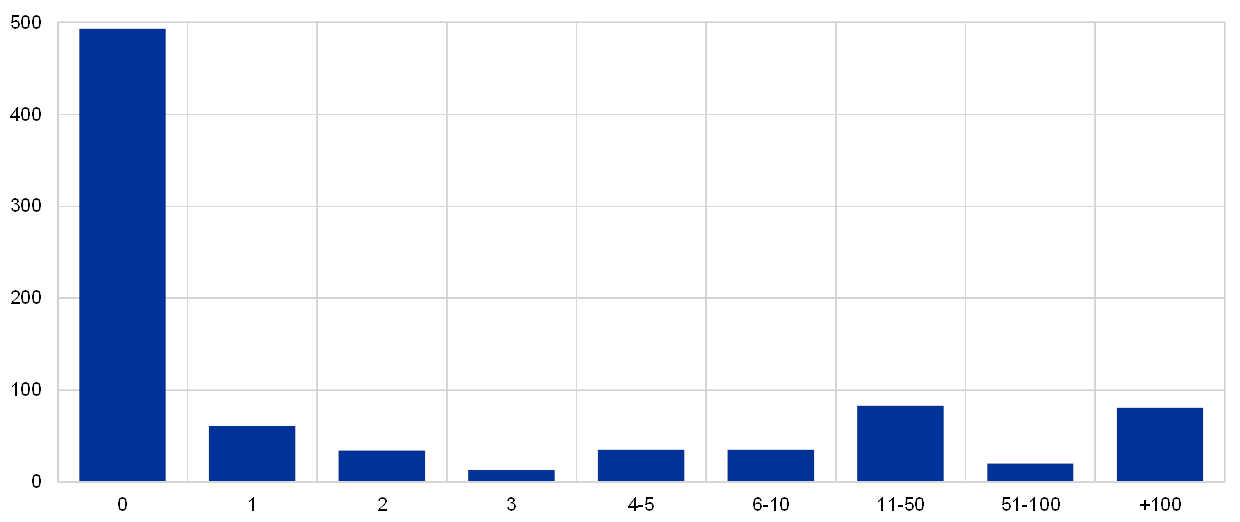

In more detail, Chart 24 shows that around 493 direct participants do not send or receive any tiered payments while 61 send or receive payments on behalf of only one tiered banking group. At the other end of the spectrum, around 81 direct participants act as a settlement bank for more than 100 tiered banking groups.

Chart 24

Tiered groups per direct participant group

(x-axis: tiered participants; y-axis: direct participants)

1.14 Money market transactions in TARGET2

Market participants use TARGET2 for settling unsecured money market transactions in central bank money. By applying the Furfine algorithm[30] it is possible to identify which TARGET2 transactions are related to money market loans, or, more precisely, to the unsecured overnight money market.[31] This unique dataset is updated regularly to obtain the latest information about the money market. Overall, TARGET2 transaction data provide a rich source of information for both the analysis of monetary policy implementation and TARGET2 operations. The importance of the money market is thus twofold: (i) it is an important vehicle for the redistribution of liquidity among TARGET2 participants, and; (ii) it is a large-value and time-critical area of business that the operator needs to be aware of, in particular when dealing with abnormal situations.

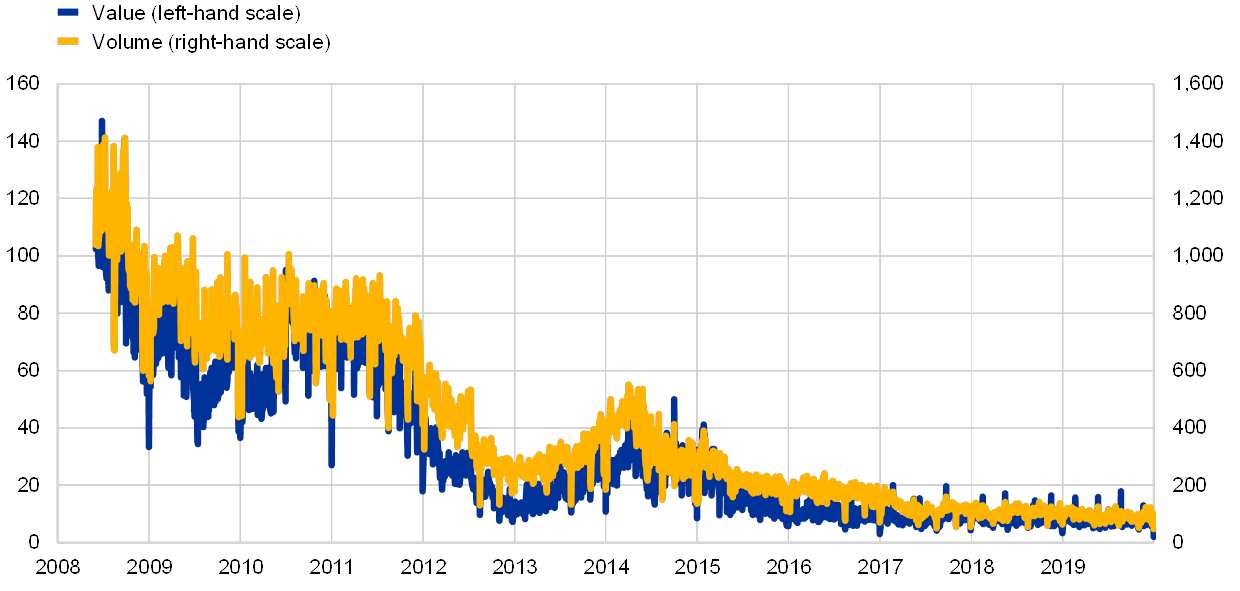

The dataset has been developed using the TARGET2 simulator environment and comprises data from June 2008 onwards.[32] In 2019, around 23,400 money market loans, with a total value of about €1.96 trillion, were identified. Overall, the amount of unsecured funds traded in the overnight market during 2019 continued to fall (see Chart 25). This fall can be attributed to the increase in overall excess liquidity within the Eurosystem, and non-standard monetary policy instruments.

Chart 25

Unsecured overnight money market activity in TARGET2

(left-hand scale: daily totals, EUR billions; right-hand scale: number of transactions)

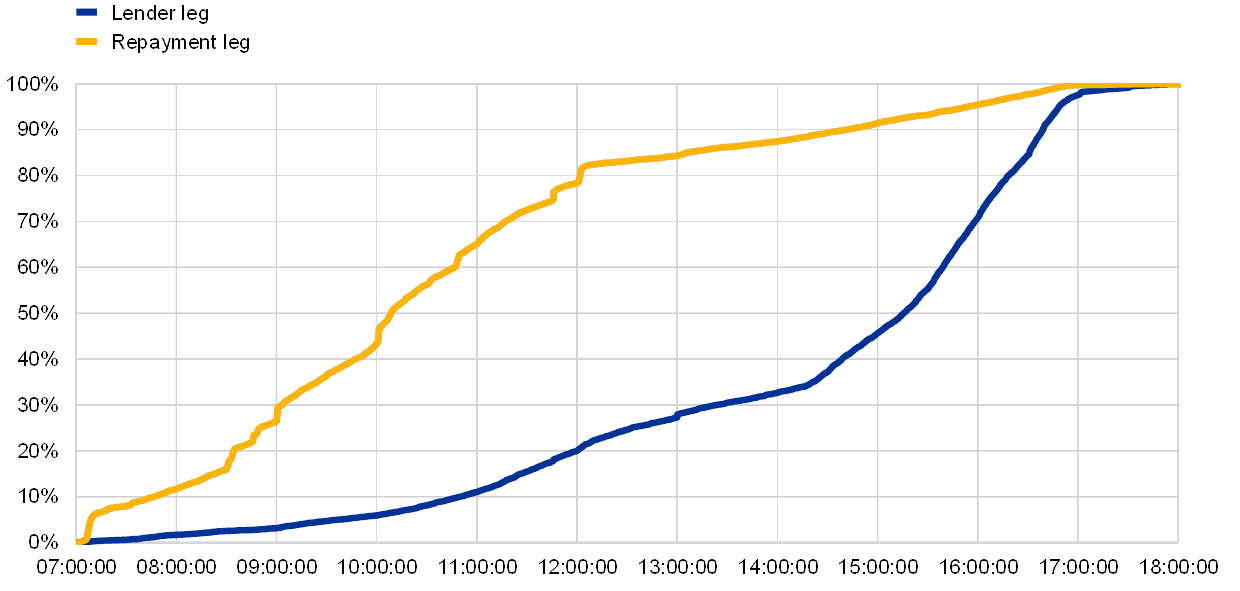

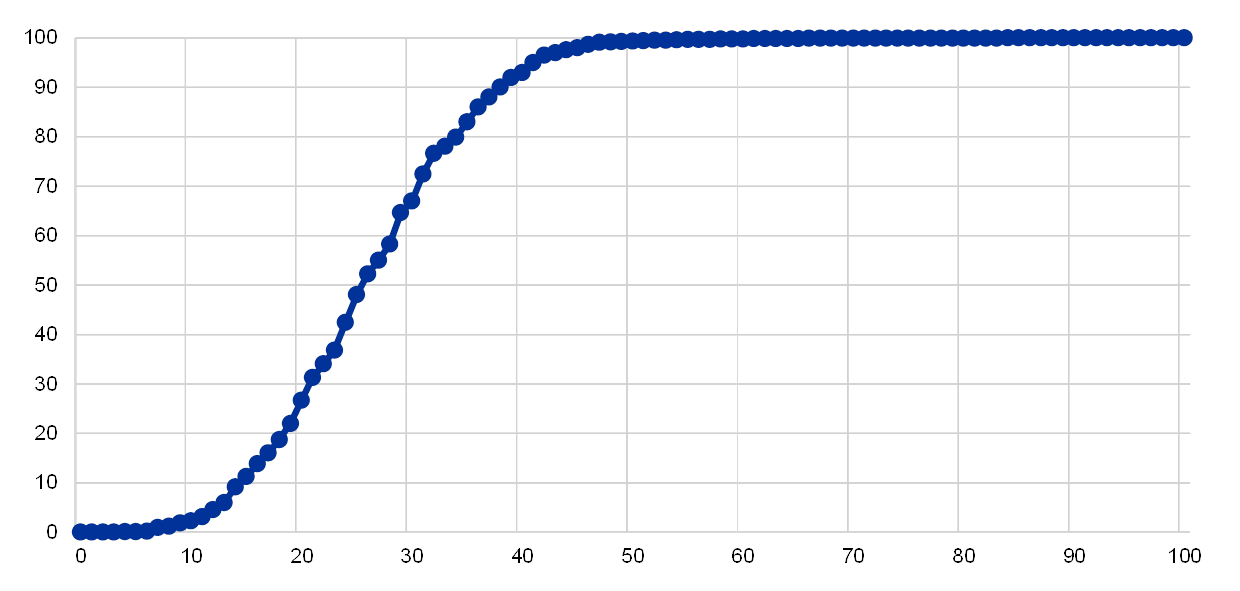

Chart 26 complements this analysis by showing the cumulative distribution in value of all money market transactions across the day in 2019. On the lending leg, 50% of the total value is settled by around 15:15, while 98% is settled by around 17:00. This confirms the assumption that the last hours of TARGET2 operations are particularly important for the interbank market. In terms of repayment, three-quarters of the loans are repaid by around 11:45 and 90% by around 14:45. These patterns ensure that the repaid liquidity can be reused for payment purposes later that day.

Chart 26

Cumulative distribution of money market transactions during the day

(in terms of value)

1.15 Shares of national banking communities

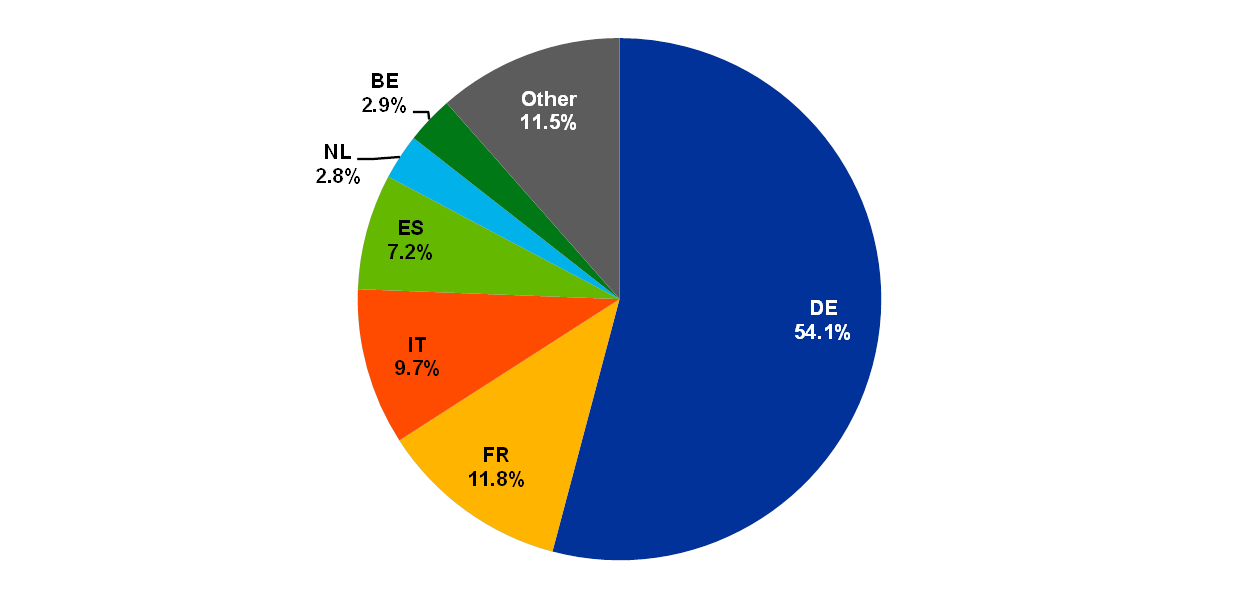

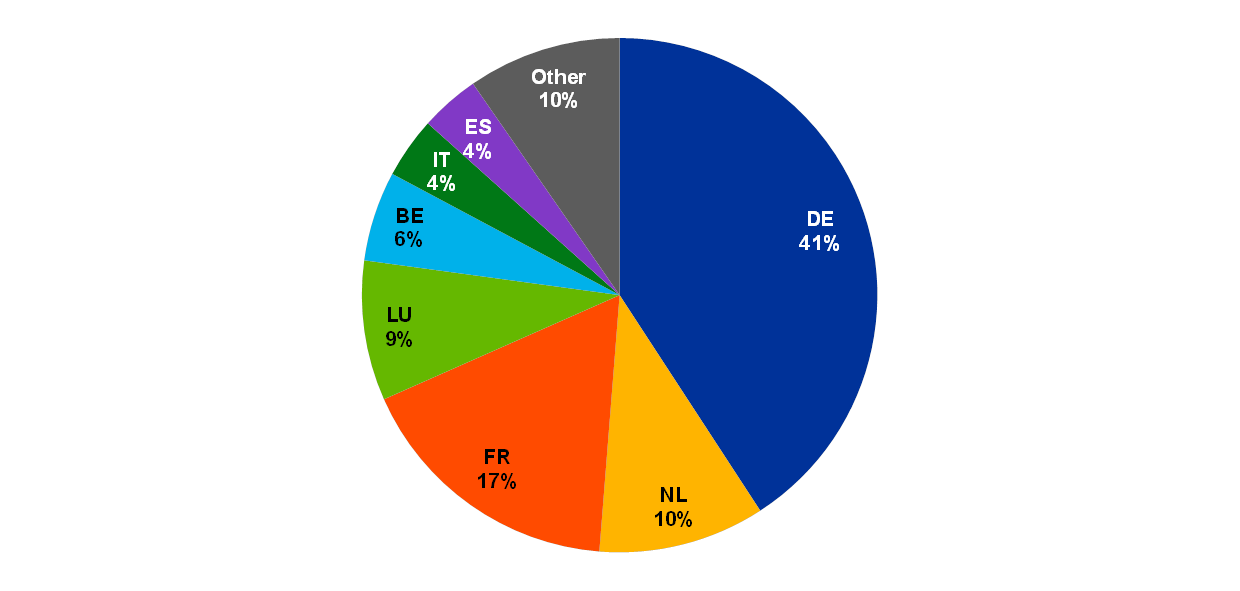

The following two charts break down TARGET2 volumes and turnover according to the share of the biggest national banking communities contributing to its traffic.

Chart 27

Country contribution to TARGET2 volume

Chart 28

Country contribution to TARGET2 value

In terms of volume, in 2019, similar to previous years, the largest contributor to TARGET2 traffic was Germany, which accounted for more than half of the transactions settled in the system. Adding France, Italy, Spain, the Netherlands and Belgium, the share of transactions increases to 88%, which is on a par with previous years. The shares of the biggest contributors to the TARGET2 volume changed as, in comparison with previous years, significantly lower volumes were recorded in the Netherlands, mainly because UK banks rerouted traffic to TARGET2 via new subsidiary/branch connections to the system in preparation for Brexit.[33] In addition, the drop in the Netherlands was due to some customer payment transactions shifting to instant payments (see Box 1).

With regard to turnover, Germany is the main contributor, followed by France, the Netherlands and Luxembourg. The top four countries by turnover generated over three-quarters of the total value settled in TARGET2 in 2019. The concentration of turnover changed slightly compared with the year before: the Netherlands experienced a 6 percentage point drop in its share of total turnover for the above-mentioned reasons while the shares of Germany, France and Luxembourg all increased by two percentage points.

It should be noted that the high concentration of both TARGET2 values and volumes in certain countries is not only the result of the size of particular markets. It can also be attributed to the fact that, since November 2007, the TARGET2 system has allowed the activities of banking groups to be consolidated around a single RTGS account held by the group’s head office, thereby increasing the concentration in countries where a large number of these groups are incorporated.

1.16 Pattern of intraday flows

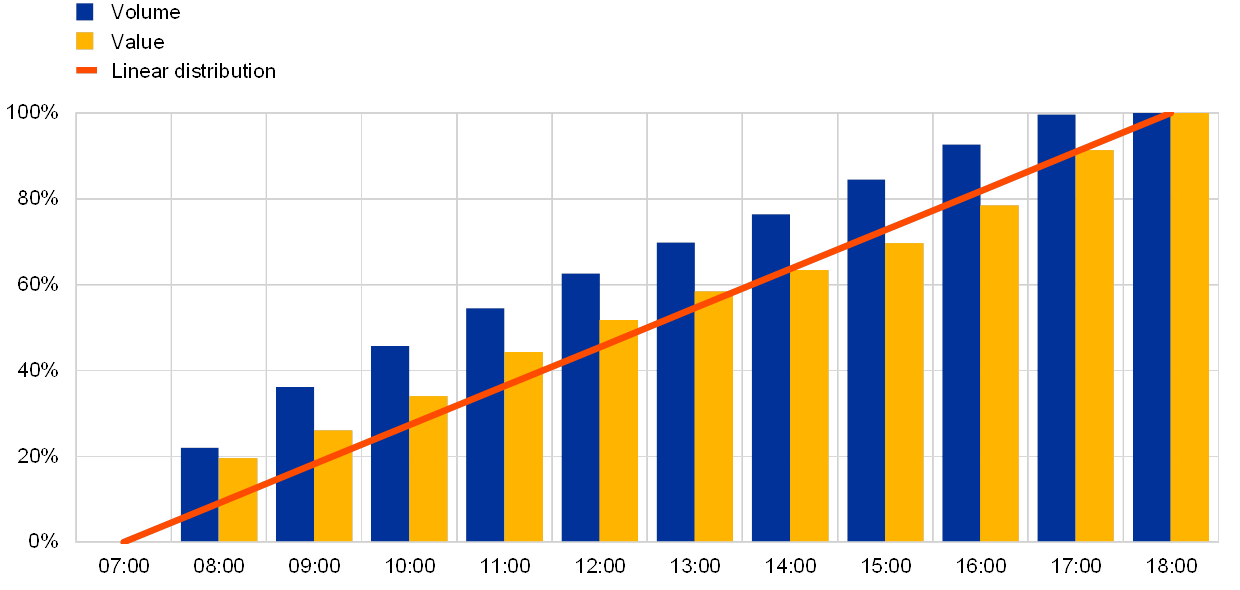

Chart 29 shows the intraday distribution of TARGET2 traffic, i.e. the percentage of daily volumes and values processed at different times of the day in 2019. This indicator is important for the operator of TARGET2 as it represents the extent to which settlement is evenly spread throughout the day or concentrated at certain peak times. Ideally, the value/volume distribution should be as close as possible to linear to avoid liquidity and operational risk.

Chart 29

Intraday distribution of TARGET2 traffic in 2019

(x-axis: time of the day; y-axis: percentage of daily volumes and values)

In terms of value, the path is typically very close to a linear distribution, indicating an even spread throughout the day, which in turn ensures the smooth settlement of TARGET2 transactions.

In terms of volume, the curve is well above the linear distribution, with over one-fifth of transactions being submitted to the system within one hour after the start of operations – these include transactions sent during the night by participants and warehoused payments – and almost half within three hours after the start. By one hour before the system closes, almost 100% of the TARGET2 volume has already been processed. A comparison with previous years shows no significant deviations.

2 TARGET2 service level and availability

In 2019, all payments settled in the payments module of TARGET2 were processed in less than five minutes. This was also the case in 2018.

Service delivery times and payment processing times also remained stable in 2019, confirming the high performance level of TARGET2’s SSP. It should be noted that this excellent performance is very advantageous for the banking community, particularly for its real-time liquidity management.

Payment processing times are measured for all the payments settled in TARGET2, with the exception of the following: ancillary system settlement transactions using the ASI, payments settled during the first hour of operations (see below on the “morning queue effect”), and payments that have not been settled because of a lack of funds or a breach of limit. In practice, around 30% of all TARGET2 payments fall into these three categories of exceptions, meaning that the statistics on processing times apply to around 70% of the system’s traffic.

With regard to requests or enquiries, 99.90%[34] were processed in less than one minute and only 0.10% in one to three minutes, with levels remaining the same as in 2018.

Chart 30 helps to better quantify the system’s performance by showing the distribution of processing times on the SSP, i.e. the percentage of traffic with a processing time below a certain number of seconds. The reference point taken is the peak day of the year recorded by the SSP, 30 September 2019, when 525,075 payments were settled. The chart shows that on this day 50% of transactions were settled within 26 seconds and 90% within 39 seconds, thereby confirming the system’s high level of performance.

Chart 30

Processing times on 30 September 2019, excluding the first hour

(x-axis: seconds ; y-axis: percentage)

A specific phenomenon worth reporting in the context of TARGET2 performance is the “morning queue effect”. When TARGET2 starts daylight operations at 07:00, a very high number of transactions (about 20% of the daily volume on peak days) are already waiting for settlement, corresponding either to payments submitted by banks on previous days with a future value date (i.e. “warehoused payments”) or to payments released by banks via SWIFT in the hours preceding the opening of the system. On peak days, more than 100,000 transactions may be processed in the first hour, which affects the average settlement time during this period. This huge volume of transactions normally takes around 30 to 45 minutes to process and, to neutralise this effect, the first hour of operations is excluded when TARGET2 processing times are calculated.

Specifically in the first hour, the use of urgency flags (“urgent” and “highly urgent”) is still highly recommended for payments considered to be time-critical (such as CLS pay-ins). Using urgency flags circumvents settlement delays by using different queues (one queue for each type of priority). In addition, attention should be drawn to the possibilities offered in TARGET2 to reserve funds for highly urgent and urgent payments (see Section 1.8 The use of prioritisation).

2.1 Technical availability

In the light of TARGET2’s importance for the functioning of the financial system and the knock-on effects that any potential malfunctions could have on other market infrastructures, the Eurosystem pays particular attention to ensuring its smooth operation. This is clearly underlined by the fact that the SSP of TARGET2 achieved 100% technical availability in 2019.

Technical availability is measured on TARGET2 business days during the day-trade phase (including end-of-day processing), from Monday to Friday between 07:00 and 18:45 (19:00 on the last day of the minimum reserve period), including extensions required to complete the operational day (e.g. delayed closing owing to a technical problem in TARGET2 or in T2S, which has an effect on TARGET2, or to major problems in ancillary systems settling in TARGET2). The availability measurement does not include systems or networks not directly managed by TARGET2 (in particular, the availability of the SWIFTNet services). Incidents occurring during night-time settlement are not included either.

Technical availability is not intended to measure the impact of partial outages involving TARGET2’s SSP. For example, incidents affecting only the processing of ancillary system transactions without any effect on other payment processing activities cannot be measured within this figure, although they have an overall impact on TARGET2 and are taken into account when assessing the system’s performance. However, such incidents are, where applicable, considered when measuring processing times and, in addition, reported transparently and followed up accordingly.

2.2 Incidents in TARGET2

The ECB publishes up-to-date information about the availability of TARGET2 via the Market Information Dissemination tool. All incidents relating to TARGET2 are followed up with a detailed incident report and risk management process. The aim of this approach is to learn from these events to avoid a recurrence of the incidents or incidents of a similar nature.

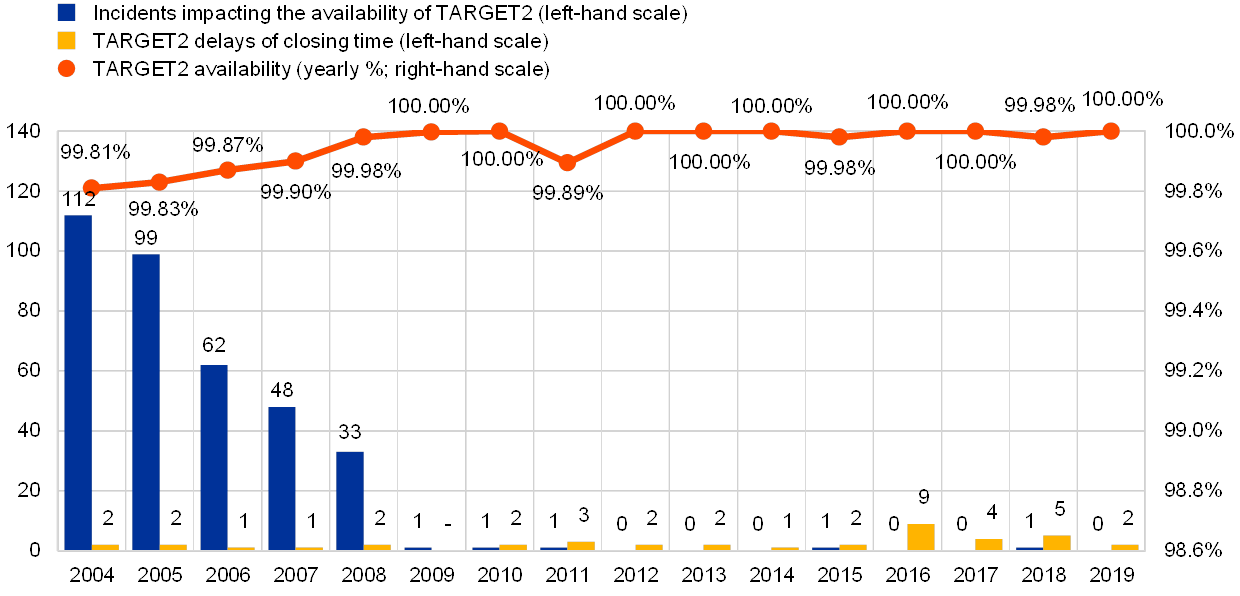

Chart 31

TARGET2 incidents and delays in closing the system

Chart 28

(left-hand scale: number of incidents/delays; right-hand scale: yearly data in percentages)

In 2019, TARGET2 experienced some technical issues which, in one case (on 5 July), led to a delay in the delivery of outgoing messages from TARGET2.

In addition to this incident and a number of less significant issues affecting TARGET2 operations on a few occasions, the closing of the interbank payment cut-off at 18:00 was delayed twice in 2019[35] due to problems related to the repatriation of funds from T2S back to TARGET2 RTGS accounts.

3 TARGET2 participants

3.1 RTGS accounts

In December 2019, the total number of RTGS accounts active in TARGET2 (encompassing the direct participants, the technical accounts, the ancillary system accounts and the special-purpose accounts) was 1,943, i.e. largely unchanged from the end of 2018.

Chart 32

Number of RTGS accounts in TARGET2

Internet-based participation

In November 2010, internet-based participation was introduced to allow small banks to obtain a direct connection to TARGET2 without necessarily being connected to the SWIFT network. The service, which is subject to a monthly fee of €70, is designed mainly for low-volume participants who wish to hold an account directly with their central bank: either an RTGS account[36] or a home accounting module account (provided the respective central bank has opted for this module). While the initial number of internet-based participants was relatively modest (68 at the end of 2012), it increased significantly in 2013 (reaching 509 participants by the end of 2013) with the phasing-out of the last proprietary home accounts still offering payment settlement services. Another increase during the second half of 2016 was driven by some banks opening TARGET2 accounts via internet-based access solely for the purpose of settling the long-term refinancing operations. In December 2019, the overall number of internet-based participants was 554, which portrays a gradual decline in this type of participation since the end of 2016. The largest share of internet-based participants is in Germany, followed by France and Italy.

Chart 33

Internet-based participants

3.2 Participation types

At the end of December 2019, 1,050[37] direct participants held an account on the SSP of TARGET2 and were registered as such in the TARGET2 directory. Through these direct participants, 597 indirect participants from the EEA, as well as 4,194 correspondents worldwide, were able to settle their transactions in TARGET2.

Table 2

Participation types

Including the branches of direct and indirect participants, a total of 44,953 BICs around the world (82% of which are located in the EEA) were accessible via TARGET2 at the end of 2019. Compared with the number of reachable BICs at the end of 2018, this figure represents a drop of around 9%, driven mainly by the decrease in the number of addressable BIC holders associated with branches of direct and indirect participants.

Participants and institutions addressable via TARGET2 are listed in the TARGET2 directory, which is available to all direct participants for information and routing purposes. In addition to the direct participants that hold an RTGS account for sending payments to and receiving payments from all other direct participants, a number of banks have opted for the opening of special-purpose RTGS accounts, which are not reported as direct participants in the TARGET2 directory. These special-purpose accounts are used, for instance, for the settlement of a specific business, e.g. Eurosystem open market operations or to fulfil reserve obligations in countries where reserves are computed on RTGS accounts. There were 514 of these accounts, also called “unpublished BICs”, at the end of 2019 (550 in 2018).

Box 4

Treatment of a TARGET2 participant in resolution

According to the Financial Stability Board’s “Guidance on Continuity of Access to Financial Market Infrastructures (FMIs) for a Firm in Resolution” of 6 July 2017 (the “FSB Guidance”), “providers of critical FMI services should take appropriate steps to consider and plan for the interaction between the resolution regimes of their FMI service users and their own risk management framework; thereby clarifying the actions they may take in a resolution scenario, to support firms and authorities in enhancing resolution readiness.”

In line with the FSB Guidance, the TARGET2 Guideline stipulates that the taking of crisis prevention measures or crisis management measures within the meaning of Directive 2014/59/EU (BRRD) against a PM account/T2S DCA/TIPS DCA holder will not automatically qualify as the opening of insolvency proceedings within the meaning of the Directive 98/26/EC (SFD) or the TARGET2 Guideline. This means that there would be no automatic suspension or termination of the account of an entity in resolution. At the same time, the TARGET2 operator retains its discretion to suspend or terminate an account holder’s participation, in accordance with Article 34.2 of the TARGET2 Guideline, following an assessment of the particular circumstances of each situation on a case-by-case basis. This is also in line with the FSB Guidance, which recognises that FMIs need to manage their own risk and protect their participants from contagion risk, as well as with Principle 18 of the Principles for Financial Market Infrastructures of the Committee on Payment and Market Infrastructures and the International Organisation of Securities Commissions (CPMI-IOSCO PFMIs).

The TARGET2 Guideline does not automatically trigger any legally binding rights, obligations or procedures related to a participant entering into resolution. However, participants are required to inform the relevant central bank immediately if they become subject to crisis prevention measures or crisis management measures within the meaning of the BRRD. Where applicable, individual central banks will engage with their participants and ensure that participants are aware of, for example, playbooks (to the extent these exist and include FMI participants) or other procedures and information needs the central bank may have defined for resolution events.

Moreover, to comply with the FSB Guidance, on 4 October 2019 the TARGET2 Guideline was amended to allow central banks to disclose payment, technical or organisational information on a participant to the resolution authorities (in addition to the supervisory and oversight authorities) of Member States and the EU, including central banks, to the extent that this is necessary for the performance of their public tasks, and provided that in all such cases the disclosure is not in conflict with the applicable law.

In an update of the Information Guide for TARGET2 Users of November 2019, TARGET participants were informed of the Eurosystem’s general approach to the resolution of a TARGET2 participant.

3.3 Ancillary systems

At the end of 2019, a total of 82[38] ancillary systems were using the TARGET2 SSP for settlement purposes, including 32 retail payment systems, 20 securities settlement systems and 17 clearing houses (including four central counterparties).

Of the 76 ancillary systems using the SSP for settlement purposes, 57 made use of the Ancillary System Interface (ASI), a feature which was developed to facilitate and harmonise the cash settlement of these systems in TARGET2[39]. The number of times each of the six available ASI models was used at the end of the year is shown in Table 3.

Table 3

ASI settlement model

* An ancillary system may make use of more than one ASI settlement model.

1) As a result of the migration to T2S, Model 1 (which supports the integrated model) is no longer used.

4 TARGET2 financial performance

4.1 Cost recovery objectives

The objective initially set by the ECB Governing Council in 2007 was for TARGET2 to recover all its costs (with the exception of the “public good factor”[40]) over the six-year amortisation period, i.e. between May 2008 and April 2014. This included its development costs, running costs, overhead costs and capital costs.

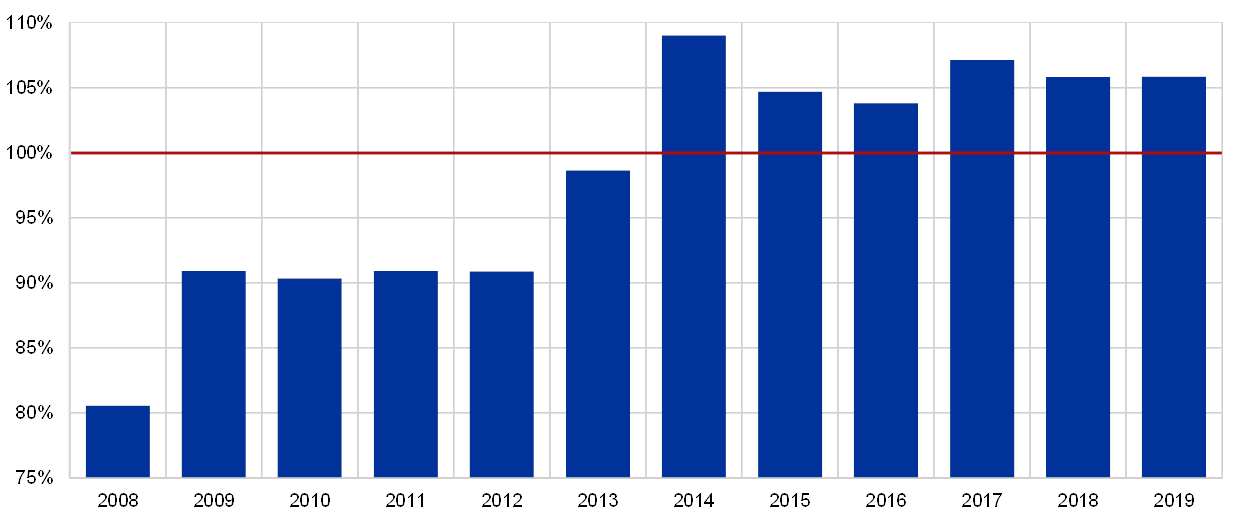

The evolution of TARGET2’s cost recovery rate since the finalisation of its migration phase in 2008 is shown in Chart 34 below.

Chart 34

TARGET2 annual cost recovery rate

Note: 2008 only July-December.

At the time of TARGET2’s development, a number of assumptions were made about the volume of operations in relation to cost recovery. It was estimated that in the first year of operations (i.e. from May 2008 to April 2009), TARGET2 would settle a total of 93.05 million transactions and that this figure would then need to increase by an average of 6% per year. Although the objective was met in the year the system was launched, the overall economic slowdown and exceptional market conditions in the following years made it impossible to meet the target 6% increase. Since TARGET2’s launch, the system has seen an average annual decrease in billed traffic of 0.8%, which largely explains why cost recovery, for the first few years of operation, was only around 90%.

In July 2012, acknowledging this underperformance, the Eurosystem decided to amend TARGET2’s single pricing scheme as of January 2013. The fixed periodic fee for users was increased, while transaction fees remained unchanged. The new pricing scheme represents an acceptable compromise, with a limited increase in the participants’ fees and a reasonable extension of the system’s payback period. In 2013 the amended pricing scheme helped to bring cost recovery close to 100%.

In 2014, the majority[41] of the investment costs were amortised, which substantially reduced the costs still to be recovered. This lifted cost recovery to more than 100% – these annual profits are used to offset the losses accumulated over the first years of operation.

While TARGET2 has generated annual profits since 2014, the level of cost recovery has fluctuated considerably on an annual basis. The reasons for this are, first, that the SEPA migration end date resulted in a one-off drop in the total amount of customer payments settled in TARGET2. Second, T2S migration had an effect on TARGET2 from both a cost and a revenue perspective. TARGET2 underwent adaptations in preparation for the launch of T2S, the costs of which started to be recouped from 2015 onwards. These adaptation costs are passed on to system participants in the form of a specific fee.[42] Furthermore, the successful migration of the respective CSDs to T2S from June 2015 onwards reduced the total amount of ancillary system transactions settled in TARGET2.

The total amount of billable traffic in TARGET2 decreased slightly, by 0.2 million transactions, in 2019, and overall revenues decreased to €44.2 million. However, annual cost recovery remained constant at 105.8% between 2018 and 2019. This is because the development costs of the interface to T2S had been fully amortised by the end of 2018.

4.2 Financial performance of TARGET2 in 2019

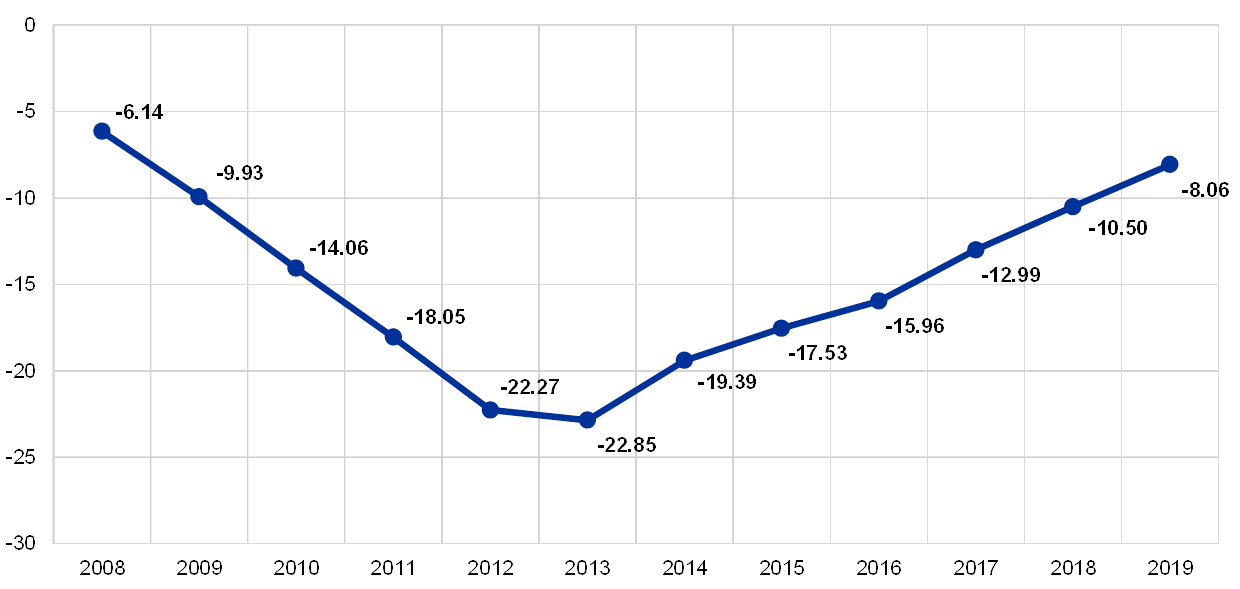

In 2019, the total annual costs to be recovered for the provision of the core services of TARGET2 amounted to €41.7 million. On the revenue side, TARGET2 participants were billed for 85.9 million transactions which, together with the fixed monthly fees, generated total revenues of €44.2 million. This resulted in a cost recovery rate of 105.8% and an annual profit of €2.4 million. At the end of 2019, the loss accumulated since the launch of TARGET2 had therefore decreased by the same amount, and stood at €8.1 million.

Chart 35

Accumulated profit

(EUR millions)

Note: 2008 only July-December.

4.3 Analysis of the revenues collected in 2019

Based on 2019 figures, the following observations can be made.

- 94% of the direct participants in the SSP opted for the flat fee option (i.e. option A), while 6% opted for the degressive fee option (i.e. option B).[43] This shows that TARGET2 is capable of attracting both the major market players as well as a large number of small and medium-sized institutions.

- The participants opting for pricing option B generated, in total, around 88% of billed traffic.[44] As a result of this concentration effect, 31% of all billed transactions were priced at the lowest pricing band, i.e. €0.125. This demonstrates that key participants, particularly multi-country banks, benefited from the attractive degressive fee option offered by TARGET2 and from the competitive group pricing offers.[45]

- Transactions between credit institutions generate around 90% of TARGET2 volumes, with the remaining 10% attributable to ancillary system transactions.